Key Insights

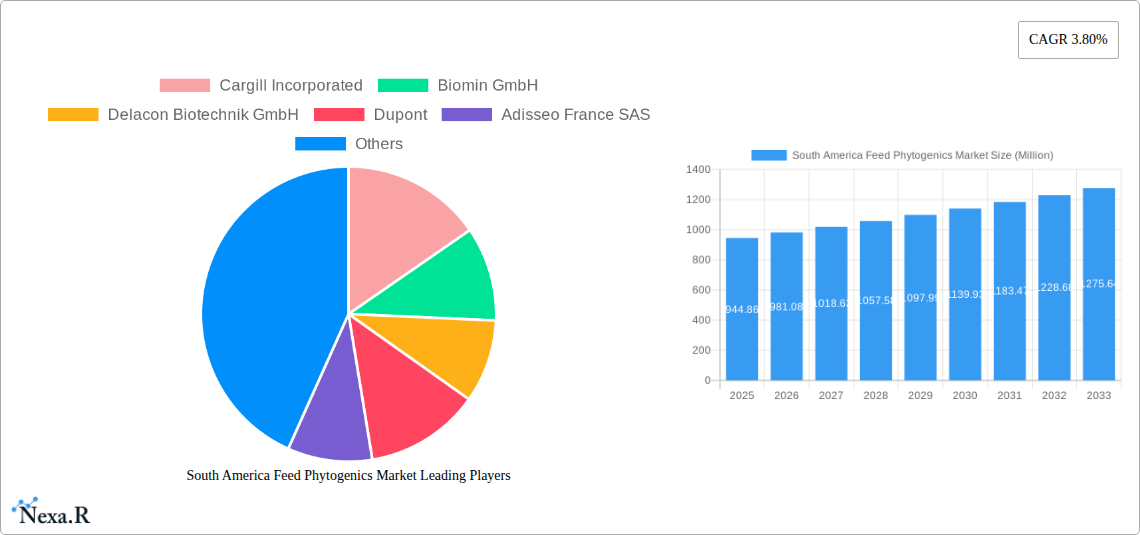

The South America Feed Phytogenics Market is poised for robust growth, projected to reach an estimated $944.86 million in 2025, expanding at a steady compound annual growth rate (CAGR) of 3.8% through 2033. This expansion is fueled by an increasing demand for natural and sustainable animal feed additives across the region, driven by heightened consumer awareness regarding animal welfare, food safety, and the desire to reduce reliance on synthetic additives. The market's trajectory is significantly influenced by the growing adoption of phytogenics for enhancing feed intake and digestibility, as well as for their flavoring and aroma properties, particularly in the poultry, swine, and ruminant sectors. Emerging economies within South America are demonstrating a pronounced interest in these innovative solutions, seeking to optimize livestock production efficiency and improve the quality of animal-derived products.

South America Feed Phytogenics Market Market Size (In Million)

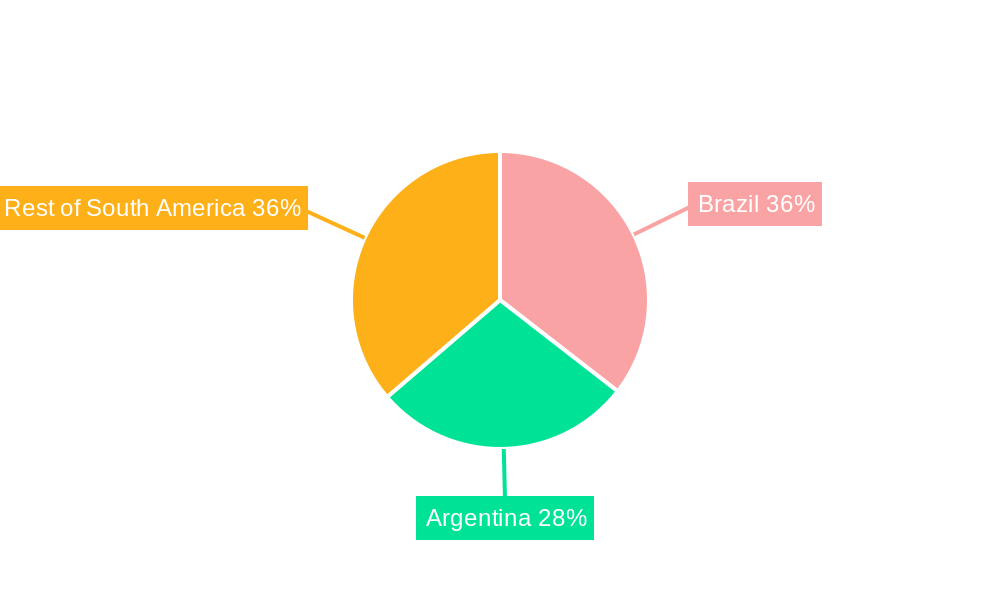

Key market drivers include the escalating prevalence of diseases in livestock and poultry, necessitating innovative solutions for immune support and gut health, areas where phytogenics excel. Growing concerns over antibiotic resistance further propel the shift towards natural feed alternatives. The market is segmented by ingredients into Herbs and Spices, Essential Oils, and Others, with Herbs and Spices likely holding a significant share due to their wide availability and cost-effectiveness. Applications range from Feed Intake and Digestibility to Flavoring and Aroma, with the former expected to dominate as producers prioritize gut health and nutrient absorption. Geographically, Brazil and Argentina are anticipated to lead the market, owing to their substantial livestock industries and progressive agricultural practices. However, "Rest of South America" is also expected to witness considerable growth as more countries embrace these advanced feed technologies. While growth is strong, potential challenges might include the initial cost of certain high-potency phytogenic compounds and the need for consistent product standardization to ensure efficacy across diverse farming conditions.

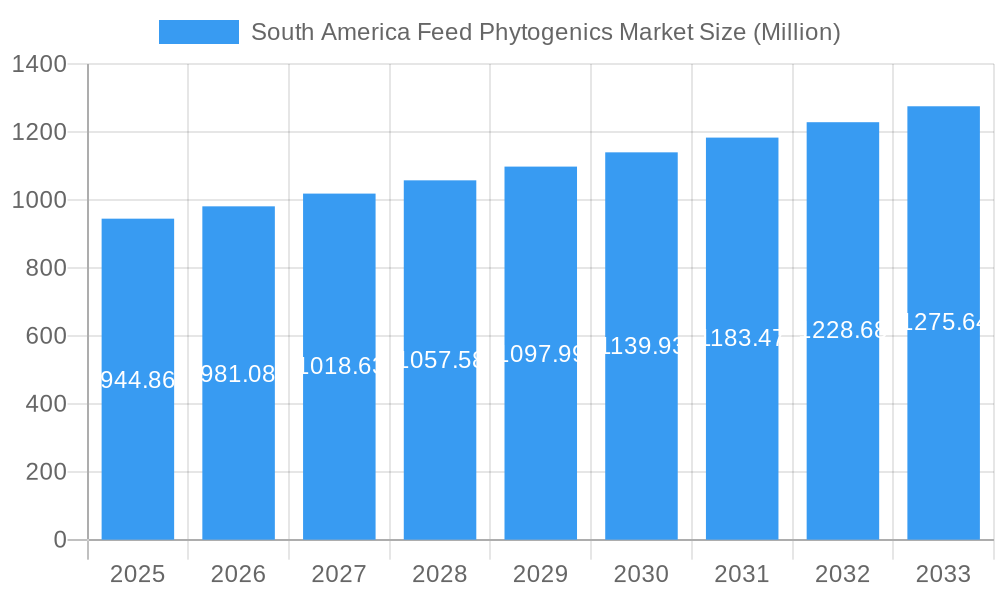

South America Feed Phytogenics Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the South America Feed Phytogenics Market, designed for maximum visibility and industry engagement.

This in-depth market research report provides a comprehensive analysis of the South America Feed Phytogenics Market, offering critical insights into its dynamics, growth trajectory, and competitive landscape. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning demand for natural and sustainable animal feed additives. We delve into key segments, including Ingredients (Herbs and Spices, Essential Oils, Others), Applications (Feed Intake and Digestibility, Flavoring and Aroma, Others), and Animal Types (Ruminant, Poultry, Swine, Aquaculture, Others), across major geographies like Brazil, Argentina, and the Rest of South America.

South America Feed Phytogenics Market Market Dynamics & Structure

The South America Feed Phytogenics Market is characterized by a moderately concentrated structure, with key players like Cargill Incorporated, Biomin GmbH, Delacon Biotechnik GmbH, Dupont, Adisseo France SAS, Kemin Industries Inc, Pancosma, and Natural Remedie vying for market share. Technological innovation is a primary driver, fueled by increasing research and development in plant-based compounds for enhanced animal health and performance. Regulatory frameworks, while evolving, are increasingly favorable towards natural alternatives to synthetic additives. Competitive product substitutes, primarily traditional feed additives and antibiotics, pose a challenge, but the growing consumer preference for ethically and sustainably sourced animal products is shifting the landscape. End-user demographics reveal a strong demand from large-scale livestock producers and a growing interest from smaller, specialized farms. Mergers and acquisitions (M&A) are expected to shape market consolidation, with an estimated X M&A deal volumes anticipated during the forecast period, impacting market share percentages for leading entities and creating opportunities for agile market entrants. Key innovation barriers include the standardization of product efficacy and the need for robust scientific validation.

South America Feed Phytogenics Market Growth Trends & Insights

The South America Feed Phytogenics Market is poised for robust expansion, projected to witness a significant CAGR of XX% from 2025 to 2033. This growth is underpinned by a paradigm shift in animal nutrition, moving away from antibiotic growth promoters towards natural, plant-derived solutions. The market size is estimated to reach USD XXX million in 2025 and is expected to further grow to USD YYY million by 2033. Adoption rates for phytogenics are accelerating across the region, driven by a heightened awareness of animal welfare, food safety, and the demand for antibiotic-free meat and dairy products. Technological disruptions, such as advancements in extraction and formulation techniques, are enhancing the efficacy and bioavailability of phytogenic compounds, making them more competitive and appealing to feed manufacturers. Consumer behavior shifts are a critical catalyst, with an increasing segment of the population actively seeking products from animals raised without antibiotics. This trend directly influences feed additive choices, propelling the demand for phytogenics. Market penetration is still in its nascent stages in some sub-regions, indicating substantial untapped potential. The focus is shifting towards optimizing feed intake and digestibility, with phytogenics proving effective in improving nutrient utilization and reducing gut health issues, leading to enhanced overall animal performance and profitability for producers. The growing global emphasis on sustainable agriculture further bolsters the market for these eco-friendly feed solutions.

Dominant Regions, Countries, or Segments in South America Feed Phytogenics Market

Brazil is emerging as the dominant force in the South America Feed Phytogenics Market, driven by its massive poultry and swine production sectors and proactive adoption of innovative feed technologies. The country's strong agricultural infrastructure and government initiatives supporting sustainable farming practices create a fertile ground for phytogenics. Brazil's market share in the overall regional phytogenics market is estimated at a significant XX% in 2025, with projections indicating continued dominance throughout the forecast period. The Poultry segment is a primary driver of this growth, accounting for an estimated XX% of the total market demand for feed phytogenics in 2025. This is attributed to the high volume of poultry produced for both domestic consumption and export, coupled with the pressing need to improve feed efficiency and reduce the incidence of common poultry diseases. Essential oils and herbs and spices are the leading ingredients in this segment, valued for their antimicrobial, antioxidant, and gut-health promoting properties.

Further bolstering Brazil's position are its robust economic policies that encourage investment in the agricultural sector and its advanced logistics networks that facilitate the efficient distribution of feed additives. The "Rest of South America" region, encompassing countries like Colombia and Peru, is also showing promising growth, fueled by increasing investments in aquaculture and a rising demand for premium animal protein.

In terms of applications, Feed Intake and Digestibility holds the largest market share, estimated at XX% in 2025. Phytogenics are proving exceptionally effective in enhancing nutrient absorption, promoting a healthy gut microbiome, and stimulating feed consumption, thereby improving the overall economic viability of animal production. This application directly addresses the industry's need for optimized resource utilization and improved animal performance.

South America Feed Phytogenics Market Product Landscape

The South America Feed Phytogenics Market is witnessing a surge in innovative product offerings characterized by enhanced efficacy and targeted applications. Manufacturers are focusing on developing sophisticated blends of Herbs and Spices and Essential Oils, leveraging their synergistic properties for improved animal health and productivity. Key product innovations include microencapsulated phytogenics for better stability and controlled release, as well as synergistic formulations designed to address specific challenges like gut inflammation and stress in various animal species. Performance metrics are increasingly being validated through rigorous scientific studies, showcasing improvements in feed conversion ratios, reduced antibiotic reliance, and enhanced immune responses. The unique selling propositions lie in their natural origin, sustainability credentials, and the ability to meet the growing consumer demand for antibiotic-free animal products, thereby positioning these products as premium solutions in the feed additive market.

Key Drivers, Barriers & Challenges in South America Feed Phytogenics Market

Key Drivers:

- Increasing Demand for Antibiotic-Free Products: Growing consumer concern over antibiotic resistance is a major impetus for adopting natural feed additives like phytogenics.

- Focus on Animal Health and Welfare: Phytogenics offer natural solutions for improving gut health, reducing stress, and boosting immunity in livestock.

- Technological Advancements: Innovations in extraction, encapsulation, and formulation are enhancing the efficacy and bioavailability of phytogenic compounds.

- Supportive Regulatory Environment: A shift towards more sustainable and natural agricultural practices is being reflected in evolving regulations globally.

Key Barriers & Challenges:

- Price Sensitivity and Cost-Effectiveness: Phytogenics can be more expensive than traditional feed additives, posing a challenge in price-sensitive markets.

- Standardization and Efficacy Validation: Ensuring consistent product quality and scientifically proving efficacy across diverse farming conditions remains crucial.

- Supply Chain Volatility: Dependence on agricultural raw materials can lead to supply chain disruptions due to climate or geopolitical factors.

- Lack of Awareness and Technical Expertise: Some producers may lack the knowledge or expertise to effectively integrate phytogenics into their feeding programs.

Emerging Opportunities in South America Feed Phytogenics Market

Emerging opportunities in the South America Feed Phytogenics Market lie in the development of specialized phytogenic blends tailored for specific animal health challenges, such as combating emerging pathogens or improving reproductive performance. Untapped markets in countries with developing livestock industries present significant growth potential. Furthermore, the integration of phytogenics into organic and free-range farming systems offers a niche but rapidly expanding segment. Innovative applications focusing on stress reduction in aquaculture species and the development of novel delivery systems for improved palatability and absorption are also on the horizon, catering to evolving consumer preferences for sustainably produced, high-quality animal protein.

Growth Accelerators in the South America Feed Phytogenics Market Industry

Long-term growth in the South America Feed Phytogenics Market will be significantly accelerated by continued investment in research and development, leading to the discovery of novel plant compounds with potent bioactivities. Strategic partnerships between feed manufacturers, ingredient suppliers, and research institutions are crucial for validating efficacy and driving market adoption. Furthermore, market expansion strategies focusing on educating farmers about the benefits of phytogenics and demonstrating their economic advantages will be key catalysts. The growing global trend towards sustainable food systems and the increasing pressure to reduce antibiotic usage in animal agriculture will continue to propel the demand for these natural feed solutions.

Key Players Shaping the South America Feed Phytogenics Market Market

Cargill Incorporated Biomin GmbH Delacon Biotechnik GmbH Dupont Adisseo France SAS Kemin Industries Inc Pancosma Natural Remedie

Notable Milestones in South America Feed Phytogenics Market Sector

- 2023: Biomin GmbH launches a new line of synergistic phytogenic feed additives with enhanced gut health benefits.

- 2022: Kemin Industries Inc. expands its presence in Brazil with a new research and development facility focused on animal nutrition.

- 2021: Adisseo France SAS acquires a leading phytogenics producer, strengthening its portfolio in natural feed additives.

- 2020: Delacon Biotechnik GmbH introduces innovative encapsulation technology for improved phytogenic ingredient stability.

- 2019: Dupont invests in sustainable sourcing initiatives for key botanical ingredients used in animal feed.

In-Depth South America Feed Phytogenics Market Market Outlook

The future outlook for the South America Feed Phytogenics Market is exceptionally bright, driven by an unyielding global push towards sustainable and antibiotic-free animal production. Growth accelerators such as ongoing scientific validation of efficacy, strategic collaborations between industry leaders, and proactive government support for natural feed solutions will solidify the market's expansion. The increasing consumer demand for transparency and naturalness in their food choices will continue to propel the adoption of phytogenics across all animal segments. Strategic opportunities abound for companies that can offer cost-effective, scientifically backed, and sustainably sourced phytogenic solutions, ensuring profitable growth and a significant impact on the region's animal nutrition landscape.

South America Feed Phytogenics Market Segmentation

-

1. Ingredients

- 1.1. Herbs and Spices

- 1.2. Essential Oils

- 1.3. Others

-

2. Application

- 2.1. Feed Intake and Digestibility

- 2.2. Flavoring and Aroma

- 2.3. Others

-

3. Animal Type

- 3.1. Ruminant

- 3.2. Poultry

- 3.3. Swine

- 3.4. Aquaculture

- 3.5. Others

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Feed Phytogenics Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Phytogenics Market Regional Market Share

Geographic Coverage of South America Feed Phytogenics Market

South America Feed Phytogenics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Production of Animal Feed Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 5.1.1. Herbs and Spices

- 5.1.2. Essential Oils

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Feed Intake and Digestibility

- 5.2.2. Flavoring and Aroma

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Ruminant

- 5.3.2. Poultry

- 5.3.3. Swine

- 5.3.4. Aquaculture

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 6. Brazil South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 6.1.1. Herbs and Spices

- 6.1.2. Essential Oils

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Feed Intake and Digestibility

- 6.2.2. Flavoring and Aroma

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Animal Type

- 6.3.1. Ruminant

- 6.3.2. Poultry

- 6.3.3. Swine

- 6.3.4. Aquaculture

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 7. Argentina South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 7.1.1. Herbs and Spices

- 7.1.2. Essential Oils

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Feed Intake and Digestibility

- 7.2.2. Flavoring and Aroma

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Animal Type

- 7.3.1. Ruminant

- 7.3.2. Poultry

- 7.3.3. Swine

- 7.3.4. Aquaculture

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 8. Rest of South America South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 8.1.1. Herbs and Spices

- 8.1.2. Essential Oils

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Feed Intake and Digestibility

- 8.2.2. Flavoring and Aroma

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Animal Type

- 8.3.1. Ruminant

- 8.3.2. Poultry

- 8.3.3. Swine

- 8.3.4. Aquaculture

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Cargill Incorporated

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Biomin GmbH

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Delacon Biotechnik GmbH

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Dupont

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Adisseo France SAS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Kemin Industries Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Pancosma

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Natural Remedie

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Cargill Incorporated

List of Figures

- Figure 1: South America Feed Phytogenics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Feed Phytogenics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 2: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 4: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: South America Feed Phytogenics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 7: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 9: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 12: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 14: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 17: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 19: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Phytogenics Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the South America Feed Phytogenics Market?

Key companies in the market include Cargill Incorporated, Biomin GmbH, Delacon Biotechnik GmbH, Dupont, Adisseo France SAS, Kemin Industries Inc, Pancosma, Natural Remedie.

3. What are the main segments of the South America Feed Phytogenics Market?

The market segments include Ingredients, Application, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Production of Animal Feed Driving the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Phytogenics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Phytogenics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Phytogenics Market?

To stay informed about further developments, trends, and reports in the South America Feed Phytogenics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence