Key Insights

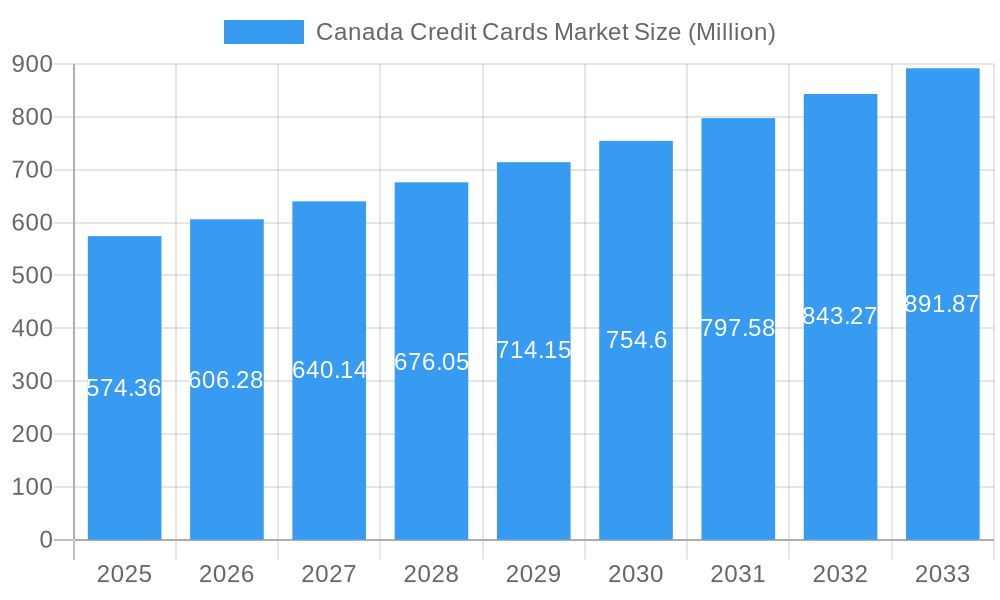

The Canadian credit card market, valued at $574.36 million in 2025, is projected to experience robust growth, driven by increasing consumer spending, the expansion of e-commerce, and the proliferation of rewards programs. Key players like Canadian Tire Corporation, Triangle Rewards, and major banks (CIBC, Royal Bank of Canada, Scotiabank, TD Bank) fiercely compete for market share, leveraging partnerships with retailers (Costco, Air Canada) and offering diverse product offerings tailored to specific consumer segments. The market's growth is fueled by the increasing adoption of digital payment methods, a growing preference for contactless transactions, and the introduction of innovative features such as embedded finance and personalized rewards programs. However, regulatory scrutiny related to interest rates and fees, as well as concerns surrounding consumer debt levels, pose potential constraints. The competitive landscape necessitates ongoing innovation and strategic partnerships to maintain a leading position.

Canada Credit Cards Market Market Size (In Million)

The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 5.34%, indicating a substantial market expansion. This growth will be influenced by shifting consumer preferences toward credit cards offering greater value and flexibility. The rise of buy-now-pay-later (BNPL) services, though technically not traditional credit cards, presents both an opportunity and a challenge for established players. The market will likely witness further consolidation as smaller players struggle to compete with the established banks and large retailers offering integrated financial services. Growth strategies will focus on enhancing customer experience, personalized offers, improved fraud prevention measures, and responsible lending practices. Geographical segmentation within Canada is expected to show variations in growth rates based on factors such as income levels and regional economic activity. Further analysis of specific market segments (which are not provided) would provide a more granular understanding of growth opportunities and potential challenges.

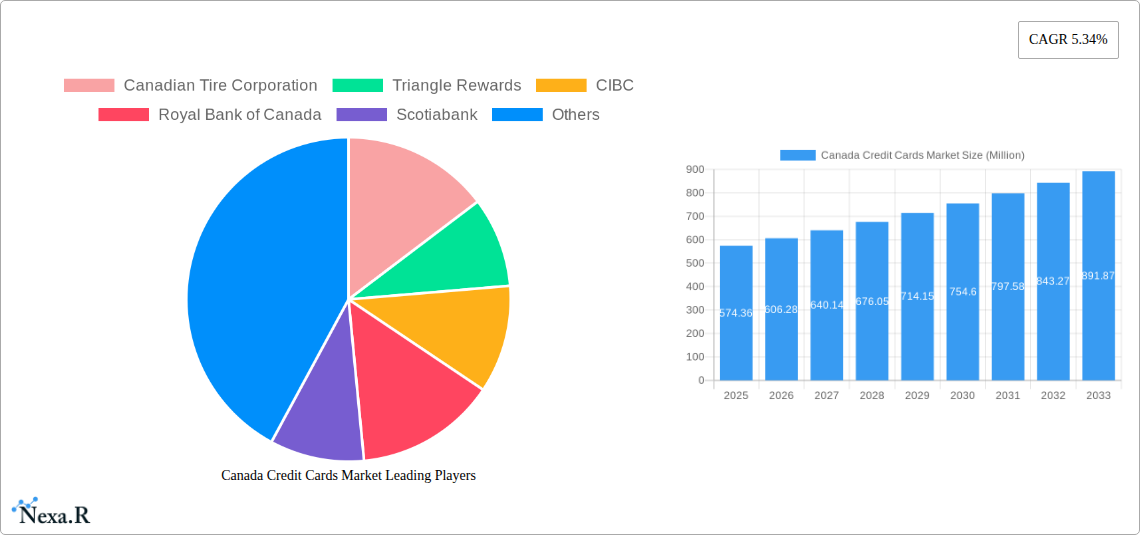

Canada Credit Cards Market Company Market Share

Canada Credit Cards Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada credit cards market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The market size is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Canada Credit Cards Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the Canadian credit card market. The market exhibits a moderately concentrated structure, with key players such as Royal Bank of Canada, TD Bank, Scotiabank, and CIBC holding significant market share. However, the emergence of fintech companies and the increasing adoption of digital payment methods are intensifying competition.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Contactless payments, mobile wallets, and embedded finance are key drivers of innovation.

- Regulatory Framework: The Office of the Superintendent of Financial Institutions (OSFI) plays a crucial role in regulating the credit card industry.

- Competitive Substitutes: Debit cards, prepaid cards, and alternative payment methods pose competitive threats.

- End-User Demographics: Growth is driven by the increasing number of credit-active consumers and rising disposable incomes.

- M&A Trends: The recent acquisition of HSBC Bank Canada by RBC highlights the ongoing consolidation within the sector. The total value of M&A deals in the period 2019-2024 was approximately xx Million.

Canada Credit Cards Market Growth Trends & Insights

The Canadian credit cards market has witnessed consistent growth over the past five years, driven by factors such as increasing consumer spending, expanding e-commerce adoption, and the proliferation of rewards programs. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration has increased steadily, with xx% of the adult population holding at least one credit card in 2025. Technological disruptions, such as the rise of BNPL services and embedded finance, are reshaping the market dynamics, leading to increased competition and innovation. Consumer behaviour shifts, including a preference for digital channels and personalized rewards programs, are also influencing the market’s trajectory. Analysis further shows a correlation between economic growth and credit card spending.

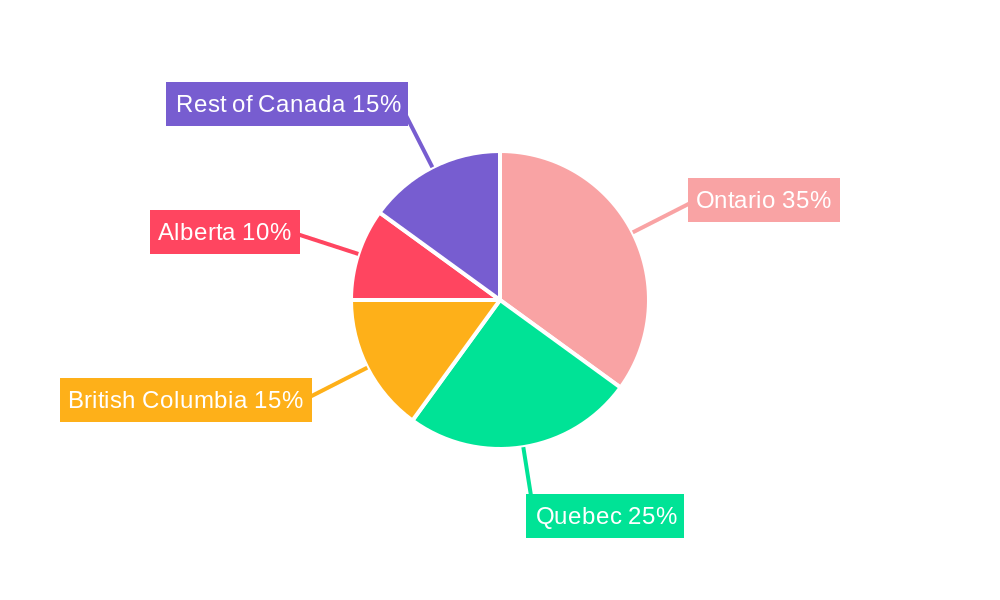

Dominant Regions, Countries, or Segments in Canada Credit Cards Market

The Canadian credit cards market shows relatively even distribution across regions, with higher concentration in urban areas. Ontario and Quebec represent the largest segments, driven by higher population density and economic activity. Provincial-level economic policies and infrastructure investments play a crucial role in regional growth patterns.

- Key Drivers: Strong economic growth in major provinces, increasing disposable incomes, and favorable regulatory environments.

- Dominance Factors: High population density, robust economic activity, and established financial infrastructure.

- Growth Potential: Continued urbanization and expansion of financial services in less developed regions presents significant growth opportunities.

Canada Credit Cards Market Product Landscape

The Canadian credit card market offers a diverse range of products catering to different consumer segments. This includes general-purpose cards, rewards cards (cash back, points, miles), secured cards, and business cards. Innovation is evident in the integration of digital features, such as contactless payments, mobile wallets, and personalized rewards programs, enhancing user experience and convenience. Competition is fierce, with companies striving to differentiate their offerings through unique selling propositions, focusing on superior rewards, competitive interest rates, and improved customer service.

Key Drivers, Barriers & Challenges in Canada Credit Cards Market

Key Drivers:

- Growing consumer spending and e-commerce adoption.

- Increasing penetration of smartphones and digital payments.

- Rise of rewards programs and loyalty initiatives.

Key Barriers and Challenges:

- Intense competition from both established banks and fintech companies.

- Increasing regulatory scrutiny and compliance costs.

- Potential economic downturns impacting consumer spending.

- The rise of buy-now-pay-later (BNPL) services presents a challenge to traditional credit cards. The market share of BNPL is currently at xx% in 2025 and is expected to grow to xx% by 2033.

Emerging Opportunities in Canada Credit Cards Market

Untapped markets within the Canadian credit card sector include underserved populations, such as young adults and new immigrants. Opportunities exist in developing innovative products tailored to specific customer segments and leveraging emerging technologies like AI and machine learning to enhance risk assessment and fraud prevention. The increasing demand for sustainable and responsible lending practices presents an opportunity for credit card providers to differentiate themselves and attract environmentally-conscious consumers.

Growth Accelerators in the Canada Credit Cards Market Industry

Technological advancements, such as improved fraud detection systems and enhanced personalization capabilities, are key drivers of long-term growth. Strategic partnerships between financial institutions and fintech companies are also accelerating innovation and expanding market reach. The expansion into new market segments, such as the gig economy and small businesses, provides substantial growth potential.

Key Players Shaping the Canada Credit Cards Market Market

- Canadian Tire Corporation

- Triangle Rewards

- CIBC

- Royal Bank of Canada

- Scotiabank

- TD Bank

- Costco Mastercard

- Air Canada Partnership

- BMO

- Tangerine Bank

- Desjardins Group

- List Not Exhaustive

Notable Milestones in Canada Credit Cards Market Sector

- March 2024: RBC acquires HSBC Bank Canada for CAD 13.5 billion, significantly altering market share dynamics.

- January 2023: Desjardins Group transitions its credit card processing to Finserv Inc., aiming to enhance offerings and operational efficiency.

In-Depth Canada Credit Cards Market Market Outlook

The Canadian credit cards market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and ongoing consolidation within the industry. Strategic partnerships, expansion into new market segments, and the development of innovative products will be crucial for sustained success. The market's future potential is significant, offering attractive opportunities for both established players and emerging fintech companies.

Canada Credit Cards Market Segmentation

-

1. Card Type

- 1.1. General Purpose Credit Cards

- 1.2. Specialty & Other Credit Cards

-

2. Application

- 2.1. Food & Groceries

- 2.2. Health & Pharmacy

- 2.3. Restaurants & Bars

- 2.4. Consumer Electronics

- 2.5. Media & Entertainment

- 2.6. Travel & Tourism

- 2.7. Other Applications

-

3. Provider

- 3.1. Visa

- 3.2. MasterCard

- 3.3. Other Providers

Canada Credit Cards Market Segmentation By Geography

- 1. Canada

Canada Credit Cards Market Regional Market Share

Geographic Coverage of Canada Credit Cards Market

Canada Credit Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Credit Card and Bonus and Reward Points Associated; Easy Re-payment Option such as EMI

- 3.3. Market Restrains

- 3.3.1. Usage of Credit Card and Bonus and Reward Points Associated; Easy Re-payment Option such as EMI

- 3.4. Market Trends

- 3.4.1. Offers and Discounts are Steadily Increasing the Usage of Credit Cards

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Credit Cards Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. General Purpose Credit Cards

- 5.1.2. Specialty & Other Credit Cards

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Groceries

- 5.2.2. Health & Pharmacy

- 5.2.3. Restaurants & Bars

- 5.2.4. Consumer Electronics

- 5.2.5. Media & Entertainment

- 5.2.6. Travel & Tourism

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Visa

- 5.3.2. MasterCard

- 5.3.3. Other Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Canadian Tire Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Triangle Rewards

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CIBC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Bank of Canada

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Scotiabank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TD Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Costco Mastercard

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Air Canada Partnership

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BMO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tangerine Bank

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Desjardins Group**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Canadian Tire Corporation

List of Figures

- Figure 1: Canada Credit Cards Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Credit Cards Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Credit Cards Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: Canada Credit Cards Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 3: Canada Credit Cards Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Canada Credit Cards Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Canada Credit Cards Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 6: Canada Credit Cards Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 7: Canada Credit Cards Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Canada Credit Cards Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Canada Credit Cards Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 10: Canada Credit Cards Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 11: Canada Credit Cards Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Canada Credit Cards Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: Canada Credit Cards Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 14: Canada Credit Cards Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 15: Canada Credit Cards Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Canada Credit Cards Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Credit Cards Market?

The projected CAGR is approximately 5.34%.

2. Which companies are prominent players in the Canada Credit Cards Market?

Key companies in the market include Canadian Tire Corporation, Triangle Rewards, CIBC, Royal Bank of Canada, Scotiabank, TD Bank, Costco Mastercard, Air Canada Partnership, BMO, Tangerine Bank, Desjardins Group**List Not Exhaustive.

3. What are the main segments of the Canada Credit Cards Market?

The market segments include Card Type, Application, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 574.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Credit Card and Bonus and Reward Points Associated; Easy Re-payment Option such as EMI.

6. What are the notable trends driving market growth?

Offers and Discounts are Steadily Increasing the Usage of Credit Cards.

7. Are there any restraints impacting market growth?

Usage of Credit Card and Bonus and Reward Points Associated; Easy Re-payment Option such as EMI.

8. Can you provide examples of recent developments in the market?

March 2024: HSBC Holdings successfully concluded the sale of its Canadian unit, HSBC Bank Canada, to Royal Bank of Canada (RBC) for a total transaction value of CAD 13.5 billion (equivalent to USD 9.96 billion).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Credit Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Credit Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Credit Cards Market?

To stay informed about further developments, trends, and reports in the Canada Credit Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence