Key Insights

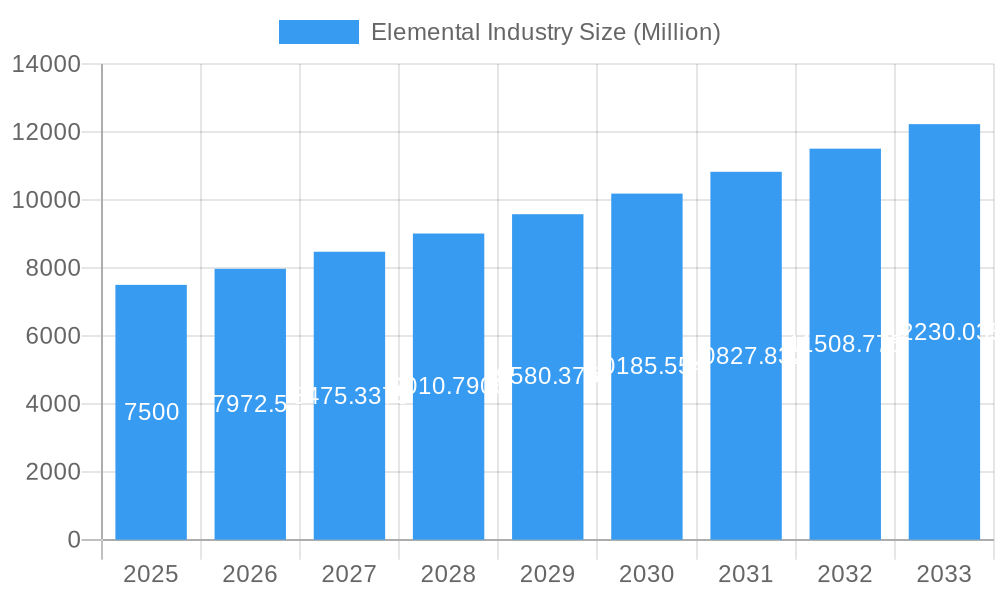

The global Elemental Analysis market is projected to experience significant expansion, reaching an estimated size of $1.93 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This growth is driven by increasing demand across key sectors, notably pharmaceuticals and biotechnology, due to stringent regulatory mandates and accelerated drug discovery efforts. Research institutions also significantly contribute, utilizing elemental analysis for cutting-edge scientific and material science advancements. Key market drivers include the continuous evolution of analytical instrumentation and the critical need for precise elemental quantification in diverse matrices, from environmental samples to biological compounds. Furthermore, advancements in both destructive and nondestructive analytical techniques are expanding application scope and enhancing analytical efficiency.

Elemental Industry Market Size (In Billion)

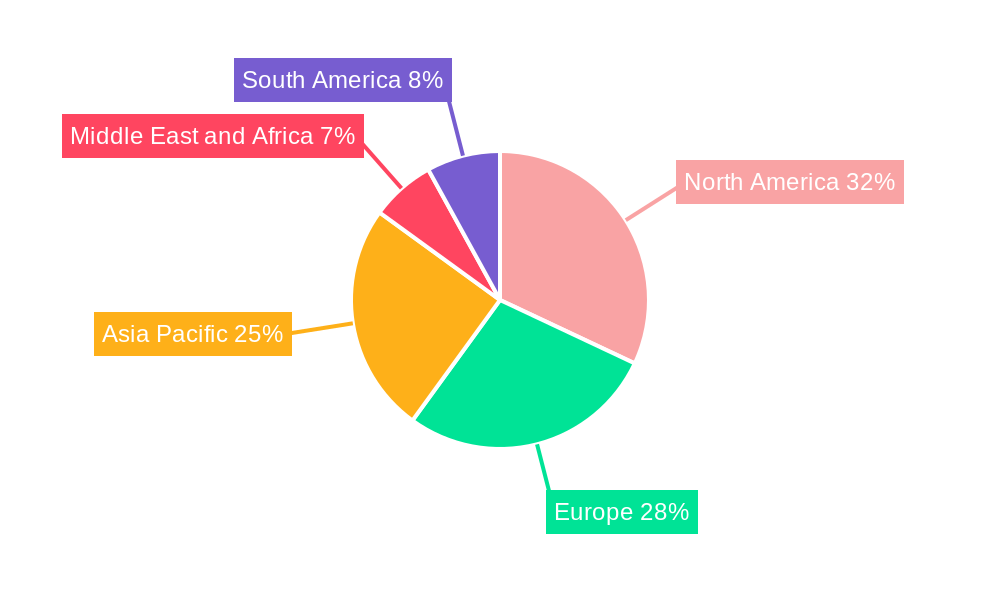

The market landscape is shaped by technological innovation and evolving end-user requirements. Destructive techniques remain crucial for comprehensive elemental profiling, while nondestructive methods like X-Ray Fluorescence (XRF) and Fourier Transform Infrared Spectroscopy (FTIR) are increasingly adopted for their speed and sample preservation capabilities. Geographically, North America and Europe are anticipated to retain substantial market shares, supported by robust research infrastructure and a strong presence of pharmaceutical and chemical industries. The Asia Pacific region, especially China, Japan, and India, is expected to exhibit the highest growth rates, fueled by escalating R&D investments, expanding industrial bases, and a heightened emphasis on quality control across sectors such as agriculture, food & beverage, and environmental monitoring. Market challenges, including high initial equipment investment and skilled workforce needs, are being mitigated by the development of more accessible and user-friendly analytical solutions.

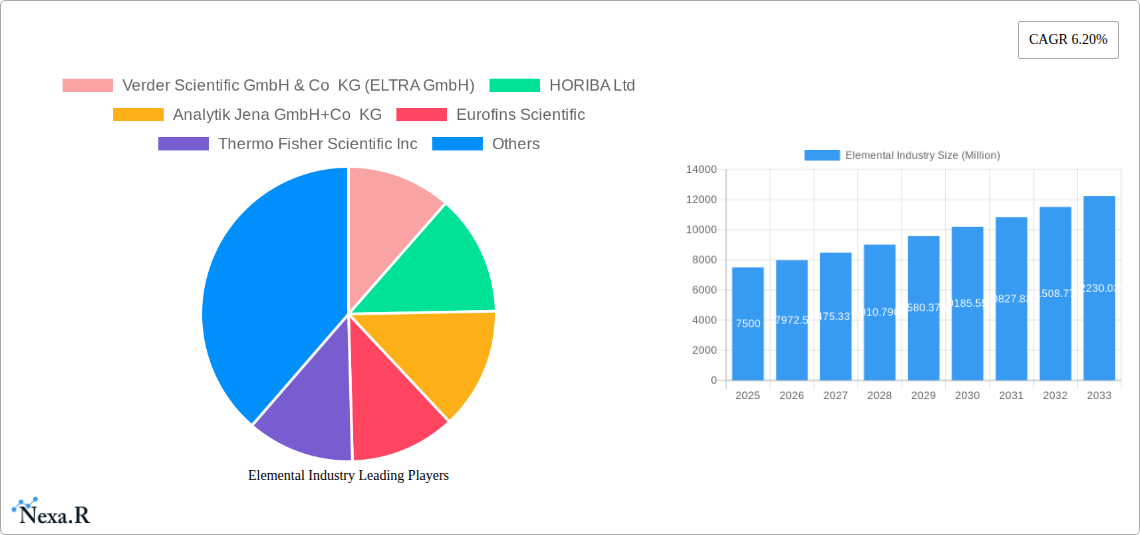

Elemental Industry Company Market Share

Elemental Industry Market Insights: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report delivers a meticulous examination of the global Elemental Industry, a critical sector supporting diverse applications from pharmaceuticals to metallurgy. Leveraging high-traffic keywords such as "elemental analysis," "XRF spectroscopy," "ICP-MS," "organic elemental analysis," and "inorganic elemental analysis," this report is optimized for maximum search engine visibility and immediate engagement with industry professionals. It provides a granular breakdown of market dynamics, growth trajectories, regional dominance, product landscapes, and key players, offering actionable intelligence for strategic decision-making. The report covers parent and child market segments to offer a holistic view of the industry's intricate structure and vast potential. All values are presented in Million units for clarity and ease of use.

Elemental Industry Market Dynamics & Structure

The Elemental Industry exhibits a moderately concentrated market structure, characterized by the significant presence of established global players alongside a growing number of specialized regional providers. Technological innovation serves as a primary driver, with continuous advancements in analytical techniques like X-Ray Fluorescence Spectroscopy (XRF) and Inductively Coupled Plasma Mass Spectrometry (ICP-MS) enhancing precision, speed, and the ability to detect lower concentrations of elements. Regulatory frameworks, particularly in sectors like pharmaceuticals and environmental monitoring, mandate rigorous elemental analysis, thus underpinning consistent demand. Competitive product substitutes exist, primarily in the form of alternative analytical methodologies, but core elemental analysis technologies offer unique advantages in specific applications. End-user demographics span a wide spectrum, from Pharmaceutical and Biotechnology Companies requiring trace element analysis for drug development and quality control, to Research Organizations pushing the boundaries of scientific discovery, and diverse industrial sectors like metal production and environmental agencies. Mergers and acquisitions (M&A) trends are moderate, with larger corporations acquiring niche technology providers to expand their portfolios and market reach.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation Drivers: Advancements in sensitivity, speed, and elemental detection limits.

- Regulatory Frameworks: Strict regulations in pharmaceuticals, environmental, and food safety sectors.

- Competitive Product Substitutes: Alternative analytical methods for specific elemental detection.

- End-User Demographics: Broad base including pharmaceuticals, biotechnology, research, and industrial manufacturing.

- M&A Trends: Strategic acquisitions to enhance product portfolios and market access.

Elemental Industry Growth Trends & Insights

The global Elemental Industry is poised for robust growth, driven by increasing demand for high-precision elemental analysis across a multitude of sectors. The market size is projected to expand significantly, fueled by escalating investments in research and development within the pharmaceutical and biotechnology industries, where elemental profiling is crucial for drug efficacy and safety. Adoption rates for advanced elemental analysis technologies are on an upward trajectory, particularly for sophisticated techniques like ICP-MS and XRF, which offer unparalleled accuracy and throughput. Technological disruptions, such as the miniaturization of analytical instruments and the integration of artificial intelligence for data interpretation, are further catalyzing market expansion. Consumer behavior shifts, including a growing emphasis on product safety and environmental sustainability, are also indirectly influencing the demand for elemental analysis to verify compliance and purity. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period.

- Market Size Evolution: Significant projected expansion due to R&D investments.

- Adoption Rates: Increasing uptake of advanced ICP-MS and XRF technologies.

- Technological Disruptions: Miniaturization, AI integration, and automation in analytical instruments.

- Consumer Behavior Shifts: Growing demand for product safety and environmental compliance verification.

- CAGR: Estimated at 6.5% for the forecast period (2025-2033).

- Market Penetration: Deepening penetration in existing markets and expansion into emerging applications.

Dominant Regions, Countries, or Segments in Elemental Industry

North America, particularly the United States, currently dominates the Elemental Industry landscape, driven by its robust pharmaceutical and biotechnology sectors, extensive research infrastructure, and stringent regulatory environment for quality control and environmental monitoring. The region's significant investment in advanced scientific instrumentation and a high concentration of leading research organizations further solidify its leadership. Within the segment landscape, Organic Elemental Analysis holds a substantial market share due to its critical role in drug discovery, chemical synthesis, and food safety testing. Pharmaceutical and Biotechnology Companies represent the largest end-user segment, consistently driving demand for precise and sensitive elemental detection capabilities.

Dominant Region: North America, led by the United States.

- Key Drivers: Strong pharmaceutical & biotechnology R&D, advanced research infrastructure, stringent regulations.

- Market Share: Approximately 35% of the global market.

- Growth Potential: Continued innovation and increasing demand for quality assurance.

Dominant Segment (Type): Organic Elemental Analysis.

- Key Drivers: Pharmaceutical drug development, chemical industry applications, food safety analysis.

- Market Share: Estimated at 55% of the Type segment.

- Growth Potential: Expansion in personalized medicine and advanced materials research.

Dominant End User: Pharmaceutical and Biotechnology Companies.

- Key Drivers: Stringent regulatory requirements, demand for drug purity and efficacy, R&D investments.

- Market Share: Constituting over 40% of the overall end-user market.

- Growth Potential: Driven by pipeline development and a focus on innovative therapeutics.

Key Technologies Driving Growth:

- Nondestructive Technologies: X-Ray Fluorescence Spectroscopy (XRF) for rapid screening and material identification.

- Destructive Technologies: Combustion Analysis for precise determination of carbon, hydrogen, nitrogen, and sulfur content.

Elemental Industry Product Landscape

The Elemental Industry product landscape is characterized by a continuous stream of innovative analytical instruments and consumables designed for enhanced performance and application versatility. Key product advancements include the development of more compact and portable elemental analyzers, enabling on-site analysis and reducing turnaround times. Innovations in X-Ray Fluorescence Spectroscopy (XRF) are leading to improved detection limits and faster scanning capabilities for a wider range of elements. In the realm of destructive analysis, advancements in combustion analyzers are focusing on greater automation and reduced sample preparation requirements. Furthermore, sophisticated ICP-MS systems continue to evolve, offering multi-elemental analysis with exceptional sensitivity and accuracy, crucial for trace element detection in complex matrices. These product innovations directly address the evolving needs of end-users seeking greater efficiency, cost-effectiveness, and higher analytical precision.

Key Drivers, Barriers & Challenges in Elemental Industry

Key Drivers:

- Technological Advancements: Continuous innovation in analytical techniques like ICP-MS and XRF, offering higher sensitivity, speed, and lower detection limits.

- Stringent Regulatory Requirements: Growing emphasis on product safety and quality control across industries like pharmaceuticals, food, and environmental monitoring drives demand for accurate elemental analysis.

- Rising R&D Investments: Increased funding in pharmaceutical, biotechnology, and materials science sectors fuels the need for advanced analytical instrumentation.

- Growing Awareness of Environmental Monitoring: Concerns about pollution and the need for accurate elemental composition analysis for environmental impact assessments.

Barriers & Challenges:

- High Initial Investment Cost: Sophisticated elemental analysis equipment can be expensive, posing a barrier for smaller organizations.

- Availability of Skilled Personnel: A shortage of trained professionals to operate and maintain advanced analytical instruments.

- Complex Sample Matrices: Analyzing elements in highly complex or corrosive samples can be challenging, requiring specialized sample preparation techniques.

- Intense Competition: A crowded market with numerous players offering similar solutions can lead to price pressures.

- Supply Chain Disruptions: Potential disruptions in the supply of critical components or raw materials for instrument manufacturing can impact production and delivery.

Emerging Opportunities in Elemental Industry

Emerging opportunities within the Elemental Industry are abundant, driven by the increasing demand for elemental analysis in novel applications and evolving scientific frontiers. The burgeoning field of personalized medicine necessitates highly precise elemental profiling of biological samples. Furthermore, the expanding use of advanced materials in electronics, aerospace, and renewable energy sectors is creating a strong demand for elemental characterization to ensure material integrity and performance. The growth of the global food industry, coupled with heightened consumer awareness regarding food safety and origin, presents a significant opportunity for elemental analysis in authenticity verification and contaminant detection. The development of field-portable elemental analyzers for on-site analysis in remote or challenging environments also represents a substantial untapped market.

Growth Accelerators in the Elemental Industry Industry

Several key factors are acting as powerful growth accelerators for the Elemental Industry. Technological breakthroughs in detector sensitivity and mass spectrometry resolution are enabling the analysis of previously undetectable trace elements, opening new avenues for research and diagnostics. Strategic partnerships between instrument manufacturers and end-user industries, such as collaborations between analytical companies and pharmaceutical giants, facilitate the co-development of tailored solutions and accelerate market adoption. The increasing focus on sustainability and circular economy principles is also driving demand for elemental analysis in recycling processes and the development of eco-friendly materials. Moreover, the expansion of elemental analysis into emerging economies, driven by industrialization and rising healthcare standards, provides a significant avenue for market growth.

Key Players Shaping the Elemental Industry Market

- Verder Scientific GmbH & Co KG (ELTRA GmbH)

- HORIBA Ltd

- Analytik Jena GmbH+Co KG

- Eurofins Scientific

- Thermo Fisher Scientific Inc

- Bruker

- Agilent Technologies Inc

- Elemental Analysis Inc

- PerkinElmer Inc

- Angstrom Advanced Inc

- Shimadzu Corporation

- Rigaku Corporation

Notable Milestones in Elemental Industry Sector

- July 2022: SPECTRO Analytical Instruments launched the SPECTROMAXx LMX10 arc/spark OES analyzer, featuring advanced calibrations, extended ranges, and improved LODs for metal analysis.

- May 2022: Analytik Jena introduced its PlasmaQuant MS series ICP-MS devices, offering efficient routine drinking water analysis with high throughput and accuracy for 21 elements.

In-Depth Elemental Industry Market Outlook

The Elemental Industry is set to experience sustained and accelerated growth, driven by a confluence of technological innovation, evolving regulatory landscapes, and expanding application horizons. The market's future potential is significantly bolstered by the increasing demand for ultra-trace element analysis in critical sectors like pharmaceuticals and environmental monitoring. Strategic opportunities lie in the development of more automated, user-friendly, and cost-effective analytical solutions that cater to a broader user base. Furthermore, the integration of AI and machine learning for data interpretation and predictive analysis promises to unlock new efficiencies and insights. The expansion of elemental analysis into emerging applications, such as in-situ monitoring for industrial processes and advanced materials characterization, will be crucial growth catalysts, ensuring the industry remains at the forefront of scientific and industrial advancement.

Elemental Industry Segmentation

-

1. Type

- 1.1. Organic Elemental Analysis

- 1.2. Inorganic Elemental Analysis

-

2. Technology

-

2.1. Destructive Technologies

- 2.1.1. Wet Digestion

- 2.1.2. Combustion Analysis

- 2.1.3. Others

-

2.2. Nondestructive Technologies

- 2.2.1. X-Ray Fluorescence Spectroscopy (XRF)

- 2.2.2. Fourier Transform Infrared Spectroscopy (FTIR)

-

2.1. Destructive Technologies

-

3. End User

- 3.1. Pharmaceutical and Biotechnology Companies

- 3.2. Research Organizations

- 3.3. Others

Elemental Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Elemental Industry Regional Market Share

Geographic Coverage of Elemental Industry

Elemental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing R&D Funding in Life Sciences; Mandating Government Regulations for Elemental Analysis of Pharmaceutical and Healthcare Products

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Personnel

- 3.4. Market Trends

- 3.4.1. Inorganic Elemental Analysis Dominate the Global Elemental Analysis Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Elemental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Organic Elemental Analysis

- 5.1.2. Inorganic Elemental Analysis

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Destructive Technologies

- 5.2.1.1. Wet Digestion

- 5.2.1.2. Combustion Analysis

- 5.2.1.3. Others

- 5.2.2. Nondestructive Technologies

- 5.2.2.1. X-Ray Fluorescence Spectroscopy (XRF)

- 5.2.2.2. Fourier Transform Infrared Spectroscopy (FTIR)

- 5.2.1. Destructive Technologies

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical and Biotechnology Companies

- 5.3.2. Research Organizations

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Elemental Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Organic Elemental Analysis

- 6.1.2. Inorganic Elemental Analysis

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Destructive Technologies

- 6.2.1.1. Wet Digestion

- 6.2.1.2. Combustion Analysis

- 6.2.1.3. Others

- 6.2.2. Nondestructive Technologies

- 6.2.2.1. X-Ray Fluorescence Spectroscopy (XRF)

- 6.2.2.2. Fourier Transform Infrared Spectroscopy (FTIR)

- 6.2.1. Destructive Technologies

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical and Biotechnology Companies

- 6.3.2. Research Organizations

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Elemental Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Organic Elemental Analysis

- 7.1.2. Inorganic Elemental Analysis

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Destructive Technologies

- 7.2.1.1. Wet Digestion

- 7.2.1.2. Combustion Analysis

- 7.2.1.3. Others

- 7.2.2. Nondestructive Technologies

- 7.2.2.1. X-Ray Fluorescence Spectroscopy (XRF)

- 7.2.2.2. Fourier Transform Infrared Spectroscopy (FTIR)

- 7.2.1. Destructive Technologies

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical and Biotechnology Companies

- 7.3.2. Research Organizations

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Elemental Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Organic Elemental Analysis

- 8.1.2. Inorganic Elemental Analysis

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Destructive Technologies

- 8.2.1.1. Wet Digestion

- 8.2.1.2. Combustion Analysis

- 8.2.1.3. Others

- 8.2.2. Nondestructive Technologies

- 8.2.2.1. X-Ray Fluorescence Spectroscopy (XRF)

- 8.2.2.2. Fourier Transform Infrared Spectroscopy (FTIR)

- 8.2.1. Destructive Technologies

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical and Biotechnology Companies

- 8.3.2. Research Organizations

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Elemental Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Organic Elemental Analysis

- 9.1.2. Inorganic Elemental Analysis

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Destructive Technologies

- 9.2.1.1. Wet Digestion

- 9.2.1.2. Combustion Analysis

- 9.2.1.3. Others

- 9.2.2. Nondestructive Technologies

- 9.2.2.1. X-Ray Fluorescence Spectroscopy (XRF)

- 9.2.2.2. Fourier Transform Infrared Spectroscopy (FTIR)

- 9.2.1. Destructive Technologies

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical and Biotechnology Companies

- 9.3.2. Research Organizations

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Elemental Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Organic Elemental Analysis

- 10.1.2. Inorganic Elemental Analysis

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Destructive Technologies

- 10.2.1.1. Wet Digestion

- 10.2.1.2. Combustion Analysis

- 10.2.1.3. Others

- 10.2.2. Nondestructive Technologies

- 10.2.2.1. X-Ray Fluorescence Spectroscopy (XRF)

- 10.2.2.2. Fourier Transform Infrared Spectroscopy (FTIR)

- 10.2.1. Destructive Technologies

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical and Biotechnology Companies

- 10.3.2. Research Organizations

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Verder Scientific GmbH & Co KG (ELTRA GmbH)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HORIBA Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Analytik Jena GmbH+Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eurofins Scientific

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bruker

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Agilent Technologies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Elemental Analysis Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PerkinElmer Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Angstrom Advanced Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shimadzu Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rigaku Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Verder Scientific GmbH & Co KG (ELTRA GmbH)

List of Figures

- Figure 1: Global Elemental Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Elemental Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Elemental Industry Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Elemental Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Elemental Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Elemental Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Elemental Industry Revenue (billion), by Technology 2025 & 2033

- Figure 8: North America Elemental Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 9: North America Elemental Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Elemental Industry Volume Share (%), by Technology 2025 & 2033

- Figure 11: North America Elemental Industry Revenue (billion), by End User 2025 & 2033

- Figure 12: North America Elemental Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Elemental Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Elemental Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Elemental Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Elemental Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Elemental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Elemental Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Elemental Industry Revenue (billion), by Type 2025 & 2033

- Figure 20: Europe Elemental Industry Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Elemental Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Elemental Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Elemental Industry Revenue (billion), by Technology 2025 & 2033

- Figure 24: Europe Elemental Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 25: Europe Elemental Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Europe Elemental Industry Volume Share (%), by Technology 2025 & 2033

- Figure 27: Europe Elemental Industry Revenue (billion), by End User 2025 & 2033

- Figure 28: Europe Elemental Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Elemental Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Elemental Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Elemental Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Elemental Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Elemental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Elemental Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Elemental Industry Revenue (billion), by Type 2025 & 2033

- Figure 36: Asia Pacific Elemental Industry Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific Elemental Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Elemental Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Elemental Industry Revenue (billion), by Technology 2025 & 2033

- Figure 40: Asia Pacific Elemental Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Asia Pacific Elemental Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Asia Pacific Elemental Industry Volume Share (%), by Technology 2025 & 2033

- Figure 43: Asia Pacific Elemental Industry Revenue (billion), by End User 2025 & 2033

- Figure 44: Asia Pacific Elemental Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Elemental Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Elemental Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Elemental Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Elemental Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Elemental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Elemental Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Elemental Industry Revenue (billion), by Type 2025 & 2033

- Figure 52: Middle East and Africa Elemental Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Middle East and Africa Elemental Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Elemental Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Elemental Industry Revenue (billion), by Technology 2025 & 2033

- Figure 56: Middle East and Africa Elemental Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 57: Middle East and Africa Elemental Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 58: Middle East and Africa Elemental Industry Volume Share (%), by Technology 2025 & 2033

- Figure 59: Middle East and Africa Elemental Industry Revenue (billion), by End User 2025 & 2033

- Figure 60: Middle East and Africa Elemental Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa Elemental Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Elemental Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Elemental Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East and Africa Elemental Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Elemental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Elemental Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Elemental Industry Revenue (billion), by Type 2025 & 2033

- Figure 68: South America Elemental Industry Volume (K Unit), by Type 2025 & 2033

- Figure 69: South America Elemental Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: South America Elemental Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: South America Elemental Industry Revenue (billion), by Technology 2025 & 2033

- Figure 72: South America Elemental Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 73: South America Elemental Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 74: South America Elemental Industry Volume Share (%), by Technology 2025 & 2033

- Figure 75: South America Elemental Industry Revenue (billion), by End User 2025 & 2033

- Figure 76: South America Elemental Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: South America Elemental Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Elemental Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Elemental Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: South America Elemental Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Elemental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Elemental Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Elemental Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Elemental Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Elemental Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Global Elemental Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 5: Global Elemental Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Elemental Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Elemental Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Elemental Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Elemental Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Elemental Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Elemental Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Global Elemental Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 13: Global Elemental Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Elemental Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Elemental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Elemental Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Elemental Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Elemental Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 25: Global Elemental Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Global Elemental Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Global Elemental Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Global Elemental Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Elemental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Elemental Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: France Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Spain Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Elemental Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Global Elemental Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 45: Global Elemental Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 46: Global Elemental Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 47: Global Elemental Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 48: Global Elemental Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Elemental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Elemental Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: China Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: India Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Australia Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Korea Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Elemental Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 64: Global Elemental Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 65: Global Elemental Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 66: Global Elemental Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 67: Global Elemental Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 68: Global Elemental Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Elemental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Elemental Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: GCC Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Elemental Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 78: Global Elemental Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 79: Global Elemental Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 80: Global Elemental Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 81: Global Elemental Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 82: Global Elemental Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 83: Global Elemental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 84: Global Elemental Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Brazil Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: Argentina Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Elemental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Elemental Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Elemental Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Elemental Industry?

Key companies in the market include Verder Scientific GmbH & Co KG (ELTRA GmbH), HORIBA Ltd, Analytik Jena GmbH+Co KG, Eurofins Scientific, Thermo Fisher Scientific Inc, Bruker, Agilent Technologies Inc, Elemental Analysis Inc, PerkinElmer Inc, Angstrom Advanced Inc, Shimadzu Corporation, Rigaku Corporation.

3. What are the main segments of the Elemental Industry?

The market segments include Type, Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing R&D Funding in Life Sciences; Mandating Government Regulations for Elemental Analysis of Pharmaceutical and Healthcare Products.

6. What are the notable trends driving market growth?

Inorganic Elemental Analysis Dominate the Global Elemental Analysis Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Personnel.

8. Can you provide examples of recent developments in the market?

In July 2022, SPECTRO Analytical Instruments launched the SPECTROMAXx LMX10 arc/spark OES analyzer for elemental analysis in metal-producing and fabricating plants and iron and non-ferrous foundries. The LMX10 has new advancements, including complete new factory calibrations, extended calibration ranges and element selections, optimized source excitation parameters, and improved limits of detection (LODs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Elemental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Elemental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Elemental Industry?

To stay informed about further developments, trends, and reports in the Elemental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence