Key Insights

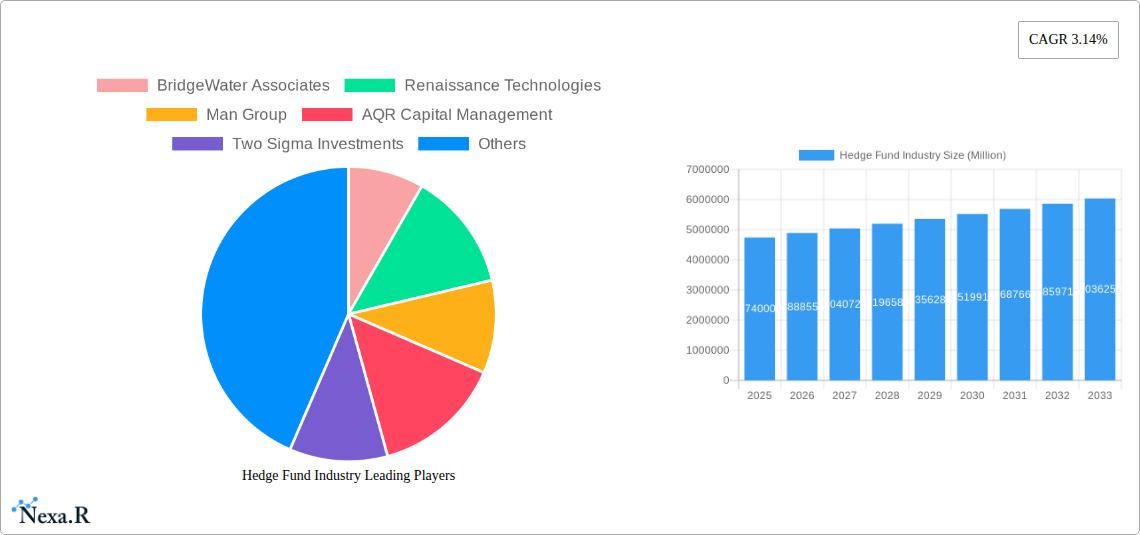

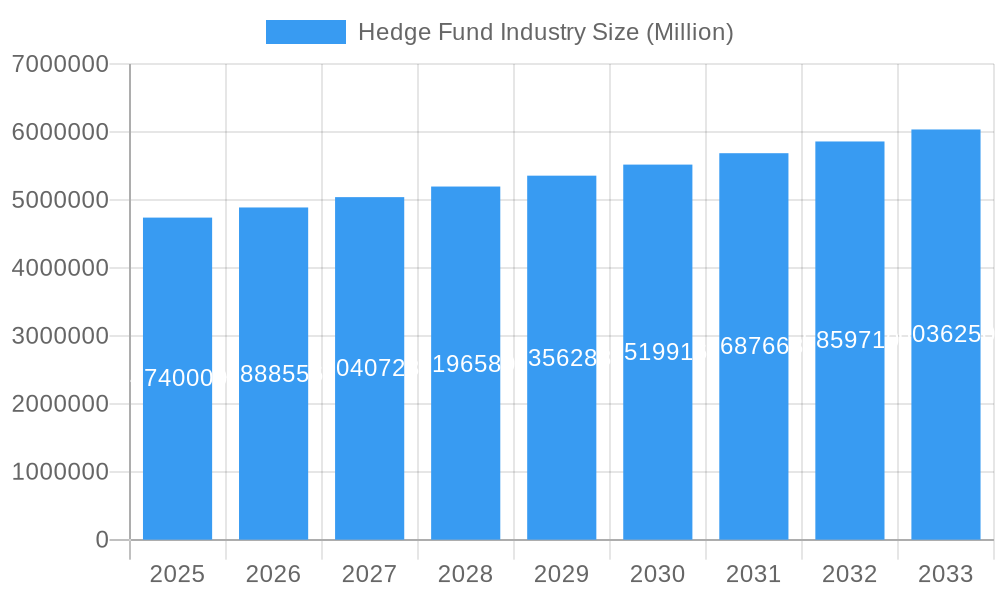

The global hedge fund industry, currently valued at $4.74 trillion (2025), is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.14% from 2025 to 2033. This growth is fueled by several key factors. Increasing investor interest in alternative investment strategies, seeking higher returns in volatile market conditions, is a significant driver. Technological advancements, particularly in artificial intelligence and machine learning, are enhancing investment strategies and operational efficiencies within the industry. Furthermore, the ongoing expansion of global financial markets and the rise of sophisticated investment products contribute to this upward trajectory. However, regulatory scrutiny and increased compliance costs represent considerable headwinds. Additionally, persistent market volatility and potential macroeconomic downturns pose challenges to sustained growth. The industry's segmentation includes various strategies, such as long-short equity, global macro, quantitative, and event-driven, each contributing differently to overall growth and attracting diverse investor profiles. Major players like Bridgewater Associates, Renaissance Technologies, and BlackRock Advisors dominate the market landscape, exhibiting significant influence over industry trends and investment decisions.

Hedge Fund Industry Market Size (In Million)

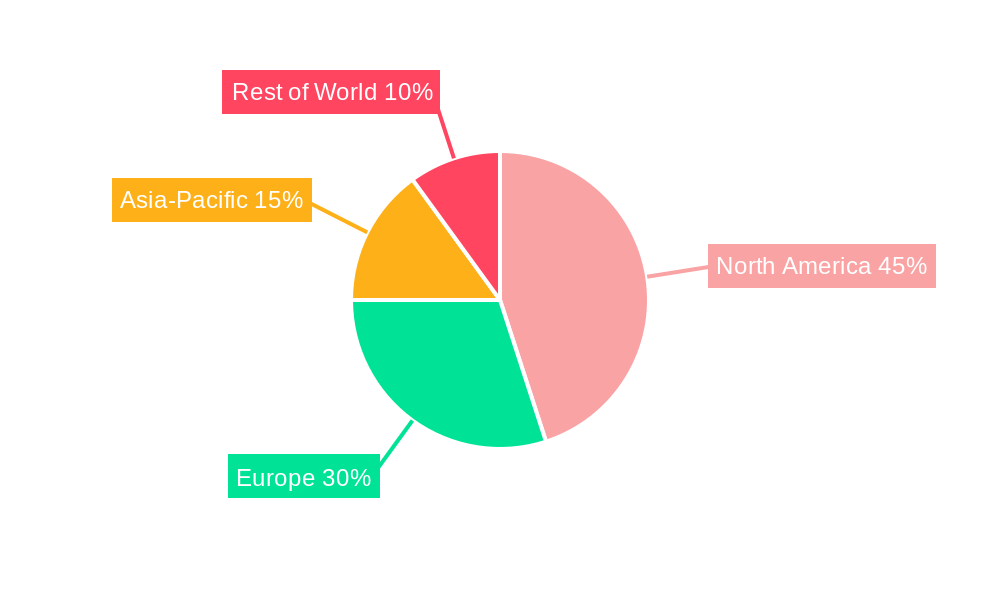

The competitive landscape is marked by both established giants and emerging boutique firms. Established firms benefit from extensive networks and proven track records, while newer players often leverage innovative technologies and specialized strategies to gain market share. Geographical diversification plays a vital role in the industry’s success, with North America and Europe retaining significant market shares while Asia-Pacific and other emerging regions contribute to steady growth. Sustained performance and risk management remain crucial factors determining the long-term success of hedge funds, as investor confidence is directly correlated to the industry's resilience and adaptability to changing market conditions. Future growth will likely depend on the industry's ability to innovate, adapt to regulatory changes, and consistently deliver attractive risk-adjusted returns.

Hedge Fund Industry Company Market Share

Hedge Fund Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Hedge Fund Industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) to project future market values in millions.

Hedge Fund Industry Market Dynamics & Structure

The global hedge fund industry, a dynamic and sophisticated sector of alternative investments, is projected to reach a substantial valuation of $XX million in 2024. This market is characterized by a discernible trend towards high market concentration, where a few prominent players manage a significant portion of assets. Simultaneously, the industry is a hotbed of technological innovation, with cutting-edge advancements reshaping investment strategies and operational efficiencies. Navigating this landscape requires a keen understanding of influential regulatory frameworks, particularly those emphasizing robust risk management and enhanced transparency. Furthermore, the hedge fund sector faces ongoing competitive pressure from a diverse array of alternative investment vehicles. Strategic mergers and acquisitions (M&A) continue to play a pivotal role in shaping the market's structure and competitive dynamics.

- Market Concentration: A select group of leading firms wield considerable influence, controlling a substantial percentage of the total assets under management (AUM). In 2024, the top 10 firms collectively account for approximately xx% of the global market share, underscoring the concentrated nature of the industry.

- Technological Innovation: The integration of technologies such as artificial intelligence (AI), machine learning, and big data analytics is revolutionizing how hedge funds approach investment strategies and enhance operational efficiency. While these advancements offer significant advantages, the substantial initial investment costs can present a formidable barrier to entry for smaller, emerging firms.

- Regulatory Framework: A complex web of stringent regulations, including but not limited to landmark legislation like Dodd-Frank and MiFID II, is in place to bolster transparency and safeguard against systemic risk. Adherence to these regulations necessitates significant compliance costs, representing a considerable operational expenditure for hedge fund managers.

- Competitive Substitutes: The hedge fund industry actively competes for investor capital with a range of other alternative asset classes, including private equity, venture capital, and real estate investment trusts (REITs). This competitive landscape presents ongoing challenges and opportunities for differentiation.

- End-User Demographics: The primary clientele for hedge funds comprises sophisticated investors. This includes high-net-worth individuals (HNWIs), large institutional investors such as pension funds and endowments, and influential sovereign wealth funds.

- M&A Trends: Consolidation remains a significant and ongoing trend within the hedge fund industry. Larger, established firms frequently acquire smaller players to achieve greater economies of scale, broaden their product offerings, and gain access to novel technologies and talent. In 2024, the market witnessed xx M&A deals, with a combined value of approximately $xx million, reflecting a sustained period of strategic consolidation.

Hedge Fund Industry Growth Trends & Insights

The hedge fund industry experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, driven by factors such as increasing investor interest in alternative investments, technological advancements leading to enhanced investment strategies, and the diversification of investment opportunities across various asset classes. Market penetration among HNWIs remains relatively high, but there is increasing demand from institutional investors. Adoption of new technologies, particularly in quantitative trading strategies, is a key growth driver. Consumer behavior shifts toward a greater focus on risk-adjusted returns and ESG (environmental, social, and governance) factors are influencing investment preferences. The market is projected to reach $xx million by 2033, with a projected CAGR of xx% during the forecast period.

Dominant Regions, Countries, or Segments in Hedge Fund Industry

The United States continues to assert its dominance as the preeminent region for the hedge fund industry, commanding an impressive xx% of the global market share in 2024. Following the US, Europe holds the second-largest share at xx%, with Asia emerging as a significant and rapidly growing market at xx%. The sustained leadership of the United States can be attributed to a confluence of powerful factors:

- Deep Capital Markets: The US boasts the world's most extensive and liquid capital markets. This robust infrastructure facilitates highly efficient capital allocation and enables the execution of sophisticated investment strategies.

- Regulatory Environment: While characterized by its stringency, the US regulatory environment offers a degree of stability and predictability, which can be attractive to both domestic and international investors seeking a well-defined operational framework.

- Talent Pool: The United States is home to an exceptionally deep and diverse talent pool of highly skilled investment professionals, including seasoned portfolio managers and cutting-edge quantitative analysts.

- Innovation Hub: Major innovation centers like Silicon Valley and New York City are at the forefront of financial technology (fintech) advancements, providing a fertile ground for the industry's continued growth and evolution.

Beyond these dominant regions, other geographical areas are exhibiting substantial growth potential. Asia, in particular, is a key focus, propelled by the burgeoning wealth of HNWIs and the increasing sophistication of institutional investors in countries such as China and Singapore.

Hedge Fund Industry Product Landscape

Hedge funds offer a diverse array of investment strategies, from long/short equity and global macro to quantitative strategies and distressed debt. Product innovation focuses on leveraging advanced technologies (AI, machine learning) to enhance portfolio construction, risk management, and trade execution. The emphasis is shifting toward strategies with lower correlations to traditional markets and higher risk-adjusted returns. Unique selling propositions often revolve around specialized expertise, proprietary technology, and consistent performance track records.

Key Drivers, Barriers & Challenges in Hedge Fund Industry

Key Drivers: The sustained growth of the hedge fund industry is being propelled by several powerful forces. These include significant technological advancements, particularly in AI and machine learning, a rising global demand for alternative investments from investors seeking diversification and enhanced returns, and the continuous expansion of the HNWI population worldwide. Furthermore, the increasing globalization of financial markets and strategic expansion into emerging economies present considerable new opportunities for capital deployment and client acquisition.

Key Challenges: Despite the positive drivers, the industry confronts significant hurdles. Navigating complex and ever-evolving regulatory compliance costs remains a primary concern. The environment is marked by intense competition from both established and emerging players, as well as from other asset classes. Periods of heightened market volatility can also pose substantial challenges to performance and investor confidence. Emerging threats such as sophisticated cybersecurity risks and the ongoing imperative for talent retention are also critical considerations for hedge fund managers.

Emerging Opportunities in Hedge Fund Industry

Untapped markets in emerging economies, the rise of ESG investing, and the increasing application of alternative data sources present significant opportunities. Furthermore, the development of innovative strategies that leverage AI and machine learning to identify arbitrage opportunities and manage risk effectively will be crucial for future growth.

Growth Accelerators in the Hedge Fund Industry

The future growth trajectory of the hedge fund industry is poised to be significantly accelerated by continued technological breakthroughs. Innovations in areas like AI, blockchain technology, and advanced big data analytics are set to unlock new avenues for alpha generation and operational efficiency. Cultivating strategic partnerships with leading fintech companies will be crucial for enhancing operational capabilities, expanding data intelligence, and accessing novel technological solutions. Furthermore, expanding into new geographic markets and adeptly developing innovative investment strategies that cater to the evolving preferences and risk appetites of investors will be paramount for achieving sustainable long-term growth.

Key Players Shaping the Hedge Fund Industry Market

- Bridgewater Associates

- Renaissance Technologies

- Man Group

- AQR Capital Management

- Two Sigma Investments

- Millennium Management

- Elliott Management

- BlackRock Advisors

- Citadel

- Davidson Kempner Capital

- List Not Exhaustive

Notable Milestones in Hedge Fund Industry Sector

- November 2022: BlackRock Alternatives acquired Jupiter Power LLC, expanding its presence in the renewable energy sector. This highlights the increasing interest of large financial institutions in sustainable investments.

- August 2022: Two Sigma's acquisition of Hivemind Software demonstrates the ongoing trend of incorporating advanced technologies into investment strategies to enhance data processing and analysis capabilities.

In-Depth Hedge Fund Industry Market Outlook

The future of the hedge fund industry is marked by continuous technological innovation, increased regulatory scrutiny, and a growing emphasis on ESG considerations. Strategic partnerships, expansion into untapped markets, and the development of sophisticated risk management strategies will be crucial for success. The industry's long-term growth potential remains strong, driven by the enduring demand for alternative investment solutions and the continuous evolution of investment strategies. The market is poised for significant expansion, particularly in regions with burgeoning wealth and rapidly developing capital markets.

Hedge Fund Industry Segmentation

-

1. Core Strategy

- 1.1. Equity Strategies

- 1.2. Macro Strategies

- 1.3. Event Driven Strategies

- 1.4. Credit Strategies

- 1.5. Relative Value Strategies

- 1.6. Niche Strategies

- 1.7. Multi-Strategy

- 1.8. Managed Futures/CTA Strategies

-

2. Manager Location

-

2.1. North America

- 2.1.1. United states

- 2.1.2. Canada

- 2.1.3. Mexico

-

2.2. Europe

- 2.2.1. United Kingdom

- 2.2.2. Sweden

- 2.2.3. France

- 2.2.4. Switzerland

- 2.2.5. Rest of Europe

-

2.3. Asia-Pacific

- 2.3.1. Hong Kong

- 2.3.2. Australia

- 2.3.3. Rest of Asia-Pacific

-

2.4. Latin America

- 2.4.1. Brazil

- 2.4.2. Rest of Latin America

-

2.5. Middle East and Africa

- 2.5.1. United Arab Emirates

- 2.5.2. Saudi Arabia

- 2.5.3. Rest of Middle East and Africa

-

2.1. North America

Hedge Fund Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hedge Fund Industry Regional Market Share

Geographic Coverage of Hedge Fund Industry

Hedge Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emerging Demand for Smaller or Newer Fund Managers; Recovering Performance of Existing Hedge Funds

- 3.3. Market Restrains

- 3.3.1. Emerging Demand for Smaller or Newer Fund Managers; Recovering Performance of Existing Hedge Funds

- 3.4. Market Trends

- 3.4.1. Investments in Digital Assets is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Core Strategy

- 5.1.1. Equity Strategies

- 5.1.2. Macro Strategies

- 5.1.3. Event Driven Strategies

- 5.1.4. Credit Strategies

- 5.1.5. Relative Value Strategies

- 5.1.6. Niche Strategies

- 5.1.7. Multi-Strategy

- 5.1.8. Managed Futures/CTA Strategies

- 5.2. Market Analysis, Insights and Forecast - by Manager Location

- 5.2.1. North America

- 5.2.1.1. United states

- 5.2.1.2. Canada

- 5.2.1.3. Mexico

- 5.2.2. Europe

- 5.2.2.1. United Kingdom

- 5.2.2.2. Sweden

- 5.2.2.3. France

- 5.2.2.4. Switzerland

- 5.2.2.5. Rest of Europe

- 5.2.3. Asia-Pacific

- 5.2.3.1. Hong Kong

- 5.2.3.2. Australia

- 5.2.3.3. Rest of Asia-Pacific

- 5.2.4. Latin America

- 5.2.4.1. Brazil

- 5.2.4.2. Rest of Latin America

- 5.2.5. Middle East and Africa

- 5.2.5.1. United Arab Emirates

- 5.2.5.2. Saudi Arabia

- 5.2.5.3. Rest of Middle East and Africa

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Core Strategy

- 6. North America Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Core Strategy

- 6.1.1. Equity Strategies

- 6.1.2. Macro Strategies

- 6.1.3. Event Driven Strategies

- 6.1.4. Credit Strategies

- 6.1.5. Relative Value Strategies

- 6.1.6. Niche Strategies

- 6.1.7. Multi-Strategy

- 6.1.8. Managed Futures/CTA Strategies

- 6.2. Market Analysis, Insights and Forecast - by Manager Location

- 6.2.1. North America

- 6.2.1.1. United states

- 6.2.1.2. Canada

- 6.2.1.3. Mexico

- 6.2.2. Europe

- 6.2.2.1. United Kingdom

- 6.2.2.2. Sweden

- 6.2.2.3. France

- 6.2.2.4. Switzerland

- 6.2.2.5. Rest of Europe

- 6.2.3. Asia-Pacific

- 6.2.3.1. Hong Kong

- 6.2.3.2. Australia

- 6.2.3.3. Rest of Asia-Pacific

- 6.2.4. Latin America

- 6.2.4.1. Brazil

- 6.2.4.2. Rest of Latin America

- 6.2.5. Middle East and Africa

- 6.2.5.1. United Arab Emirates

- 6.2.5.2. Saudi Arabia

- 6.2.5.3. Rest of Middle East and Africa

- 6.2.1. North America

- 6.1. Market Analysis, Insights and Forecast - by Core Strategy

- 7. South America Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Core Strategy

- 7.1.1. Equity Strategies

- 7.1.2. Macro Strategies

- 7.1.3. Event Driven Strategies

- 7.1.4. Credit Strategies

- 7.1.5. Relative Value Strategies

- 7.1.6. Niche Strategies

- 7.1.7. Multi-Strategy

- 7.1.8. Managed Futures/CTA Strategies

- 7.2. Market Analysis, Insights and Forecast - by Manager Location

- 7.2.1. North America

- 7.2.1.1. United states

- 7.2.1.2. Canada

- 7.2.1.3. Mexico

- 7.2.2. Europe

- 7.2.2.1. United Kingdom

- 7.2.2.2. Sweden

- 7.2.2.3. France

- 7.2.2.4. Switzerland

- 7.2.2.5. Rest of Europe

- 7.2.3. Asia-Pacific

- 7.2.3.1. Hong Kong

- 7.2.3.2. Australia

- 7.2.3.3. Rest of Asia-Pacific

- 7.2.4. Latin America

- 7.2.4.1. Brazil

- 7.2.4.2. Rest of Latin America

- 7.2.5. Middle East and Africa

- 7.2.5.1. United Arab Emirates

- 7.2.5.2. Saudi Arabia

- 7.2.5.3. Rest of Middle East and Africa

- 7.2.1. North America

- 7.1. Market Analysis, Insights and Forecast - by Core Strategy

- 8. Europe Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Core Strategy

- 8.1.1. Equity Strategies

- 8.1.2. Macro Strategies

- 8.1.3. Event Driven Strategies

- 8.1.4. Credit Strategies

- 8.1.5. Relative Value Strategies

- 8.1.6. Niche Strategies

- 8.1.7. Multi-Strategy

- 8.1.8. Managed Futures/CTA Strategies

- 8.2. Market Analysis, Insights and Forecast - by Manager Location

- 8.2.1. North America

- 8.2.1.1. United states

- 8.2.1.2. Canada

- 8.2.1.3. Mexico

- 8.2.2. Europe

- 8.2.2.1. United Kingdom

- 8.2.2.2. Sweden

- 8.2.2.3. France

- 8.2.2.4. Switzerland

- 8.2.2.5. Rest of Europe

- 8.2.3. Asia-Pacific

- 8.2.3.1. Hong Kong

- 8.2.3.2. Australia

- 8.2.3.3. Rest of Asia-Pacific

- 8.2.4. Latin America

- 8.2.4.1. Brazil

- 8.2.4.2. Rest of Latin America

- 8.2.5. Middle East and Africa

- 8.2.5.1. United Arab Emirates

- 8.2.5.2. Saudi Arabia

- 8.2.5.3. Rest of Middle East and Africa

- 8.2.1. North America

- 8.1. Market Analysis, Insights and Forecast - by Core Strategy

- 9. Middle East & Africa Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Core Strategy

- 9.1.1. Equity Strategies

- 9.1.2. Macro Strategies

- 9.1.3. Event Driven Strategies

- 9.1.4. Credit Strategies

- 9.1.5. Relative Value Strategies

- 9.1.6. Niche Strategies

- 9.1.7. Multi-Strategy

- 9.1.8. Managed Futures/CTA Strategies

- 9.2. Market Analysis, Insights and Forecast - by Manager Location

- 9.2.1. North America

- 9.2.1.1. United states

- 9.2.1.2. Canada

- 9.2.1.3. Mexico

- 9.2.2. Europe

- 9.2.2.1. United Kingdom

- 9.2.2.2. Sweden

- 9.2.2.3. France

- 9.2.2.4. Switzerland

- 9.2.2.5. Rest of Europe

- 9.2.3. Asia-Pacific

- 9.2.3.1. Hong Kong

- 9.2.3.2. Australia

- 9.2.3.3. Rest of Asia-Pacific

- 9.2.4. Latin America

- 9.2.4.1. Brazil

- 9.2.4.2. Rest of Latin America

- 9.2.5. Middle East and Africa

- 9.2.5.1. United Arab Emirates

- 9.2.5.2. Saudi Arabia

- 9.2.5.3. Rest of Middle East and Africa

- 9.2.1. North America

- 9.1. Market Analysis, Insights and Forecast - by Core Strategy

- 10. Asia Pacific Hedge Fund Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Core Strategy

- 10.1.1. Equity Strategies

- 10.1.2. Macro Strategies

- 10.1.3. Event Driven Strategies

- 10.1.4. Credit Strategies

- 10.1.5. Relative Value Strategies

- 10.1.6. Niche Strategies

- 10.1.7. Multi-Strategy

- 10.1.8. Managed Futures/CTA Strategies

- 10.2. Market Analysis, Insights and Forecast - by Manager Location

- 10.2.1. North America

- 10.2.1.1. United states

- 10.2.1.2. Canada

- 10.2.1.3. Mexico

- 10.2.2. Europe

- 10.2.2.1. United Kingdom

- 10.2.2.2. Sweden

- 10.2.2.3. France

- 10.2.2.4. Switzerland

- 10.2.2.5. Rest of Europe

- 10.2.3. Asia-Pacific

- 10.2.3.1. Hong Kong

- 10.2.3.2. Australia

- 10.2.3.3. Rest of Asia-Pacific

- 10.2.4. Latin America

- 10.2.4.1. Brazil

- 10.2.4.2. Rest of Latin America

- 10.2.5. Middle East and Africa

- 10.2.5.1. United Arab Emirates

- 10.2.5.2. Saudi Arabia

- 10.2.5.3. Rest of Middle East and Africa

- 10.2.1. North America

- 10.1. Market Analysis, Insights and Forecast - by Core Strategy

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BridgeWater Associates

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renaissance Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Man Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AQR Capital Management

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Two Sigma Investments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Millennium Management

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elliot Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BlackRock Advisors

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Citadel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Davidson Kempner Capital**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BridgeWater Associates

List of Figures

- Figure 1: Global Hedge Fund Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Hedge Fund Industry Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 4: North America Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 5: North America Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 6: North America Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 7: North America Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 8: North America Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 9: North America Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 10: North America Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 11: North America Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 16: South America Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 17: South America Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 18: South America Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 19: South America Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 20: South America Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 21: South America Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 22: South America Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 23: South America Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 25: South America Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 28: Europe Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 29: Europe Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 30: Europe Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 31: Europe Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 32: Europe Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 33: Europe Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 34: Europe Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 35: Europe Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 37: Europe Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 40: Middle East & Africa Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 41: Middle East & Africa Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 42: Middle East & Africa Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 43: Middle East & Africa Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 44: Middle East & Africa Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 45: Middle East & Africa Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 46: Middle East & Africa Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 47: Middle East & Africa Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Hedge Fund Industry Revenue (Million), by Core Strategy 2025 & 2033

- Figure 52: Asia Pacific Hedge Fund Industry Volume (Trillion), by Core Strategy 2025 & 2033

- Figure 53: Asia Pacific Hedge Fund Industry Revenue Share (%), by Core Strategy 2025 & 2033

- Figure 54: Asia Pacific Hedge Fund Industry Volume Share (%), by Core Strategy 2025 & 2033

- Figure 55: Asia Pacific Hedge Fund Industry Revenue (Million), by Manager Location 2025 & 2033

- Figure 56: Asia Pacific Hedge Fund Industry Volume (Trillion), by Manager Location 2025 & 2033

- Figure 57: Asia Pacific Hedge Fund Industry Revenue Share (%), by Manager Location 2025 & 2033

- Figure 58: Asia Pacific Hedge Fund Industry Volume Share (%), by Manager Location 2025 & 2033

- Figure 59: Asia Pacific Hedge Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Hedge Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 61: Asia Pacific Hedge Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Hedge Fund Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 2: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 3: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 4: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 5: Global Hedge Fund Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Hedge Fund Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 8: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 9: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 10: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 11: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 20: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 21: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 22: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 23: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Brazil Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 32: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 33: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 34: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 35: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Germany Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: France Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Italy Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Spain Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Russia Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 56: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 57: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 58: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 59: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Turkey Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Israel Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: GCC Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Global Hedge Fund Industry Revenue Million Forecast, by Core Strategy 2020 & 2033

- Table 74: Global Hedge Fund Industry Volume Trillion Forecast, by Core Strategy 2020 & 2033

- Table 75: Global Hedge Fund Industry Revenue Million Forecast, by Manager Location 2020 & 2033

- Table 76: Global Hedge Fund Industry Volume Trillion Forecast, by Manager Location 2020 & 2033

- Table 77: Global Hedge Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Hedge Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 79: China Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: India Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Japan Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Hedge Fund Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Hedge Fund Industry Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hedge Fund Industry?

The projected CAGR is approximately 3.14%.

2. Which companies are prominent players in the Hedge Fund Industry?

Key companies in the market include BridgeWater Associates, Renaissance Technologies, Man Group, AQR Capital Management, Two Sigma Investments, Millennium Management, Elliot Management, BlackRock Advisors, Citadel, Davidson Kempner Capital**List Not Exhaustive.

3. What are the main segments of the Hedge Fund Industry?

The market segments include Core Strategy, Manager Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Emerging Demand for Smaller or Newer Fund Managers; Recovering Performance of Existing Hedge Funds.

6. What are the notable trends driving market growth?

Investments in Digital Assets is Driving the Market.

7. Are there any restraints impacting market growth?

Emerging Demand for Smaller or Newer Fund Managers; Recovering Performance of Existing Hedge Funds.

8. Can you provide examples of recent developments in the market?

November 2022: BlackRock Alternatives (BlackRock), through a fund managed by its diversified infrastructure business, agreed to acquire Jupiter Power LLC (Jupiter). Jupiter Power is a leading United States operator and developer of stand-alone, utility-scale battery energy storage systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hedge Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hedge Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hedge Fund Industry?

To stay informed about further developments, trends, and reports in the Hedge Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence