Key Insights

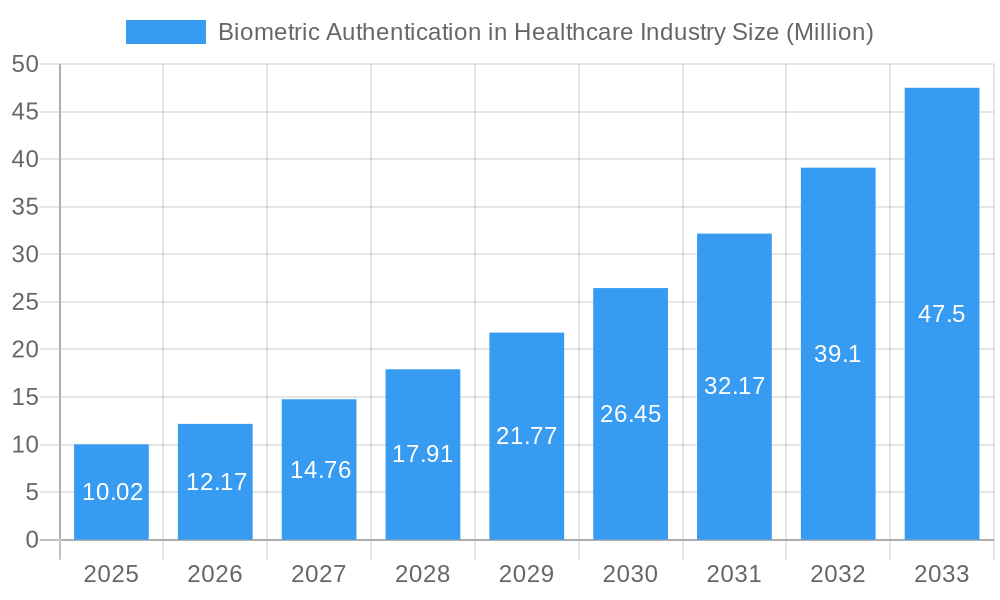

The global Biometric Authentication in Healthcare market is poised for remarkable expansion, projected to reach approximately USD 10.02 million and grow at an impressive Compound Annual Growth Rate (CAGR) of 21.29% during the forecast period of 2025-2033. This robust growth is underpinned by an escalating demand for enhanced data security and patient privacy within the healthcare ecosystem. The increasing adoption of digital health solutions, coupled with the rising incidence of cyber threats targeting sensitive patient information, are significant drivers propelling the market forward. Furthermore, the imperative to streamline patient identification and streamline access to medical records for authorized personnel is fostering a greater reliance on advanced biometric technologies. The shift towards value-based care models also necessitates secure and efficient patient management systems, where biometrics play a crucial role in ensuring accurate patient data and preventing medical errors.

Biometric Authentication in Healthcare Industry Market Size (In Million)

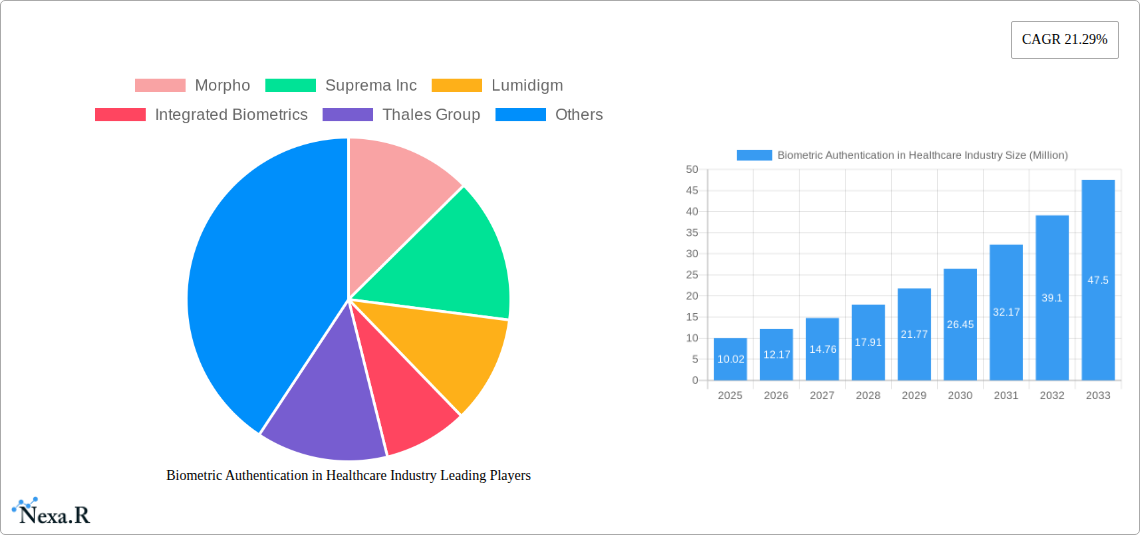

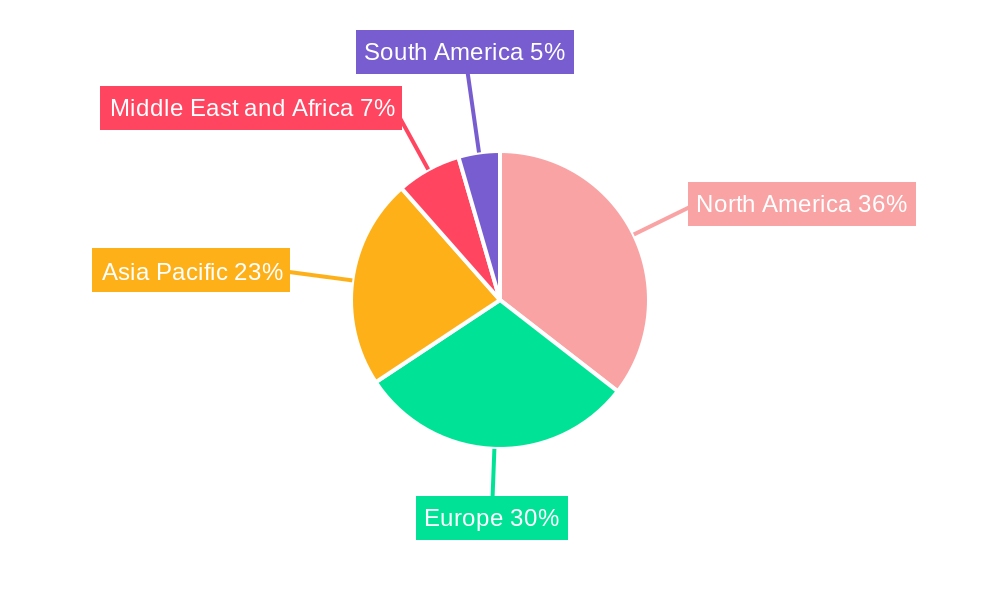

The market is segmented across various technologies, with Multi-factor Authentication (MFA) expected to dominate due to its superior security capabilities. In terms of applications, Medical Record and Data Center Security and Patient Identification and Tracking are anticipated to witness substantial growth, reflecting the critical need for safeguarding sensitive health information and ensuring accurate patient provenance. Hospitals and Clinics are expected to be the leading end-users, driven by the need to secure patient data and improve operational efficiency. Geographically, North America and Europe are currently the dominant regions, owing to established healthcare infrastructure and stringent data privacy regulations. However, the Asia Pacific region is projected to exhibit the fastest growth, fueled by increasing healthcare digitalization and a burgeoning patient population. Key players like Morpho, Suprema Inc., and Thales Group are actively investing in research and development to introduce innovative biometric solutions tailored for the healthcare sector, further stimulating market dynamism.

Biometric Authentication in Healthcare Industry Company Market Share

Biometric Authentication in Healthcare Industry: Market Analysis and Growth Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the global biometric authentication market within the healthcare industry. We delve into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, emerging opportunities, and influential players, providing a robust outlook for the period of 2019-2033. Leveraging high-traffic keywords, this report is optimized for search engine visibility, making it an indispensable resource for industry professionals, researchers, and investors seeking to understand the evolving landscape of secure patient and data access in healthcare.

Biometric Authentication in Healthcare Industry Market Dynamics & Structure

The biometric authentication market in healthcare is characterized by a moderate to high level of concentration, driven by significant technological innovation and the increasing demand for enhanced data security and patient identification. Key drivers include the rising threat of cyberattacks targeting sensitive health information and the growing adoption of electronic health records (EHRs). Regulatory frameworks, such as HIPAA in the United States and GDPR in Europe, also mandate robust security measures, compelling healthcare providers to invest in advanced authentication solutions. Competitive product substitutes, while present in traditional access control methods, are increasingly being outperformed by the inherent security and convenience of biometrics. End-user demographics are diverse, ranging from large hospital networks to specialized clinics and research institutions, each with unique security requirements. Mergers and acquisitions (M&A) are also shaping the market, with larger players acquiring innovative startups to broaden their product portfolios and market reach.

- Market Concentration: Moderate to High, with a few dominant players and a growing number of specialized solution providers.

- Technological Innovation Drivers: Increasing cyber threats, EHR adoption, demand for patient convenience, and advancements in biometric sensor technology.

- Regulatory Frameworks: HIPAA, GDPR, and other regional data privacy and security regulations act as significant drivers for adoption.

- Competitive Product Substitutes: Traditional password-based systems, smart cards, and multi-factor authentication methods that do not involve biometrics.

- End-User Demographics: Hospitals, clinics, research institutions, laboratories, and remote patient monitoring services.

- M&A Trends: Strategic acquisitions by larger technology firms to expand their healthcare biometric offerings.

Biometric Authentication in Healthcare Industry Growth Trends & Insights

The global biometric authentication in healthcare market is poised for substantial growth, driven by an escalating need for secure patient identification, access control for sensitive medical records, and the increasing adoption of digital health technologies. The market size, estimated at a significant xx Million units in the base year 2025, is projected to experience a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This upward trajectory is underpinned by the continuous evolution of biometric technologies, including advancements in facial recognition, fingerprint scanning, iris recognition, and voice biometrics, offering greater accuracy and user-friendliness. The growing penetration of smart devices and wearables in healthcare further fuels the demand for seamless and secure authentication solutions for remote patient monitoring and telehealth services. Consumer behavior is shifting towards embracing biometric solutions for their convenience and perceived security, reducing reliance on cumbersome passwords and PINs. Technological disruptions, such as the development of contactless biometrics, are gaining traction, especially in the post-pandemic era, further accelerating adoption rates.

The market will witness increased integration of multi-factor authentication (MFA) solutions, combining biometrics with other authentication methods to provide an exceptionally high level of security for critical healthcare data. The expansion of healthcare infrastructure in developing economies and government initiatives promoting digital health are also contributing to the market's expansion. Key market segments, such as patient identification and tracking, are expected to see the highest growth due to the critical need for accurate patient identification to prevent medical errors and ensure proper care delivery. The increasing volume of sensitive patient data being digitized and stored remotely necessitates advanced security measures, making biometric authentication a cornerstone of modern healthcare IT infrastructure. The shift towards value-based care models also emphasizes the need for efficient and secure patient management systems, where biometrics play a crucial role.

Dominant Regions, Countries, or Segments in Biometric Authentication in Healthcare Industry

North America is anticipated to emerge as the dominant region in the global biometric authentication in healthcare industry, driven by its advanced healthcare infrastructure, high adoption rates of digital health technologies, and stringent regulatory environment. The United States, in particular, plays a pivotal role due to significant investments in healthcare IT, widespread implementation of Electronic Health Records (EHRs), and a proactive approach to cybersecurity. The presence of leading healthcare organizations and technology providers, coupled with strong government support for innovation in the healthcare sector, further solidifies North America's leadership.

Within the technology segment, Multi-factor Authentication (MFA) is projected to be a major growth driver. The increasing sophistication of cyber threats targeting healthcare data necessitates layered security approaches, making MFA solutions, which often incorporate biometric factors, highly sought after. This is particularly evident in critical applications like medical record and data center security.

In terms of application, Patient Identification and Tracking is expected to exhibit the fastest growth. Accurate and secure patient identification is paramount to prevent medical errors, ensure correct treatment, and streamline workflows. Biometric solutions offer a reliable and efficient method for achieving this, reducing the risk of duplicate records or misidentification.

Among end-users, Hospitals/Clinics represent the largest and most influential segment. These institutions handle vast amounts of sensitive patient data and have a constant need for secure access control for both patients and healthcare providers. The increasing implementation of EHR systems and the drive for operational efficiency further propel the adoption of biometric authentication in this segment.

- Dominant Region: North America

- Key Drivers in North America: Advanced healthcare infrastructure, high digital health adoption, stringent regulations (HIPAA), significant investment in healthcare IT.

- Leading Country: United States

- Dominance Factors: Proactive cybersecurity stance, widespread EHR implementation, presence of major technology and healthcare players, government initiatives.

- Dominant Technology Segment: Multi-factor Authentication (MFA)

- Key Drivers for MFA: Rising cyber threats, need for robust data protection, regulatory mandates, enhanced user experience through layered security.

- Market Share Potential: High, as it integrates with various biometric modalities for comprehensive security.

- Dominant Application Segment: Patient Identification and Tracking

- Key Drivers for Patient ID: Prevention of medical errors, accurate patient management, streamlined clinical workflows, regulatory compliance.

- Growth Potential: Significant, due to the critical nature of patient safety and data integrity.

- Dominant End User Segment: Hospitals/Clinics

- Key Drivers for Hospitals/Clinics: Large volumes of sensitive data, need for secure access for staff and patients, EHR implementation, operational efficiency goals.

- Market Penetration: Already high and expected to grow further with advanced solution deployments.

Biometric Authentication in Healthcare Industry Product Landscape

The product landscape for biometric authentication in healthcare is rapidly evolving, marked by significant technological advancements and a focus on enhanced accuracy, speed, and user experience. Innovations include the development of multimodal biometric systems that combine multiple authentication methods (e.g., fingerprint and facial recognition) for superior security. Contactless biometrics, such as facial and iris recognition, have gained prominence, driven by hygiene concerns and convenience. Wearable biometric devices are also emerging, enabling continuous patient monitoring and personalized healthcare. Performance metrics such as False Acceptance Rate (FAR) and False Rejection Rate (FRR) continue to improve, making biometric solutions increasingly reliable for sensitive healthcare applications. Companies are differentiating through unique selling propositions like liveness detection to prevent spoofing and advanced encryption for data protection.

Key Drivers, Barriers & Challenges in Biometric Authentication in Healthcare Industry

The biometric authentication in healthcare industry is propelled by several key drivers. The escalating number of cyberattacks and data breaches targeting sensitive patient information is a primary catalyst, driving the demand for robust security solutions. Regulatory compliance with mandates like HIPAA and GDPR, which emphasize data privacy and security, further incentivizes adoption. The increasing adoption of EHRs and the growth of telemedicine necessitate secure patient identification and access control. Moreover, the inherent convenience and user-friendliness of biometrics compared to traditional authentication methods are enhancing patient and provider experiences.

However, significant barriers and challenges exist. The initial implementation cost of biometric systems can be substantial, posing a hurdle for smaller healthcare facilities. Concerns regarding data privacy and potential misuse of biometric data, despite robust encryption, remain a challenge for public acceptance. Integration complexities with existing legacy IT systems in healthcare organizations can also lead to implementation delays and increased costs. Furthermore, the accuracy of some biometric technologies can be affected by environmental factors or individual physiological changes, leading to occasional authentication failures.

Emerging Opportunities in Biometric Authentication in Healthcare Industry

Emerging opportunities in the biometric authentication in healthcare industry lie in the expansion of remote patient monitoring and telehealth services, where secure and convenient authentication is crucial. The development of AI-powered biometric systems capable of identifying potential health issues through subtle biometric changes presents a groundbreaking avenue. Untapped markets in developing regions with rapidly growing healthcare sectors also offer significant potential. Furthermore, the integration of biometrics into wearable medical devices for continuous health tracking and personalized medicine represents a rapidly growing niche. The increasing demand for identity verification in clinical trials and pharmaceutical research also opens new avenues for biometric solutions.

Growth Accelerators in the Biometric Authentication in Healthcare Industry Industry

Technological breakthroughs in areas like behavioral biometrics, which analyzes unique patterns of user interaction, are set to accelerate market growth by offering a more passive and secure authentication layer. Strategic partnerships between biometric technology providers and healthcare IT companies are crucial for developing integrated solutions that address specific clinical needs. The growing emphasis on patient-centric care and the demand for seamless digital patient journeys will further drive the adoption of user-friendly biometric authentication. Market expansion strategies targeting emerging economies, coupled with government initiatives promoting digital healthcare adoption, will also act as significant growth accelerators.

Key Players Shaping the Biometric Authentication in Healthcare Industry Market

- Morpho

- Suprema Inc

- Lumidigm

- Integrated Biometrics

- Thales Group

- Fujitsu Limited

- Facetec Inc

- Crossmatch Technologies Inc

- Bio-Key International Inc

- Imprivata Inc

- NEC Corporation

- Zkteco Inc

Notable Milestones in Biometric Authentication in Healthcare Industry Sector

- March 2022: BioIntelliSense launched its medical-grade BioButton Rechargeable wearable device, enabling continuous multi-parameter monitoring of 20+ vital signs for up to 30 days on a single charge.

- January 2022: Mitsubishi Electric Corporation unveiled HealthCam, a facial recognition health monitoring system capable of tracking heart rate, blood oxygen levels, temperature, and other health indicators.

In-Depth Biometric Authentication in Healthcare Industry Market Outlook

The future outlook for biometric authentication in the healthcare industry is exceptionally promising, driven by a confluence of technological advancements, evolving security demands, and patient-centric healthcare initiatives. Growth accelerators, including the increasing sophistication of AI in analyzing biometric data for health insights and the widespread adoption of multimodal authentication systems, will further fortify the market. Strategic partnerships between biometric vendors and leading healthcare organizations will streamline the integration of these technologies into clinical workflows. The continued expansion of telehealth and remote patient monitoring, underpinned by secure and convenient biometric access, will create substantial market potential. The industry is moving towards a future where biometrics are not just for security but are integral to personalized medicine and proactive health management, creating significant strategic opportunities for innovation and market leadership.

Biometric Authentication in Healthcare Industry Segmentation

-

1. Technology

- 1.1. Single-factor Authentication

- 1.2. Multi-factor Authentication

- 1.3. Other Technologies

-

2. Application

- 2.1. Medical Record and Data Center Security

- 2.2. Patient Identification and Tracking

- 2.3. Care Provider Authentication

- 2.4. Home/Remote Patient Monitoring

- 2.5. Other Applications

-

3. End User

- 3.1. Hospital/Clinics

- 3.2. Research and Clinical Laboratory

- 3.3. Other End Users

Biometric Authentication in Healthcare Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Biometric Authentication in Healthcare Industry Regional Market Share

Geographic Coverage of Biometric Authentication in Healthcare Industry

Biometric Authentication in Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Implementation of Government Initiatives Supporting the Adoption of Biometrics in Healthcare; Rising Incidence of Healthcare Data Breaches and Medical Identity Theft

- 3.3. Market Restrains

- 3.3.1. High Cost of Biometric Devices; Issues Related to the Use of Biometric Technologies

- 3.4. Market Trends

- 3.4.1. Multifactor-factor Authentication is Expected to Cover a Large Share of the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biometric Authentication in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Single-factor Authentication

- 5.1.2. Multi-factor Authentication

- 5.1.3. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical Record and Data Center Security

- 5.2.2. Patient Identification and Tracking

- 5.2.3. Care Provider Authentication

- 5.2.4. Home/Remote Patient Monitoring

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital/Clinics

- 5.3.2. Research and Clinical Laboratory

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Biometric Authentication in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Single-factor Authentication

- 6.1.2. Multi-factor Authentication

- 6.1.3. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical Record and Data Center Security

- 6.2.2. Patient Identification and Tracking

- 6.2.3. Care Provider Authentication

- 6.2.4. Home/Remote Patient Monitoring

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospital/Clinics

- 6.3.2. Research and Clinical Laboratory

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Biometric Authentication in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Single-factor Authentication

- 7.1.2. Multi-factor Authentication

- 7.1.3. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical Record and Data Center Security

- 7.2.2. Patient Identification and Tracking

- 7.2.3. Care Provider Authentication

- 7.2.4. Home/Remote Patient Monitoring

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospital/Clinics

- 7.3.2. Research and Clinical Laboratory

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Biometric Authentication in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Single-factor Authentication

- 8.1.2. Multi-factor Authentication

- 8.1.3. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical Record and Data Center Security

- 8.2.2. Patient Identification and Tracking

- 8.2.3. Care Provider Authentication

- 8.2.4. Home/Remote Patient Monitoring

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospital/Clinics

- 8.3.2. Research and Clinical Laboratory

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Biometric Authentication in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Single-factor Authentication

- 9.1.2. Multi-factor Authentication

- 9.1.3. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Medical Record and Data Center Security

- 9.2.2. Patient Identification and Tracking

- 9.2.3. Care Provider Authentication

- 9.2.4. Home/Remote Patient Monitoring

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospital/Clinics

- 9.3.2. Research and Clinical Laboratory

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Biometric Authentication in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Single-factor Authentication

- 10.1.2. Multi-factor Authentication

- 10.1.3. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Medical Record and Data Center Security

- 10.2.2. Patient Identification and Tracking

- 10.2.3. Care Provider Authentication

- 10.2.4. Home/Remote Patient Monitoring

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospital/Clinics

- 10.3.2. Research and Clinical Laboratory

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Morpho

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Suprema Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lumidigm

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Integrated Biometrics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujitsu Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Facetec Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crossmatch Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bio-Key International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Imprivata Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NEC Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Zkteco Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Morpho

List of Figures

- Figure 1: Global Biometric Authentication in Healthcare Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Biometric Authentication in Healthcare Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Biometric Authentication in Healthcare Industry Revenue (Million), by Technology 2025 & 2033

- Figure 4: North America Biometric Authentication in Healthcare Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 5: North America Biometric Authentication in Healthcare Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Biometric Authentication in Healthcare Industry Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Biometric Authentication in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Biometric Authentication in Healthcare Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Biometric Authentication in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Biometric Authentication in Healthcare Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Biometric Authentication in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Biometric Authentication in Healthcare Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Biometric Authentication in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Biometric Authentication in Healthcare Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Biometric Authentication in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Biometric Authentication in Healthcare Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Biometric Authentication in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Biometric Authentication in Healthcare Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Biometric Authentication in Healthcare Industry Revenue (Million), by Technology 2025 & 2033

- Figure 20: Europe Biometric Authentication in Healthcare Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 21: Europe Biometric Authentication in Healthcare Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Europe Biometric Authentication in Healthcare Industry Volume Share (%), by Technology 2025 & 2033

- Figure 23: Europe Biometric Authentication in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 24: Europe Biometric Authentication in Healthcare Industry Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Biometric Authentication in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Biometric Authentication in Healthcare Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Biometric Authentication in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Biometric Authentication in Healthcare Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Biometric Authentication in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Biometric Authentication in Healthcare Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Biometric Authentication in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Biometric Authentication in Healthcare Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Biometric Authentication in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Biometric Authentication in Healthcare Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Biometric Authentication in Healthcare Industry Revenue (Million), by Technology 2025 & 2033

- Figure 36: Asia Pacific Biometric Authentication in Healthcare Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 37: Asia Pacific Biometric Authentication in Healthcare Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Asia Pacific Biometric Authentication in Healthcare Industry Volume Share (%), by Technology 2025 & 2033

- Figure 39: Asia Pacific Biometric Authentication in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 40: Asia Pacific Biometric Authentication in Healthcare Industry Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Biometric Authentication in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Biometric Authentication in Healthcare Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Biometric Authentication in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Biometric Authentication in Healthcare Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Biometric Authentication in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Biometric Authentication in Healthcare Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Biometric Authentication in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Biometric Authentication in Healthcare Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Biometric Authentication in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Biometric Authentication in Healthcare Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Biometric Authentication in Healthcare Industry Revenue (Million), by Technology 2025 & 2033

- Figure 52: Middle East and Africa Biometric Authentication in Healthcare Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 53: Middle East and Africa Biometric Authentication in Healthcare Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Middle East and Africa Biometric Authentication in Healthcare Industry Volume Share (%), by Technology 2025 & 2033

- Figure 55: Middle East and Africa Biometric Authentication in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Biometric Authentication in Healthcare Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Biometric Authentication in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Biometric Authentication in Healthcare Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Biometric Authentication in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East and Africa Biometric Authentication in Healthcare Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa Biometric Authentication in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Biometric Authentication in Healthcare Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Biometric Authentication in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Biometric Authentication in Healthcare Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Biometric Authentication in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Biometric Authentication in Healthcare Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Biometric Authentication in Healthcare Industry Revenue (Million), by Technology 2025 & 2033

- Figure 68: South America Biometric Authentication in Healthcare Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 69: South America Biometric Authentication in Healthcare Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 70: South America Biometric Authentication in Healthcare Industry Volume Share (%), by Technology 2025 & 2033

- Figure 71: South America Biometric Authentication in Healthcare Industry Revenue (Million), by Application 2025 & 2033

- Figure 72: South America Biometric Authentication in Healthcare Industry Volume (K Unit), by Application 2025 & 2033

- Figure 73: South America Biometric Authentication in Healthcare Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: South America Biometric Authentication in Healthcare Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: South America Biometric Authentication in Healthcare Industry Revenue (Million), by End User 2025 & 2033

- Figure 76: South America Biometric Authentication in Healthcare Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: South America Biometric Authentication in Healthcare Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Biometric Authentication in Healthcare Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Biometric Authentication in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Biometric Authentication in Healthcare Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Biometric Authentication in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Biometric Authentication in Healthcare Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 11: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 25: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 44: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 45: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 64: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 65: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 67: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 78: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 79: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 80: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 81: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 82: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 83: Global Biometric Authentication in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Biometric Authentication in Healthcare Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Biometric Authentication in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Biometric Authentication in Healthcare Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biometric Authentication in Healthcare Industry?

The projected CAGR is approximately 21.29%.

2. Which companies are prominent players in the Biometric Authentication in Healthcare Industry?

Key companies in the market include Morpho, Suprema Inc, Lumidigm, Integrated Biometrics, Thales Group, Fujitsu Limited, Facetec Inc , Crossmatch Technologies Inc, Bio-Key International Inc, Imprivata Inc, NEC Corporation, Zkteco Inc.

3. What are the main segments of the Biometric Authentication in Healthcare Industry?

The market segments include Technology, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Implementation of Government Initiatives Supporting the Adoption of Biometrics in Healthcare; Rising Incidence of Healthcare Data Breaches and Medical Identity Theft.

6. What are the notable trends driving market growth?

Multifactor-factor Authentication is Expected to Cover a Large Share of the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Biometric Devices; Issues Related to the Use of Biometric Technologies.

8. Can you provide examples of recent developments in the market?

In March 2022, BioIntelliSense, has launched its medical-grade BioButton Rechargeable wearable device. The new BioButton Rechargeable device allows for continuous multi-parameter monitoring of a broad range of 20+ vital signs and physiologic biometrics for up to 30 days on a single charge, based on configuration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biometric Authentication in Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biometric Authentication in Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biometric Authentication in Healthcare Industry?

To stay informed about further developments, trends, and reports in the Biometric Authentication in Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence