Key Insights

The global Cell Banking Outsourcing Market is projected for significant expansion, expected to reach $16.07 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 17.2%. This growth is underpinned by rising demand for advanced cell-based therapies, the increasing costs and complexity of in-house cell banking infrastructure, and the need for specialized expertise in managing sensitive biological materials. Pharmaceutical and biotechnology firms are increasingly leveraging outsourcing to focus on core R&D, ensuring regulatory compliance and preserving cell line integrity. Market growth is further stimulated by advancements in cell culture, cryopreservation, and the expanding applications of stem cells in regenerative medicine.

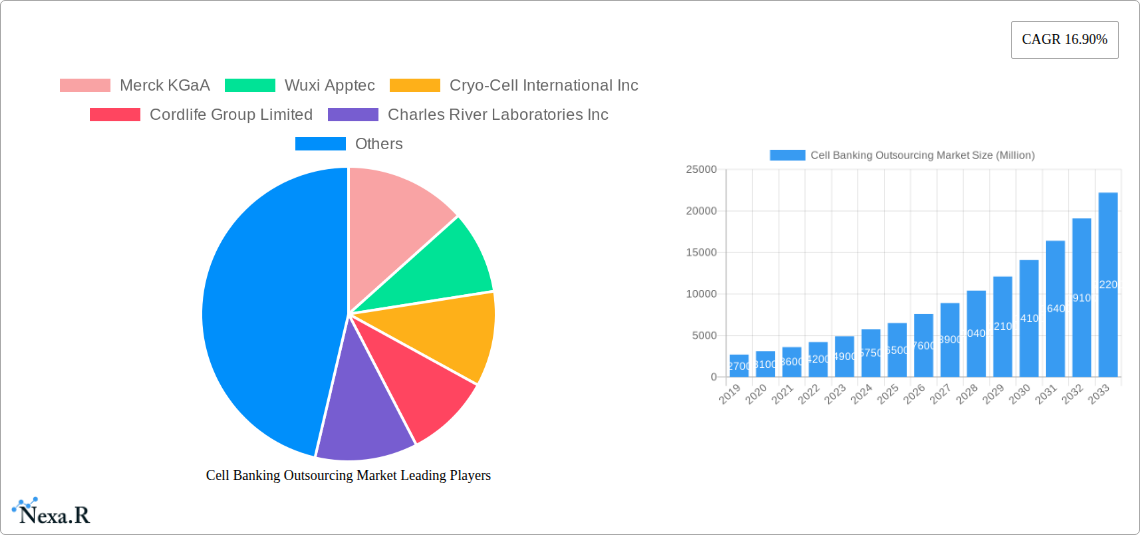

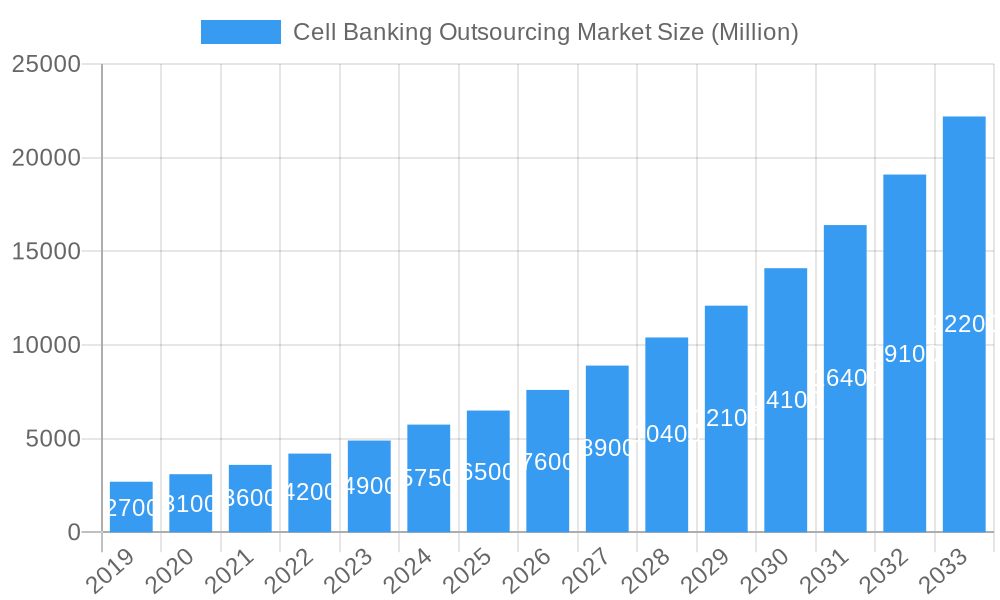

Cell Banking Outsourcing Market Market Size (In Billion)

The market is segmented by service type, with Stem Cell Banking, including Cord, Adult, Dental, and Induced Pluripotent Stem Cell Banking, being a leading segment due to the therapeutic potential of stem cells. Viral Cell Banking is also experiencing substantial growth, driven by the development of viral vectors for gene therapies and vaccine production. Key market trends include the integration of advanced analytics and AI for cell line characterization, innovations in bio-containers for improved cell viability, and the expansion of services into emerging markets like Asia Pacific and South America. While high initial investment and skilled personnel shortages present potential restraints, strategic partnerships and collaborations are expected to drive market advancement.

Cell Banking Outsourcing Market Company Market Share

Comprehensive Report: Cell Banking Outsourcing Market - Growth, Trends, and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global Cell Banking Outsourcing Market, meticulously examining its current landscape, historical trajectory, and future potential. Designed for industry professionals, investors, and strategic decision-makers, this report leverages high-traffic keywords and a granular segmentation approach to offer unparalleled insights into market dynamics, growth drivers, competitive strategies, and emerging opportunities. With a study period spanning from 2019 to 2033, and a base and estimated year of 2025, this analysis offers a robust forecast for the critical 2025–2033 period. All monetary values are presented in Million units.

Cell Banking Outsourcing Market Market Dynamics & Structure

The Cell Banking Outsourcing Market is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving end-user demands. Market concentration, while present with key players like Merck KGaA, Wuxi Apptec, and Charles River Laboratories Inc., is also influenced by the rise of specialized service providers and contract development and manufacturing organizations (CDMOs). Technological innovation is a primary driver, with advancements in cell culture techniques, cryopreservation, and quality control constantly pushing the boundaries of what is achievable. Regulatory frameworks, particularly Good Manufacturing Practices (GMP) and Good Laboratory Practices (GLP), are paramount, dictating the quality and safety standards for cell banking operations. Competitive product substitutes, while not directly replacing the core service of cell banking, can emerge in the form of in-house development capabilities or alternative therapeutic modalities that reduce the reliance on cell-based products. End-user demographics are shifting, with an increasing demand from pharmaceutical and biotechnology companies for personalized medicine, cell and gene therapies, and regenerative medicine applications. Mergers and acquisition (M&A) trends are active, reflecting a consolidation phase where larger entities acquire specialized capabilities or expand their geographic reach.

- Market Concentration: Key players hold significant market share, but a growing number of niche service providers contribute to market fragmentation.

- Technological Innovation Drivers: Advancements in gene editing, cell therapy manufacturing platforms, and AI-driven data analytics are key innovation enablers.

- Regulatory Frameworks: Stringent guidelines from FDA, EMA, and other regulatory bodies are critical for market entry and sustained operations, impacting compliance costs and operational complexity.

- Competitive Product Substitutes: While direct substitutes are limited, alternative manufacturing processes for biologics and advancements in non-cell-based therapies can indirectly influence demand.

- End-User Demographics: Growing prevalence of chronic diseases and increased R&D investment in cell and gene therapies are driving demand.

- M&A Trends: Strategic acquisitions to gain access to novel technologies, expand service portfolios, and enhance geographical presence are prevalent. Approximately 15-20% of market growth in the historical period was attributed to M&A activities.

Cell Banking Outsourcing Market Growth Trends & Insights

The Cell Banking Outsourcing Market is poised for robust expansion, driven by the accelerating development and commercialization of cell and gene therapies, regenerative medicine, and advanced biologics. The market size is projected to witness a significant surge, evolving from an estimated USD 3,500 Million in the base year 2025 to an impressive USD 8,900 Million by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12.5%. This impressive growth trajectory is fueled by several critical trends. Firstly, the increasing complexity and cost associated with in-house cell line development and banking are compelling more pharmaceutical and biotechnology companies to outsource these specialized services to experienced CDMOs. This allows them to focus on their core competencies of drug discovery and development while ensuring high-quality, compliant cell banking solutions. Secondly, the burgeoning pipeline of cell and gene therapies, many of which are in late-stage clinical trials or nearing regulatory approval, directly translates into a higher demand for GMP-compliant Master Cell Banks (MCBs) and Working Cell Banks (WCBs). The market penetration of outsourced cell banking services is steadily increasing, as more companies recognize the efficiency, scalability, and cost-effectiveness offered by specialized providers. Technological disruptions, such as advances in cell engineering, automation in cell culture, and sophisticated cryopreservation techniques, are continuously enhancing the capabilities of cell banking services, enabling the preservation and expansion of a wider range of cell types for diverse therapeutic applications. Consumer behavior shifts are also playing a role, with an increasing willingness among patients and healthcare providers to embrace novel cell-based therapies, thus indirectly boosting the demand for the foundational cell banking services required for their production. The increasing adoption of induced pluripotent stem cells (iPSCs) for therapeutic and research purposes further contributes to market expansion.

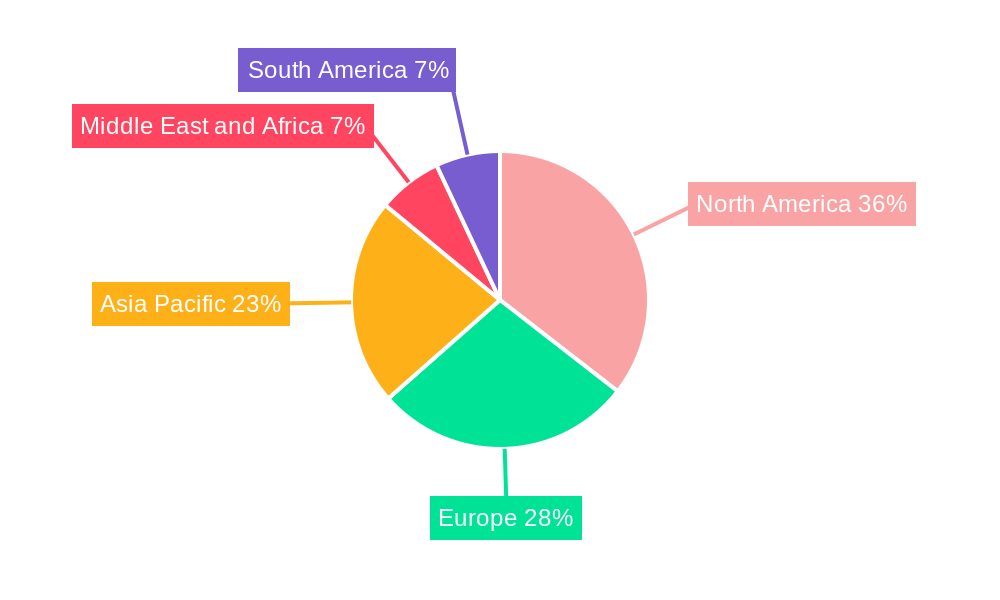

Dominant Regions, Countries, or Segments in Cell Banking Outsourcing Market

The global Cell Banking Outsourcing Market is currently dominated by North America, driven by its robust biopharmaceutical ecosystem, substantial R&D investments, and a well-established regulatory framework. The region benefits from the presence of leading pharmaceutical and biotechnology companies, a high concentration of academic research institutions, and a mature CDMO landscape. Specifically, the United States accounts for a significant portion of the market, with its advanced healthcare infrastructure and strong government support for regenerative medicine research. Key growth drivers in this region include a high prevalence of chronic diseases, a strong pipeline of cell and gene therapies, and favorable reimbursement policies for innovative treatments.

Within the market segmentation, Stem Cell Banking stands out as a critical and rapidly expanding segment, particularly Cord Stem Cell Banking and Adult Stem Cell Banking. This dominance is attributed to the immense therapeutic potential of stem cells in treating a wide array of diseases, from hematological disorders to neurological conditions and autoimmune diseases. The growing awareness among expectant parents regarding the lifelong benefits of preserving cord blood stem cells further fuels the demand for cord stem cell banking services, positioning it as a significant growth engine. Induced Pluripotent Stem cell Banking is also gaining traction due to its versatility in disease modeling and regenerative medicine applications.

From a Bank Type perspective, Master Cell Banking (MCB) services are pivotal. MCBs are the fundamental starting point for all cell-based manufacturing processes, ensuring genetic stability and batch-to-batch consistency. The demand for high-quality, well-characterized MCBs is consistently high, driven by regulatory requirements for product safety and efficacy. Consequently, companies offering robust MCB development and characterization services are strategically positioned for market leadership. The market share for MCB services is estimated to be around 45% of the total cell banking outsourcing market in the base year 2025.

- Dominant Region: North America, with the United States as a key contributor, exhibiting an estimated market share of 40% in 2025.

- Dominant Cell Type: Stem Cell Banking, with Cord Stem Cell Banking and Adult Stem Cell Banking leading the sub-segments, collectively representing approximately 55% of the stem cell banking market in 2025.

- Dominant Bank Type: Master Cell Banking, serving as the foundational bank for numerous cell-based therapies and products.

- Key Drivers in Dominant Segments:

- North America: Significant R&D funding, presence of major biopharmaceutical players, and supportive regulatory environment.

- Stem Cell Banking: Expanding therapeutic applications, increasing public awareness, and advancements in regenerative medicine.

- Master Cell Banking: Stringent regulatory requirements for product consistency and safety in cell and gene therapies.

Cell Banking Outsourcing Market Product Landscape

The Cell Banking Outsourcing Market's product landscape is defined by highly specialized services and platforms designed to ensure the quality, safety, and efficacy of cell lines for therapeutic and research purposes. Key innovations revolve around advanced cryopreservation techniques that maximize cell viability post-thaw, rigorous genetic characterization methods to ensure stability and prevent mutations, and comprehensive quality control assays that adhere to stringent regulatory standards. Unique selling propositions often lie in the ability to handle diverse cell types, from primary cells to engineered cell lines and stem cells, and to scale production efficiently while maintaining GMP compliance. Technological advancements include the implementation of automated cell culture systems, sophisticated biobanking management software for seamless data tracking and retrieval, and the development of novel viral vector production and banking solutions for gene therapy applications.

Key Drivers, Barriers & Challenges in Cell Banking Outsourcing Market

Key Drivers:

- Growing demand for cell and gene therapies: The rapidly expanding pipeline and increasing approvals of these novel treatments necessitate robust cell banking solutions.

- Outsourcing trend: Pharmaceutical and biotech companies increasingly opt for outsourcing to leverage specialized expertise, reduce costs, and accelerate timelines.

- Advancements in regenerative medicine: Breakthroughs in stem cell research and applications are driving demand for reliable cell banking services.

- Stringent regulatory requirements: The need for GMP-compliant cell banks ensures quality and safety, favoring specialized outsourcing providers.

Barriers & Challenges:

- High initial investment costs: Establishing and maintaining GMP-compliant cell banking facilities requires significant capital expenditure.

- Complex regulatory landscape: Navigating evolving and stringent regulatory requirements across different regions can be challenging.

- Supply chain disruptions: Ensuring a consistent supply of high-quality raw materials and reagents is crucial and can be susceptible to disruptions.

- Skilled workforce shortage: A limited pool of experienced professionals in cell biology, cryopreservation, and regulatory affairs poses a challenge.

- Data security and intellectual property concerns: Protecting sensitive cell line data and intellectual property is a paramount concern for clients. An estimated 10-15% of potential growth can be inhibited by these challenges.

Emerging Opportunities in Cell Banking Outsourcing Market

Emerging opportunities in the Cell Banking Outsourcing Market are closely tied to the advancements in personalized medicine and the growing therapeutic applications of rare cell types. The increasing focus on rare disease treatments is creating a demand for specialized cell banking services tailored to these specific cell populations. Furthermore, the development of off-the-shelf allogeneic cell therapies presents a significant opportunity for large-scale, standardized cell banking solutions. The integration of advanced analytics and artificial intelligence for predictive modeling of cell viability and quality control also opens new avenues for innovation and service enhancement. The expansion of cell banking services for novel modalities, such as engineered immune cells and exosome-based therapies, represents a significant untapped market. The global market for cell therapy manufacturing is projected to reach USD 25,000 Million by 2030, with cell banking being a critical enabler.

Growth Accelerators in the Cell Banking Outsourcing Market Industry

Several catalysts are accelerating the long-term growth of the Cell Banking Outsourcing Market. Technological breakthroughs in areas like CRISPR gene editing and advanced cell engineering are expanding the repertoire of cells that can be banked and utilized therapeutically. Strategic partnerships between CDMOs, academic institutions, and biopharmaceutical companies are fostering innovation and facilitating the seamless transfer of technology from research to commercialization. Market expansion strategies, including geographical diversification into emerging markets with growing biopharmaceutical sectors, are also crucial growth accelerators. The increasing number of clinical trials for cell and gene therapies worldwide, currently exceeding 1,500, directly fuels the demand for contract cell banking services.

Key Players Shaping the Cell Banking Outsourcing Market Market

- Merck KGaA

- Wuxi Apptec

- Cryo-Cell International Inc

- Cordlife Group Limited

- Charles River Laboratories Inc

- SGS Life Sciences

- Reliance Life Sciences

- GBI

- Texcell

- Lonza

- Clean Biologics

- Cryoviva India

- LifeCell International Pvt Ltd

Notable Milestones in Cell Banking Outsourcing Market Sector

- May 2022: Anja Health raised USD 4.5 million in seed funding to make cord blood stem cell banking accessible for everyone, regardless of race, socioeconomic status, or income. The new funding will strengthen the company's leadership team, promote strategic growth, and foster its community.

- April 2022: Pluristyx, a biotechnology business focused on advanced therapeutic tools and services, and Accelerated Biosciences, a regenerative medicine pioneer in the utilization of proprietary human trophoblast stem cells (hTSCs), agreed to generate clinical-grade hESC banks under GMP guidelines (GMP).

- April 2022: ATUM, a California-based bioengineering company, launched its Good Manufacturing Practices (cGMP)-compliant Master Cell Banking production services. New capability enables ATUM to provide an end-to-end cell line development solution, from DNA design through Master Cell Bank (MCB) and Working Cell Bank (WCB) release, supporting Investigational New Drug (IND) applications.

In-Depth Cell Banking Outsourcing Market Market Outlook

The future outlook for the Cell Banking Outsourcing Market is exceptionally bright, characterized by sustained growth and increasing strategic importance. The market is expected to be driven by a confluence of factors, including the continued expansion of the cell and gene therapy pipeline, the growing adoption of personalized medicine approaches, and ongoing technological advancements in cell manufacturing and preservation. Key growth accelerators will include the formation of strategic alliances between CDMOs and innovative biotech startups, the expansion of service offerings to encompass more complex cell types and therapeutic modalities, and the increasing integration of digital technologies for enhanced data management and quality control. The market's trajectory indicates a significant increase in outsourcing adoption as more companies recognize the value of specialized expertise and cost efficiencies. This presents a fertile ground for investment and strategic development in the coming years, with the global market projected to reach an estimated USD 8,900 Million by 2033.

Cell Banking Outsourcing Market Segmentation

-

1. Bank Type

- 1.1. Master Cell Banking

- 1.2. Working Cell Banking

- 1.3. Viral Cell Banking

-

2. Cell Type

-

2.1. Stem Cell Banking

- 2.1.1. Cord Stem Cell Banking

- 2.1.2. Adult Stem Cell Banking

- 2.1.3. Dental Stem Cell Banking

- 2.1.4. Induced Pluripotent Stem cell Banking

- 2.2. Non-stem Cell Banking

-

2.1. Stem Cell Banking

Cell Banking Outsourcing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cell Banking Outsourcing Market Regional Market Share

Geographic Coverage of Cell Banking Outsourcing Market

Cell Banking Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For Cell Therapies; Increasing Awareness for Stem Cell Banking; Rise in Burden of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of Therapies; Legal and Changing Ethical Issues During Collection

- 3.4. Market Trends

- 3.4.1. Induced Pluripotent Stem Cell Banking Segment is Expected to Hold a Major Share in the Market Studied.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cell Banking Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bank Type

- 5.1.1. Master Cell Banking

- 5.1.2. Working Cell Banking

- 5.1.3. Viral Cell Banking

- 5.2. Market Analysis, Insights and Forecast - by Cell Type

- 5.2.1. Stem Cell Banking

- 5.2.1.1. Cord Stem Cell Banking

- 5.2.1.2. Adult Stem Cell Banking

- 5.2.1.3. Dental Stem Cell Banking

- 5.2.1.4. Induced Pluripotent Stem cell Banking

- 5.2.2. Non-stem Cell Banking

- 5.2.1. Stem Cell Banking

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Bank Type

- 6. North America Cell Banking Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Bank Type

- 6.1.1. Master Cell Banking

- 6.1.2. Working Cell Banking

- 6.1.3. Viral Cell Banking

- 6.2. Market Analysis, Insights and Forecast - by Cell Type

- 6.2.1. Stem Cell Banking

- 6.2.1.1. Cord Stem Cell Banking

- 6.2.1.2. Adult Stem Cell Banking

- 6.2.1.3. Dental Stem Cell Banking

- 6.2.1.4. Induced Pluripotent Stem cell Banking

- 6.2.2. Non-stem Cell Banking

- 6.2.1. Stem Cell Banking

- 6.1. Market Analysis, Insights and Forecast - by Bank Type

- 7. Europe Cell Banking Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Bank Type

- 7.1.1. Master Cell Banking

- 7.1.2. Working Cell Banking

- 7.1.3. Viral Cell Banking

- 7.2. Market Analysis, Insights and Forecast - by Cell Type

- 7.2.1. Stem Cell Banking

- 7.2.1.1. Cord Stem Cell Banking

- 7.2.1.2. Adult Stem Cell Banking

- 7.2.1.3. Dental Stem Cell Banking

- 7.2.1.4. Induced Pluripotent Stem cell Banking

- 7.2.2. Non-stem Cell Banking

- 7.2.1. Stem Cell Banking

- 7.1. Market Analysis, Insights and Forecast - by Bank Type

- 8. Asia Pacific Cell Banking Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Bank Type

- 8.1.1. Master Cell Banking

- 8.1.2. Working Cell Banking

- 8.1.3. Viral Cell Banking

- 8.2. Market Analysis, Insights and Forecast - by Cell Type

- 8.2.1. Stem Cell Banking

- 8.2.1.1. Cord Stem Cell Banking

- 8.2.1.2. Adult Stem Cell Banking

- 8.2.1.3. Dental Stem Cell Banking

- 8.2.1.4. Induced Pluripotent Stem cell Banking

- 8.2.2. Non-stem Cell Banking

- 8.2.1. Stem Cell Banking

- 8.1. Market Analysis, Insights and Forecast - by Bank Type

- 9. Middle East and Africa Cell Banking Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Bank Type

- 9.1.1. Master Cell Banking

- 9.1.2. Working Cell Banking

- 9.1.3. Viral Cell Banking

- 9.2. Market Analysis, Insights and Forecast - by Cell Type

- 9.2.1. Stem Cell Banking

- 9.2.1.1. Cord Stem Cell Banking

- 9.2.1.2. Adult Stem Cell Banking

- 9.2.1.3. Dental Stem Cell Banking

- 9.2.1.4. Induced Pluripotent Stem cell Banking

- 9.2.2. Non-stem Cell Banking

- 9.2.1. Stem Cell Banking

- 9.1. Market Analysis, Insights and Forecast - by Bank Type

- 10. South America Cell Banking Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Bank Type

- 10.1.1. Master Cell Banking

- 10.1.2. Working Cell Banking

- 10.1.3. Viral Cell Banking

- 10.2. Market Analysis, Insights and Forecast - by Cell Type

- 10.2.1. Stem Cell Banking

- 10.2.1.1. Cord Stem Cell Banking

- 10.2.1.2. Adult Stem Cell Banking

- 10.2.1.3. Dental Stem Cell Banking

- 10.2.1.4. Induced Pluripotent Stem cell Banking

- 10.2.2. Non-stem Cell Banking

- 10.2.1. Stem Cell Banking

- 10.1. Market Analysis, Insights and Forecast - by Bank Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merck KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wuxi Apptec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cryo-Cell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cordlife Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Charles River Laboratories Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SGS Life Sciences

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Reliance Life Sciences

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GBI

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texcell

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lonza

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Clean Biologics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cryoviva India

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LifeCell International Pvt Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Merck KGaA

List of Figures

- Figure 1: Global Cell Banking Outsourcing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cell Banking Outsourcing Market Revenue (billion), by Bank Type 2025 & 2033

- Figure 3: North America Cell Banking Outsourcing Market Revenue Share (%), by Bank Type 2025 & 2033

- Figure 4: North America Cell Banking Outsourcing Market Revenue (billion), by Cell Type 2025 & 2033

- Figure 5: North America Cell Banking Outsourcing Market Revenue Share (%), by Cell Type 2025 & 2033

- Figure 6: North America Cell Banking Outsourcing Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cell Banking Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cell Banking Outsourcing Market Revenue (billion), by Bank Type 2025 & 2033

- Figure 9: Europe Cell Banking Outsourcing Market Revenue Share (%), by Bank Type 2025 & 2033

- Figure 10: Europe Cell Banking Outsourcing Market Revenue (billion), by Cell Type 2025 & 2033

- Figure 11: Europe Cell Banking Outsourcing Market Revenue Share (%), by Cell Type 2025 & 2033

- Figure 12: Europe Cell Banking Outsourcing Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Cell Banking Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cell Banking Outsourcing Market Revenue (billion), by Bank Type 2025 & 2033

- Figure 15: Asia Pacific Cell Banking Outsourcing Market Revenue Share (%), by Bank Type 2025 & 2033

- Figure 16: Asia Pacific Cell Banking Outsourcing Market Revenue (billion), by Cell Type 2025 & 2033

- Figure 17: Asia Pacific Cell Banking Outsourcing Market Revenue Share (%), by Cell Type 2025 & 2033

- Figure 18: Asia Pacific Cell Banking Outsourcing Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Cell Banking Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Cell Banking Outsourcing Market Revenue (billion), by Bank Type 2025 & 2033

- Figure 21: Middle East and Africa Cell Banking Outsourcing Market Revenue Share (%), by Bank Type 2025 & 2033

- Figure 22: Middle East and Africa Cell Banking Outsourcing Market Revenue (billion), by Cell Type 2025 & 2033

- Figure 23: Middle East and Africa Cell Banking Outsourcing Market Revenue Share (%), by Cell Type 2025 & 2033

- Figure 24: Middle East and Africa Cell Banking Outsourcing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Cell Banking Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Cell Banking Outsourcing Market Revenue (billion), by Bank Type 2025 & 2033

- Figure 27: South America Cell Banking Outsourcing Market Revenue Share (%), by Bank Type 2025 & 2033

- Figure 28: South America Cell Banking Outsourcing Market Revenue (billion), by Cell Type 2025 & 2033

- Figure 29: South America Cell Banking Outsourcing Market Revenue Share (%), by Cell Type 2025 & 2033

- Figure 30: South America Cell Banking Outsourcing Market Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Cell Banking Outsourcing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 2: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Cell Type 2020 & 2033

- Table 3: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 5: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Cell Type 2020 & 2033

- Table 6: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 11: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Cell Type 2020 & 2033

- Table 12: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 20: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Cell Type 2020 & 2033

- Table 21: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 29: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Cell Type 2020 & 2033

- Table 30: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 35: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Cell Type 2020 & 2033

- Table 36: Global Cell Banking Outsourcing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Cell Banking Outsourcing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell Banking Outsourcing Market?

The projected CAGR is approximately 17.2%.

2. Which companies are prominent players in the Cell Banking Outsourcing Market?

Key companies in the market include Merck KGaA, Wuxi Apptec, Cryo-Cell International Inc, Cordlife Group Limited, Charles River Laboratories Inc, SGS Life Sciences, Reliance Life Sciences, GBI, Texcell, Lonza, Clean Biologics, Cryoviva India, LifeCell International Pvt Ltd.

3. What are the main segments of the Cell Banking Outsourcing Market?

The market segments include Bank Type, Cell Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For Cell Therapies; Increasing Awareness for Stem Cell Banking; Rise in Burden of Chronic Diseases.

6. What are the notable trends driving market growth?

Induced Pluripotent Stem Cell Banking Segment is Expected to Hold a Major Share in the Market Studied..

7. Are there any restraints impacting market growth?

High Cost of Therapies; Legal and Changing Ethical Issues During Collection.

8. Can you provide examples of recent developments in the market?

May 2022: Anja Health raised USD 4.5 million in seed funding to make cord blood stem cell banking accessible for everyone, regardless of race, socioeconomic status, or income. The new funding will strengthen the company's leadership team, promote strategic growth, and foster its community.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cell Banking Outsourcing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cell Banking Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cell Banking Outsourcing Market?

To stay informed about further developments, trends, and reports in the Cell Banking Outsourcing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence