Key Insights

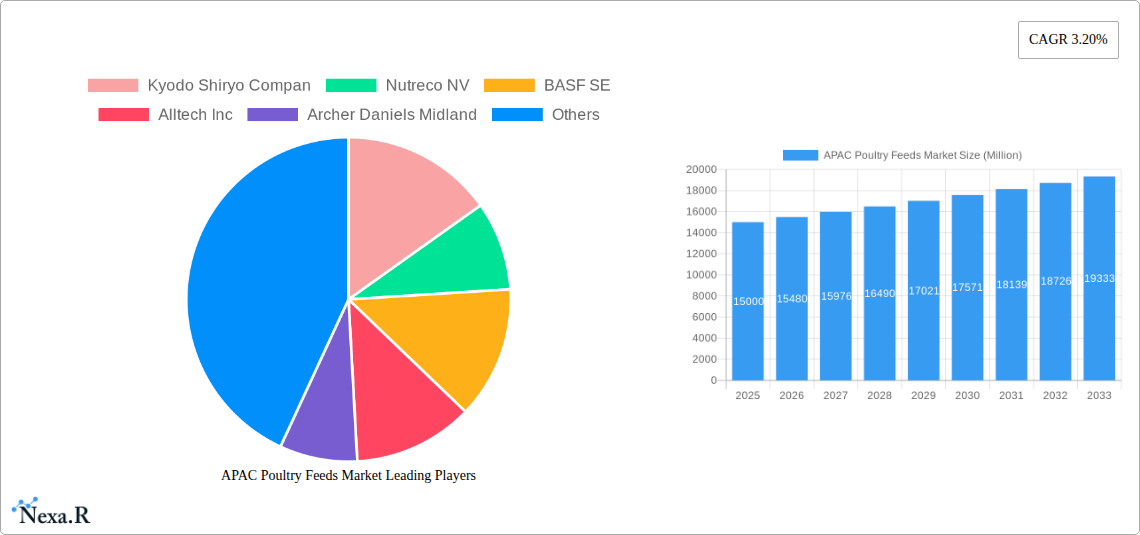

The Asia-Pacific (APAC) poultry feed market is projected for significant expansion, driven by a growing population, escalating demand for poultry products, and rising middle-class incomes. Advancements in poultry farming methodologies are enhancing efficiency and yield, further bolstering market growth. Key growth catalysts include the widespread adoption of modern poultry farming technologies, increasing consumer preference for poultry meat due to its cost-effectiveness and nutritional benefits, and a concentrated effort to elevate poultry feed quality for improved bird health and productivity. The market is segmented by feed supplement type (vitamins, amino acids), animal type (layers, broilers, turkeys), and primary ingredients (cereal grains, oilseed meals). Prominent growth is anticipated in the probiotics and prebiotics segments, reflecting an increasing emphasis on gut health and the utilization of natural feed additives. Despite challenges such as volatile raw material prices and potential regulatory shifts, the APAC poultry feed market forecasts a robust Compound Annual Growth Rate (CAGR) of 3.2%. The market size was valued at approximately $73.97 billion in the base year 2025 and is expected to grow over the forecast period. Major industry players include Kyodo Shiryo, Nutreco, BASF, Alltech, ADM, Cargill, and Kent Feeds. India and China are identified as pivotal growth drivers within the APAC region, owing to their substantial poultry populations and expanding economies.

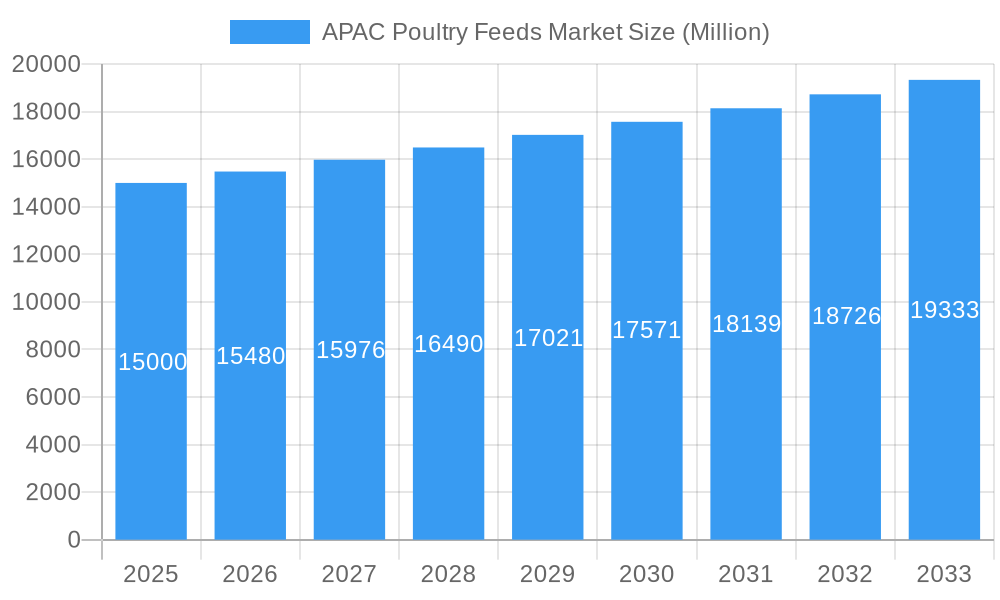

APAC Poultry Feeds Market Market Size (In Billion)

Market expansion is influenced by stringent feed safety and quality regulations, which are spurring innovation and the development of more sustainable and efficient feed solutions. Additionally, the growing adoption of precision feeding techniques and the application of data analytics for optimizing feed formulations are contributing to enhanced profitability for poultry farmers. Potential constraints include the impact of geopolitical factors on raw material supply chains and increasing environmental concerns associated with poultry farming. Strategic investments by major players in research and development for innovative feed solutions, tailored to specific poultry breeds and farming conditions, will be crucial in shaping the market's future. The ongoing trend towards sustainable and environmentally friendly feed production will also significantly influence market dynamics.

APAC Poultry Feeds Market Company Market Share

APAC Poultry Feeds Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific poultry feeds market, offering invaluable insights for industry professionals, investors, and strategic planners. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. It segments the market by animal type (layer, broiler, turkey, others), ingredients (cereal, oilseed meal, molasses, fish oil and fish meal, supplements, other ingredients), and supplements (vitamins, amino acids, antibiotics, enzymes, antioxidants, acidifiers, prebiotics, probiotics, other supplements), providing a granular understanding of this dynamic market valued at xx Million units in 2025.

APAC Poultry Feeds Market Dynamics & Structure

This section analyzes the APAC poultry feeds market's structure, focusing on market concentration, technological advancements, regulatory landscapes, competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activity. We quantify market share amongst key players and delve into the qualitative factors impacting market evolution. The analysis covers:

- Market Concentration: The market is characterized by [describe level of concentration - e.g., moderate concentration with a few dominant players] with a combined market share of approximately xx% for the top 5 players in 2025.

- Technological Innovation: Advancements in feed formulation, precision feeding technologies, and the increasing adoption of digital solutions are key drivers. However, challenges remain in technology transfer and adoption across the diverse APAC region.

- Regulatory Frameworks: Varying regulations across countries within APAC regarding antibiotic usage and feed safety standards create complexities for market players. Compliance costs and varying standards are significant barriers.

- Competitive Product Substitutes: The market faces competition from alternative protein sources and increasing consumer awareness of sustainable feed practices. This pressure is expected to increase in the forecast period.

- End-User Demographics: The rising demand for poultry products fueled by a growing population and increasing disposable income in many APAC countries is a key driver. Changing dietary habits also influence the demand for specific feed types.

- M&A Trends: The past five years have witnessed [number] M&A deals in the APAC poultry feeds market, primarily driven by [mention key drivers, e.g., expansion into new markets, vertical integration]. This trend is projected to continue, with an estimated xx number of deals expected during the forecast period.

APAC Poultry Feeds Market Growth Trends & Insights

This section leverages both primary and secondary research to comprehensively analyze the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the APAC poultry feeds market. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as [mention key factors driving growth, e.g., rising poultry consumption, increasing demand for high-quality feed, technological advancements]. The market penetration of [specific feed type or technology] is expected to reach xx% by 2033. Detailed analysis will cover:

- Market Size Evolution (historical and projected)

- Adoption rates of different feed types and technologies

- Technological disruption analysis, including the impact of AI and data analytics

- Consumer behaviour shift analysis focusing on demand for sustainable and organic feeds.

Dominant Regions, Countries, or Segments in APAC Poultry Feeds Market

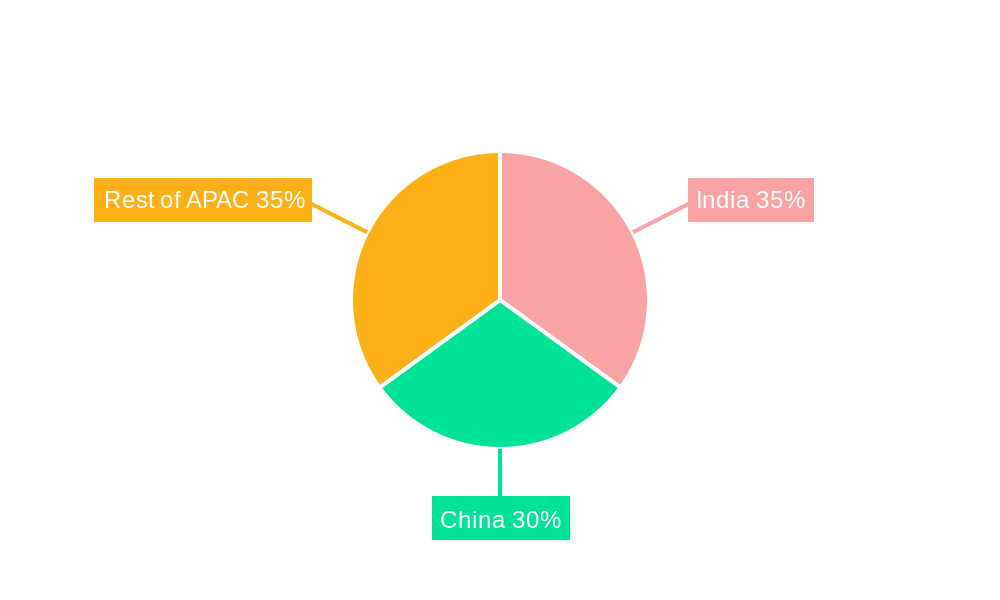

This section identifies the leading regions, countries, and segments within the APAC poultry feeds market driving its growth. The market is characterized by significant contributions from established players and rapidly developing economies. Countries such as **China** and **India** are poised to dominate the market due to a confluence of factors including their vast poultry production capacities, expanding domestic consumption, and government initiatives aimed at boosting agricultural output. Supportive government policies, including subsidies and incentives for feed manufacturers, coupled with robust infrastructure development for transportation and storage, are further fueling this dominance. The **broiler segment** is projected to maintain its position as the largest segment, anticipated to represent approximately 60-65% of the market share in 2025. This is closely followed by the **layer segment**, expected to capture around 25-30% of the market. Within the supplements, the **vitamins segment** currently holds the largest market share, estimated at 35-40%. This dominance is driven by the increasing awareness among poultry farmers regarding the critical role of vitamins in enhancing bird immunity, improving growth rates, and boosting overall production efficiency, coupled with a growing demand for fortified feed solutions.

- Key Drivers:

- Rapid urbanization leading to increased demand for protein sources like poultry.

- A growing middle class with rising disposable incomes and a shift towards more meat-inclusive diets.

- Government initiatives promoting food security and agricultural modernization, including support for the poultry sector.

- Significant investments in advanced feed processing technologies and sustainable farming practices.

- Dominance Factors:

- Extensive and established poultry production networks across key countries.

- Unwavering demand for high-quality, safe, and affordable poultry products.

- A generally favorable and evolving regulatory environment that encourages industry growth and investment.

APAC Poultry Feeds Market Product Landscape

The APAC poultry feeds market is a dynamic ecosystem characterized by a wide array of sophisticated product offerings and a relentless pursuit of innovation in feed formulations. Manufacturers are continuously developing advanced feed solutions designed to optimize nutritional value, maximize feed conversion ratios, and significantly enhance animal health and welfare. Key innovations are centered around customized feed blends tailored to the precise nutritional requirements of different bird breeds, ages, and production stages. The integration of probiotics and prebiotics is a significant trend, focusing on improving gut health, bolstering immune responses, and reducing the reliance on antibiotics. Furthermore, the adoption of technologically advanced feed processing techniques, such as pelleting and extrusion, ensures better nutrient digestibility and palatability. These innovations collectively contribute to improved overall animal health, a marked reduction in disease incidence, enhanced productivity, and a more sustainable approach to poultry farming. The overarching focus remains on improving nutrient bioavailability, minimizing the environmental footprint of poultry operations, and championing superior animal welfare standards.

Key Drivers, Barriers & Challenges in APAP Poultry Feeds Market

Key Drivers: Rising disposable incomes in developing economies, increased demand for poultry meat, and government initiatives promoting poultry farming are primary drivers. Technological advancements in feed formulation and processing further enhance the market. The adoption of precision feeding techniques and improved data analytics contributes to enhanced feed efficiency and reduced operational costs.

Challenges: Fluctuations in raw material prices, stringent regulatory compliance requirements related to feed safety and antibiotic use, and competition from substitute protein sources present significant challenges. Supply chain disruptions, especially during times of geopolitical uncertainty, impact market stability. The fragmented nature of the market in certain APAC regions also poses challenges for market consolidation and standardization.

Emerging Opportunities in APAC Poultry Feeds Market

The APAC poultry feeds market is ripe with exciting and substantial growth opportunities, particularly within the burgeoning segments of organic and sustainable feed, functional feed additives, and the strategic implementation of precision feeding technologies. Several untapped markets, especially across diverse economies in Southeast Asia, represent significant untapped potential for market expansion and penetration. A growing global and regional consumer consciousness regarding animal welfare and the imperative for sustainable poultry farming practices is creating a fertile ground for companies to innovate and market specialized feed products that directly address these evolving consumer demands and ethical considerations. The demand for feed solutions that promote a natural approach to animal health and environmental stewardship is steadily increasing.

Growth Accelerators in the APAP Poultry Feeds Market Industry

Technological breakthroughs in feed formulation and processing, strategic partnerships between feed manufacturers and poultry producers, and expansion strategies into new and emerging markets are key growth accelerators. Government incentives promoting poultry farming and investments in infrastructure development further enhance market growth. The increasing adoption of digital technologies for farm management and data analytics optimizes production processes and resource efficiency.

Key Players Shaping the APAC Poultry Feeds Market Market

Notable Milestones in APAC Poultry Feeds Market Sector

- 2020: [Company X] launched a new line of organic poultry feed.

- 2021: [Company Y] acquired [Company Z], expanding its market reach in Southeast Asia.

- 2022: New regulations regarding antibiotic use in poultry feed were implemented in [Country A].

- 2023: Significant investment in automated feed production facilities in [Country B].

- 2024: [mention another milestone]

In-Depth APAC Poultry Feeds Market Market Outlook

The APAC poultry feeds market is poised for robust growth in the coming years, driven by a confluence of factors including rising poultry consumption, increasing demand for high-quality feed, and technological advancements. Strategic partnerships, investments in sustainable feed solutions, and penetration into untapped markets will be crucial for success. The market's future potential hinges on addressing challenges associated with supply chain stability, regulatory compliance, and the growing need for environmentally friendly and sustainable production practices. This necessitates innovative approaches to feed formulation and production while adhering to stringent quality and safety standards.

APAC Poultry Feeds Market Segmentation

-

1. Animal Type

- 1.1. Layer

- 1.2. Broiler

- 1.3. Turkey

- 1.4. Other Animal Types

-

2. Ingredient

- 2.1. Cereal

- 2.2. Oilseed Meal

- 2.3. Molasses

- 2.4. Fish Oil and Fish Meal

- 2.5. Supplements

- 2.6. Other Ingredients

-

3. Supplements

- 3.1. Vitamins

- 3.2. Amino Acids

- 3.3. Antibiotics

- 3.4. Enzymes

- 3.5. Antioxidants

- 3.6. Acidifiers

- 3.7. Prebiotics

- 3.8. Probiotics

- 3.9. Other Supplements

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. India

- 4.1.2. China

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. Pakistan

- 4.1.6. Rest of Asia-Pacific

-

4.1. Asia-Pacific

APAC Poultry Feeds Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. Australia

- 1.5. Pakistan

- 1.6. Rest of Asia Pacific

APAC Poultry Feeds Market Regional Market Share

Geographic Coverage of APAC Poultry Feeds Market

APAC Poultry Feeds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increased Consumption of Poultry Meat

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Layer

- 5.1.2. Broiler

- 5.1.3. Turkey

- 5.1.4. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereal

- 5.2.2. Oilseed Meal

- 5.2.3. Molasses

- 5.2.4. Fish Oil and Fish Meal

- 5.2.5. Supplements

- 5.2.6. Other Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Supplements

- 5.3.1. Vitamins

- 5.3.2. Amino Acids

- 5.3.3. Antibiotics

- 5.3.4. Enzymes

- 5.3.5. Antioxidants

- 5.3.6. Acidifiers

- 5.3.7. Prebiotics

- 5.3.8. Probiotics

- 5.3.9. Other Supplements

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. India

- 5.4.1.2. China

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. Pakistan

- 5.4.1.6. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kyodo Shiryo Compan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nutreco NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alltech Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniels Midland

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kent Feeds

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Kyodo Shiryo Compan

List of Figures

- Figure 1: APAC Poultry Feeds Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Poultry Feeds Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Poultry Feeds Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 2: APAC Poultry Feeds Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 3: APAC Poultry Feeds Market Revenue billion Forecast, by Supplements 2020 & 2033

- Table 4: APAC Poultry Feeds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: APAC Poultry Feeds Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: APAC Poultry Feeds Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: APAC Poultry Feeds Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 8: APAC Poultry Feeds Market Revenue billion Forecast, by Supplements 2020 & 2033

- Table 9: APAC Poultry Feeds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: APAC Poultry Feeds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: India APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: China APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Japan APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Australia APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Pakistan APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Asia Pacific APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Poultry Feeds Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the APAC Poultry Feeds Market?

Key companies in the market include Kyodo Shiryo Compan, Nutreco NV, BASF SE, Alltech Inc, Archer Daniels Midland, Cargill Inc, Kent Feeds.

3. What are the main segments of the APAC Poultry Feeds Market?

The market segments include Animal Type, Ingredient, Supplements, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increased Consumption of Poultry Meat.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Poultry Feeds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Poultry Feeds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Poultry Feeds Market?

To stay informed about further developments, trends, and reports in the APAC Poultry Feeds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence