Key Insights

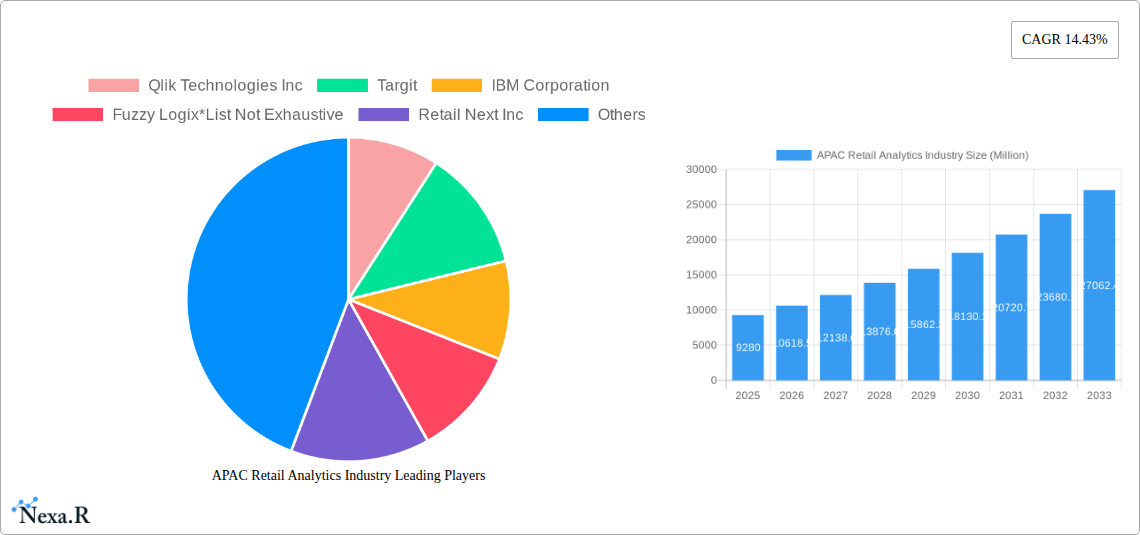

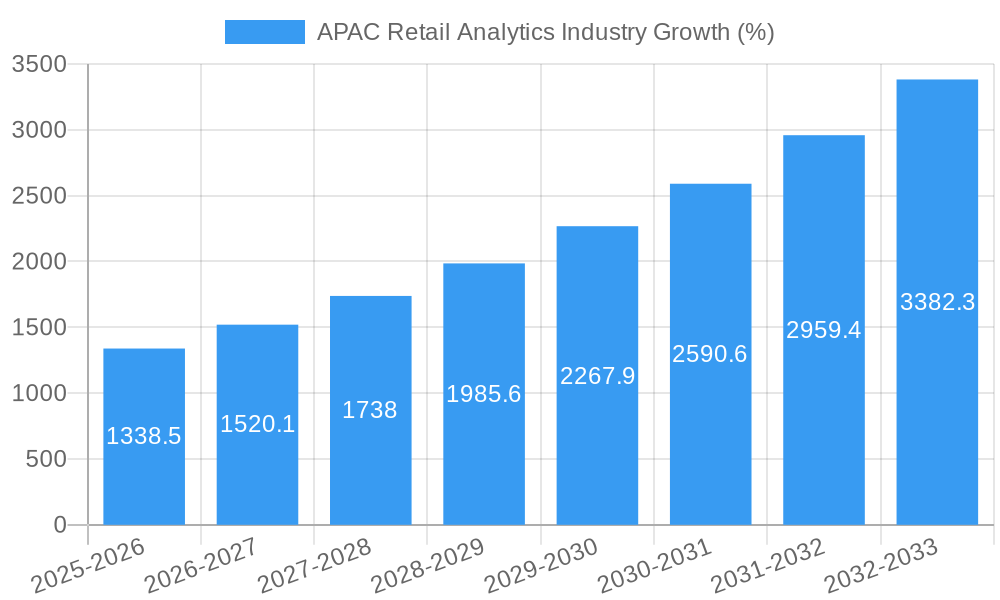

The Asia-Pacific (APAC) retail analytics market, valued at $9.28 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.43% from 2025 to 2033. This surge is driven by the increasing adoption of advanced analytics solutions by both small and medium enterprises (SMEs) and large-scale organizations. The rise of e-commerce, coupled with the need for improved customer experience and operational efficiency, fuels this demand. Key trends include the growing preference for cloud-based (on-demand) solutions offering scalability and cost-effectiveness, the increasing integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics, and the expanding use of data visualization tools for actionable insights. While data security concerns and the need for skilled professionals pose challenges, the overall market outlook remains highly positive. The diverse segments within the market, including solutions (analytics, visualization, data management), services (integration, support, and consulting), and various module types (strategy & planning, marketing, financial management, store operations, merchandising, supply chain management), contribute to the market's complexity and potential. Significant growth is expected across all segments, driven by the varying needs of retailers across the region.

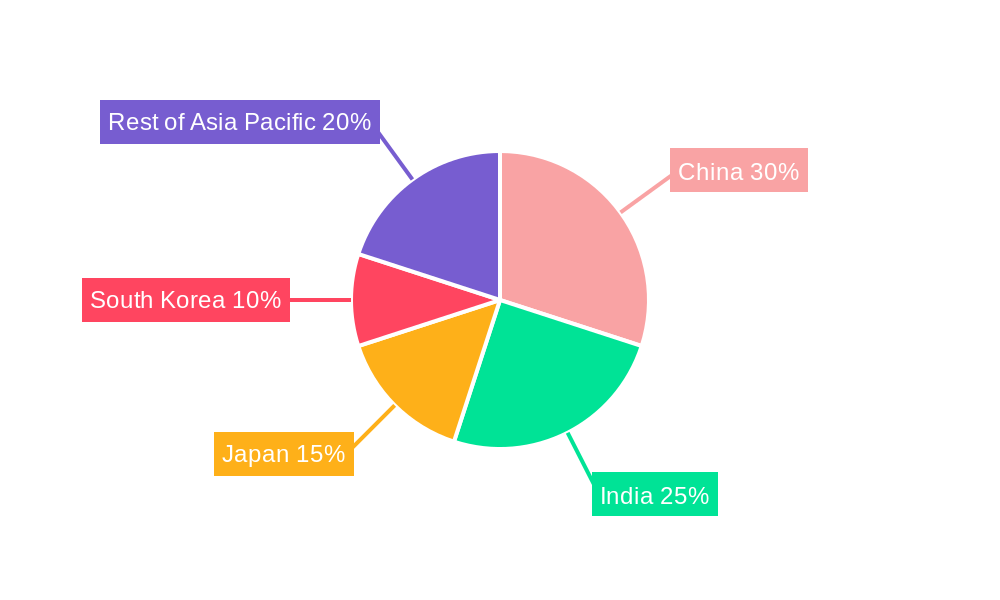

The significant growth drivers in APAC are the region's burgeoning middle class, rising smartphone penetration, and increasing digitalization of retail operations. China, India, and Japan are expected to be major contributors to market growth, given their large retail sectors and rapid technological adoption. However, the market's success depends on addressing challenges such as ensuring data quality, overcoming integration complexities across different systems, and providing appropriate training and support for users to effectively leverage the power of retail analytics. Companies are focusing on developing user-friendly interfaces and customized solutions to address specific retailer needs, further fueling market expansion. The forecast period of 2025-2033 promises continued substantial growth, underpinned by ongoing technological advancements and the increasing adoption of data-driven decision-making within the retail sector across the APAC region.

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) retail analytics market, encompassing market size, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is crucial for businesses, investors, and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. It segments the market by business type (SMEs and large-scale organizations), deployment mode (on-premise and on-demand), type (solutions and services), and module type (strategy & planning, marketing, financial management, store operations, merchandising, supply chain management, and others).

APAC Retail Analytics Industry Market Dynamics & Structure

The APAC retail analytics market is characterized by increasing market concentration, driven by the consolidation of major players and the emergence of innovative solutions. Technological advancements, particularly in artificial intelligence (AI) and big data analytics, are key innovation drivers. Regulatory frameworks, including data privacy regulations, significantly influence market dynamics. The competitive landscape features both established players and agile startups, creating a dynamic environment with increasing substitution of traditional methods with advanced analytics solutions. The end-user demographic is diverse, ranging from small and medium-sized enterprises (SMEs) to large-scale retail organizations. The market is witnessing a rise in mergers and acquisitions (M&A) activity as larger companies acquire smaller firms to expand their capabilities and market share.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: AI-powered solutions, cloud-based analytics platforms, and real-time data processing are driving significant innovation.

- Regulatory Framework: Data privacy regulations (e.g., GDPR, CCPA equivalents in APAC) influence data collection and usage practices.

- M&A Activity: xx M&A deals were recorded in the APAC retail analytics market during 2019-2024.

- End-User Demographics: The market comprises a mix of SMEs and large-scale organizations, with large-scale organizations driving a larger portion of the market currently.

APAC Retail Analytics Industry Growth Trends & Insights

The APAC retail analytics market has experienced robust growth during the historical period (2019-2024). Driven by factors such as increasing adoption of digital technologies by retailers, growing demand for data-driven decision-making, and the rise of e-commerce, the market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration increased from xx% in 2019 to xx% in 2024, indicating growing awareness and adoption of retail analytics solutions. Technological disruptions, like the rise of AI and IoT, are revolutionizing data collection and analysis, enabling more accurate insights and predictive capabilities. Consumer behavior shifts, particularly the increasing preference for personalized experiences, are further boosting demand for retail analytics. The total market size is estimated to reach xx Million units by 2025 and xx Million units by 2033.

Dominant Regions, Countries, or Segments in APAC Retail Analytics Industry

China and India are the dominant regions in the APAC retail analytics market due to their large and rapidly expanding retail sectors. Other countries such as Japan, South Korea, Australia, and Singapore are experiencing significant growth driven by increasing adoption of e-commerce and growing demand for efficient supply chain management. The large-scale organizations segment dominates the market due to their higher investment capacity and greater need for sophisticated analytics solutions. On-demand deployment models are gaining popularity due to their cost-effectiveness and flexibility. The solutions segment accounts for a significant share of the market revenue. Among the modules, merchandising (assortment optimization and shopper path analytics), supply chain management, and marketing are the fastest-growing segments.

- Key Drivers:

- Rapid growth of e-commerce in major APAC economies.

- Increasing adoption of digital technologies by retailers.

- Government initiatives promoting digitalization and innovation in the retail sector.

- Dominance Factors:

- Large retail market size in China and India.

- High adoption rates of advanced analytics solutions in developed APAC countries.

- Presence of numerous multinational retail companies in the region.

APAC Retail Analytics Industry Product Landscape

The APAC retail analytics market offers a wide range of products and services, including cloud-based analytics platforms, data visualization tools, predictive analytics solutions, and specialized retail analytics applications. Key features are real-time data processing, advanced AI capabilities, and seamless integration with existing retail systems. These solutions enable retailers to gain actionable insights into customer behavior, optimize supply chain operations, personalize marketing campaigns, and improve operational efficiency. The emphasis is shifting towards solutions that offer predictive capabilities and integrate across various touchpoints, enhancing the customer experience and overall business performance.

Key Drivers, Barriers & Challenges in APAC Retail Analytics Industry

Key Drivers: The increasing adoption of e-commerce, the growth of omnichannel retailing, the need for data-driven decision-making, and the rising availability of big data are some of the key drivers of market growth. Technological advancements like AI, machine learning, and cloud computing are also enabling more sophisticated analytics solutions.

Challenges: The lack of data literacy, data security and privacy concerns, the high cost of implementation, and the integration challenges with legacy systems are significant barriers to adoption. Data quality issues, lack of skilled professionals and stiff competition pose further restraints. A conservative estimate suggests these challenges have impacted market growth by approximately xx% in 2024.

Emerging Opportunities in APAP Retail Analytics Industry

The APAC retail analytics market presents several emerging opportunities including the growing adoption of AI and machine learning, the increasing use of IoT devices for data collection, and the rise of personalized marketing campaigns. The potential of untapped markets in Southeast Asia presents substantial opportunities for growth. Advancements in big data analytics and the increasing need for efficient supply chain management also pave the way for innovative applications.

Growth Accelerators in the APAC Retail Analytics Industry

Technological breakthroughs such as enhanced AI algorithms and cloud computing capabilities are significantly accelerating market growth. Strategic partnerships between technology providers and retail companies are fostering innovation and adoption. Market expansion strategies, focusing on underserved markets in Southeast Asia and the increasing adoption of omnichannel retail strategies are further propelling growth.

Key Players Shaping the APAC Retail Analytics Industry Market

- Qlik Technologies Inc

- Targit

- IBM Corporation

- Fuzzy Logix

- Retail Next Inc

- Adobe Systems Incorporated

- Pentaho Corporation

- Microstrategy Inc

- Zoho Corporation

- Tableau Software Inc

- Alteryx Inc

- Oracle Corporation

- ZAP Business Intelligence

- SAP SE

- Prevedere Software Inc

Notable Milestones in APAC Retail Analytics Industry Sector

- August 2022: Maxis' investment in ComeBy signals growing interest in leveraging advanced analytics for enhanced customer engagement and optimized in-store sales.

- June 2022: Amazon's launch of Store Analytics provides valuable insights into consumer behavior within its frictionless checkout stores, potentially influencing CPG strategies and product development.

In-Depth APAC Retail Analytics Industry Market Outlook

The APAC retail analytics market is poised for continued robust growth, driven by technological advancements, increasing digitalization across the retail sector, and the growing need for data-driven decision-making. Opportunities abound for companies that can offer innovative, scalable, and user-friendly solutions that address the specific needs of retailers in diverse APAC markets. Strategic partnerships, acquisitions, and expansion into untapped markets will be crucial for achieving long-term success in this dynamic sector. The market is expected to witness further consolidation with larger companies acquiring smaller ones to bolster their technological capabilities and expand market share.

APAC Retail Analytics Industry Segmentation

-

1. Mode of Deployment

- 1.1. On-Premise

- 1.2. On-Demand

-

2. Type

- 2.1. Solution

- 2.2. Services (Integration, Support & Consulting)

-

3. Module Type

- 3.1. Strategy

- 3.2. Marketing (Pricing, Loyalty and Segment Analysis)

- 3.3. Financial Management (Accounts Management)

- 3.4. Store Op

- 3.5. Merchand

- 3.6. Supply C

- 3.7. Other Module Types

-

4. Business Type

- 4.1. Small and Medium Enterprises

- 4.2. Large-scale Organizations

-

5. Geography

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

APAC Retail Analytics Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

APAC Retail Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Predictive Analysis; Sustained increase in volume of data; Growing demand for sales forecasting

- 3.3. Market Restrains

- 3.3.1. Lack of general awareness and expertise in emerging regions; Standardization and Integration issues

- 3.4. Market Trends

- 3.4.1. Solutions Segment is Anticipated to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.1.1. On-Premise

- 5.1.2. On-Demand

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solution

- 5.2.2. Services (Integration, Support & Consulting)

- 5.3. Market Analysis, Insights and Forecast - by Module Type

- 5.3.1. Strategy

- 5.3.2. Marketing (Pricing, Loyalty and Segment Analysis)

- 5.3.3. Financial Management (Accounts Management)

- 5.3.4. Store Op

- 5.3.5. Merchand

- 5.3.6. Supply C

- 5.3.7. Other Module Types

- 5.4. Market Analysis, Insights and Forecast - by Business Type

- 5.4.1. Small and Medium Enterprises

- 5.4.2. Large-scale Organizations

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. India

- 5.6.3. Japan

- 5.6.4. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 6. China APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 6.1.1. On-Premise

- 6.1.2. On-Demand

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solution

- 6.2.2. Services (Integration, Support & Consulting)

- 6.3. Market Analysis, Insights and Forecast - by Module Type

- 6.3.1. Strategy

- 6.3.2. Marketing (Pricing, Loyalty and Segment Analysis)

- 6.3.3. Financial Management (Accounts Management)

- 6.3.4. Store Op

- 6.3.5. Merchand

- 6.3.6. Supply C

- 6.3.7. Other Module Types

- 6.4. Market Analysis, Insights and Forecast - by Business Type

- 6.4.1. Small and Medium Enterprises

- 6.4.2. Large-scale Organizations

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. India

- 6.5.3. Japan

- 6.5.4. South Korea

- 6.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 7. India APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 7.1.1. On-Premise

- 7.1.2. On-Demand

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solution

- 7.2.2. Services (Integration, Support & Consulting)

- 7.3. Market Analysis, Insights and Forecast - by Module Type

- 7.3.1. Strategy

- 7.3.2. Marketing (Pricing, Loyalty and Segment Analysis)

- 7.3.3. Financial Management (Accounts Management)

- 7.3.4. Store Op

- 7.3.5. Merchand

- 7.3.6. Supply C

- 7.3.7. Other Module Types

- 7.4. Market Analysis, Insights and Forecast - by Business Type

- 7.4.1. Small and Medium Enterprises

- 7.4.2. Large-scale Organizations

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. India

- 7.5.3. Japan

- 7.5.4. South Korea

- 7.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 8. Japan APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 8.1.1. On-Premise

- 8.1.2. On-Demand

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solution

- 8.2.2. Services (Integration, Support & Consulting)

- 8.3. Market Analysis, Insights and Forecast - by Module Type

- 8.3.1. Strategy

- 8.3.2. Marketing (Pricing, Loyalty and Segment Analysis)

- 8.3.3. Financial Management (Accounts Management)

- 8.3.4. Store Op

- 8.3.5. Merchand

- 8.3.6. Supply C

- 8.3.7. Other Module Types

- 8.4. Market Analysis, Insights and Forecast - by Business Type

- 8.4.1. Small and Medium Enterprises

- 8.4.2. Large-scale Organizations

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. South Korea

- 8.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 9. South Korea APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 9.1.1. On-Premise

- 9.1.2. On-Demand

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solution

- 9.2.2. Services (Integration, Support & Consulting)

- 9.3. Market Analysis, Insights and Forecast - by Module Type

- 9.3.1. Strategy

- 9.3.2. Marketing (Pricing, Loyalty and Segment Analysis)

- 9.3.3. Financial Management (Accounts Management)

- 9.3.4. Store Op

- 9.3.5. Merchand

- 9.3.6. Supply C

- 9.3.7. Other Module Types

- 9.4. Market Analysis, Insights and Forecast - by Business Type

- 9.4.1. Small and Medium Enterprises

- 9.4.2. Large-scale Organizations

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. South Korea

- 9.1. Market Analysis, Insights and Forecast - by Mode of Deployment

- 10. China APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. India APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Japan APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. South Korea APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of Asia Pacific APAC Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Qlik Technologies Inc

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Targit

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 IBM Corporation

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Fuzzy Logix*List Not Exhaustive

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Retail Next Inc

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Adobe Systems Incorporated

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Pentaho Corporation

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Microstrategy Inc

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Zoho Corporation

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Tableau Software Inc

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Alteryx Inc

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Oracle Corporation

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 ZAP Business Intelligence

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 SAP SE

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 Prevedere Software Inc

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.1 Qlik Technologies Inc

List of Figures

- Figure 1: APAC Retail Analytics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: APAC Retail Analytics Industry Share (%) by Company 2024

List of Tables

- Table 1: APAC Retail Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: APAC Retail Analytics Industry Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 3: APAC Retail Analytics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: APAC Retail Analytics Industry Revenue Million Forecast, by Module Type 2019 & 2032

- Table 5: APAC Retail Analytics Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 6: APAC Retail Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 7: APAC Retail Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: APAC Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: APAC Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: APAC Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: APAC Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: APAC Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: APAC Retail Analytics Industry Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 19: APAC Retail Analytics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: APAC Retail Analytics Industry Revenue Million Forecast, by Module Type 2019 & 2032

- Table 21: APAC Retail Analytics Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 22: APAC Retail Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: APAC Retail Analytics Industry Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 25: APAC Retail Analytics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: APAC Retail Analytics Industry Revenue Million Forecast, by Module Type 2019 & 2032

- Table 27: APAC Retail Analytics Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 28: APAC Retail Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: APAC Retail Analytics Industry Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 31: APAC Retail Analytics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 32: APAC Retail Analytics Industry Revenue Million Forecast, by Module Type 2019 & 2032

- Table 33: APAC Retail Analytics Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 34: APAC Retail Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 35: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: APAC Retail Analytics Industry Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 37: APAC Retail Analytics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: APAC Retail Analytics Industry Revenue Million Forecast, by Module Type 2019 & 2032

- Table 39: APAC Retail Analytics Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 40: APAC Retail Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: APAC Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Retail Analytics Industry?

The projected CAGR is approximately 14.43%.

2. Which companies are prominent players in the APAC Retail Analytics Industry?

Key companies in the market include Qlik Technologies Inc, Targit, IBM Corporation, Fuzzy Logix*List Not Exhaustive, Retail Next Inc, Adobe Systems Incorporated, Pentaho Corporation, Microstrategy Inc, Zoho Corporation, Tableau Software Inc, Alteryx Inc, Oracle Corporation, ZAP Business Intelligence, SAP SE, Prevedere Software Inc.

3. What are the main segments of the APAC Retail Analytics Industry?

The market segments include Mode of Deployment, Type, Module Type, Business Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Predictive Analysis; Sustained increase in volume of data; Growing demand for sales forecasting.

6. What are the notable trends driving market growth?

Solutions Segment is Anticipated to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Lack of general awareness and expertise in emerging regions; Standardization and Integration issues.

8. Can you provide examples of recent developments in the market?

August 2022: Maxis invested in ComeBy, a Malaysia-based retail analytics startup, to bolster innovation and digitalization within the retail industry. ComeBy offers brick-and-mortar retailers valuable insights into individual shopper preferences before reaching the checkout counter. The company asserts that its approach, which combines both active and passive tracking, enhances customer engagement and optimizes in-store sales, as well as remarketing and merchandising efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Retail Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Retail Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Retail Analytics Industry?

To stay informed about further developments, trends, and reports in the APAC Retail Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence