Key Insights

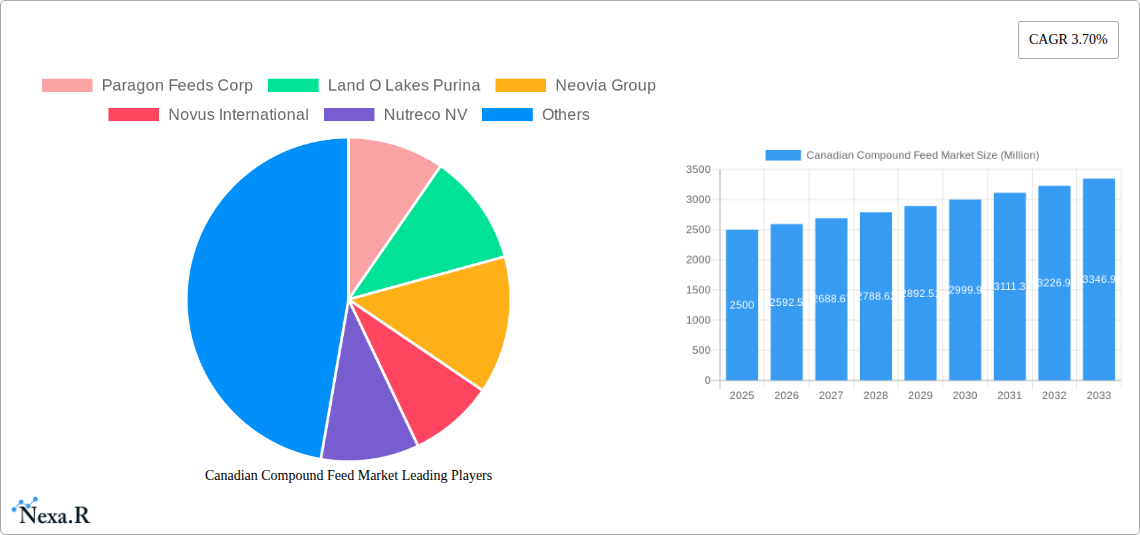

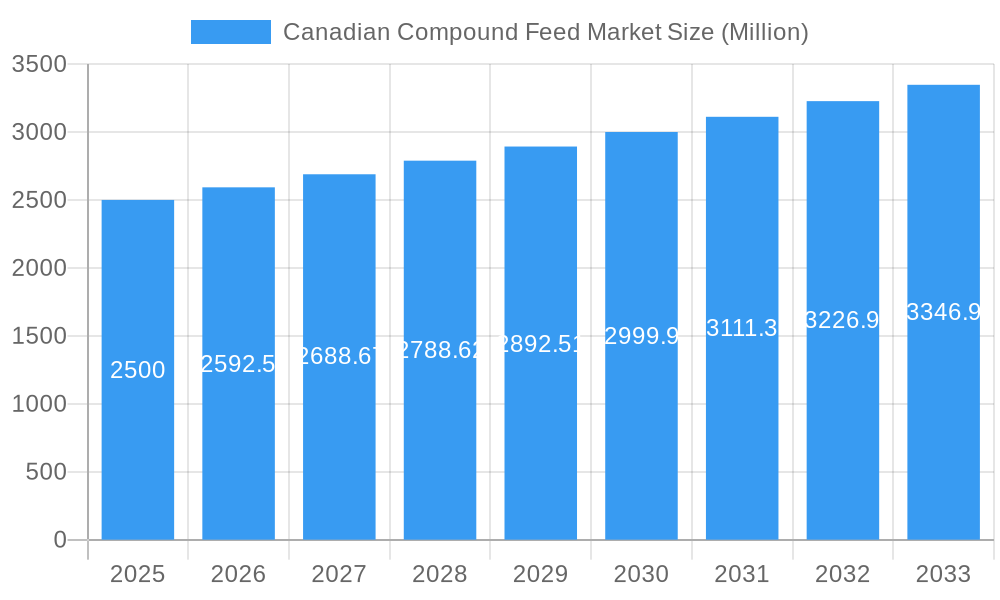

The Canadian compound feed market demonstrates significant growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 1.9%. This expansion is fueled by escalating livestock production, particularly in the poultry and swine sectors, and a rising demand for efficient, specialized animal nutrition solutions. The market is segmented by key ingredients, with cereals, cakes, and meals continuing to be primary components. However, there is a notable increase in the adoption of specialized supplements, indicating a market shift towards enhancing animal health and productivity. This trend mirrors global developments in the feed industry, highlighting the growing importance of value-added products. Canada's strong agricultural foundation and export capacity further bolster the compound feed market through robust domestic consumption and international trade. Major industry participants, including Paragon Feeds Corp. and Land O'Lakes Purina, are actively meeting these demands through innovation and market diversification. Anticipated growth is also attributed to increasing government support for sustainable farming practices and advancements in feed formulation technologies aimed at optimizing nutrient utilization and minimizing environmental impact. The market size is estimated at 13.7 billion in the base year 2025.

Canadian Compound Feed Market Market Size (In Billion)

While the outlook is positive, the Canadian compound feed market faces challenges including price volatility of key ingredients due to global commodity markets and stringent regulations concerning feed safety and environmental sustainability. Nevertheless, the market is well-equipped to address these obstacles. Continued investment in research and development, strategic collaborations, and a growing emphasis on sustainable feed production are expected to drive future growth and market consolidation. The diverse animal segments, encompassing ruminants, poultry, swine, and aquaculture, offer a broad spectrum of market opportunities. Developing specialized feed formulations that cater to the unique nutritional requirements of specific animal types will be paramount for sustained success in this competitive environment.

Canadian Compound Feed Market Company Market Share

Canadian Compound Feed Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canadian compound feed market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals seeking to navigate this dynamic sector. The market is segmented by animal type (ruminants, poultry, swine, aquaculture, other animal types) and ingredient (cereals, cakes & meals, by-products, supplements). The total market size is predicted to reach xx Million by 2033.

Canadian Compound Feed Market Dynamics & Structure

The Canadian compound feed market is characterized by a moderately concentrated structure, with several large multinational players dominating alongside smaller, regional companies. Technological innovation, driven by increasing demand for efficient and sustainable feed solutions, is a key driver. Stringent regulatory frameworks governing feed safety and animal welfare significantly influence market operations. Competitive pressures arise from substitute products, particularly those focusing on alternative protein sources. End-user demographics, notably evolving consumer preferences towards ethically sourced and sustainably produced animal products, are shaping market trends. Mergers and acquisitions (M&A) activity, as seen in recent years, plays a significant role in consolidating market share.

- Market Concentration: The top 5 players hold approximately xx% of the market share (2024).

- Technological Innovation: Focus on precision feeding, automation, and data-driven optimization.

- Regulatory Landscape: Strict adherence to Canadian Food Inspection Agency (CFIA) regulations.

- Competitive Substitutes: Growing interest in alternative protein sources poses a challenge.

- M&A Activity: xx M&A deals recorded between 2019 and 2024, indicating consolidation.

- Innovation Barriers: High R&D costs and regulatory hurdles hinder innovation.

Canadian Compound Feed Market Growth Trends & Insights

The Canadian compound feed market exhibited a CAGR of xx% during the historical period (2019-2024). This growth is primarily attributed to factors such as increasing livestock population, rising demand for animal protein, and technological advancements in feed formulations. Adoption rates of innovative feed technologies, such as precision feeding and automated systems, are steadily increasing. Technological disruptions, like the introduction of novel feed ingredients and improved processing methods, are driving efficiency and sustainability. Consumer behavior shifts towards greater awareness of animal welfare and sustainable production practices are influencing demand for ethically sourced and environmentally friendly feed products. The projected CAGR for the forecast period (2025-2033) is xx%. Market penetration of specialized feeds, such as those enriched with probiotics or functional ingredients, is expected to grow significantly.

Dominant Regions, Countries, or Segments in Canadian Compound Feed Market

The poultry segment dominates the Canadian compound feed market, followed by ruminants and swine. Growth in these segments is driven by the increasing demand for meat and dairy products. The geographic distribution shows higher concentration in provinces with significant agricultural activity. Ontario and Quebec are leading regions due to their high livestock population density. The cereals segment leads in terms of ingredient usage, followed by cakes & meals and by-products. Supplements are a growing segment, driven by the demand for enhanced feed efficiency and animal health.

- Poultry: High demand for poultry meat and eggs drives significant market growth.

- Ruminants: Steady growth driven by dairy and beef production.

- Swine: Moderate growth reflects the relatively stable pork production sector.

- Cereals: Remains the dominant ingredient due to its cost-effectiveness and nutritional value.

- Supplements: Growing segment driven by focus on improved animal health and productivity.

- Key Drivers: Government support for agriculture, technological advancements in feed production, increasing consumer demand for animal protein.

Canadian Compound Feed Market Product Landscape

The Canadian compound feed market offers a diverse range of products catering to the specific nutritional requirements of different animal types. Innovations focus on improved digestibility, enhanced nutrient utilization, and the incorporation of functional ingredients to improve animal health and welfare. Products are categorized based on animal type, life stage, and specific nutritional needs. Key performance metrics include feed conversion ratio (FCR), animal growth rate, and overall health parameters. Unique selling propositions often center around improved feed efficiency, enhanced animal productivity, and sustainability. Technological advancements such as precision feeding and automated systems are driving product innovation.

Key Drivers, Barriers & Challenges in Canadian Compound Feed Market

Key Drivers: Increasing demand for animal protein, technological advancements leading to higher feed efficiency, government support for the agricultural sector, growing awareness of animal health and welfare.

Challenges: Fluctuating feed ingredient prices due to global market volatility, stringent regulations related to feed safety and environmental impact, increasing competition from international players, supply chain disruptions and labor shortages negatively impacting production and distribution, xx% increase in input costs leading to a xx% reduction in profit margins in 2024.

Emerging Opportunities in Canadian Compound Feed Market

Growing consumer demand for sustainably produced animal products creates opportunities for organic and environmentally friendly feed solutions. The increasing focus on animal health and welfare opens avenues for specialized feeds with added functional ingredients. Opportunities also exist in developing customized feed solutions for specific animal breeds and production systems. Expansion into niche markets, such as those catering to specific dietary requirements of companion animals, presents promising avenues for growth.

Growth Accelerators in the Canadian Compound Feed Market Industry

Technological advancements in feed formulation and processing are crucial catalysts for growth. Strategic partnerships between feed manufacturers and technology providers can drive innovation and efficiency. Market expansion strategies targeting emerging markets and export opportunities are crucial. Sustainable practices and reduced environmental impact are key for long-term market success.

Key Players Shaping the Canadian Compound Feed Market Market

- Paragon Feeds Corp

- Land O Lakes Purina

- Neovia Group

- Novus International

- Nutreco NV

- Alltech Inc

- Archer Daniels Midland

- Cargill Inc

- New Hope Group

- Canadian Organic Feeds Limited

Notable Milestones in Canadian Compound Feed Market Sector

- November 2022: ADDiCAN expands production capacity with a new grain and processing plant in Slemon Park, PEI.

- May 2022: Trouw Nutrition Canada commences construction of a new feed mill in Chilliwack, BC.

In-Depth Canadian Compound Feed Market Market Outlook

The Canadian compound feed market is poised for continued growth, driven by technological advancements, increasing demand for animal protein, and a focus on sustainability. Strategic partnerships, innovations in feed formulation, and expansion into new markets will shape the future of this dynamic sector. The long-term outlook is positive, with significant opportunities for growth and innovation. The market's future success hinges on adapting to evolving consumer preferences, navigating regulatory changes, and embracing sustainable practices.

Canadian Compound Feed Market Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

-

2.4. Supplements

- 2.4.1. Vitamins

- 2.4.2. Amino Acid

- 2.4.3. Enzymes

- 2.4.4. Prebiotics and Probiotics

- 2.4.5. Acidifiers

- 2.4.6. Other Supplements

Canadian Compound Feed Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Canadian Compound Feed Market Regional Market Share

Geographic Coverage of Canadian Compound Feed Market

Canadian Compound Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Inclination Towards Meat and Increasing Exports

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Canadian Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.2.4.1. Vitamins

- 5.2.4.2. Amino Acid

- 5.2.4.3. Enzymes

- 5.2.4.4. Prebiotics and Probiotics

- 5.2.4.5. Acidifiers

- 5.2.4.6. Other Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Canadian Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.2.4.1. Vitamins

- 6.2.4.2. Amino Acid

- 6.2.4.3. Enzymes

- 6.2.4.4. Prebiotics and Probiotics

- 6.2.4.5. Acidifiers

- 6.2.4.6. Other Supplements

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. South America Canadian Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.2.4.1. Vitamins

- 7.2.4.2. Amino Acid

- 7.2.4.3. Enzymes

- 7.2.4.4. Prebiotics and Probiotics

- 7.2.4.5. Acidifiers

- 7.2.4.6. Other Supplements

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Europe Canadian Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.2.4.1. Vitamins

- 8.2.4.2. Amino Acid

- 8.2.4.3. Enzymes

- 8.2.4.4. Prebiotics and Probiotics

- 8.2.4.5. Acidifiers

- 8.2.4.6. Other Supplements

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Middle East & Africa Canadian Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes & Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.2.4.1. Vitamins

- 9.2.4.2. Amino Acid

- 9.2.4.3. Enzymes

- 9.2.4.4. Prebiotics and Probiotics

- 9.2.4.5. Acidifiers

- 9.2.4.6. Other Supplements

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Asia Pacific Canadian Compound Feed Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes & Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.2.4.1. Vitamins

- 10.2.4.2. Amino Acid

- 10.2.4.3. Enzymes

- 10.2.4.4. Prebiotics and Probiotics

- 10.2.4.5. Acidifiers

- 10.2.4.6. Other Supplements

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Paragon Feeds Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Land O Lakes Purina

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Neovia Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Novus International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nutreco NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alltech Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Archer Daniels Midland

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cargill Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 New Hope Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Canadian Organic Feeds Limite

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Paragon Feeds Corp

List of Figures

- Figure 1: Global Canadian Compound Feed Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Canadian Compound Feed Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 3: North America Canadian Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Canadian Compound Feed Market Revenue (billion), by Ingredient 2025 & 2033

- Figure 5: North America Canadian Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: North America Canadian Compound Feed Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Canadian Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Canadian Compound Feed Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 9: South America Canadian Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: South America Canadian Compound Feed Market Revenue (billion), by Ingredient 2025 & 2033

- Figure 11: South America Canadian Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 12: South America Canadian Compound Feed Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Canadian Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Canadian Compound Feed Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 15: Europe Canadian Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Canadian Compound Feed Market Revenue (billion), by Ingredient 2025 & 2033

- Figure 17: Europe Canadian Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 18: Europe Canadian Compound Feed Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Canadian Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Canadian Compound Feed Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 21: Middle East & Africa Canadian Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: Middle East & Africa Canadian Compound Feed Market Revenue (billion), by Ingredient 2025 & 2033

- Figure 23: Middle East & Africa Canadian Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 24: Middle East & Africa Canadian Compound Feed Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Canadian Compound Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Canadian Compound Feed Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 27: Asia Pacific Canadian Compound Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Asia Pacific Canadian Compound Feed Market Revenue (billion), by Ingredient 2025 & 2033

- Figure 29: Asia Pacific Canadian Compound Feed Market Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Asia Pacific Canadian Compound Feed Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Canadian Compound Feed Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Canadian Compound Feed Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 2: Global Canadian Compound Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 3: Global Canadian Compound Feed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Canadian Compound Feed Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 5: Global Canadian Compound Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 6: Global Canadian Compound Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Canadian Compound Feed Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Global Canadian Compound Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 12: Global Canadian Compound Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Canadian Compound Feed Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 17: Global Canadian Compound Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 18: Global Canadian Compound Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Canadian Compound Feed Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 29: Global Canadian Compound Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 30: Global Canadian Compound Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Canadian Compound Feed Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 38: Global Canadian Compound Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 39: Global Canadian Compound Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Canadian Compound Feed Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadian Compound Feed Market?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Canadian Compound Feed Market?

Key companies in the market include Paragon Feeds Corp, Land O Lakes Purina, Neovia Group, Novus International, Nutreco NV, Alltech Inc, Archer Daniels Midland, Cargill Inc, New Hope Group, Canadian Organic Feeds Limite.

3. What are the main segments of the Canadian Compound Feed Market?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Growing Inclination Towards Meat and Increasing Exports.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: ADDiCAN, a producer of animal nutritional products, has purchased a grain and processing plant in Slemon Park, Prince Edward Island, Canada. The facility, ADDiCAN's second in Canada, will extend the company's production and bulk handling capabilities for the North American and worldwide markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadian Compound Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadian Compound Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadian Compound Feed Market?

To stay informed about further developments, trends, and reports in the Canadian Compound Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence