Key Insights

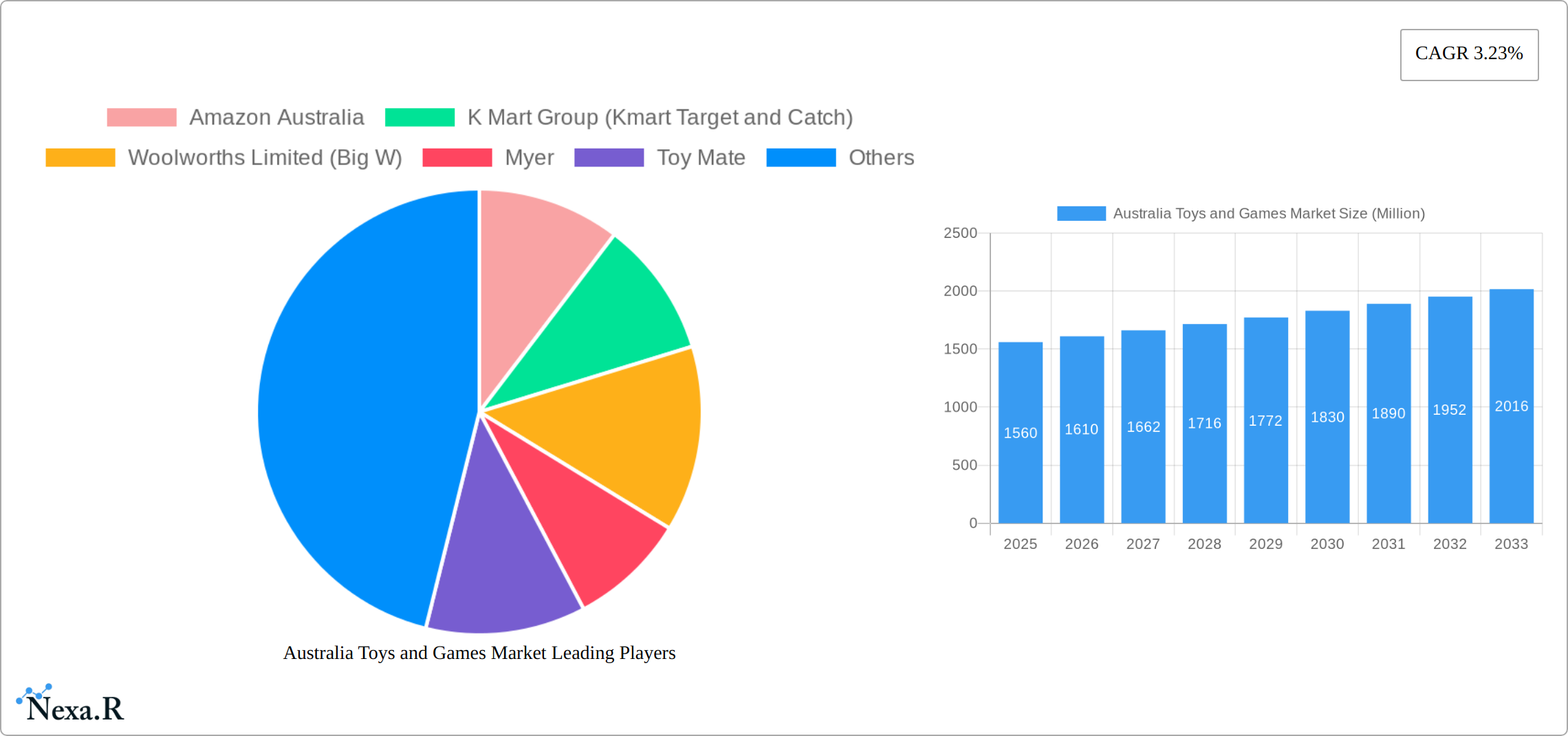

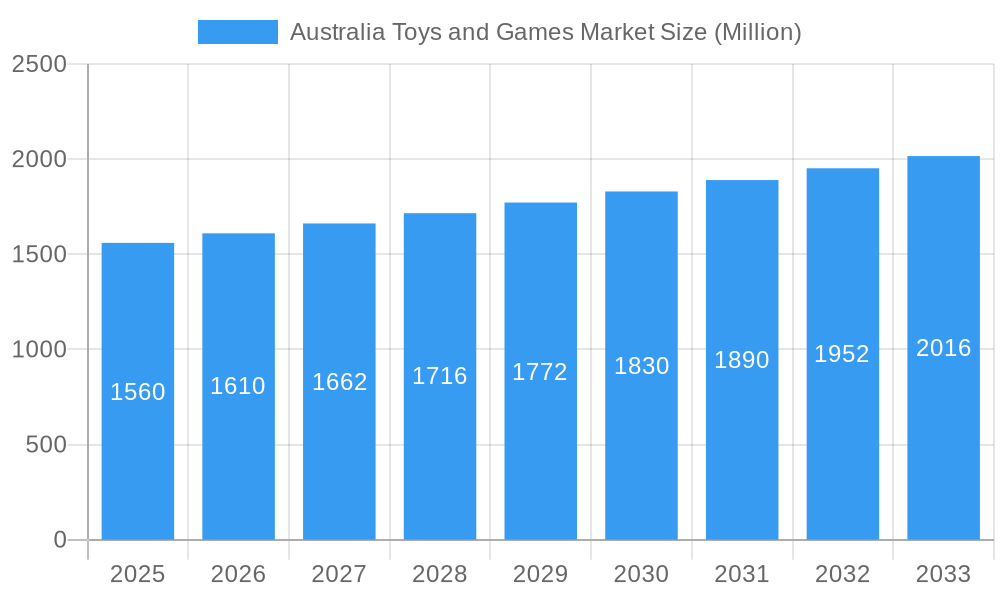

The Australian toys and games market, valued at $1.56 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.23% from 2025 to 2033. This growth is fueled by several key drivers. Increased disposable incomes, particularly amongst young families, contribute significantly to higher spending on toys and games. The rising popularity of interactive and educational toys, catering to the growing awareness of the importance of early childhood development, further boosts market expansion. E-commerce platforms like Amazon Australia, Catch, and eBay continue to expand their market share, offering wider product selections and convenient purchasing options for consumers. Furthermore, the resurgence of classic board games and puzzles, appealing to a broad demographic seeking family-friendly entertainment options, contributes to the market's vitality. However, potential restraints exist, including economic fluctuations impacting consumer spending and increasing competition from imported goods. The market segmentation includes categories such as action figures, dolls, board games, video games, and educational toys. Major players like Amazon Australia, Kmart, Woolworths (Big W), Myer, and independent retailers like Toyworld and EB Games compete intensely for market dominance, adopting diverse strategies to engage their target audiences.

Australia Toys and Games Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace due to external economic factors. The increasing adoption of digital platforms and innovative technologies in toy design, such as augmented reality and interactive elements, will likely shape market trends. Successful players will need to adapt to changing consumer preferences, embracing sustainable and ethically sourced products, and focusing on personalized customer experiences to maintain their competitive edge. Market segmentation will remain crucial, with businesses targeting specific demographics and preferences to maximize sales. The ongoing integration of online and offline retail channels will be essential for reaching consumers effectively, necessitating a comprehensive omnichannel strategy for sustained growth in this dynamic market.

Australia Toys and Games Market Company Market Share

Australia Toys and Games Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian toys and games market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth trends, key players, and future opportunities within the Australian toys and games sector, including both the parent market and its key child segments. The report utilizes data expressed in million units.

Australia Toys and Games Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends shaping the Australian toys and games market. We delve into market concentration, examining the market share held by key players such as Amazon Australia, Kmart Group (Kmart, Target, and Catch), Woolworths Limited (Big W), Myer, Toy Mate, David Jones, Mighty Ape, Toyworld, eBay, EB Games, JB Hi-Fi, and other prominent online retailers (including Online Toys Australia, Kogan, Temple & Webster, and Costco – list not exhaustive). The analysis includes:

- Market Concentration: A detailed breakdown of market share distribution amongst major players, highlighting the presence of both established giants and emerging online retailers. We estimate that the top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Examination of the role of technological advancements, such as AI-powered toys and augmented reality games, in driving market growth and changing consumer preferences. We identify innovation barriers such as high R&D costs and the need for robust cybersecurity measures.

- Regulatory Framework: Analysis of Australian regulations concerning toy safety, labeling, and advertising, assessing their impact on market dynamics.

- Competitive Product Substitutes: Assessment of substitute products or services that compete for consumer spending, including digital entertainment alternatives and other leisure activities.

- End-User Demographics: A deep dive into the demographic segmentation of the market, analyzing consumer preferences and purchasing behavior across different age groups and income levels.

- M&A Trends: An overview of recent mergers and acquisitions within the industry, including their impact on market consolidation and competitive dynamics. We estimate xx M&A deals occurred in the historical period.

Australia Toys and Games Market Growth Trends & Insights

This section provides a comprehensive analysis of the Australian toys and games market's evolution, examining market size shifts, adoption rates of new product categories, transformative technological disruptions, and dynamic consumer behavior trends spanning from 2019 to 2033. Utilizing extensive market research data, we visually represent the market's growth trajectory, highlighting critical metrics such as the Compound Annual Growth Rate (CAGR) and market penetration levels. Our analysis delves into the multifaceted impact of influential factors, including:

- The dynamic interplay of evolving consumer preferences and purchasing patterns, significantly shaped by prevailing economic conditions and prevailing social trends.

- The pervasive rise of online retail channels and the accelerated digital transformation sweeping across the toys and games sector.

- The profound influence of cutting-edge technological advancements, such as augmented reality (AR) and virtual reality (VR) technologies, on product innovation and consumer engagement.

- The crucial impact of evolving regulatory frameworks and stringent safety standards on shaping market dynamics and growth opportunities.

We project a robust market size of approximately [Insert Specific Number] million units by 2025, with an anticipated CAGR of [Insert Specific Percentage]% during the forecast period (2025-2033).

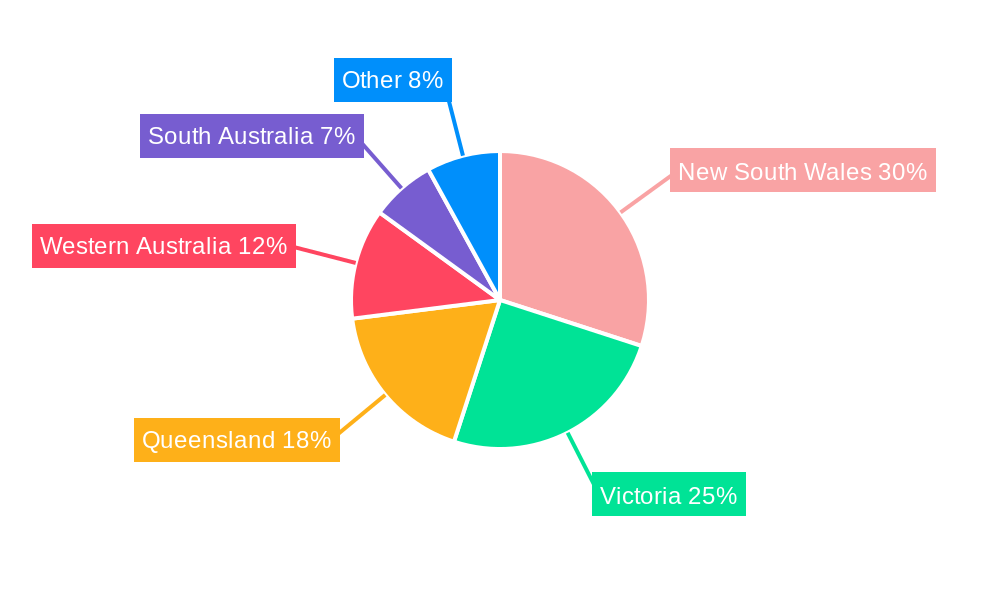

Dominant Regions, Countries, or Segments in Australia Toys and Games Market

This section identifies the leading regions, countries, or segments driving market growth in Australia. We analyze dominance factors, including market share and growth potential, providing insights into regional disparities and key drivers of growth.

- Key Drivers: We examine factors such as economic strength, population demographics, infrastructure development, and government policies that influence regional market performance. Strong economic growth in specific states contributes significantly to market expansion.

- Dominance Factors: We analyze the reasons behind the dominance of certain regions or segments, including consumer preferences, retail infrastructure, and the presence of major players. We find that xx region holds the largest market share due to xx factors.

Australia Toys and Games Market Product Landscape

This section provides a concise overview of the product landscape within the Australian toys and games market. It details product innovations, applications, and performance metrics, highlighting unique selling propositions and technological advancements in categories such as educational toys, video games, and action figures. Recent innovations include a strong focus on STEM toys and eco-friendly materials.

Key Drivers, Barriers & Challenges in Australia Toys and Games Market

This section identifies and analyzes the key drivers and challenges impacting the Australian toys and games market.

Key Drivers:

- Increasing disposable incomes and changing consumer spending patterns.

- Growth in e-commerce and online retail channels.

- Technological innovations and the adoption of new technologies.

- Government initiatives to promote early childhood development and education.

Key Challenges:

- Intense competition from both domestic and international players.

- Fluctuations in economic conditions and consumer confidence.

- Supply chain disruptions and increased transportation costs (estimated impact: xx% on overall market growth in 2024).

- Stringent safety regulations and compliance requirements.

Emerging Opportunities in Australia Toys and Games Market

This section illuminates the burgeoning trends and untapped opportunities within the Australian toys and games market, pointing towards areas of significant potential growth. Key emerging opportunities include:

- A substantial and growing demand for educational and STEM (Science, Technology, Engineering, and Mathematics)-focused toys that foster learning and skill development.

- An increasing consumer appetite for personalized and customized toys, offering unique and tailored play experiences.

- The expanding popularity of innovative service models such as subscription boxes and flexible toy rental services, catering to evolving consumer needs and preferences.

- A notable market expansion for highly sought-after collectible toys and games, driven by passionate hobbyists and collectors.

Growth Accelerators in the Australia Toys and Games Market Industry

The sustained long-term growth of the Australian toys and games market is poised to be significantly propelled by a confluence of strategic factors. These include the accelerated integration of advanced technologies like Augmented Reality (AR) and Virtual Reality (VR) into product offerings, fostering more immersive and engaging play. Strategic partnerships and collaborations between pioneering toy manufacturers and forward-thinking technology companies will be crucial for innovation and market penetration. Furthermore, the expansion into underserved new markets and the cultivation of novel customer segments will unlock substantial growth avenues. This proactive strategy will also involve adeptly leveraging the pervasive influence of influencer marketing and robust social media engagement to effectively reach and resonate with broader target audiences.

Key Players Shaping the Australia Toys and Games Market Market

- Amazon Australia

- K Mart Group (encompassing Kmart, Target, and Catch)

- Woolworths Group (including Big W)

- Myer

- Toy Mate

- David Jones

- Mighty Ape

- Toyworld

- ebay Australia

- EB Games

- JB Hi-Fi

- Other Prominent Retailers (including Online Toys Australia, Kogan, Temple & Webster, Costco, and others) This list is not exhaustive and serves as an illustrative overview of key market participants.

Notable Milestones in Australia Toys and Games Market Sector

- January 2023: Amazon Web Services (AWS) launched its second infrastructure region in Australia, enhancing cloud computing capabilities and potentially boosting e-commerce operations for toy retailers.

- June 2023: The acquisition of ImmediateScripts by API, now part of Wesfarmers' health division, indirectly impacts the market by highlighting increased investment in digital health and potentially influencing related toy and game development.

In-Depth Australia Toys and Games Market Market Outlook

The Australian toys and games market is strategically positioned for sustained and dynamic growth, underpinned by robust economic fundamentals, continuously evolving consumer preferences, and the relentless pace of technological innovation. Significant strategic opportunities are available for astute companies to capitalize on the escalating demand for eco-friendly and educational toys, the growing desire for personalized play experiences, and the seamless integration of digital technologies. The future trajectory of this market will be fundamentally shaped by the agility of businesses in adapting to shifting consumer demands and by the foresight in forging strategic partnerships that effectively harness the transformative power of technological advancements.

Australia Toys and Games Market Segmentation

-

1. Type

- 1.1. Card Games

- 1.2. Construction Sets and Models

- 1.3. Dolls and Stuffed Toys

- 1.4. Plastic and Other Toys

- 1.5. Puzzles

- 1.6. Toys for Toddlers and Kids

- 1.7. Video Game Consoles

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

Australia Toys and Games Market Segmentation By Geography

- 1. Australia

Australia Toys and Games Market Regional Market Share

Geographic Coverage of Australia Toys and Games Market

Australia Toys and Games Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development

- 3.4. Market Trends

- 3.4.1. Rise in the Number of People Buying Video Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Toys and Games Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Card Games

- 5.1.2. Construction Sets and Models

- 5.1.3. Dolls and Stuffed Toys

- 5.1.4. Plastic and Other Toys

- 5.1.5. Puzzles

- 5.1.6. Toys for Toddlers and Kids

- 5.1.7. Video Game Consoles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon Australia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 K Mart Group (Kmart Target and Catch)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Woolworths Limited (Big W)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Myer

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toy Mate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 David Jones

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mighty Ape

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyworld

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ebay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EB Games

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 JB Hifi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Other Prominent Retailers (Online Toys Australia KoganTemple & Webster Costco etc )**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon Australia

List of Figures

- Figure 1: Australia Toys and Games Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Toys and Games Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Toys and Games Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australia Toys and Games Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Australia Toys and Games Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Australia Toys and Games Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Australia Toys and Games Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Toys and Games Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Australia Toys and Games Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Australia Toys and Games Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Australia Toys and Games Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Australia Toys and Games Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Australia Toys and Games Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Toys and Games Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Toys and Games Market?

The projected CAGR is approximately 3.23%.

2. Which companies are prominent players in the Australia Toys and Games Market?

Key companies in the market include Amazon Australia, K Mart Group (Kmart Target and Catch), Woolworths Limited (Big W), Myer, Toy Mate, David Jones, Mighty Ape, Toyworld, ebay, EB Games, JB Hifi, Other Prominent Retailers (Online Toys Australia KoganTemple & Webster Costco etc )**List Not Exhaustive.

3. What are the main segments of the Australia Toys and Games Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development.

6. What are the notable trends driving market growth?

Rise in the Number of People Buying Video Games.

7. Are there any restraints impacting market growth?

Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development.

8. Can you provide examples of recent developments in the market?

January 2023: Amazon Web Services (AWS) introduced the second AWS infrastructure Region in Australia, constituting a global physical site with clustered data centers. The recently launched AWS Asia-Pacific (Melbourne) Region aims to bring advanced AWS technologies, including computing, storage, artificial intelligence (AI), and machine learning, in closer proximity to a broader customer base. This initiative aims to reduce network latency, enabling customers to meet local data residency regulations more effectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Toys and Games Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Toys and Games Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Toys and Games Market?

To stay informed about further developments, trends, and reports in the Australia Toys and Games Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence