Key Insights

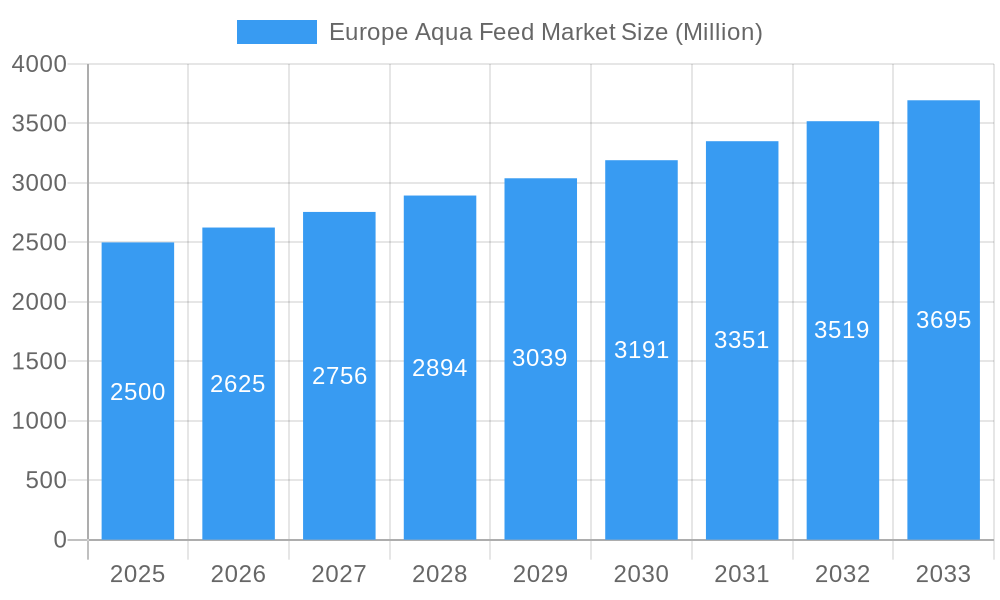

The European aquafeed market, estimated at €31230 million in the base year 2025, is poised for substantial expansion. Projections indicate a compound annual growth rate (CAGR) of 7.4% from 2025 to 2033. This growth is primarily driven by escalating consumer demand for seafood, necessitating intensified aquaculture practices. Advancements in feed formulation, emphasizing enhanced nutrition and sustainability, are crucial for increasing yields and fish health. Additionally, a growing awareness of the environmental footprint of conventional feed ingredients is accelerating the adoption of sustainable alternatives like insect-based proteins and algae, opening new market avenues. Key challenges include volatile raw material pricing, stringent regulations on feed composition and environmental impact, and disease outbreaks impacting aquaculture production. The market is segmented by fish species (crustaceans, mollusks), ingredients (cereals, fishmeal, supplements), and key geographical markets including Germany, France, Italy, and the United Kingdom.

Europe Aqua Feed Market Market Size (In Billion)

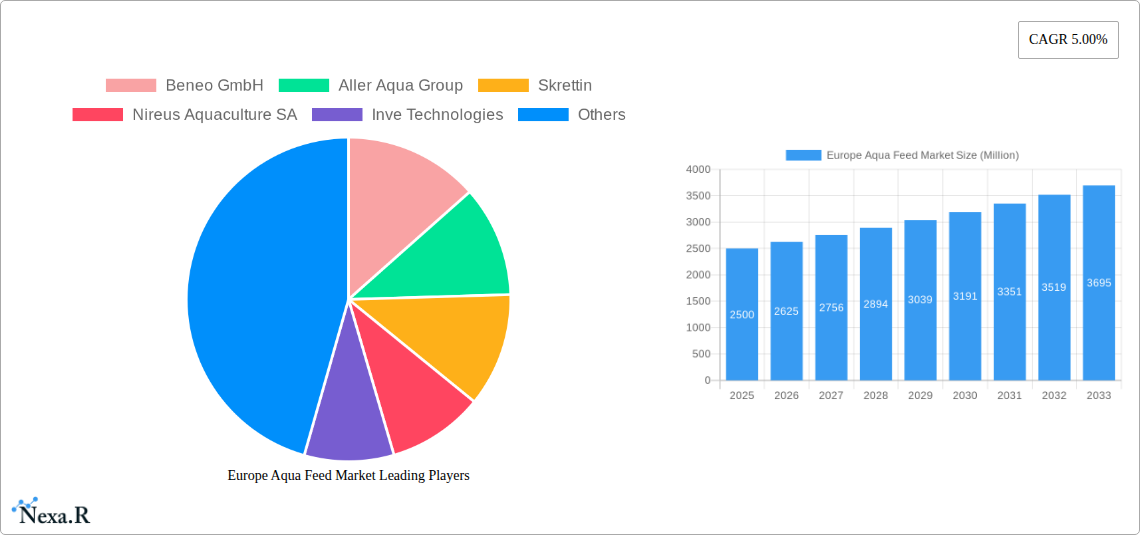

The competitive arena comprises a blend of global corporations and regional enterprises. Leading companies such as Beneo GmbH, Aller Aqua Group, Skretting, and Nutreco NV are dedicated to research and development for innovation and market penetration. Future market development will be influenced by continuous innovation in sustainable feed solutions, government initiatives supporting aquaculture sustainability, and evolving consumer preferences for responsibly sourced seafood. The forecast period anticipates sustained growth, contingent on market participants effectively managing raw material volatility and regulatory complexities to leverage market potential. Detailed analysis of specific market segments and regional dynamics will offer deeper insights into market trends and investment opportunities.

Europe Aqua Feed Market Company Market Share

Europe Aqua Feed Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Aqua Feed market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by type (Fish Feed), ingredient (Cereals, Fishmeal, Supplements, Other Ingredients), species (Other Fish Species: Crustaceans Feed, Other Crustacean: Mollusks Feed, Other Aquafeed), and country (Germany, France, Italy, Spain, United Kingdom, Norway, Rest of Europe). The market is valued in million units.

Europe Aqua Feed Market Dynamics & Structure

The European aqua feed market exhibits a moderately consolidated structure with several major players and numerous smaller regional operators. Technological innovation, driven by the need for sustainable and efficient feed solutions, is a key dynamic. Stringent regulatory frameworks concerning feed composition and environmental impact significantly influence market practices. Competitive pressures arise from substitute products like insect-based protein and single-cell protein. The end-user demographics encompass a diverse range of aquaculture farms, from small-scale operations to large-scale industrial producers. Market consolidation is also occurring via M&A activity.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on sustainable ingredients (e.g., insect meal, single-cell protein), precision feeding, and feed efficiency.

- Regulatory Framework: Stringent regulations on feed composition, antibiotics, and environmental impact.

- Competitive Substitutes: Insect-based protein, single-cell protein, and alternative protein sources.

- M&A Trends: Increasing consolidation through acquisitions and mergers to expand market reach and product portfolios (xx deals recorded in the past 5 years).

- Innovation Barriers: High R&D costs, regulatory approvals, and consumer acceptance of novel ingredients.

Europe Aqua Feed Market Growth Trends & Insights

The European aqua feed market is experiencing robust growth, driven by increasing global demand for seafood, the expansion of aquaculture production, and the adoption of intensive farming practices. Technological disruptions, such as the rise of precision feeding technologies and the incorporation of novel ingredients, are significantly influencing market dynamics. Changing consumer preferences towards sustainably sourced seafood are also impacting the market.

- Market Size Evolution: The market size increased from xx million units in 2019 to xx million units in 2024, with a projected CAGR of xx% during the forecast period.

- Adoption Rates: High adoption of innovative feed solutions amongst large-scale aquaculture producers.

- Technological Disruptions: Precision feeding technologies, novel ingredient incorporation, and automation in feed production are key disruptions.

- Consumer Behavior Shifts: Growing demand for sustainably produced seafood is driving the demand for eco-friendly aquafeed.

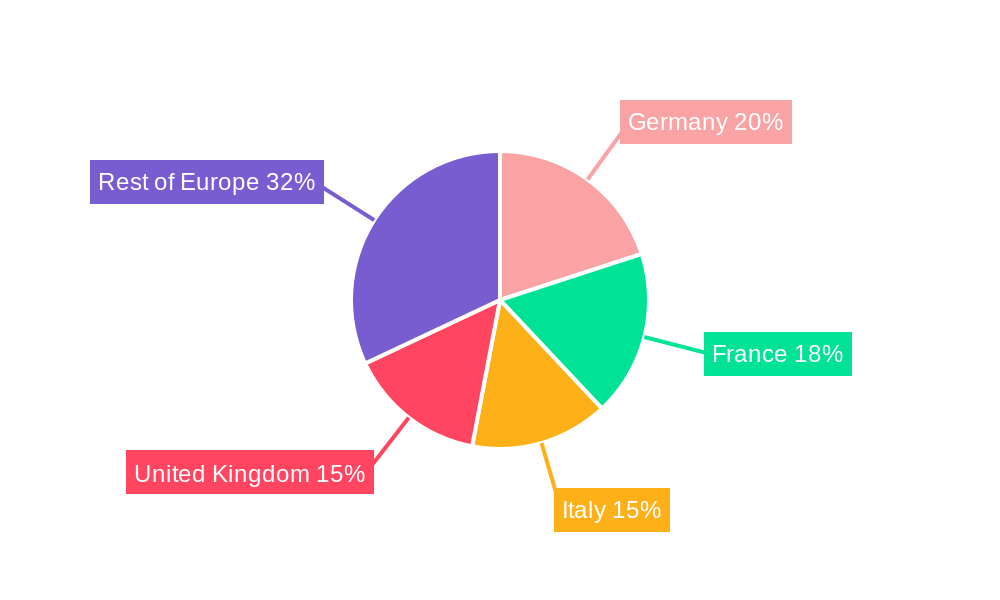

Dominant Regions, Countries, or Segments in Europe Aqua Feed Market

Norway and the United Kingdom are currently leading the European aqua feed market due to their established aquaculture industries and high per capita seafood consumption. The Fish Feed segment dominates by type, while the Fishmeal segment holds a significant share by ingredient. Within species, the demand for feeds for other fish species is relatively higher compared to other crustacean and mollusks.

- Norway: Strong aquaculture sector, particularly for salmon, high demand for high-quality feed.

- United Kingdom: Large and well-established aquaculture industry, diverse fish species.

- Germany: Growing aquaculture sector, increasing demand for sustainable feed solutions.

- Fish Feed Segment: High market share due to the dominance of finfish aquaculture.

- Fishmeal Segment: High demand for traditional protein sources, though facing sustainability concerns.

Europe Aqua Feed Market Product Landscape

The European aqua feed market offers a wide range of products catering to different species and farming practices. Innovations focus on improving feed efficiency, enhancing fish health, and reducing environmental impact. Formulations incorporate novel ingredients, such as insect meal and single-cell protein, alongside traditional components. Unique selling propositions often emphasize sustainability, traceability, and improved performance metrics like growth rate and feed conversion ratio. Technological advancements are centered around precision feeding and automation.

Key Drivers, Barriers & Challenges in Europe Aqua Feed Market

Key Drivers:

- Surging Consumer Demand for Seafood: A rising global population and increased awareness of the health benefits of fish and shellfish are significantly boosting the demand for seafood across Europe, directly fueling the need for high-quality aquafeed.

- Robust Expansion of the Aquaculture Industry: Driven by a need to supplement declining wild fish stocks and meet escalating demand, aquaculture operations in Europe are expanding their capacity and diversifying species farmed, creating a sustained demand for specialized aquafeeds.

- Technological Innovations in Feed Production: Continuous advancements in feed formulation, manufacturing processes, and ingredient sourcing are leading to more nutritious, digestible, and efficient aquafeeds, optimizing fish growth and reducing waste.

- Governmental Support for Sustainable Aquaculture: European governments are increasingly investing in and promoting sustainable aquaculture practices, including the development and adoption of eco-friendly aquafeeds, which incentivizes market growth.

Key Challenges:

- Volatility in Raw Material Prices: The aqua feed market is susceptible to price fluctuations in key raw materials like fishmeal, fish oil, and soy, impacting production costs and profitability for feed manufacturers.

- Sustainability Concerns with Traditional Ingredients: Growing environmental concerns regarding the sourcing of traditional ingredients like fishmeal and fish oil are pushing the industry towards the adoption of alternative, more sustainable protein and lipid sources.

- Stringent Regulatory Landscape: Compliance with complex and evolving European Union regulations concerning feed safety, ingredient sourcing, environmental impact, and animal welfare presents a significant hurdle for market participants.

- Intensifying Competition and Substitute Products: The market faces competition not only from other aquafeed producers but also from alternative protein sources for human consumption, necessitating a focus on differentiation and value proposition.

Emerging Opportunities in Europe Aqua Feed Market

- Demand for Sustainable and Traceable Aquafeed: Consumers and regulators are increasingly prioritizing aquafeeds that are produced sustainably, with transparent supply chains and minimal environmental impact. This presents a significant opportunity for companies offering eco-friendly and traceable feed solutions.

- Advancements in Precision Feeding Technologies: The adoption of sophisticated feeding systems that deliver the right amount of feed at the right time, tailored to specific species and growth stages, offers improved feed efficiency, reduced waste, and better fish health, driving demand for innovative feed technologies.

- Growth in Land-Based Aquaculture (RAS): Recirculating Aquaculture Systems (RAS) are gaining traction in Europe due to their environmental benefits and reduced reliance on natural water bodies. This sector requires specialized feeds that are optimized for closed-system environments.

- Development and Integration of Novel Ingredients: Research and development into alternative protein and lipid sources like insect meal, algae, and single-cell proteins (e.g., yeast, bacteria) offer promising solutions to reduce reliance on conventional ingredients and enhance the nutritional profile of aquafeeds.

Growth Accelerators in the Europe Aqua Feed Market Industry

Strategic partnerships between feed manufacturers and aquaculture producers are driving market growth by facilitating the development and adoption of innovative feed solutions. Technological breakthroughs in feed formulation and production, coupled with the expanding land-based aquaculture sector, are creating new opportunities for market expansion. Furthermore, government initiatives promoting sustainable aquaculture practices are contributing to the growth of the market.

Key Players Shaping the Europe Aqua Feed Market Market

- Beneo GmbH

- Aller Aqua Group

- Skretting

- Nireus Aquaculture SA

- Inve Technologies

- Nutreco NV

- Avanti Feeds Ltd

- Agravis Raiffeisen AG

- Alltech Inc

- Cargill Inc

- Bern Aqua NV

- Bluestar Adessio Company

- Biomar Group

Notable Milestones in Europe Aqua Feed Market Sector

- September 2021: The Conservation Fund's Freshwater Institute and Cargill joined forces to conduct research aimed at evaluating and improving aquafeeds specifically designed for the expanding land-based aquaculture industry.

- August 2022: Skretting, a global leader in aquafeed, entered into a strategic partnership with eniferBio to advance the testing and incorporation of PEKILO™ protein, a novel microbial protein, into feeds for Atlantic salmon and rainbow trout.

- November 2022: Hima Seafood, a prominent Norwegian land-based trout farm operating a Recirculating Aquaculture System (RAS), secured a significant five-year supply contract with Skretting Norway, highlighting the growing importance of RAS-specific feed solutions.

In-Depth Europe Aqua Feed Market Market Outlook

The European aqua feed market is poised for substantial growth, propelled by a convergence of favorable market dynamics. The persistent rise in aquaculture production, coupled with an ever-increasing consumer appetite for sustainably sourced and efficiently produced seafood, will serve as primary catalysts for market expansion. Furthermore, the relentless pace of technological innovation, particularly in the realms of precision feeding technologies and the integration of novel, sustainable ingredients, is set to revolutionize feed formulations and delivery systems, thereby optimizing fish health and growth. Strategic alliances and collaborative ventures between leading aquafeed manufacturers and aquaculture producers will play a pivotal role in fostering innovation, driving market penetration, and addressing complex industry challenges. The market is projected to experience robust growth, reaching an estimated [Insert Specific Market Value Here] million units by 2033, presenting a fertile ground for both established industry giants and emerging innovators to capitalize on emerging opportunities.

Europe Aqua Feed Market Segmentation

-

1. Type

-

1.1. Fish Feed

- 1.1.1. Carp

- 1.1.2. Salmon

- 1.1.3. Tilapia

- 1.1.4. Catfish

- 1.1.5. Other Fish Species

-

1.2. Crustaceans Feed

- 1.2.1. Shrimp

- 1.2.2. Other Crustacean

- 1.3. Mollusks Feed

- 1.4. Other Aquafeed

-

1.1. Fish Feed

-

2. Ingredient

- 2.1. Cereals

- 2.2. Fishmeal

- 2.3. Supplements

- 2.4. Other Ingredients

Europe Aqua Feed Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Aqua Feed Market Regional Market Share

Geographic Coverage of Europe Aqua Feed Market

Europe Aqua Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Consumption of Seafood with Rising Awareness on Thier Health Benefits

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Aqua Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fish Feed

- 5.1.1.1. Carp

- 5.1.1.2. Salmon

- 5.1.1.3. Tilapia

- 5.1.1.4. Catfish

- 5.1.1.5. Other Fish Species

- 5.1.2. Crustaceans Feed

- 5.1.2.1. Shrimp

- 5.1.2.2. Other Crustacean

- 5.1.3. Mollusks Feed

- 5.1.4. Other Aquafeed

- 5.1.1. Fish Feed

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Fishmeal

- 5.2.3. Supplements

- 5.2.4. Other Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Beneo GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aller Aqua Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Skrettin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nireus Aquaculture SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inve Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutreco NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avanti Feeds Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agravis Raiffeisen AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alltech Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cargill Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bern Aqua NV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bluestar Adessio Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Biomar Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Beneo GmbH

List of Figures

- Figure 1: Europe Aqua Feed Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Aqua Feed Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Aqua Feed Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Aqua Feed Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 3: Europe Aqua Feed Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Aqua Feed Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Europe Aqua Feed Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 6: Europe Aqua Feed Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Aqua Feed Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Aqua Feed Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Europe Aqua Feed Market?

Key companies in the market include Beneo GmbH, Aller Aqua Group, Skrettin, Nireus Aquaculture SA, Inve Technologies, Nutreco NV, Avanti Feeds Ltd, Agravis Raiffeisen AG, Alltech Inc, Cargill Inc, Bern Aqua NV, Bluestar Adessio Company, Biomar Group.

3. What are the main segments of the Europe Aqua Feed Market?

The market segments include Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 31230 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increase in Consumption of Seafood with Rising Awareness on Thier Health Benefits.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Norwegian RAS trout farmer, Hima Seafood, signed a five-year contract with Skretting Norway to be the main feed supplier for the trout production that will start up at Rjukan in Telemark in 2023

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Aqua Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Aqua Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Aqua Feed Market?

To stay informed about further developments, trends, and reports in the Europe Aqua Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence