Key Insights

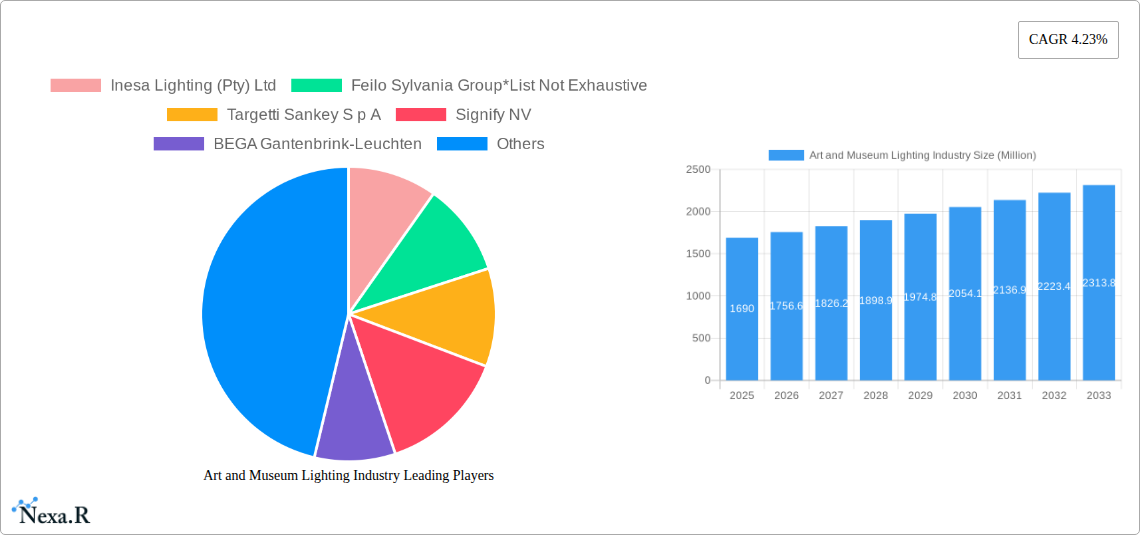

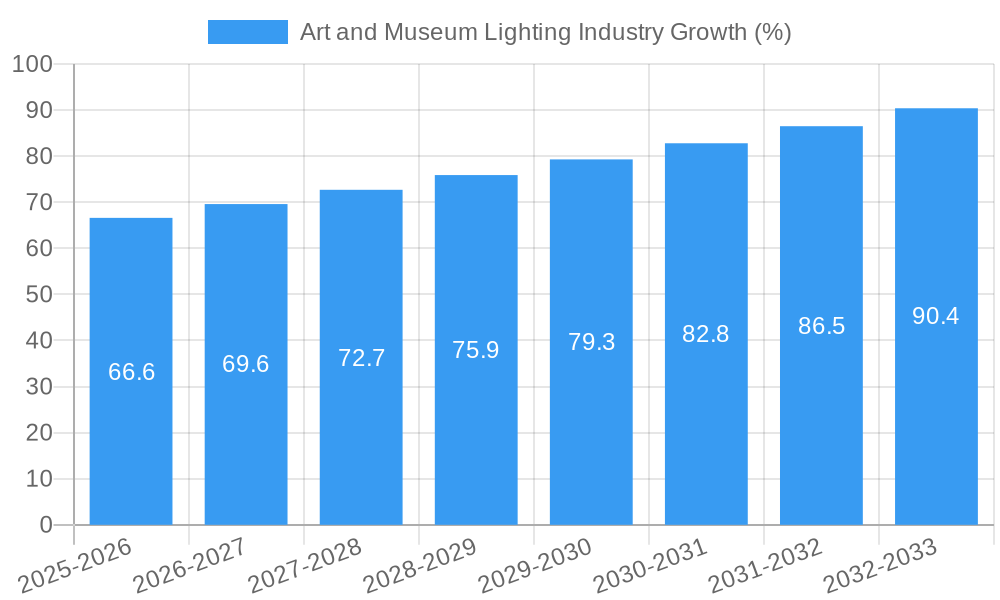

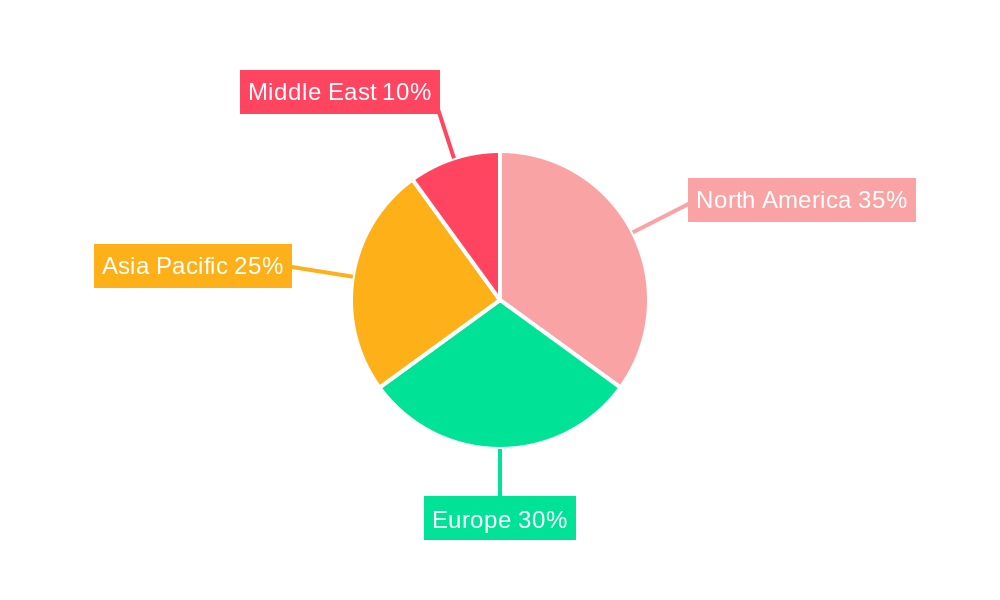

The art and museum lighting market, valued at $1.69 billion in 2025, is projected to experience steady growth, driven by increasing investments in museum infrastructure, a rising appreciation for art preservation, and the growing adoption of energy-efficient LED lighting solutions. The market's Compound Annual Growth Rate (CAGR) of 4.23% from 2019 to 2024 suggests a continued upward trajectory through 2033. Key growth drivers include the rising demand for specialized lighting systems that enhance the aesthetic appeal and protect valuable artifacts. The shift towards LED technology is a significant trend, offering energy savings, longer lifespan, and improved color rendering, thereby reducing operational costs and environmental impact. While the market faces some restraints, such as high initial investment costs for advanced lighting systems and the need for specialized installation expertise, the overall outlook remains positive. The market segmentation reveals a strong preference for LED lighting over non-LED options, reflecting the aforementioned benefits. Similarly, indoor applications currently dominate the market, driven by the concentrated nature of art and museum displays. Leading companies like Signify, Osram, and Acuity Brands are at the forefront of innovation, continually developing cutting-edge solutions tailored to the specific needs of art preservation and display. Regional markets, including North America and Europe, are expected to maintain significant market share driven by established museum infrastructure and robust economies. The Asia-Pacific region, however, presents a significant growth opportunity, driven by increasing investment in cultural infrastructure and tourism.

This growth is expected to be fueled by several factors, including the increasing number of museums and art galleries globally, the rising demand for high-quality lighting solutions that enhance the viewing experience and protect valuable artworks, and technological advancements in LED lighting technology. The adoption of smart lighting systems, which allow for precise control over lighting levels and color temperature, is also driving market growth. Furthermore, governmental initiatives promoting energy efficiency and sustainable practices are encouraging the adoption of energy-efficient lighting solutions in museums and art galleries. Competition is intense, with a number of major players vying for market share. Successful companies will need to offer innovative products, superior customer service, and competitive pricing to maintain their position in this dynamic market. Future market growth will depend on factors such as economic conditions, technological advancements, and government regulations.

Art and Museum Lighting Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Art and Museum Lighting industry, encompassing market dynamics, growth trends, regional performance, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market of commercial lighting and the child market of specialized lighting for museums and art galleries, providing a granular understanding of this niche but significant sector. The market value is projected at xx Million in 2025.

Art and Museum Lighting Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the art and museum lighting market. The market is characterized by a moderate level of concentration, with several key players holding significant market share. However, the presence of numerous smaller, specialized firms contributes to a dynamic competitive environment.

- Market Concentration: The top five players account for approximately 40% of the global market share (estimated).

- Technological Innovation: LED technology dominates, driving energy efficiency and color rendering improvements. However, innovation in areas such as dynamic lighting and smart controls remains crucial.

- Regulatory Frameworks: Energy efficiency regulations and building codes significantly influence product adoption and market growth.

- Competitive Product Substitutes: While few direct substitutes exist, the market faces indirect competition from other types of lighting solutions in commercial settings.

- End-User Demographics: The market is driven by museums, art galleries, historical sites, and other cultural institutions worldwide. Growth is linked to the expansion of these institutions and rising public interest in cultural heritage.

- M&A Trends: The past five years have seen xx M&A deals within the art and museum lighting market, driven by efforts to expand product portfolios and geographical reach.

Art and Museum Lighting Industry Growth Trends & Insights

The Art and Museum Lighting market experienced significant growth during the historical period (2019-2024), driven by the increasing adoption of energy-efficient LED lighting solutions and a growing demand for high-quality illumination in museums and art galleries. The market is expected to maintain a steady CAGR of xx% during the forecast period (2025-2033), reaching a projected value of xx Million by 2033.

Technological disruptions, such as the introduction of advanced LED technologies with improved color rendering and control systems, are shaping consumer behavior and driving market growth. The shift towards energy-efficient lighting solutions is a primary driver of adoption. The rising focus on enhancing visitor experience and preserving artwork is also significantly impacting market growth. Market penetration of LED lighting in the segment is estimated at xx% in 2025 and is expected to increase substantially by 2033.

Dominant Regions, Countries, or Segments in Art and Museum Lighting Industry

North America currently holds the largest market share, driven by a high concentration of museums and art galleries, and a strong emphasis on energy efficiency. However, the Asia-Pacific region is anticipated to experience the highest growth rate in the forecast period.

By Type:

- LED: The LED segment dominates, driven by energy efficiency, longevity, and superior color rendering capabilities.

- Non-LED: This segment is gradually declining due to the increasing advantages of LED technology.

By Application:

- Indoor: Indoor lighting accounts for a larger market share compared to outdoor lighting, as most art and artifacts are displayed indoors.

- Outdoor: Outdoor applications are growing steadily, with increasing demand for landscape and exterior lighting in cultural institutions.

Key Drivers:

- Strong government support for cultural heritage preservation.

- Increasing investment in museum infrastructure and modernization.

- Growing demand for energy-efficient lighting solutions in commercial spaces.

Art and Museum Lighting Industry Product Landscape

The art and museum lighting market offers a range of products, including track lighting, spotlights, ambient lighting, and specialized systems designed to minimize UV and heat damage to artwork. Innovations focus on improving color rendering index (CRI) values and incorporating smart controls for precise light management. Unique selling propositions include specialized color temperatures to highlight specific artwork features and innovative fixture designs to minimize visual intrusion.

Key Drivers, Barriers & Challenges in Art and Museum Lighting Industry

Key Drivers:

- Growing demand for energy-efficient and environmentally friendly lighting solutions.

- Technological advancements leading to improved color rendering and control systems.

- Increasing awareness of the importance of proper lighting for artwork preservation.

Key Challenges:

- High initial investment costs associated with installing advanced lighting systems.

- Difficulty in balancing energy efficiency with the need for high-quality illumination.

- Competition from cheaper, lower-quality lighting options. Supply chain disruptions in recent years have led to xx% increase in material costs.

Emerging Opportunities in Art and Museum Lighting Industry

Emerging opportunities include the integration of smart lighting systems with building management systems (BMS) to optimize energy consumption and enhance visitor experiences. There's significant potential in developing specialized lighting solutions for different types of artwork, and exploring new materials and technologies to further improve energy efficiency and light quality. Untapped markets in developing economies with expanding cultural institutions also present considerable growth potential.

Growth Accelerators in the Art and Museum Lighting Industry Industry

Technological advancements, particularly in LED technology and control systems, are a significant growth accelerator. Strategic partnerships between lighting manufacturers and museum operators foster innovation and market expansion. Increased government funding for cultural preservation initiatives also drives market growth.

Key Players Shaping the Art and Museum Lighting Industry Market

- Inesa Lighting (Pty) Ltd

- Feilo Sylvania Group

- Targetti Sankey S p A

- Signify NV

- BEGA Gantenbrink-Leuchten

- Acuity Brands Inc

- Lumenpulse Group

- OSRAM Licht AG

- iGuzzini illuminazione S p A

- ERCO GmbH

Notable Milestones in Art and Museum Lighting Industry Sector

- December 2022: Signify launched the Philips Hexa-bulb and O-Bulb in India, adding decorative options to its LED portfolio.

- July 2022: The University of Idaho implemented a Musco Lighting LED system in the ASUI Kibbie-Activity Center, showcasing energy-efficient upgrades in large-scale applications.

In-Depth Art and Museum Lighting Industry Market Outlook

The future of the Art and Museum Lighting market is bright, driven by continued technological innovation and the growing global demand for energy-efficient and aesthetically pleasing lighting solutions. Strategic partnerships and market expansion into emerging economies present significant opportunities for growth. The market is poised for sustained expansion, with a focus on sophisticated control systems, enhanced color rendering, and environmentally conscious materials.

Art and Museum Lighting Industry Segmentation

-

1. Type

- 1.1. LED

- 1.2. Non-LED

-

2. Application

- 2.1. Indoor

- 2.2. Outdoor

Art and Museum Lighting Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Middle East

Art and Museum Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of LED Luminaires in Museum and Art Galleries; Growing Demand for Electing Lighting System with a Smart Control System

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about the Advantages of the LED Lights

- 3.4. Market Trends

- 3.4.1. LED Segment is Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. LED

- 5.1.2. Non-LED

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. LED

- 6.1.2. Non-LED

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Indoor

- 6.2.2. Outdoor

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. LED

- 7.1.2. Non-LED

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Indoor

- 7.2.2. Outdoor

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. LED

- 8.1.2. Non-LED

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Indoor

- 8.2.2. Outdoor

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. LED

- 9.1.2. Non-LED

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Indoor

- 9.2.2. Outdoor

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Asia Pacific Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Middle East Art and Museum Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Inesa Lighting (Pty) Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Feilo Sylvania Group*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Targetti Sankey S p A

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Signify NV

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 BEGA Gantenbrink-Leuchten

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Acuity Brands Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Lumenpulse Group

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 OSRAM Licht AG

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 iGuzzini illuminazione S p A

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 ERCO GmbH

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Inesa Lighting (Pty) Ltd

List of Figures

- Figure 1: Global Art and Museum Lighting Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Asia Pacific Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Art and Museum Lighting Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Art and Museum Lighting Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Art and Museum Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Art and Museum Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Asia Pacific Art and Museum Lighting Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Asia Pacific Art and Museum Lighting Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Asia Pacific Art and Museum Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Asia Pacific Art and Museum Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Asia Pacific Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Art and Museum Lighting Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Art and Museum Lighting Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Art and Museum Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Art and Museum Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East Art and Museum Lighting Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East Art and Museum Lighting Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East Art and Museum Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Middle East Art and Museum Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Middle East Art and Museum Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East Art and Museum Lighting Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Art and Museum Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Art and Museum Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Art and Museum Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Art and Museum Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Art and Museum Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Art and Museum Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Art and Museum Lighting Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Art and Museum Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Art and Museum Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Art and Museum Lighting Industry?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Art and Museum Lighting Industry?

Key companies in the market include Inesa Lighting (Pty) Ltd, Feilo Sylvania Group*List Not Exhaustive, Targetti Sankey S p A, Signify NV, BEGA Gantenbrink-Leuchten, Acuity Brands Inc, Lumenpulse Group, OSRAM Licht AG, iGuzzini illuminazione S p A, ERCO GmbH.

3. What are the main segments of the Art and Museum Lighting Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of LED Luminaires in Museum and Art Galleries; Growing Demand for Electing Lighting System with a Smart Control System.

6. What are the notable trends driving market growth?

LED Segment is Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness about the Advantages of the LED Lights.

8. Can you provide examples of recent developments in the market?

December 2022: Signify announced the launch of two uniquely shaped LED bulbs in India, Philips Hexa-bulb and O-Bulb. These hexagonal and circular bulbs can be used as decorative lights for an elegant touch to the indoor space and come with a single plug-and-play form that can be easily installed into existing LED bulb sockets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Art and Museum Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Art and Museum Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Art and Museum Lighting Industry?

To stay informed about further developments, trends, and reports in the Art and Museum Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence