Key Insights

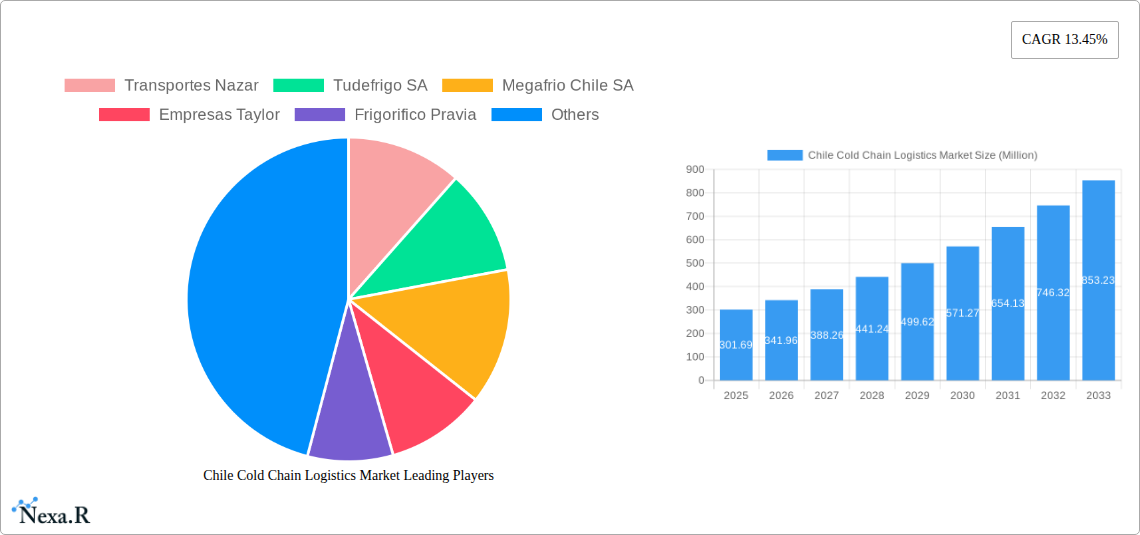

The Chilean cold chain logistics market, valued at $301.69 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.45% from 2025 to 2033. This surge is driven by several key factors. The increasing demand for fresh produce, dairy products, and processed foods, particularly for export, necessitates efficient cold chain solutions. Furthermore, the burgeoning pharmaceutical and life sciences sectors in Chile are fueling the need for reliable temperature-controlled transportation and storage. Growth in e-commerce and a rising consumer preference for fresh, high-quality products further contribute to market expansion. While challenges exist, such as infrastructure limitations in certain regions and potential fluctuations in fuel prices, the overall market outlook remains positive. Key players like Transportes Nazar, Tudefrigo SA, and Megafrio Chile SA are actively investing in technology and expanding their service offerings to meet the growing demand. The market segmentation reveals strong performance across chilled, frozen, and ambient temperature services, with the horticulture (fresh fruits and vegetables) and dairy sectors being significant end-users. The expansion of value-added services like blast freezing and inventory management provides further opportunities for market players.

Chile Cold Chain Logistics Market Market Size (In Million)

The continued growth trajectory is expected to be influenced by government initiatives promoting agricultural exports and improvements in cold chain infrastructure. However, maintaining consistent quality control throughout the supply chain and addressing sustainability concerns related to energy consumption and environmental impact will be crucial for long-term success. The competitive landscape remains dynamic, with both established players and emerging companies vying for market share. Strategic partnerships, technological advancements (such as real-time tracking and temperature monitoring), and a focus on customer-centric service delivery will be vital for sustained growth and profitability in the Chilean cold chain logistics market over the next decade.

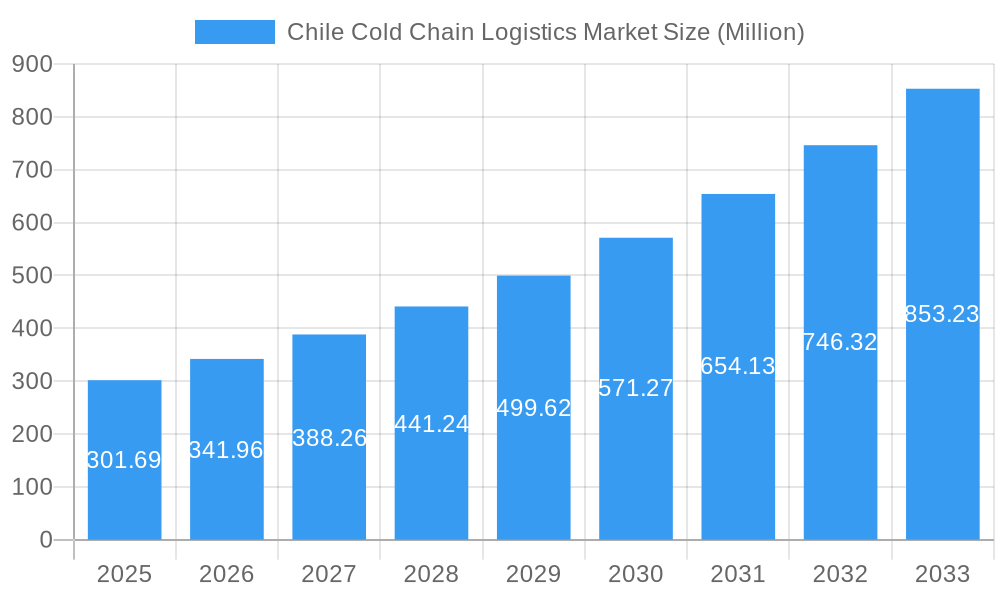

Chile Cold Chain Logistics Market Company Market Share

Chile Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Chile cold chain logistics market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033. The report segments the market by service type (storage, transportation, value-added services), temperature (chilled, frozen, ambient), and end-user industry (horticulture, dairy, meat/poultry/fish, processed food, pharma/life sciences/chemicals, and others). The market size is presented in million units.

Chile Cold Chain Logistics Market Market Dynamics & Structure

The Chilean cold chain logistics market is characterized by a moderately concentrated structure with a mix of large multinational players and smaller domestic operators. The market size in 2025 is estimated at xx million units. Key dynamics include:

- Technological Innovation: Adoption of IoT, blockchain, and AI-powered solutions is driving efficiency and transparency. However, high initial investment costs pose a barrier for smaller companies.

- Regulatory Framework: Government regulations regarding food safety and temperature control are stringent, influencing market practices and investment decisions. Recent policy changes are driving investment into cold chain infrastructure.

- Competitive Landscape: Intense competition exists among established players like Transportes Nazar, Tudefrigo SA, Megafrio Chile SA, Empresas Taylor, Frigorifico Pravia, Friofort SA, Frigorificos Puerto Montt, and Ceva Logistics, as well as numerous smaller regional operators and 63 other companies. Market share is fairly distributed, with no single dominant player, though the top five players control approximately xx% of the market.

- M&A Activity: The past five years have witnessed xx M&A deals, primarily driven by consolidation efforts and expansion into new segments. The forecast period is expected to see an increase to xx deals.

- End-User Demographics: Growth is fueled by rising demand for fresh produce, processed foods, and pharmaceuticals, with the horticulture and dairy sectors being major drivers. Changes in consumer preferences towards high-quality, convenient food products are impacting cold chain demand.

Chile Cold Chain Logistics Market Growth Trends & Insights

The Chilean cold chain logistics market has demonstrated robust expansion from 2019 to 2024, achieving a Compound Annual Growth Rate (CAGR) of 8.5%. This growth trajectory is poised for further acceleration, with projections indicating a market size of USD 1.2 billion by 2033, exhibiting a significant CAGR of 9.2%. This upward trend is underpinned by a confluence of dynamic factors:

The market's evolution is marked by an increasing adoption rate of cutting-edge technologies, with IoT sensor deployment for real-time temperature and humidity monitoring growing by an estimated 15% annually. Blockchain integration for enhanced supply chain transparency and traceability is also gaining traction, with pilot programs showing potential to reduce spoilage by up to 10%. Technological disruptions, such as the advent of automated guided vehicles (AGVs) in warehouses and predictive analytics for inventory management, are revolutionizing operational efficiency. Simultaneously, shifts in consumer behavior, driven by a growing preference for fresh, organic, and premium food products, are creating a sustained demand for high-quality cold chain services. For instance, the demand for imported fruits like berries has surged by 20% in the last two years, necessitating stringent cold chain preservation from port to plate.

Dominant Regions, Countries, or Segments in Chile Cold Chain Logistics Market

The central region of Chile dominates the cold chain logistics market, driven by high population density and agricultural output. However, growth is expected in southern regions due to the increasing aquaculture industry. The most significant segments by service include:

- Storage: Represents xx% of the market due to the need for secure warehousing of temperature-sensitive goods. The growth in this segment is driven by increased investment in modern warehousing facilities and expansion of existing facilities.

- Transportation: Accounts for xx% of the market, with refrigerated trucking playing a crucial role in maintaining product quality during transit. Recent infrastructure investments are further supporting this segment's growth.

- Value-Added Services: This segment is experiencing the fastest growth, at a CAGR of xx%, driven by increased demand for specialized services such as blast freezing, labeling, and inventory management. This is especially true in the pharmaceutical and food processing sectors.

[Paragraphs detailing dominant end-user segments – horticulture, dairy, meat/poultry/fish, processed food, pharma/life sciences/chemicals – detailing their contribution, growth potential, and supporting factors. The contribution percentage should be included]

Chile Cold Chain Logistics Market Product Landscape

The product landscape is characterized by a sophisticated integration of technologically advanced refrigeration units, advanced temperature monitoring systems, and intelligent logistics software. These innovations are paramount in ensuring optimal product quality and significantly minimizing waste. A pronounced emphasis is being placed on energy efficiency and the adoption of environmentally friendly solutions. Features such as advanced insulation technologies for temperature stability and the utilization of energy-saving refrigerants are becoming increasingly prevalent, reflecting a commitment to both operational excellence and sustainability.

Key Drivers, Barriers & Challenges in Chile Cold Chain Logistics Market

Key Drivers:

- Escalating consumer demand for high-quality fresh produce, dairy, and processed foods, driven by evolving dietary preferences.

- The burgeoning pharmaceutical and life sciences sectors, requiring precise temperature control for vaccines, biologics, and specialized medications, with a projected 7% annual growth.

- Proactive government initiatives and investments aimed at modernizing and expanding cold chain infrastructure nationwide.

- Continuous technological advancements that are enhancing efficiency, reducing operational costs, and minimizing product spoilage.

Challenges:

- Substantial initial infrastructure investment costs for establishing and upgrading cold storage facilities and transportation networks.

- Persistent limitations in adequate cold storage capacity, particularly in emerging or remote regions of the country.

- Vulnerability to fluctuations in global fuel prices, which directly impact the cost of refrigerated transportation.

- Navigating and adhering to increasingly stringent national and international regulatory compliance requirements for food and pharmaceutical safety.

Emerging Opportunities in Chile Cold Chain Logistics Market

Emerging opportunities include expansion into underserved rural areas, increasing adoption of sustainable and eco-friendly practices (eg. reduced-carbon footprint solutions), and the development of specialized cold chain solutions for niche products such as organic produce and high-value pharmaceuticals. The growth of e-commerce is also creating new opportunities for last-mile delivery solutions.

Growth Accelerators in the Chile Cold Chain Logistics Market Industry

The industry's growth is being significantly propelled by technological advancements, including the wider deployment of automation in warehousing, sophisticated AI-powered route optimization algorithms that reduce transit times and fuel consumption, and pervasive real-time temperature monitoring systems. Strategic collaborations and partnerships between leading logistics providers and innovative technology companies are further solidifying the industry's competitive edge. Moreover, substantial investments, both from private enterprises and public funding, are actively expanding cold chain infrastructure, thereby boosting overall capacity and operational efficiency across the sector.

Key Players Shaping the Chile Cold Chain Logistics Market Market

- Transportes Nazar

- Tudefrigo SA

- Megafrio Chile SA

- Empresas Taylor

- Frigorifico Pravia

- Friofort SA

- Frigorificos Puerto Montt

- Ceva Logistics

- 63 Other Companies

- Emergent Cold LatAm

- TIBA Chile

Notable Milestones in Chile Cold Chain Logistics Market Sector

- 2021-Q3: Megafrio Chile SA expands its warehousing capacity in Santiago.

- 2022-Q1: Government announces funding for infrastructure development in southern Chile.

- 2023-Q2: Several mergers and acquisitions occur within the smaller-scale logistics companies.

- 2024-Q4: A major player introduces an advanced temperature monitoring system. (More details are needed for accurate representation.)

In-Depth Chile Cold Chain Logistics Market Market Outlook

The Chilean cold chain logistics market is projected to experience substantial and sustained growth over the next decade. Continued strategic investments in state-of-the-art infrastructure, coupled with the proactive integration of technological innovations and the fostering of robust strategic partnerships, will be critical in driving this expansion. Furthermore, addressing existing regulatory complexities and enhancing the resilience of supply chains against potential disruptions will be instrumental in elevating industry competitiveness and unlocking new avenues for growth. The overarching commitment to sustainability and the adoption of eco-friendly solutions will continue to be a defining characteristic, shaping the future trajectory and ethical considerations of the industry.

Chile Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 3.3. Meat, Fish, and Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

Chile Cold Chain Logistics Market Segmentation By Geography

- 1. Chile

Chile Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Chile Cold Chain Logistics Market

Chile Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Fruit Exports

- 3.3. Market Restrains

- 3.3.1. 4.; Challenges of First Mile Distribution in Chile

- 3.4. Market Trends

- 3.4.1. Growth Of E-commerce Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 5.3.3. Meat, Fish, and Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transportes Nazar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tudefrigo SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Megafrio Chile SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Empresas Taylor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frigorifico Pravia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Friofort SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Frigorificos Puerto Montt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ceva Logistics**List Not Exhaustive 6 3 Other Companie

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emergent Cold LatAm

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TIBA Chile

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transportes Nazar

List of Figures

- Figure 1: Chile Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Chile Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Chile Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Chile Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Chile Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Chile Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Chile Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Chile Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Chile Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Cold Chain Logistics Market?

The projected CAGR is approximately 13.45%.

2. Which companies are prominent players in the Chile Cold Chain Logistics Market?

Key companies in the market include Transportes Nazar, Tudefrigo SA, Megafrio Chile SA, Empresas Taylor, Frigorifico Pravia, Friofort SA, Frigorificos Puerto Montt, Ceva Logistics**List Not Exhaustive 6 3 Other Companie, Emergent Cold LatAm, TIBA Chile.

3. What are the main segments of the Chile Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.69 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Fruit Exports.

6. What are the notable trends driving market growth?

Growth Of E-commerce Driving The Market.

7. Are there any restraints impacting market growth?

4.; Challenges of First Mile Distribution in Chile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Chile Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence