Key Insights

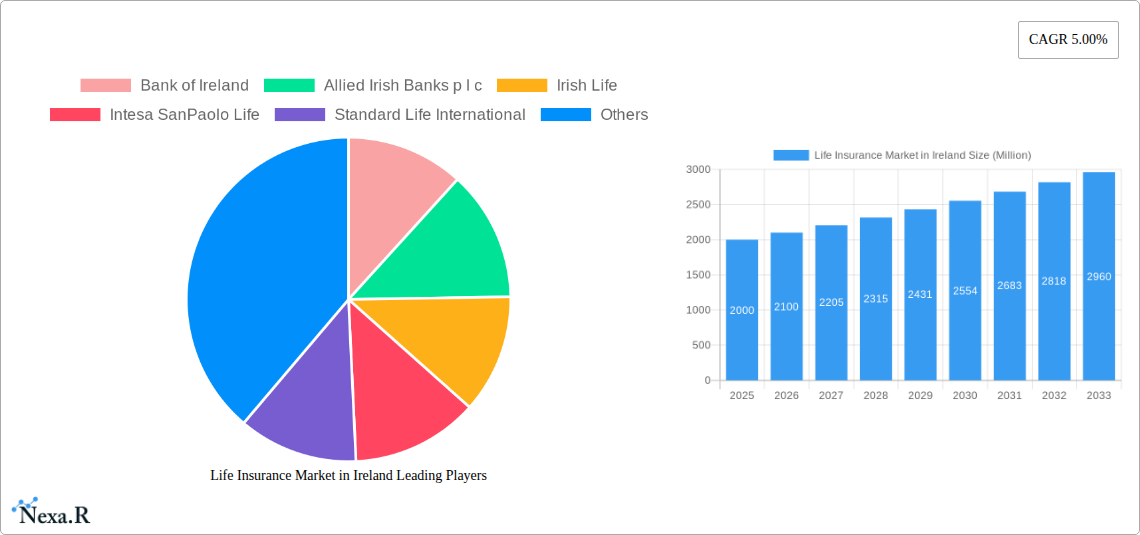

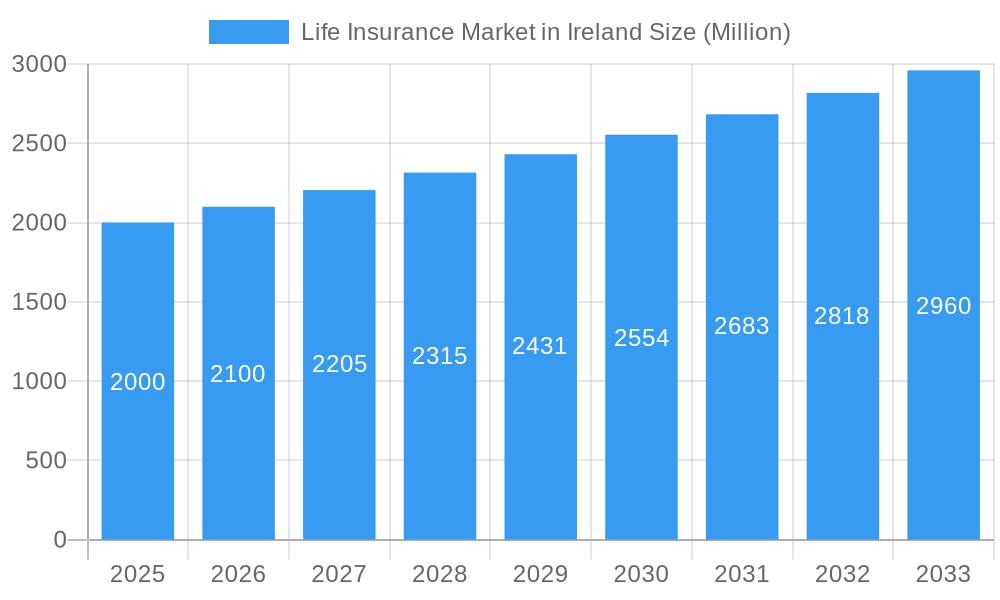

The Irish life insurance market, valued at approximately €2 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 5.00% from 2025 to 2033. This growth is driven by several key factors. An aging population necessitates increased demand for retirement planning and long-term care solutions, fueling the market's expansion. Furthermore, rising awareness of financial security needs and the increasing prevalence of sophisticated financial products, like unit-linked and investment-linked policies, are contributing to market expansion. The growing adoption of digital technologies within the insurance sector is also streamlining operations, improving customer engagement and driving sales. Key players like Bank of Ireland, Allied Irish Banks, and Irish Life are leveraging these trends, while facing competitive pressures from international insurers such as Intesa SanPaolo Life and Zurich Insurance Group. The market is segmented by product type (e.g., term life, whole life, endowment), distribution channel (e.g., online, brokers, banks), and customer demographics, each contributing varying levels of growth within the overall market.

Life Insurance Market in Ireland Market Size (In Billion)

Regulatory changes aimed at enhancing consumer protection and promoting transparency could impact market dynamics. While the market displays a positive outlook, potential economic downturns or shifts in consumer preferences could exert downward pressure on growth. The competitive landscape is characterized by both established domestic players and international competitors, resulting in a dynamic market where innovation and customer service are crucial for success. Companies are focusing on developing personalized products, improving customer service, and leveraging technology to enhance their market position. The projected market size for 2033 would be approximately €2.8 billion, based on the 5% CAGR from the €2 billion 2025 valuation, though this is a projection and subject to market fluctuations.

Life Insurance Market in Ireland Company Market Share

Life Insurance Market in Ireland: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Life Insurance Market in Ireland, covering market dynamics, growth trends, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market of the Irish financial services sector and its child market segment of life insurance, providing granular data and forecasts.

Life Insurance Market in Ireland Market Dynamics & Structure

This section analyzes the Irish life insurance market's structure, focusing on market concentration, technological advancements, regulatory influences, competitive dynamics, and M&A activity. The market is characterized by a mix of established domestic and international players, leading to a moderately consolidated landscape. Quantitative data, including market share breakdowns and M&A deal volumes, will be presented alongside qualitative assessments of factors impacting market dynamics.

- Market Concentration: xx% market share held by top 5 players in 2024. Expected consolidation in the coming years.

- Technological Innovation: Increasing adoption of InsurTech solutions driving efficiency and customer experience improvements. However, significant barriers to entry exist for smaller players due to investment costs.

- Regulatory Framework: Stringent regulatory oversight impacts product development and market entry. Compliance costs represent a significant challenge.

- Competitive Landscape: Intense competition among established players, with new entrants focusing on niche segments. Pricing pressures and product differentiation are key strategic priorities.

- M&A Activity: xx M&A deals recorded between 2019-2024, with a focus on strategic acquisitions to enhance market share and expand product portfolios. Further consolidation expected.

- End-User Demographics: Aging population and rising awareness of financial planning driving demand for life insurance products.

Life Insurance Market in Ireland Growth Trends & Insights

This section provides a detailed analysis of the life insurance market's growth trajectory in Ireland, using comprehensive market sizing data, CAGR figures, and penetration rates. The analysis incorporates technological disruptions and shifting consumer preferences to provide a nuanced understanding of the market's evolution. The section will examine how factors such as increasing disposable income and changing consumer behaviour influence market growth.

- Market Size Evolution: Market size in 2024: xx Million. Projected growth to xx Million by 2033. CAGR (2025-2033): xx%.

- Adoption Rates: Penetration rates increasing steadily, with specific segments (e.g., term life, whole life) showing varying growth rates.

- Technological Disruptions: Digitalization, AI, and big data analytics are transforming product offerings, distribution channels, and customer interactions.

- Consumer Behavior: Shift towards online purchasing and personalized products. Growing demand for bundled services and integrated financial planning solutions.

Dominant Regions, Countries, or Segments in Life Insurance Market in Ireland

This section pinpoints the leading regions or segments within the Irish life insurance market responsible for driving growth. Factors like economic policies, infrastructural developments, and regulatory environments are examined to explain regional dominance.

- Dominant Segment: Term life insurance dominates the market, with a market share of xx% in 2024. This is primarily driven by affordability and its straightforward nature.

- Regional Variations: Dublin and surrounding areas constitute the largest market, owing to higher concentrations of income and awareness. However, growth opportunities are seen in other regions as financial literacy improves.

- Growth Potential: Opportunities for growth exist in under-penetrated segments like critical illness and retirement planning. Furthermore, the shift toward digitalization presents lucrative opportunities.

Life Insurance Market in Ireland Product Landscape

This section examines the product innovations, applications, and performance metrics of life insurance products within the Irish market. Key features, unique selling propositions, and technological advancements driving product evolution are analyzed.

The Irish market offers a variety of products including term life, whole life, endowment, and investment-linked policies. Innovation centers around customization, digital platforms, and integration with other financial services. Insurers are increasingly incorporating health and wellness features to incentivize healthier lifestyles and attract younger customers.

Key Drivers, Barriers & Challenges in Life Insurance Market in Ireland

This section identifies the key factors driving market growth, including technology adoption, economic conditions, and supportive government policies. Conversely, challenges like regulatory hurdles, supply chain issues, and intense competition are examined.

Key Drivers:

- Increased awareness of financial planning and protection needs.

- Favorable regulatory environment promoting insurance penetration.

- Technological advancements offering greater efficiency and customer experience.

Key Barriers & Challenges:

- Intense competition leading to pricing pressures.

- Stringent regulatory compliance costs.

- Economic uncertainty impacting consumer confidence and spending.

Emerging Opportunities in Life Insurance Market in Ireland

This section explores opportunities for market expansion, focusing on untapped customer segments, innovative applications, and changing consumer preferences.

- Expansion into under-penetrated rural markets.

- Development of customized insurance products catering to specific needs.

- Integration of life insurance with other financial services through fintech partnerships.

Growth Accelerators in the Life Insurance Market in Ireland Industry

This section identifies the long-term growth catalysts, including technological breakthroughs, strategic collaborations, and broader market expansion strategies.

Technological advancements like AI and machine learning will streamline operations, enhance risk assessment, and personalize customer offerings. Strategic partnerships with fintech companies will create innovative product offerings and distribution channels. Expansion into underserved markets through increased financial literacy campaigns will further accelerate growth.

Key Players Shaping the Life Insurance Market in Ireland Market

- Bank of Ireland

- Allied Irish Banks p.l.c

- Irish Life

- Intesa SanPaolo Life

- Standard Life International

- Zurich Insurance Group

- Darta Saving Life Assurance

- XL Insurance

- New Ireland Assurance

- Utmost Paneurope

- Partner Reinsurance Europe

Notable Milestones in Life Insurance Market in Ireland Sector

- May 23, 2022: FINEOS partnered with EY Ireland to accelerate digital transformation in the insurance sector, impacting operational efficiency and customer experience.

- April 18, 2022: Assured Partners entered the Irish market through the acquisition of Gallivan Murphy Insurance Brokers Limited, signaling increased competition and potential for further market expansion.

In-Depth Life Insurance Market in Ireland Market Outlook

The Irish life insurance market is poised for sustained growth over the forecast period, driven by increasing financial awareness, technological innovation, and strategic partnerships. Opportunities lie in expanding into underserved segments, developing customized products, and leveraging digital platforms to enhance customer engagement. Continued market consolidation is expected, with larger players likely to acquire smaller firms. The market will likely witness further investments in technology and digital transformation as companies race to enhance efficiency and customer experience.

Life Insurance Market in Ireland Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Property Insurance

- 1.2.2. Motor insurance

- 1.2.3. Health and accident insurance

- 1.2.4. Travel Insurance

- 1.2.5. Rest of Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Brokers

- 2.2. Agents

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Life Insurance Market in Ireland Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Life Insurance Market in Ireland Regional Market Share

Geographic Coverage of Life Insurance Market in Ireland

Life Insurance Market in Ireland REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Online Sale of Insurance Policy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Property Insurance

- 5.1.2.2. Motor insurance

- 5.1.2.3. Health and accident insurance

- 5.1.2.4. Travel Insurance

- 5.1.2.5. Rest of Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Brokers

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. North America Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-life Insurance

- 6.1.2.1. Property Insurance

- 6.1.2.2. Motor insurance

- 6.1.2.3. Health and accident insurance

- 6.1.2.4. Travel Insurance

- 6.1.2.5. Rest of Non-Life Insurance

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 6.2.1. Brokers

- 6.2.2. Agents

- 6.2.3. Banks

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 7. South America Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-life Insurance

- 7.1.2.1. Property Insurance

- 7.1.2.2. Motor insurance

- 7.1.2.3. Health and accident insurance

- 7.1.2.4. Travel Insurance

- 7.1.2.5. Rest of Non-Life Insurance

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 7.2.1. Brokers

- 7.2.2. Agents

- 7.2.3. Banks

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 8. Europe Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-life Insurance

- 8.1.2.1. Property Insurance

- 8.1.2.2. Motor insurance

- 8.1.2.3. Health and accident insurance

- 8.1.2.4. Travel Insurance

- 8.1.2.5. Rest of Non-Life Insurance

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 8.2.1. Brokers

- 8.2.2. Agents

- 8.2.3. Banks

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 9. Middle East & Africa Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-life Insurance

- 9.1.2.1. Property Insurance

- 9.1.2.2. Motor insurance

- 9.1.2.3. Health and accident insurance

- 9.1.2.4. Travel Insurance

- 9.1.2.5. Rest of Non-Life Insurance

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 9.2.1. Brokers

- 9.2.2. Agents

- 9.2.3. Banks

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 10. Asia Pacific Life Insurance Market in Ireland Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-life Insurance

- 10.1.2.1. Property Insurance

- 10.1.2.2. Motor insurance

- 10.1.2.3. Health and accident insurance

- 10.1.2.4. Travel Insurance

- 10.1.2.5. Rest of Non-Life Insurance

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 10.2.1. Brokers

- 10.2.2. Agents

- 10.2.3. Banks

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bank of Ireland

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Allied Irish Banks p l c

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Irish Life

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intesa SanPaolo Life

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Standard Life International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zurich Insurance Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Darta Saving Life Assurance

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 XL Insurance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 New Ireland Assurance

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Utmost Paneurope

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Partner Reinsurance Europe**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Bank of Ireland

List of Figures

- Figure 1: Global Life Insurance Market in Ireland Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 3: North America Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 4: North America Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 5: North America Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 6: North America Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 9: South America Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 10: South America Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 11: South America Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 12: South America Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 15: Europe Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 16: Europe Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 17: Europe Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 18: Europe Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 21: Middle East & Africa Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 22: Middle East & Africa Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 23: Middle East & Africa Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 24: Middle East & Africa Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Life Insurance Market in Ireland Revenue (undefined), by Insurance type 2025 & 2033

- Figure 27: Asia Pacific Life Insurance Market in Ireland Revenue Share (%), by Insurance type 2025 & 2033

- Figure 28: Asia Pacific Life Insurance Market in Ireland Revenue (undefined), by Channel of Distribution 2025 & 2033

- Figure 29: Asia Pacific Life Insurance Market in Ireland Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 30: Asia Pacific Life Insurance Market in Ireland Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Life Insurance Market in Ireland Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 2: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 3: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 5: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 6: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 11: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 12: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 17: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 18: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 29: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 30: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 38: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Channel of Distribution 2020 & 2033

- Table 39: Global Life Insurance Market in Ireland Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Life Insurance Market in Ireland Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life Insurance Market in Ireland?

The projected CAGR is approximately 0.6%.

2. Which companies are prominent players in the Life Insurance Market in Ireland?

Key companies in the market include Bank of Ireland, Allied Irish Banks p l c, Irish Life, Intesa SanPaolo Life, Standard Life International, Zurich Insurance Group, Darta Saving Life Assurance, XL Insurance, New Ireland Assurance, Utmost Paneurope, Partner Reinsurance Europe**List Not Exhaustive.

3. What are the main segments of the Life Insurance Market in Ireland?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Online Sale of Insurance Policy.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On May 23, 2022, FINEOS partnered with EY Ireland to accelerate smart digital transformation for insurance carriers in the life, accident, and health industry. It will positively impact the employee benefits value chain, from insurers and employers to employees, while also achieving tangible operational efficiencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life Insurance Market in Ireland," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life Insurance Market in Ireland report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life Insurance Market in Ireland?

To stay informed about further developments, trends, and reports in the Life Insurance Market in Ireland, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence