Key Insights

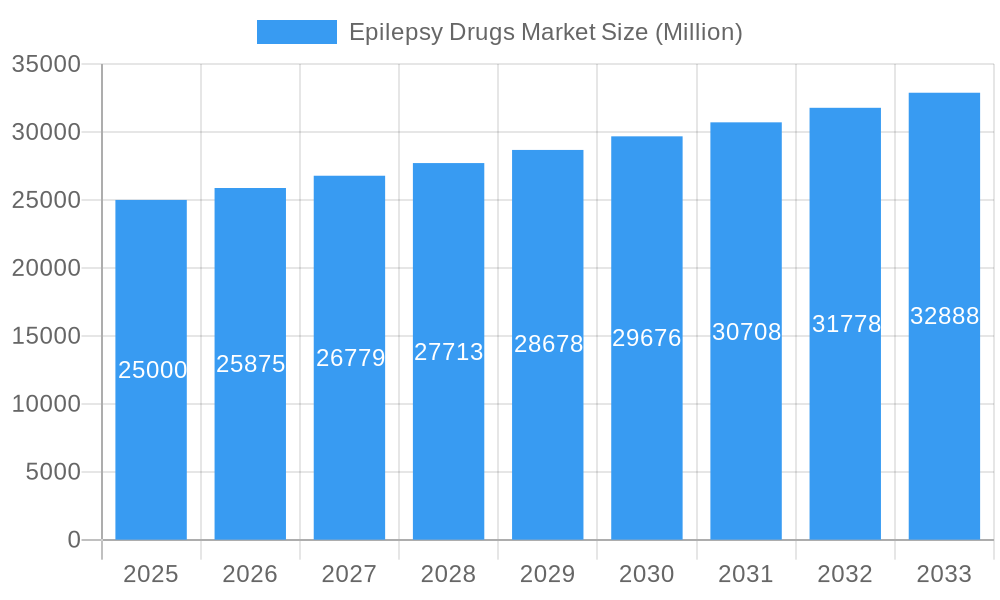

The global Epilepsy Drugs Market is poised for steady expansion, projected to reach a substantial market size of approximately USD 25,000 million by 2025 and exhibit a Compound Annual Growth Rate (CAGR) of 3.50% through 2033. This sustained growth is primarily fueled by an increasing global prevalence of epilepsy, driven by factors such as a growing and aging population, advancements in diagnostic techniques leading to earlier detection, and a rise in neurological disorders. The market's dynamic landscape is further shaped by ongoing research and development efforts leading to the introduction of novel and more effective anti-epileptic drugs (AEDs), including next-generation treatments with improved safety profiles and efficacy. Key therapeutic segments include First, Second, and Third Generation Anti-epileptics, with a growing emphasis on newer drug classes addressing specific seizure types and patient populations.

Epilepsy Drugs Market Market Size (In Billion)

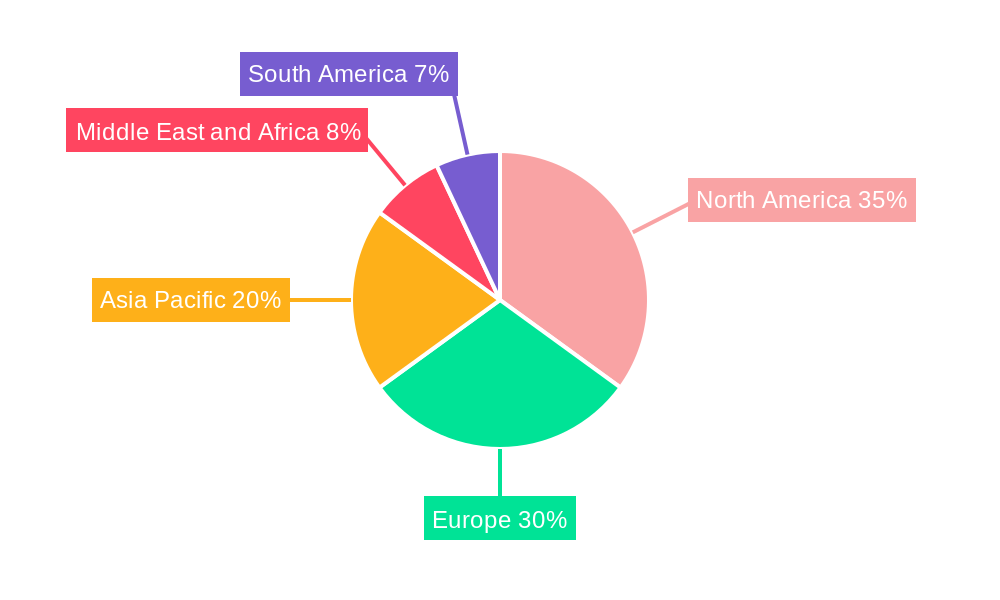

Distribution channels play a crucial role in market accessibility, with Hospital Pharmacies and Retail Pharmacies forming the backbone of drug delivery. However, the emergence of "Other Distribution Channels," potentially encompassing online pharmacies and direct-to-patient services, indicates a shift towards more convenient and diversified access points for epilepsy medications. Despite the positive growth trajectory, the market faces certain restraints, including the high cost of newer AEDs, which can limit accessibility for a significant patient segment, particularly in low- and middle-income countries. Stringent regulatory hurdles for drug approval and patent expirations for established drugs also present challenges. Geographically, North America and Europe are expected to remain dominant markets due to robust healthcare infrastructure, high disposable incomes, and early adoption of advanced therapies. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing healthcare expenditure, a large patient pool, and improving access to advanced treatments.

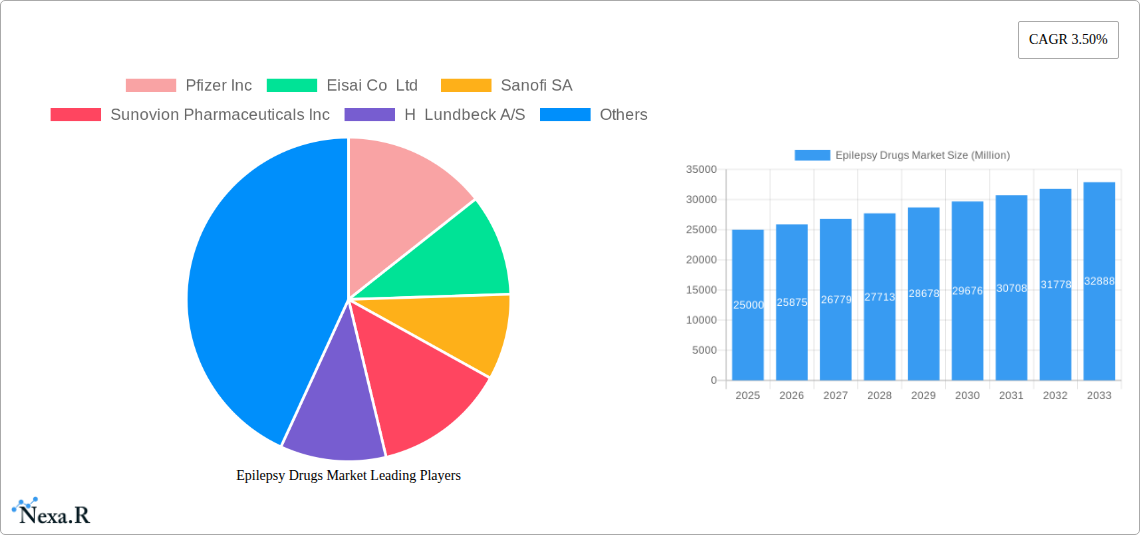

Epilepsy Drugs Market Company Market Share

This comprehensive Epilepsy Drugs Market report offers an in-depth analysis of the global market landscape, providing critical insights into market dynamics, growth trends, regional dominance, product innovations, and the competitive strategies of key players. Designed for pharmaceutical companies, healthcare providers, investors, and regulatory bodies, this report leverages extensive data and expert analysis to guide strategic decision-making in this vital therapeutic area.

Child Market: Anti-Epileptic Drugs (AEDs) Market

Parent Market: Neurology Drugs Market

Epilepsy Drugs Market Market Dynamics & Structure

The global Epilepsy Drugs Market is characterized by a moderate concentration of leading pharmaceutical giants, alongside a growing number of specialized biotechnology firms focusing on novel therapeutic approaches. Technological innovation is a primary driver, with significant investment in research and development aimed at discovering and developing next-generation anti-epileptic drugs (AEDs) with improved efficacy and reduced side effects. Regulatory frameworks, particularly stringent approvals by bodies like the FDA and EMA, play a crucial role in shaping product pipelines and market access.

- Market Concentration: Dominated by a mix of large pharmaceutical players and niche biotech companies.

- Technological Innovation: Driven by advancements in neuroscience, genetics, and drug delivery systems.

- Regulatory Frameworks: Strict approval processes influence product launches and market entry.

- Competitive Product Substitutes: The emergence of new drug classes and non-pharmacological treatments presents a competitive landscape.

- End-User Demographics: Growing prevalence of epilepsy globally and an aging population contribute to increasing demand.

- M&A Trends: Strategic acquisitions and partnerships are evident as companies seek to expand their portfolios and leverage R&D capabilities. For example, the Epilepsy Drugs Market has seen an estimated XX M&A deal volumes in the past three years, with an average deal value of USD XX million. Innovation barriers include the complex pathogenesis of epilepsy and the high failure rate in clinical trials.

Epilepsy Drugs Market Growth Trends & Insights

The Epilepsy Drugs Market is projected to witness robust growth, driven by an increasing global incidence of epilepsy, coupled with significant advancements in treatment modalities. The market size is expected to evolve from an estimated USD XX million in 2024 to reach USD XX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This expansion is fueled by higher adoption rates of newer generation AEDs, which offer improved seizure control and better tolerability profiles compared to older treatments. Technological disruptions, such as the development of precision medicine approaches tailored to specific genetic subtypes of epilepsy, are further revolutionizing treatment paradigms.

Consumer behavior shifts are also influencing market dynamics, with increasing patient awareness regarding epilepsy management and a growing preference for treatments that minimize cognitive side effects and improve quality of life. The market penetration of advanced AEDs is on an upward trajectory, as healthcare providers increasingly recognize their benefits. The estimated market size for the Epilepsy Drugs Market in the base year, 2025, is projected to be USD XX million.

Dominant Regions, Countries, or Segments in Epilepsy Drugs Market

North America, particularly the United States, currently dominates the Epilepsy Drugs Market, driven by a high prevalence of epilepsy, advanced healthcare infrastructure, significant R&D investments, and a favorable regulatory environment for new drug approvals. The region's market share in the global Epilepsy Drugs Market is estimated to be approximately XX% in 2025.

Drugs: Third Generation Anti-epileptics are emerging as the leading segment, exhibiting substantial growth potential. This dominance is attributed to their enhanced efficacy, improved safety profiles, and reduced drug-drug interactions compared to first and second-generation counterparts. The market share of Third Generation Anti-epileptics is projected to be XX% by 2025, with a CAGR of XX% during the forecast period.

- Key Drivers in North America:

- Economic Policies: Robust healthcare spending and strong pharmaceutical industry support.

- Infrastructure: Widespread access to specialized neurological care and diagnostic facilities.

- R&D Investment: Significant funding for epilepsy research and drug development.

- High Prevalence: A substantial patient population seeking advanced treatment options.

Distribution Channel: Hospital Pharmacy remains a critical channel, ensuring access to a wide range of epilepsy medications and facilitating specialized patient care. However, Retail Pharmacies are witnessing steady growth due to increasing patient convenience and the availability of generic AEDs.

Epilepsy Drugs Market Product Landscape

The Epilepsy Drugs Market product landscape is characterized by continuous innovation focused on developing novel molecular entities and improved formulations to address unmet clinical needs. Products range from well-established first-generation antiepileptics like Phenytoin and Carbamazepine to more advanced second and third-generation drugs such as Levetiracetam, Lacosamide, and Perampanel. Emerging therapeutic avenues include cannabidiol-based formulations, such as GW Pharmaceuticals' Epidiolex, approved for specific rare epilepsy syndromes, showcasing the impact of specialized product development. These innovations are driven by a deeper understanding of epilepsy pathophysiology, leading to targeted therapies with enhanced efficacy and reduced adverse effects, offering unique selling propositions in a competitive market.

Key Drivers, Barriers & Challenges in Epilepsy Drugs Market

Key Drivers:

- Rising Global Prevalence of Epilepsy: Increasing incidence rates worldwide fuel sustained demand for effective treatments.

- Advancements in Drug Discovery: Ongoing research leading to novel AEDs with improved safety and efficacy profiles.

- Growing Awareness and Diagnosis: Increased patient and physician awareness improves diagnosis rates and treatment initiation.

- Favorable Regulatory Pathways: Expedited review processes for promising epilepsy therapies.

Key Barriers & Challenges:

- High R&D Costs and Clinical Trial Failures: The significant investment and risk associated with developing new drugs.

- Complex Disease Pathogenesis: The intricate and varied mechanisms of epilepsy make drug development challenging.

- Generic Competition and Pricing Pressures: The impact of off-patent drugs on market revenue for branded medications.

- Adverse Drug Reactions and Tolerability Issues: The need for treatments with minimal side effects to improve patient adherence.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of essential medications. The estimated impact of regulatory hurdles on drug development timelines is approximately XX months.

Emerging Opportunities in Epilepsy Drugs Market

Emerging opportunities in the Epilepsy Drugs Market lie in personalized medicine approaches, leveraging genetic profiling to identify the most effective treatments for individual patients. The development of novel drug delivery systems, such as long-acting injectables and implantable devices, offers significant potential for improving patient adherence and seizure control. Furthermore, the exploration of non-pharmacological interventions, including neurostimulation techniques and digital therapeutics, presents a complementary and potentially synergistic market. Untapped markets in developing economies with a growing burden of epilepsy and limited access to advanced treatments also represent substantial growth avenues.

Growth Accelerators in the Epilepsy Drugs Market Industry

Long-term growth in the Epilepsy Drugs Market is being accelerated by significant technological breakthroughs in understanding the genetic and molecular underpinnings of epilepsy, paving the way for highly targeted therapies. Strategic partnerships between pharmaceutical giants and innovative biotechnology firms are crucial for pooling resources and expertise to expedite the development and commercialization of novel treatments. Market expansion strategies, particularly focusing on emerging economies with a high unmet need for epilepsy management, represent a key growth catalyst. The increasing focus on rare and refractory epilepsy syndromes is also driving the development of specialized therapies with significant market potential.

Key Players Shaping the Epilepsy Drugs Market Market

- Pfizer Inc

- Eisai Co Ltd

- Sanofi SA

- Sunovion Pharmaceuticals Inc

- H Lundbeck A/S

- Novartis AG

- Alkem Labs

- Takeda Pharmaceutical Company Limited

- Abbott Laboratories

- UCB S A

- Johnson & Johnson

- GW Pharmaceuticals plc

- Sun Pharmaceutical Industries Limited

- GlaxoSmithKline PLC

Notable Milestones in Epilepsy Drugs Market Sector

- March 2022: Lupin received approval from the United States Food and Drug Administration for its abbreviated new Vigabatrin application (ANDA). This is an anti-epileptic drug available as an oral solution USP (500 mg).

- March 2022: Marinus Pharmaceuticals' drug Ztalmy also received approval from the United States Food and Drug Administration for treating seizures in patients with CDKL5 deficiency, an inherited form of epilepsy.

In-Depth Epilepsy Drugs Market Market Outlook

The Epilepsy Drugs Market is poised for sustained and significant growth, driven by a confluence of scientific advancements, expanding healthcare access, and an increasing understanding of epilepsy. Future market potential will be unlocked through the continued development of precision medicines, addressing the diverse genetic and phenotypic presentations of the condition. Strategic opportunities lie in forging collaborations to accelerate the clinical development of novel therapeutic candidates and exploring innovative delivery mechanisms that enhance patient compliance and outcomes. The increasing global focus on improving the quality of life for individuals with epilepsy will continue to be a primary impetus for market expansion and innovation.

Epilepsy Drugs Market Segmentation

-

1. Drugs

- 1.1. First Generation Anti-epileptics

- 1.2. Second Generation Anti-epileptics

- 1.3. Third Generation Anti-epileptics

-

2. Distribution Channel

- 2.1. Hospital Pharmacy

- 2.2. Retail Pharmacies

- 2.3. Other Distribution Channels

Epilepsy Drugs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Epilepsy Drugs Market Regional Market Share

Geographic Coverage of Epilepsy Drugs Market

Epilepsy Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the New Drug Approvals over the Past Few Years; Increase in the Cases of Epilepsy

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated With the Drugs; Recent Patent Expiration of Major Brands

- 3.4. Market Trends

- 3.4.1. Second Generation Anti-epileptics is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Epilepsy Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 5.1.1. First Generation Anti-epileptics

- 5.1.2. Second Generation Anti-epileptics

- 5.1.3. Third Generation Anti-epileptics

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hospital Pharmacy

- 5.2.2. Retail Pharmacies

- 5.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 6. North America Epilepsy Drugs Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 6.1.1. First Generation Anti-epileptics

- 6.1.2. Second Generation Anti-epileptics

- 6.1.3. Third Generation Anti-epileptics

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hospital Pharmacy

- 6.2.2. Retail Pharmacies

- 6.2.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 7. Europe Epilepsy Drugs Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 7.1.1. First Generation Anti-epileptics

- 7.1.2. Second Generation Anti-epileptics

- 7.1.3. Third Generation Anti-epileptics

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hospital Pharmacy

- 7.2.2. Retail Pharmacies

- 7.2.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 8. Asia Pacific Epilepsy Drugs Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 8.1.1. First Generation Anti-epileptics

- 8.1.2. Second Generation Anti-epileptics

- 8.1.3. Third Generation Anti-epileptics

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hospital Pharmacy

- 8.2.2. Retail Pharmacies

- 8.2.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 9. Middle East and Africa Epilepsy Drugs Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drugs

- 9.1.1. First Generation Anti-epileptics

- 9.1.2. Second Generation Anti-epileptics

- 9.1.3. Third Generation Anti-epileptics

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hospital Pharmacy

- 9.2.2. Retail Pharmacies

- 9.2.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Drugs

- 10. South America Epilepsy Drugs Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drugs

- 10.1.1. First Generation Anti-epileptics

- 10.1.2. Second Generation Anti-epileptics

- 10.1.3. Third Generation Anti-epileptics

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hospital Pharmacy

- 10.2.2. Retail Pharmacies

- 10.2.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Drugs

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pfizer Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eisai Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sanofi SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sunovion Pharmaceuticals Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 H Lundbeck A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Novartis AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alkem Labs

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Takeda Pharmaceutical Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abbott Laboratories

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UCB S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Johnson & Johnson

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GW Pharmaceuticals plc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sun Pharmaceutical Industries Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GlaxoSmithKline PLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Pfizer Inc

List of Figures

- Figure 1: Global Epilepsy Drugs Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Epilepsy Drugs Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Epilepsy Drugs Market Revenue (Million), by Drugs 2025 & 2033

- Figure 4: North America Epilepsy Drugs Market Volume (K Unit), by Drugs 2025 & 2033

- Figure 5: North America Epilepsy Drugs Market Revenue Share (%), by Drugs 2025 & 2033

- Figure 6: North America Epilepsy Drugs Market Volume Share (%), by Drugs 2025 & 2033

- Figure 7: North America Epilepsy Drugs Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Epilepsy Drugs Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 9: North America Epilepsy Drugs Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Epilepsy Drugs Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Epilepsy Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Epilepsy Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Epilepsy Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Epilepsy Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Epilepsy Drugs Market Revenue (Million), by Drugs 2025 & 2033

- Figure 16: Europe Epilepsy Drugs Market Volume (K Unit), by Drugs 2025 & 2033

- Figure 17: Europe Epilepsy Drugs Market Revenue Share (%), by Drugs 2025 & 2033

- Figure 18: Europe Epilepsy Drugs Market Volume Share (%), by Drugs 2025 & 2033

- Figure 19: Europe Epilepsy Drugs Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: Europe Epilepsy Drugs Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 21: Europe Epilepsy Drugs Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Epilepsy Drugs Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Epilepsy Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Epilepsy Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Epilepsy Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Epilepsy Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Epilepsy Drugs Market Revenue (Million), by Drugs 2025 & 2033

- Figure 28: Asia Pacific Epilepsy Drugs Market Volume (K Unit), by Drugs 2025 & 2033

- Figure 29: Asia Pacific Epilepsy Drugs Market Revenue Share (%), by Drugs 2025 & 2033

- Figure 30: Asia Pacific Epilepsy Drugs Market Volume Share (%), by Drugs 2025 & 2033

- Figure 31: Asia Pacific Epilepsy Drugs Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Epilepsy Drugs Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Epilepsy Drugs Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Epilepsy Drugs Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Epilepsy Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Epilepsy Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Epilepsy Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Epilepsy Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Epilepsy Drugs Market Revenue (Million), by Drugs 2025 & 2033

- Figure 40: Middle East and Africa Epilepsy Drugs Market Volume (K Unit), by Drugs 2025 & 2033

- Figure 41: Middle East and Africa Epilepsy Drugs Market Revenue Share (%), by Drugs 2025 & 2033

- Figure 42: Middle East and Africa Epilepsy Drugs Market Volume Share (%), by Drugs 2025 & 2033

- Figure 43: Middle East and Africa Epilepsy Drugs Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East and Africa Epilepsy Drugs Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 45: Middle East and Africa Epilepsy Drugs Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East and Africa Epilepsy Drugs Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East and Africa Epilepsy Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Epilepsy Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Epilepsy Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Epilepsy Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Epilepsy Drugs Market Revenue (Million), by Drugs 2025 & 2033

- Figure 52: South America Epilepsy Drugs Market Volume (K Unit), by Drugs 2025 & 2033

- Figure 53: South America Epilepsy Drugs Market Revenue Share (%), by Drugs 2025 & 2033

- Figure 54: South America Epilepsy Drugs Market Volume Share (%), by Drugs 2025 & 2033

- Figure 55: South America Epilepsy Drugs Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: South America Epilepsy Drugs Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 57: South America Epilepsy Drugs Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: South America Epilepsy Drugs Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: South America Epilepsy Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Epilepsy Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Epilepsy Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Epilepsy Drugs Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Epilepsy Drugs Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 2: Global Epilepsy Drugs Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 3: Global Epilepsy Drugs Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Epilepsy Drugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Epilepsy Drugs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Epilepsy Drugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Epilepsy Drugs Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 8: Global Epilepsy Drugs Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 9: Global Epilepsy Drugs Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Epilepsy Drugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Epilepsy Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Epilepsy Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Epilepsy Drugs Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 20: Global Epilepsy Drugs Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 21: Global Epilepsy Drugs Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Epilepsy Drugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Epilepsy Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Epilepsy Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Epilepsy Drugs Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 38: Global Epilepsy Drugs Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 39: Global Epilepsy Drugs Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Epilepsy Drugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Epilepsy Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Epilepsy Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Epilepsy Drugs Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 56: Global Epilepsy Drugs Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 57: Global Epilepsy Drugs Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Epilepsy Drugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Epilepsy Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Epilepsy Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: GCC Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Epilepsy Drugs Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 68: Global Epilepsy Drugs Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 69: Global Epilepsy Drugs Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 70: Global Epilepsy Drugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 71: Global Epilepsy Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Epilepsy Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Epilepsy Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Epilepsy Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Epilepsy Drugs Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Epilepsy Drugs Market?

Key companies in the market include Pfizer Inc, Eisai Co Ltd , Sanofi SA, Sunovion Pharmaceuticals Inc, H Lundbeck A/S, Novartis AG, Alkem Labs, Takeda Pharmaceutical Company Limited, Abbott Laboratories, UCB S A, Johnson & Johnson, GW Pharmaceuticals plc, Sun Pharmaceutical Industries Limited, GlaxoSmithKline PLC.

3. What are the main segments of the Epilepsy Drugs Market?

The market segments include Drugs, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the New Drug Approvals over the Past Few Years; Increase in the Cases of Epilepsy.

6. What are the notable trends driving market growth?

Second Generation Anti-epileptics is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects Associated With the Drugs; Recent Patent Expiration of Major Brands.

8. Can you provide examples of recent developments in the market?

March 2022: Lupin received approval from the United States Food and Drug Administration for its abbreviated new Vigabatrin application (ANDA). It is an anti-epileptic drug available as an oral solution USP (500 mg).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Epilepsy Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Epilepsy Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Epilepsy Drugs Market?

To stay informed about further developments, trends, and reports in the Epilepsy Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence