Key Insights

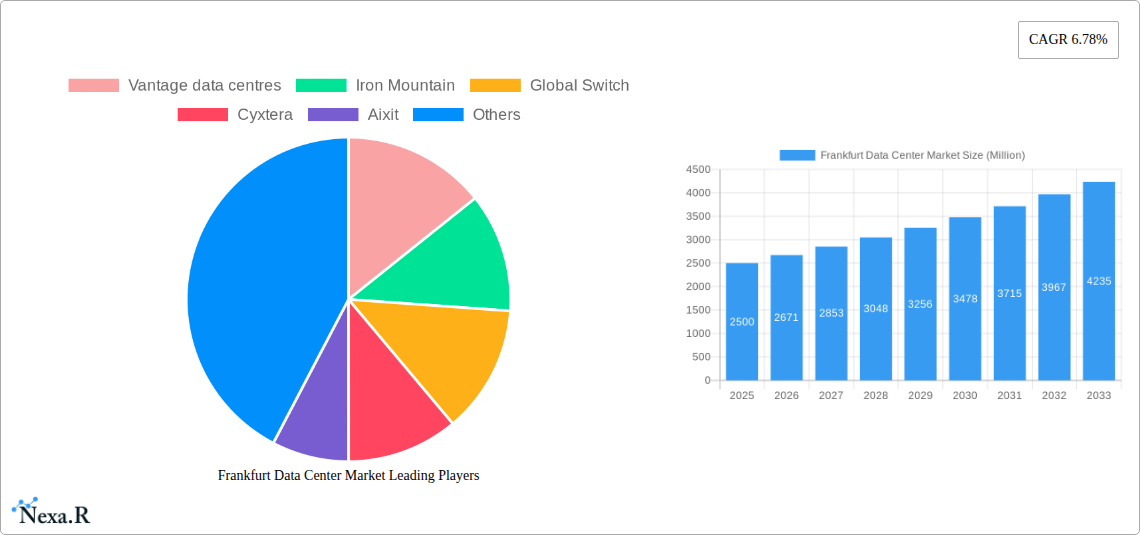

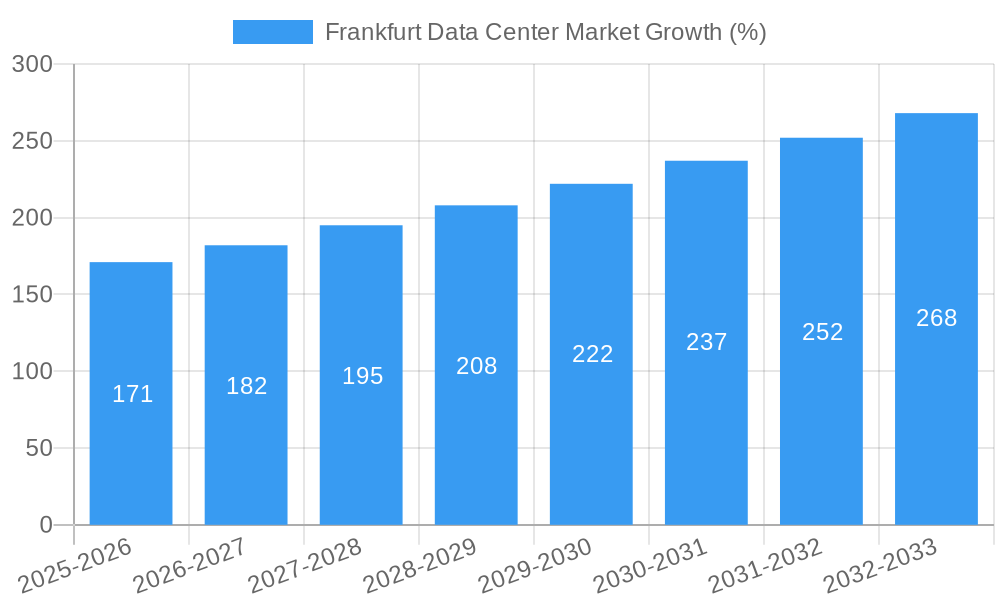

The Frankfurt data center market, a pivotal hub within Europe's digital infrastructure, exhibits robust growth potential. Driven by increasing cloud adoption, the burgeoning e-commerce sector, and stringent data sovereignty regulations within the European Union, the market is experiencing significant expansion. The 6.78% CAGR indicates a sustained upward trajectory, projecting substantial market value increases throughout the forecast period (2025-2033). While precise figures for market size (XX) are unavailable, a reasonable estimation based on comparable European markets and the provided CAGR suggests a 2025 market size in the range of €2-3 billion. The diverse segmentations within the market further highlight its dynamism. Hyperscale colocation facilities are witnessing particularly strong growth fueled by major cloud providers' expansion in the region. The demand from sectors like BFSI (Banking, Financial Services, and Insurance) and the e-commerce industry underscores Frankfurt's strategic location as a gateway to Europe. However, potential restraints include energy costs and securing sufficient skilled labor to support the growing infrastructure.

The strong presence of established players like Equinix, Digital Realty, and Vantage Data Centers alongside newer entrants indicates a competitive landscape. Tier 1 facilities are likely to dominate the market share due to their superior infrastructure and connectivity, catering to the demanding needs of hyperscale providers. The increasing adoption of sustainable practices in data center operations, alongside ongoing infrastructure development within the region, presents both opportunities and challenges for market participants. Further analysis of specific segment performance—particularly the breakdown by colocation type, end-user sector, and data center size—will provide a more granular understanding of the market's future development and investment opportunities. Future growth is strongly linked to continued investments in connectivity, enhanced energy efficiency measures, and a focus on addressing potential workforce limitations. This ensures the Frankfurt data center market remains a key player in supporting Europe's digital transformation.

Frankfurt Data Center Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Frankfurt data center market, encompassing market dynamics, growth trends, dominant segments, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data and qualitative analysis to offer actionable insights for industry professionals, investors, and strategic decision-makers. The Frankfurt data center market, a crucial node in European digital infrastructure, is dissected across parent markets (Data Center Market in Germany/Europe) and child markets (specific segments within Frankfurt). Market values are presented in millions.

Frankfurt Data Center Market Dynamics & Structure

The Frankfurt data center market exhibits a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is relatively high, with a few major players like Equinix, Digital Realty, and Global Switch holding significant market share (estimated at xx%). However, the presence of smaller, specialized providers like Aixit and Deft contributes to competitive diversity. Technological innovation, driven by advancements in AI, machine learning, and edge computing, is a major growth driver, pushing demand for higher capacity and more energy-efficient solutions. The regulatory environment, particularly regarding data privacy (GDPR) and energy efficiency, plays a significant role. While there are competitive product substitutes like cloud services, colocation remains a preferred choice for many businesses seeking greater control and customization. The end-user demographics are diverse, spanning cloud & IT, telecom, finance (BFSI), and manufacturing sectors. M&A activity has been moderate in recent years (xx deals in the last five years), reflecting consolidation and expansion strategies among key players.

- Market Concentration: High, with top players holding xx% market share.

- Technological Drivers: AI, machine learning, edge computing.

- Regulatory Framework: GDPR, energy efficiency regulations.

- Competitive Substitutes: Cloud services.

- End-User Demographics: Cloud & IT, Telecom, BFSI, Manufacturing, etc.

- M&A Activity: Moderate, xx deals in the last five years.

Frankfurt Data Center Market Growth Trends & Insights

The Frankfurt data center market has experienced robust growth over the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace (CAGR of xx%), driven by increasing digitalization, the growth of cloud computing and the demand for low latency services. Market penetration rates for colocation services are high in the established segments, leaving room for growth primarily in emerging sectors like edge computing and hyperscale deployments. Technological disruptions, such as the increased adoption of liquid cooling and AI-powered resource management, are optimizing efficiency and reducing costs. Consumer behavior shifts towards greater demand for sustainability and renewable energy solutions are also influencing market development. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

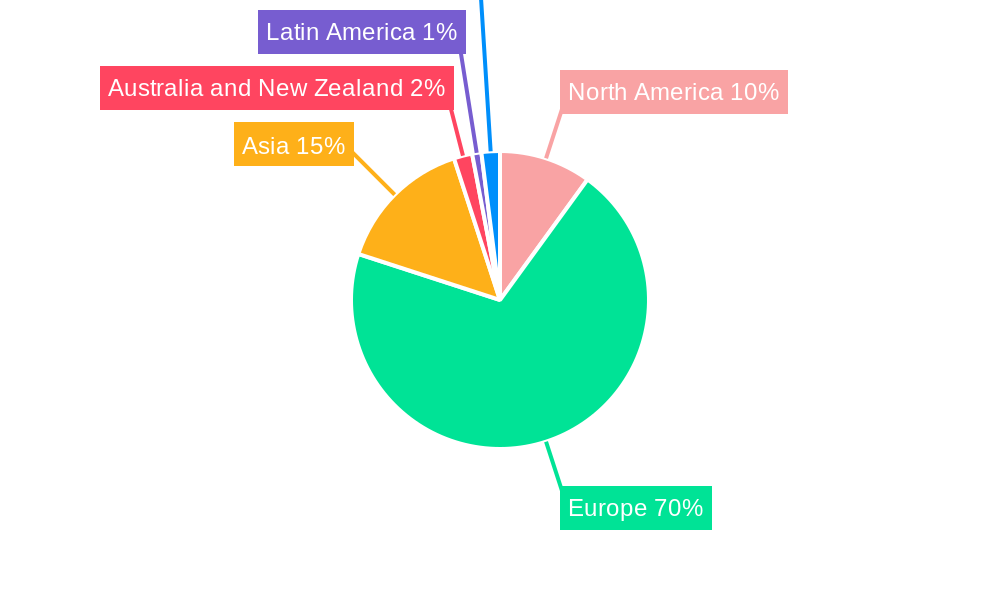

Dominant Regions, Countries, or Segments in Frankfurt Data Center Market

Within the Frankfurt data center market, the city itself is the dominant region. High demand from major cloud providers and enterprises makes it a primary hub for data center operations. Specific segments driving growth include:

- Tier Type: Tier III and Tier IV data centers account for the largest share due to their higher reliability and capacity.

- Absorption: Utilized capacity is high, reflecting strong demand.

- Colocation Type: Wholesale colocation is a dominant segment, given the needs of large enterprises and hyperscale providers.

- End User: The Cloud & IT sector is a major driver, followed by the BFSI sector.

- DC Size: Medium and large data centers dominate the market, reflecting the needs of a range of enterprise clients.

Key drivers for this dominance include established digital infrastructure, strong connectivity, and a business-friendly environment. The growth potential lies in expanding into adjacent regions and catering to growing demand from specific sectors like e-commerce and manufacturing.

Frankfurt Data Center Market Product Landscape

The Frankfurt data center market offers a range of products, from basic colocation services to highly customized, energy-efficient solutions. Innovations focus on improving power efficiency, density, and resilience. Products are differentiated through unique selling propositions such as advanced cooling technologies (e.g., liquid cooling), enhanced security features, and sustainability initiatives. Performance metrics like power usage effectiveness (PUE) and uptime are crucial for attracting clients. The market sees a trend towards modular designs for scalable and flexible deployments.

Key Drivers, Barriers & Challenges in Frankfurt Data Center Market

Key Drivers: Increased digitalization, growth of cloud computing, demand for low-latency services, and government support for digital infrastructure development are driving the market.

Challenges: High energy costs, limited availability of suitable land, and intense competition among providers are significant barriers. The impact of these challenges can be seen in fluctuating prices and delays in project completion.

Emerging Opportunities in Frankfurt Data Center Market

Emerging opportunities include expanding into edge computing, meeting the growing demand for sustainable and green data centers, and catering to the specific needs of niche industries such as fintech and healthcare. The adoption of AI-powered solutions for resource optimization and predictive maintenance also presents significant opportunities.

Growth Accelerators in the Frankfurt Data Center Market Industry

Strategic partnerships, technological breakthroughs in energy efficiency and cooling technologies, and expansion into new markets are accelerating long-term growth. Furthermore, the increasing focus on sustainability is attracting environmentally conscious enterprises.

Key Players Shaping the Frankfurt Data Center Market Market

- Vantage data centres

- Iron Mountain

- Global Switch

- Cyxtera

- Aixit

- Equinix

- Telehouse

- Leaseweb

- Cyrusone

- Lumen Technologies Inc

- Digital Realty

- Zenlayer

- NTT

- Deft

- DARZ

Notable Milestones in Frankfurt Data Center Market Sector

- April 2023: Green Mountain and KMW launch a joint venture to build a 54MW data center near Mainz, emphasizing renewable energy sources.

- May 2022: Alibaba Cloud opens an AI-focused data center in Frankfurt, highlighting the growing demand for AI infrastructure.

In-Depth Frankfurt Data Center Market Market Outlook

The Frankfurt data center market is poised for continued growth, driven by sustained demand for digital infrastructure, technological advancements, and a focus on sustainability. Strategic partnerships and investments in green technologies will further shape the market landscape. Opportunities exist for providers to differentiate themselves through innovative solutions and a commitment to environmental responsibility. The long-term outlook is positive, with significant potential for expansion and consolidation.

Frankfurt Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Frankfurt Data Center Market Segmentation By Geography

- 1. Germany

Frankfurt Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness Among Internet Users About Secure Web Access; Managing Strict Regulations and Compliance

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About the Importance of Security Certificates; Using of Self-Signed Certificates

- 3.4. Market Trends

- 3.4.1. Tier 3 Segment is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Vantage data centres

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Iron Mountain

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Global Switch

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cyxtera

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aixit

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Equinix

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Telehouse

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Leaseweb

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cyrusone

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Lumen Technologies Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Digital Realty

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Zenlayer

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 NTT

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Deft

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 DARZ

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Vantage data centres

List of Figures

- Figure 1: Frankfurt Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Frankfurt Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Frankfurt Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Frankfurt Data Center Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 3: Frankfurt Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 4: Frankfurt Data Center Market Volume Thousand Forecast, by DC Size 2019 & 2032

- Table 5: Frankfurt Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 6: Frankfurt Data Center Market Volume Thousand Forecast, by Tier Type 2019 & 2032

- Table 7: Frankfurt Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 8: Frankfurt Data Center Market Volume Thousand Forecast, by Absorption 2019 & 2032

- Table 9: Frankfurt Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Frankfurt Data Center Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 11: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 13: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 15: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 17: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 19: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 21: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 23: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 25: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 27: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 29: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 31: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 33: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 35: Frankfurt Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 36: Frankfurt Data Center Market Volume Thousand Forecast, by DC Size 2019 & 2032

- Table 37: Frankfurt Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 38: Frankfurt Data Center Market Volume Thousand Forecast, by Tier Type 2019 & 2032

- Table 39: Frankfurt Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 40: Frankfurt Data Center Market Volume Thousand Forecast, by Absorption 2019 & 2032

- Table 41: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Frankfurt Data Center Market?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the Frankfurt Data Center Market?

Key companies in the market include Vantage data centres, Iron Mountain, Global Switch, Cyxtera, Aixit, Equinix, Telehouse, Leaseweb, Cyrusone, Lumen Technologies Inc, Digital Realty, Zenlayer, NTT, Deft, DARZ.

3. What are the main segments of the Frankfurt Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness Among Internet Users About Secure Web Access; Managing Strict Regulations and Compliance.

6. What are the notable trends driving market growth?

Tier 3 Segment is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness About the Importance of Security Certificates; Using of Self-Signed Certificates.

8. Can you provide examples of recent developments in the market?

April 2023 : Green Mountain, a Norwegian data centre firm, has launched a joint venture with energy firm KMW to build a new campus south of Frankfurt, Germany. The two corporations have created a 50:50 partnership to build a 54MW data center near Mainz. Three structures are proposed for the 25,000 sqm (269,100 sq ft) FRA1-Main site, which will be next to KMW's power plants. According to the firms, the buildings can handle both multi-tenant contracts and dedicated buildings. Power will be supplied by KMW's renewable portfolio, with backup power supplied by the local KMW gas plant rather than backup generators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Frankfurt Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Frankfurt Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Frankfurt Data Center Market?

To stay informed about further developments, trends, and reports in the Frankfurt Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence