Key Insights

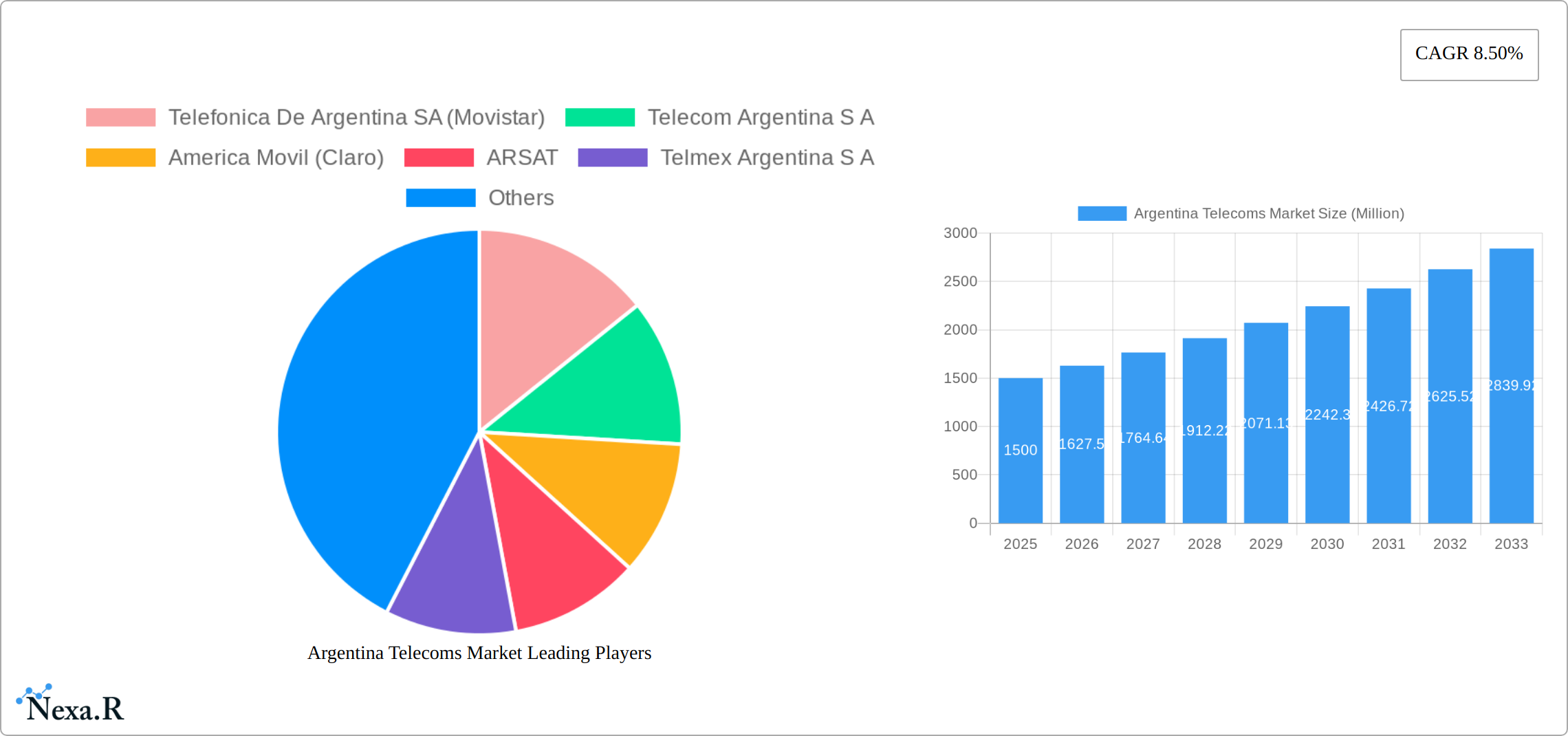

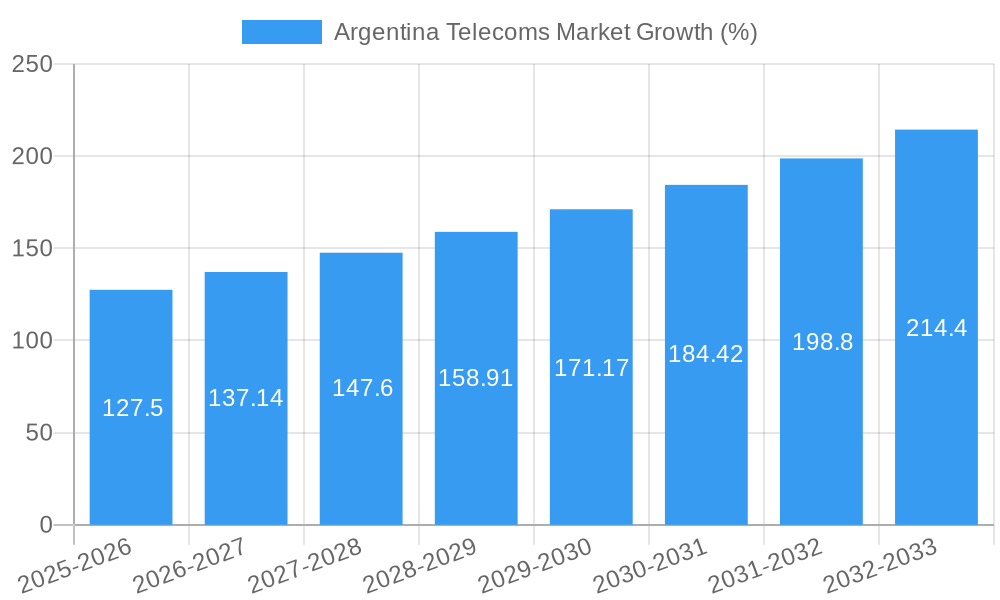

The Argentina Telecoms market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.50% from 2025 to 2033. This growth is fueled by several key drivers. Increasing smartphone penetration and data consumption are significantly boosting demand for wireless data and messaging services, including internet and handset data packages. The rise of over-the-top (OTT) platforms and pay-TV services further contributes to market expansion, as consumers increasingly opt for streaming services and online entertainment. Furthermore, government initiatives aimed at improving digital infrastructure and expanding broadband access are creating a favorable environment for market growth. However, economic volatility and regulatory hurdles present potential restraints. Fluctuations in the Argentine peso and inflation can impact consumer spending on telecom services. Similarly, complexities in regulatory frameworks can hinder investment and market expansion. The market is segmented into Voice Services, Wireless Data and Messaging Services (including various data packages and discounts), and OTT and PayTV Services. Each segment is experiencing varying growth rates, with data services showing the most significant expansion due to the aforementioned drivers. Competition among major players like Telefonica De Argentina SA (Movistar), Telecom Argentina S A, America Movil (Claro), ARSAT, Telmex Argentina S A, and Telecentro SA is intense, shaping pricing strategies and service offerings. Analysis of average revenue per user (ARPU) across these segments reveals crucial insights into pricing models and consumer behavior.

Looking ahead, the Argentina Telecoms market is expected to witness continued growth, driven by increasing digital adoption and the growing demand for high-speed internet access. However, addressing the challenges posed by economic instability and regulatory complexities will be critical for sustained expansion. Strategies focusing on affordable data packages, innovative service offerings, and robust infrastructure investments are likely to become increasingly important for market players to maintain competitiveness and capitalize on the market's growth potential. The strategic deployment of 5G technology will be a key differentiator and a major growth driver in the coming years. Furthermore, the expansion of fixed broadband access, especially in underserved rural areas, will unlock new market segments and drive further growth. Continuous monitoring of consumer preferences and adapting service offerings accordingly are essential for long-term success in this dynamic market.

Argentina Telecoms Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Argentina telecoms market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. It leverages extensive data and expert insights to deliver actionable intelligence for industry professionals, investors, and strategic decision-makers. The report covers the parent market (Telecommunications) and child markets (Voice Services, Wireless Data & Messaging, OTT & Pay TV), offering detailed segmentation and forecasts from 2020 to 2027, and projections extending to 2033.

Keywords: Argentina Telecom Market, Telecom Argentina, Telefonica Argentina, Movistar, Claro, ARSAT, Telmex Argentina, Telecentro, 5G Argentina, Telecom Market Argentina, Argentina Telecom Industry, Wireless Data Argentina, Pay TV Argentina, OTT Argentina, Voice Services Argentina, Average Revenue Per User (ARPU) Argentina, Telecom Market Size Argentina, Telecom Market Growth Argentina

Argentina Telecoms Market Dynamics & Structure

The Argentine telecoms market is characterized by moderate concentration, with key players like Telefonica de Argentina SA (Movistar), Telecom Argentina S.A., and America Movil (Claro) dominating market share. Technological innovation, driven primarily by 5G deployment and increased data consumption, is a significant growth driver. However, regulatory frameworks and economic volatility influence market stability. The market faces competition from Over-the-Top (OTT) services, impacting traditional voice and messaging revenue streams. M&A activity remains moderate, with occasional strategic partnerships impacting the competitive landscape.

- Market Concentration: Telecom Argentina S.A. and Telefonica de Argentina SA (Movistar) hold approximately xx% and xx% market share respectively, indicating a moderately concentrated market. America Movil (Claro) holds xx%.

- Technological Innovation: The adoption of 5G technology is a key driver, although infrastructure investments and spectrum allocation present challenges.

- Regulatory Framework: ENAcom's regulatory policies and spectrum auctions influence market competition and investment decisions.

- Competitive Substitutes: OTT services (e.g., WhatsApp, Skype) compete with traditional voice and messaging services.

- End-User Demographics: Growing smartphone penetration and increasing internet adoption drive demand for data services, particularly amongst younger demographics.

- M&A Trends: Consolidation in the market is limited, with strategic partnerships being more prevalent than large-scale mergers and acquisitions. The number of M&A deals in the last five years totals approximately xx.

Argentina Telecoms Market Growth Trends & Insights

The Argentina telecoms market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by increasing mobile penetration, rising data consumption, and the expansion of broadband services. The market size in 2024 was estimated at xx Million. The adoption of 4G LTE continues to grow, laying the foundation for a rapid 5G rollout. However, economic instability and inflation have impacted consumer spending, influencing ARPU and overall market growth. Technological disruptions, such as the rise of OTT platforms, present both opportunities and challenges for traditional telcos. Shifts in consumer behavior towards bundled services and data-centric plans further shape market dynamics. Market penetration for mobile services stands at approximately xx% in 2024, with significant potential for growth in underserved areas. The forecast period (2025-2033) projects a CAGR of xx%, driven by 5G expansion and the increasing demand for higher bandwidth services.

Dominant Regions, Countries, or Segments in Argentina Telecoms Market

The Buenos Aires metropolitan area and major urban centers are the most dominant regions, characterized by high population density and greater infrastructure development, thus leading to higher market penetration and ARPU. Within the service segments, wireless data and messaging services represent the fastest-growing segment, fueled by increased smartphone adoption and rising internet usage. OTT and Pay TV services are also experiencing significant growth, though they exert competitive pressure on traditional telco revenue streams.

- Key Drivers:

- High population density in urban areas.

- Advanced infrastructure development in major cities.

- Increasing smartphone penetration and internet adoption.

- Government initiatives to improve digital infrastructure.

- Dominant Segment: Wireless Data and Messaging Services show the highest growth potential, with a projected CAGR of xx% during the forecast period. The Average Revenue Per User (ARPU) for the overall service segment in 2024 is estimated at xx.

- Market Size Estimates (Million):

- Voice Services (2020-2027): 2020- xx, 2021- xx, 2022-xx, 2023-xx, 2024-xx, 2025-xx, 2026-xx, 2027-xx

- Wireless Data & Messaging (2020-2027): 2020- xx, 2021- xx, 2022-xx, 2023-xx, 2024-xx, 2025-xx, 2026-xx, 2027-xx

- OTT & Pay TV (2020-2027): 2020- xx, 2021- xx, 2022-xx, 2023-xx, 2024-xx, 2025-xx, 2026-xx, 2027-xx

Argentina Telecoms Market Product Landscape

The Argentine telecoms market offers a wide range of products and services, including prepaid and postpaid mobile plans with varying data allowances and bundled services. Innovation focuses on enhancing network infrastructure, offering competitive data packages, and developing value-added services like OTT platforms and entertainment bundles. Key differentiators include network coverage, data speeds, customer service quality, and the breadth of bundled offerings. Technological advancements include the deployment of 5G, network virtualization, and the use of AI for network optimization and customer service improvements.

Key Drivers, Barriers & Challenges in Argentina Telecoms Market

Key Drivers: Increased smartphone penetration, rising demand for data services, government initiatives to expand digital infrastructure, and the rollout of 5G technology are all key drivers.

Challenges and Restraints: Economic instability, inflation, and fluctuating currency exchange rates impact consumer spending and investment decisions. Regulatory hurdles, including spectrum allocation processes and licensing requirements, can hinder market expansion. Intense competition from both established players and emerging OTT providers presents ongoing challenges. Supply chain disruptions can impact the availability of equipment and infrastructure components. The estimated negative impact of these challenges on the market growth in 2024 is approximately xx Million.

Emerging Opportunities in Argentina Telecoms Market

Untapped opportunities exist in expanding broadband access to underserved rural areas, offering tailored services to specific demographic segments (e.g., SMEs, education sector), and capitalizing on the growing popularity of IoT applications. The development of innovative applications and services, such as cloud-based solutions and digital entertainment platforms, also presents substantial growth potential. Evolving consumer preferences for bundled services and personalized experiences offer further avenues for innovation.

Growth Accelerators in the Argentina Telecoms Market Industry

Technological breakthroughs in 5G, edge computing, and network virtualization are key catalysts for long-term growth. Strategic partnerships between telecom operators and technology providers can drive innovation and accelerate market expansion. Government initiatives to expand digital infrastructure, particularly in rural areas, will stimulate demand for telecom services and further accelerate market growth.

Key Players Shaping the Argentina Telecoms Market Market

- Telefonica De Argentina SA (Movistar) [link to Telefonica's global website]

- Telecom Argentina S A [link to Telecom Argentina's website]

- America Movil (Claro) [link to America Movil's website]

- ARSAT

- Telmex Argentina S A

- Telecentro SA

Notable Milestones in Argentina Telecoms Market Sector

- November 2022: Telecom Argentina announced plans to complete its 5G core deployment by 2024, including deployment in dynamic spectrum sharing (DSS) mode and aiming for over 160 5G sites by year-end.

- October 2022: Movistar partnered with Metrotel for coordinated infrastructure installation initiatives to improve connectivity and introduce new service offerings.

In-Depth Argentina Telecoms Market Market Outlook

The Argentine telecoms market holds significant long-term growth potential, driven by sustained investments in infrastructure, the expansion of 5G networks, and the growing demand for data-centric services. Strategic partnerships, technological advancements, and government support will further accelerate market expansion. Opportunities exist to tap into underserved markets, develop innovative applications, and cater to evolving consumer preferences. The market is expected to witness a period of significant transformation, characterized by increased competition, technological innovation, and ongoing regulatory developments.

Argentina Telecoms Market Segmentation

-

1. Service Type

- 1.1. Voice services

- 1.2. data services

- 1.3. OTT and PayTV services

-

2. Technology

- 2.1. Fixed-line

- 2.2. wireless

- 2.3. satellite

-

3. End User

- 3.1. Consumers

- 3.2. businesses

- 3.3. government agencies

Argentina Telecoms Market Segmentation By Geography

- 1. Argentina

Argentina Telecoms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Internet Coverage; Robust OTT Demand

- 3.3. Market Restrains

- 3.3.1. Limitation of Real-time Wireless Control Due to Communication Delays

- 3.4. Market Trends

- 3.4.1. Robust Internet Coverage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Telecoms Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Voice services

- 5.1.2. data services

- 5.1.3. OTT and PayTV services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fixed-line

- 5.2.2. wireless

- 5.2.3. satellite

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Consumers

- 5.3.2. businesses

- 5.3.3. government agencies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Telefonica De Argentina SA (Movistar)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telecom Argentina S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 America Movil (Claro)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ARSAT

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telmex Argentina S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telecentro SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Telefonica De Argentina SA (Movistar)

List of Figures

- Figure 1: Argentina Telecoms Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Telecoms Market Share (%) by Company 2024

List of Tables

- Table 1: Argentina Telecoms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Telecoms Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Argentina Telecoms Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Argentina Telecoms Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 5: Argentina Telecoms Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Argentina Telecoms Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 7: Argentina Telecoms Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Argentina Telecoms Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Argentina Telecoms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Argentina Telecoms Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Argentina Telecoms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Argentina Telecoms Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Argentina Telecoms Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Argentina Telecoms Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 15: Argentina Telecoms Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Argentina Telecoms Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 17: Argentina Telecoms Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Argentina Telecoms Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Argentina Telecoms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Argentina Telecoms Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Telecoms Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Argentina Telecoms Market?

Key companies in the market include Telefonica De Argentina SA (Movistar), Telecom Argentina S A, America Movil (Claro), ARSAT, Telmex Argentina S A, Telecentro SA.

3. What are the main segments of the Argentina Telecoms Market?

The market segments include Service Type, Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Internet Coverage; Robust OTT Demand.

6. What are the notable trends driving market growth?

Robust Internet Coverage.

7. Are there any restraints impacting market growth?

Limitation of Real-time Wireless Control Due to Communication Delays.

8. Can you provide examples of recent developments in the market?

In November 2022, Telecom Argentina announced that it would finish the 5G core deployment in 2024. To prepare for the spectrum auction that industry regulator Enacom intends to organize in the first quarter of 2023, the operator has started deploying an autonomous 5G core. The business has begun rolling out 5G in dynamic spectrum sharing (DSS) mode to finish the process in 2024 and anticipates having more than 160 sites by the end of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Telecoms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Telecoms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Telecoms Market?

To stay informed about further developments, trends, and reports in the Argentina Telecoms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence