Key Insights

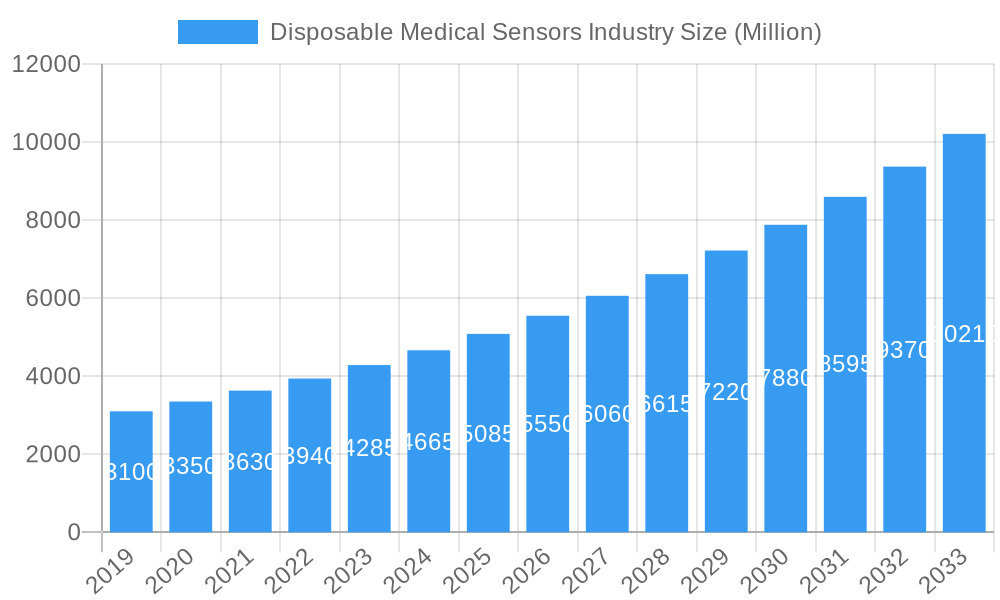

The Disposable Medical Sensors market is projected to experience robust growth, reaching an estimated

Disposable Medical Sensors Industry Market Size (In Billion)

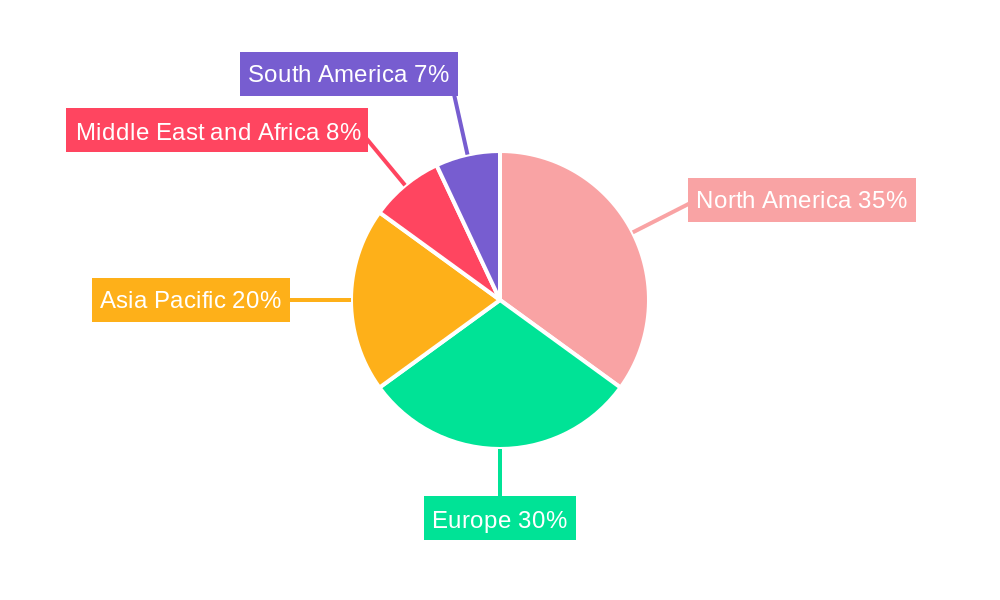

The primary application is patient monitoring, reflecting the global shift towards proactive and remote healthcare. Diagnostics represent another significant application, leveraging disposable sensors for sterile and cost-effective medical testing. Key market drivers include the growing adoption of wearable medical devices, integration of IoT in healthcare for personalized treatment, and increased disposable incomes in emerging economies, fostering preventative healthcare initiatives. However, challenges such as stringent regulatory approval processes, data security concerns, manufacturing costs for advanced sensors, and environmental disposal considerations warrant attention. Geographically, North America and Europe currently dominate the market due to well-established healthcare infrastructures. The Asia Pacific region is a rapidly growing segment, driven by its large population, increasing healthcare spending, and heightened awareness of advanced medical diagnostics. The Middle East & Africa and South America present significant untapped growth opportunities.

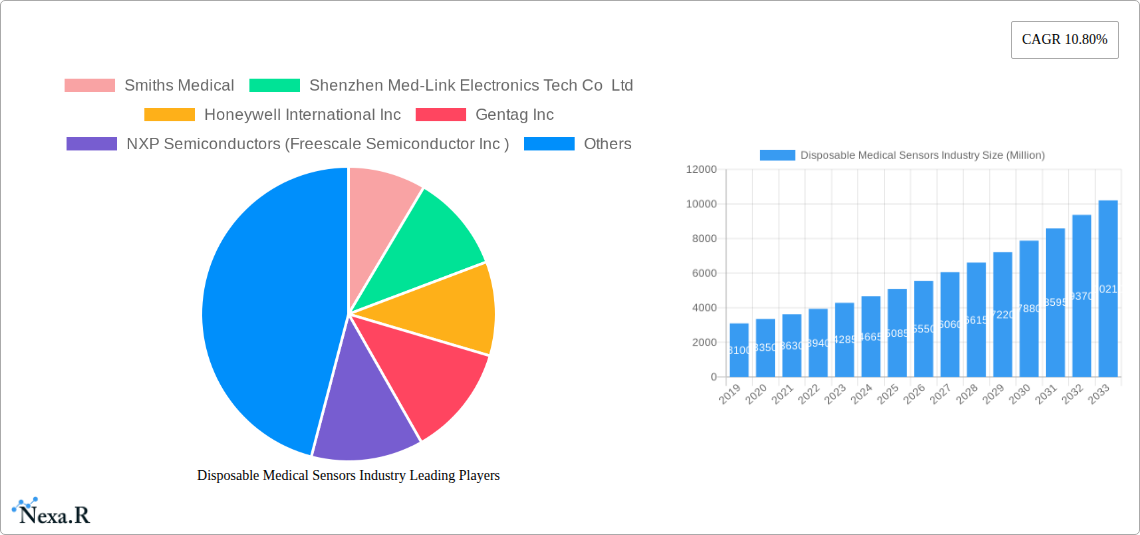

Disposable Medical Sensors Industry Company Market Share

Disposable Medical Sensors Industry Report: Market Analysis and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global disposable medical sensors market, a rapidly expanding sector driven by advancements in healthcare technology and the increasing demand for remote patient monitoring and point-of-care diagnostics. The study covers a detailed historical period from 2019 to 2024, with a base year of 2025 and a robust forecast period extending to 2033. We provide critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and the competitive environment, with all values presented in Million units. This report is an essential resource for stakeholders seeking to understand the current state and future trajectory of the disposable medical sensors industry, including wearable health sensors, biosensors for diagnostics, and temperature sensors for medical devices.

Disposable Medical Sensors Industry Market Dynamics & Structure

The disposable medical sensors market exhibits a moderate to highly fragmented structure, with a mix of large multinational corporations and specialized niche players. Innovation is a primary driver, fueled by the relentless pursuit of enhanced accuracy, miniaturization, and cost-effectiveness in sensor technology. Regulatory frameworks, particularly those from the FDA and EMA, play a crucial role in market entry and product development, ensuring patient safety and efficacy. Competitive product substitutes exist, primarily in the form of reusable sensors for certain applications, but the convenience and infection control benefits of disposables often outweigh these alternatives. End-user demographics are shifting towards an aging global population, increasing prevalence of chronic diseases, and a growing preference for home-based healthcare solutions, all of which are positively impacting demand. Mergers and acquisitions (M&A) are observed as companies seek to expand their product portfolios, gain access to new technologies, and consolidate market share. For instance, the acquisition of innovative sensor startups by larger medical device manufacturers is a recurring theme, fostering consolidation and accelerating technological integration.

- Market Concentration: Moderate to highly fragmented with key players holding significant but not dominant market shares.

- Technological Innovation Drivers: Miniaturization, wireless connectivity (IoT), AI-driven data analysis, improved biocompatibility, and cost reduction.

- Regulatory Frameworks: Strict compliance with FDA, EMA, and other regional health authority regulations impacting product approval and market access.

- Competitive Product Substitutes: Reusable sensors for specific applications, though their use is declining in favor of disposables for infection control and convenience.

- End-User Demographics: Aging population, rising chronic disease burden, increasing home healthcare adoption, and demand for personalized medicine.

- M&A Trends: Strategic acquisitions of innovative startups by established players to enhance technological capabilities and market reach.

Disposable Medical Sensors Industry Growth Trends & Insights

The disposable medical sensors market is poised for substantial growth, driven by an escalating demand for non-invasive diagnostics, continuous patient monitoring, and the burgeoning field of personalized medicine. The market size is projected to expand significantly from an estimated value of [Insert Estimated Market Size in Million Units for 2025] million units in 2025 to reach [Insert Projected Market Size in Million Units for 2033] million units by 2033, reflecting a compelling Compound Annual Growth Rate (CAGR) of [Insert Predicted CAGR]%. This robust expansion is underpinned by several key trends. Firstly, the adoption rates of wearable healthcare devices are soaring, fueled by increasing consumer awareness of health and wellness, coupled with the affordability and accessibility of these technologies. The integration of disposable sensors into these wearables allows for continuous, real-time data collection, empowering individuals and healthcare providers with actionable insights. Secondly, technological disruptions are continuously reshaping the landscape. The development of novel materials, advanced manufacturing techniques, and the integration of smart functionalities like wireless data transmission and on-chip processing are leading to more sophisticated and versatile disposable sensors. This includes breakthroughs in biosensors capable of detecting a wider array of biomarkers and image sensors with improved resolution for diagnostic applications. Thirdly, consumer behavior is shifting towards proactive health management. Individuals are increasingly seeking tools that enable them to monitor their health proactively, leading to a greater demand for at-home diagnostic solutions and continuous monitoring devices that leverage disposable sensors. The convenience, disposability, and reduced risk of infection associated with these sensors make them ideal for widespread consumer adoption. Furthermore, the growing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory illnesses necessitates continuous monitoring, creating a sustained demand for disposable sensors used in glucose monitoring, ECG, and pulse oximetry. The healthcare industry's focus on value-based care and reducing hospital readmissions also amplifies the need for effective remote patient monitoring solutions, where disposable sensors play a pivotal role. The integration of artificial intelligence (AI) and machine learning (ML) with data generated by disposable sensors is further enhancing their value proposition, enabling predictive diagnostics and personalized treatment plans.

Dominant Regions, Countries, or Segments in Disposable Medical Sensors Industry

The disposable medical sensors industry is experiencing dynamic growth across various regions and segments, with North America currently leading the market due to its advanced healthcare infrastructure, high disposable income, and strong emphasis on technological adoption in healthcare. The region’s robust research and development ecosystem, coupled with favorable reimbursement policies for innovative medical devices, significantly contributes to its dominance.

- North America (USA, Canada):

- Key Drivers: High prevalence of chronic diseases, early adoption of wearable technology and remote patient monitoring, significant R&D investment, strong presence of leading medical device manufacturers.

- Market Share: Holds a substantial portion of the global market share due to its established healthcare system and consumer readiness for advanced health solutions.

- Growth Potential: Continued growth is expected, driven by an aging population and increasing demand for home-based healthcare and personalized medicine.

While North America holds the current lead, Asia Pacific is emerging as the fastest-growing region. This surge is attributed to factors such as a large and growing population, increasing healthcare expenditure, rising awareness of preventive healthcare, and the burgeoning medical tourism sector. Government initiatives promoting digital health and increasing investments by local and international players are also fueling this rapid expansion. Countries like China and India are major contributors to this growth, driven by their vast patient populations and increasing penetration of affordable healthcare solutions.

- Asia Pacific (China, India, Japan):

- Key Drivers: Rapidly expanding middle class, increasing healthcare expenditure, government focus on improving healthcare access, growing adoption of wearable devices.

- Market Share: Experiencing the highest CAGR, poised to challenge established markets in the coming years.

- Growth Potential: Significant untapped potential due to a large patient base and increasing disposable incomes, driving demand for both advanced and cost-effective disposable sensor solutions.

The Biosensor segment, within the product category, is anticipated to be a primary growth engine. This is largely due to the increasing demand for rapid and accurate diagnostic tests, particularly in point-of-care settings and for the management of chronic diseases like diabetes (e.g., continuous glucose monitoring sensors). The development of highly sensitive biosensors for detecting a wide range of biomarkers is revolutionizing diagnostics and personalized medicine.

- Product Segment Dominance: Biosensor

- Key Drivers: Advancements in biotechnology, demand for early disease detection, rise of home-based testing, increasing applications in companion diagnostics.

- Market Share: Expected to command a significant share due to its critical role in diagnostics and disease management.

- Growth Potential: High growth potential fueled by ongoing research into new detection methods and biomarkers.

In terms of applications, Patient Monitoring is a dominant and rapidly growing segment. The shift towards remote patient monitoring, driven by the need for continuous health tracking, early intervention, and reducing healthcare costs, makes disposable sensors indispensable. Their use in wearable devices for vital sign monitoring (heart rate, SpO2, temperature) and in implantable or wearable devices for chronic disease management is expanding exponentially.

- Application Segment Dominance: Patient Monitoring

- Key Drivers: Aging population, prevalence of chronic diseases, growth of telehealth and remote patient monitoring, focus on proactive healthcare.

- Market Share: Holds the largest share due to the continuous need for vital sign tracking and management of ongoing health conditions.

- Growth Potential: Sustained high growth driven by the increasing acceptance and implementation of remote care models globally.

Disposable Medical Sensors Industry Product Landscape

The disposable medical sensors market is characterized by a diverse and evolving product landscape, with innovations focused on enhanced functionality, miniaturization, and cost-effectiveness. Biosensors are at the forefront, offering rapid and accurate detection of biological substances, critical for diagnostics and disease management. Image sensors are finding increasing application in portable diagnostic devices. Accelerometers are vital components in wearable devices for activity tracking and fall detection. Temperature sensors are ubiquitous for monitoring patient and ambient temperatures, especially in critical care and neonatal applications. The “Others” category encompasses a range of specialized sensors, including pressure sensors and electrochemical sensors, catering to niche but growing applications. Key advancements include the integration of wireless communication capabilities, improved biocompatibility for wearable and implantable applications, and the development of self-powered or energy-efficient sensors. The unique selling propositions lie in their single-use nature, minimizing infection risks, their disposable design for convenience, and their ability to provide real-time data for critical decision-making in healthcare.

Key Drivers, Barriers & Challenges in Disposable Medical Sensors Industry

The disposable medical sensors industry is propelled by several key drivers, including the escalating prevalence of chronic diseases globally, demanding continuous and accessible monitoring solutions. Technological advancements, such as miniaturization, enhanced accuracy, and the integration of IoT capabilities, are making these sensors more sophisticated and user-friendly. The growing adoption of telehealth and remote patient monitoring further amplifies demand for disposable sensors.

- Technological Drivers: Miniaturization, improved accuracy, wireless connectivity, AI integration.

- Economic Drivers: Cost-effectiveness of disposables for specific applications, increasing healthcare spending.

- Policy-Driven Factors: Government initiatives supporting digital health and remote care.

However, the market faces significant barriers and challenges. High research and development costs, coupled with stringent regulatory approvals, can slow down innovation and market entry. Supply chain disruptions, particularly for specialized raw materials, pose a risk to consistent production. Fierce competition among established players and emerging startups can lead to price pressures. Ensuring data security and privacy for the vast amounts of health data generated by these sensors is another critical concern.

- Supply Chain Issues: Raw material availability, manufacturing capacity.

- Regulatory Hurdles: Lengthy and complex approval processes.

- Competitive Pressures: Price wars, rapid product obsolescence.

- Data Security & Privacy: Protecting sensitive patient information.

Emerging Opportunities in Disposable Medical Sensors Industry

Emerging opportunities in the disposable medical sensors industry are abundant and diverse. The expansion of the Internet of Medical Things (IoMT) is creating immense potential for interconnected disposable sensors that enable seamless data flow between patients, devices, and healthcare providers. The development of smart patches with integrated disposable sensors for continuous drug delivery monitoring and wound assessment presents a significant avenue. Furthermore, the increasing demand for at-home diagnostics for a wider range of conditions, beyond diabetes, opens up new application areas. The integration of AI and machine learning with disposable sensor data is paving the way for predictive analytics, enabling early detection of health deteriorations and personalized interventions. Untapped markets in developing economies, with increasing healthcare access, also offer substantial growth prospects.

Growth Accelerators in the Disposable Medical Sensors Industry Industry

Several factors are acting as significant growth accelerators for the disposable medical sensors industry. Continued technological breakthroughs, particularly in material science and nanotechnology, are leading to the development of more sensitive, smaller, and more power-efficient sensors. Strategic partnerships between sensor manufacturers, device companies, and healthcare providers are crucial for accelerating product development and market penetration. For instance, collaborations aimed at integrating disposable sensors into existing Electronic Health Record (EHR) systems streamline data management and clinical decision-making. Market expansion strategies, including penetration into emerging economies and the development of specialized sensor solutions for rare diseases, are also key accelerators. The increasing focus on preventive healthcare and wellness, supported by government policies and growing consumer awareness, further fuels the demand for personal health monitoring devices that rely heavily on disposable sensors.

Key Players Shaping the Disposable Medical Sensors Industry Market

- Smiths Medical

- Shenzhen Med-Link Electronics Tech Co Ltd

- Honeywell International Inc

- Gentag Inc

- NXP Semiconductors (Freescale Semiconductor Inc)

- GE Healthcare

- Nuova GmbH

- Medical Sensors India Pvt Ltd

- Koninklijke Philips N V

- Sensirion AG

- Starboard Medical Inc

- Medtronic plc

Notable Milestones in Disposable Medical Sensors Industry Sector

- April 2022: Variohm EuroSensor developed a new NTC thermistor specifically for medical equipment, designed for precise sensing of small body temperature changes and ambient medical area temperatures.

- February 2022: EnSilica launched the ENS62020, an ultra-low-power healthcare sensor interface IC, enabling enhanced vital sign monitoring in wearable healthcare and medical devices.

In-Depth Disposable Medical Sensors Industry Market Outlook

The future outlook for the disposable medical sensors industry is exceptionally bright, characterized by sustained high growth driven by innovation and increasing global healthcare needs. Growth accelerators such as advancements in biosensor technology, the burgeoning IoMT ecosystem, and the expanding market for remote patient monitoring will continue to shape the industry's trajectory. Strategic alliances and collaborations will be crucial for unlocking new market opportunities and expediting the development and commercialization of next-generation disposable sensors. The increasing demand for personalized medicine and preventative healthcare solutions will further solidify the indispensable role of these sensors in modern healthcare delivery. Emerging applications in areas like advanced wound care, non-invasive drug delivery monitoring, and sophisticated diagnostic tools will unlock significant untapped market potential, ensuring a robust and dynamic future for this vital sector.

Disposable Medical Sensors Industry Segmentation

-

1. Product

- 1.1. Biosensor

- 1.2. Image Sensor

- 1.3. Accelerometer

- 1.4. Temperature Sensors

- 1.5. Others

-

2. Application

- 2.1. Patient Monitoring

- 2.2. Diagnostics

- 2.3. Therapeutics

Disposable Medical Sensors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Disposable Medical Sensors Industry Regional Market Share

Geographic Coverage of Disposable Medical Sensors Industry

Disposable Medical Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Healthcare Expenditure; Enhanced Investments by Venture Capital Firms to Develop Novel Disposable Medical Devices Sensors; Rapid Increase in Advancement an Acceptance of Sensor Technology

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Scenario; Lack of Awareness in New Diagnostics Technologies

- 3.4. Market Trends

- 3.4.1. Patient Monitoring is Expected to Show Rapid Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Disposable Medical Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Biosensor

- 5.1.2. Image Sensor

- 5.1.3. Accelerometer

- 5.1.4. Temperature Sensors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Patient Monitoring

- 5.2.2. Diagnostics

- 5.2.3. Therapeutics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Disposable Medical Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Biosensor

- 6.1.2. Image Sensor

- 6.1.3. Accelerometer

- 6.1.4. Temperature Sensors

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Patient Monitoring

- 6.2.2. Diagnostics

- 6.2.3. Therapeutics

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Disposable Medical Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Biosensor

- 7.1.2. Image Sensor

- 7.1.3. Accelerometer

- 7.1.4. Temperature Sensors

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Patient Monitoring

- 7.2.2. Diagnostics

- 7.2.3. Therapeutics

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Disposable Medical Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Biosensor

- 8.1.2. Image Sensor

- 8.1.3. Accelerometer

- 8.1.4. Temperature Sensors

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Patient Monitoring

- 8.2.2. Diagnostics

- 8.2.3. Therapeutics

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Disposable Medical Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Biosensor

- 9.1.2. Image Sensor

- 9.1.3. Accelerometer

- 9.1.4. Temperature Sensors

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Patient Monitoring

- 9.2.2. Diagnostics

- 9.2.3. Therapeutics

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Disposable Medical Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Biosensor

- 10.1.2. Image Sensor

- 10.1.3. Accelerometer

- 10.1.4. Temperature Sensors

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Patient Monitoring

- 10.2.2. Diagnostics

- 10.2.3. Therapeutics

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Smiths Medical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shenzhen Med-Link Electronics Tech Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gentag Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NXP Semiconductors (Freescale Semiconductor Inc )

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GE Healthcare

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nuova GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Medical Sensors India Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke Philips N V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sensirion AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Starboard Medical Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Medtronic plc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Smiths Medical

List of Figures

- Figure 1: Global Disposable Medical Sensors Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Disposable Medical Sensors Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Disposable Medical Sensors Industry Revenue (billion), by Product 2025 & 2033

- Figure 4: North America Disposable Medical Sensors Industry Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Disposable Medical Sensors Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Disposable Medical Sensors Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Disposable Medical Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Disposable Medical Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Disposable Medical Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Disposable Medical Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Disposable Medical Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Disposable Medical Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Disposable Medical Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Disposable Medical Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Disposable Medical Sensors Industry Revenue (billion), by Product 2025 & 2033

- Figure 16: Europe Disposable Medical Sensors Industry Volume (K Unit), by Product 2025 & 2033

- Figure 17: Europe Disposable Medical Sensors Industry Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Disposable Medical Sensors Industry Volume Share (%), by Product 2025 & 2033

- Figure 19: Europe Disposable Medical Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Disposable Medical Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Disposable Medical Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Disposable Medical Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Disposable Medical Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Disposable Medical Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Disposable Medical Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Disposable Medical Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Disposable Medical Sensors Industry Revenue (billion), by Product 2025 & 2033

- Figure 28: Asia Pacific Disposable Medical Sensors Industry Volume (K Unit), by Product 2025 & 2033

- Figure 29: Asia Pacific Disposable Medical Sensors Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Asia Pacific Disposable Medical Sensors Industry Volume Share (%), by Product 2025 & 2033

- Figure 31: Asia Pacific Disposable Medical Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Disposable Medical Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Disposable Medical Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Disposable Medical Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Disposable Medical Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Disposable Medical Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Disposable Medical Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Disposable Medical Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Disposable Medical Sensors Industry Revenue (billion), by Product 2025 & 2033

- Figure 40: Middle East and Africa Disposable Medical Sensors Industry Volume (K Unit), by Product 2025 & 2033

- Figure 41: Middle East and Africa Disposable Medical Sensors Industry Revenue Share (%), by Product 2025 & 2033

- Figure 42: Middle East and Africa Disposable Medical Sensors Industry Volume Share (%), by Product 2025 & 2033

- Figure 43: Middle East and Africa Disposable Medical Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: Middle East and Africa Disposable Medical Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Disposable Medical Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Disposable Medical Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Disposable Medical Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Disposable Medical Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Disposable Medical Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Disposable Medical Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Disposable Medical Sensors Industry Revenue (billion), by Product 2025 & 2033

- Figure 52: South America Disposable Medical Sensors Industry Volume (K Unit), by Product 2025 & 2033

- Figure 53: South America Disposable Medical Sensors Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: South America Disposable Medical Sensors Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: South America Disposable Medical Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 56: South America Disposable Medical Sensors Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Disposable Medical Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Disposable Medical Sensors Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Disposable Medical Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Disposable Medical Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Disposable Medical Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Disposable Medical Sensors Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 21: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 56: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 57: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 58: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 68: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 69: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 70: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Disposable Medical Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Disposable Medical Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Disposable Medical Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Disposable Medical Sensors Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Disposable Medical Sensors Industry?

The projected CAGR is approximately 18.54%.

2. Which companies are prominent players in the Disposable Medical Sensors Industry?

Key companies in the market include Smiths Medical, Shenzhen Med-Link Electronics Tech Co Ltd, Honeywell International Inc, Gentag Inc, NXP Semiconductors (Freescale Semiconductor Inc ), GE Healthcare, Nuova GmbH, Medical Sensors India Pvt Ltd, Koninklijke Philips N V, Sensirion AG, Starboard Medical Inc, Medtronic plc.

3. What are the main segments of the Disposable Medical Sensors Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.55 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Healthcare Expenditure; Enhanced Investments by Venture Capital Firms to Develop Novel Disposable Medical Devices Sensors; Rapid Increase in Advancement an Acceptance of Sensor Technology.

6. What are the notable trends driving market growth?

Patient Monitoring is Expected to Show Rapid Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Scenario; Lack of Awareness in New Diagnostics Technologies.

8. Can you provide examples of recent developments in the market?

In April 2022, Variohm EuroSensor has developed a new NTC thermistor especially designed for medical equipment use and particularly aimed at sensing small temperature changes in the body and ambient medical area temperatures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Disposable Medical Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Disposable Medical Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Disposable Medical Sensors Industry?

To stay informed about further developments, trends, and reports in the Disposable Medical Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence