Key Insights

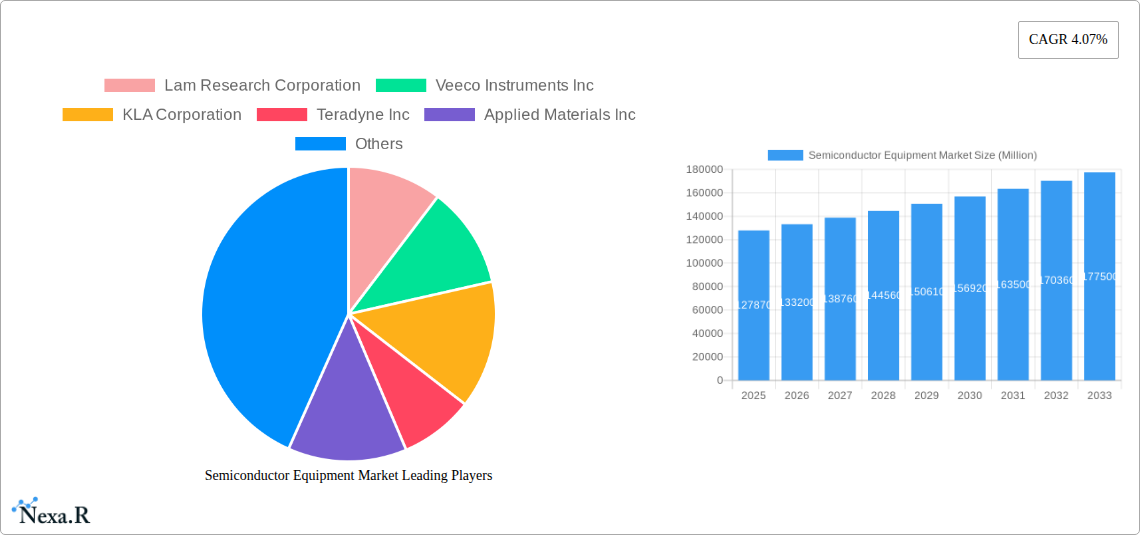

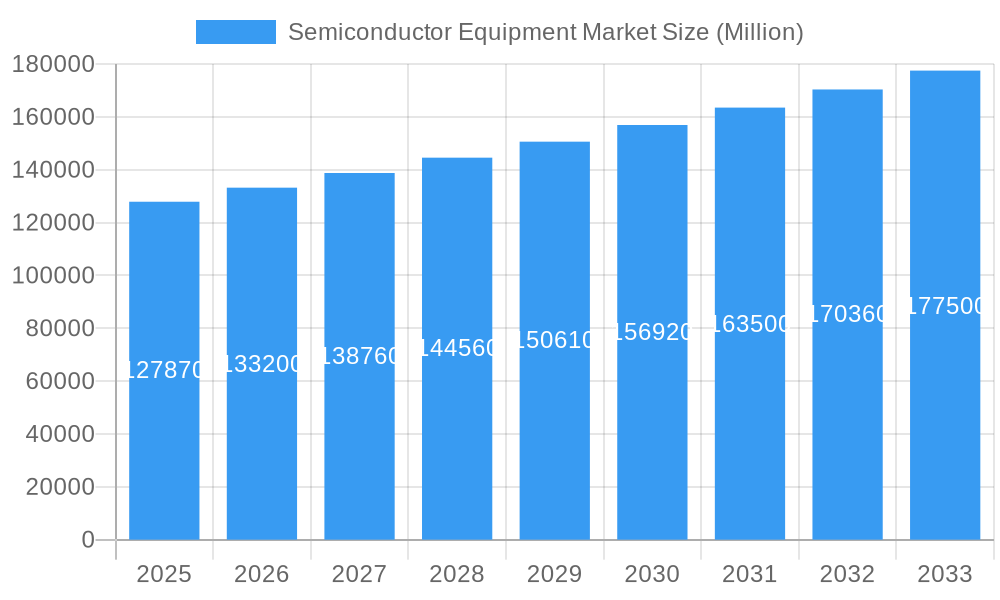

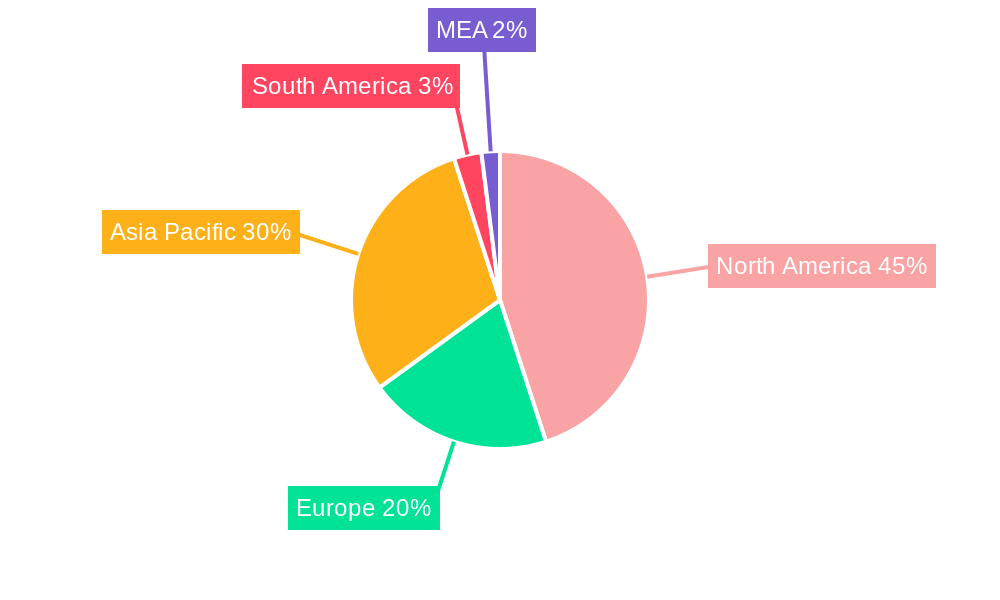

The semiconductor equipment market, valued at $127.87 billion in 2025, is projected to experience robust growth, driven by the increasing demand for advanced semiconductor devices across various applications, including 5G infrastructure, artificial intelligence, and the Internet of Things (IoT). A compound annual growth rate (CAGR) of 4.07% from 2025 to 2033 indicates a significant expansion of the market over the forecast period. Key drivers include the ongoing miniaturization of chips, necessitating more sophisticated and precise equipment, and the growing adoption of advanced process nodes in the semiconductor manufacturing process. Furthermore, substantial investments in research and development by leading semiconductor companies and governments worldwide are fueling innovation and driving the demand for cutting-edge equipment. The market segmentation reveals a significant share held by front-end equipment, followed by back-end equipment, reflecting the critical role of these components in the overall chip manufacturing process. The IDM (Integrated Device Manufacturer) segment holds a substantial market share, indicating the crucial role played by companies manufacturing their own chips. Geographically, North America and Asia-Pacific regions are expected to remain dominant, driven by the presence of major semiconductor manufacturers and a strong technological ecosystem.

Semiconductor Equipment Market Market Size (In Billion)

The competitive landscape is highly consolidated, with major players like Lam Research, Applied Materials, and ASML holding significant market share. These companies are constantly investing in research and development to maintain their technological edge and meet the growing demands of the industry. However, the market also faces certain restraints, including the high capital expenditure required for purchasing advanced semiconductor equipment, geopolitical uncertainties impacting supply chains, and the cyclical nature of the semiconductor industry. Despite these challenges, the long-term outlook for the semiconductor equipment market remains positive, driven by the pervasive adoption of semiconductors in various industries and the continuous technological advancements in the semiconductor industry. This necessitates a constant upgrade cycle for manufacturing equipment, ensuring continued market expansion.

Semiconductor Equipment Market Company Market Share

Semiconductor Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Semiconductor Equipment Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by equipment type (Front-end Equipment, Back-end Equipment) and supply chain participants (IDM, OSAT, Foundry), offering granular insights into this crucial industry. The market size is projected to reach xx Million units by 2033, presenting substantial opportunities for stakeholders.

Semiconductor Equipment Market Dynamics & Structure

The semiconductor equipment market is characterized by high capital expenditure, technological complexity, and intense competition among a relatively concentrated group of leading players. Market concentration is high, with a few dominant players holding significant market share.

Market Concentration: Applied Materials, Lam Research, Tokyo Electron, ASML, and KLA Corporation collectively account for approximately xx% of the global market share in 2025.

Technological Innovation Drivers: Continuous miniaturization of chips, advancements in process technologies (e.g., EUV lithography), and the rise of specialized semiconductor devices (e.g., AI chips) fuel demand for sophisticated equipment.

Regulatory Frameworks: Government policies promoting domestic semiconductor manufacturing, along with export controls and trade regulations, influence market dynamics.

Competitive Product Substitutes: Limited direct substitutes exist; however, technological advancements constantly redefine performance benchmarks, leading to competitive upgrades.

End-User Demographics: The primary end users are IDMs (Integrated Device Manufacturers), foundries, and OSATs (Outsourced Semiconductor Assembly and Test services). Growth in each segment directly impacts equipment demand.

M&A Trends: Strategic acquisitions and mergers are frequent, driven by the need to consolidate market share, acquire technological expertise, and expand product portfolios. An estimated xx M&A deals were recorded between 2019 and 2024.

Semiconductor Equipment Market Growth Trends & Insights

The semiconductor equipment market has experienced robust growth over the past few years, driven primarily by increasing demand for semiconductors across various end-use applications, including smartphones, automotive electronics, and data centers. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements such as the adoption of advanced node processes, increasing complexity of integrated circuits, and rising investments in research and development across the semiconductor industry. The adoption rate of new technologies like EUV lithography is a key growth driver, as is the expanding global demand for high-performance computing and 5G infrastructure. Shifts in consumer behavior, such as increasing reliance on smart devices and the Internet of Things (IoT), also contribute to the overall market expansion. Market penetration of advanced equipment like those producing 3nm chips is steadily increasing.

Dominant Regions, Countries, or Segments in Semiconductor Equipment Market

The Asia-Pacific region, particularly Taiwan, South Korea, and China, dominates the semiconductor equipment market, accounting for the largest market share due to the concentration of leading semiconductor manufacturers.

By Equipment Type: The front-end equipment segment holds a larger market share compared to the back-end equipment segment, reflecting the higher complexity and capital intensity of front-end processes.

By Supply Chain Participants: Foundries and IDMs represent the largest consumer base for semiconductor equipment, reflecting their significant investment in capacity expansion.

Key Drivers:

- Strong government support and investments in the semiconductor sector in Asia-Pacific.

- Large-scale manufacturing facilities and a well-established supply chain.

- High demand for consumer electronics and advanced technologies.

Dominance Factors:

- Presence of major semiconductor manufacturers and fabrication plants.

- Government incentives for semiconductor technology advancement and manufacturing.

- High level of technological expertise and skilled workforce.

Semiconductor Equipment Market Product Landscape

The semiconductor equipment market features a wide range of sophisticated products, including lithography systems, etching systems, deposition systems, and testing equipment. Continuous innovation focuses on enhancing precision, throughput, and yield. Key advancements include the development of EUV lithography systems enabling the creation of smaller and more powerful chips and advancements in advanced packaging equipment. Manufacturers are emphasizing automation, improved process control, and reduced environmental impact in their product designs. These features are major selling points differentiating products in an intensely competitive market.

Key Drivers, Barriers & Challenges in Semiconductor Equipment Market

Key Drivers:

- Technological Advancements: The continuous push for smaller, faster, and more energy-efficient chips drives demand for cutting-edge equipment.

- Growing Semiconductor Demand: The expanding applications of semiconductors in electronics, automotive, and industrial sectors fuels market growth.

- Government Support: Numerous governments are investing heavily in domestic semiconductor production, boosting demand for equipment.

Key Challenges & Restraints:

- Supply Chain Disruptions: Geopolitical factors and pandemic-related challenges create supply chain bottlenecks, impacting equipment availability and costs.

- High Capital Expenditure: The high cost of advanced equipment presents a significant barrier to entry for smaller companies.

- Intense Competition: The market is dominated by a few large players, resulting in fierce competition and price pressure. This results in an approximate xx% reduction in profit margin for new market entrants.

Emerging Opportunities in Semiconductor Equipment Market

- Growth in Specialized Semiconductors: The increasing demand for AI chips, high-performance computing chips, and other specialized semiconductors creates new market opportunities.

- Expansion into Emerging Markets: Untapped markets in developing countries present significant growth potential for equipment manufacturers.

- Advanced Packaging Technologies: The adoption of advanced packaging technologies like 3D stacking opens up opportunities for specialized equipment.

Growth Accelerators in the Semiconductor Equipment Market Industry

Technological breakthroughs in areas like EUV lithography and advanced materials are pivotal in driving long-term growth. Strategic partnerships between equipment manufacturers and semiconductor companies are crucial for technology development and market penetration. Government incentives and investments aimed at bolstering domestic semiconductor manufacturing capabilities also accelerate growth significantly, boosting demand for advanced equipment.

Key Players Shaping the Semiconductor Equipment Market Market

Notable Milestones in Semiconductor Equipment Market Sector

- June 2022: RIBER secured an order for a multi-4' GSMBE 49 production system, highlighting the demand for advanced MBE equipment in datacom applications.

- June 2022: Veeco's Propel R&D MOCVD system was selected by Taiwan's National Applied Research Laboratories, demonstrating the growing adoption of advanced deposition systems in research and development.

In-Depth Semiconductor Equipment Market Market Outlook

The semiconductor equipment market is poised for sustained growth, driven by ongoing technological advancements, increased semiconductor demand across diverse applications, and significant investments from governments and private entities. Strategic opportunities lie in developing innovative equipment for specialized semiconductors, expanding into emerging markets, and forging strong partnerships across the semiconductor value chain. The market's future hinges on addressing challenges related to supply chain resilience, mitigating geopolitical risks, and fostering sustainable manufacturing practices.

Semiconductor Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Front-end Equipment

- 1.1.1. Lithography Equipment

- 1.1.2. Etch Equipment

- 1.1.3. Deposition Equipment

- 1.1.4. Metrology/Inspection Equipment

- 1.1.5. Material Removal/Cleaning Equipment

- 1.1.6. Photoresist Processing Equipment

- 1.1.7. Other Equipment Types

-

1.2. Back-end Equipment

- 1.2.1. Test Equipment

- 1.2.2. Assembly and Packaging Equipment

-

1.1. Front-end Equipment

-

2. End-User Industry

- 2.1. consumer electronics

- 2.2. automotive

- 2.3. other industries

- 2.4. industrial

Semiconductor Equipment Market Segmentation By Geography

- 1. North America: United States Canada Mexico

- 2. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe

- 3. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific

- 4. South America : Brazil, Argentina, Rest of South America

- 5. MEA: Middle East, Africa

Semiconductor Equipment Market Regional Market Share

Geographic Coverage of Semiconductor Equipment Market

Semiconductor Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Consumer Electronic Devices; Proliferation of AI

- 3.2.2 IoT

- 3.2.3 And Connected Devices Across Industry Verticals

- 3.3. Market Restrains

- 3.3.1. Dynamic Nature of Technologies Requires Several Changes in Manufacturing Equipment

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Consumer Electronic Devices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Front-end Equipment

- 5.1.1.1. Lithography Equipment

- 5.1.1.2. Etch Equipment

- 5.1.1.3. Deposition Equipment

- 5.1.1.4. Metrology/Inspection Equipment

- 5.1.1.5. Material Removal/Cleaning Equipment

- 5.1.1.6. Photoresist Processing Equipment

- 5.1.1.7. Other Equipment Types

- 5.1.2. Back-end Equipment

- 5.1.2.1. Test Equipment

- 5.1.2.2. Assembly and Packaging Equipment

- 5.1.1. Front-end Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. consumer electronics

- 5.2.2. automotive

- 5.2.3. other industries

- 5.2.4. industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America: United States Canada Mexico

- 5.3.2. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe

- 5.3.3. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific

- 5.3.4. South America : Brazil, Argentina, Rest of South America

- 5.3.5. MEA: Middle East, Africa

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America: United States Canada Mexico Semiconductor Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Front-end Equipment

- 6.1.1.1. Lithography Equipment

- 6.1.1.2. Etch Equipment

- 6.1.1.3. Deposition Equipment

- 6.1.1.4. Metrology/Inspection Equipment

- 6.1.1.5. Material Removal/Cleaning Equipment

- 6.1.1.6. Photoresist Processing Equipment

- 6.1.1.7. Other Equipment Types

- 6.1.2. Back-end Equipment

- 6.1.2.1. Test Equipment

- 6.1.2.2. Assembly and Packaging Equipment

- 6.1.1. Front-end Equipment

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. consumer electronics

- 6.2.2. automotive

- 6.2.3. other industries

- 6.2.4. industrial

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Front-end Equipment

- 7.1.1.1. Lithography Equipment

- 7.1.1.2. Etch Equipment

- 7.1.1.3. Deposition Equipment

- 7.1.1.4. Metrology/Inspection Equipment

- 7.1.1.5. Material Removal/Cleaning Equipment

- 7.1.1.6. Photoresist Processing Equipment

- 7.1.1.7. Other Equipment Types

- 7.1.2. Back-end Equipment

- 7.1.2.1. Test Equipment

- 7.1.2.2. Assembly and Packaging Equipment

- 7.1.1. Front-end Equipment

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. consumer electronics

- 7.2.2. automotive

- 7.2.3. other industries

- 7.2.4. industrial

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Front-end Equipment

- 8.1.1.1. Lithography Equipment

- 8.1.1.2. Etch Equipment

- 8.1.1.3. Deposition Equipment

- 8.1.1.4. Metrology/Inspection Equipment

- 8.1.1.5. Material Removal/Cleaning Equipment

- 8.1.1.6. Photoresist Processing Equipment

- 8.1.1.7. Other Equipment Types

- 8.1.2. Back-end Equipment

- 8.1.2.1. Test Equipment

- 8.1.2.2. Assembly and Packaging Equipment

- 8.1.1. Front-end Equipment

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. consumer electronics

- 8.2.2. automotive

- 8.2.3. other industries

- 8.2.4. industrial

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Front-end Equipment

- 9.1.1.1. Lithography Equipment

- 9.1.1.2. Etch Equipment

- 9.1.1.3. Deposition Equipment

- 9.1.1.4. Metrology/Inspection Equipment

- 9.1.1.5. Material Removal/Cleaning Equipment

- 9.1.1.6. Photoresist Processing Equipment

- 9.1.1.7. Other Equipment Types

- 9.1.2. Back-end Equipment

- 9.1.2.1. Test Equipment

- 9.1.2.2. Assembly and Packaging Equipment

- 9.1.1. Front-end Equipment

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. consumer electronics

- 9.2.2. automotive

- 9.2.3. other industries

- 9.2.4. industrial

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. MEA: Middle East, Africa Semiconductor Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10.1.1. Front-end Equipment

- 10.1.1.1. Lithography Equipment

- 10.1.1.2. Etch Equipment

- 10.1.1.3. Deposition Equipment

- 10.1.1.4. Metrology/Inspection Equipment

- 10.1.1.5. Material Removal/Cleaning Equipment

- 10.1.1.6. Photoresist Processing Equipment

- 10.1.1.7. Other Equipment Types

- 10.1.2. Back-end Equipment

- 10.1.2.1. Test Equipment

- 10.1.2.2. Assembly and Packaging Equipment

- 10.1.1. Front-end Equipment

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. consumer electronics

- 10.2.2. automotive

- 10.2.3. other industries

- 10.2.4. industrial

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lam Research Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Veeco Instruments Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KLA Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teradyne Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Applied Materials Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Screen Holdings Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hitachi High -Technologies Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tokyo Electron Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ASML Holding Semiconductor Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Lam Research Corporation

List of Figures

- Figure 1: Global Semiconductor Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Semiconductor Equipment Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America: United States Canada Mexico Semiconductor Equipment Market Revenue (Million), by Equipment Type 2025 & 2033

- Figure 4: North America: United States Canada Mexico Semiconductor Equipment Market Volume (K Unit), by Equipment Type 2025 & 2033

- Figure 5: North America: United States Canada Mexico Semiconductor Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 6: North America: United States Canada Mexico Semiconductor Equipment Market Volume Share (%), by Equipment Type 2025 & 2033

- Figure 7: North America: United States Canada Mexico Semiconductor Equipment Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 8: North America: United States Canada Mexico Semiconductor Equipment Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 9: North America: United States Canada Mexico Semiconductor Equipment Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 10: North America: United States Canada Mexico Semiconductor Equipment Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 11: North America: United States Canada Mexico Semiconductor Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America: United States Canada Mexico Semiconductor Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America: United States Canada Mexico Semiconductor Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America: United States Canada Mexico Semiconductor Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Revenue (Million), by Equipment Type 2025 & 2033

- Figure 16: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Volume (K Unit), by Equipment Type 2025 & 2033

- Figure 17: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 18: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Volume Share (%), by Equipment Type 2025 & 2033

- Figure 19: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 20: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 21: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 22: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 23: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Revenue (Million), by Equipment Type 2025 & 2033

- Figure 28: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Volume (K Unit), by Equipment Type 2025 & 2033

- Figure 29: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 30: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Volume Share (%), by Equipment Type 2025 & 2033

- Figure 31: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 32: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 33: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 34: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 35: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Revenue (Million), by Equipment Type 2025 & 2033

- Figure 40: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Volume (K Unit), by Equipment Type 2025 & 2033

- Figure 41: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 42: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Volume Share (%), by Equipment Type 2025 & 2033

- Figure 43: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 44: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 45: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 46: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 47: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America : Brazil, Argentina, Rest of South America Semiconductor Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: MEA: Middle East, Africa Semiconductor Equipment Market Revenue (Million), by Equipment Type 2025 & 2033

- Figure 52: MEA: Middle East, Africa Semiconductor Equipment Market Volume (K Unit), by Equipment Type 2025 & 2033

- Figure 53: MEA: Middle East, Africa Semiconductor Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 54: MEA: Middle East, Africa Semiconductor Equipment Market Volume Share (%), by Equipment Type 2025 & 2033

- Figure 55: MEA: Middle East, Africa Semiconductor Equipment Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 56: MEA: Middle East, Africa Semiconductor Equipment Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 57: MEA: Middle East, Africa Semiconductor Equipment Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 58: MEA: Middle East, Africa Semiconductor Equipment Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 59: MEA: Middle East, Africa Semiconductor Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 60: MEA: Middle East, Africa Semiconductor Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: MEA: Middle East, Africa Semiconductor Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: MEA: Middle East, Africa Semiconductor Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: Global Semiconductor Equipment Market Volume K Unit Forecast, by Equipment Type 2020 & 2033

- Table 3: Global Semiconductor Equipment Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Semiconductor Equipment Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 5: Global Semiconductor Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Semiconductor Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Semiconductor Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 8: Global Semiconductor Equipment Market Volume K Unit Forecast, by Equipment Type 2020 & 2033

- Table 9: Global Semiconductor Equipment Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Global Semiconductor Equipment Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: Global Semiconductor Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Semiconductor Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 14: Global Semiconductor Equipment Market Volume K Unit Forecast, by Equipment Type 2020 & 2033

- Table 15: Global Semiconductor Equipment Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Semiconductor Equipment Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 17: Global Semiconductor Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Semiconductor Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Semiconductor Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 20: Global Semiconductor Equipment Market Volume K Unit Forecast, by Equipment Type 2020 & 2033

- Table 21: Global Semiconductor Equipment Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 22: Global Semiconductor Equipment Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 23: Global Semiconductor Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Semiconductor Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Semiconductor Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 26: Global Semiconductor Equipment Market Volume K Unit Forecast, by Equipment Type 2020 & 2033

- Table 27: Global Semiconductor Equipment Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 28: Global Semiconductor Equipment Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 29: Global Semiconductor Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Semiconductor Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Semiconductor Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 32: Global Semiconductor Equipment Market Volume K Unit Forecast, by Equipment Type 2020 & 2033

- Table 33: Global Semiconductor Equipment Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 34: Global Semiconductor Equipment Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 35: Global Semiconductor Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Semiconductor Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Equipment Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Semiconductor Equipment Market?

Key companies in the market include Lam Research Corporation, Veeco Instruments Inc, KLA Corporation, Teradyne Inc, Applied Materials Inc, Screen Holdings Co Ltd, Hitachi High -Technologies Corporation, Tokyo Electron Limited, ASML Holding Semiconductor Company.

3. What are the main segments of the Semiconductor Equipment Market?

The market segments include Equipment Type, End-User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 127.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Consumer Electronic Devices; Proliferation of AI. IoT. And Connected Devices Across Industry Verticals.

6. What are the notable trends driving market growth?

Increasing Demand for Consumer Electronic Devices.

7. Are there any restraints impacting market growth?

Dynamic Nature of Technologies Requires Several Changes in Manufacturing Equipment.

8. Can you provide examples of recent developments in the market?

June 2022: RIBER, a global market player for molecular beam epitaxy (MBE) equipment serving the semiconductor industry, announced an order for a multi-4' GSMBE 49 production system. The new generation of datacom devices requires highly precise control of the epitaxial growth process, which is achieved by the recognized performance of Riber's machines and by the sophistication of the machine's control software. The ordered machine is expected to be delivered in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Equipment Market?

To stay informed about further developments, trends, and reports in the Semiconductor Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence