Key Insights

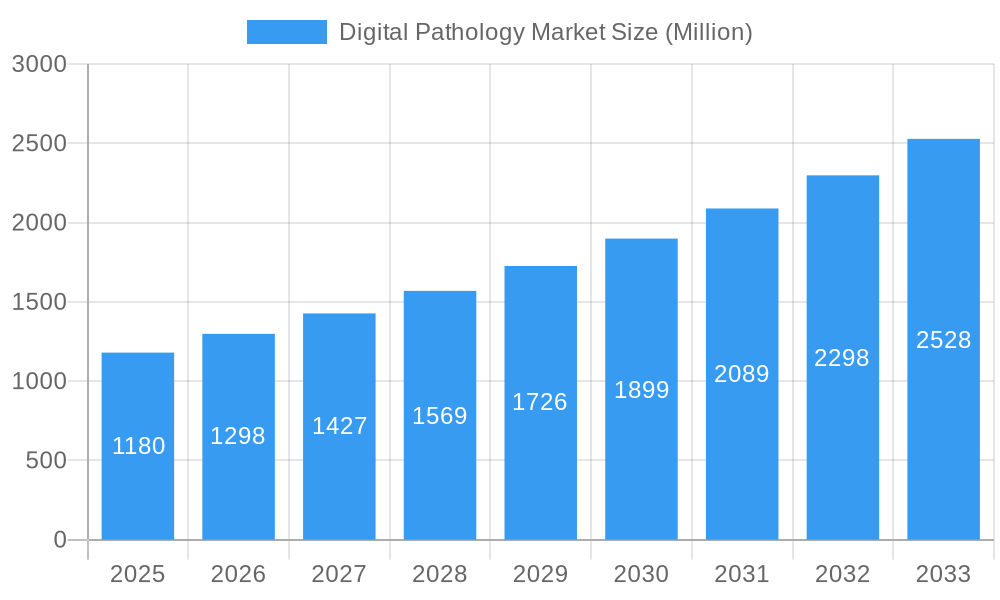

The Digital Pathology Market is poised for significant expansion, projected to reach USD 1.18 billion in value. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.99%, indicating a dynamic and rapidly evolving industry. The market's expansion is primarily fueled by advancements in diagnostic technologies, increasing adoption of AI-driven solutions for image analysis, and a growing need for enhanced efficiency and accuracy in disease diagnosis. The pharmaceutical and biotechnology sectors are leading the charge, leveraging digital pathology for drug discovery and development, while hospitals and reference laboratories are integrating these solutions to improve patient care and streamline workflows. The shift towards precision medicine and personalized treatment strategies further amplifies the demand for detailed, quantifiable data that digital pathology provides.

Digital Pathology Market Market Size (In Billion)

Key drivers for this market surge include the continuous innovation in scanner technology, leading to higher resolution and faster scan times, coupled with sophisticated software solutions that offer advanced analytical capabilities. The increasing volume of research and development activities, particularly in oncology, necessitates efficient methods for analyzing complex tissue samples, a role that digital pathology excels at. Moreover, the growing awareness of the benefits of digital pathology, such as improved collaboration among pathologists, remote access to slides, and reduced turnaround times, is accelerating its adoption worldwide. While the initial investment in infrastructure and training may present a restrain, the long-term cost savings and improved diagnostic outcomes are compelling compelling reasons for market players and end-users to embrace this transformative technology.

Digital Pathology Market Company Market Share

Here is a compelling, SEO-optimized report description for the Digital Pathology Market, integrated with high-traffic keywords and structured for maximum visibility and engagement:

Gain unparalleled insights into the digital pathology market with this in-depth report. Explore the burgeoning landscape of computational pathology, AI in pathology, and whole slide imaging (WSI), crucial for disease diagnosis, drug discovery, and precision medicine. This report meticulously analyzes the global digital pathology market size, growth trends, and future outlook, offering critical intelligence for stakeholders in pharmaceuticals, biotechnology, CROs, and hospitals. Understand the transformative impact of digital pathology solutions on anatomical pathology and laboratory workflows.

Digital Pathology Market Market Dynamics & Structure

The digital pathology market is characterized by a dynamic interplay of technological innovation and evolving regulatory landscapes. Market concentration is moderate, with key players investing heavily in R&D to drive advancements in AI-powered pathology and cloud-based pathology platforms. Technological innovation drivers include the increasing demand for faster and more accurate disease diagnosis, the need for enhanced collaboration among pathologists, and the development of sophisticated image analysis software. Regulatory frameworks, such as FDA approvals for digital pathology scanners and software, are becoming more defined, providing clarity for market entry and product development. Competitive product substitutes are emerging, particularly in the realm of advanced AI algorithms that can augment or even automate certain diagnostic tasks. End-user demographics are shifting, with a growing adoption rate among pharmaceutical companies for drug development and validation, and an increasing integration into routine diagnostics in hospitals and reference laboratories. Mergers and acquisitions (M&A) are a significant trend, with larger entities acquiring innovative startups to enhance their product portfolios and market reach. For instance, the recent acquisition of a leading computational pathology startup by a major diagnostics company signifies this consolidation trend.

- Market Concentration: Moderate, with a growing number of specialized players and increasing consolidation.

- Technological Innovation Drivers: AI for diagnostics, WSI advancements, interoperability of systems, cloud integration.

- Regulatory Frameworks: Evolving but crucial for market acceptance and reimbursement, impacting digital pathology scanner and software approvals.

- Competitive Product Substitutes: Advanced AI algorithms, automated staining techniques, sophisticated laboratory information systems (LIS).

- End-User Demographics: Expanding use in drug discovery and clinical trials alongside traditional disease diagnosis.

- M&A Trends: Strategic acquisitions of AI startups and smaller technology providers by established players to bolster offerings in computational pathology.

Digital Pathology Market Growth Trends & Insights

The digital pathology market is poised for significant expansion, driven by the pervasive need for efficiency and accuracy in healthcare diagnostics. From a market size of approximately $1,500 million in 2024, the market is projected to witness robust growth propelled by increasing adoption rates of digital pathology solutions across diverse healthcare settings. Technological disruptions, such as the integration of artificial intelligence and machine learning within pathology software, are revolutionizing diagnostic capabilities. These advancements are enabling faster and more precise interpretation of whole slide images, leading to improved patient outcomes and reduced diagnostic turnaround times. Consumer behavior shifts are also playing a pivotal role, with a growing demand for personalized medicine and a greater reliance on digital tools for healthcare management. AI in pathology is moving beyond research into clinical applications, empowering pathologists with enhanced analytical tools for disease diagnosis and prognostication. The adoption of digital pathology scanners is becoming a standard practice in leading institutions, facilitating seamless workflow integration and remote consultation capabilities. Market penetration is accelerating as the cost-effectiveness of digital solutions becomes more apparent, especially when considering the long-term benefits of improved diagnostic accuracy and operational efficiency in pathology labs.

The forecast period (2025-2033) is expected to witness a compound annual growth rate (CAGR) of approximately 10-12%, driven by these multifaceted trends. The global digital pathology market is evolving from a niche technology to an indispensable component of modern healthcare infrastructure. As the technology matures and its benefits are further validated through extensive research and clinical trials, the market will continue to expand. The increasing prevalence of chronic diseases, coupled with the growing need for early detection and precise diagnosis, will further fuel the demand for advanced digital pathology services. The development of interoperable platforms and standardized protocols will facilitate broader adoption and seamless integration into existing healthcare IT ecosystems.

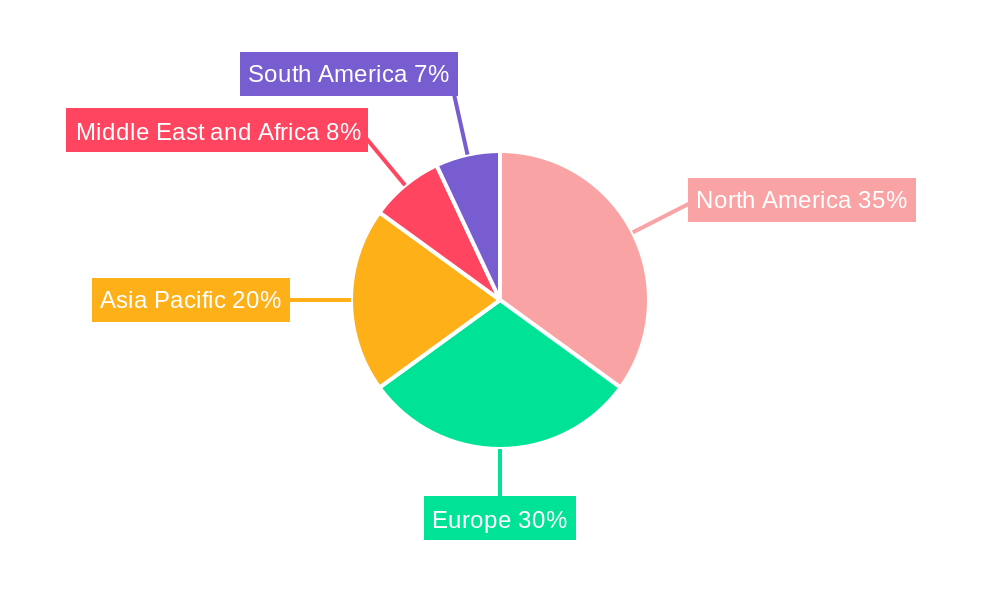

Dominant Regions, Countries, or Segments in Digital Pathology Market

The digital pathology market is witnessing significant growth across various regions and segments, with North America and Europe currently leading the charge. In the Product segment, Scanners represent a substantial market share, driven by the critical need for high-resolution whole slide imaging capabilities. Companies like Leica Biosystems, Danaher Corporation (Leica Biosystems Nussloch GmbH), and Roche (Ventana Medical Systems Inc.) are at the forefront of scanner innovation. Software is another dominant segment, with AI in pathology algorithms and image analysis software experiencing rapid advancement and adoption. Companies such as Visiopharm A/S, 3DHistech Ltd, and Proscia Inc. are key players in this domain, offering solutions for computational pathology and automated analysis. The Application segment of Disease Diagnosis is the primary growth driver, as digital pathology offers unparalleled accuracy and efficiency in identifying various pathologies. Its role in drug discovery and development is also rapidly expanding, with pharmaceutical and biotechnology companies leveraging digital tools for preclinical and clinical research.

In terms of End User, Pharmaceutical, Biotechnology, Companies and CROs are significant contributors, utilizing digital pathology for drug efficacy testing, biomarker identification, and toxicology studies. Hospitals and Reference Laboratories are increasingly adopting these technologies for routine diagnostics and improved patient care. The dominance of certain regions is influenced by factors such as favorable government initiatives for healthcare digitization, strong research and development ecosystems, and the presence of leading academic institutions and healthcare providers. For instance, the robust healthcare infrastructure and significant investment in R&D in the United States fuel the demand for advanced digital pathology solutions. Similarly, European countries are actively promoting digital health initiatives, driving the adoption of digital pathology scanners and software. The market share within these dominant regions is further amplified by strategic partnerships and collaborations aimed at accelerating the integration of digital pathology into mainstream clinical practice.

- Dominant Product Segment: Scanners, fueled by demand for high-resolution WSI.

- Leading Software Providers: Companies focusing on AI-powered analysis and computational pathology.

- Key Application Driver: Disease Diagnosis, with significant growth in Drug Discovery.

- Primary End Users: Pharmaceutical, Biotechnology, Companies and CROs; Hospitals and Reference Laboratories.

- Regional Dominance Factors: Government support, R&D investment, healthcare infrastructure.

Digital Pathology Market Product Landscape

The digital pathology market product landscape is defined by continuous innovation in digital pathology scanners, sophisticated software solutions, and robust storage systems. Advancements in scanner technology are delivering higher resolution, faster scan times, and improved automation, enabling the capture of intricate cellular details crucial for accurate disease diagnosis. Pathology software is evolving beyond simple image viewing, incorporating powerful AI in pathology algorithms for image analysis, quantitative measurements, and predictive diagnostics. These platforms facilitate seamless integration with Laboratory Information Systems (LIS) and Electronic Health Records (EHRs), enhancing workflow efficiency. Secure and scalable storage systems are essential for managing the large datasets generated by whole slide imaging. Innovations are also emerging in other products, including advanced staining techniques and robotic microscopes, further enhancing the capabilities within the digital pathology ecosystem.

Key Drivers, Barriers & Challenges in Digital Pathology Market

The digital pathology market is propelled by several key drivers. The escalating need for enhanced diagnostic accuracy and speed in disease diagnosis is paramount. Technological advancements in AI in pathology and whole slide imaging (WSI) are enabling more precise analysis and faster turnaround times. Furthermore, the growing demand for remote diagnostics and telepathology solutions, particularly amplified by recent global health events, is a significant growth accelerator. The increasing focus on personalized medicine and companion diagnostics in drug discovery also fuels the adoption of digital pathology.

- Key Drivers:

- Need for improved diagnostic accuracy and efficiency.

- Advancements in AI and WSI technology.

- Demand for telepathology and remote diagnostics.

- Growth of personalized medicine and companion diagnostics.

However, the market faces significant barriers and challenges. High initial investment costs for digital pathology scanners and infrastructure can be a deterrent for some institutions. Regulatory hurdles and the need for robust validation of AI algorithms for clinical use pose ongoing challenges. Interoperability issues between different vendor systems and the management of massive data volumes require robust IT infrastructure. Pathologist resistance to change and the need for extensive training also present adoption challenges.

- Barriers & Challenges:

- High initial capital investment.

- Complex regulatory approval processes for AI algorithms.

- Interoperability concerns between different platforms.

- Data management and security challenges.

- Pathologist training and adoption resistance.

Emerging Opportunities in Digital Pathology Market

Emerging opportunities within the digital pathology market lie in the expanding applications of AI in pathology for predictive analytics and prognostication. The growing demand for computational pathology solutions in rare disease diagnosis and infectious disease outbreak monitoring presents untapped potential. Furthermore, the integration of digital pathology data with other omics data (genomics, proteomics) offers new avenues for precision medicine and personalized treatment strategies. The development of user-friendly, cloud-based platforms catering to smaller laboratories and emerging markets also represents a significant growth area.

Growth Accelerators in the Digital Pathology Market Industry

The digital pathology market industry is experiencing sustained growth acceleration driven by key catalysts. Continued innovation in AI algorithms, leading to increasingly sophisticated diagnostic and prognostic capabilities, is a primary driver. Strategic partnerships between technology providers, diagnostic companies, and academic research institutions are fostering the development and validation of new applications. Market expansion into underserved regions, coupled with favorable reimbursement policies for digital pathology services, will further catalyze long-term growth. The increasing adoption of digital pathology in clinical trials for pharmaceutical development is also a significant accelerator.

Key Players Shaping the Digital Pathology Market Market

- Visiopharm A/S

- Danaher Corporation (Leica Biosystems Nussloch GmbH)

- 3DHistech Ltd

- Nikon Corporation

- Proscia Inc

- F Hoffmann-La Roche Ltd (Ventana Medical Systems Inc )

- XIFIN Inc

- Leica Biosystems

- Koninklijke Philips NV

- Hamamatsu Photonics K K

- Mikroscan Technologies Inc

- Olympus Corporation

- Sectra AG

Notable Milestones in Digital Pathology Market Sector

- June 2022: SpIntellx, Inc. and Inspirata have collaborated to integrate the SpIntellx HistoMapr-Breast platform and Inspirata's Dynamyx software into one seamless solution. HistoMapr-Breast is the one and only computational pathology software that taps the power of explainable artificial intelligence (xAI) for healthcare providers to diagnose, prognosticate and treat breast cancer more efficiently and accurately.

- June 2022: Roche has launched and CE-IVD marking of the next-generation Ventana DP 600 slide scanner for digital pathology.

In-Depth Digital Pathology Market Market Outlook

The future outlook for the digital pathology market is exceptionally promising, driven by the synergistic combination of technological advancements and growing healthcare demands. The continuous evolution of AI in pathology will unlock new frontiers in predictive diagnostics and therapeutic guidance, further solidifying its role in precision medicine. Strategic collaborations and market expansion into emerging economies will broaden access to these transformative technologies. The increasing integration of digital pathology solutions into routine clinical workflows, supported by favorable regulatory landscapes and reimbursement policies, will accelerate market penetration and solidify its position as an indispensable tool in modern healthcare.

Digital Pathology Market Segmentation

-

1. Product

- 1.1. Scanner

- 1.2. Software

- 1.3. Storage Systems

- 1.4. Other Products

-

2. Application

- 2.1. Disease Diagnosis

- 2.2. Drug Discovery

- 2.3. Education and Training

-

3. End User

- 3.1. Pharmaceutical, Biotechnology, Companies and CROs

- 3.2. Hospital and Reference Laboratories

- 3.3. Other End Users

Digital Pathology Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Digital Pathology Market Regional Market Share

Geographic Coverage of Digital Pathology Market

Digital Pathology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Number of Tele-consultations; Rising Adoption of Digital Pathology to Enhance Lab Efficiency; Increasing Application in Drug Discovery and Companion Diagnostics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Concerns for Primary Diagnosis; Lack of Standard Guidelines for Digital Pathology

- 3.4. Market Trends

- 3.4.1. Disease Diagnosis Segment is Expected to Hold Significant Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Pathology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Scanner

- 5.1.2. Software

- 5.1.3. Storage Systems

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Disease Diagnosis

- 5.2.2. Drug Discovery

- 5.2.3. Education and Training

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical, Biotechnology, Companies and CROs

- 5.3.2. Hospital and Reference Laboratories

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Digital Pathology Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Scanner

- 6.1.2. Software

- 6.1.3. Storage Systems

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Disease Diagnosis

- 6.2.2. Drug Discovery

- 6.2.3. Education and Training

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical, Biotechnology, Companies and CROs

- 6.3.2. Hospital and Reference Laboratories

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Digital Pathology Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Scanner

- 7.1.2. Software

- 7.1.3. Storage Systems

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Disease Diagnosis

- 7.2.2. Drug Discovery

- 7.2.3. Education and Training

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical, Biotechnology, Companies and CROs

- 7.3.2. Hospital and Reference Laboratories

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Digital Pathology Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Scanner

- 8.1.2. Software

- 8.1.3. Storage Systems

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Disease Diagnosis

- 8.2.2. Drug Discovery

- 8.2.3. Education and Training

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical, Biotechnology, Companies and CROs

- 8.3.2. Hospital and Reference Laboratories

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Digital Pathology Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Scanner

- 9.1.2. Software

- 9.1.3. Storage Systems

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Disease Diagnosis

- 9.2.2. Drug Discovery

- 9.2.3. Education and Training

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical, Biotechnology, Companies and CROs

- 9.3.2. Hospital and Reference Laboratories

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Digital Pathology Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Scanner

- 10.1.2. Software

- 10.1.3. Storage Systems

- 10.1.4. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Disease Diagnosis

- 10.2.2. Drug Discovery

- 10.2.3. Education and Training

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical, Biotechnology, Companies and CROs

- 10.3.2. Hospital and Reference Laboratories

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Visiopharm A/S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danaher Corporation (Leica Biosystems Nussloch GmbH)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 3DHistech Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nikon Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Proscia Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 F Hoffmann-La Roche Ltd (Ventana Medical Systems Inc )

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 XIFIN Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leica Biosystems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke Philips NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hamamatsu Photonics K K

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mikroscan Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Olympus Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sectra AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Visiopharm A/S

List of Figures

- Figure 1: Global Digital Pathology Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Digital Pathology Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Digital Pathology Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Digital Pathology Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Digital Pathology Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Digital Pathology Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Digital Pathology Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Digital Pathology Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Digital Pathology Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Digital Pathology Market Revenue (Million), by Product 2025 & 2033

- Figure 11: Europe Digital Pathology Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Digital Pathology Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Digital Pathology Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Digital Pathology Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Digital Pathology Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Digital Pathology Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Digital Pathology Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Digital Pathology Market Revenue (Million), by Product 2025 & 2033

- Figure 19: Asia Pacific Digital Pathology Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Digital Pathology Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Digital Pathology Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Digital Pathology Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Digital Pathology Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Digital Pathology Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Digital Pathology Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Digital Pathology Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Digital Pathology Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Digital Pathology Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Digital Pathology Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Digital Pathology Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East and Africa Digital Pathology Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Digital Pathology Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Digital Pathology Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Digital Pathology Market Revenue (Million), by Product 2025 & 2033

- Figure 35: South America Digital Pathology Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Digital Pathology Market Revenue (Million), by Application 2025 & 2033

- Figure 37: South America Digital Pathology Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Digital Pathology Market Revenue (Million), by End User 2025 & 2033

- Figure 39: South America Digital Pathology Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Digital Pathology Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Digital Pathology Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Pathology Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Digital Pathology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Digital Pathology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Digital Pathology Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Digital Pathology Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Digital Pathology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Digital Pathology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Digital Pathology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Digital Pathology Market Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Digital Pathology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Digital Pathology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Digital Pathology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Digital Pathology Market Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Digital Pathology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Digital Pathology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Digital Pathology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Digital Pathology Market Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Digital Pathology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Digital Pathology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Digital Pathology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Digital Pathology Market Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global Digital Pathology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Digital Pathology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Digital Pathology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Digital Pathology Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Pathology Market?

The projected CAGR is approximately 9.99%.

2. Which companies are prominent players in the Digital Pathology Market?

Key companies in the market include Visiopharm A/S, Danaher Corporation (Leica Biosystems Nussloch GmbH), 3DHistech Ltd, Nikon Corporation, Proscia Inc, F Hoffmann-La Roche Ltd (Ventana Medical Systems Inc ), XIFIN Inc, Leica Biosystems, Koninklijke Philips NV, Hamamatsu Photonics K K, Mikroscan Technologies Inc, Olympus Corporation, Sectra AG.

3. What are the main segments of the Digital Pathology Market?

The market segments include Product, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of Tele-consultations; Rising Adoption of Digital Pathology to Enhance Lab Efficiency; Increasing Application in Drug Discovery and Companion Diagnostics.

6. What are the notable trends driving market growth?

Disease Diagnosis Segment is Expected to Hold Significant Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Concerns for Primary Diagnosis; Lack of Standard Guidelines for Digital Pathology.

8. Can you provide examples of recent developments in the market?

June 2022: SpIntellx, Inc. and Inspirata have collaborated to integrate the SpIntellx HistoMapr-Breast platform and Inspirata's Dynamyx software into one seamless solution. HistoMapr-Breast is the one and only computational pathology software that taps the power of explainable artificial intelligence (xAI) for healthcare providers to diagnose, prognosticate and treat breast cancer more efficiently and accurately.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Pathology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Pathology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Pathology Market?

To stay informed about further developments, trends, and reports in the Digital Pathology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence