Key Insights

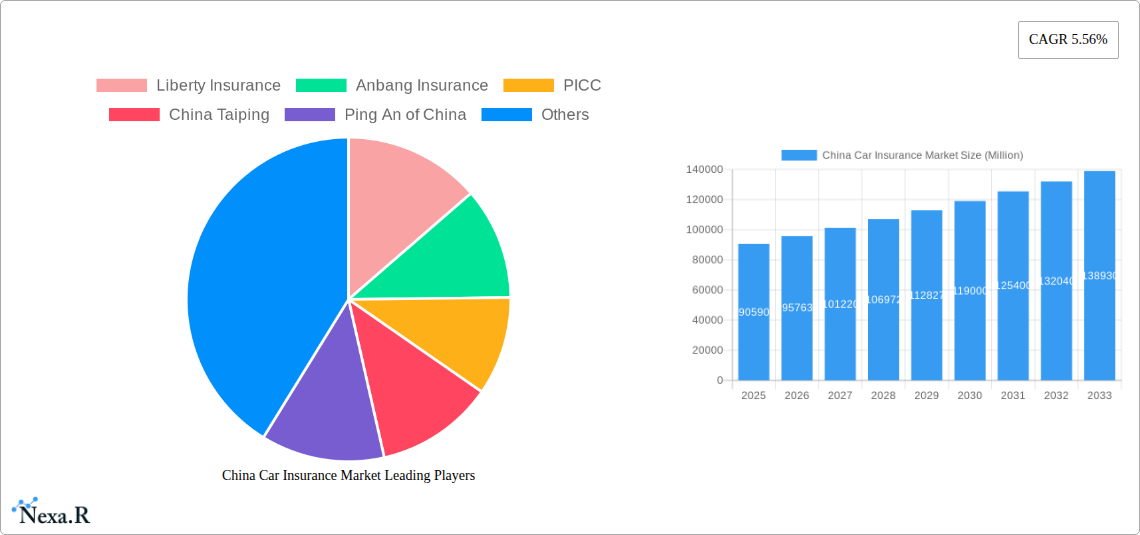

The China car insurance market, valued at $90.59 billion in 2025, is projected to experience robust growth, driven by a burgeoning middle class, increasing car ownership, and stricter government regulations on mandatory insurance coverage. The Compound Annual Growth Rate (CAGR) of 5.56% from 2025 to 2033 signifies a substantial expansion of the market over the forecast period. Key growth drivers include rising disposable incomes fueling higher vehicle purchases, the expanding commercial vehicle fleet, and a shift towards comprehensive coverage options. The market is segmented by coverage type (third-party liability, collision/comprehensive, and others), application (personal and commercial vehicles), and distribution channels (direct sales, agents, brokers, banks, and online platforms). While the market faces potential restraints such as economic fluctuations and intense competition among established players like Ping An of China, Liberty Insurance, and Allianz, the overall positive trajectory is driven by the country's significant economic growth and increasing motorization rates. The dominance of established players is also challenged by the increasing prominence of online distribution channels, impacting the market dynamics.

China Car Insurance Market Market Size (In Billion)

The market's segmentation offers diverse opportunities for insurers. Third-party liability insurance remains a substantial segment, fueled by mandatory insurance regulations. However, there is significant potential for growth in collision and comprehensive coverage as consumer awareness and affordability improve. The distribution channel landscape is evolving, with online sales gaining traction and challenging traditional agents and brokers. This necessitates insurers to adapt their strategies and embrace digitalization to remain competitive. Regional variations within China also present opportunities for targeted marketing and product development. Considering the steady CAGR and the market dynamics, strategic investments in digital infrastructure and customer service are critical for sustained success within the competitive China car insurance market. The long-term outlook remains positive, projecting continued expansion through 2033.

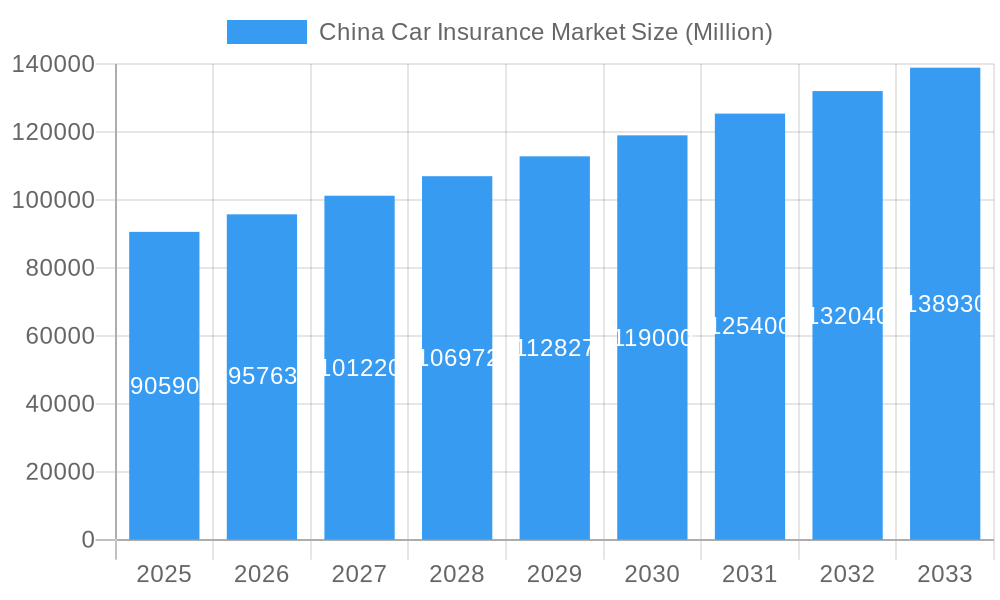

China Car Insurance Market Company Market Share

China Car Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China car insurance market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this rapidly evolving market. The market is segmented by coverage (Third-Party Liability Coverage, Collision/Comprehensive/Other Optional Coverage), application (Personal Vehicles, Commercial Vehicles), and distribution channel (Direct Sales, Insurance Agents, Brokers, Banks, Online, Other Distribution Channels). The total market size is predicted to reach xx Million units by 2033.

China Car Insurance Market Dynamics & Structure

The China car insurance market exhibits a complex interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with key players like Ping An of China, PICC, and Sinosafe holding significant market share, but a vibrant competitive landscape also exists. Technological innovation, driven by the rise of Insurtech and digitalization, is reshaping the industry. Stringent regulatory frameworks imposed by the Chinese government play a crucial role in market stability and growth. The emergence of innovative products and services, alongside competitive substitutes, is also impacting market dynamics. The end-user demographics are shifting towards younger, tech-savvy consumers, influencing product development and distribution strategies. Furthermore, the market is witnessing increasing M&A activity, as illustrated by recent mergers (detailed further in this report).

- Market Concentration: Moderate, with top players holding xx% market share in 2024.

- Technological Innovation: Rapid adoption of digital platforms and AI-driven solutions.

- Regulatory Framework: Stringent regulations influence product offerings and distribution channels.

- Competitive Substitutes: Alternative risk management solutions impacting market penetration.

- End-User Demographics: Shifting towards younger, digitally native consumers.

- M&A Trends: Increasing consolidation through mergers and acquisitions, totaling xx deals in the last 5 years. (e.g., xx% increase year-on-year).

China Car Insurance Market Growth Trends & Insights

The China car insurance market has witnessed substantial growth throughout the historical period (2019-2024). Driven by rising car ownership, expanding middle class, and increasing awareness of insurance benefits, the market exhibits a significant CAGR of xx% during 2019-2024. Technological disruptions, including the implementation of telematics and usage-based insurance (UBI), have influenced consumer behaviour. A clear shift towards online distribution channels is also observed, reflecting the growing digital literacy and convenience-seeking preferences among Chinese consumers. Market penetration has increased steadily, with xx% of vehicle owners holding insurance in 2024. The forecast period (2025-2033) projects continued growth, albeit at a slightly moderated pace due to market maturity, but still retaining significant potential. The overall market size is projected to reach xx Million units by 2033.

Dominant Regions, Countries, or Segments in China Car Insurance Market

While data for granular regional breakdown is limited for this report, the market's growth is predominantly driven by high-density urban areas and provinces with robust economic activity. In terms of segments, the Personal Vehicles application segment demonstrates the highest growth potential and largest market share, reflecting the surging private car ownership. Within coverage types, Third-Party Liability Coverage remains the dominant segment due to mandatory requirements. However, Collision/Comprehensive/Other Optional Coverage is showing faster growth, indicating increased consumer demand for comprehensive protection. Online distribution channels are increasingly important, though traditional channels like insurance agents remain significant players.

- Key Growth Drivers: Expanding middle class, rising car ownership, increasing urbanization, government policies promoting insurance penetration.

- Dominant Segments: Personal Vehicles (xx% market share in 2024), Third-Party Liability Coverage (xx% market share in 2024), Online Distribution (xx% market share in 2024).

- Growth Potential: Highest in Personal Vehicles and Collision/Comprehensive/Other Optional Coverage segments, and within online distribution channels.

China Car Insurance Market Product Landscape

The China car insurance market offers a diverse range of products, from basic third-party liability coverage to comprehensive packages incorporating collision, theft, and other optional add-ons. Technological advancements are driving the development of innovative products such as usage-based insurance (UBI), leveraging telematics data to personalize premiums and offer tailored risk management solutions. Many insurers are also incorporating digital platforms and mobile apps to streamline the purchasing process and enhance customer experience, emphasizing personalized service and value-added benefits as key USPs.

Key Drivers, Barriers & Challenges in China Car Insurance Market

Key Drivers: Rising car ownership, increasing awareness of insurance benefits, government initiatives promoting insurance penetration, technological advancements in Insurtech, and the expansion of online distribution channels.

Challenges: Intense competition among established and new players, fluctuating fuel prices impacting consumer spending on insurance, and the regulatory complexities associated with the insurance sector. Supply chain disruptions due to geopolitical factors can lead to higher costs and reduced availability of certain insurance products.

Emerging Opportunities in China Car Insurance Market

Untapped opportunities exist in expanding insurance coverage to rural areas, developing tailored products for specific vehicle types (e.g., electric vehicles), and leveraging emerging technologies like AI and blockchain for fraud detection and risk assessment. Furthermore, there's potential for growth in niche markets like commercial vehicle insurance and specialized insurance products for high-value vehicles.

Growth Accelerators in the China Car Insurance Market Industry

The long-term growth of the China car insurance market is propelled by strategic partnerships between Insurtech companies and traditional insurers, technological advancements in data analytics and AI for risk management, and the continued expansion of the Chinese automotive market itself. Government support for financial technology and digitalization continues to act as a catalyst.

Key Players Shaping the China Car Insurance Market Market

- Liberty Insurance

- Anbang Insurance

- PICC

- China Taiping

- Ping An of China

- Sinosafe

- Sunshine

- Bank of China

- Zurich General Insurance

- Allianz

Notable Milestones in China Car Insurance Market Sector

- May 2022: Merger of Auto Services Group Limited (Sun Car Online Insurance Agency) and Goldenbridge Acquisition Limited, signifying increased digitalization in the sector.

- January 2023: Merger of Cheche Group (auto insurance technology platform) and Prime Impact Acquisition I, further accelerating the digital transformation of the car insurance market.

In-Depth China Car Insurance Market Market Outlook

The China car insurance market is poised for continued growth in the coming years, driven by a multitude of factors. The increasing adoption of technology, the expansion of the middle class and private vehicle ownership, along with supportive government policies, creates a favourable environment for sustained expansion. Strategic partnerships and investments in innovative products and services will be key to success for companies operating in this dynamic market. The market will increasingly benefit from further technology driven efficiency and penetration.

China Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Insurance Agents

- 3.3. Brokers

- 3.4. Banks

- 3.5. Online

- 3.6. Other Distribution Channels

China Car Insurance Market Segmentation By Geography

- 1. China

China Car Insurance Market Regional Market Share

Geographic Coverage of China Car Insurance Market

China Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in the China; Increase in Road Traffic Accidents

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claim; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Rising Road Traffic Accidents

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Insurance Agents

- 5.3.3. Brokers

- 5.3.4. Banks

- 5.3.5. Online

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Liberty Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Anbang Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PICC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Taiping

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ping An of China

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sinosafe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunshine

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bank of China

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zurich General Insurance**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allianz

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Liberty Insurance

List of Figures

- Figure 1: China Car Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Car Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: China Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: China Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: China Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: China Car Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 6: China Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: China Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: China Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Car Insurance Market?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the China Car Insurance Market?

Key companies in the market include Liberty Insurance, Anbang Insurance, PICC, China Taiping, Ping An of China, Sinosafe, Sunshine, Bank of China, Zurich General Insurance**List Not Exhaustive, Allianz.

3. What are the main segments of the China Car Insurance Market?

The market segments include Coverage, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in the China; Increase in Road Traffic Accidents.

6. What are the notable trends driving market growth?

Rising Road Traffic Accidents.

7. Are there any restraints impacting market growth?

Increase in Cost of Claim; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

May 2022: Auto Services Group Limited, which exists as a leading provider of digitalized auto services and auto insurance through Sun Car Online Insurance Agency in China, merged with Goldenbridge Acquisition Limited, a British Virgin Islands special purpose acquisition company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Car Insurance Market?

To stay informed about further developments, trends, and reports in the China Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence