Key Insights

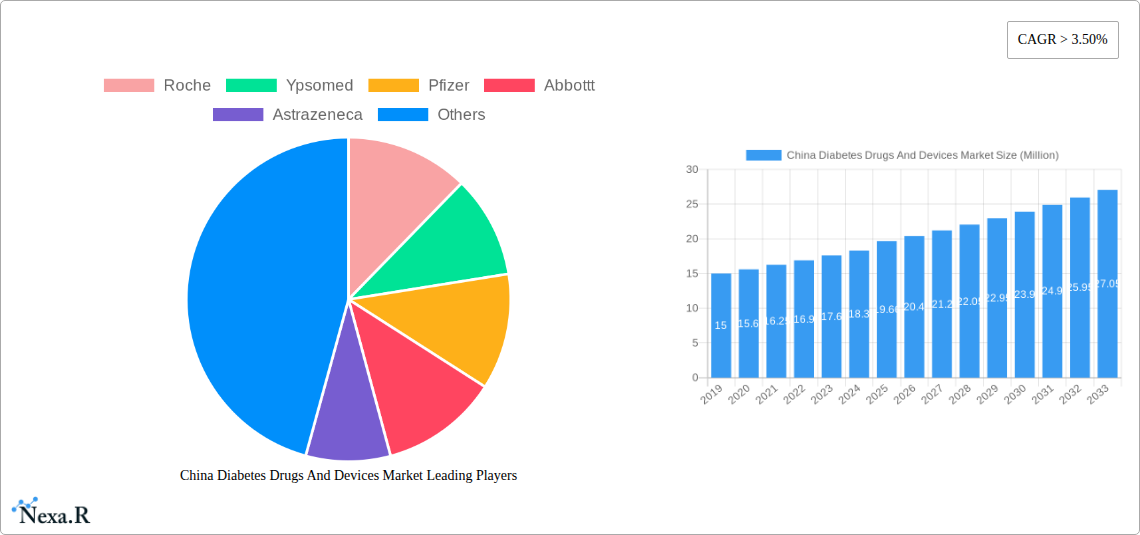

The China Diabetes Drugs and Devices Market is poised for substantial growth, driven by an increasing prevalence of diabetes and a rising demand for advanced treatment solutions. Valued at an estimated 19.66 million units, the market is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.50% through 2033. This robust growth is underpinned by several key factors. Firstly, the burgeoning diabetes population in China, exacerbated by lifestyle changes and an aging demographic, creates an ever-expanding patient base. Secondly, significant advancements in diabetes management technology, including sophisticated monitoring devices like continuous glucose monitors (CGMs) and advanced insulin delivery systems such as insulin pumps and smart pens, are enhancing treatment efficacy and patient convenience, thereby fueling market adoption. Furthermore, an increasing awareness of diabetes complications and a growing emphasis on proactive health management are compelling individuals to invest in these innovative solutions.

China Diabetes Drugs And Devices Market Market Size (In Million)

The market segmentation highlights a dynamic interplay between drugs and devices. Within devices, both self-monitoring blood glucose devices and CGMs are seeing increased uptake, while insulin pumps and disposable pens are gaining traction in insulin management. The drugs segment is characterized by a strong presence of oral anti-diabetes drugs, insulin drugs, and combination therapies, with non-insulin injectable drugs also emerging as a significant growth area. Major global and domestic players are actively investing in research and development, introducing novel products and expanding their market reach within China. The market's trajectory is further supported by supportive government initiatives aimed at improving diabetes care and increasing access to innovative treatments. Despite potential challenges such as pricing pressures and regulatory hurdles, the overall outlook for the China Diabetes Drugs and Devices Market remains exceptionally positive, driven by unmet medical needs and a relentless pursuit of better diabetes management outcomes.

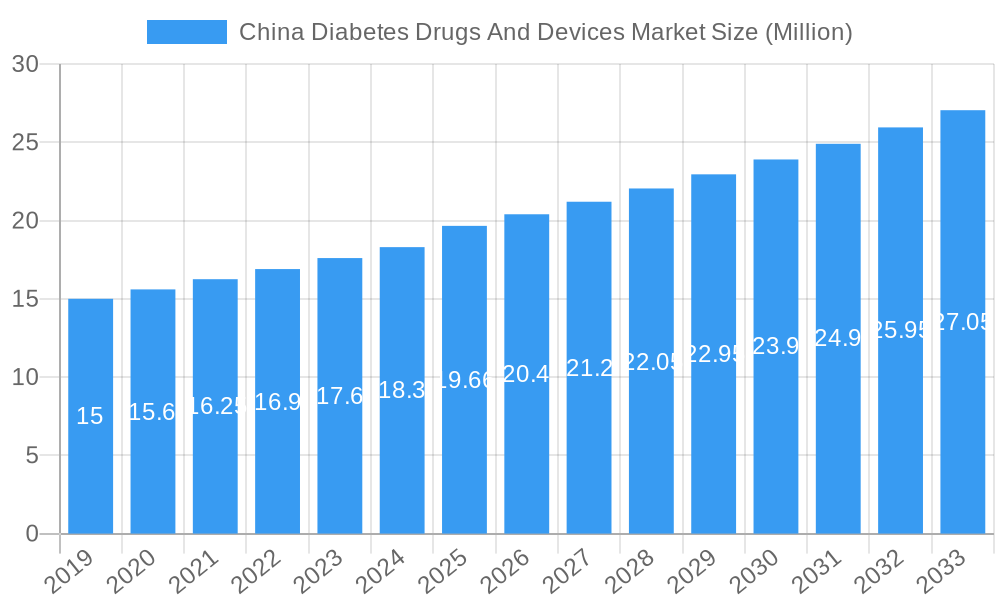

China Diabetes Drugs And Devices Market Company Market Share

China Diabetes Drugs and Devices Market: Comprehensive Analysis and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic China Diabetes Drugs and Devices Market, providing an in-depth analysis of market size, growth trends, competitive landscape, and future opportunities. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report offers critical insights for stakeholders seeking to understand and capitalize on this rapidly evolving sector. We present all values in Million units, with estimated figures where exact data is unavailable.

China Diabetes Drugs And Devices Market Market Dynamics & Structure

The China diabetes drugs and devices market exhibits a complex and evolving structure, characterized by increasing market concentration in key therapeutic areas and device categories. Technological innovation remains a primary driver, with advancements in continuous glucose monitoring (CGM) systems and novel oral anti-diabetic drugs significantly shaping product offerings. The regulatory framework, though progressively supportive of innovation and affordability, presents both opportunities and challenges. Competitive product substitutes are abundant, particularly in oral anti-diabetic drugs, leading to price sensitivity and a focus on differentiated therapies and devices. End-user demographics are shifting, with an aging population and a growing prevalence of type 2 diabetes driving demand. Merger and acquisition (M&A) trends are observed as companies seek to expand their portfolios and market reach.

- Market Concentration: Leading companies are consolidating market share in insulin and CGM segments.

- Technological Innovation Drivers: Development of AI-powered diabetes management apps, advanced insulin delivery systems, and non-invasive glucose monitoring technologies.

- Regulatory Frameworks: Government initiatives promoting bulk drug purchasing and reimbursement policies for diabetes-related treatments.

- Competitive Product Substitutes: Increasing availability of biosimilar insulins and generic oral anti-diabetic drugs.

- End-User Demographics: Rising incidence of diabetes due to lifestyle changes and an aging population.

- M&A Trends: Strategic acquisitions aimed at enhancing product pipelines and market access, with approximately 3-5 significant deals anticipated annually over the forecast period.

China Diabetes Drugs And Devices Market Growth Trends & Insights

The China diabetes drugs and devices market is poised for substantial growth, driven by an escalating diabetes epidemic, increasing healthcare expenditure, and a growing patient awareness regarding disease management. The market size is projected to witness a significant upward trajectory, fueled by the increasing adoption of advanced diabetes management devices and innovative drug therapies. Technological disruptions, such as the integration of artificial intelligence in diabetes management applications and the development of smart insulin delivery systems, are revolutionizing patient care and adherence. Consumer behavior is shifting towards proactive disease management, with a greater emphasis on personalized treatment plans and convenient monitoring solutions. The adoption rates for Continuous Blood Glucose Monitoring (CGM) devices are expected to surge, reflecting a growing preference for real-time glucose insights over traditional self-monitoring. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately 10-12% from 2025 to 2033. This growth is further propelled by government initiatives aimed at improving access to high-quality diabetes care and reducing the economic burden of the disease. The penetration of advanced diabetes management solutions is anticipated to double within the next decade as awareness and affordability increase, leading to a more robust and proactive approach to diabetes care across the nation.

Dominant Regions, Countries, or Segments in China Diabetes Drugs And Devices Market

Within the diverse China Diabetes Drugs and Devices Market, the Devices segment, specifically Continuous Blood Glucose Monitoring (CGM), is emerging as a dominant growth driver, alongside Insulin Drugs. This dominance is attributed to several interconnected factors, including evolving patient needs and technological advancements.

- Continuous Blood Glucose Monitoring (CGM): This segment's ascendancy is fueled by its ability to provide real-time, comprehensive glucose data, enabling more precise insulin dosing and proactive management. The increasing demand for convenience and accuracy among patients, particularly those with type 1 diabetes and complex type 2 diabetes management, has significantly propelled its market share. The rising disposable income in major urban centers further facilitates the adoption of these relatively higher-priced devices. Market share for CGM within the broader monitoring devices segment is projected to grow from approximately 15% in 2025 to over 35% by 2033, representing a significant shift in patient preference and technological integration.

- Insulin Drugs: While facing price pressures from centralized procurement initiatives, insulin drugs remain a cornerstone of diabetes treatment due to their indispensability for many patients. The sheer volume of patients requiring insulin therapy ensures its continued market dominance. The market is witnessing a bifurcation, with increased demand for advanced insulin formulations like ultra-long-acting insulins and biosimil insulins offering cost-effective alternatives. The market share of insulin drugs within the overall drug segment is expected to remain robust, though growth may be tempered by the rise of non-insulin injectables and oral medications for specific patient profiles.

Key Drivers:

- Technological Advancements: The continuous innovation in CGM sensors, offering improved accuracy, smaller form factors, and better connectivity, is a primary catalyst.

- Government Initiatives: Policies promoting bulk procurement of drugs and devices aim to increase affordability, indirectly boosting the volume of dispensed insulin and encouraging wider access to monitoring technologies.

- Rising Diabetes Prevalence: The unabated increase in diabetes incidence across China directly translates to a larger patient pool requiring both drug therapies and management devices.

- Patient Empowerment and Awareness: Greater access to health information and a growing desire for personalized health management are driving patients to seek more sophisticated monitoring tools.

China Diabetes Drugs And Devices Market Product Landscape

The product landscape within the China Diabetes Drugs and Devices Market is characterized by a dynamic interplay of innovation and accessibility. Significant product innovations are emerging in both the drugs and devices segments. In the drug category, advancements are seen in novel oral anti-diabetic drugs with improved efficacy and reduced side effects, alongside more sophisticated insulin formulations offering better glycemic control and convenience. On the devices front, the focus is on enhancing the user experience and data integration for self-monitoring blood glucose devices and continuous blood glucose monitoring systems. Integration with mobile health applications, remote patient monitoring capabilities, and AI-driven insights are becoming increasingly prominent, offering unique selling propositions that empower patients and clinicians with actionable data for better diabetes management.

Key Drivers, Barriers & Challenges in China Diabetes Drugs And Devices Market

Key Drivers:

- Escalating Diabetes Prevalence: The rapidly growing number of individuals diagnosed with diabetes in China is the primary growth engine.

- Technological Advancements: Continuous innovation in diabetes monitoring devices (CGM, smart meters) and drug delivery systems (insulin pumps, smart pens) is enhancing treatment efficacy and patient convenience.

- Government Support & Healthcare Reforms: Initiatives like centralized drug procurement and increased reimbursement for diabetes-related care are improving affordability and accessibility.

- Rising Disposable Income & Health Awareness: Growing patient awareness and the ability to afford advanced treatments are driving demand for premium products.

Barriers & Challenges:

- Pricing Pressures: Centralized procurement policies, while improving affordability, can impact profit margins for drug manufacturers.

- Regulatory Hurdles: Navigating the complex regulatory approval processes for new drugs and medical devices can be time-consuming and resource-intensive.

- Infrastructure Gaps: Uneven distribution of advanced healthcare facilities and skilled professionals, particularly in rural areas, can limit access to cutting-edge treatments.

- Competition: The market is highly competitive, with numerous domestic and international players vying for market share, leading to intense price wars in certain segments.

- Supply Chain Disruptions: Global and domestic supply chain vulnerabilities can impact the availability and cost of raw materials and finished products.

Emerging Opportunities in China Diabetes Drugs And Devices Market

Emerging opportunities in the China Diabetes Drugs and Devices Market lie in the burgeoning demand for integrated diabetes management solutions. The growing penetration of digital health platforms, coupled with the increasing adoption of wearable technology, presents a fertile ground for developing smart diabetes management ecosystems. There is also a significant opportunity in catering to the growing elderly population with diabetes, requiring specialized care and devices. Furthermore, the untapped potential in lower-tier cities and rural areas, where access to advanced treatments is still limited, offers substantial growth prospects through localized distribution and affordable product offerings.

Growth Accelerators in the China Diabetes Drugs And Devices Market Industry

Several key growth accelerators are propelling the China Diabetes Drugs and Devices Market forward. Technological breakthroughs, such as the development of non-invasive glucose monitoring technologies and advanced AI-powered predictive analytics for diabetes management, are poised to revolutionize patient care. Strategic partnerships between device manufacturers, pharmaceutical companies, and digital health providers are fostering innovation and creating comprehensive treatment pathways. Furthermore, market expansion strategies targeting underserved regions and specific patient demographics, alongside a continued focus on improving product affordability and accessibility through government collaborations, will significantly bolster long-term market growth.

Key Players Shaping the China Diabetes Drugs And Devices Market Market

- Roche

- Ypsomed

- Pfizer

- Abbott

- AstraZeneca

- Eli Lilly

- Sanofi

- Novartis

- Medtronic

- Tandem

- Insulet

- Novo Nordisk

- Dexcom

Notable Milestones in China Diabetes Drugs And Devices Market Sector

- April 2023: The National Healthcare Security Administration announced that China's diabetes patients can now access high-quality and more affordable insulin products, as the country's drug bulk-buying program for insulin products led to an average price cut of 48%. The centralized procurement is estimated to save CNY 9 billion (about USD 1.31 billion) in diabetes-related health expenditures yearly.

- June 2022: LifeScan announced that the peer-reviewed journal Diabetes Technology and Therapeutics (DTT) has published Real World Evidence of Improved Glycemic Control in People with Diabetes using a Bluetooth-connected Blood Glucose Meter with Mobile Diabetes Management Application using the OneTouch Reveal mobile app with the OneTouch Verio Reflect meter- synced via Bluetooth wireless technology could support improved glycemic control for people with diabetes.

In-Depth China Diabetes Drugs And Devices Market Market Outlook

The future outlook for the China Diabetes Drugs and Devices Market is exceptionally promising, driven by a confluence of factors that create robust growth accelerators. The ongoing digital transformation in healthcare is leading to the widespread adoption of connected devices and AI-driven platforms, enhancing personalized treatment and patient engagement. Strategic collaborations between global and domestic players are expected to accelerate the introduction of cutting-edge therapies and devices tailored to the specific needs of the Chinese population. Furthermore, the government's sustained commitment to improving public health and reducing the burden of chronic diseases ensures continued policy support for market expansion and innovation. The market is set to experience significant advancements in preventative care and early diagnosis, alongside innovative drug formulations and next-generation device technologies, solidifying its position as a critical and rapidly growing sector within the global healthcare landscape.

China Diabetes Drugs And Devices Market Segmentation

-

1. Devices

-

1.1. Monitoring Devices

- 1.1.1. Self-monitoring Blood Glucose Devices

- 1.1.2. Continuous Blood Glucose Monitoring

-

1.2. Management Devices

- 1.2.1. Insulin Pump

- 1.2.2. Insulin Syringes

- 1.2.3. Insulin Cartridges

- 1.2.4. Disposable Pens

-

1.1. Monitoring Devices

-

2. Drugs

- 2.1. Oral Anti-Diabetes Drugs

- 2.2. Insulin Drugs

- 2.3. Combination Drugs

- 2.4. Non-Insulin Injectable Drugs

China Diabetes Drugs And Devices Market Segmentation By Geography

- 1. China

China Diabetes Drugs And Devices Market Regional Market Share

Geographic Coverage of China Diabetes Drugs And Devices Market

China Diabetes Drugs And Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Continuous Glucose Monitoring Segment Expected to Witness the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Diabetes Drugs And Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Monitoring Devices

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.2. Continuous Blood Glucose Monitoring

- 5.1.2. Management Devices

- 5.1.2.1. Insulin Pump

- 5.1.2.2. Insulin Syringes

- 5.1.2.3. Insulin Cartridges

- 5.1.2.4. Disposable Pens

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Drugs

- 5.2.1. Oral Anti-Diabetes Drugs

- 5.2.2. Insulin Drugs

- 5.2.3. Combination Drugs

- 5.2.4. Non-Insulin Injectable Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ypsomed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pfizer

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbottt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astrazeneca

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novartis

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Medtronic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tandem

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Insulet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novo Nordisk

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dexcom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: China Diabetes Drugs And Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Diabetes Drugs And Devices Market Share (%) by Company 2025

List of Tables

- Table 1: China Diabetes Drugs And Devices Market Revenue Million Forecast, by Devices 2020 & 2033

- Table 2: China Diabetes Drugs And Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: China Diabetes Drugs And Devices Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 4: China Diabetes Drugs And Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 5: China Diabetes Drugs And Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Diabetes Drugs And Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: China Diabetes Drugs And Devices Market Revenue Million Forecast, by Devices 2020 & 2033

- Table 8: China Diabetes Drugs And Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 9: China Diabetes Drugs And Devices Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 10: China Diabetes Drugs And Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 11: China Diabetes Drugs And Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Diabetes Drugs And Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Diabetes Drugs And Devices Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the China Diabetes Drugs And Devices Market?

Key companies in the market include Roche, Ypsomed, Pfizer, Abbottt, Astrazeneca, Eli Lilly, Sanofi, Novartis, Medtronic, Tandem, Insulet, Novo Nordisk, Dexcom.

3. What are the main segments of the China Diabetes Drugs And Devices Market?

The market segments include Devices, Drugs.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.66 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Continuous Glucose Monitoring Segment Expected to Witness the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

April 2023: The National Healthcare Security Administration announced that China's diabetes patients can now access high-quality and more affordable insulin products, as the country's drug bulk-buying program for insulin products led to an average price cut of 48%. The centralized procurement is estimated to save CNY 9 billion (about USD 1.31 billion) in diabetes-related health expenditures yearly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Diabetes Drugs And Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Diabetes Drugs And Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Diabetes Drugs And Devices Market?

To stay informed about further developments, trends, and reports in the China Diabetes Drugs And Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence