Key Insights

China's Diagnostic Imaging Equipment Market is set for significant growth, fueled by an aging demographic, rising chronic disease incidence, and increased demand for advanced healthcare. The market is projected to reach $5.86 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 16.75% from 2025 to 2033, potentially reaching approximately $20 billion by 2033. Government initiatives to enhance healthcare infrastructure and accessibility, coupled with substantial R&D investments in innovative technologies like AI-powered diagnostics and portable equipment, are key growth drivers. Growing patient awareness of early disease detection further stimulates demand for diagnostic imaging.

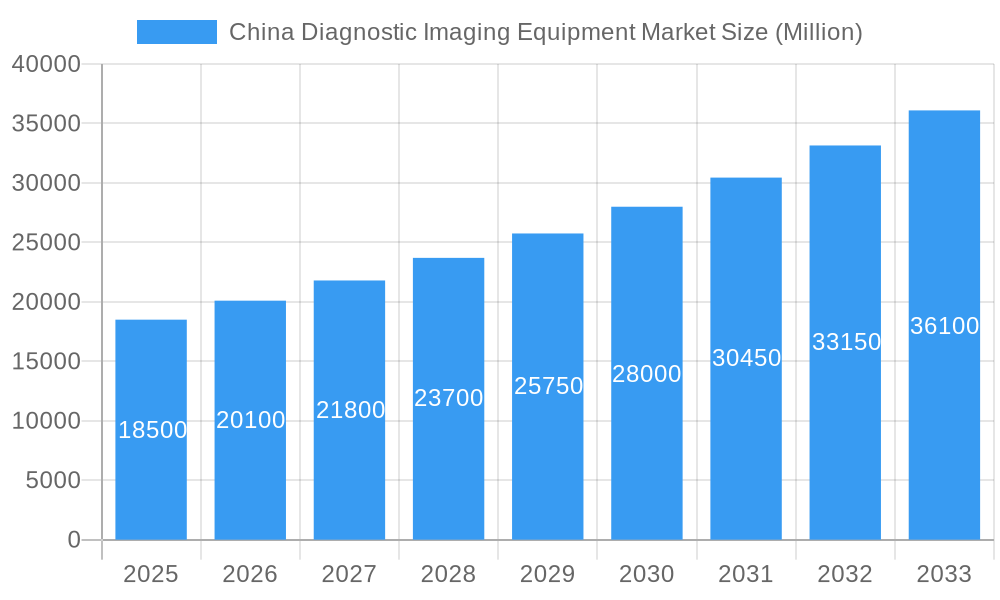

China Diagnostic Imaging Equipment Market Market Size (In Billion)

The market landscape is diverse. Computed Tomography (CT) and Magnetic Resonance Imaging (MRI) systems are expected to dominate due to their broad diagnostic capabilities. Ultrasound is also poised for growth, driven by its non-invasive and cost-effective nature. Cardiology, Oncology, and Neurology are the leading application segments, reflecting the growing prevalence of related diseases. Hospitals will continue to be the primary end-users, with specialized diagnostic centers also expanding. While high equipment costs and the need for skilled personnel may present challenges, ongoing technological advancements and increasing healthcare expenditure in China are anticipated to drive sustained market expansion.

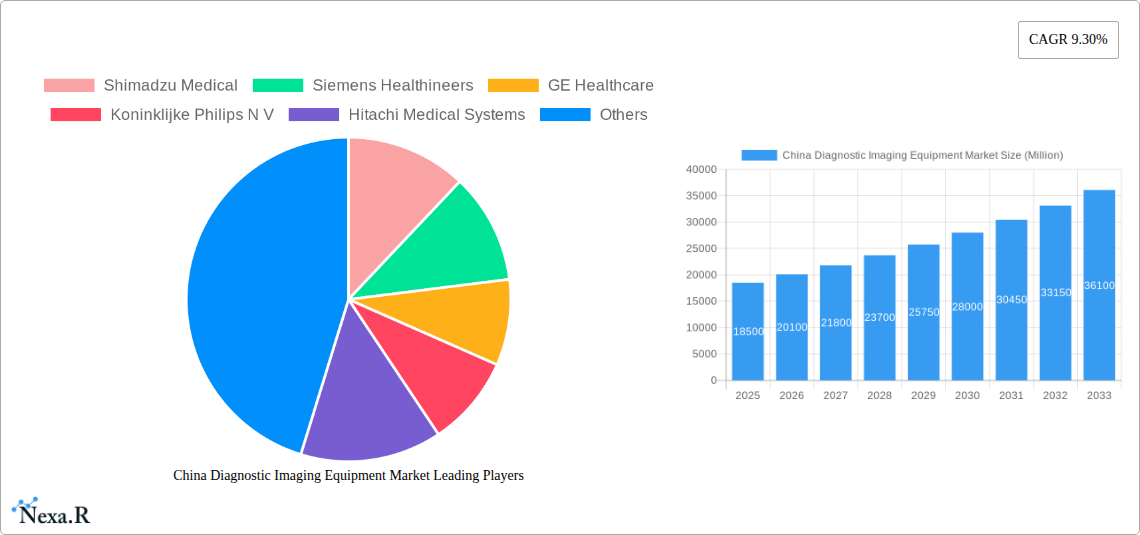

China Diagnostic Imaging Equipment Market Company Market Share

China Diagnostic Imaging Equipment Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a comprehensive analysis of the China Diagnostic Imaging Equipment Market, providing critical insights for stakeholders looking to navigate this dynamic and rapidly expanding sector. Covering the period from 2019 to 2033, with a base year of 2025, this study delves into market dynamics, growth trends, regional dominance, product landscape, key players, and future opportunities. Leveraging high-traffic keywords such as "China medical imaging," "diagnostic equipment China," "MRI China," "CT scanners China," "ultrasound devices China," and "X-ray machines China," this report is optimized for maximum search engine visibility and engagement within the industry.

China Diagnostic Imaging Equipment Market Market Dynamics & Structure

The China diagnostic imaging equipment market is characterized by a moderate to high concentration, with a few global giants and a growing number of domestic players vying for market share. Technological innovation serves as a primary driver of market growth, fueled by substantial R&D investments from leading companies and government initiatives promoting advanced healthcare technologies. Regulatory frameworks, while evolving, are becoming more streamlined, facilitating market entry and adoption of new equipment. Competitive product substitutes are present, particularly in less complex imaging modalities, but the demand for advanced, high-resolution diagnostic tools remains robust. End-user demographics are shifting towards an aging population and a growing middle class with increased disposable income and a higher demand for preventative healthcare, directly impacting the need for sophisticated diagnostic imaging. Mergers and acquisitions (M&A) are becoming more prevalent as larger companies seek to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Dominated by a mix of multinational corporations and ambitious domestic manufacturers, with an increasing trend towards consolidation.

- Technological Innovation: Driven by advancements in AI-powered diagnostics, higher resolution imaging, and miniaturization of equipment.

- Regulatory Landscape: Government support for healthcare modernization, coupled with evolving standards for medical device approval, influences market dynamics.

- Competitive Dynamics: Intense competition exists across all segments, with a focus on price, performance, and after-sales service.

- M&A Activity: Increasing as companies seek synergistic benefits and broader market access, contributing to market consolidation.

China Diagnostic Imaging Equipment Market Growth Trends & Insights

The China Diagnostic Imaging Equipment Market is poised for sustained and robust growth over the forecast period (2025-2033). This expansion is underpinned by a confluence of factors including increasing healthcare expenditure, a growing emphasis on early disease detection, and the continuous adoption of cutting-edge technologies. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of XX%, reaching an estimated value of XXXX million units by 2033. A significant trend is the accelerating adoption rate of advanced imaging modalities such as MRI (Magnetic Resonance Imaging) and Computed Tomography (CT), driven by their superior diagnostic capabilities in fields like oncology, neurology, and cardiology. Technological disruptions, including the integration of Artificial Intelligence (AI) into imaging systems for automated analysis and improved workflow efficiency, are reshaping the market landscape. Furthermore, consumer behavior shifts are playing a crucial role, with an increasing willingness among Chinese consumers to invest in private healthcare services and preventative screenings, leading to a higher demand for sophisticated diagnostic imaging equipment in both public and private healthcare institutions. The expanding reach of healthcare services into Tier 2 and Tier 3 cities, coupled with government initiatives aimed at improving healthcare infrastructure, further contributes to market penetration. The growing prevalence of chronic diseases and an aging population further amplify the need for diagnostic imaging solutions. The market's trajectory is a testament to China's commitment to upgrading its healthcare system and enhancing the quality of patient care, making it a pivotal region for global diagnostic imaging innovation and sales.

Dominant Regions, Countries, or Segments in China Diagnostic Imaging Equipment Market

The Product segment of Ultrasound is emerging as a dominant force in the China Diagnostic Imaging Equipment Market, showcasing exceptional growth potential and widespread adoption across various healthcare settings. This dominance is propelled by its versatility, relatively lower cost compared to MRI and CT scanners, and its extensive applications in obstetrics and gynecology, cardiology, abdominal imaging, and point-of-care diagnostics.

- Ultrasound's Market Leadership: The segment's growth is primarily driven by its affordability, portability, and the increasing demand for non-invasive diagnostic procedures, especially in burgeoning diagnostic centers and smaller clinics.

- Key Drivers for Ultrasound Dominance:

- Economic Policies: Government initiatives promoting primary healthcare and accessible diagnostic services favor cost-effective solutions like ultrasound.

- Infrastructure Development: The expansion of healthcare facilities, particularly in rural and semi-urban areas, necessitates portable and easy-to-deploy imaging technologies.

- Technological Advancements: Innovations in ultrasound technology, including Doppler imaging, 3D/4D imaging, and portable handheld devices, have significantly enhanced its diagnostic capabilities and appeal.

- Application Expansion: Its use in specialized areas like interventional radiology, musculoskeletal imaging, and pain management further broadens its market penetration.

- Market Share and Growth Potential: Ultrasound is projected to capture a significant market share, estimated at XX% of the total diagnostic imaging equipment market by 2028, with a forecasted CAGR of XX% during the study period. This growth is fueled by the increasing number of ultrasound procedures performed annually, estimated at over XXX million units.

- Dominance Factors: The combination of accessibility, affordability, and expanding applications positions ultrasound as a cornerstone of diagnostic imaging in China. The ease of use and minimal patient preparation required also contribute to its widespread adoption in diverse clinical settings.

- Comparison with Other Segments: While MRI and CT scanners remain crucial for complex diagnoses, their higher cost and infrastructure requirements limit their ubiquity. X-ray, though a foundational modality, faces competition from more advanced technologies for specific applications. Nuclear imaging, while vital for certain specialized diagnoses, has a more niche market.

China Diagnostic Imaging Equipment Market Product Landscape

The China Diagnostic Imaging Equipment Market is defined by a diverse and innovative product landscape. MRI scanners are at the forefront of advanced diagnostics, offering unparalleled soft tissue contrast for neurological and oncological applications. Computed Tomography (CT) scanners continue to evolve with faster scan times and reduced radiation doses, crucial for emergency care and detailed anatomical imaging. Ultrasound devices, ranging from large-scale machines to portable handheld units, are indispensable for their versatility, non-invasiveness, and broad applications in cardiology, obstetrics, and point-of-care diagnostics. X-ray systems, including digital radiography (DR) and computed radiography (CR), remain fundamental for skeletal imaging and chest diagnostics. The market also sees significant advancements in Nuclear Imaging, with PET-CT and SPECT offering functional insights for disease detection and management. Fluoroscopy continues to be vital for real-time imaging in interventional procedures, while Mammography plays a critical role in breast cancer screening. Others, encompassing specialized equipment like angiography systems and optical coherence tomography (OCT), further contribute to the comprehensive diagnostic capabilities available. These products are increasingly incorporating AI, enhancing image quality, reducing scan times, and improving diagnostic accuracy, thereby driving adoption and patient outcomes.

Key Drivers, Barriers & Challenges in China Diagnostic Imaging Equipment Market

Key Drivers: The China diagnostic imaging equipment market is propelled by several key drivers. The escalating prevalence of chronic diseases like cancer, cardiovascular ailments, and neurological disorders necessitates advanced diagnostic tools. Government initiatives focused on expanding healthcare access and improving medical infrastructure, particularly in underserved regions, are significantly boosting demand. The growing disposable income and increasing health consciousness among the Chinese population are driving the adoption of high-end imaging equipment and preventative healthcare services. Technological advancements, including AI integration for enhanced image analysis and workflow optimization, are also key accelerators.

- Drivers:

- Rising chronic disease burden.

- Government investment in healthcare infrastructure.

- Increasing consumer health awareness and spending power.

- Rapid technological innovation and AI integration.

Barriers & Challenges: Despite the strong growth trajectory, the market faces several challenges. High acquisition costs and maintenance expenses for advanced imaging equipment can be a barrier, especially for smaller healthcare facilities. Stringent regulatory approval processes, though improving, can still lead to delays in market entry for new products. Intense market competition, both from established global players and emerging domestic manufacturers, puts pressure on pricing and profit margins. Supply chain disruptions, particularly concerning specialized components, can impact production and delivery timelines. The shortage of skilled radiologists and technicians trained to operate and interpret advanced imaging modalities also presents a hurdle.

- Barriers & Challenges:

- High capital investment and operational costs.

- Complex and evolving regulatory landscape.

- Intense price competition and market saturation in certain segments.

- Supply chain vulnerabilities and component sourcing issues.

- Shortage of trained healthcare professionals.

Emerging Opportunities in China Diagnostic Imaging Equipment Market

Emerging opportunities in the China Diagnostic Imaging Equipment Market are abundant, driven by evolving healthcare needs and technological advancements. The increasing demand for point-of-care diagnostics presents a significant opportunity for portable and user-friendly imaging devices, especially in remote areas and emergency settings. The widespread adoption of AI-powered diagnostic solutions is opening new avenues for enhanced diagnostic accuracy and efficiency, offering lucrative prospects for companies investing in this area. Furthermore, the growing focus on personalized medicine is driving the need for advanced imaging techniques that can provide detailed insights into individual patient conditions, creating demand for specialized equipment. The expansion of private healthcare and the growing preference for specialized medical services are also fostering opportunities for advanced imaging solutions in niche applications. The burgeoning health-tech ecosystem in China is also creating fertile ground for innovation and collaboration.

- Opportunities:

- Growth in point-of-care and portable imaging devices.

- Integration of AI for advanced diagnostics and workflow enhancement.

- Demand for imaging solutions supporting personalized medicine.

- Expansion of private healthcare and specialized medical services.

- Untapped potential in lower-tier cities and rural areas.

Growth Accelerators in the China Diagnostic Imaging Equipment Market Industry

Several catalysts are accelerating the long-term growth of the China Diagnostic Imaging Equipment Market. Continuous technological breakthroughs, such as advancements in detector technology, novel contrast agents, and sophisticated image reconstruction algorithms, are driving the development of next-generation imaging systems. Strategic partnerships and collaborations between domestic and international companies are fostering knowledge transfer, accelerating product development, and expanding market reach. Government policies that prioritize healthcare modernization and innovation, including subsidies and favorable regulatory environments for advanced medical technologies, are acting as significant growth engines. The increasing focus on preventative healthcare and early disease detection is creating a sustained demand for advanced imaging equipment. Furthermore, market expansion strategies by key players, including investments in local manufacturing and R&D facilities, are strengthening their competitive positions and contributing to overall market growth.

Key Players Shaping the China Diagnostic Imaging Equipment Market Market

- Shimadzu Medical

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips N V

- Hitachi Medical Systems

- Carestream Health Inc

- FUJIFILM Holdings Corporation

- Canon Medical Systems Corporation

- Hologic Corporation

Notable Milestones in China Diagnostic Imaging Equipment Market Sector

- 2019: Significant increase in government funding for public hospitals, leading to accelerated procurement of advanced imaging equipment.

- 2020: Introduction of AI-powered diagnostic software for radiology, improving image analysis efficiency.

- 2021: Major players establish local R&D centers to cater to the specific needs of the Chinese market.

- 2022: Increased focus on remote diagnostic imaging solutions to address healthcare disparities.

- 2023: Launch of new generation CT scanners with reduced radiation doses and faster scanning capabilities.

- 2024: Growing trend of strategic acquisitions and partnerships to expand product portfolios and market reach.

In-Depth China Diagnostic Imaging Equipment Market Market Outlook

The China Diagnostic Imaging Equipment Market is on an upward trajectory, driven by robust underlying growth accelerators. The continuous push for technological innovation, particularly in AI integration and ultra-high-resolution imaging, promises to redefine diagnostic capabilities. Strategic alliances and collaborations will continue to play a pivotal role in market expansion and technology diffusion. Government support for healthcare infrastructure development and a growing emphasis on preventative medicine will ensure sustained demand. The increasing purchasing power of the Chinese population and the expanding private healthcare sector present significant opportunities for advanced and specialized imaging solutions. The market outlook is exceptionally positive, signaling substantial potential for growth and innovation in the coming years.

China Diagnostic Imaging Equipment Market Segmentation

-

1. Product

- 1.1. MRI

- 1.2. Computed Tomography

- 1.3. Ultrasound

- 1.4. X-Ray

- 1.5. Nuclear Imaging

- 1.6. Fluroscopy

- 1.7. Mamography

- 1.8. Others

-

2. Application

- 2.1. Cardiology

- 2.2. Oncology

- 2.3. Neurology

- 2.4. Orthopedics

- 2.5. Gastroentrology

- 2.6. Gynecology

- 2.7. Other Application

-

3. End-User

- 3.1. Hospitals

- 3.2. Diagnostic Centers

- 3.3. Others

China Diagnostic Imaging Equipment Market Segmentation By Geography

- 1. China

China Diagnostic Imaging Equipment Market Regional Market Share

Geographic Coverage of China Diagnostic Imaging Equipment Market

China Diagnostic Imaging Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing aging population; Increased adoption of diagnostic imaging by the medical industry; Increased incidence of chronic diseases

- 3.3. Market Restrains

- 3.3.1. ; Expensive procedures and equipment

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Holds the Largest Share in the China Diagnostic Imaging Equipment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Diagnostic Imaging Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. MRI

- 5.1.2. Computed Tomography

- 5.1.3. Ultrasound

- 5.1.4. X-Ray

- 5.1.5. Nuclear Imaging

- 5.1.6. Fluroscopy

- 5.1.7. Mamography

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Oncology

- 5.2.3. Neurology

- 5.2.4. Orthopedics

- 5.2.5. Gastroentrology

- 5.2.6. Gynecology

- 5.2.7. Other Application

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Diagnostic Centers

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shimadzu Medical

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Healthineers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke Philips N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Medical Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Carestream Health Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FUJIFILM Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Canon Medical Systems Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Carestream Health Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hologic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shimadzu Medical

List of Figures

- Figure 1: China Diagnostic Imaging Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Diagnostic Imaging Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Diagnostic Imaging Equipment Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: China Diagnostic Imaging Equipment Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: China Diagnostic Imaging Equipment Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: China Diagnostic Imaging Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: China Diagnostic Imaging Equipment Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: China Diagnostic Imaging Equipment Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: China Diagnostic Imaging Equipment Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: China Diagnostic Imaging Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: China Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Diagnostic Imaging Equipment Market?

The projected CAGR is approximately 16.75%.

2. Which companies are prominent players in the China Diagnostic Imaging Equipment Market?

Key companies in the market include Shimadzu Medical, Siemens Healthineers, GE Healthcare, Koninklijke Philips N V, Hitachi Medical Systems, Carestream Health Inc, FUJIFILM Holdings Corporation, Canon Medical Systems Corporation, Carestream Health Inc, Hologic Corporation.

3. What are the main segments of the China Diagnostic Imaging Equipment Market?

The market segments include Product, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.86 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing aging population; Increased adoption of diagnostic imaging by the medical industry; Increased incidence of chronic diseases.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Holds the Largest Share in the China Diagnostic Imaging Equipment Market.

7. Are there any restraints impacting market growth?

; Expensive procedures and equipment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Diagnostic Imaging Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Diagnostic Imaging Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Diagnostic Imaging Equipment Market?

To stay informed about further developments, trends, and reports in the China Diagnostic Imaging Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence