Key Insights

The Asia-Pacific domestic courier market is poised for substantial expansion, projected to reach $172.37 billion by 2025. This growth is fueled by the region's booming e-commerce sector, increasing cross-border trade, and the adoption of advanced logistics technologies. An anticipated Compound Annual Growth Rate (CAGR) of 7.7% between 2025 and 2033 underscores this significant market trajectory. Key growth catalysts include the surge in online shopping, particularly in emerging economies, business expansion into new markets, and a heightened demand for efficient delivery services across diverse industries such as healthcare, manufacturing, and financial services. The market is segmented by delivery speed (express and non-express), shipment weight (light, medium, and heavy), end-user industry (with e-commerce as the dominant segment), and business models (B2B, B2C, and C2C). Intense competition exists among major players like DHL, FedEx, UPS, and numerous regional logistics providers. The growing demand for expedited and reliable delivery is driving investment in technology upgrades, including automated sorting systems and real-time tracking. Challenges such as fluctuating fuel prices, infrastructure limitations in certain areas, and evolving consumer expectations for transparency and speed persist. Market growth is expected to be uneven, with countries possessing robust digital infrastructure and strong e-commerce penetration experiencing more rapid expansion. Strategic partnerships, technological innovation, and efficient last-mile delivery solutions are critical for success in this dynamic market.

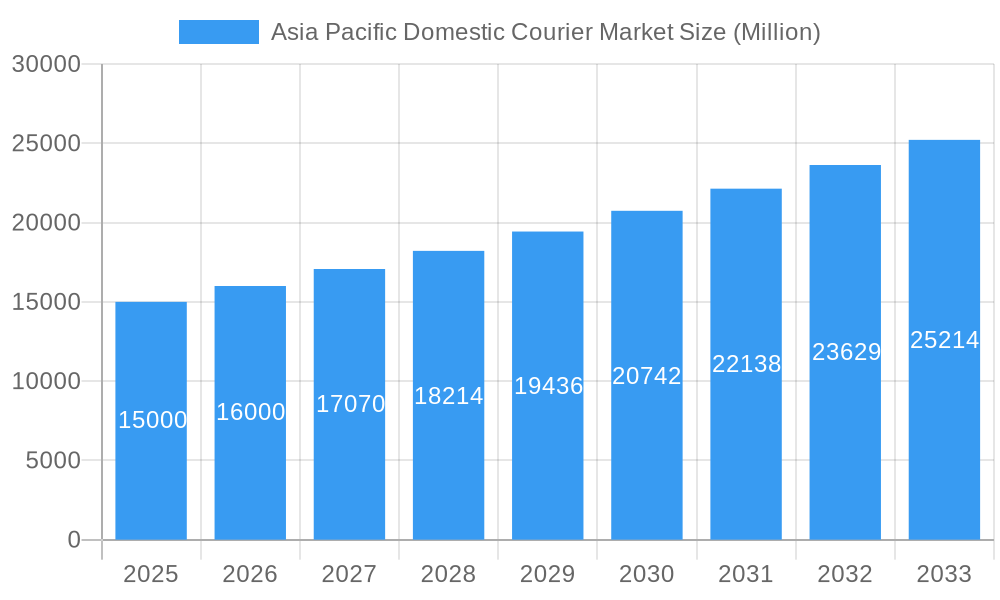

Asia Pacific Domestic Courier Market Market Size (In Billion)

The market's segmentation offers both opportunities and complexities. The e-commerce segment is expected to retain its leading position, driven by a growing middle class and increasing internet and smartphone penetration. However, growth in sub-segments like heavier shipments for manufacturing and industrial goods presents lucrative avenues for specialized courier services. The diverse range of business models necessitates adaptable service offerings and pricing strategies to cater to unique segment needs. This requires operational flexibility and technological integration to enable efficient scaling of services while maintaining high quality and competitive pricing. Geographical variations in infrastructure and regulations will continue to shape market dynamics, compelling companies to adopt localized strategies to navigate logistical challenges and regulatory environments.

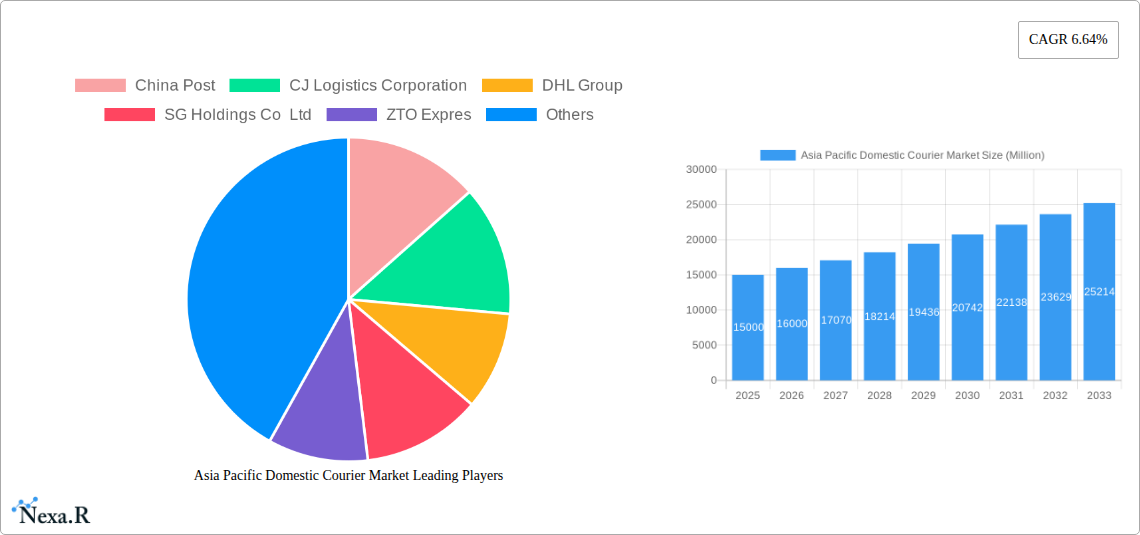

Asia Pacific Domestic Courier Market Company Market Share

Asia Pacific Domestic Courier Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a deep dive into the Asia Pacific domestic courier market, analyzing its current state, growth trajectories, and future potential. Valued at xx Million units in 2025, the market is poised for significant expansion, driven by the region's burgeoning e-commerce sector and increasing demand for efficient logistics solutions. The report covers the period from 2019 to 2033, with 2025 serving as the base year. Key segments analyzed include express and non-express delivery, varying shipment weights (light, medium, heavy), diverse end-user industries, and prevalent business models (B2B, B2C, C2C). Leading players like China Post, DHL Group, FedEx, and SF Express are profiled, offering insights into their market strategies and competitive landscape.

Asia Pacific Domestic Courier Market Dynamics & Structure

The Asia Pacific domestic courier market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is relatively high, with a few major players dominating significant market share, although numerous smaller regional players also compete. Technological advancements, such as AI-powered delivery solutions and automated sorting systems, are key innovation drivers, but high implementation costs and infrastructure limitations present barriers. Regulatory frameworks vary across countries, impacting operational efficiency and compliance. Competitive product substitutes, such as postal services and specialized delivery networks, exert pressure on pricing and service offerings. The market exhibits diverse end-user demographics, with e-commerce driving substantial volume. M&A activity is moderate, with larger players consolidating their market position through acquisitions of smaller, specialized firms.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Technological Innovation: AI, automation, and IoT are key drivers, but high initial investment poses challenges.

- Regulatory Frameworks: Vary significantly across countries, impacting operational costs and ease of entry.

- Competitive Substitutes: Postal services and niche delivery networks offer alternatives.

- End-User Demographics: E-commerce is the primary growth driver, followed by other sectors like manufacturing and healthcare.

- M&A Activity: xx deals were recorded between 2019 and 2024, with a projected xx deals by 2033.

Asia Pacific Domestic Courier Market Growth Trends & Insights

The Asia Pacific domestic courier market has demonstrated exceptional resilience and robust expansion over the historical period (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of approximately **12.5%**. This impressive growth trajectory is primarily propelled by the relentless surge in e-commerce penetration across the region, with key contributors including China, India, Indonesia, and Vietnam. The escalating pace of urbanization, coupled with a significant increase in disposable incomes, further fuels the market's expansion by driving consumer demand for goods and services. Technological innovations, notably the integration of Artificial Intelligence (AI) and advanced automation within logistics operations, have been instrumental in revolutionizing efficiency and significantly accelerating delivery speeds, thereby elevating customer satisfaction levels. Evolving consumer preferences, characterized by an increasing demand for faster, more reliable, and transparent delivery options, have directly amplified the need for premium express courier services. We project a sustained CAGR of **11.8%** during the forecast period (2025-2033), with the market size anticipated to reach approximately **USD 350 Billion** by 2033. The market penetration for express delivery services is expected to climb from **65%** in 2025 to a substantial **78%** by 2033.

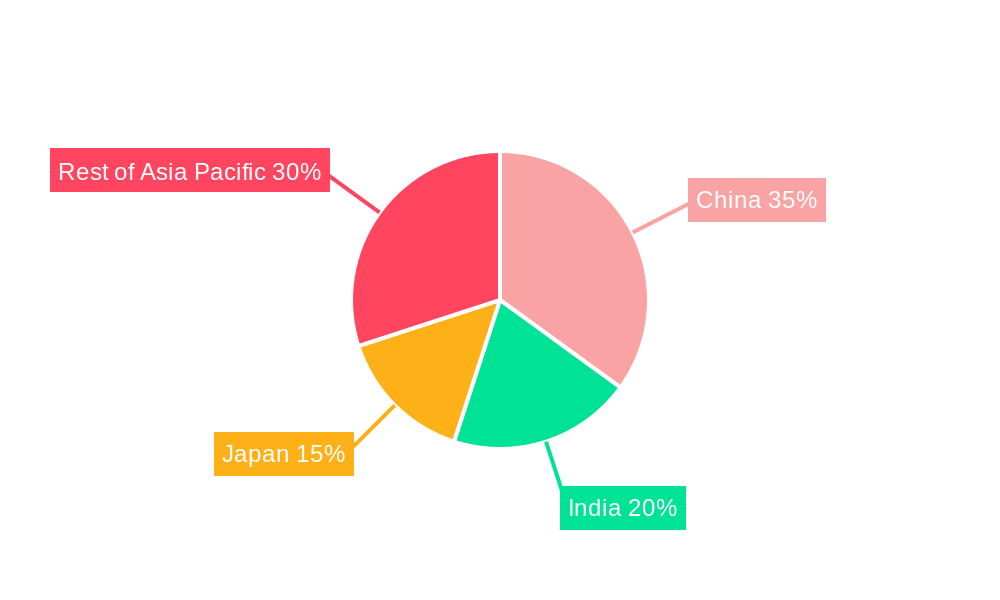

Dominant Regions, Countries, or Segments in Asia Pacific Domestic Courier Market

China remains the dominant market in the Asia Pacific region, accounting for approximately xx% of the total market value in 2025, driven by its massive e-commerce sector and robust logistics infrastructure. India and Indonesia are also experiencing significant growth, propelled by expanding internet penetration and rising consumer spending. Within the segments, the express delivery segment holds the largest market share, exceeding xx% in 2025, due to increasing customer preference for faster delivery. E-commerce continues to be the largest end-user industry, contributing over xx% of the overall market volume. The B2C model dominates, reflecting the growth in online shopping.

Key Growth Drivers:

- Booming e-commerce sector in China, India, and Southeast Asia.

- Rapid urbanization and rising middle class.

- Government initiatives promoting digitalization and infrastructure development.

- Technological advancements improving efficiency and delivery speed.

Dominant Factors:

- China's massive market size and advanced logistics infrastructure.

- India's rapid digitalization and growing e-commerce penetration.

- Southeast Asia's young population and high mobile phone usage.

- High demand for express delivery services across the region.

Asia Pacific Domestic Courier Market Product Landscape

The Asia Pacific domestic courier market showcases a diverse product landscape, with offerings ranging from standard courier services to specialized solutions for temperature-sensitive goods and high-value items. Key product innovations include the integration of AI and machine learning for optimized route planning and delivery, real-time tracking and delivery notifications, and enhanced packaging solutions for improved product protection. These innovations aim to enhance efficiency, reduce costs, and improve the overall customer experience. Unique selling propositions revolve around speed, reliability, tracking capabilities, and specialized handling for various goods. Technological advancements are focused on automation, digitization, and sustainability.

Key Drivers, Barriers & Challenges in Asia Pacific Domestic Courier Market

Key Drivers: The foundational drivers of this dynamic market include the phenomenal and ongoing expansion of the e-commerce ecosystem, a growing middle class with rising disposable incomes, rapid urbanization leading to concentrated consumer bases, and proactive government initiatives aimed at bolstering infrastructure development, including logistics networks. Furthermore, cutting-edge technological advancements, such as the implementation of AI-powered route optimization, predictive analytics for demand forecasting, and enhanced real-time tracking systems, are crucial in boosting operational efficiency and significantly improving the overall customer experience.

Challenges & Restraints: The market faces several headwinds that can impact profitability and operational fluidity. These include the inherent volatility of fuel costs, fluctuating currency exchange rates which affect international and domestic pricing, and the escalating labor costs associated with a growing demand for skilled logistics personnel. Navigating complex and often disparate regulatory landscapes and differing operational standards across various countries present significant logistical and compliance challenges. The intensely competitive nature of the market, characterized by the presence of both well-established giants and agile new entrants, exerts considerable price pressures and can constrain profit margins. Additionally, the inherent susceptibility of supply chains to disruptions, as starkly highlighted during global events like the COVID-19 pandemic, underscores the ongoing need for enhanced resilience and contingency planning. The cumulative impact of these challenges is estimated to temper the market's annual growth rate by approximately **2-3%**.

Emerging Opportunities in Asia Pacific Domestic Courier Market

Untapped markets in rural areas and smaller cities present significant growth potential. The increasing adoption of drone technology for last-mile delivery offers cost-effective solutions, particularly in challenging terrains. The growing demand for specialized services, such as cold chain logistics for pharmaceuticals and perishable goods, creates new opportunities for market expansion. Personalized delivery options and enhanced customer service are key to gaining competitive advantage.

Growth Accelerators in the Asia Pacific Domestic Courier Market Industry

Strategic partnerships and collaborations between courier companies and e-commerce platforms can unlock significant growth potential. Investments in advanced technologies, such as AI and blockchain, can streamline operations and enhance security. Market expansion into new geographical areas and the development of innovative services tailored to specific industries will fuel future growth.

Key Players Shaping the Asia Pacific Domestic Courier Market Market

- China Post Group Corporation Limited

- CJ Logistics Corporation

- DHL Group

- SG Holdings Co Ltd (owner of Sagawa Express)

- ZTO Express (Cayman) Inc.

- FedEx Corporation

- United Parcel Service of America Inc (UPS)

- YTO Express (Logistics) Co., Ltd.

- Yamato Holdings Co., Ltd. (owner of Yamato Transport)

- SF Express (KEX-SF)

- Blue Dart Express Limited

- DTDC Express Limited

- Toll Group (a division of Japan Post Holdings)

- JWD Group (JWD InfoLogistics Public Company Limited)

Notable Milestones in Asia Pacific Domestic Courier Market Sector

- June 2023: China Post launches its first integrated indoor and outdoor “Robot Plus” AI delivery solution, enhancing last-mile delivery efficiency.

- April 2023: China Post and Ping An Bank launch an intelligent archives service center, integrating auto finance and logistics services.

- March 2023: Colowide MD Co. Ltd and Yamato Transport Co. Ltd agree to optimize the Colowide Group supply chain, showcasing technological collaboration within the sector.

In-Depth Asia Pacific Domestic Courier Market Market Outlook

The Asia Pacific domestic courier market is strategically positioned for continued and significant growth, underpinned by the persistent and expanding influence of e-commerce, the ongoing integration of transformative technological advancements, and supportive government policies aimed at fostering trade and logistics. To maintain a competitive edge and capitalize on emerging opportunities, strategic and substantial investments in upgrading physical infrastructure, embracing advanced automation solutions, and accelerating digital transformation initiatives will be paramount. Companies that prioritize the development and deployment of innovative service offerings, champion sustainable operational practices, and maintain an unwavering focus on delivering exceptional customer-centric experiences are best poised to thrive and lead in this dynamic and rapidly evolving market landscape. The market is therefore expected to maintain a healthy and consistent growth trajectory, presenting lucrative and abundant opportunities for both established, leading players and ambitious new entrants seeking to carve out their niche.

Asia Pacific Domestic Courier Market Segmentation

-

1. Speed Of Delivery

- 1.1. Express

- 1.2. Non-Express

-

2. Shipment Weight

- 2.1. Heavy Weight Shipments

- 2.2. Light Weight Shipments

- 2.3. Medium Weight Shipments

-

3. End User Industry

- 3.1. E-Commerce

- 3.2. Financial Services (BFSI)

- 3.3. Healthcare

- 3.4. Manufacturing

- 3.5. Primary Industry

- 3.6. Wholesale and Retail Trade (Offline)

- 3.7. Others

-

4. Model

- 4.1. Business-to-Business (B2B)

- 4.2. Business-to-Consumer (B2C)

- 4.3. Consumer-to-Consumer (C2C)

Asia Pacific Domestic Courier Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Domestic Courier Market Regional Market Share

Geographic Coverage of Asia Pacific Domestic Courier Market

Asia Pacific Domestic Courier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Domestic Courier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.1.1. Express

- 5.1.2. Non-Express

- 5.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.2.1. Heavy Weight Shipments

- 5.2.2. Light Weight Shipments

- 5.2.3. Medium Weight Shipments

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. E-Commerce

- 5.3.2. Financial Services (BFSI)

- 5.3.3. Healthcare

- 5.3.4. Manufacturing

- 5.3.5. Primary Industry

- 5.3.6. Wholesale and Retail Trade (Offline)

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Model

- 5.4.1. Business-to-Business (B2B)

- 5.4.2. Business-to-Consumer (B2C)

- 5.4.3. Consumer-to-Consumer (C2C)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CJ Logistics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SG Holdings Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ZTO Expres

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Parcel Service of America Inc (UPS)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 YTO Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamato Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SF Express (KEX-SF)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Blue Dart Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC Express Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Toll Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 JWD Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 China Post

List of Figures

- Figure 1: Asia Pacific Domestic Courier Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Domestic Courier Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Domestic Courier Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 2: Asia Pacific Domestic Courier Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 3: Asia Pacific Domestic Courier Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Asia Pacific Domestic Courier Market Revenue billion Forecast, by Model 2020 & 2033

- Table 5: Asia Pacific Domestic Courier Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Domestic Courier Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 7: Asia Pacific Domestic Courier Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 8: Asia Pacific Domestic Courier Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 9: Asia Pacific Domestic Courier Market Revenue billion Forecast, by Model 2020 & 2033

- Table 10: Asia Pacific Domestic Courier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia Pacific Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Domestic Courier Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia Pacific Domestic Courier Market?

Key companies in the market include China Post, CJ Logistics Corporation, DHL Group, SG Holdings Co Ltd, ZTO Expres, FedEx, United Parcel Service of America Inc (UPS), YTO Express, Yamato Holdings, SF Express (KEX-SF), Blue Dart Express, DTDC Express Limited, Toll Group, JWD Group.

3. What are the main segments of the Asia Pacific Domestic Courier Market?

The market segments include Speed Of Delivery, Shipment Weight, End User Industry, Model.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.37 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution in China. The intelligent delivery solution relies on a combination of unmanned vehicles outdoors and robots indoors, constructing an integrated indoor and outdoor unmanned distribution mode and developing a last-mile logistics network with AI transport capacity sharing.April 2023: China Post and the Automobile Consumption Financial Center of Ping An Bank Co. Ltd launched an intelligent archives service center in Guangdong to promote the service integration of auto finance and express and logistics businesses.March 2023: Colowide MD Co. Ltd, which oversees merchandising for the Colowide Group, and Yamato Transport Co. Ltd entered an agreement. The two companies will promote the visualization and optimization of the entire supply chain of Colowide Group, which operates multiple brands such as Gyu-Kaku, Kappa Sushi, and OOTOYA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Domestic Courier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Domestic Courier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Domestic Courier Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Domestic Courier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence