Key Insights

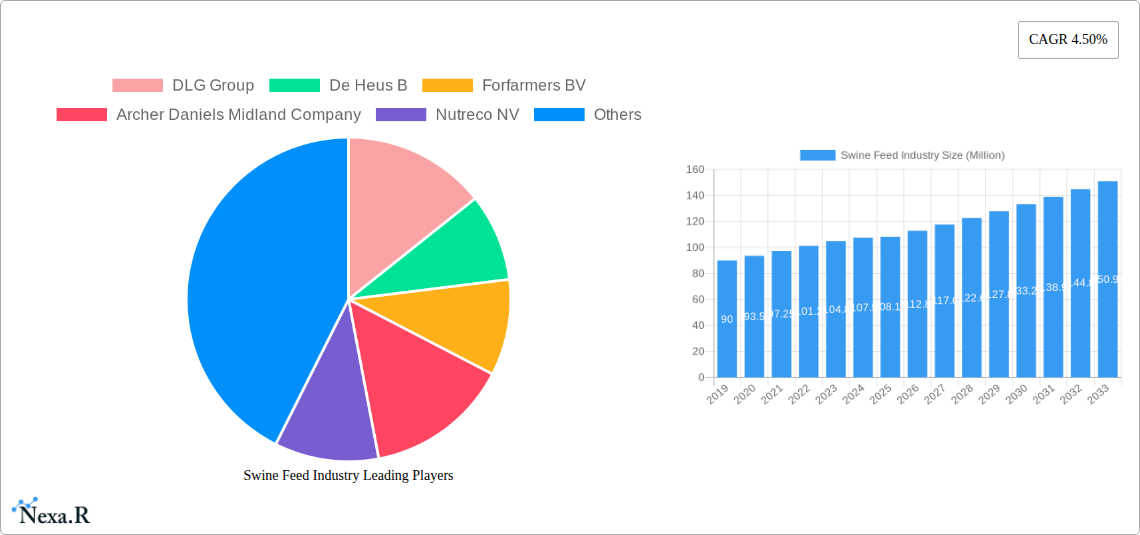

The global Swine Feed Industry is poised for substantial growth, currently valued at approximately 108.15 Million USD. This robust market is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.50% through 2033. This sustained expansion is underpinned by several key drivers, most notably the increasing global demand for pork as a primary protein source, driven by a growing population and rising disposable incomes in emerging economies. Advancements in animal nutrition research, leading to the development of more efficient and healthier feed formulations, also play a crucial role. Furthermore, technological innovations in feed production and supply chain management are enhancing operational efficiency and contributing to market expansion. The industry is also witnessing a strong trend towards the adoption of specialized feed for different stages of a pig's life, focusing on optimized growth, health, and reproductive performance. This includes a surge in demand for feed enriched with specific supplements like enzymes, amino acids, and probiotics, aimed at improving gut health and nutrient absorption.

Swine Feed Industry Market Size (In Million)

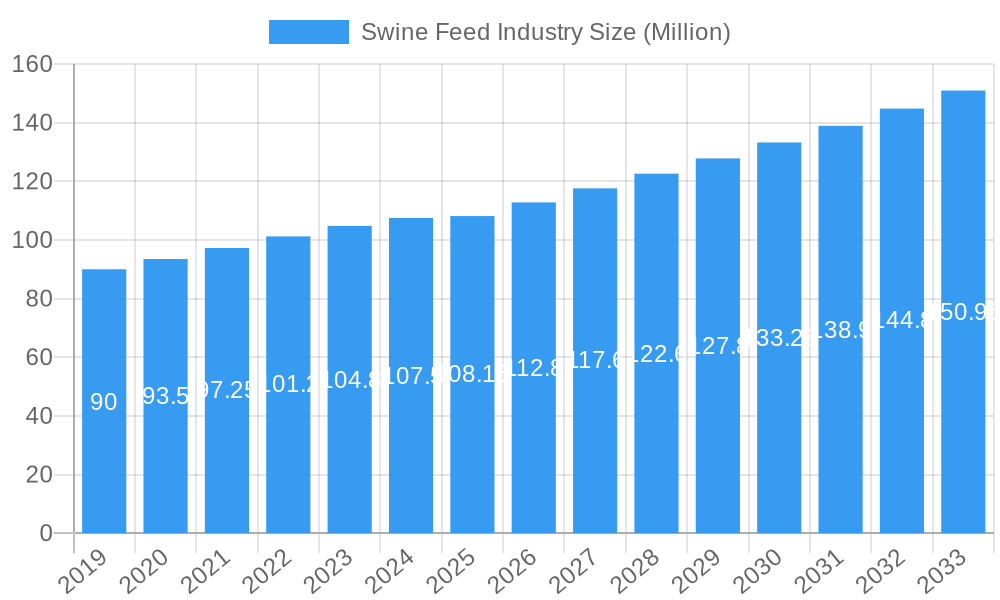

However, the industry is not without its challenges. The escalating cost of raw materials, such as grains and oilseeds, presents a significant restraint on profitability, prompting a continuous search for cost-effective alternatives and improved ingredient utilization. Volatility in commodity prices, influenced by factors like climate change and geopolitical events, adds another layer of complexity. Regulatory pressures related to feed safety, environmental sustainability, and the judicious use of feed additives also necessitate ongoing adaptation and investment. Despite these hurdles, the industry's trajectory remains upward, fueled by innovations in feed ingredients and supplements. Key segments include a wide array of ingredients like cereals, oilseed meal, and molasses, alongside crucial supplements such as vitamins, amino acids, and enzymes, all contributing to enhanced animal well-being and productivity. Major players like Cargill, Nutreco, and Archer Daniels Midland Company are actively shaping the market through strategic investments and product development.

Swine Feed Industry Company Market Share

Unlock critical insights into the global swine feed market with this in-depth report, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future opportunities from 2019–2033. This report is meticulously crafted for industry professionals seeking to understand the evolving swine feed market size, animal nutrition industry trends, and the impact of feed ingredients and swine feed supplements on livestock health and productivity. With a base year of 2025 and a forecast period extending to 2033, this analysis provides actionable intelligence on parent and child markets, driven by high-traffic keywords such as pig feed market, livestock feed market, and animal feed ingredients.

Swine Feed Industry Market Dynamics & Structure

The global swine feed market is characterized by a moderate to high level of concentration, with leading players actively engaged in strategic expansions and acquisitions. Technological innovation, particularly in feed enzymes, amino acids, and acidifiers, is a significant driver, enhancing feed efficiency and animal health. Regulatory frameworks concerning feed safety, antibiotic use, and sustainability are increasingly influencing market operations. Competitive product substitutes are evolving, with a growing emphasis on non-antibiotic growth promoters. End-user demographics are shifting, with an increasing demand for high-quality, sustainable pork production. Mergers and acquisitions (M&A) are prominent, facilitating market consolidation and expansion into new geographies.

- Market Concentration: Dominated by a few key global players, with ongoing consolidation.

- Technological Innovation: Driven by advancements in feed formulation, gut health solutions, and precision nutrition.

- Regulatory Frameworks: Strict regulations on feed additives, traceability, and environmental impact.

- Competitive Product Substitutes: Rise of probiotics, prebiotics, and organic acids as alternatives to antibiotics.

- End-User Demographics: Increasing demand for high-quality, safe, and sustainably produced pork.

- M&A Trends: Strategic acquisitions to enhance production capacity, expand product portfolios, and gain market share.

Swine Feed Industry Growth Trends & Insights

The global swine feed market is poised for substantial growth, driven by the increasing global demand for animal protein and the growing awareness of optimized animal nutrition for enhanced productivity and health. This market is projected to witness a significant Compound Annual Growth Rate (CAGR) over the forecast period (2025–2033). Key trends include the rising adoption of specialized swine feed supplements like vitamins, antioxidants, and enzymes to improve feed conversion ratios and reduce the incidence of diseases. Technological disruptions are continually reshaping the industry, with advancements in feed processing, digital farming, and data analytics enabling more precise and efficient feeding strategies. Consumer behavior shifts towards demanding transparency in food production and sustainable farming practices are also indirectly influencing the swine feed sector, pushing for the development of more environmentally friendly and ethically produced feed solutions. The market penetration of advanced feed formulations and novel ingredients is expected to rise steadily.

XXX reports indicate that the market size evolution is robust, fueled by population growth and rising disposable incomes in emerging economies, which consequently boosts the demand for pork products. The adoption rates of scientifically formulated swine feed ingredients like cereals, cereals by-products, and oilseed meal are steadily increasing as producers recognize their vital role in meeting the nutritional requirements of different swine breeds and life stages. Technological disruptions, including the development of mycotoxin binders and immune modulators, are significantly impacting the industry by improving animal resilience and reducing losses. Consumer preferences for "natural" and "antibiotic-free" pork are further accelerating the demand for alternative nutritional solutions and preventative health strategies within the swine farming ecosystem.

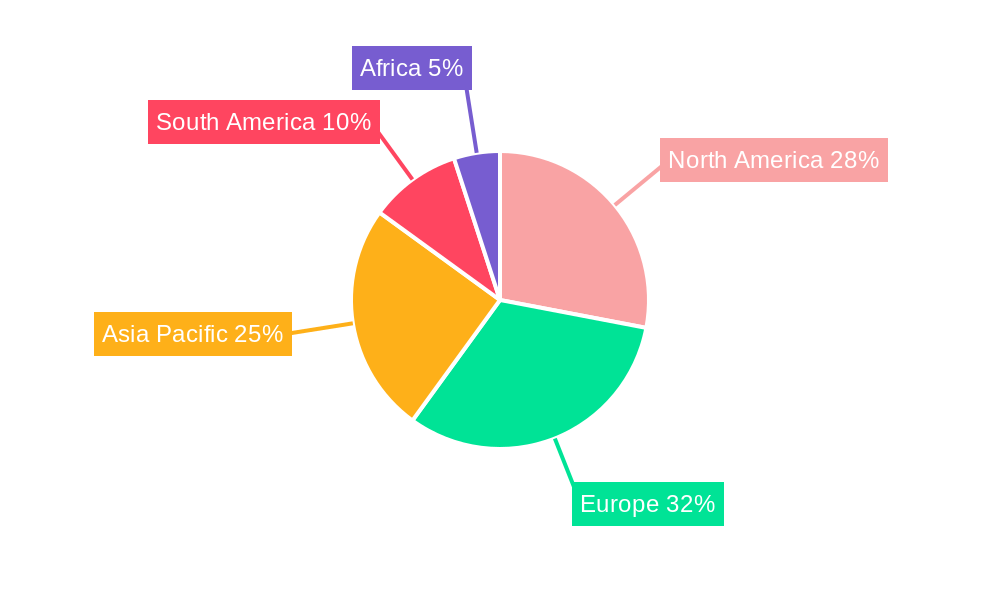

Dominant Regions, Countries, or Segments in Swine Feed Industry

Asia Pacific is emerging as a dominant region in the global swine feed market, driven by its rapidly growing population, increasing per capita consumption of meat, and a burgeoning middle class. Countries like China, Vietnam, and the Philippines are significant contributors to this growth. Within the swine feed segments, oilseed meal and cereals are the most dominant feed ingredients due to their widespread availability and essential role in providing protein and energy to swine.

In the supplements category, amino acids, particularly lysine, methionine, and threonine, are crucial for optimizing growth performance and reducing nitrogen excretion. The increasing focus on animal health and welfare, coupled with the need to reduce antibiotic usage, is also boosting the demand for enzymes and acidifiers.

- Dominant Region: Asia Pacific, with China leading as a major producer and consumer of pork.

- Key Drivers: Growing population, rising disposable incomes, expanding pig farming operations, and government support for animal agriculture.

- Market Share & Growth Potential: Asia Pacific holds a substantial market share and is projected to experience the highest growth rate due to increasing demand for animal protein.

- Dominant Ingredients:

- Cereals (e.g., Corn, Wheat): Primary source of energy, crucial for large-scale feed production.

- Oilseed Meal (e.g., Soybean Meal): Essential for protein content, vital for muscle development.

- Market Share & Growth Potential: High market share due to their foundational role in swine diets.

- Dominant Supplements:

- Amino Acids (e.g., Lysine, Methionine): Essential for optimizing growth and reducing feed costs by allowing for lower crude protein diets.

- Enzymes: Improve nutrient digestibility and absorption, leading to better feed efficiency.

- Market Share & Growth Potential: Growing demand driven by the need for sustainable and efficient pork production.

Swine Feed Industry Product Landscape

The swine feed industry is characterized by a diverse and evolving product landscape, focusing on enhanced nutritional delivery, improved animal health, and increased production efficiency. Innovations in swine feed formulations include precision nutrition solutions tailored to specific growth stages and genetic profiles, as well as the development of functional feeds that support gut health and immune responses. Key product applications range from starter feeds for piglets to grower and finisher feeds for market hogs, with specialized diets for breeding sows. Performance metrics such as improved Average Daily Gain (ADG), Feed Conversion Ratio (FCR), and reduced mortality rates are central to product development. Unique selling propositions often revolve around the inclusion of novel ingredients, such as probiotics, prebiotics, and specialized plant extracts, which offer alternatives to traditional feed additives. Technological advancements are also leading to the development of extruded and pelleted feeds that enhance palatability and digestibility.

Key Drivers, Barriers & Challenges in Swine Feed Industry

Key Drivers:

- Growing Global Demand for Pork: Increasing population and rising incomes in developing economies are driving demand for animal protein.

- Technological Advancements: Innovations in feed formulation, gut health solutions, and precision nutrition improve efficiency and animal well-being.

- Focus on Animal Health and Welfare: Increased emphasis on disease prevention and optimal growth performance necessitates advanced feed solutions.

- Economic Policies and Trade Agreements: Supportive government policies and favorable trade agreements can boost market expansion.

Barriers & Challenges:

- Volatile Raw Material Prices: Fluctuations in the cost of cereals, oilseed meal, and other key ingredients significantly impact production costs.

- Stringent Regulatory Landscape: Evolving regulations on feed additives and environmental impact can pose compliance challenges.

- Disease Outbreaks: The occurrence of diseases like African Swine Fever can lead to significant market disruptions and reduced demand.

- Supply Chain Disruptions: Global events and logistical challenges can affect the availability and cost of raw materials and finished products.

- Environmental Concerns: Growing pressure to reduce the environmental footprint of livestock farming, including feed production and waste management.

Emerging Opportunities in Swine Feed Industry

Emerging opportunities in the swine feed industry are centered around sustainability, digital integration, and the development of value-added products. The demand for sustainable animal feed solutions, including those produced from alternative protein sources and with reduced environmental impact, is rapidly growing. The integration of digital technologies, such as AI-powered feed management systems and blockchain for traceability, offers significant potential for optimizing operations and enhancing transparency. Furthermore, there is an increasing opportunity in developing specialized swine feed supplements that target specific health challenges, such as immune support and gut microbiome modulation, catering to the "antibiotic-free" trend. Untapped markets in regions with developing livestock sectors also present considerable growth potential.

Growth Accelerators in the Swine Feed Industry Industry

Several catalysts are accelerating long-term growth in the swine feed industry. Technological breakthroughs in areas like genomics and precision feeding are enabling more accurate and efficient nutrient delivery, leading to improved animal performance and reduced waste. Strategic partnerships between feed manufacturers, ingredient suppliers, and research institutions are fostering innovation and the development of next-generation feed solutions. Market expansion strategies, particularly in emerging economies with a growing appetite for pork, are opening up new revenue streams. The increasing focus on the circular economy within agriculture also presents an opportunity, with the valorization of by-products from other industries into feed ingredients.

Key Players Shaping the Swine Feed Industry Market

- DLG Group

- De Heus B

- Forfarmers BV

- Archer Daniels Midland Company

- Nutreco NV

- Charoen Pokphand Foods

- Alltech Inc

- Land O' Lakes Inc

- Cargill Inc

- J D Heiskell & Co

- KENT Nutrition Group

Notable Milestones in Swine Feed Industry Sector

- January, 2023: Cargill expanded their partnership with BASF in the animal nutrition business, adding research and development capabilities and new markets to the partners' existing feed enzymes distribution agreements. This partnership helped develop, produce, market, and sell customer-centric enzyme products and solutions for animals, including swine.

- May, 2022: ADM company acquired a feed mill in Polomolok, South Cotabato, from South Sunrays Milling Corporation. The acquisition helps in providing a wide range of products to meet Asia's demand in the animal nutrition market.

- July, 2021: De Heus acquired a feed manufacturing company Coppens Diervoeding, a Netherland-based company specializing in the pig farming sector. This acquisition helped the company to increase its production capacity by 400k and strengthen its regional presence.

In-Depth Swine Feed Industry Market Outlook

The future outlook for the swine feed industry is exceptionally strong, driven by a confluence of escalating global pork demand and continuous advancements in animal nutrition science. The market is set to benefit from the increasing adoption of sustainable feeding practices, the development of novel feed ingredients that enhance both animal health and environmental stewardship, and the pervasive integration of digital technologies for optimized farm management. Strategic collaborations and investments in research and development will remain pivotal in unlocking new growth avenues, particularly in the realm of functional feeds and precise nutritional interventions. As the industry navigates evolving consumer expectations and regulatory landscapes, innovation in producing high-quality, safe, and efficiently produced pork will be paramount, ensuring sustained market expansion and profitability for stakeholders.

Swine Feed Industry Segmentation

-

1. Ingredients

- 1.1. Cereals

- 1.2. Cereals by products

- 1.3. Oilseed Meal

- 1.4. Molasses

- 1.5. Supplements

- 1.6. Other Ingredients

-

2. Supplements

- 2.1. Antibiotics

- 2.2. Vitamins

- 2.3. Antioxidants

- 2.4. Amino Acids

- 2.5. Enzymes

- 2.6. Acidifiers

- 2.7. Other Supplements

Swine Feed Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. France

- 2.4. Germany

- 2.5. Russia

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

Swine Feed Industry Regional Market Share

Geographic Coverage of Swine Feed Industry

Swine Feed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for High-value Animal Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Swine Feed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 5.1.1. Cereals

- 5.1.2. Cereals by products

- 5.1.3. Oilseed Meal

- 5.1.4. Molasses

- 5.1.5. Supplements

- 5.1.6. Other Ingredients

- 5.2. Market Analysis, Insights and Forecast - by Supplements

- 5.2.1. Antibiotics

- 5.2.2. Vitamins

- 5.2.3. Antioxidants

- 5.2.4. Amino Acids

- 5.2.5. Enzymes

- 5.2.6. Acidifiers

- 5.2.7. Other Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 6. North America Swine Feed Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 6.1.1. Cereals

- 6.1.2. Cereals by products

- 6.1.3. Oilseed Meal

- 6.1.4. Molasses

- 6.1.5. Supplements

- 6.1.6. Other Ingredients

- 6.2. Market Analysis, Insights and Forecast - by Supplements

- 6.2.1. Antibiotics

- 6.2.2. Vitamins

- 6.2.3. Antioxidants

- 6.2.4. Amino Acids

- 6.2.5. Enzymes

- 6.2.6. Acidifiers

- 6.2.7. Other Supplements

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 7. Europe Swine Feed Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 7.1.1. Cereals

- 7.1.2. Cereals by products

- 7.1.3. Oilseed Meal

- 7.1.4. Molasses

- 7.1.5. Supplements

- 7.1.6. Other Ingredients

- 7.2. Market Analysis, Insights and Forecast - by Supplements

- 7.2.1. Antibiotics

- 7.2.2. Vitamins

- 7.2.3. Antioxidants

- 7.2.4. Amino Acids

- 7.2.5. Enzymes

- 7.2.6. Acidifiers

- 7.2.7. Other Supplements

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 8. Asia Pacific Swine Feed Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 8.1.1. Cereals

- 8.1.2. Cereals by products

- 8.1.3. Oilseed Meal

- 8.1.4. Molasses

- 8.1.5. Supplements

- 8.1.6. Other Ingredients

- 8.2. Market Analysis, Insights and Forecast - by Supplements

- 8.2.1. Antibiotics

- 8.2.2. Vitamins

- 8.2.3. Antioxidants

- 8.2.4. Amino Acids

- 8.2.5. Enzymes

- 8.2.6. Acidifiers

- 8.2.7. Other Supplements

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 9. South America Swine Feed Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 9.1.1. Cereals

- 9.1.2. Cereals by products

- 9.1.3. Oilseed Meal

- 9.1.4. Molasses

- 9.1.5. Supplements

- 9.1.6. Other Ingredients

- 9.2. Market Analysis, Insights and Forecast - by Supplements

- 9.2.1. Antibiotics

- 9.2.2. Vitamins

- 9.2.3. Antioxidants

- 9.2.4. Amino Acids

- 9.2.5. Enzymes

- 9.2.6. Acidifiers

- 9.2.7. Other Supplements

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 10. Africa Swine Feed Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 10.1.1. Cereals

- 10.1.2. Cereals by products

- 10.1.3. Oilseed Meal

- 10.1.4. Molasses

- 10.1.5. Supplements

- 10.1.6. Other Ingredients

- 10.2. Market Analysis, Insights and Forecast - by Supplements

- 10.2.1. Antibiotics

- 10.2.2. Vitamins

- 10.2.3. Antioxidants

- 10.2.4. Amino Acids

- 10.2.5. Enzymes

- 10.2.6. Acidifiers

- 10.2.7. Other Supplements

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DLG Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 De Heus B

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Forfarmers BV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Archer Daniels Midland Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nutreco NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Charoen Pokphand Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alltech Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Land O' Lakes Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cargill Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 J D Heiskell & Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KENT Nutrition Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DLG Group

List of Figures

- Figure 1: Global Swine Feed Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Swine Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 3: North America Swine Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 4: North America Swine Feed Industry Revenue (Million), by Supplements 2025 & 2033

- Figure 5: North America Swine Feed Industry Revenue Share (%), by Supplements 2025 & 2033

- Figure 6: North America Swine Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Swine Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Swine Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 9: Europe Swine Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 10: Europe Swine Feed Industry Revenue (Million), by Supplements 2025 & 2033

- Figure 11: Europe Swine Feed Industry Revenue Share (%), by Supplements 2025 & 2033

- Figure 12: Europe Swine Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Swine Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Swine Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 15: Asia Pacific Swine Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 16: Asia Pacific Swine Feed Industry Revenue (Million), by Supplements 2025 & 2033

- Figure 17: Asia Pacific Swine Feed Industry Revenue Share (%), by Supplements 2025 & 2033

- Figure 18: Asia Pacific Swine Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Swine Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Swine Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 21: South America Swine Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 22: South America Swine Feed Industry Revenue (Million), by Supplements 2025 & 2033

- Figure 23: South America Swine Feed Industry Revenue Share (%), by Supplements 2025 & 2033

- Figure 24: South America Swine Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Swine Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Africa Swine Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 27: Africa Swine Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 28: Africa Swine Feed Industry Revenue (Million), by Supplements 2025 & 2033

- Figure 29: Africa Swine Feed Industry Revenue Share (%), by Supplements 2025 & 2033

- Figure 30: Africa Swine Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Africa Swine Feed Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Swine Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 2: Global Swine Feed Industry Revenue Million Forecast, by Supplements 2020 & 2033

- Table 3: Global Swine Feed Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Swine Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 5: Global Swine Feed Industry Revenue Million Forecast, by Supplements 2020 & 2033

- Table 6: Global Swine Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Swine Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 12: Global Swine Feed Industry Revenue Million Forecast, by Supplements 2020 & 2033

- Table 13: Global Swine Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Swine Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 22: Global Swine Feed Industry Revenue Million Forecast, by Supplements 2020 & 2033

- Table 23: Global Swine Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Swine Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 30: Global Swine Feed Industry Revenue Million Forecast, by Supplements 2020 & 2033

- Table 31: Global Swine Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Swine Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 36: Global Swine Feed Industry Revenue Million Forecast, by Supplements 2020 & 2033

- Table 37: Global Swine Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Africa Swine Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Swine Feed Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Swine Feed Industry?

Key companies in the market include DLG Group, De Heus B, Forfarmers BV, Archer Daniels Midland Company, Nutreco NV, Charoen Pokphand Foods, Alltech Inc, Land O' Lakes Inc, Cargill Inc, J D Heiskell & Co, KENT Nutrition Group.

3. What are the main segments of the Swine Feed Industry?

The market segments include Ingredients, Supplements.

4. Can you provide details about the market size?

The market size is estimated to be USD 108.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Demand for High-value Animal Protein.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

January, 2023: Cargill expanded their partnership with BASF in the animal nutrition business, adding research and development capabilities and new markets to the partners' existing feed enzymes distribution agreements. This partnership helped develop, produce, market, and sell customer-centric enzyme products and solutions for animals, including swine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Swine Feed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Swine Feed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Swine Feed Industry?

To stay informed about further developments, trends, and reports in the Swine Feed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence