Key Insights

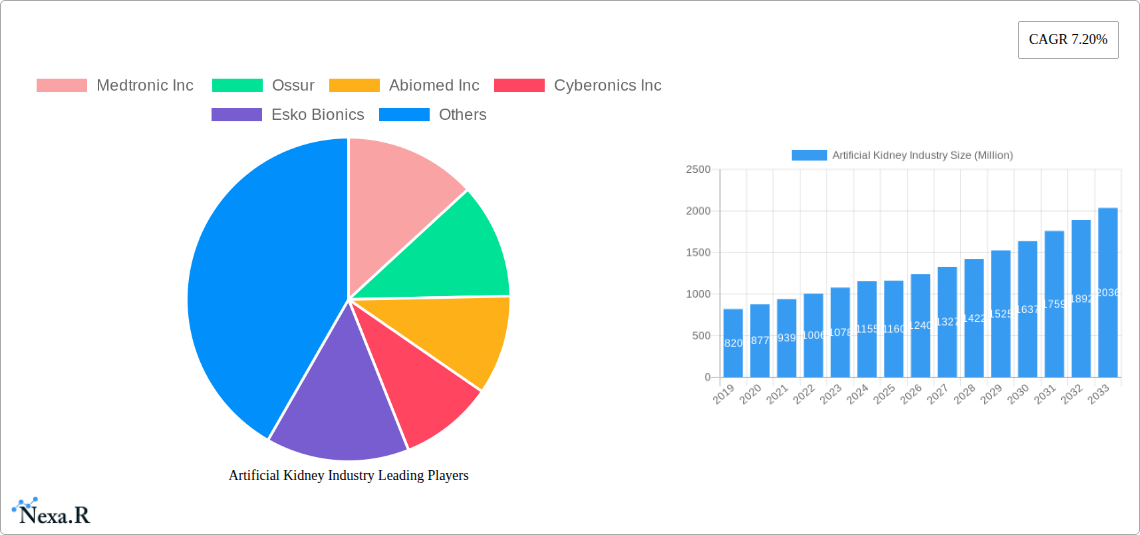

The global Artificial Organs market is poised for significant expansion, projected to reach $1,160 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 7.20% from 2019 to 2033, indicating a dynamic and upward trajectory for this critical healthcare sector. The increasing prevalence of chronic diseases, coupled with advancements in medical technology and a growing demand for improved patient outcomes, are primary drivers of this market. Innovations in artificial organs are offering life-saving alternatives for individuals suffering from organ failure, thereby reducing waiting lists for transplants and improving the quality of life for countless patients. The market is segmented across various artificial organ types, including artificial kidneys, artificial lungs, and cochlear implants, as well as bionic solutions for vision, hearing, and orthopedics. These segments are all contributing to the overall market's impressive growth.

Artificial Kidney Industry Market Size (In Million)

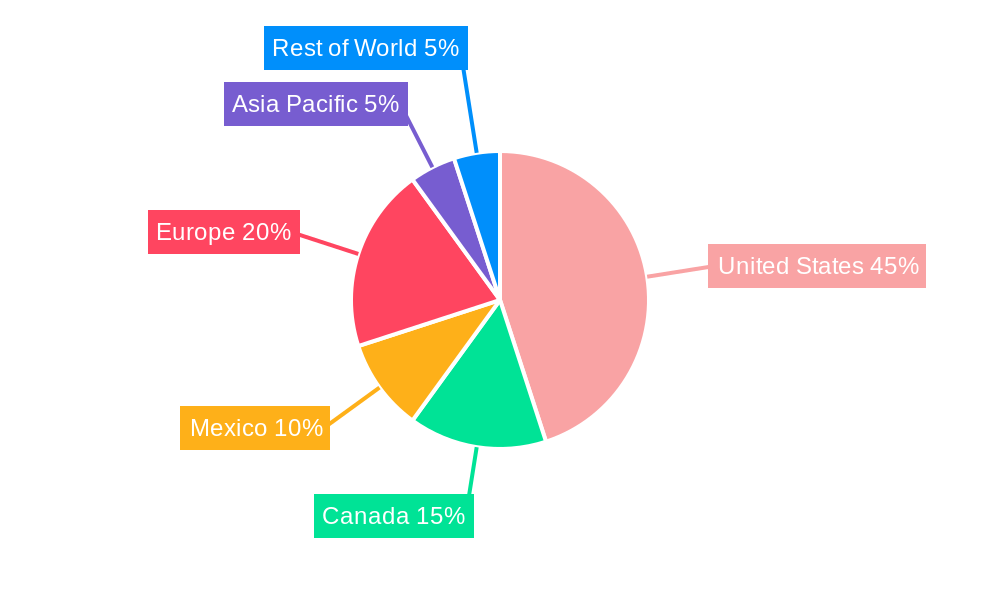

The North American region, particularly the United States, is expected to dominate the Artificial Organs market, driven by its advanced healthcare infrastructure, high R&D investments, and a large patient pool. Mexico and Canada are also anticipated to witness steady growth, supported by expanding healthcare access and increasing adoption of innovative medical devices. Emerging trends such as the development of implantable and wearable artificial organs, coupled with personalized organ regeneration technologies, are set to further propel market expansion. However, the high cost of these sophisticated medical devices and stringent regulatory approvals may pose moderate restraints. Despite these challenges, the continuous pursuit of innovative solutions by leading companies like Medtronic, Abiomed, and Boston Scientific Corporation is expected to overcome these hurdles and ensure sustained market growth.

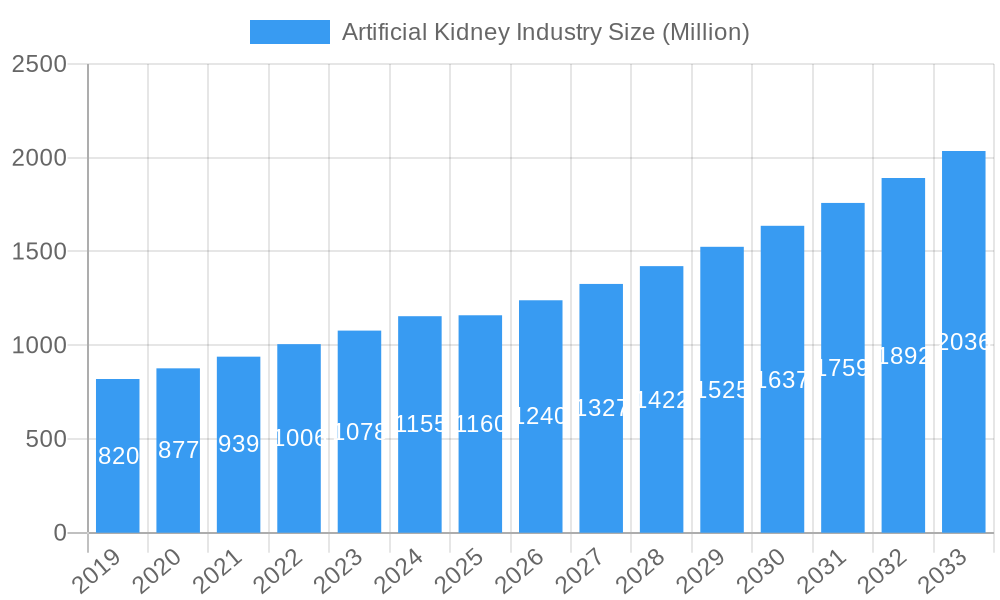

Artificial Kidney Industry Company Market Share

Artificial Kidney Industry Report: Advancing Bioartificial Solutions for Renal Health

This comprehensive report delves into the dynamic Artificial Kidney Industry, a critical segment within the burgeoning artificial organ and bionics markets. With a focus on innovative artificial organ solutions, particularly the artificial kidney, and advancements in cardiac bionics and other bionic technologies, this analysis explores market evolution from 2019–2024 (Historical Period) through 2025 (Base Year & Estimated Year) to 2033 (Forecast Period). We provide in-depth insights into market size, growth drivers, regional dominance, technological breakthroughs, and key players shaping the future of renal replacement therapy. This report is a vital resource for stakeholders in the medical device, biotechnology, and healthcare sectors seeking to understand and capitalize on the immense potential of the artificial kidney market.

Artificial Kidney Industry Market Dynamics & Structure

The Artificial Kidney Industry is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demographics. Market concentration is moderate, with a few key players leading in research and development for advanced artificial organs, while a larger number of companies contribute to specialized components and peripheral technologies. Technological innovation is a primary driver, fueled by the urgent need for more effective and less invasive renal replacement therapies. The pursuit of a fully functional bioartificial kidney is at the forefront of this innovation wave. Regulatory frameworks, particularly those established by health authorities in the United States, Canada, and Mexico, play a crucial role in market access and product approval, influencing the pace of development and commercialization. Competitive product substitutes, primarily dialysis machines and organ transplantation, continue to shape market dynamics, pushing for superior performance and accessibility from artificial kidney solutions. End-user demographics, including the growing prevalence of chronic kidney disease (CKD) globally, underscore the increasing demand for advanced treatments. Mergers and acquisition (M&A) trends reflect strategic moves by established medical device companies to acquire promising artificial kidney technologies and expand their portfolios in the artificial organ segment. For instance, the United States and Canada have seen several strategic acquisitions in the bionics and artificial organ space, indicating a consolidation of expertise and resources to accelerate innovation.

- Market Concentration: Moderate, with increasing consolidation around key R&D hubs.

- Technological Innovation Drivers: Need for improved patient outcomes, reduced treatment burden, and development of implantable devices.

- Regulatory Frameworks: Stringent approval processes in North America, driving focus on safety and efficacy.

- Competitive Product Substitutes: Dialysis (hemodialysis, peritoneal dialysis) and kidney transplantation.

- End-User Demographics: Rising global incidence of CKD and end-stage renal disease (ESRD).

- M&A Trends: Focus on acquiring innovative bioartificial kidney and implantable device technologies. The volume of M&A deals is projected to increase by approximately 15% over the forecast period as larger players seek to bolster their artificial organ portfolios.

Artificial Kidney Industry Growth Trends & Insights

The Artificial Kidney Industry is poised for significant expansion, driven by a convergence of technological advancements and an escalating global healthcare burden. The projected Compound Annual Growth Rate (CAGR) for the artificial kidney market is an impressive xx% from 2025 to 2033, indicating substantial market size evolution. This growth trajectory is underpinned by increasing adoption rates of advanced renal replacement therapies that offer superior quality of life and reduced complications compared to traditional methods. Technological disruptions, such as the development of implantable and wearable artificial kidneys, are revolutionizing patient care and driving demand for these next-generation devices. Furthermore, shifts in consumer behavior, with patients actively seeking less burdensome and more integrated treatment options, are accelerating market penetration. The global market for artificial organs, including artificial kidneys, is estimated to reach $xx billion by 2033, with the artificial kidney segment alone projected to account for $xx billion. This robust growth is also influenced by spillover effects from advancements in related bionics fields, such as cardiac bionics, which have seen accelerated innovation and patient acceptance. The United States and Canada, with their advanced healthcare infrastructure and substantial investment in medical R&D, are leading the charge in adopting these novel artificial organ technologies. The market penetration of advanced artificial kidney prototypes is expected to rise from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Artificial Kidney Industry

The United States stands as the dominant region in the Artificial Kidney Industry, exhibiting unparalleled market share and growth potential. This dominance is fueled by a confluence of factors, including substantial government and private investment in medical research and development, a high prevalence of chronic kidney disease (CKD), and a robust regulatory environment that fosters innovation in artificial organs and bionics. The country's advanced healthcare infrastructure, coupled with a high disposable income that supports the adoption of cutting-edge medical technologies, further solidifies its leading position. The United States is at the forefront of developing and deploying advanced artificial kidney technologies, including promising bioartificial kidney initiatives, as evidenced by the KidneyX prize competition.

Within the Artificial Organ segment, while the artificial kidney is the primary focus of this report, advancements in artificial heart and artificial lungs technologies also contribute to the overall growth and innovation landscape. The Bionics segment, particularly cardiac bionics and orthopedic bionic devices, showcases significant market penetration and patient acceptance, creating a favorable ecosystem for the adoption of other advanced bionic solutions, including those for renal replacement.

Canada and Mexico, while smaller in market size, represent significant growth opportunities within the North American market. Canada's commitment to medical innovation, exemplified by the groundbreaking total artificial heart implantation at SickKids, demonstrates its potential in advanced artificial organ development. Mexico's growing healthcare sector and increasing demand for medical devices present a fertile ground for market expansion.

Key drivers for the United States' dominance include:

- Economic Policies: Favorable reimbursement policies and substantial R&D tax credits.

- Infrastructure: World-class research institutions and advanced clinical trial capabilities.

- Market Share: The United States currently holds an estimated xx% of the global artificial kidney market share.

- Growth Potential: Projected growth rate of xx% in the artificial kidney market within the United States from 2025 to 2033.

- Regulatory Support: Active government initiatives like KidneyX fostering novel artificial organ development.

Artificial Kidney Industry Product Landscape

The product landscape in the Artificial Kidney Industry is characterized by a relentless pursuit of miniaturization, enhanced functionality, and improved biocompatibility. Innovations range from more efficient hemodialysis machines and peritoneal dialysis solutions to ambitious research and development of implantable and wearable artificial kidneys. Key advancements include the development of sophisticated filtration membranes mimicking natural kidney function, integrated biosensors for real-time patient monitoring, and novel scaffolding techniques for bioartificial kidney development. The integration of AI and machine learning in device management promises personalized treatment protocols, further differentiating products. Unique selling propositions often revolve around reduced patient invasiveness, improved filtration efficiency, and greater patient autonomy. Technological advancements in materials science and nanotechnology are paving the way for smaller, more durable, and highly effective artificial kidney devices, poised to significantly impact the artificial organ market.

Key Drivers, Barriers & Challenges in Artificial Kidney Industry

The Artificial Kidney Industry is propelled by several key drivers, primarily the escalating global burden of chronic kidney disease (CKD) and end-stage renal disease (ESRD), creating an ever-growing patient pool demanding advanced renal replacement therapies. Technological advancements in materials science, biotechnology, and engineering are enabling the development of more sophisticated and effective artificial organs, including implantable and wearable artificial kidneys. Furthermore, supportive government initiatives and increasing healthcare expenditure worldwide are fostering R&D and market adoption. The promise of enhanced patient quality of life and reduced treatment complexity compared to traditional dialysis and transplantation is a significant market pull.

However, the industry faces considerable barriers and challenges. The high cost of developing and manufacturing advanced artificial kidney technologies presents a significant financial hurdle, impacting affordability and accessibility. Stringent regulatory approval processes, while crucial for patient safety, can lead to prolonged development timelines and increased costs. The complexity of replicating the intricate biological functions of a natural kidney remains a formidable technical challenge for creating a fully functional bioartificial kidney. Furthermore, the availability of established alternatives like dialysis and organ transplantation, alongside issues of donor organ scarcity, creates a competitive landscape. Supply chain disruptions and the need for specialized manufacturing capabilities can also pose significant restraints, particularly for novel artificial organ components.

Emerging Opportunities in Artificial Kidney Industry

Emerging opportunities in the Artificial Kidney Industry are centered on the development of next-generation artificial organs and bionics. The pursuit of a fully implantable and wearable artificial kidney represents a significant untapped market, offering the potential for complete patient autonomy and a vastly improved quality of life. Advancements in bioartificial kidney research, focusing on combining artificial components with living cells, hold immense promise for more effective and personalized renal replacement. The integration of sophisticated AI and machine learning algorithms for real-time patient monitoring and treatment optimization presents a substantial opportunity to enhance device performance and patient outcomes. Furthermore, the increasing global prevalence of CKD, particularly in emerging economies, creates a vast market for more accessible and affordable artificial kidney solutions. Exploring innovative delivery models and partnerships to increase market penetration in underserved regions is also a key opportunity.

Growth Accelerators in the Artificial Kidney Industry Industry

Several critical catalysts are accelerating the growth of the Artificial Kidney Industry. Foremost among these are breakthrough technological advancements, particularly in the realm of nanotechnology and biomaterials, which are enabling the creation of more efficient and biocompatible artificial kidney components. Strategic partnerships between leading medical device manufacturers, research institutions, and biotechnology firms are vital for pooling resources, expertise, and accelerating the R&D pipeline for artificial organs. Market expansion strategies, focusing on both developed and emerging economies, are crucial for tapping into the vast unmet needs for advanced renal replacement therapies. The increasing global healthcare expenditure and supportive government policies aimed at improving patient outcomes for chronic diseases are further fueling investment and innovation in this sector. The successful clinical trials and eventual market launch of truly functional bioartificial kidneys will act as a significant growth accelerator, potentially transforming the treatment paradigm for millions worldwide.

Key Players Shaping the Artificial Kidney Industry Market

- Medtronic Inc

- Ossur

- Abiomed Inc

- Cyberonics Inc

- Esko Bionics

- Asahi Kasei Medical Co Ltd

- Cochlear Ltd

- Boston Scientific Corporation

- Baxter International Inc

- Berlin Heart GmbH

Notable Milestones in Artificial Kidney Industry Sector

- August 2022: The United States Department of Health and Human Services (HHS) and the American Society of Nephrology (ASN) unveiled a fresh prize competition through the Kidney Innovation Accelerator (KidneyX). This competition aims to advance the development of a fully functional bioartificial kidney, signaling significant governmental support for artificial kidney innovation.

- July 2022: In Canada, a group of doctors from SickKids made medical history by successfully implanting one of the first total artificial hearts in a child. They received training on this groundbreaking technology in the United States, highlighting cross-border collaboration in advanced artificial organ development and a growing focus on pediatric applications.

In-Depth Artificial Kidney Industry Market Outlook

The Artificial Kidney Industry's future outlook is exceptionally promising, driven by a clear trajectory towards more sophisticated and patient-centric artificial organ solutions. Growth accelerators, including continuous innovation in biomaterials, the development of miniaturized and implantable devices, and increasing global demand due to rising CKD prevalence, will collectively propel the market forward. Strategic collaborations and significant investment in R&D for bioartificial kidney technologies are expected to yield groundbreaking results in the coming years. The United States, Canada, and Mexico will remain key markets, with North America leading in the adoption of advanced bionic and artificial organ technologies. The focus will increasingly shift towards solutions that offer greater autonomy and improved long-term patient outcomes, transforming the landscape of renal replacement therapy and creating substantial opportunities for stakeholders across the value chain.

Artificial Kidney Industry Segmentation

-

1. Type

-

1.1. Artificial Organ

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Artificial Lungs

- 1.1.4. Cochlear Implants

- 1.1.5. Other Organ Types

-

1.2. Bionics

- 1.2.1. Vision Bionics

- 1.2.2. Ear Bionics

- 1.2.3. Orthopedic Bionic

- 1.2.4. Cardiac Bionics

-

1.1. Artificial Organ

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

Artificial Kidney Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

Artificial Kidney Industry Regional Market Share

Geographic Coverage of Artificial Kidney Industry

Artificial Kidney Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Incidence of Disabilities and Organ Failures; High Incidence of Road Accidents Leading to Amputations; Technological Advancements in the Artificial Organ and Bionics

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures; Risk of Compatibility Issues and Malfunctions

- 3.4. Market Trends

- 3.4.1. Artificial Kidney Segment is Estimated to Witness a Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Kidney Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Artificial Organ

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Artificial Lungs

- 5.1.1.4. Cochlear Implants

- 5.1.1.5. Other Organ Types

- 5.1.2. Bionics

- 5.1.2.1. Vision Bionics

- 5.1.2.2. Ear Bionics

- 5.1.2.3. Orthopedic Bionic

- 5.1.2.4. Cardiac Bionics

- 5.1.1. Artificial Organ

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States Artificial Kidney Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Artificial Organ

- 6.1.1.1. Artificial Heart

- 6.1.1.2. Artificial Kidney

- 6.1.1.3. Artificial Lungs

- 6.1.1.4. Cochlear Implants

- 6.1.1.5. Other Organ Types

- 6.1.2. Bionics

- 6.1.2.1. Vision Bionics

- 6.1.2.2. Ear Bionics

- 6.1.2.3. Orthopedic Bionic

- 6.1.2.4. Cardiac Bionics

- 6.1.1. Artificial Organ

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada Artificial Kidney Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Artificial Organ

- 7.1.1.1. Artificial Heart

- 7.1.1.2. Artificial Kidney

- 7.1.1.3. Artificial Lungs

- 7.1.1.4. Cochlear Implants

- 7.1.1.5. Other Organ Types

- 7.1.2. Bionics

- 7.1.2.1. Vision Bionics

- 7.1.2.2. Ear Bionics

- 7.1.2.3. Orthopedic Bionic

- 7.1.2.4. Cardiac Bionics

- 7.1.1. Artificial Organ

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico Artificial Kidney Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Artificial Organ

- 8.1.1.1. Artificial Heart

- 8.1.1.2. Artificial Kidney

- 8.1.1.3. Artificial Lungs

- 8.1.1.4. Cochlear Implants

- 8.1.1.5. Other Organ Types

- 8.1.2. Bionics

- 8.1.2.1. Vision Bionics

- 8.1.2.2. Ear Bionics

- 8.1.2.3. Orthopedic Bionic

- 8.1.2.4. Cardiac Bionics

- 8.1.1. Artificial Organ

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Medtronic Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ossur

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Abiomed Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Cyberonics Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Esko Bionics

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Asahi Kasei Medical Co Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cochlear Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Boston Scientific Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Baxter International Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Berlin Heart GmbH

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Medtronic Inc

List of Figures

- Figure 1: Global Artificial Kidney Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Artificial Kidney Industry Volume Breakdown (Piece, %) by Region 2025 & 2033

- Figure 3: United States Artificial Kidney Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: United States Artificial Kidney Industry Volume (Piece), by Type 2025 & 2033

- Figure 5: United States Artificial Kidney Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: United States Artificial Kidney Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: United States Artificial Kidney Industry Revenue (Million), by Geography 2025 & 2033

- Figure 8: United States Artificial Kidney Industry Volume (Piece), by Geography 2025 & 2033

- Figure 9: United States Artificial Kidney Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: United States Artificial Kidney Industry Volume Share (%), by Geography 2025 & 2033

- Figure 11: United States Artificial Kidney Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: United States Artificial Kidney Industry Volume (Piece), by Country 2025 & 2033

- Figure 13: United States Artificial Kidney Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: United States Artificial Kidney Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Canada Artificial Kidney Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: Canada Artificial Kidney Industry Volume (Piece), by Type 2025 & 2033

- Figure 17: Canada Artificial Kidney Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Canada Artificial Kidney Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Canada Artificial Kidney Industry Revenue (Million), by Geography 2025 & 2033

- Figure 20: Canada Artificial Kidney Industry Volume (Piece), by Geography 2025 & 2033

- Figure 21: Canada Artificial Kidney Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 22: Canada Artificial Kidney Industry Volume Share (%), by Geography 2025 & 2033

- Figure 23: Canada Artificial Kidney Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Canada Artificial Kidney Industry Volume (Piece), by Country 2025 & 2033

- Figure 25: Canada Artificial Kidney Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Canada Artificial Kidney Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Mexico Artificial Kidney Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Mexico Artificial Kidney Industry Volume (Piece), by Type 2025 & 2033

- Figure 29: Mexico Artificial Kidney Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Mexico Artificial Kidney Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Mexico Artificial Kidney Industry Revenue (Million), by Geography 2025 & 2033

- Figure 32: Mexico Artificial Kidney Industry Volume (Piece), by Geography 2025 & 2033

- Figure 33: Mexico Artificial Kidney Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 34: Mexico Artificial Kidney Industry Volume Share (%), by Geography 2025 & 2033

- Figure 35: Mexico Artificial Kidney Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Mexico Artificial Kidney Industry Volume (Piece), by Country 2025 & 2033

- Figure 37: Mexico Artificial Kidney Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Mexico Artificial Kidney Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Artificial Kidney Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Artificial Kidney Industry Volume Piece Forecast, by Type 2020 & 2033

- Table 3: Global Artificial Kidney Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Artificial Kidney Industry Volume Piece Forecast, by Geography 2020 & 2033

- Table 5: Global Artificial Kidney Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Artificial Kidney Industry Volume Piece Forecast, by Region 2020 & 2033

- Table 7: Global Artificial Kidney Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Artificial Kidney Industry Volume Piece Forecast, by Type 2020 & 2033

- Table 9: Global Artificial Kidney Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Artificial Kidney Industry Volume Piece Forecast, by Geography 2020 & 2033

- Table 11: Global Artificial Kidney Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Artificial Kidney Industry Volume Piece Forecast, by Country 2020 & 2033

- Table 13: Global Artificial Kidney Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Artificial Kidney Industry Volume Piece Forecast, by Type 2020 & 2033

- Table 15: Global Artificial Kidney Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Artificial Kidney Industry Volume Piece Forecast, by Geography 2020 & 2033

- Table 17: Global Artificial Kidney Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Artificial Kidney Industry Volume Piece Forecast, by Country 2020 & 2033

- Table 19: Global Artificial Kidney Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Artificial Kidney Industry Volume Piece Forecast, by Type 2020 & 2033

- Table 21: Global Artificial Kidney Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Artificial Kidney Industry Volume Piece Forecast, by Geography 2020 & 2033

- Table 23: Global Artificial Kidney Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Artificial Kidney Industry Volume Piece Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Kidney Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Artificial Kidney Industry?

Key companies in the market include Medtronic Inc , Ossur, Abiomed Inc, Cyberonics Inc, Esko Bionics, Asahi Kasei Medical Co Ltd, Cochlear Ltd, Boston Scientific Corporation, Baxter International Inc, Berlin Heart GmbH.

3. What are the main segments of the Artificial Kidney Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Incidence of Disabilities and Organ Failures; High Incidence of Road Accidents Leading to Amputations; Technological Advancements in the Artificial Organ and Bionics.

6. What are the notable trends driving market growth?

Artificial Kidney Segment is Estimated to Witness a Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Procedures; Risk of Compatibility Issues and Malfunctions.

8. Can you provide examples of recent developments in the market?

August 2022: The United States Department of Health and Human Services (HHS) and the American Society of Nephrology (ASN) unveiled a fresh prize competition through the Kidney Innovation Accelerator (KidneyX). This competition aims to advance the development of a fully functional bioartificial kidney.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Piece.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Kidney Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Kidney Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Kidney Industry?

To stay informed about further developments, trends, and reports in the Artificial Kidney Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence