Key Insights

The global Homeopathic Medicine market is projected for robust expansion, anticipating a market size of 8.97 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 13.11%. This growth is fueled by increasing consumer preference for natural and holistic healthcare, seeking alternatives to conventional pharmaceuticals due to concerns about side effects. The rising prevalence of chronic conditions further propels demand, with homeopathic remedies offering complementary symptom relief and promoting overall well-being. Supportive government initiatives and growing acceptance of alternative medicine also contribute significantly to market growth. The "Others" application segment, covering general wellness and preventative care, is expected to see substantial expansion as consumers adopt a more proactive health approach.

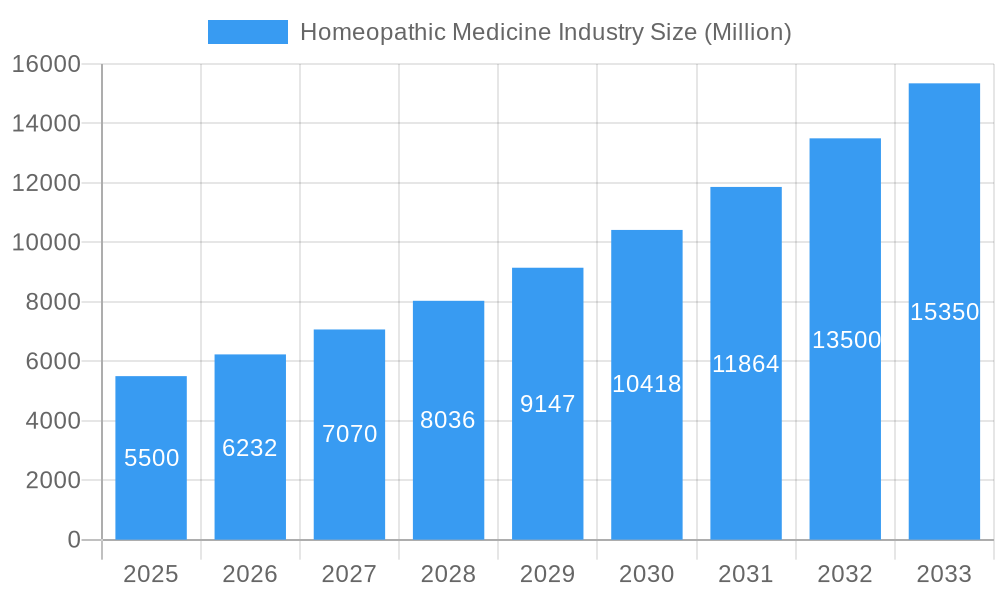

Homeopathic Medicine Industry Market Size (In Billion)

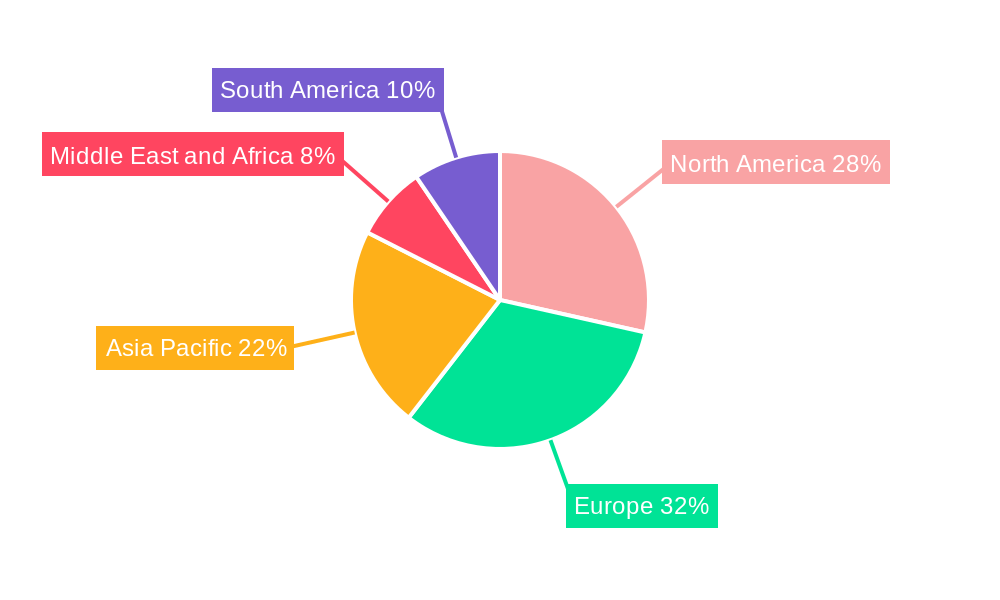

The market encompasses diverse product types such as tinctures, dilutions, and tablets, designed to meet specific consumer needs. Innovations in formulation and delivery are expected to improve accessibility and efficacy. Challenges include ongoing debates regarding scientific efficacy and stringent regulatory frameworks. However, expanding research into homeopathic principles and a growing number of practitioners are building credibility. Geographically, North America and Europe currently lead market share, but the Asia Pacific region presents a significant growth opportunity due to its rich traditional medicine heritage and a growing middle class. Key players such as Boiron, Dr. Willmar Schwabe, and Biologische Heilmittel Heel GmbH are actively investing in R&D and global expansion to leverage these evolving market dynamics.

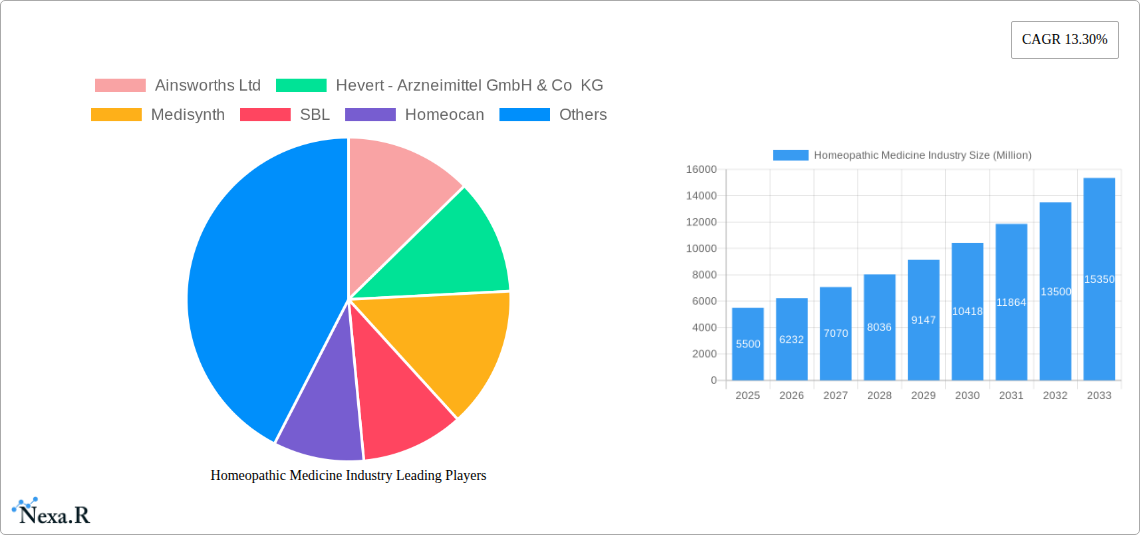

Homeopathic Medicine Industry Company Market Share

Homeopathic Medicine Industry Report: Market Analysis, Growth Trends, and Future Outlook (2019–2033)

This comprehensive report provides an in-depth analysis of the global Homeopathic Medicine Industry, offering critical insights into market dynamics, growth trajectories, regional dominance, product landscapes, and key player strategies. Covering the historical period from 2019 to 2024 and forecasting through 2033, with a base and estimated year of 2025, this study is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this evolving sector. Our analysis integrates high-traffic keywords, parent-child market segmentation, and quantitative data to maximize search visibility and deliver actionable intelligence. All values are presented in Million units for clarity and ease of comparison.

Homeopathic Medicine Industry Market Dynamics & Structure

The Homeopathic Medicine Industry exhibits a moderately concentrated market structure, characterized by a mix of established global players and numerous regional manufacturers. Technological innovation is a significant driver, focusing on advanced extraction techniques, novel product formulations, and personalized medicine approaches. However, stringent regulatory frameworks in many developed nations act as a considerable barrier to entry and product approval, influencing market dynamics and fostering a complex approval process. Competitive product substitutes, primarily from conventional pharmaceuticals and other complementary and alternative medicine (CAM) therapies, continuously challenge market share. End-user demographics are shifting towards a growing segment of health-conscious consumers, particularly millennials and Gen Z, who are increasingly seeking natural and holistic treatment options. Mergers and acquisitions (M&A) trends indicate strategic consolidation, with larger companies acquiring smaller, innovative firms to expand their product portfolios and market reach. For instance, recent M&A activities have focused on integrating advanced manufacturing processes and digital health platforms. Market Share Distribution: Leading players hold approximately 35-45% of the global market share, with the remaining distributed among medium and small-sized enterprises. Innovation Barriers: High research and development costs, lengthy clinical trial periods, and inconsistent scientific validation are key challenges.

Homeopathic Medicine Industry Growth Trends & Insights

The global Homeopathic Medicine Industry is poised for robust growth, driven by a confluence of factors including increasing consumer preference for natural healthcare solutions, growing awareness of homeopathy's therapeutic benefits, and supportive government initiatives in emerging economies. The market size is projected to expand at a significant Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033. This growth is underpinned by rising adoption rates of homeopathic remedies across diverse therapeutic areas, particularly for chronic conditions and preventive healthcare. Technological disruptions, such as advancements in homeopathic potency standardization and enhanced product bioavailability, are further fueling market penetration. Consumer behavior shifts are evident, with a discernible move away from synthetic drugs towards holistic and personalized treatment modalities, leading to a surge in demand for organic and ethically sourced homeopathic products. Market Penetration: Expected to grow from 18% in 2025 to over 25% by 2033 in key markets. Consumer Preferences: An increasing emphasis on patient empowerment and self-care is driving the adoption of over-the-counter homeopathic products. Technological Advancements: Innovations in extraction and dilution processes are improving the efficacy and consistency of homeopathic preparations. Market Size Evolution: The global market is estimated to reach $15,500 million by 2025 and is projected to exceed $25,000 million by 2033.

Dominant Regions, Countries, or Segments in Homeopathic Medicine Industry

The Plants source segment is a dominant force within the Homeopathic Medicine Industry, driven by the inherent appeal of natural remedies and the widespread availability of medicinal plants globally. This segment consistently captures a significant market share due to the perceived safety and efficacy of plant-derived homeopathic preparations across various applications. Product Type Dominance: Within product types, Dilutions represent a substantial segment, offering versatility and broad applicability for a wide range of ailments. Application Dominance: The Analgesic and Antipyretic application segment showcases strong market growth, fueled by the demand for natural pain relief and fever management solutions as alternatives to conventional painkillers. Regional Leadership: Europe, particularly Germany, holds a commanding position in the global market due to a long-standing tradition of homeopathy, robust regulatory support, and a highly informed consumer base. The presence of key manufacturers and a well-established distribution network further solidify its dominance. Country-Specific Drivers: In India, the government's recognition and promotion of traditional medicine, including homeopathy, have led to rapid market expansion. The country's large population and increasing healthcare expenditure contribute significantly to this growth. Market Share within Segments: Plants source segment holds an estimated 55% of the total market. Dilutions product type accounts for approximately 30% of the market share. Analgesic and Antipyretic applications are projected to grow at a CAGR of 7.5% through 2033.

Homeopathic Medicine Industry Product Landscape

The Homeopathic Medicine Industry's product landscape is characterized by a diverse range of formulations designed to address various health concerns. Tinctures and Dilutions remain foundational, offering concentrated and highly diluted forms of natural substances respectively, suitable for a wide spectrum of acute and chronic conditions. Tablets and capsules provide convenient and palatable dosage forms, catering to ease of administration. Innovations are focused on enhancing the bioavailability and therapeutic efficacy of existing remedies, alongside the development of novel formulations derived from an expanded array of plant, animal, and mineral sources. Unique selling propositions often revolve around the natural origin, gentle action, and personalized treatment potential of homeopathic products, appealing to consumers seeking alternatives to conventional pharmaceuticals.

Key Drivers, Barriers & Challenges in Homeopathic Medicine Industry

The Homeopathic Medicine Industry is propelled by several key drivers. Foremost is the growing consumer demand for natural, holistic, and personalized healthcare solutions, coupled with increasing awareness and acceptance of homeopathy as a viable treatment option. Supportive government policies and recognition of homeopathy in certain regions, alongside technological advancements in product development and manufacturing, also act as significant catalysts. The inherent belief in the gentle yet effective nature of these remedies further fuels adoption.

Conversely, significant barriers and challenges impede market expansion. The most prominent is the ongoing scientific debate and lack of universally accepted empirical evidence for homeopathy's efficacy, leading to regulatory hurdles and skepticism from the medical establishment. Stringent regulatory approvals in many developed countries, coupled with high research and development costs, create substantial market entry barriers. Intense competition from conventional pharmaceuticals and other alternative therapies, as well as supply chain complexities for sourcing raw materials, also present considerable challenges.

Emerging Opportunities in Homeopathic Medicine Industry

Emerging opportunities in the Homeopathic Medicine Industry lie in the growing trend of personalized medicine, where homeopathic practitioners tailor treatments to individual patient profiles. The untapped potential in emerging economies with increasing disposable incomes and a growing interest in natural health solutions presents significant market expansion prospects. Furthermore, innovative applications in areas like mental health, chronic disease management, and preventive care, supported by advancements in scientific research and educational initiatives for healthcare professionals, are poised to drive future growth. The development of specialized homeopathic formulations for niche conditions and the integration of digital health platforms for remote consultations and patient monitoring also represent promising avenues.

Growth Accelerators in the Homeopathic Medicine Industry Industry

Several factors are accelerating the long-term growth of the Homeopathic Medicine Industry. Technological breakthroughs in understanding the mechanisms of action of homeopathic remedies, coupled with more rigorous scientific validation, are crucial. Strategic partnerships between homeopathic manufacturers, research institutions, and healthcare providers are fostering greater integration into mainstream healthcare. Market expansion strategies targeting unmet needs in chronic disease management and preventive healthcare, alongside increased consumer education and awareness campaigns highlighting the benefits and safety of homeopathic treatments, will significantly boost market penetration.

Key Players Shaping the Homeopathic Medicine Industry Market

- Ainsworths Ltd

- Hevert - Arzneimittel GmbH & Co KG

- Medisynth

- SBL

- Homeocan

- Dr Reckeweg & Co

- A Nelson & Co Ltd

- Powell Laboratories Pvt Ltd

- Biologische Heilmittel Heel GmbH

- Boiron

- Dr Willmar Schwabe GmbH & Co KG

- Hahnemann Laboratories

Notable Milestones in Homeopathic Medicine Industry Sector

- August 2022: The Academy of Homeopathy Education partnered with the American Institute of Homeopathy (AIH) to launch Acute Care Homeopathy course for medical professionals in a hybrid model. The customized educational program enhances medical professionals' practice and expands the treatment tools available with acute care homeopathy. In the course, participants will learn safe and effective ways to manage pain and mitigate antibiotic overuse with FDA-regulated and approved Homeopathic remedies.

- April 2022: Kaps3 Lifesciences Pvt Ltd., headquartered in Gujarat, India, launched its 'Kaps3 Homeopathy Division' to support the growing demand for homeopathy products in the country.

In-Depth Homeopathic Medicine Industry Market Outlook

The future market potential of the Homeopathic Medicine Industry is exceptionally bright, driven by the persistent global shift towards natural and holistic healthcare. Growth accelerators include advancements in scientific research that are steadily validating homeopathic principles, coupled with strategic alliances that are integrating these therapies into conventional medical practices. Untapped markets in developing regions and innovative applications for chronic and lifestyle-related diseases present substantial opportunities for market expansion. The industry's ability to adapt to evolving consumer preferences for personalized and sustainable health solutions will be key to its continued success and significant market penetration in the coming years.

Homeopathic Medicine Industry Segmentation

-

1. Product Type

- 1.1. Tincture

- 1.2. Dilutions

- 1.3. Tablets

- 1.4. Others

-

2. Application

- 2.1. Analgesic and Antipyretic

- 2.2. Respiratory

- 2.3. Neurology

- 2.4. Others

-

3. Source

- 3.1. Plants

- 3.2. Animals

- 3.3. Minerals

Homeopathic Medicine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Homeopathic Medicine Industry Regional Market Share

Geographic Coverage of Homeopathic Medicine Industry

Homeopathic Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1199999999999% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness Regarding the Homeopathy Medicine; Rising Prevalence of Lifestyle-Associated Diseases

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about Homeopathic Products

- 3.4. Market Trends

- 3.4.1. Dilutions Segment is Expected to Hold a Significant Market Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tincture

- 5.1.2. Dilutions

- 5.1.3. Tablets

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Analgesic and Antipyretic

- 5.2.2. Respiratory

- 5.2.3. Neurology

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Source

- 5.3.1. Plants

- 5.3.2. Animals

- 5.3.3. Minerals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tincture

- 6.1.2. Dilutions

- 6.1.3. Tablets

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Analgesic and Antipyretic

- 6.2.2. Respiratory

- 6.2.3. Neurology

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Source

- 6.3.1. Plants

- 6.3.2. Animals

- 6.3.3. Minerals

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tincture

- 7.1.2. Dilutions

- 7.1.3. Tablets

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Analgesic and Antipyretic

- 7.2.2. Respiratory

- 7.2.3. Neurology

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Source

- 7.3.1. Plants

- 7.3.2. Animals

- 7.3.3. Minerals

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tincture

- 8.1.2. Dilutions

- 8.1.3. Tablets

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Analgesic and Antipyretic

- 8.2.2. Respiratory

- 8.2.3. Neurology

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Source

- 8.3.1. Plants

- 8.3.2. Animals

- 8.3.3. Minerals

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tincture

- 9.1.2. Dilutions

- 9.1.3. Tablets

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Analgesic and Antipyretic

- 9.2.2. Respiratory

- 9.2.3. Neurology

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Source

- 9.3.1. Plants

- 9.3.2. Animals

- 9.3.3. Minerals

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Tincture

- 10.1.2. Dilutions

- 10.1.3. Tablets

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Analgesic and Antipyretic

- 10.2.2. Respiratory

- 10.2.3. Neurology

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Source

- 10.3.1. Plants

- 10.3.2. Animals

- 10.3.3. Minerals

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ainsworths Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hevert - Arzneimittel GmbH & Co KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medisynth

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SBL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Homeocan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dr Reckeweg & Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A Nelson & Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Powell Laboratories Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biologische Heilmittel Heel GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boiron

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dr Willmar Schwabe GmbH & Co KG*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hahnemann Laboratories

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Ainsworths Ltd

List of Figures

- Figure 1: Global Homeopathic Medicine Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 7: North America Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 8: North America Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 15: Europe Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 16: Europe Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 23: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 24: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 31: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 32: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: South America Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 39: South America Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 40: South America Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 4: Global Homeopathic Medicine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 8: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 15: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 25: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 35: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 40: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 42: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Homeopathic Medicine Industry?

The projected CAGR is approximately 13.1199999999999%.

2. Which companies are prominent players in the Homeopathic Medicine Industry?

Key companies in the market include Ainsworths Ltd, Hevert - Arzneimittel GmbH & Co KG, Medisynth, SBL, Homeocan, Dr Reckeweg & Co, A Nelson & Co Ltd, Powell Laboratories Pvt Ltd, Biologische Heilmittel Heel GmbH, Boiron, Dr Willmar Schwabe GmbH & Co KG*List Not Exhaustive, Hahnemann Laboratories.

3. What are the main segments of the Homeopathic Medicine Industry?

The market segments include Product Type, Application, Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness Regarding the Homeopathy Medicine; Rising Prevalence of Lifestyle-Associated Diseases.

6. What are the notable trends driving market growth?

Dilutions Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness about Homeopathic Products.

8. Can you provide examples of recent developments in the market?

August 2022: the Academy of Homeopathy Education partnered with the American Institute of Homeopathy (AIH) to launch Acute Care Homeopathy course for medical professionals in a hybrid model. The customized educational program enhances medical professionals' practice and expands the treatment tools available with acute care homeopathy. In the course, participants will learn safe and effective ways to manage pain and mitigate antibiotic overuse with FDA-regulated and approved Homeopathic remedies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Homeopathic Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Homeopathic Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Homeopathic Medicine Industry?

To stay informed about further developments, trends, and reports in the Homeopathic Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence