Key Insights

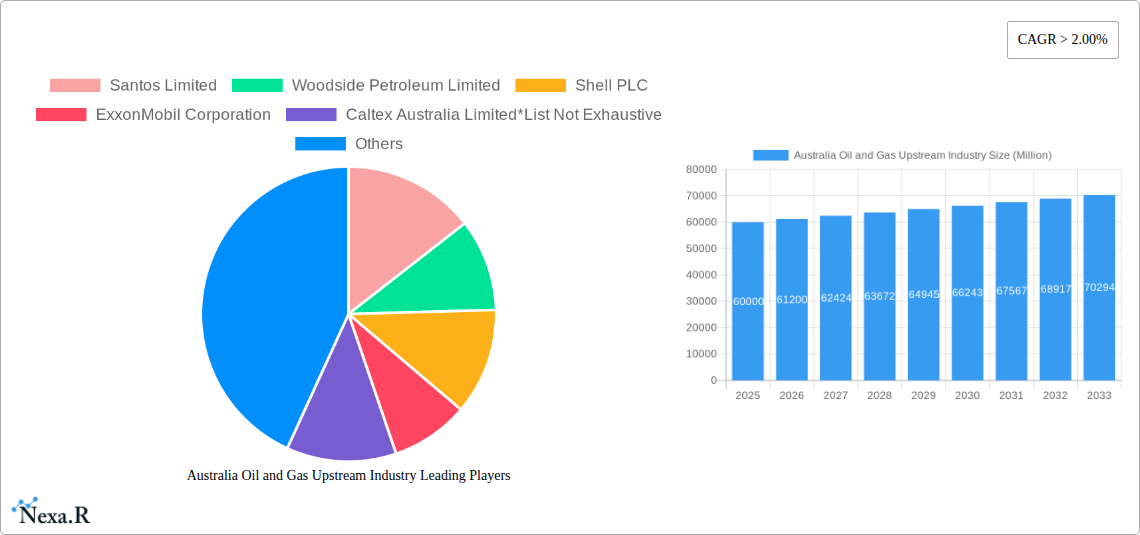

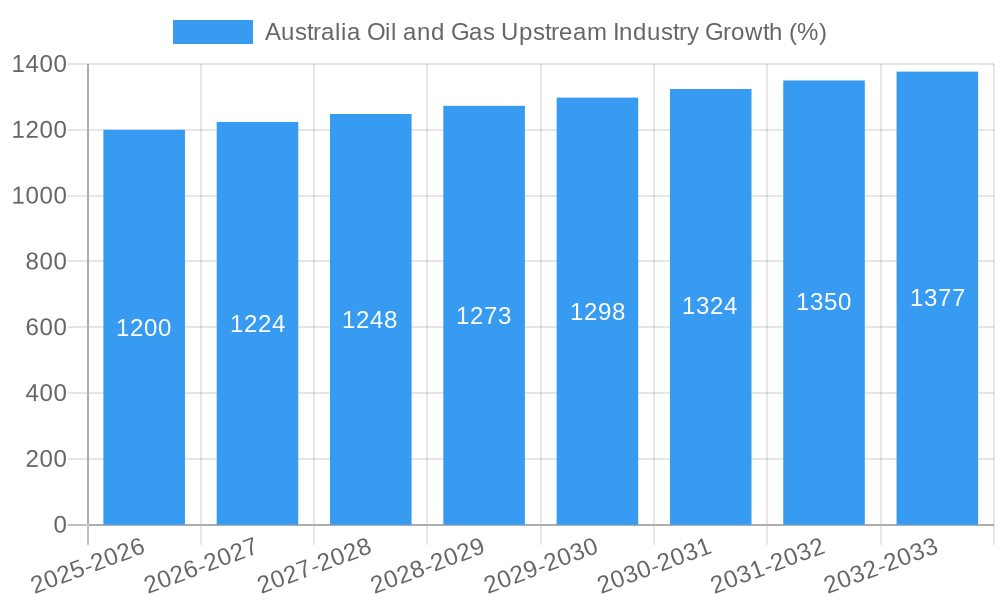

The Australian oil and gas upstream industry, encompassing onshore and offshore operations, presents a dynamic landscape characterized by moderate growth. While precise market size figures for 2025 aren't provided, considering a CAGR of over 2% and a value unit of millions, a reasonable estimate for the 2025 market size could be placed in the range of $50-70 billion AUD, given the significant investments and production levels of major players like Santos, Woodside, and Shell operating within the region. This growth is driven by sustained global energy demand, particularly for LNG exports from Australia which benefits from its strategic location and substantial reserves. Ongoing exploration and development activities, coupled with technological advancements in extraction methods (such as enhanced oil recovery techniques), further contribute to this upward trajectory. However, the industry faces constraints including fluctuating oil and gas prices, environmental regulations aimed at reducing carbon emissions, and increasing operational costs. These factors necessitate a strategic balance between production and sustainability. The onshore and offshore segments each present distinct opportunities and challenges; onshore operations may face community concerns regarding environmental impact and land access, while offshore ventures incur higher capital expenditures and operational complexities. The diverse range of companies operating within the sector, reflecting both domestic and international players, underlines the competitiveness and potential for future growth within this significant aspect of the Australian economy. The forecast period (2025-2033) is likely to witness further consolidation within the industry, with larger companies potentially acquiring smaller players to enhance market share and expand their operational footprint.

The segmentation of the Australian oil and gas upstream sector into onshore and offshore operations reflects fundamental differences in capital intensity, operational challenges, and environmental considerations. While both segments contribute significantly to national energy security and export revenues, offshore activities typically require greater investment and technological sophistication. The ongoing exploration efforts in both regions will continue to shape the industry’s development, especially given the exploration and development of new fields and reserves. Furthermore, regulatory frameworks concerning environmental sustainability, including carbon capture, utilisation and storage (CCUS) initiatives, will influence the industry's operational practices and investment strategies over the forecast period. The interaction between global energy markets and the domestic Australian energy needs will also drive changes in production levels and pricing dynamics.

Australia Oil and Gas Upstream Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of Australia's oil and gas upstream industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on both onshore and offshore operations, and encompassing oil and gas product segments, this report is an essential resource for industry professionals, investors, and strategic planners. The study period spans 2019-2033, with 2025 as the base and estimated year.

Australia Oil and Gas Upstream Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, and M&A activity within the Australian upstream oil and gas sector. The analysis incorporates both quantitative data (market share, M&A deal volumes) and qualitative factors (innovation barriers). We examine the impact of government policies, environmental regulations, and global energy market trends on the industry's structure and competitiveness.

- Market Concentration: The Australian upstream oil and gas sector exhibits a moderately concentrated market structure, with a few major players holding significant market share. Santos Limited, Woodside Petroleum Limited, and BHP Group PLC, for instance, account for xx% of total production in 2025.

- Technological Innovation: The industry is characterized by ongoing technological advancements, particularly in areas like subsea technology, AI-powered inspection, and enhanced oil recovery (EOR) techniques. However, the high cost of implementation and the need for skilled labor can act as barriers.

- Regulatory Framework: Government regulations play a significant role, influencing exploration and production activities. Environmental concerns and safety standards are key regulatory drivers.

- Competitive Product Substitutes: The rise of renewable energy sources represents a growing competitive substitute, although oil and gas continue to play a crucial role in meeting Australia's energy needs.

- End-User Demographics: The primary end-users are domestic consumers and industrial users. Export markets for LNG play a critical role in shaping industry dynamics.

- M&A Trends: The past five years have seen xx M&A deals in the Australian upstream sector, driven by consolidation, expansion strategies, and access to resources. The average deal value is estimated at xx Million.

Australia Oil and Gas Upstream Industry Growth Trends & Insights

This section provides a detailed analysis of the Australian upstream oil and gas market's growth trajectory, including market size, adoption rates, and key influencing factors. We project xx% CAGR from 2025-2033, driven by a combination of factors. This analysis uses proprietary data and various models to provide a comprehensive overview of the market evolution. Specific details on the impact of technological advancements, consumer behavior shifts, and industry disruptions are presented. The historical period (2019-2024) shows a fluctuating market size but reveals a steady upward trend in recent years.

Dominant Regions, Countries, or Segments in Australia Oil and Gas Upstream Industry

This section identifies the leading regions and segments within the Australian upstream oil and gas market. Both offshore and onshore operations contribute significantly, with offshore production particularly important. The analysis reveals that the offshore segment commands a larger market share than onshore. The geographic distribution of production varies based on the presence of significant reserves in different regions.

- Offshore Segment Dominance: The offshore segment dominates, owing to larger reserves and the technological capabilities to extract oil and gas from these locations. The growth is driven by investment in infrastructure and technological innovation.

- Key Growth Drivers: Government policies favoring energy independence, increasing global demand, and technological advancements are key growth drivers.

- Market Share and Growth Potential: The offshore segment is projected to retain its dominance, showcasing robust growth potential due to planned projects and exploration activities. The detailed regional break down shows xx% from Western Australia, xx% from Queensland, and other regions contribute xx%.

Australia Oil and Gas Upstream Industry Product Landscape

The Australian upstream oil and gas industry produces a range of products, predominantly crude oil and natural gas. Technological advancements are leading to improved extraction techniques and enhanced product quality. The focus is on maximizing recovery rates and minimizing environmental impact. Unique selling propositions are centered around the reliable supply of energy resources to both domestic and international markets.

Key Drivers, Barriers & Challenges in Australia Oil and Gas Upstream Industry

Key Drivers:

- Strong domestic demand for oil and gas fuels the industry.

- Significant reserves and ongoing exploration efforts contribute to sustained production.

- Technological innovation enhances extraction efficiency and resource recovery.

- Government incentives, including tax breaks for exploration and production, support growth.

Key Challenges & Restraints:

- Fluctuating global oil and gas prices create price volatility.

- Stringent environmental regulations and rising carbon emission concerns impose cost pressures.

- Supply chain disruptions and skilled labor shortages can impact operations. The estimated cost of labor shortages is approximately xx Million annually.

- Competition from renewable energy sources poses a long-term challenge.

Emerging Opportunities in Australia Oil and Gas Upstream Industry

- Expansion into new exploration areas, particularly in deeper water and unconventional resources.

- Development of Carbon Capture, Utilization, and Storage (CCUS) technologies to reduce emissions.

- Increased focus on gas exports, capitalizing on global demand.

- Strategic partnerships and investments in technology to improve efficiency and reduce environmental impact.

Growth Accelerators in the Australia Oil and Gas Upstream Industry Industry

Long-term growth in Australia's upstream oil and gas sector will be fueled by technological advancements, particularly in areas such as AI, data analytics, and automation. Strategic partnerships with international energy companies will facilitate capital investment and technology transfer. Exploring and developing new reserves, coupled with efforts to reduce carbon emissions, are vital for sustained growth.

Key Players Shaping the Australia Oil and Gas Upstream Industry Market

- Santos Limited

- Woodside Petroleum Limited

- Shell PLC

- ExxonMobil Corporation

- Caltex Australia Limited

- BHP Group PLC

- Origin Energy Limited

- Chevron Corporation

- BP PLC

- Total Energies SE

Notable Milestones in Australia Oil and Gas Upstream Industry Sector

- September 2021: Wood and NERA partnered to develop the Augmented Machine Vision Solution (AMVS) for subsea infrastructure inspection.

- August 2021: Chevron awarded a USD 6 billion contract to Worley for the Jansz-lo Compression project in Western Australia, involving advanced subsea compression technology.

In-Depth Australia Oil and Gas Upstream Industry Market Outlook

The Australian upstream oil and gas market exhibits strong growth potential despite the challenges. Technological innovation, strategic partnerships, and exploration activities will drive growth. The increasing global demand for LNG provides a significant opportunity for Australia to expand its export markets. However, long-term success will necessitate a balanced approach, integrating environmental sustainability with economic growth.

Australia Oil and Gas Upstream Industry Segmentation

- 1. Onshore

- 2. Offshore

Australia Oil and Gas Upstream Industry Segmentation By Geography

- 1. Australia

Australia Oil and Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets

- 3.3. Market Restrains

- 3.3.1. 4.; Shift Toward Unmanned Aircraft

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Santos Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Woodside Petroleum Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shell PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ExxonMobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Caltex Australia Limited*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BHP Group PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Origin Energy Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chevron Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BP PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Total Energies SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Santos Limited

List of Figures

- Figure 1: Australia Oil and Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Oil and Gas Upstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Oil and Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Oil and Gas Upstream Industry Revenue Million Forecast, by Onshore 2019 & 2032

- Table 3: Australia Oil and Gas Upstream Industry Revenue Million Forecast, by Offshore 2019 & 2032

- Table 4: Australia Oil and Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Oil and Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Oil and Gas Upstream Industry Revenue Million Forecast, by Onshore 2019 & 2032

- Table 7: Australia Oil and Gas Upstream Industry Revenue Million Forecast, by Offshore 2019 & 2032

- Table 8: Australia Oil and Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Oil and Gas Upstream Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Australia Oil and Gas Upstream Industry?

Key companies in the market include Santos Limited, Woodside Petroleum Limited, Shell PLC, ExxonMobil Corporation, Caltex Australia Limited*List Not Exhaustive, BHP Group PLC, Origin Energy Limited, Chevron Corporation, BP PLC, Total Energies SE.

3. What are the main segments of the Australia Oil and Gas Upstream Industry?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Shift Toward Unmanned Aircraft.

8. Can you provide examples of recent developments in the market?

In September 2021, a partnership between Wood and National Energy Resources Australia (NERA) developed an advanced AI technology known as Augmented Machine Vision Solution (AMVS). This technology is expected to assist in inspecting industrial equipment, especially subsea oil and gas infrastructure. This new innovative solution improves speed and accuracy and reduces human risk. It also has the potential to be executed in various industries to enhance reliability and reduce inspection costs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Oil and Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Oil and Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Oil and Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Australia Oil and Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence