Key Insights

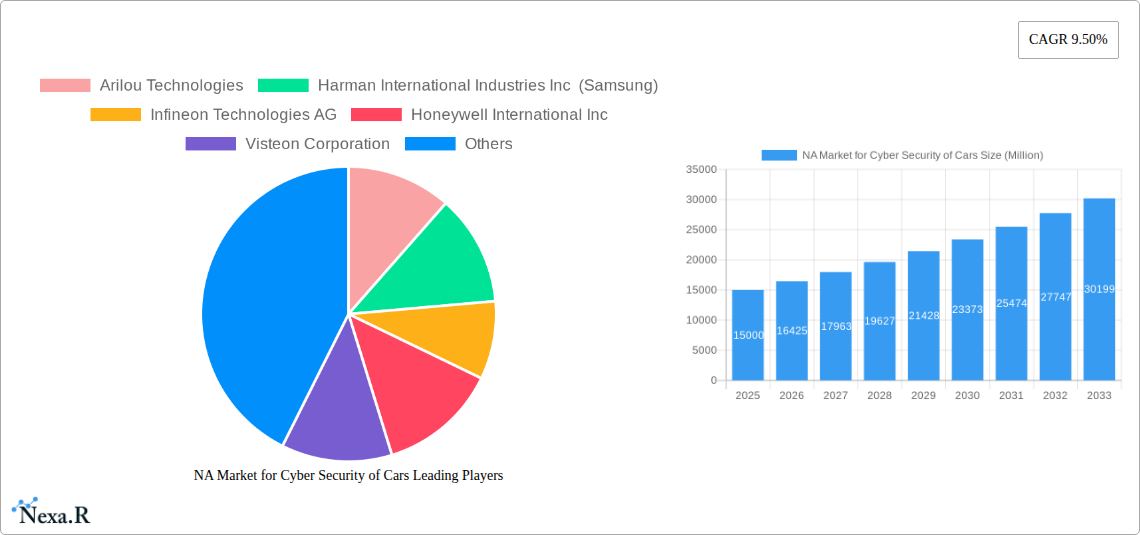

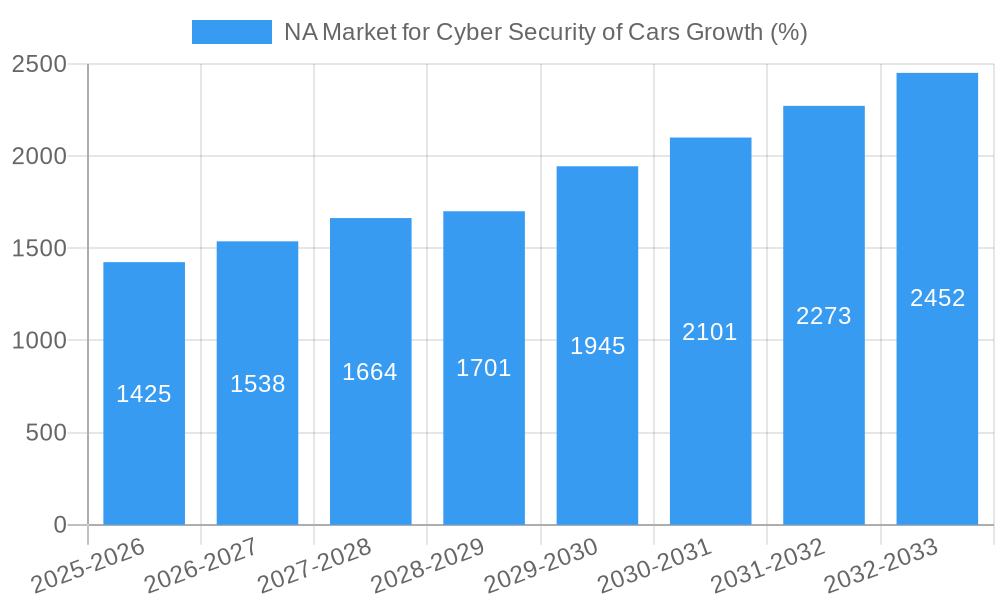

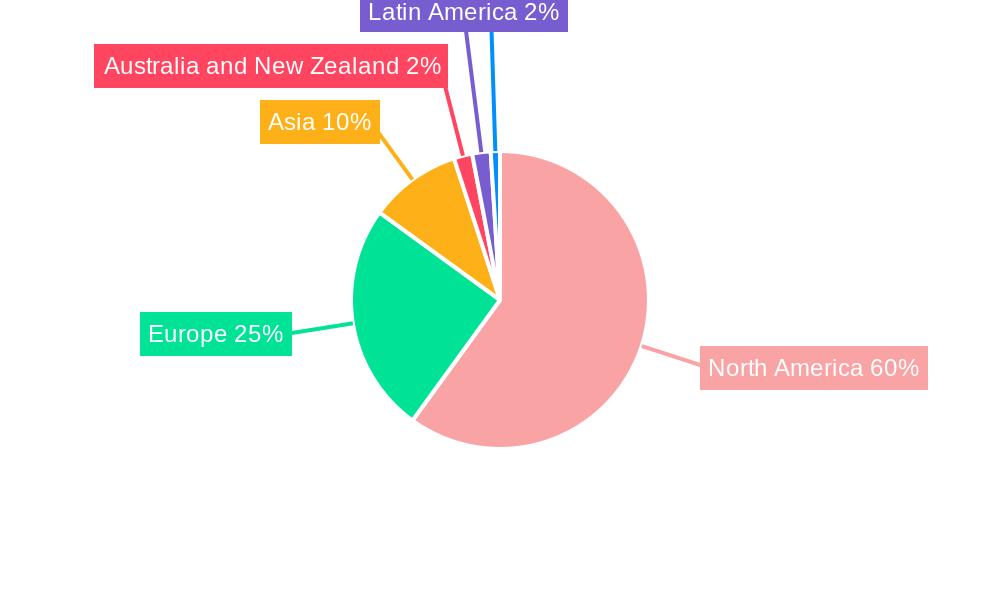

The North American market for automotive cybersecurity is experiencing robust growth, driven by the increasing connectivity and complexity of modern vehicles. The proliferation of advanced driver-assistance systems (ADAS), the integration of internet-connected features, and the rise of autonomous driving technologies have significantly expanded the attack surface, making cybersecurity a critical concern for automakers and consumers alike. This heightened vulnerability is fueling demand for a range of security solutions, including network security, application security, and cloud security. Software-based solutions are currently dominating the market due to their flexibility and cost-effectiveness, but hardware-based solutions are gaining traction for their enhanced security capabilities. The market is segmented by equipment type (network security, application security, cloud security, other), solution type (software, hardware, professional services, integration, other), and country (primarily the United States and Canada). Major players such as Harman, Infineon, Honeywell, and others are investing heavily in R&D to develop and deploy advanced cybersecurity solutions tailored to the automotive industry. The 9.5% CAGR suggests a consistent upward trajectory, reflecting the ongoing need for enhanced security measures to protect against increasingly sophisticated cyber threats. The market is expected to show significant growth over the next decade, reflecting the continued adoption of connected car technologies.

The North American dominance is primarily attributable to the high adoption rates of advanced vehicle technologies and the strong presence of automotive manufacturers and technology providers. Government regulations are also playing a significant role, driving the adoption of stricter cybersecurity standards. The market exhibits a high level of competition among established players and emerging startups, leading to continuous innovation in security solutions and services. The forecast period (2025-2033) is expected to witness significant technological advancements, including the integration of artificial intelligence and machine learning to enhance threat detection and response capabilities. This continuous evolution will be a key factor shaping the future trajectory of this vital market segment.

North American Automotive Cybersecurity Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North American (NA) market for automotive cybersecurity, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this rapidly evolving sector.

NA Market for Cyber Security of Cars Market Dynamics & Structure

The NA automotive cybersecurity market is characterized by increasing market concentration among key players, driven by technological advancements and a tightening regulatory landscape. The market is segmented by equipment type (Network Security, Application Security, Cloud Security, Other), solution type (Software-based, Hardware-based, Professional Services, Integration, Other), and geography (United States, Canada). The high cost of entry and specialized expertise create significant barriers to innovation. Mergers and acquisitions (M&A) activity is prevalent, with larger players acquiring smaller firms to expand their product portfolios and technological capabilities. The market is expected to reach xx Million units by 2033.

- Market Concentration: High, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation Drivers: Rising adoption of connected car technologies, increasing sophistication of cyberattacks, and government regulations promoting vehicle security.

- Regulatory Frameworks: Growing number of regulations and standards mandating automotive cybersecurity measures in both the US and Canada.

- Competitive Product Substitutes: Limited, as cybersecurity solutions are highly specialized and integrated into vehicle systems.

- End-User Demographics: Primarily automotive manufacturers (OEMs), Tier-1 suppliers, and aftermarket service providers.

- M&A Trends: Significant M&A activity expected to continue, driven by consolidation and expansion of capabilities. An estimated xx M&A deals occurred between 2019 and 2024.

NA Market for Cyber Security of Cars Growth Trends & Insights

The NA automotive cybersecurity market has experienced significant growth over the historical period (2019-2024) and is projected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the increasing adoption of connected car technologies, rising consumer awareness of cybersecurity risks, and stringent government regulations. The market size is expected to reach xx Million units in 2025, and xx Million units by 2033. Technological disruptions, such as the advancement of artificial intelligence (AI) and machine learning (ML) in cybersecurity, are further accelerating market expansion. Consumer behavior shifts towards greater demand for secure and reliable connected vehicles are also key drivers. Market penetration of cybersecurity solutions in new vehicles is steadily increasing, currently at approximately xx% and projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in NA Market for Cyber Security of Cars

The United States dominates the NA automotive cybersecurity market due to its larger automotive manufacturing base and higher adoption of advanced driver-assistance systems (ADAS). Canada follows as a significant market, driven by increasing vehicle connectivity and government initiatives to enhance cybersecurity infrastructure. Among the segments, network security holds the largest market share in 2025, followed by application security and cloud security. The software-based solution segment demonstrates the fastest growth rate due to its flexibility, cost-effectiveness, and ease of deployment.

- Key Drivers in the US: Large automotive manufacturing base, high adoption of connected car technologies, and robust regulatory landscape.

- Key Drivers in Canada: Growing vehicle connectivity, government investments in cybersecurity infrastructure, and expanding automotive industry.

- Dominant Segment (Equipment Type): Network security, driven by the increasing vulnerability of vehicle networks to cyberattacks.

- Dominant Segment (Solution Type): Software-based solutions due to cost-effectiveness, flexibility, and scalability.

NA Market for Cyber Security of Cars Product Landscape

The automotive cybersecurity product landscape is marked by ongoing innovation in areas such as intrusion detection and prevention systems, secure over-the-air (OTA) updates, and data encryption. Solutions are increasingly integrating AI and ML capabilities to enhance threat detection and response. Unique selling propositions include improved detection accuracy, reduced false positives, and seamless integration with existing vehicle systems. Technological advancements are focused on enhancing real-time threat detection and proactive security measures.

Key Drivers, Barriers & Challenges in NA Market for Cyber Security of Cars

Key Drivers:

- Increasing adoption of connected car technologies.

- Growing awareness of cybersecurity risks among consumers and automakers.

- Stringent government regulations promoting vehicle security.

- Advancements in AI and ML for enhanced threat detection.

Challenges and Restraints:

- High cost of implementation and maintenance of cybersecurity solutions.

- Complexity in integrating cybersecurity measures into existing vehicle architectures.

- Shortage of skilled cybersecurity professionals.

- Concerns over data privacy and security. This has resulted in a xx% reduction in investment in certain segments.

Emerging Opportunities in NA Market for Cyber Security of Cars

- Expansion into the aftermarket: Growing demand for cybersecurity solutions for older vehicles.

- Development of AI-powered solutions: Enhanced threat detection and response capabilities.

- Integration of cybersecurity with other vehicle systems: Holistic security approach.

- Focus on data privacy and security: Meeting growing consumer concerns.

Growth Accelerators in the NA Market for Cyber Security of Cars Industry

Long-term growth is driven by technological breakthroughs in AI/ML-powered cybersecurity, strategic partnerships between automotive manufacturers and cybersecurity firms, and expanding market penetration in both new and used vehicles. Government initiatives supporting cybersecurity research and development, coupled with increasing consumer awareness of security risks, further accelerate market expansion.

Key Players Shaping the NA Market for Cyber Security of Cars Market

- Arilou Technologies

- Harman International Industries Inc (Samsung)

- Infineon Technologies AG

- Honeywell International Inc

- Visteon Corporation

- NXP Semiconductors NV

- IBM Corporation

- Argus Cybersecurity

- Cisco Systems Inc

- Continental AG

- Secunet AG

- Delphi Automotive PLC

Notable Milestones in NA Market for Cyber Security of Cars Sector

- January 2020: HARMAN launched the HARMAN Ignite Marketplace, providing a secure and efficient way for automakers to deliver and update services, mitigating cybersecurity risks associated with OTA updates.

In-Depth NA Market for Cyber Security of Cars Market Outlook

The NA automotive cybersecurity market holds significant future potential, driven by continuous technological advancements, increasing vehicle connectivity, and stricter regulations. Strategic partnerships, innovation in AI/ML-based solutions, and expansion into new markets present lucrative opportunities for both established and emerging players. The market is poised for sustained growth, presenting a compelling investment landscape for those seeking to capitalize on the evolving security needs of the automotive industry.

NA Market for Cyber Security of Cars Segmentation

-

1. Solution Type

- 1.1. Software-based

- 1.2. Hardware-based

- 1.3. Professional Service

- 1.4. Integration

- 1.5. Other Types of Solution

-

2. Equipment Type

- 2.1. Network Security

- 2.2. Application Security

- 2.3. Cloud Security

- 2.4. Other Types of Security

NA Market for Cyber Security of Cars Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

NA Market for Cyber Security of Cars REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Security Threats as More Technologies Get Integrated Into Cars; Government Regulations

- 3.3. Market Restrains

- 3.3.1. Unavailability for skilled workforce

- 3.4. Market Trends

- 3.4.1. Application Security Expected to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Software-based

- 5.1.2. Hardware-based

- 5.1.3. Professional Service

- 5.1.4. Integration

- 5.1.5. Other Types of Solution

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Network Security

- 5.2.2. Application Security

- 5.2.3. Cloud Security

- 5.2.4. Other Types of Security

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. North America NA Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe NA Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia NA Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand NA Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America NA Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa NA Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Arilou Technologies

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Harman International Industries Inc (Samsung)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Infineon Technologies AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Honeywell International Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Visteon Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NXP Semiconductors NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 IBM Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Argus Cybersecurity

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cisco Systems Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Continental AG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Secunet AG

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Delphi Automotive PLC

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Arilou Technologies

List of Figures

- Figure 1: Global NA Market for Cyber Security of Cars Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America NA Market for Cyber Security of Cars Revenue (Million), by Country 2024 & 2032

- Figure 3: North America NA Market for Cyber Security of Cars Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe NA Market for Cyber Security of Cars Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe NA Market for Cyber Security of Cars Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia NA Market for Cyber Security of Cars Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia NA Market for Cyber Security of Cars Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand NA Market for Cyber Security of Cars Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand NA Market for Cyber Security of Cars Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America NA Market for Cyber Security of Cars Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America NA Market for Cyber Security of Cars Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa NA Market for Cyber Security of Cars Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa NA Market for Cyber Security of Cars Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America NA Market for Cyber Security of Cars Revenue (Million), by Solution Type 2024 & 2032

- Figure 15: North America NA Market for Cyber Security of Cars Revenue Share (%), by Solution Type 2024 & 2032

- Figure 16: North America NA Market for Cyber Security of Cars Revenue (Million), by Equipment Type 2024 & 2032

- Figure 17: North America NA Market for Cyber Security of Cars Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 18: North America NA Market for Cyber Security of Cars Revenue (Million), by Country 2024 & 2032

- Figure 19: North America NA Market for Cyber Security of Cars Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 6: NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 8: NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 10: NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 12: NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 14: NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 16: NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 18: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 19: Global NA Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico NA Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Market for Cyber Security of Cars?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the NA Market for Cyber Security of Cars?

Key companies in the market include Arilou Technologies, Harman International Industries Inc (Samsung), Infineon Technologies AG, Honeywell International Inc, Visteon Corporation, NXP Semiconductors NV, IBM Corporation, Argus Cybersecurity, Cisco Systems Inc, Continental AG, Secunet AG, Delphi Automotive PLC.

3. What are the main segments of the NA Market for Cyber Security of Cars?

The market segments include Solution Type, Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Security Threats as More Technologies Get Integrated Into Cars; Government Regulations.

6. What are the notable trends driving market growth?

Application Security Expected to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

Unavailability for skilled workforce.

8. Can you provide examples of recent developments in the market?

January 2020 - HARMAN launched the HARMAN Ignite Marketplace, an extensive network of cloud-based applications and services available on the HARMAN Ignite Cloud Platform. The HARMAN Ignite platform provides a built-in Over-the-Air (OTA) functionality, which helps manage potential risks like network problems, file tampering, and cybersecurity attacks, due to which automakers are equipped with a secure and efficient way to deliver and frequently update a robust service ecosystem while still mitigating risk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Market for Cyber Security of Cars," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Market for Cyber Security of Cars report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Market for Cyber Security of Cars?

To stay informed about further developments, trends, and reports in the NA Market for Cyber Security of Cars, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence