Key Insights

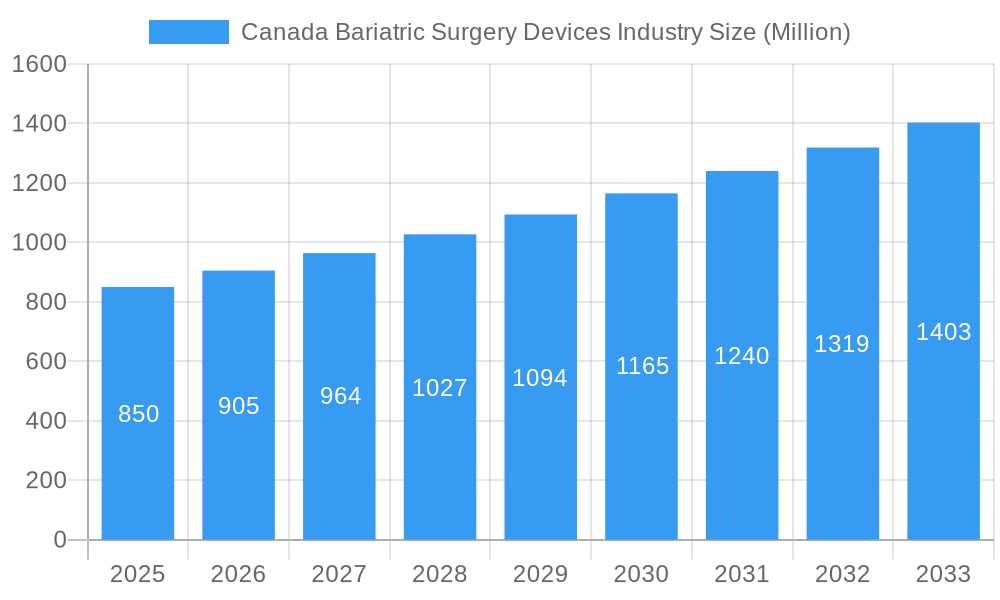

The Canadian bariatric surgery devices market is poised for significant expansion, projected to reach an estimated USD 850 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This growth is underpinned by a confluence of increasing obesity rates across Canada and a growing acceptance and demand for advanced bariatric interventions. The market is witnessing a pronounced shift towards minimally invasive procedures, driving demand for sophisticated devices like advanced suturing devices, closure devices, and stapling devices that offer improved patient outcomes, reduced recovery times, and fewer complications. Furthermore, the development and adoption of innovative implantable devices for weight management are also contributing to the market's upward trajectory, reflecting a broader trend towards integrated solutions for chronic obesity management.

Canada Bariatric Surgery Devices Industry Market Size (In Million)

Key drivers fueling this market expansion include heightened public awareness regarding the health risks associated with obesity and the long-term benefits of surgical intervention, coupled with expanding reimbursement policies for bariatric procedures. The increasing prevalence of co-morbidities such as diabetes, hypertension, and cardiovascular diseases directly linked to obesity further intensifies the need for effective weight management solutions. While the market enjoys strong growth, potential restraints may include the high cost of certain advanced devices and the need for specialized surgical training, which could impact accessibility in certain regions. However, the ongoing technological advancements and the commitment of leading companies like Medtronic PLC and 3M Company to innovation are expected to mitigate these challenges and continue to drive market penetration in Canada.

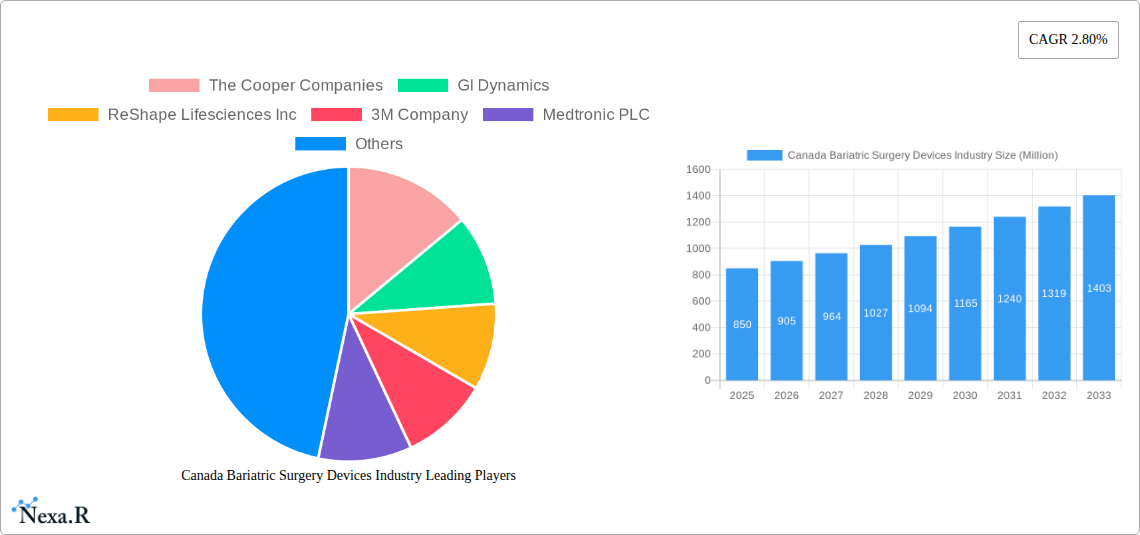

Canada Bariatric Surgery Devices Industry Company Market Share

Canada Bariatric Surgery Devices Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the Canadian bariatric surgery devices industry, providing critical insights into market dynamics, growth trajectories, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for industry stakeholders, investors, and decision-makers seeking to navigate the evolving landscape of bariatric procedures and device innovation in Canada. We meticulously examine parent and child markets, delivering precise data and actionable intelligence for strategic planning and market penetration. The report is structured to maximize SEO visibility, integrating high-traffic keywords relevant to "Canada bariatric surgery devices," "obesity treatment Canada," "weight loss surgery devices," and specific device segments.

Canada Bariatric Surgery Devices Industry Market Dynamics & Structure

The Canada bariatric surgery devices industry is characterized by a moderately concentrated market structure, with a few key players dominating significant market share, particularly in implantable and advanced assisting devices. Technological innovation is a primary driver, fueled by the demand for less invasive procedures and improved patient outcomes. Medtronic PLC, The Cooper Companies, and Olympus Corporation are at the forefront of this innovation, consistently investing in R&D for next-generation devices. Regulatory frameworks, overseen by Health Canada, play a crucial role in ensuring device safety and efficacy, influencing market access and product development timelines. Competitive product substitutes are emerging, with a growing interest in non-surgical weight management solutions, though surgical interventions remain the gold standard for significant and sustained weight loss. End-user demographics are shifting, with an increasing prevalence of obesity across younger adult populations and a growing awareness of bariatric surgery as a viable treatment option. Merger and acquisition (M&A) trends are moderately active, with larger companies seeking to acquire innovative technologies and expand their product portfolios.

- Market Concentration: Dominated by key players with established product lines.

- Technological Innovation Drivers: Demand for minimally invasive techniques, advanced diagnostics, and improved patient recovery.

- Regulatory Frameworks: Health Canada's stringent approval processes ensure device safety and efficacy.

- Competitive Product Substitutes: Non-surgical weight loss programs and pharmaceutical interventions pose indirect competition.

- End-User Demographics: Rising obesity rates and an aging population seeking effective weight management solutions.

- M&A Trends: Strategic acquisitions aimed at consolidating market share and accessing novel technologies.

Canada Bariatric Surgery Devices Industry Growth Trends & Insights

The Canadian bariatric surgery devices industry is poised for robust growth, projected to expand significantly throughout the forecast period. This expansion is driven by a confluence of factors including the escalating prevalence of obesity and related comorbidities, a growing demand for minimally invasive surgical procedures, and continuous advancements in medical device technology. The market size evolution is expected to demonstrate a healthy Compound Annual Growth Rate (CAGR), reflecting increasing patient access and physician adoption of bariatric surgery. Adoption rates for advanced bariatric devices, such as robotic-assisted surgical systems and sophisticated endoscopic devices, are on an upward trajectory. Technological disruptions are a constant feature, with ongoing research and development focusing on enhancing device precision, reducing complications, and improving patient recovery times. Consumer behavior shifts are also evident, with greater public awareness of bariatric surgery's efficacy and a growing willingness among individuals to explore surgical options for long-term weight management and improved health outcomes. The market penetration of advanced bariatric devices is anticipated to rise as healthcare providers increasingly integrate these innovative solutions into their treatment protocols. The market size is estimated to reach XX billion units by 2025, with a projected CAGR of XX% from 2025 to 2033.

Dominant Regions, Countries, or Segments in Canada Bariatric Surgery Devices Industry

Within the Canadian bariatric surgery devices industry, Assisting Devices segment, particularly Stapling Devices and Closure Devices, is expected to emerge as a dominant force driving market growth. This dominance is underpinned by several key factors. The increasing number of bariatric procedures performed annually directly translates to a higher demand for these essential consumables and instruments. Economic policies in Canada that support healthcare infrastructure development and incentivize medical technology adoption further bolster this segment. Furthermore, the widespread availability of skilled surgeons and well-equipped surgical centers across the country facilitates the utilization of these devices.

- Market Share: Stapling devices and closure devices collectively hold a substantial market share, estimated at XX% within the Assisting Devices segment in 2025.

- Growth Potential: The segment is projected to experience a CAGR of XX% from 2025 to 2033, outpacing other device categories.

- Key Drivers:

- Rising Procedural Volumes: A direct correlation exists between the increasing number of bariatric surgeries and the demand for staple and closure devices.

- Technological Advancements: Continuous innovation in staple line reinforcement, automatic reloads, and minimally invasive closure techniques enhances procedural efficiency and patient safety.

- Cost-Effectiveness: While premium products exist, the widespread availability of cost-effective staple and closure devices makes them accessible for a broader range of healthcare facilities.

- Surgical Expertise: A well-established base of surgeons proficient in using these devices in Canada ensures consistent demand.

- Infrastructure: The robust healthcare infrastructure in major Canadian provinces, including Ontario, Quebec, and British Columbia, provides a fertile ground for the widespread adoption of these devices.

Beyond Stapling and Closure Devices, Suturing Devices and Trocars also exhibit strong growth potential within the Assisting Devices category, driven by advancements in articulating instruments and novel trocar designs that minimize tissue trauma. Implantable Devices, while currently representing a smaller market share, are anticipated to see significant growth as research into more advanced and reversible implantable solutions progresses.

Canada Bariatric Surgery Devices Industry Product Landscape

The product landscape of the Canada bariatric surgery devices industry is marked by continuous innovation aimed at enhancing procedural efficacy and patient safety. Stapling devices are evolving with features like intelligent staple height adjustment and advanced staple line reinforcement to minimize leaks. Closure devices are increasingly focusing on non-suture-based technologies for faster wound healing and reduced scarring. Suturing devices are witnessing advancements in articulation and maneuverability for intricate placements during complex procedures. Trocars are being redesigned to offer lower insertion forces and improved sealing capabilities. The overarching trend is towards miniaturization, automation, and integration of smart technologies to provide surgeons with superior control and real-time feedback.

Key Drivers, Barriers & Challenges in Canada Bariatric Surgery Devices Industry

Key Drivers:

- Increasing Obesity Prevalence: The escalating rates of obesity and associated comorbidities like diabetes and cardiovascular disease are the primary drivers, necessitating effective weight management solutions.

- Technological Advancements: Development of minimally invasive surgical techniques and advanced devices that offer improved precision, reduced complications, and faster recovery times.

- Growing Awareness and Acceptance: Increased public understanding of bariatric surgery's benefits and success rates is driving demand.

- Government Initiatives: Support for healthcare infrastructure and research in weight management technologies.

Barriers & Challenges:

- High Cost of Devices and Procedures: The significant expense associated with advanced bariatric surgery devices and the procedures themselves can limit accessibility for some patients.

- Reimbursement Policies: Navigating complex and sometimes restrictive provincial reimbursement policies for bariatric surgery and devices.

- Physician Training and Expertise: The need for specialized training for surgeons and medical staff to effectively utilize new and complex bariatric devices.

- Patient Compliance and Lifestyle Changes: Long-term success depends heavily on patient adherence to post-operative dietary and exercise regimes, which can be a significant challenge.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and cost of essential bariatric surgery devices.

Emerging Opportunities in Canada Bariatric Surgery Devices Industry

Emerging opportunities in the Canada bariatric surgery devices industry lie in the development and adoption of personalized treatment approaches, leveraging AI and data analytics for enhanced patient selection and outcome prediction. There is a growing demand for non-invasive or less invasive endoscopic devices that can be used in office-based settings, expanding access to weight management interventions. Furthermore, advancements in bioabsorbable materials for surgical meshes and implants present a significant opportunity for improved patient outcomes and reduced long-term complications. The exploration of integrated digital health platforms that connect patients, surgeons, and device manufacturers for continuous monitoring and support also holds immense promise.

Growth Accelerators in the Canada Bariatric Surgery Devices Industry Industry

Long-term growth in the Canada bariatric surgery devices industry will be significantly accelerated by breakthroughs in robotic-assisted surgery, offering enhanced dexterity and precision for complex bariatric procedures. Strategic partnerships between device manufacturers and healthcare institutions will be crucial for driving the adoption of innovative technologies and establishing best practices. Market expansion strategies focusing on underserved regions and populations, coupled with educational initiatives to increase awareness and access, will also play a vital role. The continuous pursuit of more cost-effective yet highly effective devices will further democratize access to bariatric surgery.

Key Players Shaping the Canada Bariatric Surgery Devices Industry Market

- The Cooper Companies

- GI Dynamics

- ReShape Lifesciences Inc

- 3M Company

- Medtronic PLC

- Apollo Endosurgery Inc

- Olympus Corporation

Notable Milestones in Canada Bariatric Surgery Devices Industry Sector

- 2019: Introduction of advanced endoscopic sleeve gastroplasty devices, expanding non-surgical bariatric options.

- 2020: Increased adoption of robotic-assisted platforms for sleeve gastrectomy and gastric bypass procedures.

- 2021: Development and initial trials of novel bioabsorbable stapling devices aimed at reducing tissue irritation.

- 2022: Enhanced regulatory approvals for a wider range of implantable devices for weight management.

- 2023: Significant investment in R&D for AI-powered diagnostic tools to optimize patient selection for bariatric surgery.

- 2024: Growing focus on post-operative digital monitoring solutions to improve patient adherence and outcomes.

In-Depth Canada Bariatric Surgery Devices Industry Market Outlook

The future of the Canada bariatric surgery devices industry is exceptionally promising, driven by sustained demand and rapid technological evolution. Growth accelerators such as advancements in minimally invasive and robotic surgery, coupled with strategic collaborations, will continue to propel the market forward. The increasing integration of digital health solutions for patient monitoring and engagement presents a substantial opportunity for enhancing long-term success rates. Furthermore, the ongoing development of novel therapeutic approaches, including improved implantable devices and advanced endoscopic interventions, will further expand the treatment landscape. The industry is set to witness a paradigm shift towards more personalized and data-driven bariatric care, solidifying its position as a critical component of public health in Canada.

Canada Bariatric Surgery Devices Industry Segmentation

-

1. Device

-

1.1. Assisting Devices

- 1.1.1. Suturing Device

- 1.1.2. Closure Device

- 1.1.3. Stapling Device

- 1.1.4. Trocars

- 1.1.5. Other Assisting Devices

- 1.2. Implantable Devices

- 1.3. Other Devices

-

1.1. Assisting Devices

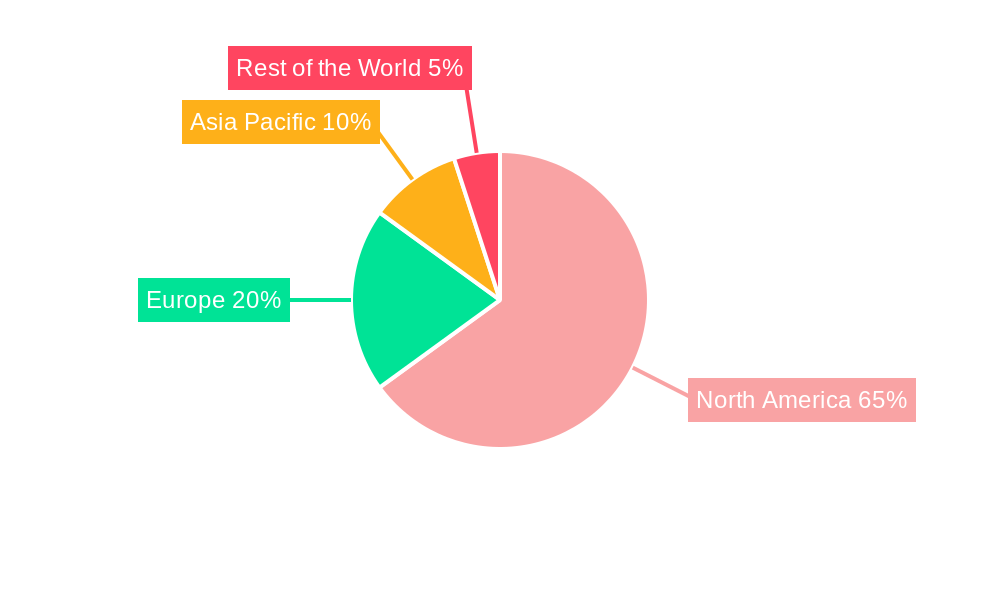

Canada Bariatric Surgery Devices Industry Segmentation By Geography

- 1. Canada

Canada Bariatric Surgery Devices Industry Regional Market Share

Geographic Coverage of Canada Bariatric Surgery Devices Industry

Canada Bariatric Surgery Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increase in Obesity Patients; Government Initiatives to Curb Obesity; Rising Prevalence of Type 2 Diabetes and Heart Diseases

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Surgery

- 3.4. Market Trends

- 3.4.1. Closure Device is Expected to Register a High CAGR in the Assisting Device Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Bariatric Surgery Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Assisting Devices

- 5.1.1.1. Suturing Device

- 5.1.1.2. Closure Device

- 5.1.1.3. Stapling Device

- 5.1.1.4. Trocars

- 5.1.1.5. Other Assisting Devices

- 5.1.2. Implantable Devices

- 5.1.3. Other Devices

- 5.1.1. Assisting Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Cooper Companies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GI Dynamics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ReShape Lifesciences Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3M Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apollo Endosurgery Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Olympus Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 The Cooper Companies

List of Figures

- Figure 1: Canada Bariatric Surgery Devices Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Bariatric Surgery Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Bariatric Surgery Devices Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 2: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 3: Canada Bariatric Surgery Devices Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Canada Bariatric Surgery Devices Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 6: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 7: Canada Bariatric Surgery Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Bariatric Surgery Devices Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Canada Bariatric Surgery Devices Industry?

Key companies in the market include The Cooper Companies, GI Dynamics, ReShape Lifesciences Inc, 3M Company, Medtronic PLC, Apollo Endosurgery Inc, Olympus Corporation.

3. What are the main segments of the Canada Bariatric Surgery Devices Industry?

The market segments include Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increase in Obesity Patients; Government Initiatives to Curb Obesity; Rising Prevalence of Type 2 Diabetes and Heart Diseases.

6. What are the notable trends driving market growth?

Closure Device is Expected to Register a High CAGR in the Assisting Device Segment.

7. Are there any restraints impacting market growth?

; High Cost of Surgery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Bariatric Surgery Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Bariatric Surgery Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Bariatric Surgery Devices Industry?

To stay informed about further developments, trends, and reports in the Canada Bariatric Surgery Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence