Key Insights

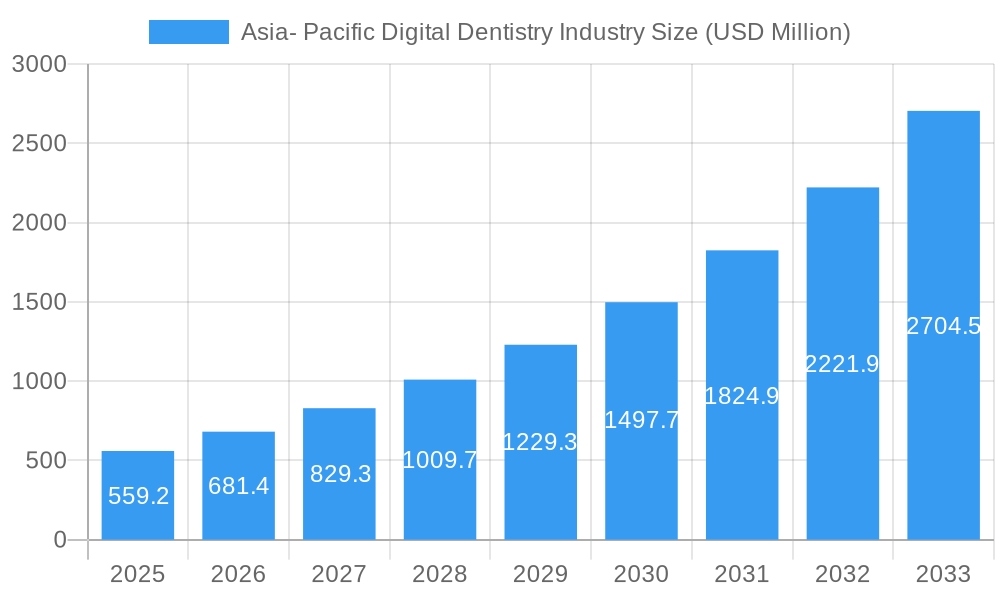

The Asia-Pacific digital dentistry market is poised for remarkable expansion, projected to reach USD 559.2 million by 2025, driven by an impressive compound annual growth rate (CAGR) of 21.78% over the forecast period. This robust growth is underpinned by several key factors, including increasing adoption of advanced dental technologies, a rising awareness of oral healthcare, and a burgeoning demand for aesthetically pleasing and functional dental solutions. The "instruments" segment is expected to lead the market, supported by continuous innovation in areas like intraoral scanners, 3D printers, and CAD/CAM systems that enhance precision and efficiency in dental procedures. Furthermore, the "consumables" segment is also set for significant growth as digital workflows necessitate specialized materials for restorative and prosthetic applications. Hospitals and dental clinics, recognizing the benefits of digital dentistry in improving patient outcomes and operational efficiency, are key end-users fueling this market surge.

Asia- Pacific Digital Dentistry Industry Market Size (In Million)

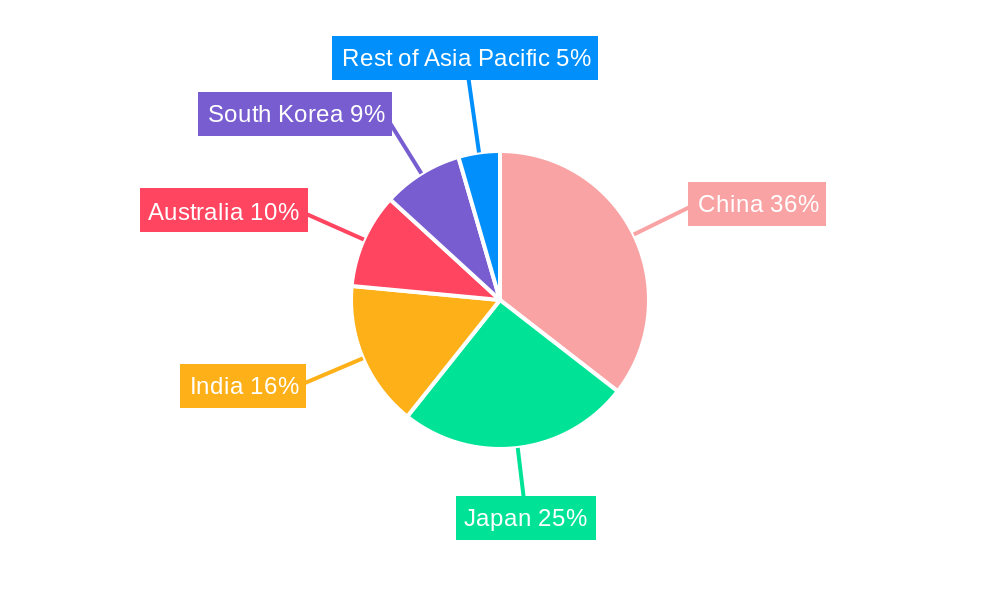

Geographically, the market in the Asia-Pacific region is characterized by strong performance in established markets like China and Japan, which are rapidly integrating digital solutions into their healthcare infrastructure. Emerging economies such as India are also demonstrating substantial growth potential, driven by increasing disposable incomes, a growing dental tourism sector, and government initiatives promoting advanced healthcare access. Australia and South Korea continue to be significant contributors, benefiting from a mature digital infrastructure and a proactive approach to adopting cutting-edge dental technologies. While restraints such as the initial high cost of digital equipment and the need for specialized training can pose challenges, the overwhelming benefits of digital dentistry, including enhanced patient comfort, reduced treatment times, and superior diagnostic capabilities, are expected to outweigh these limitations, ensuring sustained market momentum. Key players like Dentsply Sirona, Align Technology, and Planmeca are actively investing in research and development and strategic partnerships to capture a significant share of this dynamic market.

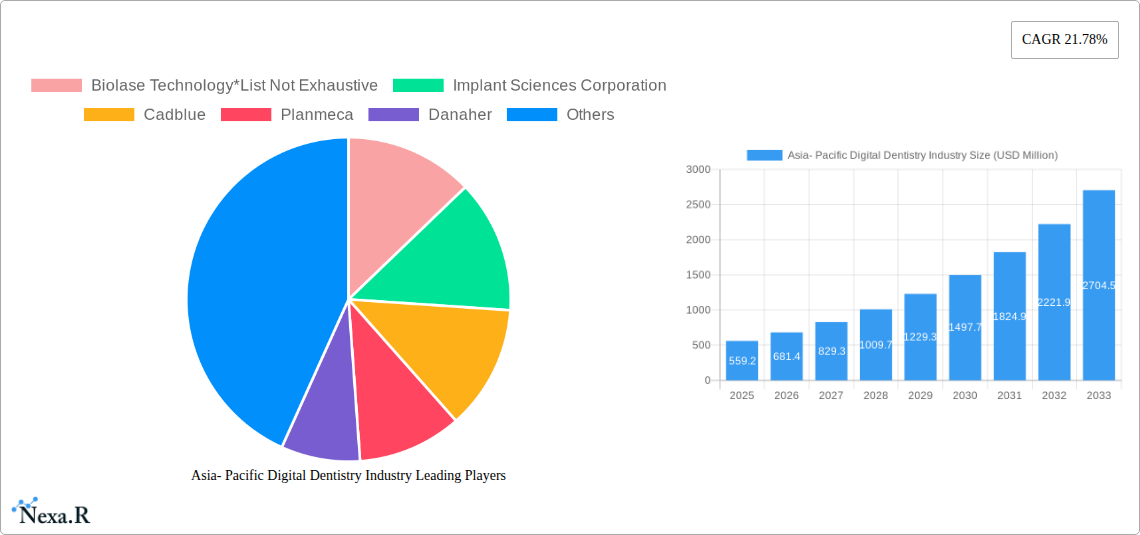

Asia- Pacific Digital Dentistry Industry Company Market Share

This comprehensive report delves into the dynamic Asia-Pacific Digital Dentistry Industry, offering an in-depth analysis of market size, growth drivers, emerging trends, and key players. With a study period spanning from 2019 to 2033, this report provides invaluable insights for industry professionals, investors, and stakeholders seeking to navigate and capitalize on the burgeoning digital transformation in dental care across China, Japan, India, Australia, South Korea, and the rest of the Asia-Pacific region. The report focuses on segments including Instruments, Consumables, and End Users such as Hospitals, Dental Clinics, and Others, presenting all monetary values in million units.

Asia- Pacific Digital Dentistry Industry Market Dynamics & Structure

The Asia-Pacific digital dentistry market is characterized by a moderately concentrated landscape, with a blend of established global players and rapidly emerging regional innovators. Technological innovation remains the paramount driver, propelled by advancements in AI-powered diagnostics, 3D printing for prosthetics and aligners, and integrated CAD/CAM systems. Regulatory frameworks are evolving to accommodate these rapid technological shifts, with a growing emphasis on data security and interoperability standards. Competitive product substitutes are emerging, particularly in the realm of traditional dental practices versus fully digital workflows, yet the superior precision and efficiency of digital solutions are increasingly favored. End-user demographics are shifting towards a more tech-savvy patient base with growing disposable incomes, demanding aesthetically pleasing and minimally invasive treatments. Mergers and acquisitions (M&A) are a significant trend, as larger corporations seek to consolidate their market position and acquire innovative technologies. For instance, the acquisition of Osteon Medical by Keystone Dental Inc. in November 2021 signifies a strategic move to bolster digital workflow capabilities.

- Market Concentration: Moderately concentrated with a few dominant global players alongside a growing number of specialized regional companies.

- Technological Innovation Drivers: AI for diagnostics, advanced 3D printing, integrated CAD/CAM systems, and patient-specific treatment planning.

- Regulatory Frameworks: Evolving to address data privacy, cybersecurity, and device approval for digital dental technologies.

- Competitive Product Substitutes: Traditional methods vs. digital workflows; increasing adoption of digital solutions due to benefits in precision and efficiency.

- End-User Demographics: Growing middle class, increased awareness of dental aesthetics, and demand for less invasive procedures.

- M&A Trends: Strategic acquisitions by established players to gain access to new technologies and market segments.

Asia- Pacific Digital Dentistry Industry Growth Trends & Insights

The Asia-Pacific digital dentistry market is poised for substantial expansion, driven by an escalating adoption rate of digital technologies across dental practices and laboratories. Market size is projected to witness a significant CAGR (Compound Annual Growth Rate) of xx% between 2025 and 2033, reaching an estimated value of $XXX million in 2025, and continuing its upward trajectory thereafter. This growth is fueled by technological disruptions such as the widespread integration of intraoral scanners, AI-driven treatment planning software, and advancements in biocompatible 3D printing materials. Consumer behavior is also shifting, with patients increasingly seeking personalized, efficient, and aesthetically superior dental care, which digital dentistry readily provides. The market penetration of digital dental solutions, while varying across countries, is steadily increasing, especially in developed economies like Japan and South Korea, and rapidly in emerging markets like India. Early adoption of digital technologies by forward-thinking dental professionals and institutions is setting new benchmarks for patient care. The increasing affordability and user-friendliness of digital dental equipment are further democratizing access to these advanced solutions, making them more accessible to a broader range of dental practitioners. Government initiatives promoting healthcare digitization and a rising awareness of oral health among the populace are also contributing to this positive growth trajectory.

Dominant Regions, Countries, or Segments in Asia- Pacific Digital Dentistry Industry

The Asia-Pacific digital dentistry industry's dominance is multifaceted, with distinct regions and segments exhibiting significant growth and influence. China stands out as a key driver of market expansion, fueled by its massive population, burgeoning middle class, and substantial investments in healthcare infrastructure and technological adoption. The country's rapidly growing dental clinics and hospitals are increasingly embracing digital dentistry solutions to improve patient care and operational efficiency. Japan, with its advanced technological landscape and highly educated populace, continues to be a mature market for sophisticated digital dental technologies, particularly in areas like orthodontics and prosthodontics. India presents a high-growth potential market, driven by increasing disposable incomes, a growing awareness of oral hygiene, and a large base of dental practitioners seeking to upgrade their practices. Australia and South Korea are also significant contributors, characterized by early adoption rates and a strong emphasis on research and development.

Within the segment breakdown, Instruments are projected to hold the largest market share, driven by the increasing demand for CAD/CAM systems, intraoral scanners, and 3D printers for both chairside and laboratory applications. Dental Clinics represent the dominant end-user segment, as these facilities are at the forefront of adopting digital technologies for direct patient treatment.

- Dominant Geography: China, due to its large population and increasing healthcare investments.

- Key Drivers in China: Growing middle class, government initiatives for healthcare modernization, and a large number of dental clinics and hospitals adopting digital solutions.

- Mature Market: Japan, with its established technological infrastructure and high demand for advanced dental solutions.

- High Growth Potential: India, driven by rising disposable incomes and increasing dental awareness.

- Dominant Segment (Type): Instruments, including CAD/CAM systems, intraoral scanners, and 3D printers.

- Dominant Segment (End User): Dental Clinics, leveraging digital solutions for direct patient care and operational efficiency.

- Market Share & Growth Potential: China is expected to command a significant market share, with India showing the highest growth potential due to its expanding healthcare sector.

Asia- Pacific Digital Dentistry Industry Product Landscape

The product landscape in the Asia-Pacific digital dentistry industry is characterized by continuous innovation, focusing on enhancing precision, efficiency, and patient comfort. Key product categories include advanced CAD/CAM milling machines for creating crowns and bridges with unparalleled accuracy, sophisticated intraoral scanners that capture detailed 3D digital impressions in minutes, and high-resolution 3D printers capable of producing surgical guides, dentures, and orthodontic aligners. Software solutions are also integral, with AI-powered diagnostic tools and treatment planning platforms streamlining workflows from initial consultation to final restoration. The unique selling proposition of these products lies in their ability to reduce chair time, minimize patient discomfort, and deliver superior aesthetic and functional outcomes. Technological advancements are leading to faster printing speeds, more biocompatible materials, and seamless integration between different digital components, creating a truly interconnected digital dental ecosystem.

Key Drivers, Barriers & Challenges in Asia- Pacific Digital Dentistry Industry

The Asia-Pacific digital dentistry industry is propelled by several key drivers. The increasing demand for aesthetically pleasing and minimally invasive dental treatments is a significant factor, as digital technologies enable highly precise and predictable outcomes. Technological advancements, including the miniaturization and increased affordability of digital equipment, are making these solutions accessible to a wider range of dental professionals. Furthermore, growing disposable incomes across the region are leading to increased patient willingness to invest in advanced dental care.

However, the industry faces certain barriers and challenges. The initial cost of investment for digital equipment can be substantial, posing a hurdle for smaller dental practices. A lack of adequate training and technical expertise among some dental professionals can also impede adoption. Regulatory hurdles related to data privacy and device certification can slow down market penetration in certain countries. Furthermore, a lack of interoperability between different digital systems from various manufacturers can create integration challenges.

- Key Drivers:

- Demand for aesthetic and minimally invasive dental treatments.

- Technological advancements and decreasing equipment costs.

- Rising disposable incomes and increased patient spending on healthcare.

- Key Barriers & Challenges:

- High initial investment costs for digital equipment.

- Shortage of skilled professionals trained in digital dentistry.

- Navigating complex and evolving regulatory landscapes.

- Ensuring interoperability between diverse digital platforms.

- Supply chain disruptions impacting the availability of components and materials.

Emerging Opportunities in Asia- Pacific Digital Dentistry Industry

Emerging opportunities in the Asia-Pacific digital dentistry industry are abundant and diverse. The untapped potential in rural and semi-urban areas of countries like India and Southeast Asian nations presents a significant growth avenue as digital solutions become more accessible. The development of AI-driven predictive diagnostics for early detection of oral diseases, such as oral cancer, offers a revolutionary application. Evolving consumer preferences for personalized and convenient dental care are driving demand for at-home aligner solutions and teledentistry platforms, which leverage digital technologies for remote consultations and treatment monitoring. Furthermore, the integration of digital dentistry with general healthcare, focusing on the oral-systemic health connection, is an emerging frontier.

- Untapped Markets: Expansion into rural and semi-urban areas across the region.

- Innovative Applications: AI for predictive diagnostics and early disease detection.

- Evolving Consumer Preferences: Growth in at-home aligner solutions and teledentistry.

- Integrated Healthcare: Focus on the oral-systemic health connection.

Growth Accelerators in the Asia- Pacific Digital Dentistry Industry Industry

Several catalysts are accelerating the long-term growth of the Asia-Pacific digital dentistry industry. Continued technological breakthroughs in areas such as bio-printing of dental tissues, advanced materials science for prosthetics, and the development of more intuitive AI algorithms for treatment planning will significantly enhance capabilities. Strategic partnerships between technology providers, dental manufacturers, and educational institutions are crucial for driving widespread adoption and ensuring adequate training. Market expansion strategies, including targeted marketing campaigns and localized product offerings, will be essential for capturing market share in diverse economies. The increasing focus on preventive dentistry, facilitated by digital diagnostic tools, is also a significant growth accelerator.

Key Players Shaping the Asia- Pacific Digital Dentistry Industry Market

- Biolase Technology

- Implant Sciences Corporation

- Cadblue

- Planmeca

- Danaher

- Zimmer Biomet

- Dentsply Sirona

- 3 Shape

- Align Technology

Notable Milestones in Asia- Pacific Digital Dentistry Industry Sector

- February 2022: Exocad, Align Technology Inc. announced participation in the 2022 Dental South China (DSC) trade show in Guangzhou, China, showcasing its software release DentalCAD 3.0 Galway and other open software solutions.

- November 2021: Keystone Dental Inc. completed the acquisition of Osteon Medical, a Melbourne, Australia-based technology company providing digital solutions for clinicians and dental laboratories, enhancing digital workflows.

In-Depth Asia- Pacific Digital Dentistry Industry Market Outlook

The Asia-Pacific digital dentistry industry is on an upward trajectory, with future market potential significantly influenced by ongoing technological innovation and strategic market expansion. The increasing integration of artificial intelligence into diagnostic and treatment planning software promises to revolutionize dental care, offering greater precision and personalized treatment pathways. Continued investment in research and development by key players will lead to the introduction of novel materials and advanced manufacturing techniques, further enhancing the efficacy and accessibility of digital dental solutions. Strategic collaborations between technology providers and dental educational institutions will be pivotal in upskilling the workforce, thereby accelerating adoption rates. Furthermore, the growing emphasis on preventive and personalized oral healthcare, strongly supported by digital technologies, will drive sustained market growth and create new avenues for innovation and revenue generation across the region.

Asia- Pacific Digital Dentistry Industry Segmentation

-

1. Type

- 1.1. Instruments

- 1.2. Consumables

-

2. End Users

- 2.1. Hospitals

- 2.2. Dental Clinics

- 2.3. Others

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia-Pacific

Asia- Pacific Digital Dentistry Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia- Pacific Digital Dentistry Industry Regional Market Share

Geographic Coverage of Asia- Pacific Digital Dentistry Industry

Asia- Pacific Digital Dentistry Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Better Dentistry and Better Aesthetic outcomes; Increase in the Disposable Income

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Digital Dentistry

- 3.4. Market Trends

- 3.4.1. The Instruments Segment is Expected to Hold a Major Market Share in the Digital Dentistry Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia- Pacific Digital Dentistry Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Instruments

- 5.1.2. Consumables

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Hospitals

- 5.2.2. Dental Clinics

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia- Pacific Digital Dentistry Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Instruments

- 6.1.2. Consumables

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. Hospitals

- 6.2.2. Dental Clinics

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. South Korea

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan Asia- Pacific Digital Dentistry Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Instruments

- 7.1.2. Consumables

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. Hospitals

- 7.2.2. Dental Clinics

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. South Korea

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia- Pacific Digital Dentistry Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Instruments

- 8.1.2. Consumables

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. Hospitals

- 8.2.2. Dental Clinics

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. South Korea

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia- Pacific Digital Dentistry Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Instruments

- 9.1.2. Consumables

- 9.2. Market Analysis, Insights and Forecast - by End Users

- 9.2.1. Hospitals

- 9.2.2. Dental Clinics

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. South Korea

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Asia- Pacific Digital Dentistry Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Instruments

- 10.1.2. Consumables

- 10.2. Market Analysis, Insights and Forecast - by End Users

- 10.2.1. Hospitals

- 10.2.2. Dental Clinics

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. South Korea

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia- Pacific Digital Dentistry Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Instruments

- 11.1.2. Consumables

- 11.2. Market Analysis, Insights and Forecast - by End Users

- 11.2.1. Hospitals

- 11.2.2. Dental Clinics

- 11.2.3. Others

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Japan

- 11.3.3. India

- 11.3.4. Australia

- 11.3.5. South Korea

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Biolase Technology*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Implant Sciences Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cadblue

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Planmeca

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Danaher

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Zimmer Biomet

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dentsply Sirona

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 3 Shape

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Align Technology

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Biolase Technology*List Not Exhaustive

List of Figures

- Figure 1: Asia- Pacific Digital Dentistry Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia- Pacific Digital Dentistry Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 3: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 7: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 11: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 15: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 19: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 23: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 27: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Asia- Pacific Digital Dentistry Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia- Pacific Digital Dentistry Industry?

The projected CAGR is approximately 21.78%.

2. Which companies are prominent players in the Asia- Pacific Digital Dentistry Industry?

Key companies in the market include Biolase Technology*List Not Exhaustive, Implant Sciences Corporation, Cadblue, Planmeca, Danaher, Zimmer Biomet, Dentsply Sirona, 3 Shape, Align Technology.

3. What are the main segments of the Asia- Pacific Digital Dentistry Industry?

The market segments include Type, End Users, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Better Dentistry and Better Aesthetic outcomes; Increase in the Disposable Income.

6. What are the notable trends driving market growth?

The Instruments Segment is Expected to Hold a Major Market Share in the Digital Dentistry Market.

7. Are there any restraints impacting market growth?

High Cost Associated with the Digital Dentistry.

8. Can you provide examples of recent developments in the market?

In February 2022, Exocad, Align technology Inc company announced its participation in the 2022 Dental South China (DSC) trade show in Guangzhou, China. Exocad showcased its software release DentalCAD3.0 Galway, plus other open software solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia- Pacific Digital Dentistry Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia- Pacific Digital Dentistry Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia- Pacific Digital Dentistry Industry?

To stay informed about further developments, trends, and reports in the Asia- Pacific Digital Dentistry Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence