Key Insights

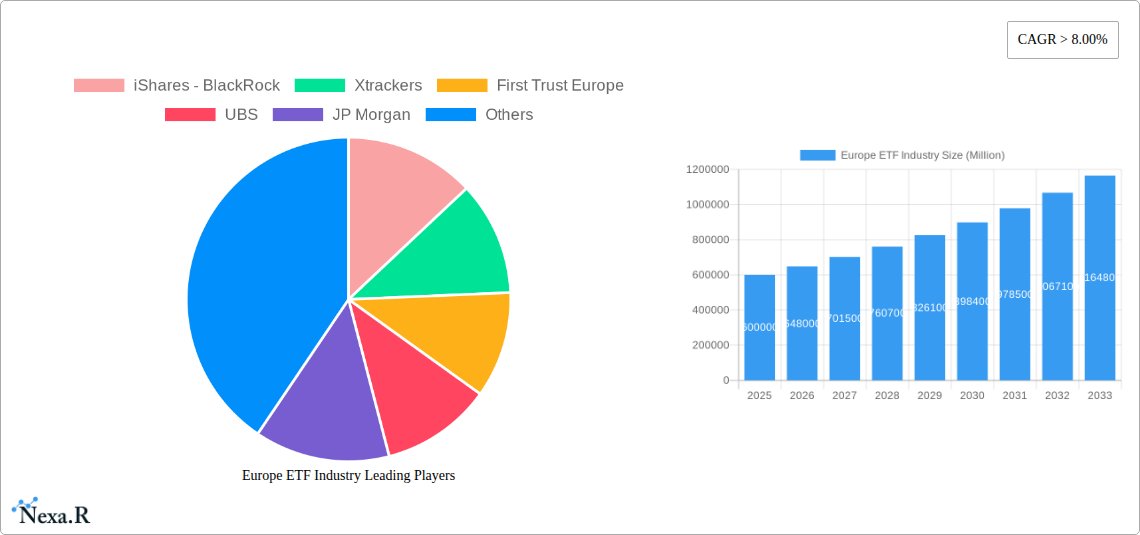

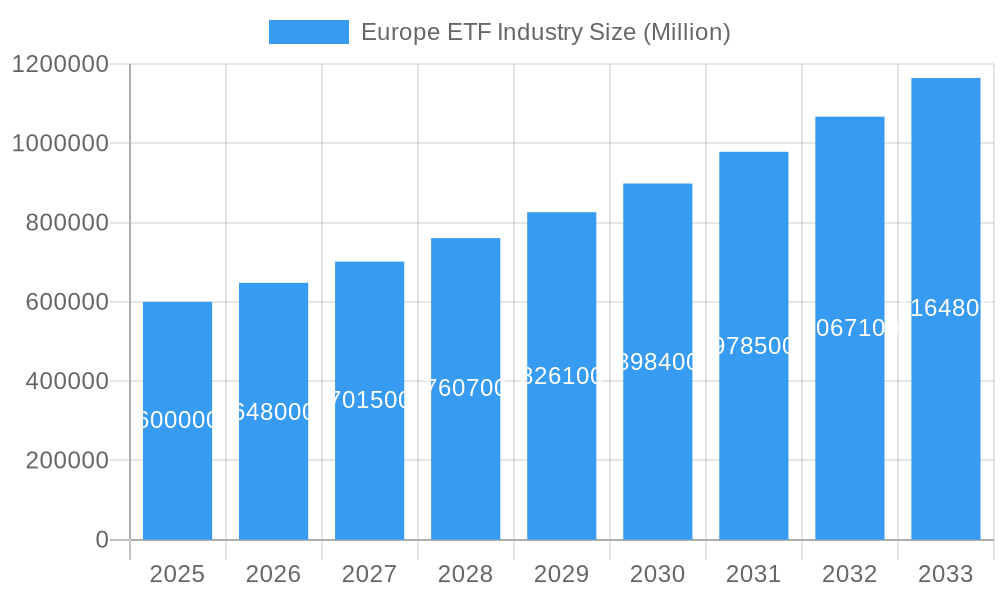

The European Exchange-Traded Fund (ETF) industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is fueled by several key drivers. Increased investor interest in diversified, low-cost investment vehicles is a primary factor. The rising popularity of passive investment strategies, alongside the growing sophistication of European investors, further contributes to this trend. Regulatory changes promoting transparency and accessibility within the European Union's financial markets are also instrumental in driving ETF adoption. Furthermore, the increasing integration of ETFs into robo-advisory platforms and the expanding product range, encompassing various asset classes and investment strategies, broaden the market appeal and attract a wider investor base. Competition among major players like iShares, Xtrackers, First Trust Europe, UBS, JP Morgan, Vanguard, Invesco, State Street, WisdomTree, and Franklin Templeton (among others) further fuels innovation and keeps management fees competitive.

Europe ETF Industry Market Size (In Billion)

The market's sustained growth is expected despite potential headwinds. Geopolitical uncertainties and macroeconomic volatility can influence investor sentiment, potentially impacting short-term growth trajectories. However, the long-term outlook remains positive, driven by the fundamental advantages of ETFs – diversification, liquidity, and cost-effectiveness. Segment analysis (while data is absent) would likely reveal strong performance in equity ETFs, fixed income ETFs, and potentially thematic ETFs aligned with sustainable investing trends. Regional variations within Europe may exist, with larger, more developed markets demonstrating higher adoption rates. The continued development of infrastructure and technology supporting ETF trading will further enhance market accessibility and drive future expansion. Estimating a starting market size in 2025 is difficult without explicit data, but based on industry reports of other ETF markets, a reasonable starting point would be around €500-700 billion (or $550-770 billion USD).

Europe ETF Industry Company Market Share

Europe ETF Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe ETF industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic market. The report leverages extensive data analysis and expert insights to deliver actionable intelligence.

Europe ETF Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends influencing the European ETF market. We examine market concentration, identifying major players and their market share, as well as exploring the impact of mergers and acquisitions (M&A) activity. The analysis also delves into the influence of technological innovation, regulatory frameworks (e.g., MiFID II), the presence of substitute products, and evolving end-user demographics.

- Market Concentration: The European ETF market is moderately concentrated, with a few dominant players holding significant market share. (Specific market share data will be provided in the report, e.g., iShares holds xx%, Xtrackers holds xx%, etc.).

- Technological Innovation: Technological advancements such as algorithmic trading, and improved data analytics are driving efficiency and innovation within the industry. The adoption of ESG (Environmental, Social, and Governance) investing is also significantly influencing product development.

- Regulatory Framework: Regulatory changes, such as those related to transparency and reporting, continue to shape the operational landscape. Compliance costs and adaptation are key considerations.

- M&A Activity: The number of M&A deals in the European ETF industry during the historical period (2019-2024) averaged xx per year, indicating moderate consolidation. (Specific numbers will be provided in the full report).

- Competitive Substitutes: Mutual funds and other investment vehicles compete with ETFs, creating competitive pressure and influencing product development. The competitive advantage of ETFs often lies in low cost and transparency.

Europe ETF Industry Growth Trends & Insights

This section provides a detailed analysis of the European ETF market's growth trajectory, examining historical data, current trends, and future projections. Key metrics such as Compound Annual Growth Rate (CAGR), market penetration rates, and adoption trends will be explored. We analyze factors driving market expansion, including technological disruptions and shifts in investor behavior. The impact of macroeconomic conditions and evolving investor preferences on market growth will also be discussed. (Specific CAGR data and penetration rates will be provided in the report).

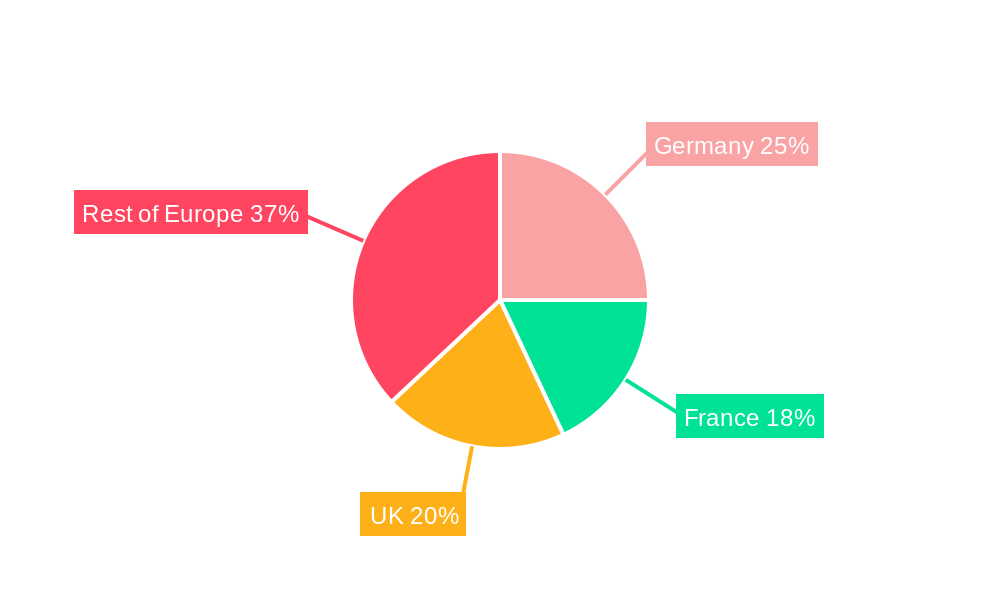

Dominant Regions, Countries, or Segments in Europe ETF Industry

This section identifies the key regions, countries, and segments within the European ETF market driving its growth. The analysis incorporates quantitative data to assess market share, growth potential, and dominant factors contributing to regional/segmental success. We delve into factors such as economic policies, infrastructure development, and investor sentiment.

- Leading Regions: (Specific regions and their contributions to market growth will be detailed in the report, with supporting data such as market size and CAGR). Examples include Germany, UK, and France.

- Key Growth Drivers: Factors like increased retail investor participation, institutional demand, and supportive regulatory environments will be explored for each dominant region.

Europe ETF Industry Product Landscape

This section examines the range of ETF products available in the European market, highlighting key features, innovations, and performance metrics. It describes the unique selling propositions and technological advancements shaping product development. This includes a discussion on the diversity of asset classes offered (e.g., equities, bonds, commodities) and investment strategies within ETFs.

Key Drivers, Barriers & Challenges in Europe ETF Industry

This section identifies the key factors driving and hindering the growth of the European ETF market. We analyze both positive and negative influences, offering insights into the market's future trajectory.

Key Drivers:

- Increasing investor awareness and demand for diversified investment options.

- Technological advancements leading to improved trading efficiencies and cost reduction.

- Supportive regulatory frameworks promoting market transparency and investor protection.

Challenges & Restraints:

- Intense competition among ETF providers.

- Volatility in global markets impacting investor sentiment and investment flows.

- Regulatory changes and compliance costs.

- Supply chain disruptions (though less directly impactful on ETF operations compared to other industries).

Emerging Opportunities in Europe ETF Industry

This section highlights emerging trends and untapped opportunities in the European ETF market. We identify potential areas for future growth and innovation, such as the rise of thematic ETFs focusing on sustainable or technological investments. The expanding adoption of ESG investing is a prominent opportunity.

Growth Accelerators in the Europe ETF Industry Industry

This section discusses long-term growth catalysts for the European ETF market. We focus on factors that will significantly contribute to its expansion in the forecast period (2025-2033). These include technological breakthroughs leading to improved data analysis, strategic partnerships broadening product reach, and expansion into new markets.

Key Players Shaping the Europe ETF Industry Market

- iShares - BlackRock

- Xtrackers

- First Trust Europe

- UBS

- JP Morgan

- Vanguard

- Invesco

- State Street

- WisdomTree

- Franklin Templeton (website link not consistently available across global sites; using list element)

Notable Milestones in Europe ETF Industry Sector

- February 2023: Vontobel launches two emerging market bond funds, signifying increased investor interest in fixed income. This reflects broader industry trends toward diversification and specialized offerings.

- February 2023: Mapfre Asset Management increases its stake in La Financière Responsable (LFR), boosting ESG capabilities and fund distribution in France. This highlights the rising importance of ESG in the ETF market and strategic acquisitions to enhance market position.

In-Depth Europe ETF Industry Market Outlook

The European ETF market is poised for continued growth throughout the forecast period (2025-2033). Technological advancements, regulatory developments, and evolving investor preferences will continue to shape market dynamics. The rise of thematic ETFs and increased adoption of ESG investing present significant opportunities. Strategic partnerships and expansion into new markets will be key for maintaining long-term growth and profitability.

Europe ETF Industry Segmentation

-

1. ETF type

- 1.1. Equity ETFs

- 1.2. Fixed Income ETFs

- 1.3. Commodity ETFs

- 1.4. Alternatives ETFs

- 1.5. Money Market ETFs

- 1.6. Mixed Assets ETFs

- 1.7. Others

Europe ETF Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe ETF Industry Regional Market Share

Geographic Coverage of Europe ETF Industry

Europe ETF Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Equity Funds occupied the Major percentage in ETF Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe ETF Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by ETF type

- 5.1.1. Equity ETFs

- 5.1.2. Fixed Income ETFs

- 5.1.3. Commodity ETFs

- 5.1.4. Alternatives ETFs

- 5.1.5. Money Market ETFs

- 5.1.6. Mixed Assets ETFs

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by ETF type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 iShares - BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xtrackers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 First Trust Europe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UBS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JP Morgan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vanguard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Invesco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 State Street

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WisdomTree

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Franklin**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 iShares - BlackRock

List of Figures

- Figure 1: Europe ETF Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe ETF Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe ETF Industry Revenue Million Forecast, by ETF type 2020 & 2033

- Table 2: Europe ETF Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe ETF Industry Revenue Million Forecast, by ETF type 2020 & 2033

- Table 4: Europe ETF Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe ETF Industry?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Europe ETF Industry?

Key companies in the market include iShares - BlackRock, Xtrackers, First Trust Europe, UBS, JP Morgan, Vanguard, Invesco, State Street, WisdomTree, Franklin**List Not Exhaustive.

3. What are the main segments of the Europe ETF Industry?

The market segments include ETF type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Equity Funds occupied the Major percentage in ETF Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Vontobel launches two emerging market bond funds in response to increased investor interest. One of the two funds (Vontobel Fund - Emerging Markets Investment Grade) aims to provide clients with access to fixed income through a lower-risk version of Vontobel's existing hard currency funds. The other fund (Vontobel Fund - Asian Bond) is Asia-focused and primarily invests in corporate bonds across the region with different maturities in various hard currencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe ETF Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe ETF Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe ETF Industry?

To stay informed about further developments, trends, and reports in the Europe ETF Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence