Key Insights

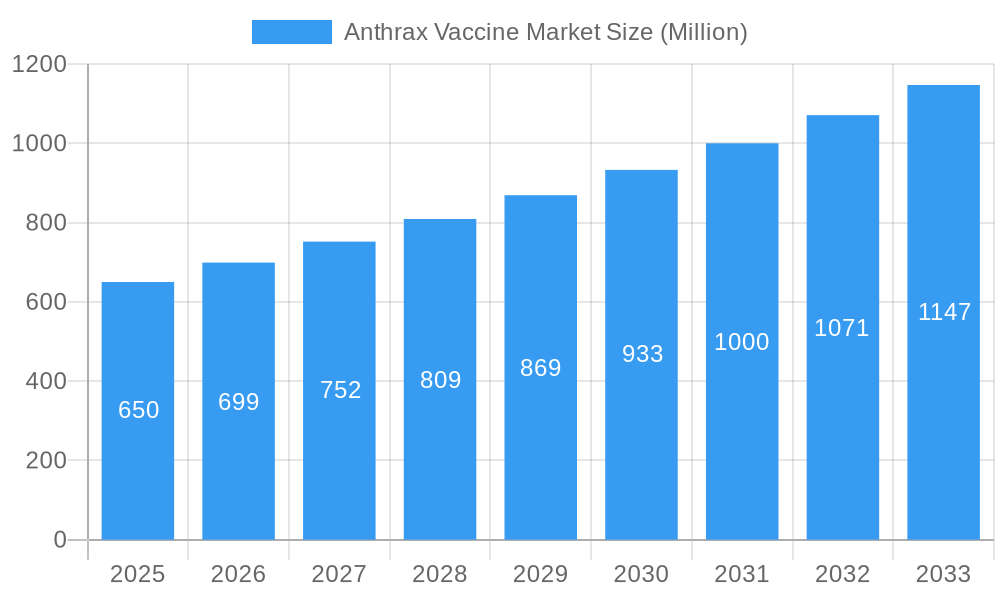

The global Anthrax Vaccine Market is projected to reach USD 650 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 7.60% through 2033. This expansion is primarily fueled by escalating concerns surrounding bioterrorism and a heightened focus on animal health necessitating prophylactic measures. The market is segmented by vaccine type, with Cell-Free PA Vaccines, including Anthrax Vaccine Absorbed (AVA) and Anthrax Vaccine Precipitated (AVP), anticipated to lead due to their proven efficacy and safety. Live Attenuated Vaccines are also expected to gain traction with advancements in research and new formulations. Applications span both animal and human health; animal health currently holds a larger share due to routine livestock vaccination, while increasing awareness of zoonotic diseases and anthrax's potential as a biological weapon are driving demand for human vaccines.

Anthrax Vaccine Market Market Size (In Billion)

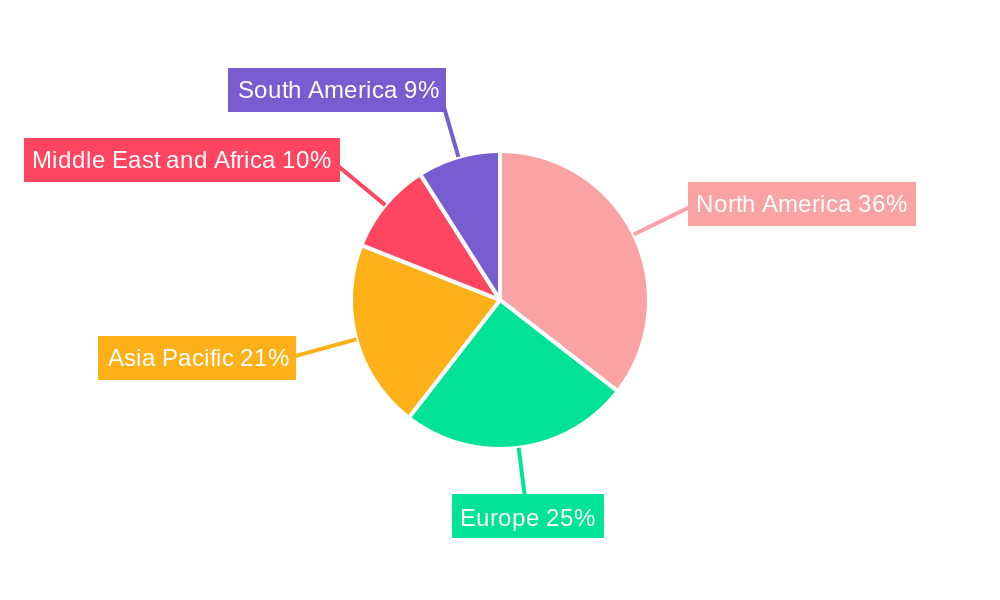

Distribution is concentrated in hospitals and pharmacies, serving as key access points for both human and animal vaccines, with veterinary clinics and specialized biological distributors also emerging. Geographically, North America, led by the United States, is expected to dominate due to significant government investments in biodefense and public health. Europe and Asia Pacific are also substantial markets, supported by increasing healthcare expenditure and a rising prevalence of zoonotic diseases. Key market players, including Emergent Bio Solutions, Merck & Co. Inc. (MSD Animal Health), and Zoetis Inc., are actively investing in research and development to enhance vaccine efficacy and introduce novel delivery systems. Potential restraints include stringent regulatory approvals and high development and manufacturing costs, though the persistent threat of anthrax and global biosecurity efforts are expected to sustain market growth.

Anthrax Vaccine Market Company Market Share

This comprehensive report offers a complete overview of the global Anthrax Vaccine Market, analyzing its current status, future trajectory, and growth dynamics. Covering a study period from 2019 to 2033, with a base year of 2025, this report provides actionable insights for stakeholders navigating the anthrax prevention landscape. We delve into parent and child market segments, exploring broad industry trends and specific product category performance, including Anthrax Vaccine Absorbed (AVA), Anthrax Vaccine Precipitated (AVP), and Live Attenuated Vaccines. The report quantifies market opportunities and challenges across animal and human health applications, via hospitals, pharmacies, and other distribution channels, presenting all values in billion.

Anthrax Vaccine Market Market Dynamics & Structure

The Anthrax Vaccine Market exhibits a concentrated structure driven by stringent regulatory requirements and substantial research and development investments. Technological innovation is a paramount driver, with ongoing efforts focused on enhancing vaccine efficacy, reducing side effects, and developing novel delivery mechanisms. Key players invest heavily in R&D to secure intellectual property and gain a competitive edge. Regulatory frameworks, particularly those overseen by agencies like the US FDA and EMA, play a crucial role in dictating market entry and product approval. The specter of bioterrorism and the need for biodefense preparedness significantly influence demand for anthrax vaccines, especially for human use. Competitive product substitutes are limited due to the specialized nature of anthrax vaccines, but advancements in alternative prophylactic or therapeutic agents could emerge. End-user demographics are bifurcated, encompassing governmental stockpiling agencies, military organizations, and the agricultural sector concerned with animal use. Mergers and acquisitions (M&A) trends are less prevalent due to the niche market and high barriers to entry, though strategic partnerships are common to share R&D costs and market access.

- Market Concentration: Dominated by a few key players with significant expertise and manufacturing capabilities.

- Technological Innovation Drivers: Focus on improved immunogenicity, thermostability, and reduced adverse events.

- Regulatory Frameworks: Strict oversight from health authorities impacting product development and market approval.

- Competitive Product Substitutes: Limited, but potential for novel therapeutics is monitored.

- End-User Demographics: Government biodefense programs, military, and veterinary sectors.

- M&A Trends: Low volume, with emphasis on strategic alliances and R&D collaborations.

Anthrax Vaccine Market Growth Trends & Insights

The global Anthrax Vaccine Market is projected to witness robust growth throughout the forecast period, fueled by heightened global biosecurity concerns and continuous advancements in vaccine technology. The market size is expected to expand significantly as governments and international organizations prioritize the development and stockpiling of effective countermeasures against potential bioterrorism threats. Adoption rates are gradually increasing, particularly for newer generation vaccines offering improved safety profiles and requiring fewer doses. Technological disruptions, such as the development of cell-free and subunit vaccines, are poised to reshape the market by offering more targeted and potentially safer alternatives to traditional live attenuated or whole-cell vaccines. Consumer behavior shifts, driven by increasing awareness of biological threats and the importance of preparedness, are contributing to a sustained demand for reliable anthrax prophylaxis. The CAGR is anticipated to be in the range of 7-9% over the forecast period, indicating strong market penetration.

- Market Size Evolution: Expected to grow from approximately $500 million in 2025 to over $900 million by 2033.

- Adoption Rates: Steadily increasing driven by government procurement and increased awareness.

- Technological Disruptions: Emergence of cell-free and subunit vaccines, offering enhanced safety and efficacy.

- Consumer Behavior Shifts: Growing demand for preventative measures against biological threats.

- Market Penetration: Significant growth potential in both developed and developing nations.

- CAGR: Estimated to be between 7-9% during the forecast period.

Dominant Regions, Countries, or Segments in Anthrax Vaccine Market

The Anthrax Vaccine Market is significantly influenced by regional geopolitical landscapes and government investments in biodefense. North America, particularly the United States, is currently the dominant region due to its substantial historical investment in biosecurity initiatives and large-scale strategic national stockpiles. The Human Use application segment, driven by the need for post-exposure prophylaxis and pre-exposure vaccination for high-risk populations such as military personnel and first responders, holds a commanding market share. Within the vaccine type segment, Cell Free PA Vaccine, encompassing Anthrax Vaccine Absorbed (AVA) and Anthrax Vaccine Precipitated (AVP), represents the most mature and widely utilized category due to established efficacy and regulatory approvals. Key drivers for this dominance include robust funding for research and development, well-established distribution channels through government agencies and military contracts, and a proactive regulatory environment that facilitates the approval of essential medical countermeasures.

- Leading Region: North America (specifically the USA) due to significant government funding and biodefense programs.

- Dominant Application: Human Use, driven by biodefense needs and pre/post-exposure prophylaxis.

- Leading Vaccine Type: Cell Free PA Vaccine (Anthrax Vaccine Absorbed (AVA), Anthrax Vaccine Precipitated (AVP)) due to established efficacy and widespread use.

- Key Drivers: Strong government procurement, military vaccination programs, and biosecurity initiatives.

- Growth Potential: Emerging markets in Asia and Europe are showing increasing interest due to rising biosecurity concerns.

- Market Share: North America accounts for approximately 45-50% of the global market.

Anthrax Vaccine Market Product Landscape

The Anthrax Vaccine Market product landscape is characterized by a focus on established, well-researched vaccines, with ongoing efforts to refine existing formulations and develop next-generation alternatives. Anthrax Vaccine Absorbed (AVA) remains a cornerstone product, providing reliable protection against Bacillus anthracis infection. Developments are increasingly centered on enhancing immunogenicity, reducing the number of doses required, and improving thermostability for easier storage and distribution. Innovations also aim to reduce reactogenicity, leading to a better safety profile for recipients. The market is witnessing a gradual shift towards cell-free vaccine technologies, which offer a more purified product and a potentially reduced risk of adverse events. These advancements are crucial for expanding the application of anthrax vaccines beyond military and high-risk civilian populations.

Key Drivers, Barriers & Challenges in Anthrax Vaccine Market

Key Drivers:

- Global Biosecurity Concerns: Persistent threat of bioterrorism and accidental releases drives demand for effective countermeasures.

- Government Mandates & Stockpiling: National biodefense strategies and strategic national stockpiles ensure consistent procurement.

- Technological Advancements: Development of more efficacious and safer vaccine formulations.

- Veterinary Applications: Need for protection against anthrax in livestock, particularly in endemic regions.

Barriers & Challenges:

- High Development Costs & Long Timelines: Significant investment and lengthy approval processes for new vaccines.

- Limited Commercial Market: Demand heavily reliant on government contracts and stockpiling, with a smaller civilian market.

- Adverse Event Concerns: Historical concerns about vaccine side effects can impact public perception and uptake.

- Regulatory Hurdles: Stringent and evolving regulatory requirements for biologics.

- Supply Chain Complexity: Ensuring consistent and reliable production and distribution of specialized vaccines.

Emerging Opportunities in Anthrax Vaccine Market

Emerging opportunities in the Anthrax Vaccine Market are largely centered on expanding the scope of prophylaxis and enhancing vaccine accessibility. The development of thermostable vaccines presents a significant opportunity to improve logistics and reduce costs in resource-limited settings, enabling wider deployment. Furthermore, research into novel delivery methods, such as needle-free administration, could revolutionize vaccine uptake, particularly for mass vaccination campaigns. The growing recognition of anthrax as a zoonotic disease with implications for both animal and human health opens avenues for integrated prevention strategies and the development of broader-spectrum biologics. Untapped markets in regions with limited existing vaccination programs, coupled with the increasing global focus on pandemic preparedness, present substantial growth potential.

Growth Accelerators in the Anthrax Vaccine Market Industry

Several catalysts are accelerating long-term growth in the Anthrax Vaccine Market. Continued government investment in biodefense research and development remains a primary accelerator, funding crucial R&D projects and ensuring market stability through procurement. Strategic partnerships between pharmaceutical companies, research institutions, and governmental agencies are fostering innovation and streamlining the development pipeline. The expansion of vaccination programs to cover a wider range of at-risk civilian populations, beyond traditional military and first responder groups, is also a significant growth driver. Moreover, the increasing recognition of the economic and social impact of potential anthrax outbreaks is compelling more nations to invest in robust prevention strategies, thereby bolstering market demand.

Key Players Shaping the Anthrax Vaccine Market Market

- Agrovet

- Bayer AG

- Proton Biopharma Ltd

- Altimmune (Pharmathene Inc)

- Colondo Serum Company

- Biogenesis Bago

- Indian Immunologics

- Zoetis Inc

- Emergent Bio Solutions

- Merck Co Inc (MSD Animal Health)

- Tiankang

- CPL Biologicals Private Limited

Notable Milestones in Anthrax Vaccine Market Sector

- October 2022: ICON plc was selected by the US Biomedical Advanced Research and Development Authority (BARDA) to execute an anthrax vaccine clinical trial for AV7909.

- June 2022: Emergent BioSolutions Inc. received FDA acceptance for the Biologics License Application (BLA) review for AV7909, an anthrax vaccine for post-exposure prophylaxis in adults.

In-Depth Anthrax Vaccine Market Market Outlook

The Anthrax Vaccine Market is poised for sustained growth, driven by a confluence of factors including escalating global biosecurity concerns and ongoing technological innovation. Future market potential is significantly shaped by continued government investment in biodefense and biosecurity initiatives, ensuring a baseline demand for effective anthrax countermeasures. Strategic opportunities lie in the development and commercialization of next-generation vaccines that offer improved safety profiles, enhanced efficacy, and novel delivery mechanisms. The increasing global emphasis on pandemic preparedness and the recognition of anthrax as a significant biological threat are expected to fuel market expansion, particularly in emerging economies. Stakeholders who can adapt to evolving regulatory landscapes and capitalize on advancements in vaccine technology will be well-positioned for success in this critical market.

Anthrax Vaccine Market Segmentation

-

1. Vaccine Type

-

1.1. Cell Free PA Vaccine

- 1.1.1. Anthrax Vaccine Absorbed (AVA)

- 1.1.2. Anthrax Vaccine Precipitated (AVP)

- 1.2. Live Attenuated Vaccine

-

1.1. Cell Free PA Vaccine

-

2. Applications

- 2.1. Animal Use

- 2.2. Human Use

-

3. Distribution Channel

- 3.1. Hospitals

- 3.2. Pharmacies

- 3.3. Other Distribution Channels

Anthrax Vaccine Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Anthrax Vaccine Market Regional Market Share

Geographic Coverage of Anthrax Vaccine Market

Anthrax Vaccine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Anthrax Globally; Rising Government Vaccination Programs; Increased Consumption of Undercooked/Raw Meat

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness for Diagnostic Test of Target Disease; High Cost of Vaccine

- 3.4. Market Trends

- 3.4.1. Animal Use Anthrax Vaccine Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anthrax Vaccine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 5.1.1. Cell Free PA Vaccine

- 5.1.1.1. Anthrax Vaccine Absorbed (AVA)

- 5.1.1.2. Anthrax Vaccine Precipitated (AVP)

- 5.1.2. Live Attenuated Vaccine

- 5.1.1. Cell Free PA Vaccine

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Animal Use

- 5.2.2. Human Use

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospitals

- 5.3.2. Pharmacies

- 5.3.3. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 6. North America Anthrax Vaccine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 6.1.1. Cell Free PA Vaccine

- 6.1.1.1. Anthrax Vaccine Absorbed (AVA)

- 6.1.1.2. Anthrax Vaccine Precipitated (AVP)

- 6.1.2. Live Attenuated Vaccine

- 6.1.1. Cell Free PA Vaccine

- 6.2. Market Analysis, Insights and Forecast - by Applications

- 6.2.1. Animal Use

- 6.2.2. Human Use

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospitals

- 6.3.2. Pharmacies

- 6.3.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 7. Europe Anthrax Vaccine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 7.1.1. Cell Free PA Vaccine

- 7.1.1.1. Anthrax Vaccine Absorbed (AVA)

- 7.1.1.2. Anthrax Vaccine Precipitated (AVP)

- 7.1.2. Live Attenuated Vaccine

- 7.1.1. Cell Free PA Vaccine

- 7.2. Market Analysis, Insights and Forecast - by Applications

- 7.2.1. Animal Use

- 7.2.2. Human Use

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospitals

- 7.3.2. Pharmacies

- 7.3.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 8. Asia Pacific Anthrax Vaccine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 8.1.1. Cell Free PA Vaccine

- 8.1.1.1. Anthrax Vaccine Absorbed (AVA)

- 8.1.1.2. Anthrax Vaccine Precipitated (AVP)

- 8.1.2. Live Attenuated Vaccine

- 8.1.1. Cell Free PA Vaccine

- 8.2. Market Analysis, Insights and Forecast - by Applications

- 8.2.1. Animal Use

- 8.2.2. Human Use

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospitals

- 8.3.2. Pharmacies

- 8.3.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 9. Middle East and Africa Anthrax Vaccine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 9.1.1. Cell Free PA Vaccine

- 9.1.1.1. Anthrax Vaccine Absorbed (AVA)

- 9.1.1.2. Anthrax Vaccine Precipitated (AVP)

- 9.1.2. Live Attenuated Vaccine

- 9.1.1. Cell Free PA Vaccine

- 9.2. Market Analysis, Insights and Forecast - by Applications

- 9.2.1. Animal Use

- 9.2.2. Human Use

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospitals

- 9.3.2. Pharmacies

- 9.3.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 10. South America Anthrax Vaccine Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 10.1.1. Cell Free PA Vaccine

- 10.1.1.1. Anthrax Vaccine Absorbed (AVA)

- 10.1.1.2. Anthrax Vaccine Precipitated (AVP)

- 10.1.2. Live Attenuated Vaccine

- 10.1.1. Cell Free PA Vaccine

- 10.2. Market Analysis, Insights and Forecast - by Applications

- 10.2.1. Animal Use

- 10.2.2. Human Use

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hospitals

- 10.3.2. Pharmacies

- 10.3.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Agrovet

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Proton Biopharma Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Altimmune (Pharmathene Inc )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colondo Serum Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Biogenesis Bago

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tiankang*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Emergent Bio Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Merck Co Inc (MSD Animal Health)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Indian Immunologics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zoetis Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Agrovet

List of Figures

- Figure 1: Global Anthrax Vaccine Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Anthrax Vaccine Market Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 3: North America Anthrax Vaccine Market Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 4: North America Anthrax Vaccine Market Revenue (billion), by Applications 2025 & 2033

- Figure 5: North America Anthrax Vaccine Market Revenue Share (%), by Applications 2025 & 2033

- Figure 6: North America Anthrax Vaccine Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America Anthrax Vaccine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Anthrax Vaccine Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Anthrax Vaccine Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Anthrax Vaccine Market Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 11: Europe Anthrax Vaccine Market Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 12: Europe Anthrax Vaccine Market Revenue (billion), by Applications 2025 & 2033

- Figure 13: Europe Anthrax Vaccine Market Revenue Share (%), by Applications 2025 & 2033

- Figure 14: Europe Anthrax Vaccine Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Europe Anthrax Vaccine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Anthrax Vaccine Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Anthrax Vaccine Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Anthrax Vaccine Market Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 19: Asia Pacific Anthrax Vaccine Market Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 20: Asia Pacific Anthrax Vaccine Market Revenue (billion), by Applications 2025 & 2033

- Figure 21: Asia Pacific Anthrax Vaccine Market Revenue Share (%), by Applications 2025 & 2033

- Figure 22: Asia Pacific Anthrax Vaccine Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Anthrax Vaccine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Anthrax Vaccine Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Anthrax Vaccine Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Anthrax Vaccine Market Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 27: Middle East and Africa Anthrax Vaccine Market Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 28: Middle East and Africa Anthrax Vaccine Market Revenue (billion), by Applications 2025 & 2033

- Figure 29: Middle East and Africa Anthrax Vaccine Market Revenue Share (%), by Applications 2025 & 2033

- Figure 30: Middle East and Africa Anthrax Vaccine Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East and Africa Anthrax Vaccine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East and Africa Anthrax Vaccine Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Anthrax Vaccine Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Anthrax Vaccine Market Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 35: South America Anthrax Vaccine Market Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 36: South America Anthrax Vaccine Market Revenue (billion), by Applications 2025 & 2033

- Figure 37: South America Anthrax Vaccine Market Revenue Share (%), by Applications 2025 & 2033

- Figure 38: South America Anthrax Vaccine Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: South America Anthrax Vaccine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Anthrax Vaccine Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Anthrax Vaccine Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Anthrax Vaccine Market Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 2: Global Anthrax Vaccine Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 3: Global Anthrax Vaccine Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Anthrax Vaccine Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Anthrax Vaccine Market Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 6: Global Anthrax Vaccine Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 7: Global Anthrax Vaccine Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Anthrax Vaccine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Anthrax Vaccine Market Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 13: Global Anthrax Vaccine Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 14: Global Anthrax Vaccine Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Anthrax Vaccine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Anthrax Vaccine Market Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 23: Global Anthrax Vaccine Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 24: Global Anthrax Vaccine Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Anthrax Vaccine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Anthrax Vaccine Market Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 33: Global Anthrax Vaccine Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 34: Global Anthrax Vaccine Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Anthrax Vaccine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Anthrax Vaccine Market Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 40: Global Anthrax Vaccine Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 41: Global Anthrax Vaccine Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Anthrax Vaccine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Anthrax Vaccine Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anthrax Vaccine Market?

The projected CAGR is approximately 13.24%.

2. Which companies are prominent players in the Anthrax Vaccine Market?

Key companies in the market include Agrovet, Bayer AG, Proton Biopharma Ltd, Altimmune (Pharmathene Inc ), Colondo Serum Company, Biogenesis Bago, Tiankang*List Not Exhaustive, Emergent Bio Solutions, Merck Co Inc (MSD Animal Health), Indian Immunologics, Zoetis Inc.

3. What are the main segments of the Anthrax Vaccine Market?

The market segments include Vaccine Type, Applications, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Anthrax Globally; Rising Government Vaccination Programs; Increased Consumption of Undercooked/Raw Meat.

6. What are the notable trends driving market growth?

Animal Use Anthrax Vaccine Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness for Diagnostic Test of Target Disease; High Cost of Vaccine.

8. Can you provide examples of recent developments in the market?

October 2022: ICON plc was selected by the US Biomedical Advanced Research and Development Authority (BARDA), part of the Administration for Strategic Preparedness and Response (ASPR) in the Department of Health and Human Services (HHS), to execute an anthrax vaccine clinical trial. The Anthrax vaccine AV7909 is currently under clinical trial evaluation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anthrax Vaccine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anthrax Vaccine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anthrax Vaccine Market?

To stay informed about further developments, trends, and reports in the Anthrax Vaccine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence