Key Insights

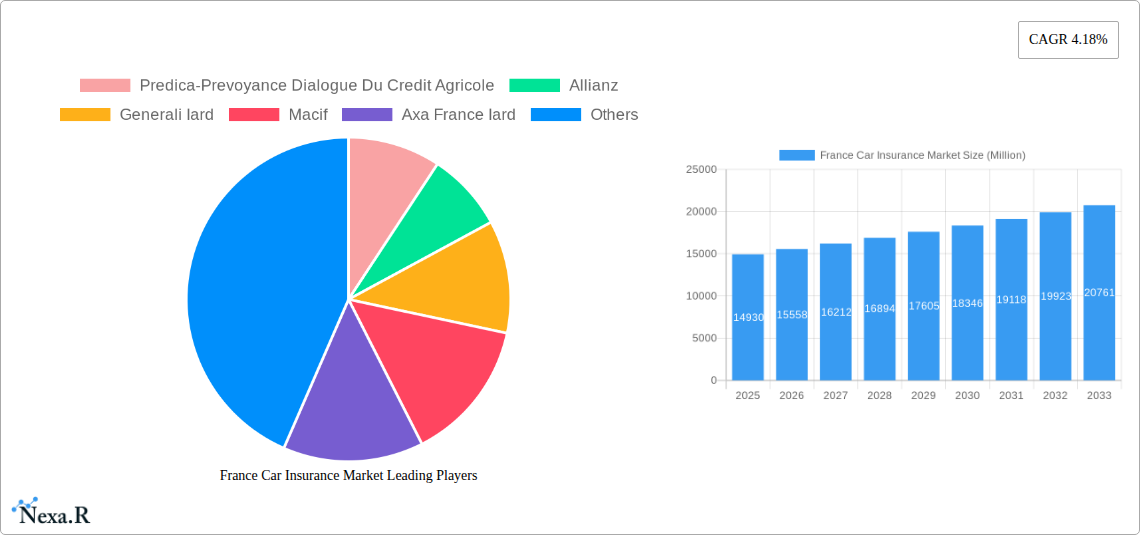

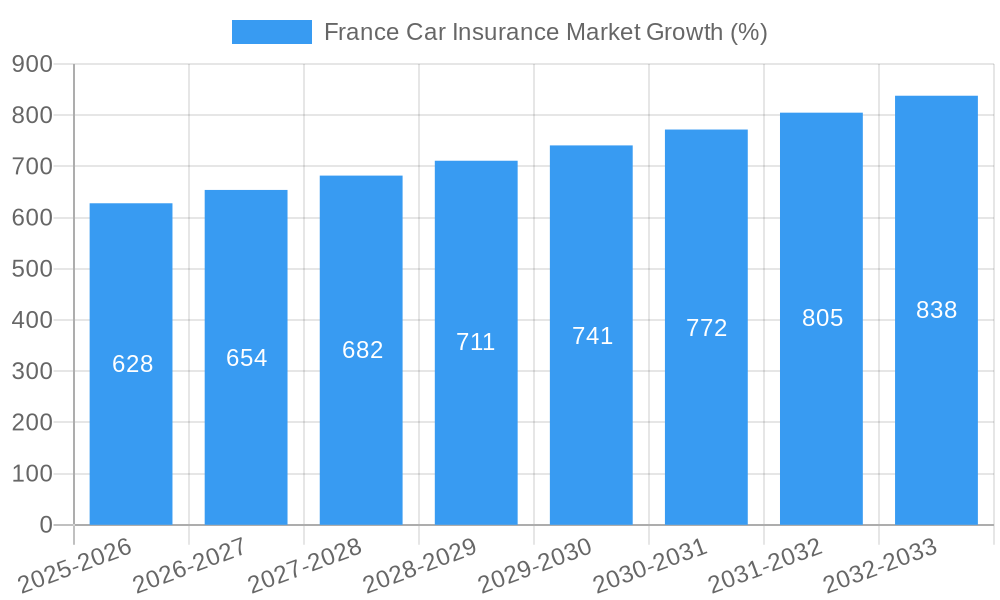

The French car insurance market, valued at €14.93 billion in 2025, demonstrates robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.18% from 2025 to 2033. This steady expansion is fueled by several key factors. Increasing car ownership, particularly among younger demographics, coupled with stringent government regulations mandating comprehensive insurance coverage, contributes significantly to market growth. Furthermore, the rising adoption of telematics and usage-based insurance (UBI) offers insurers opportunities to personalize premiums and improve risk assessment, thus boosting market penetration. Technological advancements such as AI-powered fraud detection and improved claims processing efficiency are also streamlining operations and enhancing customer experiences, creating a positive feedback loop for market expansion. Competitive pressures from established players like AXA, Allianz, and Generali, alongside emerging InsurTech startups offering innovative solutions, drive market dynamism and fuel innovation.

However, market growth is not without challenges. Economic fluctuations, particularly inflation and rising fuel costs, can impact consumer spending on insurance. Increasingly sophisticated fraud attempts, demanding robust security measures from insurers, represent a significant restraint. Moreover, maintaining customer loyalty in a competitive landscape requires continuous investment in customer service and innovative product offerings. Successfully navigating these challenges requires insurers to adopt a data-driven approach, leverage technological advancements, and prioritize customer experience to maintain market share and drive sustainable growth within the dynamic French car insurance sector. The market is further segmented by insurer type (e.g., mutual, stock company), product type (e.g., third-party liability, comprehensive), and distribution channel (e.g., online, agents).

France Car Insurance Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the France Car Insurance Market, encompassing market dynamics, growth trends, key players, and future outlook. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report delves into the parent market of the French Insurance sector and the child market of Car Insurance within France, providing a granular view of market segmentation and performance. Market values are presented in Million units.

France Car Insurance Market Dynamics & Structure

The French car insurance market is characterized by a moderately concentrated landscape, with several major players commanding significant market share. Market concentration is estimated at xx% in 2025, driven by established players like AXA France IARD and Allianz. However, smaller, specialized insurers and digital disruptors are emerging, increasing competition and fostering innovation. Technological advancements, particularly in telematics and AI-powered risk assessment, are significantly impacting the market, leading to personalized pricing and enhanced customer experiences. The regulatory framework, while generally stable, is subject to periodic updates aimed at consumer protection and market transparency. The market experiences pressure from competitive product substitutes, such as peer-to-peer insurance models and alternative risk management strategies.

- Market Concentration: xx% in 2025 (estimated), with a trend toward increased competition from new entrants.

- Technological Innovation: Telematics, AI-driven risk assessment, and digital distribution channels are key drivers.

- Regulatory Framework: Stable but subject to periodic updates focused on consumer protection.

- Competitive Substitutes: Emergence of peer-to-peer insurance and alternative risk management approaches.

- End-User Demographics: Shifting demographics influence demand patterns, necessitating targeted product offerings.

- M&A Activity: xx deals recorded between 2019-2024 (estimated), indicating consolidation within the market.

France Car Insurance Market Growth Trends & Insights

The French car insurance market is projected to witness steady growth over the forecast period (2025-2033). The market size, valued at xx million in 2025, is anticipated to reach xx million by 2033, exhibiting a CAGR of xx%. This growth is fueled by rising vehicle ownership, increasing awareness of insurance benefits, and the adoption of innovative insurance products tailored to specific customer needs. Technological disruptions, particularly the proliferation of connected cars and the use of telematics data, are accelerating the adoption of usage-based insurance (UBI) models and transforming how risk is assessed and priced. Consumer behavior shifts are influenced by digitalization and a preference for personalized and convenient insurance solutions.

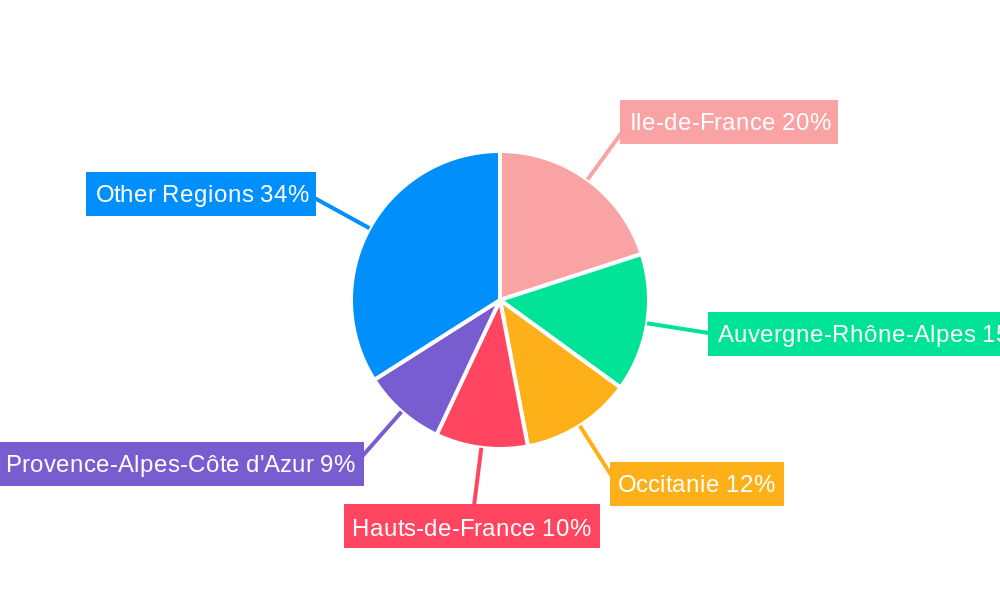

Dominant Regions, Countries, or Segments in France Car Insurance Market

The Île-de-France region demonstrates the highest market share and growth potential, driven by high vehicle density and strong economic activity. Other major regions such as Auvergne-Rhône-Alpes and Provence-Alpes-Côte d'Azur also contribute significantly to the market size. Factors influencing regional dominance include economic development, population density, and infrastructure development. Urban areas tend to show higher premiums due to increased risk factors.

- Key Drivers: Economic activity, population density, vehicle ownership, and infrastructure.

- Dominance Factors: Higher vehicle ownership rates in specific regions contribute to larger market share.

- Growth Potential: Regions with expanding economies and growing vehicle ownership exhibit higher future growth prospects.

France Car Insurance Market Product Landscape

The French car insurance market offers a range of products, including comprehensive, third-party liability, and specialized coverage for high-value vehicles. Innovation is evident in the emergence of usage-based insurance (UBI), which leverages telematics data to personalize premiums. The market is seeing the increased integration of digital tools, offering online policy management, claims processing, and customer support. Many companies are focusing on bundled products and additional services, such as roadside assistance, to enhance customer value and loyalty.

Key Drivers, Barriers & Challenges in France Car Insurance Market

Key Drivers:

- Growing vehicle ownership and increasing urbanization.

- Technological advancements in telematics and risk assessment.

- Rising awareness of insurance benefits and consumer protection regulations.

Challenges:

- Intense competition from established and new market entrants.

- Regulatory changes and compliance requirements.

- Fluctuating economic conditions and potential impacts on consumer spending. The estimated impact on market growth from these factors is xx% (estimated).

Emerging Opportunities in France Car Insurance Market

- Expanding usage-based insurance (UBI) models.

- Growth of digital distribution channels and online platforms.

- Increasing demand for specialized insurance products targeting niche segments.

- Development of embedded insurance programs within automotive ecosystems.

Growth Accelerators in the France Car Insurance Market Industry

Strategic partnerships between insurers and automotive manufacturers are driving growth by facilitating the integration of embedded insurance within vehicle purchases. Technological advancements, particularly in AI-powered risk assessment and fraud detection, improve operational efficiency and enhance underwriting capabilities. Expansion into underserved segments with targeted product offerings and improved customer service is another key driver.

Key Players Shaping the France Car Insurance Market Market

- Predica-Prévoyance Dialogue du Crédit Agricole

- Allianz

- Generali Iard

- Macif

- Axa France Iard

- Maaf

- GMF Assurances

- Inter Mutuelles Assistance GIE

- Adrea Mutuelle

- BPCE Assurances

- List Not Exhaustive

Notable Milestones in France Car Insurance Market Sector

- September 2022: Launch of BlaBlaCar Coach, an innovative app offering driver coaching and safety tips, integrated with car insurance.

- June 2023: Allianz partners with JLR to launch "Simply Drive," an embedded insurance program offering complimentary coverage for the first month of vehicle ownership.

In-Depth France Car Insurance Market Market Outlook

The French car insurance market is poised for continued growth, driven by technological innovation, increasing consumer demand for personalized services, and strategic partnerships across the automotive ecosystem. The market presents lucrative opportunities for insurers to leverage advanced technologies and data analytics to improve customer experiences and optimize operations. Strategic focus on digitalization, expansion into new segments, and the adoption of sustainable and innovative insurance solutions will be crucial for success in the coming years.

France Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Individual Agents

- 3.3. Brokers

- 3.4. Banks

- 3.5. Online

- 3.6. Other Distribution Channels

France Car Insurance Market Segmentation By Geography

- 1. France

France Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in France Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Rising Sales of Cars in France Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.4. Market Trends

- 3.4.1. Rise in Number of Traffic Accidents

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Individual Agents

- 5.3.3. Brokers

- 5.3.4. Banks

- 5.3.5. Online

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Predica-Prevoyance Dialogue Du Credit Agricole

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Allianz

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Generali Iard

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Macif

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axa France Iard

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maaf

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GMF Assurances

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Inter Mutuelles Assistance GIE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adrea Mutuelle

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BPCE Assurances**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Predica-Prevoyance Dialogue Du Credit Agricole

List of Figures

- Figure 1: France Car Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Car Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: France Car Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Car Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: France Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 4: France Car Insurance Market Volume Billion Forecast, by Coverage 2019 & 2032

- Table 5: France Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: France Car Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: France Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: France Car Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 9: France Car Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: France Car Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: France Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 12: France Car Insurance Market Volume Billion Forecast, by Coverage 2019 & 2032

- Table 13: France Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: France Car Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 15: France Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: France Car Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 17: France Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: France Car Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Car Insurance Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the France Car Insurance Market?

Key companies in the market include Predica-Prevoyance Dialogue Du Credit Agricole, Allianz, Generali Iard, Macif, Axa France Iard, Maaf, GMF Assurances, Inter Mutuelles Assistance GIE, Adrea Mutuelle, BPCE Assurances**List Not Exhaustive.

3. What are the main segments of the France Car Insurance Market?

The market segments include Coverage , Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in France Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Rise in Number of Traffic Accidents.

7. Are there any restraints impacting market growth?

Rising Sales of Cars in France Drives The Market; Increase in Road Traffic Accidents Drives The Market.

8. Can you provide examples of recent developments in the market?

June 2023: Allianz partnered with JLR and launched an embedded insurance program, Simply Drive service, which is available for every vehicle, offering clients the convenience of immediate and complimentary insurance coverage for the first month of ownership, making the purchase quicker and easier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Car Insurance Market?

To stay informed about further developments, trends, and reports in the France Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence