Key Insights

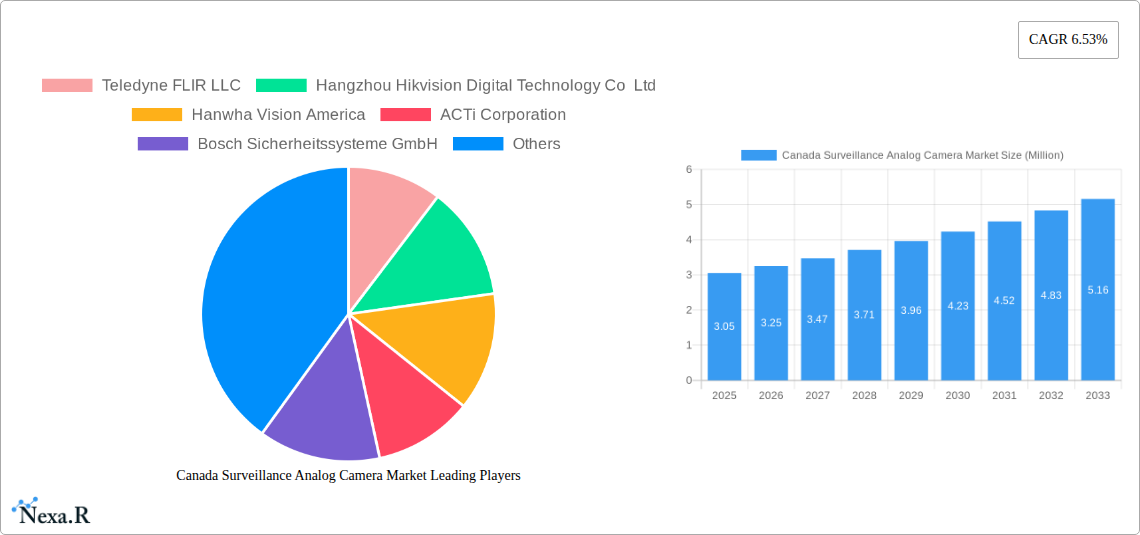

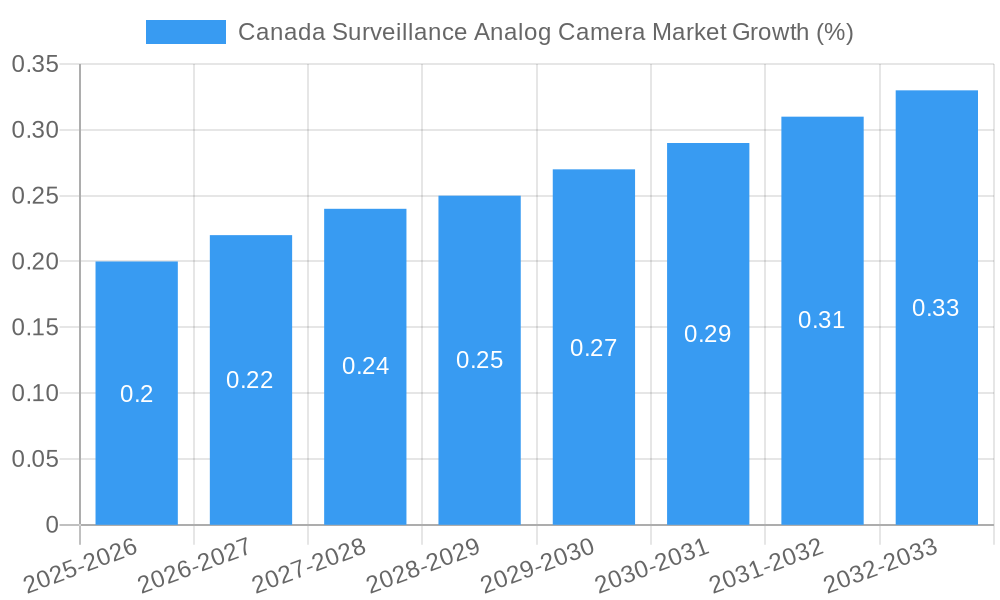

The Canada surveillance analog camera market, valued at $3.05 million in 2025, is projected to experience robust growth, driven by factors such as increasing security concerns across various sectors, including residential, commercial, and government entities. The market's Compound Annual Growth Rate (CAGR) of 6.53% from 2025 to 2033 indicates a significant expansion in market size over the forecast period. This growth is fueled by the ongoing need for reliable and cost-effective security solutions, particularly in smaller businesses and residential settings where analog cameras remain a preferred option due to their lower initial investment cost compared to IP-based systems. However, the market faces constraints including the increasing adoption of IP-based surveillance systems offering superior features like higher resolution, remote accessibility, and advanced analytics. This transition towards IP technology is expected to gradually slow the growth of the analog market in the long term, though the market will maintain relevance due to its established infrastructure and continued demand in budget-conscious segments. Key players like Teledyne FLIR, Hikvision, Hanwha Vision, and Bosch are actively competing in this market, offering a range of analog camera solutions to cater to diverse customer needs.

Despite the challenges posed by the transition to IP-based systems, the demand for analog surveillance cameras in Canada remains substantial. This is attributed to the existing infrastructure of analog systems, the lower upfront cost making it attractive to smaller businesses and individuals, and the simplicity of installation and maintenance. However, future growth hinges on manufacturers innovating within the analog sector, perhaps focusing on higher-resolution cameras and improving integration with existing systems. The market is segmented geographically (likely reflecting different adoption rates across provinces) and by application (residential, commercial, industrial, etc.), although detailed segment data is unavailable. This segmentation warrants further investigation to uncover potential niche markets and growth opportunities within the analog surveillance sector.

Canada Surveillance Analog Camera Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada surveillance analog camera market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. It serves as an essential resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market segment of the broader Canadian Security Equipment Market. The report's analysis includes detailed quantitative data, qualitative insights, and strategic recommendations. Market size values are presented in million units.

Canada Surveillance Analog Camera Market Market Dynamics & Structure

The Canadian surveillance analog camera market exhibits a moderately concentrated structure, with key players holding significant market share. Technological innovation, particularly in areas like improved low-light performance and HD over coax transmission, is a primary growth driver. Stringent regulatory frameworks concerning data privacy and security influence market dynamics, necessitating compliance with standards like PIPEDA. The market faces competition from IP-based camera systems, but analog cameras continue to retain a significant presence due to their cost-effectiveness and ease of installation in existing infrastructure. End-user demographics span diverse sectors including residential, commercial, and government entities, each with varying needs and budgets. Mergers and acquisitions (M&A) activity within the sector remains moderate, primarily focusing on enhancing product portfolios and expanding market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on improved low-light performance, HD over coax, and enhanced features like analytics.

- Regulatory Landscape: Compliance with PIPEDA and other relevant data privacy regulations is crucial.

- Competitive Landscape: Significant competition from IP-based cameras; however, analog cameras remain relevant due to cost-effectiveness and ease of integration into existing systems.

- M&A Activity: Moderate activity, driven by expansion strategies and portfolio diversification. xx M&A deals recorded between 2019-2024.

Canada Surveillance Analog Camera Market Growth Trends & Insights

The Canadian surveillance analog camera market experienced steady growth during the historical period (2019-2024), driven by factors such as increasing security concerns across various sectors and ongoing infrastructure development. The market size in 2024 was estimated at xx million units, reflecting a compound annual growth rate (CAGR) of xx% during this period. Technological advancements like the introduction of ColorVu technology with F1.0 aperture, as seen in Hikvision's recent product launches, are accelerating market adoption by offering enhanced image quality even in low-light conditions. Consumer behavior shifts toward prioritizing higher resolution and advanced features are also influencing market growth. The market penetration rate for analog cameras in specific sectors, such as residential and small commercial establishments, remains high, indicating significant market potential for future expansion. The forecast period (2025-2033) projects continued growth with a forecasted CAGR of xx%, reaching an estimated xx million units by 2033.

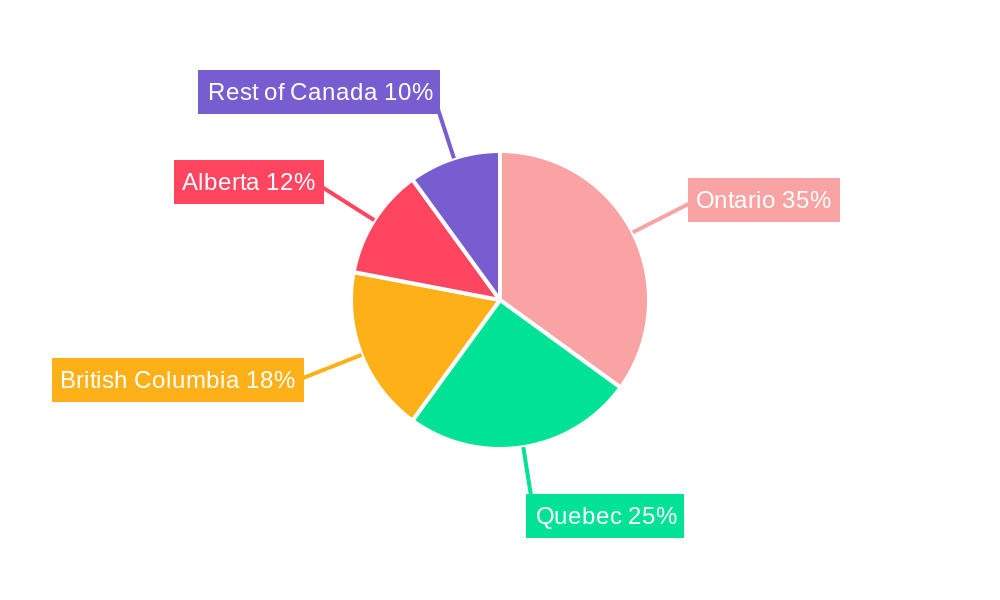

Dominant Regions, Countries, or Segments in Canada Surveillance Analog Camera Market

The Ontario region currently dominates the Canadian surveillance analog camera market, accounting for approximately xx% of total market share in 2024. This dominance is primarily attributed to the region's higher population density, robust economic activity, and concentrated presence of commercial and industrial establishments demanding enhanced security solutions. The province's well-established infrastructure and a relatively higher per capita income also drive market growth.

- Key Drivers in Ontario: High population density, strong economic activity, extensive infrastructure, and significant investment in security systems.

- Growth Potential: Continued growth is anticipated in Ontario, driven by increasing urbanization and investments in smart city initiatives. Other provinces, like British Columbia and Quebec, also present significant growth potential, although currently holding a smaller market share compared to Ontario.

Canada Surveillance Analog Camera Market Product Landscape

The Canada surveillance analog camera market encompasses a range of products, from basic CCTV cameras to advanced models featuring features like HD resolution, wide dynamic range (WDR), and integrated analytics. Recent innovations focus on enhancing low-light performance through technologies such as ColorVu and improved night vision capabilities. These advancements cater to diverse application needs, including security monitoring in retail establishments, residential properties, and industrial facilities. The market also witnesses the integration of advanced features like remote access capabilities and cloud connectivity, adding to the functionalities of analog systems. Key selling propositions center on affordability, ease of installation, and compatibility with existing analog infrastructure.

Key Drivers, Barriers & Challenges in Canada Surveillance Analog Camera Market

Key Drivers: Increasing security concerns across various sectors, robust infrastructure development, government initiatives promoting public safety, and the cost-effectiveness of analog systems compared to IP-based solutions.

Challenges: The rising popularity of IP-based camera systems presents a significant challenge to the analog market. Supply chain disruptions, particularly impacting the availability of essential components, could impact production and market growth. Stringent regulatory requirements related to data privacy and cybersecurity create hurdles for manufacturers. Competitive pressures from established and emerging players intensify the need for continuous product innovation and market differentiation. Estimated impact of supply chain issues in 2024: xx% reduction in production.

Emerging Opportunities in Canada Surveillance Analog Camera Market

The market presents opportunities for manufacturers offering cost-effective solutions with improved image quality and enhanced features. There’s potential for growth in underserved regions beyond major urban centers. Integration of analog cameras with intelligent video analytics, offering features like object detection and facial recognition, presents a strong opportunity for differentiation. Expanding into niche applications, like specialized surveillance systems for agriculture or remote monitoring, also presents untapped potential.

Growth Accelerators in the Canada Surveillance Analog Camera Market Industry

Technological advancements, particularly in enhancing low-light performance and increasing resolution, are expected to continue fueling growth. Strategic partnerships between manufacturers and system integrators facilitate wider market reach and adoption. Government initiatives to enhance public safety and infrastructure development create a favorable environment for market expansion. The ongoing need for reliable and affordable security solutions across diverse sectors assures continued demand for analog cameras in the foreseeable future.

Key Players Shaping the Canada Surveillance Analog Camera Market Market

- Teledyne FLIR LLC

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision America

- ACTi Corporation

- Bosch Sicherheitssysteme GmbH

- Pelco

- Zhejiang Uniview Technologies Co Ltd

- IDIS Ltd

- Honeywell International Inc

- Zosi Technology Lt

Notable Milestones in Canada Surveillance Analog Camera Market Sector

- October 2023: Hikvision introduced the ColorVu Fixed Turret and Bullet Cameras, featuring F1.0 aperture for enhanced low-light performance. This significantly improved image quality and spurred market interest in advanced analog camera technologies.

- April 2024: Hikvision launched the Turbo HD 8.0 lineup, introducing features like real-time communication, 180-degree video coverage, and enhanced night vision, enhancing the capabilities of analog surveillance systems and solidifying Hikvision's position in the market.

In-Depth Canada Surveillance Analog Camera Market Market Outlook

The future of the Canada surveillance analog camera market remains promising, albeit with a gradual shift towards IP-based systems. Continued advancements in analog technology, focusing on improved performance and feature integration, will sustain market growth. Strategic partnerships and expansion into niche applications will be key to unlocking further market potential. The market's long-term growth will hinge on adapting to technological shifts while maintaining the affordability and ease of implementation that have made analog cameras a mainstay in the security industry.

Canada Surveillance Analog Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation & Logistics

- 1.5. Industrial

- 1.6. Other End-user Industries

Canada Surveillance Analog Camera Market Segmentation By Geography

- 1. Canada

Canada Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country

- 3.4. Market Trends

- 3.4.1. Ease of Use and Affordability is Driving the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Surveillance Analog Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation & Logistics

- 5.1.5. Industrial

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Teledyne FLIR LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision America

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ACTi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sicherheitssysteme GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Uniview Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDIS Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zosi Technology Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Teledyne FLIR LLC

List of Figures

- Figure 1: Canada Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Surveillance Analog Camera Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Surveillance Analog Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Surveillance Analog Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Canada Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Canada Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 5: Canada Surveillance Analog Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Surveillance Analog Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Canada Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Canada Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Canada Surveillance Analog Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Canada Surveillance Analog Camera Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Surveillance Analog Camera Market?

The projected CAGR is approximately 6.53%.

2. Which companies are prominent players in the Canada Surveillance Analog Camera Market?

Key companies in the market include Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision America, ACTi Corporation, Bosch Sicherheitssysteme GmbH, Pelco, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, Honeywell International Inc, Zosi Technology Lt.

3. What are the main segments of the Canada Surveillance Analog Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country.

6. What are the notable trends driving market growth?

Ease of Use and Affordability is Driving the Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Increasing Crime Rate in Parts of the Country.

8. Can you provide examples of recent developments in the market?

April 2024: Hikvision unveiled its cutting-edge Turbo HD 8.0 lineup, enhancing its analog security offerings. This latest iteration promises users an enriched and interactive security interface, empowering them to elevate their surveillance capabilities. Turbo HD 8.0 introduces four groundbreaking features: real-time communication, 180-degree video coverage, and an enhanced night vision capability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the Canada Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence