Key Insights

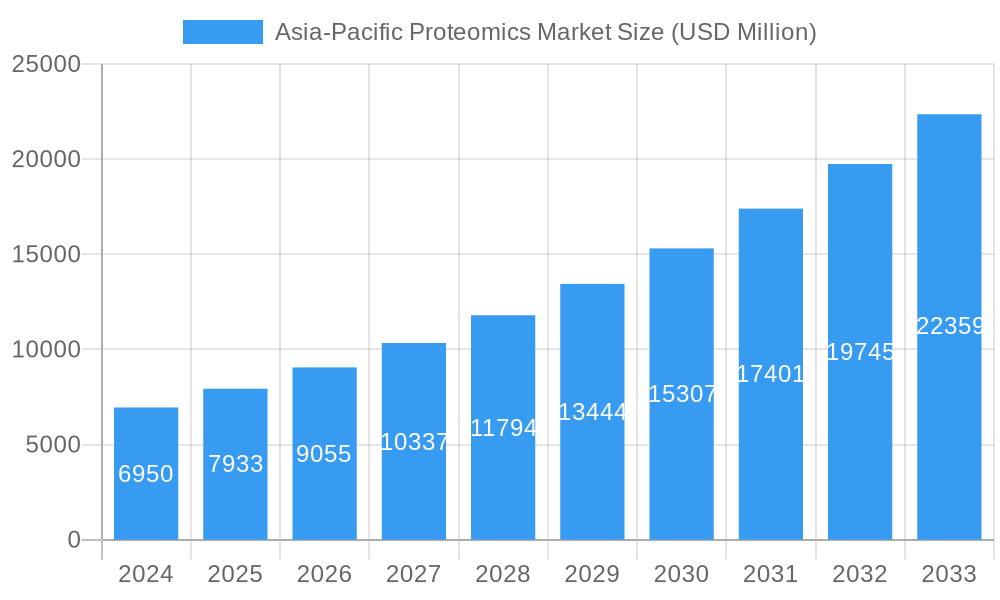

The Asia-Pacific proteomics market is poised for substantial expansion, driven by increasing investments in life sciences research, a growing prevalence of chronic diseases, and advancements in biotechnology. In 2024, the market is valued at an estimated USD 6.95 billion. This robust growth is fueled by the escalating demand for accurate diagnostics, personalized medicine, and novel drug development, areas where proteomics plays a pivotal role. Key drivers include the rapid adoption of advanced proteomic technologies such as mass spectrometry and protein microarrays, alongside a burgeoning pharmaceutical and biotechnology sector across countries like China, Japan, and India. These nations are actively pushing the boundaries of genomic and proteomic research, leading to a surge in demand for sophisticated instruments, reagents, software, and services. The market's trajectory indicates a significant upward trend, reflecting a growing understanding of the proteome's complexity and its implications for human health.

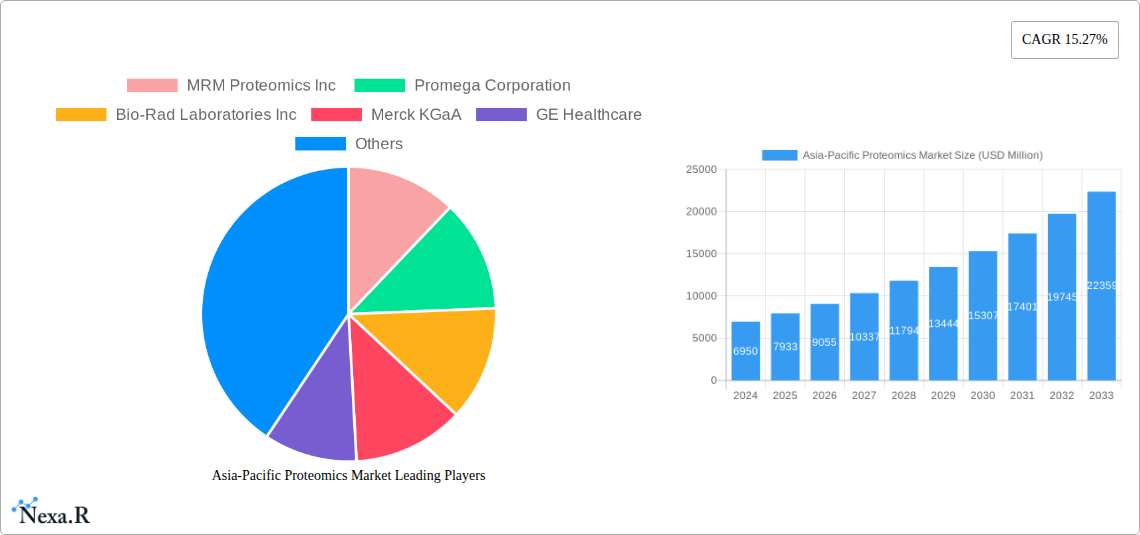

Asia-Pacific Proteomics Market Market Size (In Billion)

The projected CAGR of 14.01% from 2024 to 2033 underscores the dynamism and immense potential of the Asia-Pacific proteomics landscape. This accelerated growth is supported by a strong ecosystem of leading companies, including Thermo Fisher Scientific, Danaher Corporation, and Agilent Technologies, who are actively innovating and expanding their offerings to cater to regional needs. Emerging trends such as the integration of AI and machine learning in proteomic data analysis and the increasing use of proteomics in non-clinical applications like agriculture and environmental science are further diversifying the market. While the market demonstrates considerable promise, potential restraints may include the high cost of advanced proteomic instrumentation and a shortage of skilled bioinformatics professionals in certain sub-regions. However, the overall outlook remains overwhelmingly positive, driven by continuous technological advancements and a strong commitment to scientific progress across the Asia-Pacific region.

Asia-Pacific Proteomics Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia-Pacific Proteomics Market, providing crucial insights into its dynamics, growth trajectory, and future outlook. Covering the period from 2019 to 2033, with a focus on the base and estimated year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry professionals seeking to understand market concentration, technological innovations, regulatory landscapes, and competitive strategies. We delve into parent and child market segments, presenting all monetary values in billions of USD to ensure clarity and relevance.

Asia-Pacific Proteomics Market Dynamics & Structure

The Asia-Pacific proteomics market is characterized by a moderate to high level of concentration, driven by a few key global players and a growing number of regional innovators. Technological innovation is a primary driver, with continuous advancements in instrumentation and analytical techniques fueling market expansion. The regulatory framework, while evolving, is generally supportive of research and development in areas like drug discovery and clinical diagnostics. Competitive product substitutes, such as advanced genomics and transcriptomics, exist but proteomics offers unique insights into protein function and expression, maintaining its distinct value proposition. End-user demographics are shifting, with increasing demand from academic research institutions, pharmaceutical and biotechnology companies, and contract research organizations (CROs). Mergers and acquisitions (M&A) are a notable trend, as larger companies seek to acquire innovative technologies and expand their market reach.

- Market Concentration: Dominated by major players, but with increasing regional competition.

- Technological Innovation Drivers: Advancements in mass spectrometry, protein arrays, and bioinformatics.

- Regulatory Frameworks: Developing but increasingly favorable for R&D and diagnostics.

- Competitive Product Substitutes: Genomics, transcriptomics, and metabolomics.

- End-User Demographics: Growth in pharmaceutical, biotechnology, academic research, and diagnostics sectors.

- M&A Trends: Strategic acquisitions to enhance technological capabilities and market presence.

Asia-Pacific Proteomics Market Growth Trends & Insights

The Asia-Pacific proteomics market is poised for significant expansion, driven by the increasing application of proteomics in drug discovery, clinical diagnostics, and personalized medicine. The market size is projected to grow substantially, fueled by rising healthcare expenditures, a growing prevalence of chronic diseases, and increasing government initiatives supporting life sciences research. Adoption rates for advanced proteomics technologies are accelerating across the region, particularly in emerging economies like China and India, where investments in research infrastructure and biotechnology are surging. Technological disruptions, such as the development of high-throughput protein identification and quantification methods and the integration of artificial intelligence (AI) in data analysis, are revolutionizing the field. Consumer behavior shifts are also contributing, with a growing demand for more precise diagnostic tools and targeted therapies, which proteomics directly addresses. The market penetration of proteomics solutions is expected to deepen as awareness and accessibility increase.

Dominant Regions, Countries, or Segments in Asia-Pacific Proteomics Market

Within the Asia-Pacific proteomics market, several key regions and segments are driving substantial growth. China currently leads in market share, owing to its massive population, burgeoning biopharmaceutical industry, and significant government investment in scientific research and development. Japan and South Korea are also major contributors, characterized by their advanced technological infrastructure and strong presence of established pharmaceutical and diagnostic companies. India is emerging as a rapidly growing market, propelled by its cost-effective research capabilities, a large pool of skilled scientists, and increasing focus on drug discovery and development.

Dominant Segments:

Type: Instrument: The Spectroscopy segment, particularly mass spectrometry, is the largest contributor within instrumentation due to its indispensable role in protein identification and quantification. Chromatography is also a crucial component.

- Spectroscopy: Driven by high-resolution mass spectrometry for accurate protein analysis.

- Chromatography: Essential for protein separation and purification.

- Electrophoresis: Continued relevance for protein separation and characterization.

- Protein Microarrays: Growing applications in diagnostics and biomarker discovery.

- X-Ray Crystallography: Vital for understanding protein structures.

- Other Instrumentation Technologies: Including mass analyzers and sample preparation systems.

Application: Drug Discovery: This segment is a primary growth engine, with proteomics enabling deeper understanding of disease mechanisms, identification of novel drug targets, and evaluation of drug efficacy.

- Clinical Diagnostics: Rapidly expanding due to the potential for early disease detection and personalized treatment strategies.

- Other Applications: Including agricultural research, environmental monitoring, and food analysis.

Geography: China: Leads the market due to its extensive research funding, a large biopharmaceutical sector, and increasing adoption of advanced proteomic technologies.

- Japan: A mature market with significant investment in R&D and a strong focus on innovative therapies.

- India: A fast-growing market driven by cost-effectiveness and a burgeoning biotech industry.

- Australia: Strong in academic research and early-stage drug discovery.

- South Korea: A hub for biotechnology innovation and diagnostics development.

- Rest of Asia-Pacific: Emerging markets showing significant potential with increasing research investments.

Asia-Pacific Proteomics Market Product Landscape

The Asia-Pacific proteomics market is witnessing a surge in product innovations, ranging from advanced mass spectrometers with enhanced sensitivity and speed to user-friendly protein array platforms for high-throughput screening. Software solutions integrating AI and machine learning for complex proteomic data analysis are also gaining prominence. Key product applications span drug discovery (target identification, validation, and biomarker discovery), clinical diagnostics (early disease detection, patient stratification), and fundamental biological research. Unique selling propositions often lie in improved analytical accuracy, reduced turnaround times, and greater cost-effectiveness, enabling wider adoption across research institutions and commercial entities. Technological advancements focus on miniaturization, automation, and multiplexing capabilities to address the growing demand for comprehensive proteomic analysis.

Key Drivers, Barriers & Challenges in Asia-Pacific Proteomics Market

Key Drivers: The Asia-Pacific proteomics market is propelled by several key factors. Increasing investment in life sciences research and development by governments and private entities across the region is a significant catalyst. The growing prevalence of chronic and infectious diseases is driving demand for advanced diagnostic tools and targeted therapies, where proteomics plays a crucial role. Furthermore, technological advancements in mass spectrometry, chromatography, and bioinformatics are continuously improving the accuracy and efficiency of proteomic analysis, making it more accessible. The expanding biopharmaceutical and biotechnology sectors, particularly in China and India, are also major contributors.

- Government initiatives and funding for R&D.

- Rising burden of chronic diseases.

- Technological breakthroughs in analytical platforms.

- Growth of the biopharmaceutical industry.

Barriers & Challenges: Despite the strong growth potential, the market faces certain barriers and challenges. The high cost of sophisticated proteomics instrumentation and reagents can be a limiting factor, especially for smaller research institutions and companies. A shortage of skilled proteomics researchers and bioinformaticians also poses a challenge to widespread adoption and effective utilization of the technology. The complexity of proteomic data analysis and the need for standardized protocols can hinder reproducibility and interpretation. Moreover, evolving regulatory frameworks for novel diagnostic and therapeutic applications can create uncertainty and slow down market entry.

- High cost of instrumentation and consumables.

- Scarcity of skilled bioinformatics and proteomics experts.

- Complexity and standardization of data analysis.

- Navigating evolving regulatory pathways.

Emerging Opportunities in Asia-Pacific Proteomics Market

Emerging opportunities in the Asia-Pacific proteomics market are abundant, particularly in the realm of personalized medicine and precision oncology. The development of highly sensitive protein-based biomarkers for early cancer detection and treatment response monitoring presents a significant growth avenue. Furthermore, the application of proteomics in understanding the gut microbiome's impact on health and disease is an area ripe for exploration and commercialization. The increasing focus on infectious disease research and vaccine development, especially in light of recent global health events, also presents substantial opportunities for proteomic solutions. The growth of contract research organizations (CROs) offering specialized proteomics services is another key trend, catering to the outsourcing needs of the biopharmaceutical industry.

Growth Accelerators in the Asia-Pacific Proteomics Market Industry

Several catalysts are accelerating the growth of the Asia-Pacific proteomics market. Technological breakthroughs in AI and machine learning for proteomic data analysis are transforming the field, enabling faster and more accurate insights. Strategic partnerships and collaborations between instrument manufacturers, software developers, and research institutions are fostering innovation and market expansion. The increasing adoption of next-generation sequencing (NGS) platforms alongside proteomic analyses is providing a more comprehensive multi-omics approach to biological research. Furthermore, the growing demand for biotherapeutics and biosimilars necessitates advanced proteomic characterization, acting as a strong growth accelerator.

Key Players Shaping the Asia-Pacific Proteomics Market Market

- MRM Proteomics Inc.

- Promega Corporation

- Bio-Rad Laboratories Inc.

- Merck KGaA

- GE Healthcare

- Waters Corporation

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- Applied Biomics Inc.

- Bruker Corporation

Notable Milestones in Asia-Pacific Proteomics Market Sector

- March 2022: Biognosys, a leader in next-generation proteomics solutions for drug discovery and development, launched its expanded suite of protein platforms that provide pharmaceutical and diagnostics customers with deep biological insights across the entire R&D pipeline, from early-stage discovery to clinical settings.

- January 2022: Illumina, Inc. entered into a definitive co-development agreement with SomaLogic to bring the SomaScan Proteomics Assay onto Illumina's current and future high throughput next-generation sequencing (NGS) platforms in India.

In-Depth Asia-Pacific Proteomics Market Market Outlook

The Asia-Pacific proteomics market is characterized by robust future potential, driven by a confluence of technological innovation, increasing healthcare demands, and strategic market expansions. Growth accelerators such as advancements in AI-driven data analysis, collaborative research initiatives, and the synergistic integration of multi-omics approaches are paving the way for unprecedented discoveries. The market's trajectory is further bolstered by the expanding biopharmaceutical sector and the growing need for precision diagnostics. Strategic opportunities lie in addressing the unmet needs in personalized medicine, infectious disease research, and the development of novel therapeutics. As the region continues to invest in cutting-edge scientific infrastructure, the Asia-Pacific proteomics market is poised for sustained and significant growth, offering immense value to stakeholders across the life sciences ecosystem.

Asia-Pacific Proteomics Market Segmentation

-

1. Type

-

1.1. Instrument

- 1.1.1. Spectroscopy

- 1.1.2. Chromatography

- 1.1.3. Electrophoresis

- 1.1.4. Protein Microarrays

- 1.1.5. X-Ray Crystallography

- 1.1.6. Other Instrumentation Technologies

- 1.2. Reagents

- 1.3. Software and Services

-

1.1. Instrument

-

2. Application

- 2.1. Clinical Diagnostics

- 2.2. Drug Discovery

- 2.3. Other Applications

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. South Korea

- 3.1.6. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Proteomics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. South Korea

- 1.6. Rest of Asia Pacific

Asia-Pacific Proteomics Market Regional Market Share

Geographic Coverage of Asia-Pacific Proteomics Market

Asia-Pacific Proteomics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments

- 3.4. Market Trends

- 3.4.1. Drug Discovery Segment is Expected to Register a High Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Proteomics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Instrument

- 5.1.1.1. Spectroscopy

- 5.1.1.2. Chromatography

- 5.1.1.3. Electrophoresis

- 5.1.1.4. Protein Microarrays

- 5.1.1.5. X-Ray Crystallography

- 5.1.1.6. Other Instrumentation Technologies

- 5.1.2. Reagents

- 5.1.3. Software and Services

- 5.1.1. Instrument

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Clinical Diagnostics

- 5.2.2. Drug Discovery

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. South Korea

- 5.3.1.6. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MRM Proteomics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Promega Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bio-Rad Laboratories Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GE Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Waters Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thermo Fisher Scientific Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Danaher Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agilent Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Applied Biomics Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bruker Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 MRM Proteomics Inc

List of Figures

- Figure 1: Asia-Pacific Proteomics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Proteomics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Proteomics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Proteomics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: India Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: India Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Australia Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Australia Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: South Korea Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Asia-Pacific Proteomics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Asia-Pacific Proteomics Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Proteomics Market?

The projected CAGR is approximately 14.01%.

2. Which companies are prominent players in the Asia-Pacific Proteomics Market?

Key companies in the market include MRM Proteomics Inc , Promega Corporation, Bio-Rad Laboratories Inc, Merck KGaA, GE Healthcare, Waters Corporation, Thermo Fisher Scientific Inc, Danaher Corporation, Agilent Technologies Inc, Applied Biomics Inc, Bruker Corporation.

3. What are the main segments of the Asia-Pacific Proteomics Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements.

6. What are the notable trends driving market growth?

Drug Discovery Segment is Expected to Register a High Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Instruments.

8. Can you provide examples of recent developments in the market?

In March 2022, Biognosys, a leader in next-generation proteomics solutions for drug discovery and development, launched its expanded suite of protein platforms that provide pharmaceutical and diagnostics customers with deep biological insights across the entire R&D pipeline, from early-stage discovery to clinical settings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Proteomics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Proteomics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Proteomics Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Proteomics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence