Key Insights

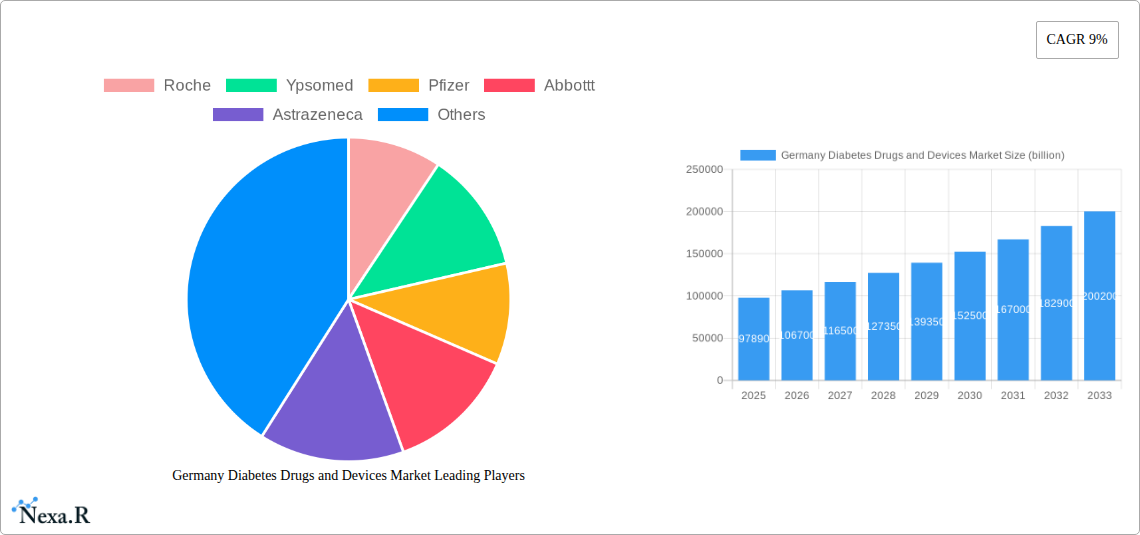

The Germany Diabetes Drugs and Devices Market is poised for significant expansion, projected to reach an impressive $97.89 billion by 2025. This robust growth is fueled by an anticipated 9% CAGR over the forecast period. Key drivers underpinning this upward trajectory include the increasing prevalence of diabetes in Germany, a growing awareness of effective diabetes management solutions, and advancements in medical technology that offer more precise and less invasive treatment options. The market is segmented into devices, encompassing both self-monitoring blood glucose devices and continuous blood glucose monitoring systems, alongside management devices like insulin pumps, syringes, cartridges, and disposable pens. Furthermore, the drugs segment is driven by a diverse range of oral anti-diabetes medications, insulin formulations, combination therapies, and non-insulin injectable drugs. Leading global players such as Roche, Abbott, Medtronic, Novo Nordisk, and Sanofi are actively investing in research and development, introducing innovative products and expanding their market reach within Germany.

Germany Diabetes Drugs and Devices Market Market Size (In Billion)

The sustained growth of the German diabetes market is also influenced by supportive government initiatives and reimbursement policies aimed at improving patient outcomes and reducing the long-term healthcare burden associated with diabetes. The aging population in Germany further contributes to the demand for diabetes-related products and services. Emerging trends include a strong shift towards personalized medicine, with treatments tailored to individual patient needs and genetic profiles, and the increasing adoption of digital health solutions and connected devices for remote patient monitoring and data management. While the market enjoys strong tailwinds, potential restraints such as the high cost of advanced treatment technologies and the need for extensive patient and healthcare provider education on new devices and therapies need to be navigated by stakeholders to ensure continued market accessibility and adoption.

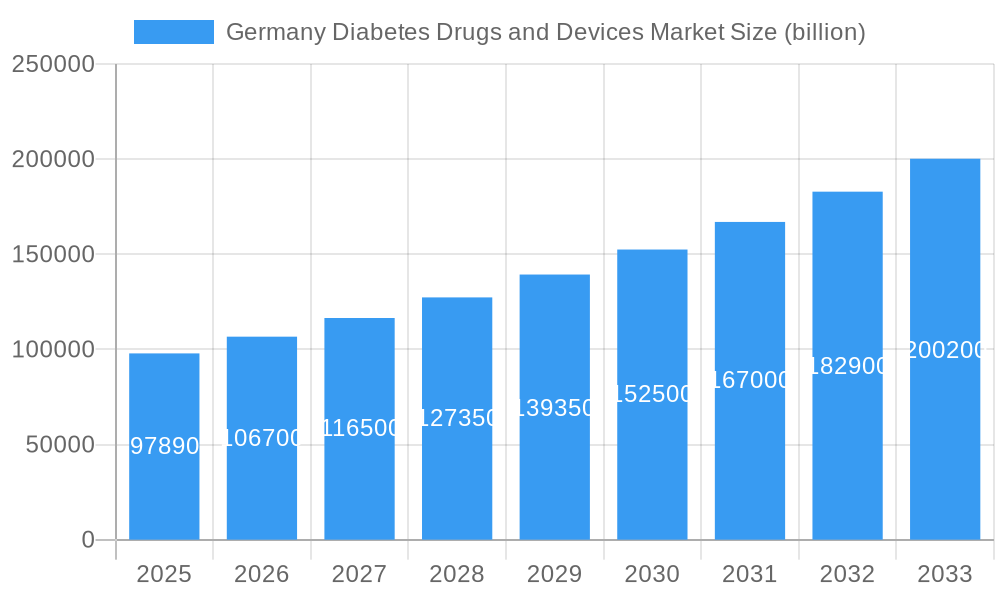

Germany Diabetes Drugs and Devices Market Company Market Share

Germany Diabetes Drugs and Devices Market: Comprehensive Market Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the Germany diabetes drugs and devices market, encompassing both parent and child markets. With a focus on key segments including Self-monitoring Blood Glucose Devices, Continuous Blood Glucose Monitoring, Insulin Pumps, Insulin Syringes, Insulin Cartridges, Disposable Pens, Oral Anti-Diabetes Drugs, Insulin Drugs, Combination Drugs, and Non-Insulin Injectable Drugs, this report offers a critical understanding of market dynamics, growth trends, and competitive landscapes. It is an indispensable resource for pharmaceutical companies, medical device manufacturers, investors, and healthcare providers seeking to navigate the evolving German diabetes care sector. All values are presented in billion units.

Germany Diabetes Drugs and Devices Market Market Dynamics & Structure

The German diabetes drugs and devices market is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving patient demographics. Market concentration is moderate, with a few key players dominating specific segments, yet the presence of numerous specialized manufacturers fosters a competitive environment. Technological innovation remains a primary driver, with continuous advancements in Continuous Blood Glucose Monitoring (CGM) and automated insulin delivery systems revolutionizing diabetes management. Regulatory bodies, such as the German Federal Institute for Drugs and Medical Devices (BfArM), play a crucial role in ensuring product safety and efficacy, thereby influencing market entry and product development strategies. Competitive product substitutes are abundant, particularly within the oral anti-diabetes drug segment, necessitating continuous differentiation and value-added offerings from market participants. End-user demographics are shifting, with an increasing prevalence of Type 2 diabetes and a growing aging population, driving demand for both established and innovative solutions. Mergers and acquisitions (M&A) trends indicate strategic consolidation and portfolio expansion, with companies like Abbott, CamDiab, and Ypsomed actively pursuing collaborations to develop integrated Automated Insulin Delivery (AID) systems.

- Market Concentration: Moderate, with key players like Roche, Novo Nordisk, and Medtronic holding significant shares in their respective segments.

- Technological Innovation: Driven by advancements in CGM, Insulin Pump technology, and digital health solutions.

- Regulatory Frameworks: Strict oversight by BfArM ensures product quality and patient safety.

- Competitive Product Substitutes: High in oral anti-diabetic and traditional insulin delivery segments, pushing for innovation in advanced therapies.

- End-User Demographics: Growing prevalence of diabetes, an aging population, and increasing awareness of self-management tools.

- M&A Trends: Focus on integrated solutions, digital health integration, and expanding therapeutic portfolios.

Germany Diabetes Drugs and Devices Market Growth Trends & Insights

The Germany diabetes drugs and devices market is poised for significant growth, fueled by a confluence of factors including an increasing diabetes prevalence, rising healthcare expenditure, and a growing emphasis on personalized and proactive diabetes management. The market size is projected to witness a robust expansion from an estimated XX billion units in 2025 to XX billion units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This growth trajectory is underpinned by escalating adoption rates of advanced diabetes technologies, particularly Continuous Blood Glucose Monitoring (CGM) systems and sophisticated Insulin Pumps. Technological disruptions, such as the integration of artificial intelligence in diabetes management platforms and the development of novel drug formulations, are further accelerating market penetration. Consumer behavior shifts are also playing a pivotal role; individuals are increasingly empowered and proactive in managing their health, actively seeking convenient, efficient, and data-driven solutions. The demand for connected devices and digital health applications that facilitate remote patient monitoring and personalized treatment plans is on the rise. Furthermore, the growing awareness campaigns and government initiatives aimed at diabetes prevention and management are contributing to a more informed patient population, driving demand for both diagnostic and therapeutic interventions. The historical period (2019–2024) has laid the groundwork for this expansion, with steady progress in drug development and device innovation.

Dominant Regions, Countries, or Segments in Germany Diabetes Drugs and Devices Market

Within the Germany diabetes drugs and devices market, the Devices segment, particularly Monitoring Devices, stands out as a dominant force driving market growth. Within Monitoring Devices, Continuous Blood Glucose Monitoring (CGM) is experiencing unparalleled expansion, surpassing the growth of traditional Self-monitoring Blood Glucose Devices. The increasing adoption of CGM systems is a direct response to the growing need for real-time glucose data, enabling more precise insulin dosing and proactive management of glycemic fluctuations. This trend is further amplified by technological advancements leading to smaller, more user-friendly, and interconnected CGM devices.

The Management Devices segment also contributes significantly, with Insulin Pumps witnessing a steady rise in adoption as they offer a more convenient and accurate alternative to multiple daily injections. While Insulin Syringes, Insulin Cartridges, and Disposable Pens remain crucial, their growth is somewhat outpaced by the innovation and demand for pump therapy and next-generation injection devices.

In the Drugs segment, Insulin Drugs continue to hold a substantial market share due to the fundamental role of insulin in diabetes treatment. However, Oral Anti-Diabetes Drugs and Non-Insulin Injectable Drugs, particularly GLP-1 receptor agonists and SGLT2 inhibitors, are demonstrating robust growth due to their efficacy in managing blood sugar, promoting weight loss, and offering cardiovascular and renal benefits. Combination Drugs are also gaining traction as they simplify treatment regimens and improve patient adherence.

The dominance of Monitoring Devices, especially CGM, can be attributed to several factors:

- Technological Sophistication: Real-time data, trend analysis, and integration with smart devices offer superior insights compared to traditional methods.

- Improved Patient Outcomes: Enhanced glycemic control, reduced risk of hypoglycemia and hyperglycemia, and better quality of life for patients.

- Reimbursement Policies: Increasing coverage and favorable reimbursement schemes for advanced monitoring technologies.

- Physician Recommendation: Healthcare professionals are increasingly advocating for CGM due to its clinical benefits.

- Growing Awareness: Patients are becoming more informed about the advantages of continuous monitoring.

Germany Diabetes Drugs and Devices Market Product Landscape

The Germany diabetes drugs and devices market is characterized by a dynamic product landscape driven by relentless innovation and a focus on improving patient outcomes. Key product innovations include the development of next-generation Continuous Blood Glucose Monitoring (CGM) systems offering extended wear times, improved accuracy, and seamless connectivity with smartphones and Insulin Pumps. In the drug sector, advancements are seen in novel insulin formulations with longer-acting profiles and reduced injection frequency, as well as the introduction of highly effective Non-Insulin Injectable Drugs like GLP-1 receptor agonists and SGLT2 inhibitors that provide broader metabolic benefits beyond glycemic control. The integration of digital health platforms with these devices and drugs is a significant trend, enabling personalized treatment plans, remote patient monitoring, and data-driven decision-making. Unique selling propositions revolve around enhanced patient convenience, improved glycemic control, reduced risk of complications, and cost-effectiveness over the long term. Technological advancements are focused on miniaturization, improved user experience, and greater interoperability across different diabetes management tools.

Key Drivers, Barriers & Challenges in Germany Diabetes Drugs and Devices Market

Key Drivers:

- Rising Diabetes Prevalence: The increasing incidence of diabetes in Germany is the primary driver for both drugs and devices.

- Technological Advancements: Innovations in CGM, Insulin Pumps, and smart insulin pens are enhancing patient care and driving adoption.

- Growing Geriatric Population: An aging population often presents with multiple comorbidities, increasing the need for comprehensive diabetes management.

- Government Initiatives & Awareness: Increased focus on diabetes prevention, early detection, and management through public health campaigns and favorable reimbursement policies.

- Demand for Personalized Medicine: Patients and healthcare providers are seeking tailored treatment approaches.

Barriers & Challenges:

- High Cost of Advanced Devices: The initial investment in technologies like Insulin Pumps and CGM can be a barrier for some patients and healthcare systems.

- Reimbursement Policies: While improving, navigating and securing reimbursement for new technologies can still be complex and a bottleneck.

- Regulatory Hurdles: Stringent approval processes for new drugs and medical devices can delay market entry.

- Data Security and Privacy Concerns: The increasing reliance on digital health platforms raises concerns about the security and privacy of patient data.

- Physician and Patient Education: Ensuring adequate training and understanding of complex new technologies among both healthcare professionals and patients is crucial for effective utilization. Supply chain disruptions, though less prevalent currently, can pose a future challenge.

Emerging Opportunities in Germany Diabetes Drugs and Devices Market

Emerging opportunities within the Germany diabetes drugs and devices market lie in the increasing integration of digital health and artificial intelligence. The development of AI-powered predictive analytics for glucose forecasting and personalized treatment recommendations presents a significant avenue for growth. Furthermore, the expansion of telehealth services for remote patient monitoring and consultations offers a convenient and cost-effective way to manage diabetes, particularly in rural areas. Untapped markets exist in developing more affordable and accessible versions of advanced diabetes technologies for broader patient segments. Evolving consumer preferences for lifestyle-integrated health solutions are driving demand for wearable devices that seamlessly track glucose levels and offer lifestyle advice. The focus on combination therapies that address multiple aspects of diabetes management, including cardiovascular and renal protection, is also a growing opportunity.

Growth Accelerators in the Germany Diabetes Drugs and Devices Market Industry

Several key catalysts are accelerating the growth of the Germany diabetes drugs and devices market. Technological breakthroughs in developing miniaturized, highly accurate, and user-friendly CGM sensors and Insulin Pumps are significantly enhancing patient adherence and outcomes. Strategic partnerships between device manufacturers, pharmaceutical companies, and digital health providers are fostering the development of integrated ecosystems for comprehensive diabetes management. For example, the collaboration between Abbott, CamDiab, and Ypsomed to develop an AID system exemplifies this trend. Market expansion strategies, including targeted marketing campaigns to healthcare professionals and patients, and the continuous refinement of reimbursement policies, are also crucial growth accelerators. The increasing focus on value-based healthcare models, where outcomes and efficiency are prioritized, further encourages the adoption of innovative and effective diabetes solutions.

Key Players Shaping the Germany Diabetes Drugs and Devices Market Market

- Roche

- Ypsomed

- Pfizer

- Abbott

- Astrazeneca

- Eli Lilly

- Sanofi

- Novartis

- Medtronic

- Tandem

- Insulet

- Novo Nordisk

- Dexcom

Notable Milestones in Germany Diabetes Drugs and Devices Market Sector

- February 2023: AstraZeneca's Forxiga (dapagliflozin) was approved in the European Union to extend the indication for heart failure with reduced ejection fraction to cover patients across the full spectrum of left ventricular ejection fraction. It includes HF with mildly reduced and preserved ejection fraction.

- April 2022: Abbott, CamDiab, and Ypsomed announced they are partnering to develop and commercialize an integrated automated insulin delivery (AID) system. The initial focus of the partnership will be on European countries. The connected, smart wearable solution is designed to continuously monitor a person's glucose levels and automatically adjust and deliver the right amount of insulin at the right time, removing the guesswork of insulin dosing.

In-Depth Germany Diabetes Drugs and Devices Market Market Outlook

The Germany diabetes drugs and devices market outlook remains exceptionally strong, driven by a sustained increase in the prevalence of diabetes and a persistent drive for innovative therapeutic and management solutions. Growth accelerators such as the ongoing advancements in Continuous Blood Glucose Monitoring (CGM) and Insulin Pump technologies, coupled with the strategic partnerships between leading industry players like Abbott, CamDiab, and Ypsomed, are pivotal in shaping the future landscape. The continuous development of novel oral anti-diabetic and non-insulin injectable drugs, exemplified by AstraZeneca's expanded indications for Forxiga, further underscores the market's potential. Future growth will likely be characterized by deeper integration of digital health platforms, artificial intelligence-driven insights, and a continued focus on personalized medicine to improve patient outcomes and enhance the quality of life for individuals living with diabetes in Germany. The market is well-positioned for significant expansion in the coming years.

Germany Diabetes Drugs and Devices Market Segmentation

-

1. Devices

-

1.1. Monitoring Devices

- 1.1.1. Self-monitoring Blood Glucose Devices

- 1.1.2. Continuous Blood Glucose Monitoring

-

1.2. Management Devices

- 1.2.1. Insulin Pump

- 1.2.2. Insulin Syringes

- 1.2.3. Insulin Cartridges

- 1.2.4. Disposable Pens

-

1.1. Monitoring Devices

-

2. Drugs

- 2.1. Oral Anti-Diabetes Drugs

- 2.2. Insulin Drugs

- 2.3. Combination Drugs

- 2.4. Non-Insulin Injectable Drugs

Germany Diabetes Drugs and Devices Market Segmentation By Geography

- 1. Germany

Germany Diabetes Drugs and Devices Market Regional Market Share

Geographic Coverage of Germany Diabetes Drugs and Devices Market

Germany Diabetes Drugs and Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. The continuous Glucose Monitoring Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Monitoring Devices

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.2. Continuous Blood Glucose Monitoring

- 5.1.2. Management Devices

- 5.1.2.1. Insulin Pump

- 5.1.2.2. Insulin Syringes

- 5.1.2.3. Insulin Cartridges

- 5.1.2.4. Disposable Pens

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Drugs

- 5.2.1. Oral Anti-Diabetes Drugs

- 5.2.2. Insulin Drugs

- 5.2.3. Combination Drugs

- 5.2.4. Non-Insulin Injectable Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ypsomed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pfizer

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbottt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astrazeneca

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novartis

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Medtronic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tandem

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Insulet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novo Nordisk

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dexcom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: Germany Diabetes Drugs and Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Diabetes Drugs and Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Diabetes Drugs and Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 2: Germany Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: Germany Diabetes Drugs and Devices Market Revenue billion Forecast, by Drugs 2020 & 2033

- Table 4: Germany Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 5: Germany Diabetes Drugs and Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Germany Diabetes Drugs and Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Germany Diabetes Drugs and Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 8: Germany Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 9: Germany Diabetes Drugs and Devices Market Revenue billion Forecast, by Drugs 2020 & 2033

- Table 10: Germany Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 11: Germany Diabetes Drugs and Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany Diabetes Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Diabetes Drugs and Devices Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Germany Diabetes Drugs and Devices Market?

Key companies in the market include Roche, Ypsomed, Pfizer, Abbottt, Astrazeneca, Eli Lilly, Sanofi, Novartis, Medtronic, Tandem, Insulet, Novo Nordisk, Dexcom.

3. What are the main segments of the Germany Diabetes Drugs and Devices Market?

The market segments include Devices, Drugs.

4. Can you provide details about the market size?

The market size is estimated to be USD 97.89 billion as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

The continuous Glucose Monitoring Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

February 2023: AstraZeneca's Forxiga (dapagliflozin) was approved in the European Union to extend the indication for heart failure with reduced ejection fraction to cover patients across the full spectrum of left ventricular ejection fraction. It includes HF with mildly reduced and preserved ejection fraction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Diabetes Drugs and Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Diabetes Drugs and Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Diabetes Drugs and Devices Market?

To stay informed about further developments, trends, and reports in the Germany Diabetes Drugs and Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence