Key Insights

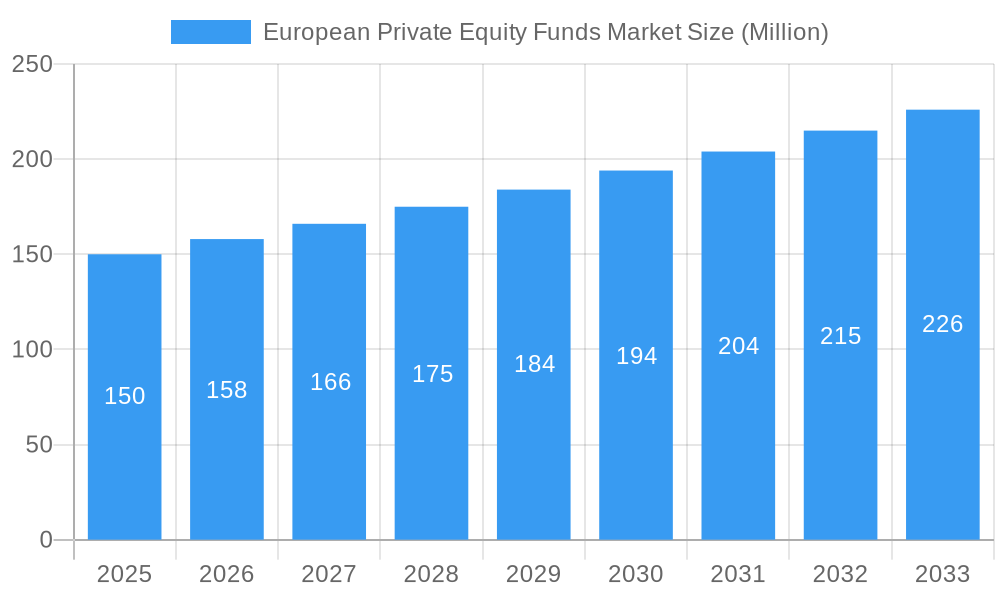

The European private equity (PE) funds market, valued at €150 million in 2025, is projected to experience robust growth, driven by several key factors. A consistently high CAGR of 5.12% over the forecast period (2025-2033) indicates a significant expansion. This growth is fueled by increased institutional investor interest, a favorable regulatory environment in many European nations encouraging PE investment, and a large pool of attractive mid-market and large-cap companies seeking capital for expansion or restructuring. The market's segmentation, encompassing various investment types (large-cap, mid-cap, small-cap) and applications (early-stage venture capital, private equity, leveraged buyouts), offers diverse opportunities for PE firms. Strong performance across multiple sectors and a rise in cross-border investments further contribute to the market's dynamism. Germany, France, the UK, and other key European markets are expected to contribute significantly to this growth, reflecting strong entrepreneurial activity and a developed financial infrastructure.

European Private Equity Funds Market Market Size (In Million)

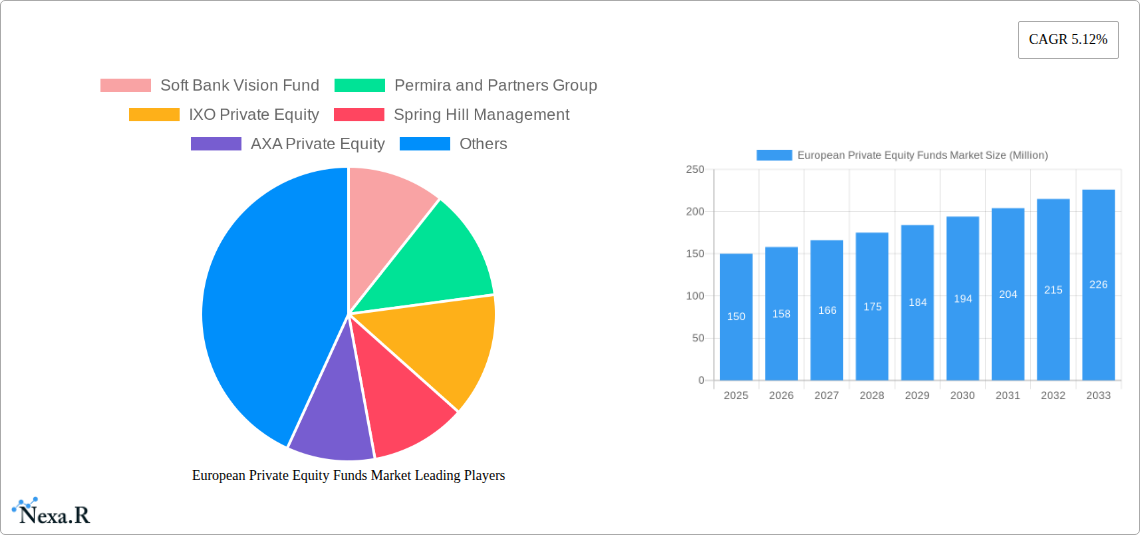

However, potential restraints exist. Economic downturns, geopolitical instability, and increased competition among PE firms for attractive deals could temper the growth rate. Furthermore, regulatory scrutiny and evolving ESG (environmental, social, and governance) considerations increasingly influence investment decisions, requiring PE firms to adapt their strategies. Despite these challenges, the long-term outlook remains positive, with continued growth expected across various market segments, driven by the increasing availability of capital and the ongoing need for private equity financing across Europe's diverse economy. Key players such as SoftBank Vision Fund, Permira, Partners Group, and others, will continue to play a significant role in shaping the market landscape.

European Private Equity Funds Market Company Market Share

European Private Equity Funds Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European Private Equity Funds Market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for investors, industry professionals, and anyone seeking to understand this dynamic market. The report utilizes both qualitative and quantitative data to provide a holistic view of the market, incorporating parent and child market segments to provide a granular understanding of the sector. The total market size in 2025 is estimated at xx Million, with a projected value of xx Million by 2033.

European Private Equity Funds Market Market Dynamics & Structure

The European Private Equity Funds market is a dynamic and evolving landscape characterized by a moderate level of concentration. While several prominent players command significant market share across various segments, the structure is also influenced by factors such as fund specialization, investment thesis, and the ability to access a robust deal pipeline. Technological innovation is a pivotal force, with advancements in data analytics, artificial intelligence (AI), and sophisticated portfolio management tools driving operational efficiencies and enhancing return potential. The regulatory environment, encompassing fund domiciliation, investor protection mandates, and reporting standards, continues to play a crucial role in shaping market activities and ensuring investor confidence. Competition from alternative asset classes, including real estate, infrastructure, and venture capital, necessitates continuous adaptation and strategic differentiation. Furthermore, the growing demographic of high-net-worth individuals and the sustained commitment from institutional investors are foundational to fueling sustained demand for private equity strategies.

- Market Concentration: While precise figures fluctuate, the top tier of European private equity firms continues to hold a substantial market share, indicating a moderately concentrated industry where established players leverage scale and expertise. (Specific percentage to be updated with latest data).

- Technological Innovation: The integration of AI and machine learning is revolutionizing the private equity lifecycle, from enhanced due diligence and predictive analytics to sophisticated portfolio monitoring and value creation strategies.

- Regulatory Framework: Navigating evolving regulatory landscapes, including those related to ESG (Environmental, Social, and Governance) compliance, cross-border fund distribution, and investor disclosures, is a critical consideration for market participants.

- M&A Activity: Mergers and acquisitions are a vital mechanism for market consolidation, strategic expansion, and accessing new capabilities within the European private equity ecosystem. (Specific transaction numbers and values to be updated with latest data).

- Competitive Substitutes: The competitive landscape is multifaceted, with investors actively evaluating private equity alongside other alternative investments like hedge funds, venture capital, and even direct investments in listed equities.

European Private Equity Funds Market Growth Trends & Insights

The European Private Equity Funds market has demonstrated robust growth over the historical period (2019-2024), buoyed by a confluence of favorable macroeconomic conditions and a pronounced surge in investor appetite for alternative investment classes seeking enhanced returns. The market experienced a notable Compound Annual Growth Rate (CAGR) during this period. Disruptive technological advancements, particularly the proliferation of fintech platforms, have significantly streamlined investment processes, democratized access to private markets, and fostered greater transparency. Shifting investor behaviors, characterized by a strategic emphasis on portfolio diversification and the pursuit of alpha generation, are continuing to act as powerful catalysts for market expansion. Consequently, the adoption rates of various private equity investment strategies are on an upward trajectory across a broad spectrum of industries. Projections for the forecast period (2025-2033) indicate a sustained and accelerated expansion, with an anticipated CAGR driven by the increasing participation of institutional capital and the burgeoning trend of thematic investing, catering to specific macro-economic or social trends. Market penetration is poised to reach new heights by 2033.

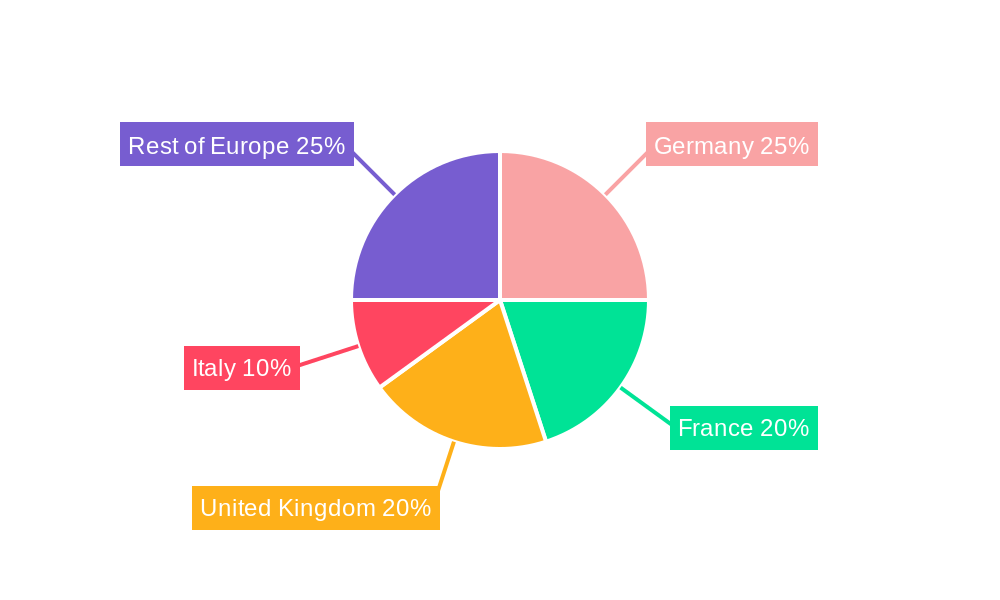

Dominant Regions, Countries, or Segments in European Private Equity Funds Market

Geographically, the United Kingdom and Germany continue to assert their dominance as the preeminent markets within Europe, contributing a substantial proportion to the overall market's growth and activity. By investment type, large-cap investments remain the most significant segment, driven by the availability of substantial target companies and the inherent pursuit of significant capital appreciation. Within the operational framework of private equity, strategies centered around Private Equity and Leveraged Buyouts constitute the most prevalent segments, underscoring the enduring appeal and efficacy of these established investment approaches among fund managers.

- Leading Regions: The UK and Germany collectively represent a dominant share of the European private equity market, benefiting from established financial ecosystems and strong deal flow. (Specific percentage to be updated).

- Investment Type: Large Cap investments continue to be a cornerstone of the market, reflecting the appetite for significant transactions and the potential for substantial returns. (Specific percentage to be updated).

- Application: Private Equity and Leveraged Buyouts are the prevailing strategies, demonstrating their continued relevance and effectiveness in value creation. (Specific percentage to be updated).

- Key Drivers: Robust economic fundamentals, conducive government policies, a mature financial infrastructure, and a deep pool of investment talent are critical contributors to the strength of these dominant regions.

European Private Equity Funds Market Product Landscape

The European private equity funds market offers a diverse range of products catering to various investor preferences and risk appetites. Funds are structured across different investment strategies, including buyouts, growth equity, and venture capital. Performance metrics, such as IRR and multiple of invested capital (MOIC), are key indicators used to evaluate the success of investments. Technological advancements, such as the use of AI-driven due diligence tools, are enhancing investment processes and improving risk management. Unique selling propositions include specialized industry expertise, global networks, and tailored investment solutions.

Key Drivers, Barriers & Challenges in European Private Equity Funds Market

Key Drivers: The European Private Equity Funds market is propelled by a supportive regulatory environment that fosters investment, coupled with an ever-increasing participation from institutional investors seeking diversification and attractive risk-adjusted returns. Technological advancements are enhancing efficiency in deal sourcing, due diligence, and portfolio management. Furthermore, a growing ecosystem of high-growth companies provides fertile ground for investment and value creation.

Key Barriers & Challenges: Economic downturns and geopolitical instability present significant headwinds, introducing uncertainty and impacting portfolio company performance. Regulatory shifts and the potential for increased scrutiny can create compliance challenges and affect deal execution timelines. Intense competition among private equity firms can lead to valuation pressures and impact fundraising efforts. Moreover, supply chain disruptions can negatively affect the operational resilience and profitability of portfolio companies, demanding proactive risk management strategies.

Emerging Opportunities in European Private Equity Funds Market

The European Private Equity Funds market is ripe with emerging opportunities, particularly in the realm of sustainable and impact investing, aligning capital with positive environmental and social outcomes. The technology sector continues to be a significant growth engine, with ongoing innovation creating new investment avenues. Expansion into previously underserved or emerging markets within Europe also presents considerable potential. The innovative application of technology in private equity operations, from AI-driven analytics to blockchain for fund administration, is creating new efficiencies and competitive advantages. Furthermore, the increasing global preference for ESG-aligned investments is opening up new strategies and attracting a broader base of investors committed to responsible business practices and sustainable value creation.

Growth Accelerators in the European Private Equity Funds Market Industry

Several factors are poised to accelerate growth, including technological breakthroughs in areas such as AI-powered due diligence, strategic partnerships between private equity firms and technology companies, and the expansion of private equity activities into new geographic markets and sectors. The increasing sophistication of data analytics and the development of new investment strategies tailored to specific market trends are also expected to fuel growth.

Key Players Shaping the European Private Equity Funds Market Market

- SoftBank Vision Fund

- Permira

- Partners Group

- IXO Private Equity

- Spring Hill Management

- AXA Private Equity

- Oakley Capital

- Heartland

- CVC Capital Partners

- Accent Equity Partners

- Other Key Players (List Not Exhaustive)

- Apax Partners

Notable Milestones in European Private Equity Funds Market Sector

- February 2023: Oakley Capital raises a record Euro 2.85 Billion (USD 3.13 Billion) for its fifth flagship fund.

- February 2023: Apax seeks to acquire up to a 40% stake in a company valued at USD 2.1 billion.

In-Depth European Private Equity Funds Market Market Outlook

The European Private Equity Funds market is poised for robust growth in the coming years, driven by a confluence of factors, including favorable economic conditions, increasing investor interest in alternative asset classes, and technological advancements that are transforming investment strategies and operations. Strategic opportunities exist for firms that can effectively leverage technology to improve efficiency, identify attractive investment opportunities, and manage risk effectively. The market's future growth trajectory is strongly linked to macroeconomic trends, regulatory changes, and the continued evolution of investor preferences.

European Private Equity Funds Market Segmentation

-

1. Investment Type

- 1.1. Large Cap

- 1.2. Mid Cap

- 1.3. Small Cap

-

2. Application

- 2.1. Early Stage Venture Capital Investment

- 2.2. Private Equity

- 2.3. Leverage Buyout

European Private Equity Funds Market Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. Switzerland

- 5. United Kingdom

- 6. Rest of Europe

European Private Equity Funds Market Regional Market Share

Geographic Coverage of European Private Equity Funds Market

European Private Equity Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Family Owned Companies Witnessing Majority Shareholding in Private Equity Industry of Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 5.1.1. Large Cap

- 5.1.2. Mid Cap

- 5.1.3. Small Cap

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Early Stage Venture Capital Investment

- 5.2.2. Private Equity

- 5.2.3. Leverage Buyout

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Switzerland

- 5.3.5. United Kingdom

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 6. Italy European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 6.1.1. Large Cap

- 6.1.2. Mid Cap

- 6.1.3. Small Cap

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Early Stage Venture Capital Investment

- 6.2.2. Private Equity

- 6.2.3. Leverage Buyout

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 7. Germany European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 7.1.1. Large Cap

- 7.1.2. Mid Cap

- 7.1.3. Small Cap

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Early Stage Venture Capital Investment

- 7.2.2. Private Equity

- 7.2.3. Leverage Buyout

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 8. France European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 8.1.1. Large Cap

- 8.1.2. Mid Cap

- 8.1.3. Small Cap

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Early Stage Venture Capital Investment

- 8.2.2. Private Equity

- 8.2.3. Leverage Buyout

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 9. Switzerland European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 9.1.1. Large Cap

- 9.1.2. Mid Cap

- 9.1.3. Small Cap

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Early Stage Venture Capital Investment

- 9.2.2. Private Equity

- 9.2.3. Leverage Buyout

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 10. United Kingdom European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 10.1.1. Large Cap

- 10.1.2. Mid Cap

- 10.1.3. Small Cap

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Early Stage Venture Capital Investment

- 10.2.2. Private Equity

- 10.2.3. Leverage Buyout

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 11. Rest of Europe European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Investment Type

- 11.1.1. Large Cap

- 11.1.2. Mid Cap

- 11.1.3. Small Cap

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Early Stage Venture Capital Investment

- 11.2.2. Private Equity

- 11.2.3. Leverage Buyout

- 11.1. Market Analysis, Insights and Forecast - by Investment Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Soft Bank Vision Fund

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Permira and Partners Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IXO Private Equity

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Spring Hill Management

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA Private Equity

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Oakley Capital

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Heartland

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CVC Capital Partners

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Accent Equity Partners*

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Other Key Players*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Apax Partners

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Soft Bank Vision Fund

List of Figures

- Figure 1: European Private Equity Funds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Private Equity Funds Market Share (%) by Company 2025

List of Tables

- Table 1: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 2: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: European Private Equity Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 5: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 8: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 11: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 14: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 17: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 20: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Private Equity Funds Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the European Private Equity Funds Market?

Key companies in the market include Soft Bank Vision Fund, Permira and Partners Group, IXO Private Equity, Spring Hill Management, AXA Private Equity, Oakley Capital, Heartland, CVC Capital Partners, Accent Equity Partners*, Other Key Players*List Not Exhaustive, Apax Partners.

3. What are the main segments of the European Private Equity Funds Market?

The market segments include Investment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Family Owned Companies Witnessing Majority Shareholding in Private Equity Industry of Europe.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

In February 2023, Oakley Capital raises a record Euro 2.85 Billion (USD 3.13 Billion) for its fifth flagship fund. Oakley will continue to invest behind the long-term megatrends that have underpinned growth and returns across economic cycles, including the consumer shift to online, business migration to the Cloud, and the growing global demand for quality, accessible education.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Private Equity Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Private Equity Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Private Equity Funds Market?

To stay informed about further developments, trends, and reports in the European Private Equity Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence