Key Insights

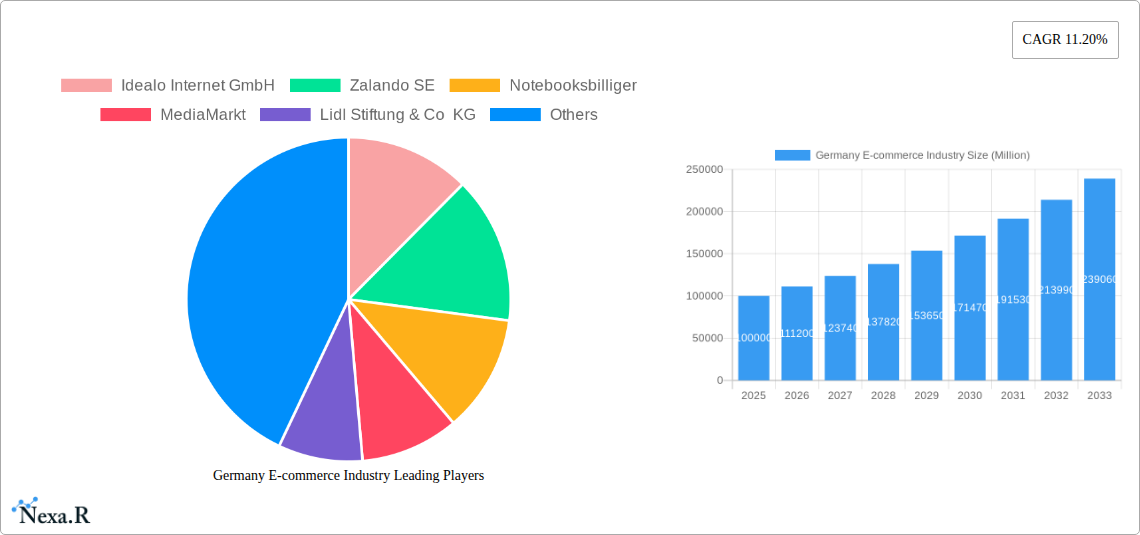

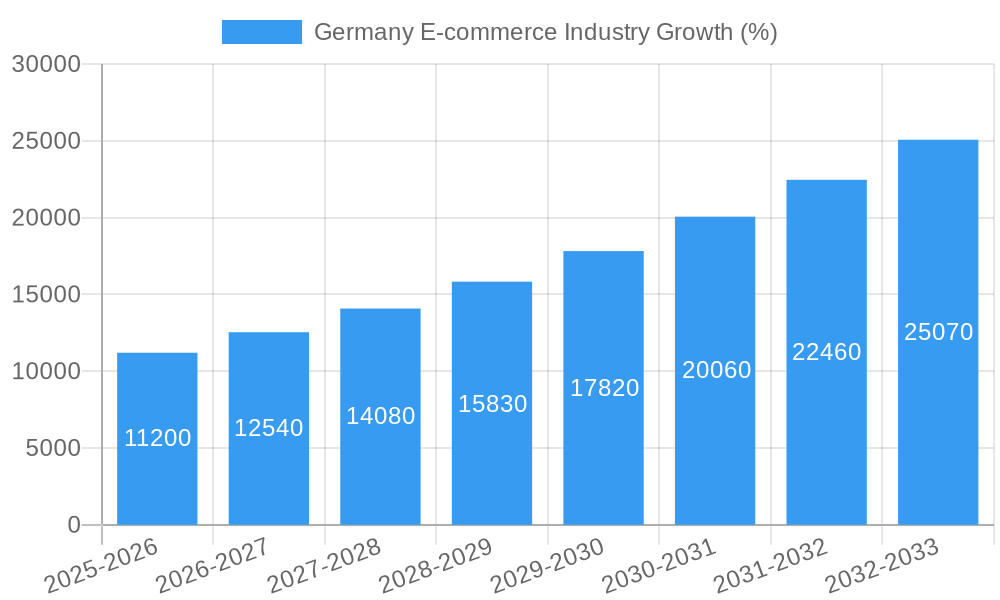

The German e-commerce market, a robust and dynamic sector, is experiencing significant growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 11.20% from 2025 to 2033. This expansion is fueled by several key factors. Increasing internet and smartphone penetration across all demographics, coupled with a rising preference for online shopping convenience, are driving substantial market expansion. Furthermore, the burgeoning popularity of mobile commerce and the increasing sophistication of online marketplaces are contributing to this trend. Strong logistics infrastructure and a generally high level of digital literacy within the German population further support the growth trajectory. Competitive pricing strategies employed by major players like Amazon.de, eBay.de, and Zalando SE, alongside the emergence of specialized niche e-commerce platforms, foster a vibrant and innovative market landscape. While potential constraints such as concerns regarding data privacy and security exist, the overall outlook remains positive, indicating substantial opportunities for both established players and new entrants.

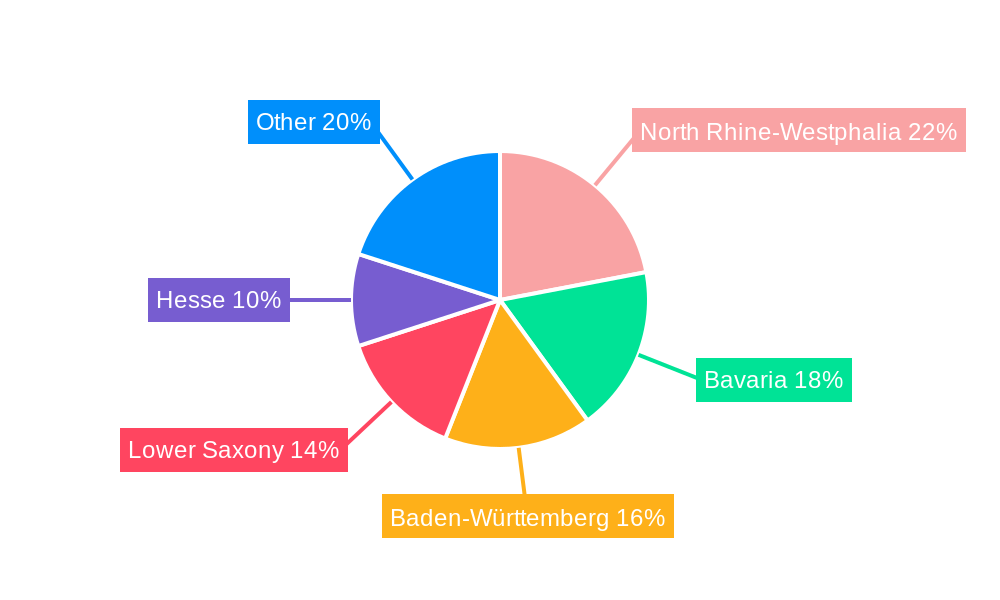

The regional distribution of e-commerce activity within Germany reflects the country's economic and demographic landscape. States like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, representing significant population centers and economic hubs, contribute disproportionately to the overall market volume. The ongoing development of robust payment infrastructure and enhanced consumer protection regulations will further solidify the German e-commerce market's position as a leading European player. This consistent growth is expected to continue, driven by technological advancements, evolving consumer behavior, and the continued expansion of online retail offerings. The market's segmentation by application will likely see continued growth in various sectors, reflecting consumer preferences for diverse product categories and shopping experiences.

Germany E-commerce Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the German e-commerce industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for businesses, investors, and industry professionals seeking to understand and capitalize on the opportunities within this dynamic market. The report segments the market by application, offering granular insights into various e-commerce sectors.

Germany E-commerce Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the German e-commerce industry. The market exhibits a high degree of concentration, with major players like Amazon and Zalando holding significant market share. However, smaller niche players and new entrants continue to challenge the established giants, leading to dynamic competition.

- Market Concentration: Amazon and Zalando hold approximately xx% and xx% market share respectively in 2024, indicating a moderately concentrated market. Other key players, including Otto and eBay, further consolidate market dominance.

- Technological Innovation: Rapid technological advancements in areas such as mobile commerce, AI-powered personalization, and logistics optimization are driving market growth. However, high initial investment costs and integration complexities pose significant barriers for smaller players.

- Regulatory Framework: The German government's regulations on data privacy (GDPR) and consumer protection significantly impact e-commerce operations. Compliance costs and evolving regulations present ongoing challenges.

- Competitive Product Substitutes: Traditional brick-and-mortar retail continues to exist as a competitor although its market share is shrinking rapidly. The rise of social commerce poses a more significant challenge.

- End-User Demographics: The German e-commerce market is characterized by a diverse customer base, with significant growth in older age segments adopting online shopping.

- M&A Trends: The industry witnessed xx M&A deals in the historical period (2019-2024), reflecting consolidation and expansion strategies by larger players.

Germany E-commerce Industry Growth Trends & Insights

The German e-commerce market has experienced significant growth throughout the historical period (2019-2024). Driven by increasing internet and smartphone penetration, rising disposable incomes, and changing consumer preferences, the market is expected to maintain a strong growth trajectory during the forecast period (2025-2033). The CAGR for the period 2025-2033 is estimated at xx%. Market penetration is projected to reach xx% by 2033. Key trends include the increasing popularity of mobile commerce, the rise of omnichannel strategies, and the growing adoption of personalized shopping experiences. Technological disruptions like the Metaverse and blockchain technology are anticipated to reshape the market in the coming years.

Dominant Regions, Countries, or Segments in Germany E-commerce Industry

The German e-commerce market shows regional variations. Urban centers like Berlin, Munich, and Hamburg exhibit higher e-commerce adoption rates driven by higher internet penetration, higher disposable incomes, and a concentration of younger demographics. Rural areas lag due to lower internet access and digital literacy rates.

- Key Drivers: Strong consumer confidence, robust digital infrastructure in urban areas, and government support for digitalization initiatives.

- Dominance Factors: High population density, higher disposable incomes, robust logistics networks, and early adoption of e-commerce technologies in urban areas. Berlin and Munich particularly lead in terms of market share and growth.

Germany E-commerce Industry Product Landscape

The German e-commerce market offers a wide range of products, encompassing fashion, electronics, groceries, and other consumer goods. Product innovation is focused on improving user experience, enhancing product discovery, and providing seamless delivery options. Key innovations include AI-powered recommendation engines, augmented reality shopping experiences, and sustainable packaging solutions.

Key Drivers, Barriers & Challenges in Germany E-commerce Industry

Key Drivers:

- Increasing internet and smartphone penetration

- Rising disposable incomes and consumer spending

- Growing preference for online shopping convenience

- Technological advancements like improved logistics and AI personalization

Key Challenges:

- Intense competition, especially from established global players

- Stringent data privacy regulations (GDPR)

- Increasing logistics costs and delivery complexities

- Potential for cyber security threats and data breaches. The total estimated financial impact of these threats over the next five years is projected to reach €xx million.

Emerging Opportunities in Germany E-commerce Industry

- Growth of mobile commerce: Leveraging mobile-first strategies and optimized mobile shopping experiences is crucial.

- Expansion into niche markets: Targeting underserved segments with specialized products and services presents opportunities.

- Personalization and AI: Implementing AI-powered solutions to enhance customer experiences and drive sales.

- Sustainability: Focusing on eco-friendly packaging, logistics, and supply chains to appeal to environmentally conscious consumers.

Growth Accelerators in the Germany E-commerce Industry

Technological advancements in areas such as AI, blockchain, and augmented reality are poised to significantly accelerate growth. Strategic partnerships between e-commerce companies and logistics providers will enhance efficiency and reduce costs. Expanding into new market segments and focusing on personalization will attract new customers and drive market expansion.

Key Players Shaping the Germany E-commerce Industry Market

- Idealo Internet GmbH

- Zalando SE

- Notebooksbilliger

- MediaMarkt

- Lidl Stiftung & Co KG

- eBay Kleinanzeigen

- Amazon de

- eBay de

- Otto GmbH

- Thomann GmbH

Notable Milestones in Germany E-commerce Industry Sector

- September 2021: Amazon announces plans to construct eight new logistics buildings in Germany by the first half of 2022, signaling significant investment and job creation.

- January 2022: Zalando expands its product assortment to include Apple and Beats products, broadening its appeal and product offerings.

- February 2022: Amazon opens a new logistics center in Kaiserslautern, creating over 1,000 jobs and strengthening its German logistics network.

In-Depth Germany E-commerce Industry Market Outlook

The German e-commerce market is poised for continued growth, driven by technological innovation, changing consumer behavior, and increasing investment. Strategic partnerships, expansion into niche markets, and a focus on personalization will be key success factors. The market presents significant opportunities for both established players and new entrants, promising substantial long-term growth potential.

Germany E-commerce Industry Segmentation

-

1. Product category

- 1.1. Fashion & apparel

- 1.2. Electronics & media

- 1.3. Food & beverages

- 1.4. Furniture & home

- 1.5. Beauty & personal care

-

2. Region

- 2.1. Germany

- 2.2. Austria

- 2.3. Switzerland

Germany E-commerce Industry Segmentation By Geography

- 1. Germany

Germany E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend Towards Making Purchases Through Smartphones; High Internet Penetration to Boost Market Growth

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Rising Adoption of M-commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product category

- 5.1.1. Fashion & apparel

- 5.1.2. Electronics & media

- 5.1.3. Food & beverages

- 5.1.4. Furniture & home

- 5.1.5. Beauty & personal care

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. Austria

- 5.2.3. Switzerland

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product category

- 6. North Rhine-Westphalia Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Idealo Internet GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zalando SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Notebooksbilliger

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MediaMarkt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lidl Stiftung & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 eBay Kleinanzeigen

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amazon de

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 eBay de

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Otto GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thomann GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Idealo Internet GmbH

List of Figures

- Figure 1: Germany E-commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany E-commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Germany E-commerce Industry Revenue Million Forecast, by Product category 2019 & 2032

- Table 4: Germany E-commerce Industry Volume K Unit Forecast, by Product category 2019 & 2032

- Table 5: Germany E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Germany E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Germany E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: North Rhine-Westphalia Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North Rhine-Westphalia Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Bavaria Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Bavaria Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Baden-Württemberg Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Baden-Württemberg Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Lower Saxony Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Lower Saxony Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Hesse Germany E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Hesse Germany E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Germany E-commerce Industry Revenue Million Forecast, by Product category 2019 & 2032

- Table 22: Germany E-commerce Industry Volume K Unit Forecast, by Product category 2019 & 2032

- Table 23: Germany E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 24: Germany E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 25: Germany E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany E-commerce Industry?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the Germany E-commerce Industry?

Key companies in the market include Idealo Internet GmbH, Zalando SE, Notebooksbilliger, MediaMarkt, Lidl Stiftung & Co KG, eBay Kleinanzeigen, Amazon de, eBay de, Otto GmbH, Thomann GmbH.

3. What are the main segments of the Germany E-commerce Industry?

The market segments include Product category, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend Towards Making Purchases Through Smartphones; High Internet Penetration to Boost Market Growth.

6. What are the notable trends driving market growth?

Rising Adoption of M-commerce.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

February 2022 - Amazon announced opening a new German logistics center in Kaiserslautern, Rhineland-Palatinate, which is scheduled to start operations in autumn 2022. With the new logistics center, Amazon will create more than 1,000 attractive jobs within the first year of operation and offer competitive wages and benefits. Amazon continues to expand its German logistics network to meet customer demand and expand product selection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany E-commerce Industry?

To stay informed about further developments, trends, and reports in the Germany E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence