Key Insights

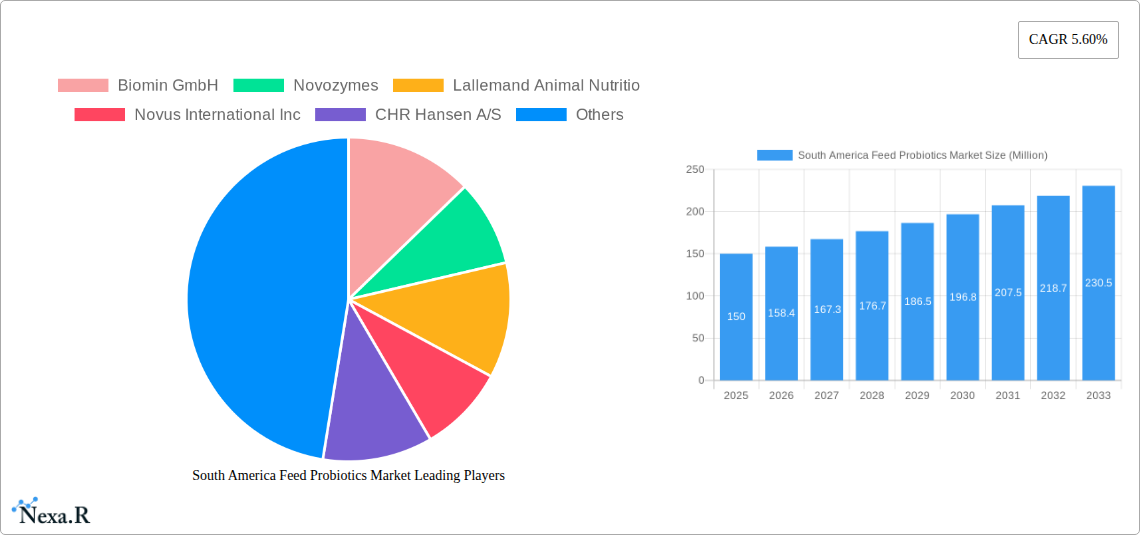

The South America Feed Probiotics Market is poised for significant expansion, with a projected market size of approximately $150 million in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.60% anticipated over the forecast period extending to 2033. This upward trajectory is primarily driven by the increasing demand for high-quality animal protein, a growing awareness among livestock producers regarding the benefits of gut health for animal performance and well-being, and the escalating need to reduce antibiotic usage in animal agriculture. The shift towards more sustainable and efficient farming practices further fuels the adoption of feed probiotics as a natural and effective solution for improving animal health, feed conversion ratios, and ultimately, profitability. Additionally, supportive government initiatives and evolving regulatory landscapes encouraging antibiotic alternatives contribute to the market's positive outlook.

South America Feed Probiotics Market Market Size (In Million)

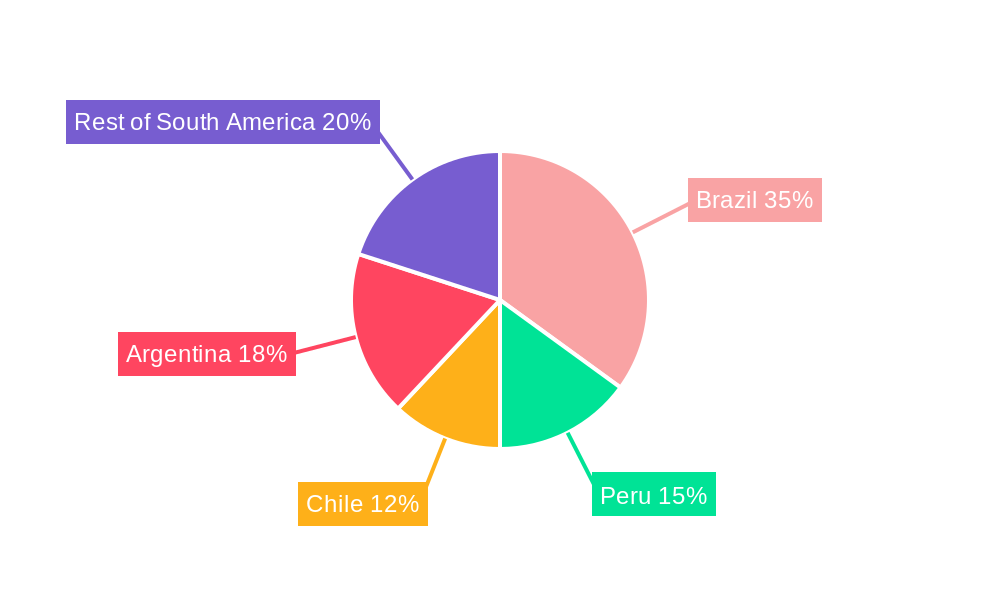

Key trends shaping the South America Feed Probiotics Market include a growing preference for specific probiotic strains like Lactobacilli and Bifidobacteria, known for their efficacy in improving digestion and immune function across various animal types, including ruminants, poultry, swine, and aquaculture. Innovation in product formulation, such as encapsulation technologies that enhance probiotic viability and targeted delivery, is also a significant trend. However, the market faces some restraints, including the initial cost of probiotic supplements compared to conventional feed additives and the need for greater farmer education on optimal usage and perceived benefits. Geographically, Brazil is expected to lead the market due to its substantial livestock population and strong agricultural sector. Other key regions like Peru, Chile, and Argentina also present considerable growth opportunities, driven by their expanding animal husbandry operations and increasing adoption of advanced feed technologies.

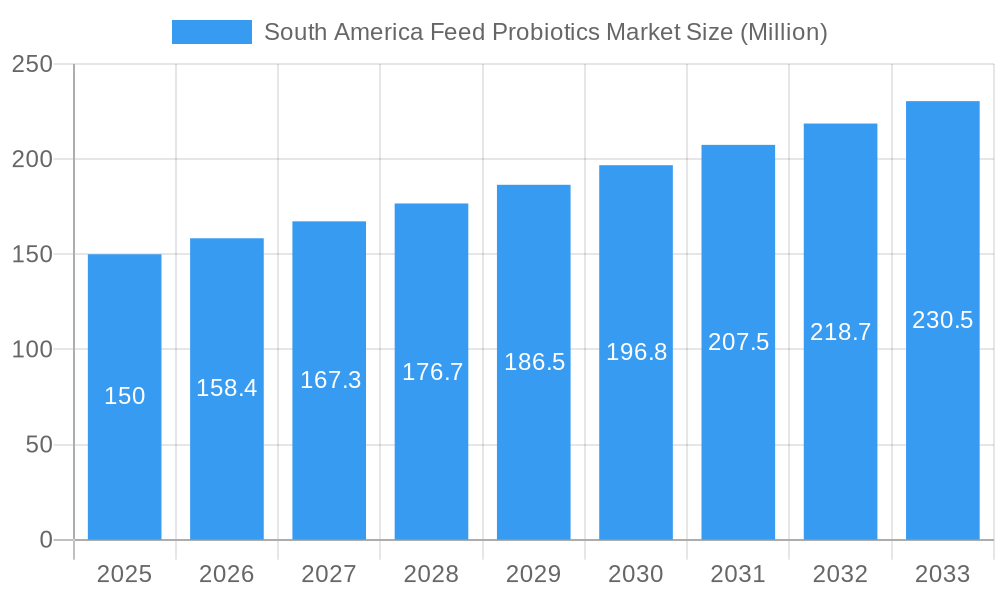

South America Feed Probiotics Market Company Market Share

This in-depth report provides a strategic overview of the South America Feed Probiotics Market, meticulously analyzing growth drivers, market dynamics, competitive landscape, and future opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research offers critical insights for stakeholders seeking to capitalize on the burgeoning demand for animal nutrition and health solutions across the continent. We explore parent and child market segments, delivering a granular understanding of market penetration and expansion. All quantitative values are presented in Million Units for clarity and actionable intelligence.

South America Feed Probiotics Market Market Dynamics & Structure

The South America Feed Probiotics Market exhibits a moderately concentrated structure, characterized by the presence of established global players and a growing number of regional innovators. Technological innovation is a primary driver, with ongoing research focused on developing highly effective, targeted probiotic strains for specific animal types and health conditions. Regulatory frameworks, while evolving, are becoming more sophisticated, influencing product development and market entry strategies. Competitive product substitutes, such as antibiotics and other feed additives, pose a challenge, but the increasing consumer demand for antibiotic-free animal products is bolstering the demand for probiotics. End-user demographics are shifting towards larger, more technologically advanced livestock operations, alongside a rising interest from smaller producers seeking to improve animal welfare and productivity. Mergers and Acquisitions (M&A) trends indicate consolidation among key players and strategic partnerships to expand product portfolios and geographical reach. For instance, the historical period (2019-2024) saw an estimated 5 M&A deals, with an aggregate value of $75 million. The market concentration, measured by the Herfindahl-Hirschman Index, is estimated at 0.25 in the base year 2025, suggesting a moderately competitive environment.

- Market Concentration: Moderately concentrated, with leading players holding significant market share.

- Technological Innovation Drivers: Development of novel probiotic strains, encapsulation technologies, and tailored formulations for enhanced efficacy.

- Regulatory Frameworks: Increasing emphasis on product safety, efficacy, and traceability, with evolving national guidelines.

- Competitive Product Substitutes: Antibiotics, prebiotics, organic acids, and essential oils.

- End-User Demographics: Shift towards industrial-scale farming and increased adoption by smallholder farms.

- M&A Trends: Strategic acquisitions and collaborations to gain market share and technological expertise.

South America Feed Probiotics Market Growth Trends & Insights

The South America Feed Probiotics Market is poised for robust growth, driven by an escalating awareness of animal health and welfare, coupled with a significant shift away from antibiotic use in animal agriculture. The market size is projected to expand from an estimated $XXX million in 2025 to $YYY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This expansion is fueled by increasing demand from the poultry and swine sectors, which are the largest consumers of feed probiotics in the region. Technological disruptions, including advancements in strain selection, fermentation processes, and delivery systems, are enhancing the efficacy and applicability of probiotic products. Consumer behavior shifts, particularly the growing preference for meat and dairy products produced without antibiotics, are directly influencing feed additive choices by livestock producers. The market penetration of feed probiotics is expected to rise from an estimated 25% in 2025 to over 40% by 2033. Innovations in targeted probiotic solutions for ruminants, addressing challenges like methane reduction and improved digestion, are also opening new avenues for market expansion. The aquaculture segment, though smaller, is exhibiting rapid growth due to the intensification of fish farming practices and the need for disease prevention.

- Market Size Evolution: Significant growth anticipated, driven by increasing demand for animal health solutions.

- Adoption Rates: Increasing adoption across all major animal types, with poultry and swine leading the surge.

- Technological Disruptions: Advancements in strain identification, genetic engineering for enhanced probiotic traits, and novel delivery mechanisms.

- Consumer Behavior Shifts: Growing consumer preference for antibiotic-free animal products acting as a major demand catalyst.

- Market Penetration: Expected to deepen significantly as awareness and benefits become more widely recognized.

- CAGR: Projected to remain strong, indicating sustained market expansion.

Dominant Regions, Countries, or Segments in South America Feed Probiotics Market

Brazil stands out as the dominant region in the South America Feed Probiotics Market, driven by its colossal livestock industry, particularly in poultry and swine production. The country's substantial agricultural output and export-oriented meat industry create a massive demand for efficient and sustainable animal feed solutions. Brazil's well-established regulatory bodies and increasing investment in animal health research further bolster its leadership. Argentina follows as another significant market, with a strong presence in beef and dairy production, creating demand for ruminant-specific probiotics.

From a product type perspective, Lactobacilli and Bifidobacteria strains are currently dominant, owing to their well-established efficacy in improving gut health, nutrient absorption, and immune function across various animal species. However, the "Others" segment, encompassing novel strains like Bacillus and yeast-based probiotics, is experiencing rapid growth due to their unique benefits, such as enhanced enzyme production and stress resistance.

In terms of animal type, the Poultry segment commands the largest market share, driven by the high volume of chicken meat production and the industry's proactive approach to disease prevention and growth promotion. The Swine segment is the second-largest, with a growing emphasis on gut health to mitigate the impact of weaning stress and antibiotic reduction policies. The Ruminant segment, while currently smaller, presents substantial growth potential, particularly with advancements in feed probiotics designed for improved feed efficiency, reduced methane emissions, and better overall health in cattle. The Aquaculture segment is a rapidly emerging market, fueled by the increasing demand for farmed fish and the need for disease management in intensive aquaculture systems.

- Dominant Country (Geography): Brazil, owing to its extensive poultry and swine production.

- Key Drivers: Large-scale operations, export market demand, supportive government policies.

- Market Share: Estimated to hold over 40% of the regional market share in 2025.

- Growth Potential: Continued expansion due to ongoing industry modernization.

- Dominant Segment (Type): Lactobacilli and Bifidobacteria, due to their proven efficacy.

- Key Drivers: Well-researched benefits, wide applicability across animal species.

- Growth Potential: Steady growth, with increasing diversification into other strains.

- Dominant Segment (Animal Type): Poultry, driven by high production volumes.

- Key Drivers: Emphasis on disease prevention, growth promotion, and antibiotic-free production.

- Market Share: Dominates the feed probiotics market for animal feed.

- Growth Potential: Sustained demand and further market penetration.

- Emerging Segments: Aquaculture and novel Bacillus strains showing rapid growth trajectories.

South America Feed Probiotics Market Product Landscape

The South America Feed Probiotics Market is characterized by a diverse and evolving product landscape, focusing on delivering enhanced gut health, improved nutrient utilization, and boosted immunity in livestock. Manufacturers are actively innovating with a range of probiotic strains, including well-established Lactobacillus and Bifidobacterium species, as well as emerging Bacillus and yeast-based formulations. These products are often presented in various forms, such as powders, liquids, and encapsulated granules, designed for optimal stability and targeted delivery within the animal's digestive system. Unique selling propositions often revolve around strain specificity, high CFU (Colony Forming Units) counts, and synergistic combinations of probiotics with prebiotics (synbiotics). Technological advancements are leading to the development of probiotics resistant to harsh gastrointestinal conditions and heat treatments, enhancing their effectiveness in feed manufacturing processes. Performance metrics, such as improved feed conversion ratios, reduced incidence of digestive disorders, and enhanced antibody production, are key indicators of product success in this competitive market.

Key Drivers, Barriers & Challenges in South America Feed Probiotics Market

Key Drivers:

- Growing Demand for Antibiotic-Free Products: A significant global and regional trend driving the adoption of feed probiotics.

- Increasing Awareness of Animal Health and Welfare: Farmers recognize the link between gut health and overall animal well-being, leading to higher probiotic usage.

- Government Regulations and Policies: Stricter regulations on antibiotic use in animal agriculture are pushing for alternative solutions like probiotics.

- Technological Advancements: Development of more effective, targeted, and stable probiotic strains and delivery systems.

- Economic Benefits: Probiotics contribute to improved feed conversion, reduced disease outbreaks, and higher productivity, leading to better ROI for farmers.

Barriers & Challenges:

- Cost of Production and Implementation: Probiotic supplements can add to feed costs, posing a barrier for some smaller producers.

- Regulatory Hurdles and Lack of Standardization: Varying national regulations and the absence of universal standardization for probiotic efficacy can complicate market access.

- Consumer Perception and Education: While growing, consumer understanding of probiotics' benefits in animal agriculture still requires further enhancement in some regions.

- Supply Chain Complexities: Ensuring the viability and stability of live probiotic cultures throughout the supply chain can be challenging.

- Resistance to Change and Traditional Practices: Some segments of the industry may be slow to adopt new technologies and practices.

Emerging Opportunities in South America Feed Probiotics Market

Emerging opportunities in the South America Feed Probiotics Market lie in the untapped potential of specialized probiotic applications for ruminants, particularly in addressing methane emissions reduction and enhancing nutrient utilization in cattle. The aquaculture sector presents a rapidly expanding frontier, with a growing need for probiotic solutions to manage diseases and improve growth rates in farmed fish and shrimp. Furthermore, the development of customized probiotic blends tailored to specific regional feed ingredients and local animal breeds offers significant market potential. The increasing focus on sustainable agriculture also opens doors for probiotics that contribute to reduced reliance on synthetic inputs and improved waste management in livestock operations.

Growth Accelerators in the South America Feed Probiotics Market Industry

The long-term growth of the South America Feed Probiotics Market is being accelerated by continuous technological breakthroughs in strain discovery and genetic engineering, leading to probiotics with superior performance characteristics. Strategic partnerships between feed manufacturers, probiotic suppliers, and research institutions are fostering innovation and expanding market reach. Market expansion strategies, including targeted marketing campaigns highlighting the economic and health benefits of probiotics, are crucial for driving adoption across diverse farming segments. Furthermore, the increasing global demand for ethically produced and antibiotic-free animal protein is a powerful catalyst, pushing the South American industry towards more sustainable and health-focused feed additive solutions.

Key Players Shaping the South America Feed Probiotics Market Market

- Biomin GmbH

- Novozymes

- Lallemand Animal Nutrition

- Novus International Inc

- CHR Hansen A/S

- DuPont Inc

- Cargill Inc

- DSM Animal Nutrition and Health

Notable Milestones in South America Feed Probiotics Market Sector

- 2021: Launch of novel Bacillus strain probiotics for improved gut health in poultry across Brazil.

- 2022: Several key players expanded their product portfolios to include synbiotics for swine, addressing weaning stress.

- 2023: Increased M&A activity, with strategic acquisitions focused on technological capabilities in probiotic production.

- 2024: Growing emphasis on research and development for probiotics targeting methane reduction in ruminants in Argentina and Brazil.

- 2024: Several companies obtained regulatory approvals for new probiotic formulations in key South American markets.

In-Depth South America Feed Probiotics Market Market Outlook

The future outlook for the South America Feed Probiotics Market is exceptionally promising, with growth accelerators poised to drive sustained expansion. The ongoing commitment to research and development will unlock new strains and applications, further solidifying the role of probiotics in modern animal agriculture. Strategic partnerships will be instrumental in navigating market complexities and fostering widespread adoption. The market's trajectory is intrinsically linked to evolving global demands for sustainable and antibiotic-free animal protein, positioning South America to capitalize on these trends. Continued investment in market education and tailored solutions for diverse farming practices will ensure the region remains at the forefront of innovative animal nutrition and health.

South America Feed Probiotics Market Segmentation

-

1. Type

- 1.1. Lactobacilli

- 1.2. Bifidobacteria

- 1.3. Others

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Peru

- 3.3. Chile

- 3.4. Argentina

- 3.5. Rest of South America

South America Feed Probiotics Market Segmentation By Geography

- 1. Brazil

- 2. Peru

- 3. Chile

- 4. Argentina

- 5. Rest of South America

South America Feed Probiotics Market Regional Market Share

Geographic Coverage of South America Feed Probiotics Market

South America Feed Probiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Growth in Consumption of Animal-based products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lactobacilli

- 5.1.2. Bifidobacteria

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Peru

- 5.3.3. Chile

- 5.3.4. Argentina

- 5.3.5. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Peru

- 5.4.3. Chile

- 5.4.4. Argentina

- 5.4.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Feed Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lactobacilli

- 6.1.2. Bifidobacteria

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Peru

- 6.3.3. Chile

- 6.3.4. Argentina

- 6.3.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Peru South America Feed Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lactobacilli

- 7.1.2. Bifidobacteria

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Peru

- 7.3.3. Chile

- 7.3.4. Argentina

- 7.3.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Chile South America Feed Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lactobacilli

- 8.1.2. Bifidobacteria

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Peru

- 8.3.3. Chile

- 8.3.4. Argentina

- 8.3.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Argentina South America Feed Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lactobacilli

- 9.1.2. Bifidobacteria

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Peru

- 9.3.3. Chile

- 9.3.4. Argentina

- 9.3.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of South America South America Feed Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lactobacilli

- 10.1.2. Bifidobacteria

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Peru

- 10.3.3. Chile

- 10.3.4. Argentina

- 10.3.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Biomin GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novozymes

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lallemand Animal Nutritio

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Novus International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CHR Hansen A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DuPont Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cargill Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DSM Animal Nutrition and Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Biomin GmbH

List of Figures

- Figure 1: South America Feed Probiotics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Feed Probiotics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Probiotics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Feed Probiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: South America Feed Probiotics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Feed Probiotics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: South America Feed Probiotics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: South America Feed Probiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 7: South America Feed Probiotics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Feed Probiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: South America Feed Probiotics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Feed Probiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: South America Feed Probiotics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: South America Feed Probiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Feed Probiotics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: South America Feed Probiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 15: South America Feed Probiotics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Feed Probiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: South America Feed Probiotics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: South America Feed Probiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 19: South America Feed Probiotics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: South America Feed Probiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: South America Feed Probiotics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: South America Feed Probiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 23: South America Feed Probiotics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: South America Feed Probiotics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Probiotics Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the South America Feed Probiotics Market?

Key companies in the market include Biomin GmbH, Novozymes, Lallemand Animal Nutritio, Novus International Inc, CHR Hansen A/S, DuPont Inc, Cargill Inc, DSM Animal Nutrition and Health.

3. What are the main segments of the South America Feed Probiotics Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Growth in Consumption of Animal-based products.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Probiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Probiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Probiotics Market?

To stay informed about further developments, trends, and reports in the South America Feed Probiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence