Key Insights

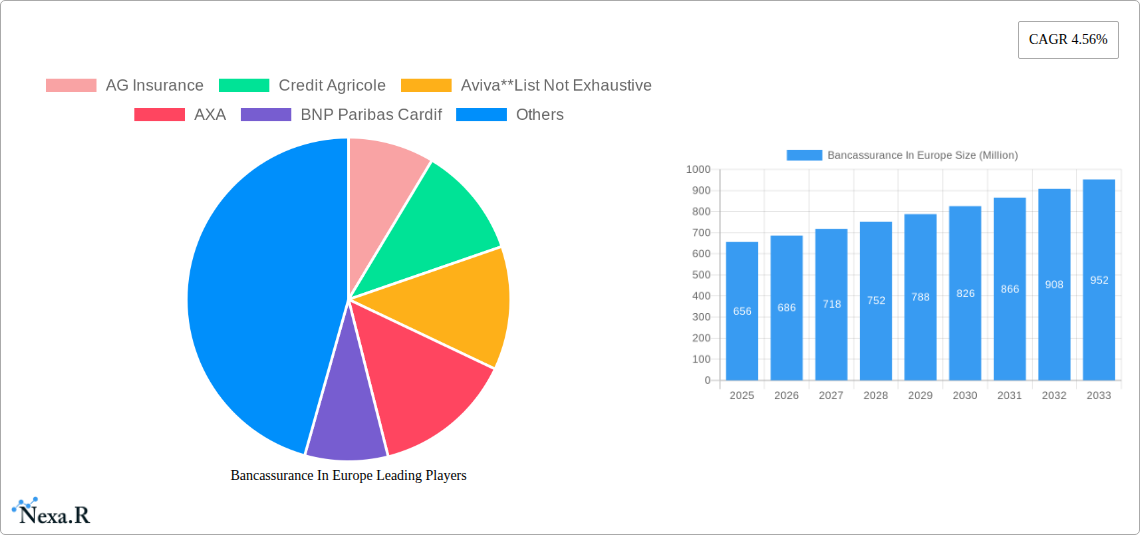

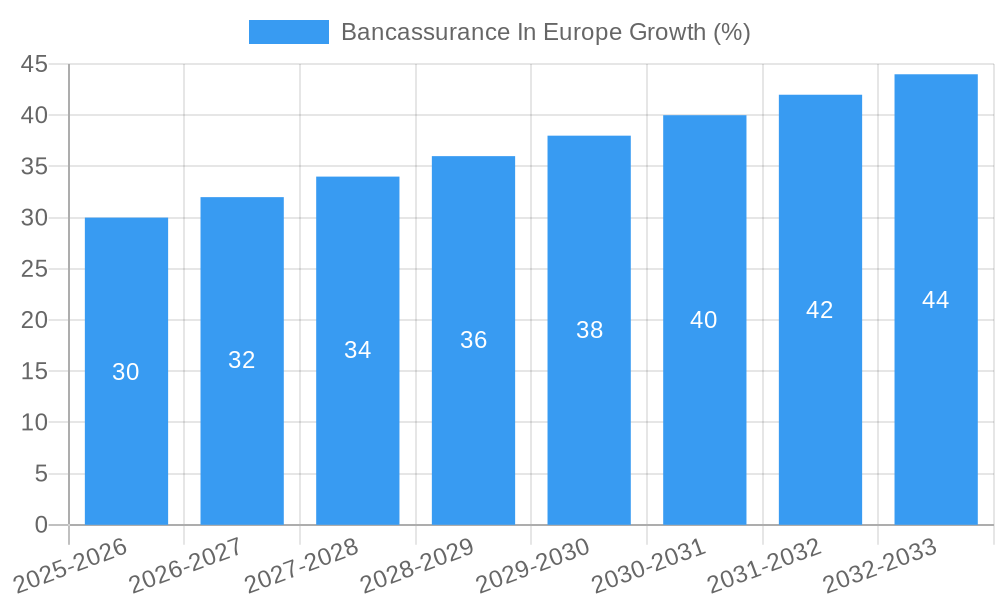

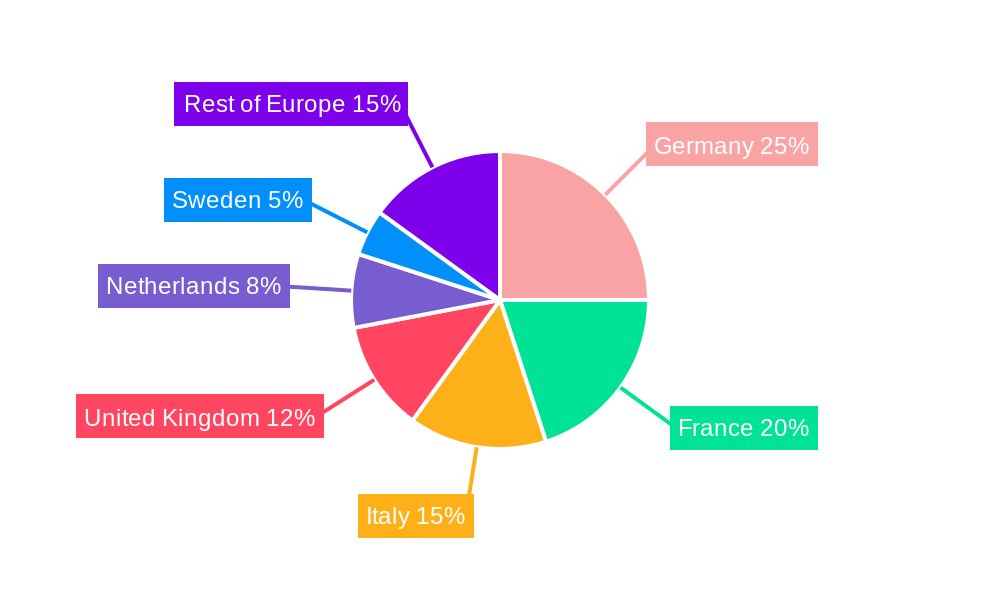

The European bancassurance market, valued at €656 million in 2025, is projected to experience steady growth, driven by several key factors. Increasing consumer demand for bundled financial products, the convenience and streamlined processes offered by bancassurance channels, and the expansion of digital banking services are all contributing to market expansion. Strategic partnerships between banks and insurance companies are also fueling growth, leveraging each other's extensive customer networks and brand recognition. Furthermore, regulatory changes promoting financial inclusion and encouraging insurance penetration are creating favorable market conditions. The market is segmented by insurance type, with life insurance and non-life insurance representing significant portions. Major players like Allianz, AXA, and Generali dominate the landscape, alongside regional banks and specialized insurers. While the market faces challenges such as increasing competition and economic volatility, the overall outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 4.56% from 2025 to 2033. Germany, France, Italy, and the United Kingdom are key contributors to the market's overall value, representing a significant portion of the European market share. The continued growth of digitalization, personalized financial products, and a focus on customer experience will continue to shape the future of bancassurance in Europe. Specific regional market performance within Europe will be impacted by economic conditions within each country and the success of digital transformation initiatives of both banks and insurers.

The forecast period of 2025-2033 promises continued growth within the European bancassurance sector. The continued adoption of digital platforms by banking and insurance institutions will facilitate greater market penetration and improved customer experience. However, the impact of macroeconomic factors such as inflation and interest rate changes will need to be considered. Successfully navigating regulatory changes and maintaining customer trust will be crucial for market leaders in sustaining growth and achieving profitability in the years ahead. The market's competitiveness will likely increase as new entrants and innovative offerings emerge. Therefore, continuous adaptation and innovation will be crucial for companies to thrive in this dynamic market.

Bancassurance in Europe: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bancassurance market in Europe, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market segment. The report includes analysis of both parent (Bancassurance in Europe) and child markets (Life Insurance and Non-life Insurance within Bancassurance). Market values are presented in millions.

Bancassurance In Europe Market Dynamics & Structure

This section analyzes the European bancassurance market's competitive landscape, technological advancements, regulatory influences, and market trends. We examine market concentration, identifying major players and their market share, while exploring the impact of mergers and acquisitions (M&A) activities. Technological innovation, regulatory frameworks (e.g., GDPR, PSD2), and the presence of competitive substitutes are assessed to provide a holistic view of market dynamics. End-user demographics and their evolving insurance needs are also considered.

- Market Concentration: The European bancassurance market exhibits a moderately concentrated structure, with key players holding significant market shares. xx% of the market is controlled by the top 5 players.

- M&A Activity: The historical period (2019-2024) saw xx M&A deals, averaging xx deals per year. This activity is expected to continue, driven by expansion strategies and consolidation within the industry.

- Technological Innovation: Digitalization, AI, and data analytics are key drivers of innovation, though integration challenges and data security concerns remain barriers.

- Regulatory Framework: Evolving regulations related to data privacy and financial services influence product development and distribution strategies.

- Competitive Substitutes: Direct insurers and online platforms pose a competitive threat, necessitating continuous innovation and adaptation.

Bancassurance In Europe Growth Trends & Insights

This section analyzes the historical and projected growth of the European bancassurance market. Utilizing robust data and forecasting methodologies, we detail market size evolution, adoption rates, and shifts in consumer behavior. The impact of technological disruptions and changing preferences on market dynamics is comprehensively explored. Specific metrics, including CAGR and market penetration rates, are provided to offer granular insights into the market's trajectory.

- Market Size: The European bancassurance market reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

- Adoption Rates: The adoption of bancassurance products is influenced by factors such as digital literacy, consumer trust, and the availability of attractive product offerings.

- Technological Disruptions: The increasing use of digital channels and fintech solutions is transforming the customer experience and driving market growth.

- Consumer Behavior Shifts: Changing consumer preferences towards personalized and digital-first solutions are impacting product design and distribution strategies.

Dominant Regions, Countries, or Segments in Bancassurance In Europe

This section identifies the leading regions, countries, or segments (Life Insurance and Non-life Insurance) driving market growth. We analyze the dominance factors contributing to their success, including market share, growth potential, and key economic and infrastructural drivers.

- Dominant Segment: The Life Insurance segment currently holds a larger market share compared to Non-life Insurance.

- Key Drivers (Life Insurance): Aging population, increasing awareness of long-term financial security, and favorable regulatory environments.

- Key Drivers (Non-life Insurance): Growing demand for motor and home insurance, rising urbanization, and increased penetration of digital channels.

- Dominant Region: Western Europe currently dominates the market, driven by higher income levels and advanced financial infrastructure. Growth is expected in Eastern Europe driven by increasing middle class and rising insurance penetration.

Bancassurance In Europe Product Landscape

This section details the innovative products shaping the bancassurance landscape. It highlights unique selling propositions (USPs) and advancements in product design and functionality. The focus is on innovative features, technological integrations, and performance metrics. The analysis captures the latest product trends and their competitive advantage.

Recent product innovations include embedded insurance offerings, personalized insurance packages tailored to individual customer needs using AI and data analytics. Enhanced digital platforms providing seamless online purchasing experiences with personalized advice and easy claim processing have also emerged as key trends.

Key Drivers, Barriers & Challenges in Bancassurance In Europe

This section outlines the key drivers and challenges faced by the bancassurance market in Europe. It analyzes how technological advancements, economic factors, and policy changes impact the market. It explores the impact of these factors using quantitative data where possible.

Key Drivers:

- Technological Advancements: Digitalization, AI, and data analytics are driving efficiency, customer engagement, and product innovation.

- Economic Growth: Stable economic conditions and rising disposable incomes contribute to increased demand for insurance products.

- Favorable Regulatory Environment: Supportive regulations can stimulate investment and innovation within the sector.

Challenges & Restraints:

- Regulatory Hurdles: Strict regulations related to data protection and financial compliance increase operational costs and complexity.

- Competitive Pressure: Intense competition from direct insurers and online platforms requires continuous innovation and cost optimization.

- Cybersecurity Threats: Data breaches and cyberattacks pose a significant threat to the sector, demanding robust security measures. This has increased operational costs by approximately xx Million in 2024.

Emerging Opportunities in Bancassurance In Europe

This section highlights promising areas for growth within the European bancassurance market. It identifies untapped markets, emerging technologies, and evolving consumer preferences that offer significant opportunities.

- Untapped Markets: Expansion into underserved regions and demographic groups presents significant growth potential.

- Innovative Applications: Integrating bancassurance products with new technologies like IoT and blockchain opens new avenues for value creation.

- Evolving Consumer Preferences: Meeting the growing demand for personalized, digital-first insurance solutions is crucial for market success.

Growth Accelerators in the Bancassurance In Europe Industry

This section identifies the catalysts driving long-term growth within the bancassurance market. The focus is on technological breakthroughs, successful partnerships, and expansion strategies.

Strategic partnerships between banks and insurers are accelerating market growth. These collaborative efforts enhance product offerings, distribution networks, and customer reach, resulting in increased market share and revenue generation. Technological advancements, such as AI and data analytics, are improving efficiency, creating personalized customer experiences, and driving market expansion. This facilitates the development of innovative product offerings and streamlined processes, leading to further growth.

Key Players Shaping the Bancassurance In Europe Market

- AG Insurance

- Credit Agricole

- Aviva

- AXA

- BNP Paribas Cardif

- Zurich

- Intesa Sanpaolo

- CNP Assurances

- Allianz

- Generali

Notable Milestones in Bancassurance In Europe Sector

- June 2023: Admiral Seguros and ING Spain launched ING Orange Auto Insurance, a digital bancassurance product. This signifies a significant move towards digitalization within the European bancassurance sector.

- February 2023: Talanx signed a ten-year bancassurance deal with Bank Millennium in Poland, expanding its presence in the Central and Eastern European market. This highlights the increasing importance of regional expansion strategies for growth.

In-Depth Bancassurance In Europe Market Outlook

The European bancassurance market presents significant long-term growth potential. Strategic partnerships, technological advancements, and expansion into new markets will continue to fuel market expansion. The increasing demand for personalized insurance solutions and the growing adoption of digital channels will further drive market growth in the coming years. The market is expected to experience robust growth, driven by an increasing focus on digital transformation, innovative product offerings, and expanding customer base.

Bancassurance In Europe Segmentation

-

1. Type of Insurance

- 1.1. Life Insurance

- 1.2. Non-life Insurance

Bancassurance In Europe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bancassurance In Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory and Technological Developments

- 3.3. Market Restrains

- 3.3.1. Competition from Other Distribution Channels

- 3.4. Market Trends

- 3.4.1. The Rising Need for Non-Life Insurance is Propelling Expansion in the Bancassurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 5.1.1. Life Insurance

- 5.1.2. Non-life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 6. North America Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 6.1.1. Life Insurance

- 6.1.2. Non-life Insurance

- 6.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 7. South America Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 7.1.1. Life Insurance

- 7.1.2. Non-life Insurance

- 7.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 8. Europe Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 8.1.1. Life Insurance

- 8.1.2. Non-life Insurance

- 8.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 9. Middle East & Africa Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 9.1.1. Life Insurance

- 9.1.2. Non-life Insurance

- 9.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 10. Asia Pacific Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 10.1.1. Life Insurance

- 10.1.2. Non-life Insurance

- 10.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 11. Germany Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 12. France Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 13. Italy Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Bancassurance In Europe Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 AG Insurance

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Credit Agricole

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Aviva**List Not Exhaustive

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 AXA

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 BNP Paribas Cardif

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Zurich

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Intesa Sanpaolo

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 CNP Assurances

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Allianz

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Generali

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 AG Insurance

List of Figures

- Figure 1: Global Bancassurance In Europe Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Europe Bancassurance In Europe Revenue (Million), by Country 2024 & 2032

- Figure 3: Europe Bancassurance In Europe Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Bancassurance In Europe Revenue (Million), by Type of Insurance 2024 & 2032

- Figure 5: North America Bancassurance In Europe Revenue Share (%), by Type of Insurance 2024 & 2032

- Figure 6: North America Bancassurance In Europe Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Bancassurance In Europe Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Bancassurance In Europe Revenue (Million), by Type of Insurance 2024 & 2032

- Figure 9: South America Bancassurance In Europe Revenue Share (%), by Type of Insurance 2024 & 2032

- Figure 10: South America Bancassurance In Europe Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Bancassurance In Europe Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Bancassurance In Europe Revenue (Million), by Type of Insurance 2024 & 2032

- Figure 13: Europe Bancassurance In Europe Revenue Share (%), by Type of Insurance 2024 & 2032

- Figure 14: Europe Bancassurance In Europe Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Bancassurance In Europe Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Bancassurance In Europe Revenue (Million), by Type of Insurance 2024 & 2032

- Figure 17: Middle East & Africa Bancassurance In Europe Revenue Share (%), by Type of Insurance 2024 & 2032

- Figure 18: Middle East & Africa Bancassurance In Europe Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Bancassurance In Europe Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Bancassurance In Europe Revenue (Million), by Type of Insurance 2024 & 2032

- Figure 21: Asia Pacific Bancassurance In Europe Revenue Share (%), by Type of Insurance 2024 & 2032

- Figure 22: Asia Pacific Bancassurance In Europe Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Bancassurance In Europe Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bancassurance In Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 3: Global Bancassurance In Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Bancassurance In Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 13: Global Bancassurance In Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 18: Global Bancassurance In Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 23: Global Bancassurance In Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 34: Global Bancassurance In Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Turkey Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Israel Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: GCC Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: North Africa Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Africa Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Middle East & Africa Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 42: Global Bancassurance In Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 43: China Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: India Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: ASEAN Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Oceania Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Bancassurance In Europe Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bancassurance In Europe?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Bancassurance In Europe?

Key companies in the market include AG Insurance, Credit Agricole, Aviva**List Not Exhaustive, AXA, BNP Paribas Cardif, Zurich, Intesa Sanpaolo, CNP Assurances, Allianz, Generali.

3. What are the main segments of the Bancassurance In Europe?

The market segments include Type of Insurance.

4. Can you provide details about the market size?

The market size is estimated to be USD 656 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory and Technological Developments.

6. What are the notable trends driving market growth?

The Rising Need for Non-Life Insurance is Propelling Expansion in the Bancassurance Market.

7. Are there any restraints impacting market growth?

Competition from Other Distribution Channels.

8. Can you provide examples of recent developments in the market?

June 2023: Admiral Seguros collaborated with ING Spain for a digital bancassurance venture. The collaboration stemmed from Admiral Group's expansion of its distribution network with insurance solutions. This joint partnership led to the creation of ING Orange Auto Insurance, a digital product designed to revolutionize the insurance sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bancassurance In Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bancassurance In Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bancassurance In Europe?

To stay informed about further developments, trends, and reports in the Bancassurance In Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence