Key Insights

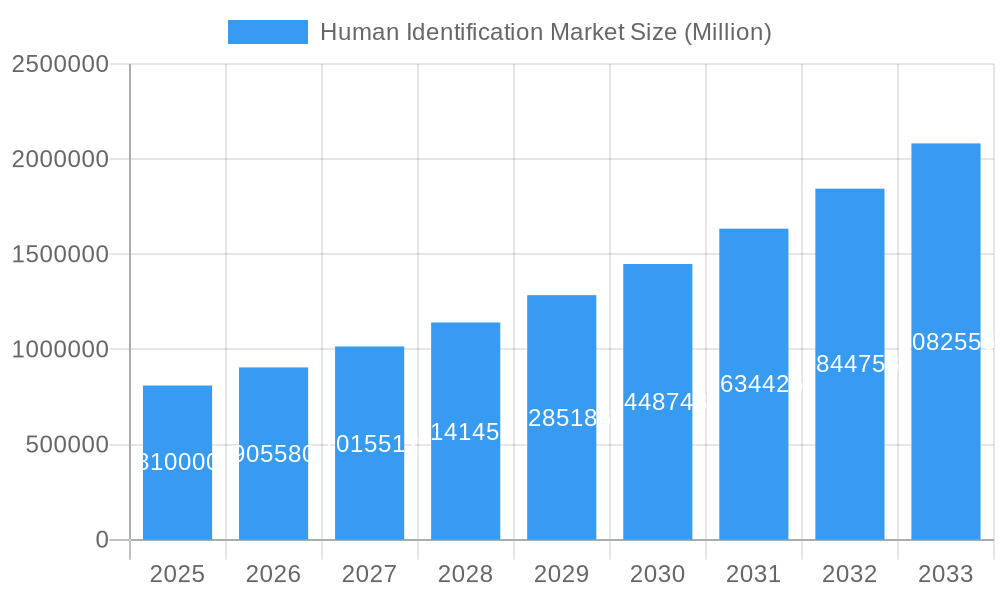

The global Human Identification Market is poised for substantial expansion, projected to reach $0.81 million by 2025, and is anticipated to experience robust growth with a Compound Annual Growth Rate (CAGR) of 11.64% during the forecast period of 2025-2033. This impressive growth trajectory is propelled by a confluence of factors, primarily the increasing demand for advanced DNA analysis in forensic investigations, the rising prevalence of genetic disorders necessitating accurate identification, and the expanding applications in paternity testing and disaster victim identification. Technological advancements, particularly in Polymerase Chain Reaction (PCR) and Next Generation Sequencing (NGS), are significantly enhancing the speed, accuracy, and efficiency of human identification processes, thereby driving market adoption. Furthermore, the growing emphasis on personalized medicine and the increasing investment in research and development by key market players are further fueling this upward trend. The market's value is denominated in millions, underscoring the significant economic activity within this sector.

Human Identification Market Market Size (In Billion)

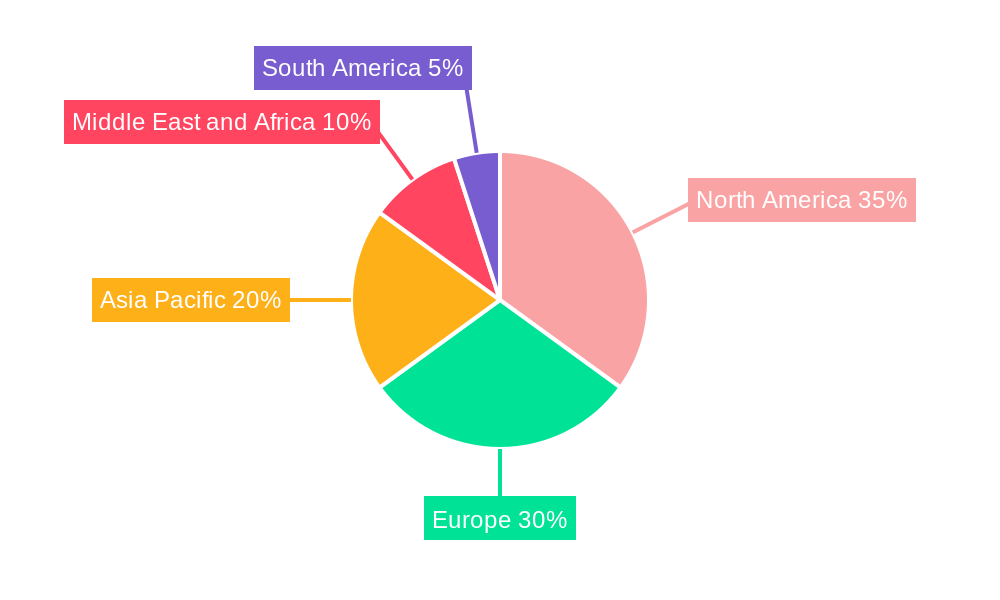

The market's segmentation reveals diverse opportunities across various technologies, products, services, and applications. Polymerase Chain Reaction (PCR) and Next Generation Sequencing (NGS) are leading technological segments, offering unparalleled precision in DNA analysis. In terms of products and services, instruments and assay kits are dominant, supported by essential software and services that streamline workflows. Forensics and paternity testing represent the largest application segments, reflecting their critical role in law enforcement and personal identification. Geographically, North America and Europe are expected to maintain significant market shares due to well-established healthcare infrastructure and robust R&D investments. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing government initiatives, rising disposable incomes, and a growing awareness of the benefits of DNA-based identification. The market's expansion is also supported by strategic collaborations and mergers among leading companies, aiming to broaden their product portfolios and geographical reach.

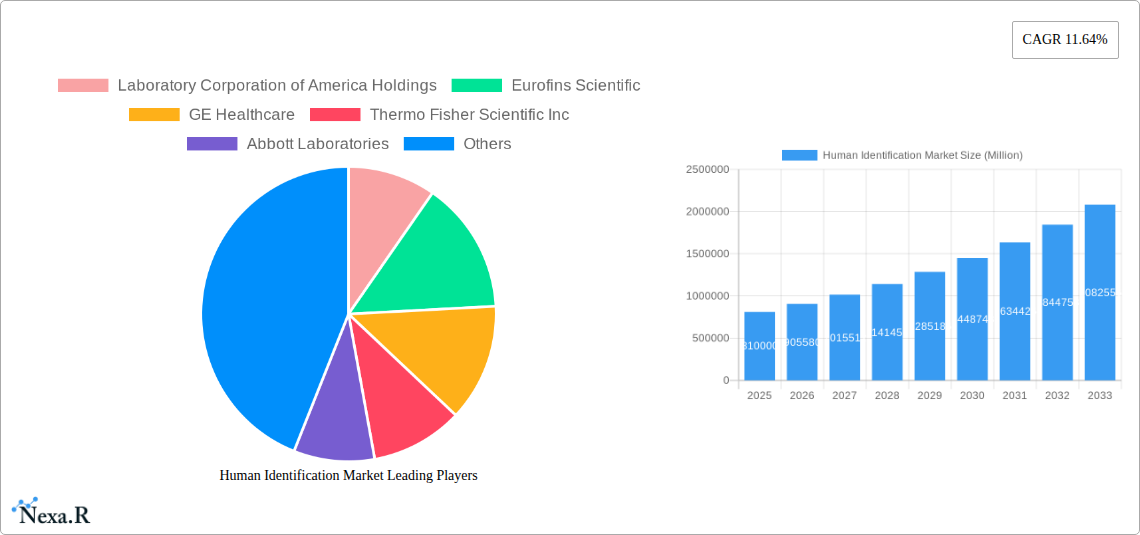

Human Identification Market Company Market Share

This in-depth report provides a detailed analysis of the global Human Identification Market, offering critical insights into its dynamics, growth trends, and future outlook. Examining key technologies, product segments, and applications, this study serves as an essential resource for stakeholders navigating this rapidly evolving industry. With a forecast period extending to 2033, the report equips industry professionals with actionable intelligence to capitalize on emerging opportunities and mitigate challenges. The human identification market encompasses a vast array of technologies and applications, from forensic science and paternity testing to disaster victim identification and personalized medicine. This report delves into the intricate market structure, identifying parent and child market segments that are driving innovation and market expansion.

Human Identification Market Dynamics & Structure

The human identification market is characterized by a moderate level of concentration, with key players like Laboratory Corporation of America Holdings, Eurofins Scientific, and Thermo Fisher Scientific Inc. dominating significant portions of the landscape. Technological innovation serves as a primary driver, with advancements in Polymerase Chain Reaction (PCR) and Next Generation Sequencing (NGS) continually expanding the capabilities and applications of human identification. Regulatory frameworks, particularly in forensic and clinical diagnostics, play a crucial role in shaping market access and adoption rates. The competitive product landscape is dynamic, with continuous introduction of novel assay kits, reagents, and advanced instrumentation. End-user demographics are diverse, ranging from law enforcement agencies and research institutions to healthcare providers and direct-to-consumer testing services. Merger and acquisition (M&A) activity has been a notable trend, with companies strategically acquiring complementary technologies and expanding their market reach. For instance, recent M&A activities have focused on consolidating nucleic acid purification and extraction technologies to streamline workflows. Barriers to innovation include the high cost of research and development, stringent regulatory approvals, and the need for specialized expertise. The market is projected to witness a CAGR of approximately 8.5% from 2025 to 2033.

- Market Concentration: Moderate, with a few key players holding substantial market share.

- Technological Innovation Drivers: Advancements in PCR, NGS, and rapid DNA analysis are pivotal.

- Regulatory Frameworks: Stringent regulations in forensic and clinical applications influence market entry.

- Competitive Product Substitutes: Ongoing development of more accurate and faster identification methods.

- End-User Demographics: Broad range from governmental bodies to private consumers.

- M&A Trends: Strategic acquisitions to broaden portfolios and enhance technological capabilities.

- Innovation Barriers: High R&D costs and complex regulatory pathways.

Human Identification Market Growth Trends & Insights

The human identification market is poised for substantial growth, driven by increasing demand for accurate and rapid genetic testing across various sectors. The global market size, estimated at approximately USD 7,500 Million in the base year 2025, is projected to reach over USD 15,000 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 8.5% during the forecast period of 2025–2033. This growth is fueled by the expanding applications of DNA analysis in forensic investigations, the rising prevalence of genetic disorders, and the increasing adoption of direct-to-consumer (DTC) genetic testing. Technological disruptions, particularly the advancement of Next Generation Sequencing (NGS) technologies, are enabling faster, more comprehensive, and cost-effective genetic analysis, thereby driving adoption rates. The shift towards personalized medicine and the growing emphasis on precision diagnostics further bolster market expansion. Consumer behavior is increasingly leaning towards proactive health management and ancestry tracing, leading to a surge in demand for paternity testing and other non-forensic applications. The integration of artificial intelligence and machine learning in data analysis is also revolutionizing the interpretation of genetic information, paving the way for more insightful diagnostics and identification. The historical period from 2019 to 2024 saw steady growth, with the market size evolving from approximately USD 5,000 Million in 2019 to an estimated USD 7,000 Million in 2024. The base year, 2025, is a crucial reference point for understanding the current market valuation and projected trajectory. Key growth accelerators include the increasing number of criminal investigations requiring DNA evidence, the growing need for efficient disaster victim identification systems, and the expanding use of genetic testing in clinical settings for disease diagnosis and prognosis. The market penetration of rapid DNA analysis technologies is also a significant factor contributing to the overall market expansion.

Dominant Regions, Countries, or Segments in Human Identification Market

The North America region currently stands as a dominant force in the global Human Identification Market, driven by its robust healthcare infrastructure, significant investments in research and development, and the presence of leading technology providers. Within North America, the United States spearheads market growth, owing to stringent law enforcement requirements for forensic DNA analysis and a burgeoning direct-to-consumer genetic testing market. The market size for North America is estimated to be around USD 2,800 Million in 2025, with a projected growth to USD 5,600 Million by 2033.

Analyzing by Technology, Polymerase Chain Reaction (PCR) continues to hold a significant market share due to its established reliability, versatility, and relative cost-effectiveness in amplifying DNA samples for identification. However, Next Generation Sequencing (NGS) is emerging as a key growth driver, offering enhanced throughput, higher resolution, and the ability to analyze larger genomic regions, crucial for complex forensic cases and comprehensive genetic analysis. The market for PCR-based technologies is estimated at USD 1,500 Million in 2025, while NGS is projected to grow at a CAGR of over 10% during the forecast period.

In terms of Product & Service, Instruments constitute a substantial segment, forming the backbone of human identification laboratories. This includes advanced sequencers, PCR machines, and capillary electrophoresis instruments. The Assay Kits and Reagents segment is also critical, providing the necessary consumables for DNA extraction, amplification, and analysis. Software and Services, encompassing bioinformatics tools and data analysis platforms, are experiencing rapid growth as the volume of genetic data increases. The Instruments segment is valued at approximately USD 2,000 Million in 2025, with Assay Kits and Reagents at USD 1,800 Million.

Geographically, key drivers in North America include favorable government funding for forensic science initiatives, the presence of major diagnostic and life science companies like Thermo Fisher Scientific Inc. and Abbott Laboratories, and a high adoption rate of advanced genetic technologies. The US market alone is projected to contribute over 70% of the regional revenue in 2025.

From an Application perspective, Forensic Applications remain the largest segment, driven by the ongoing need for accurate identification of suspects, victims in mass casualty events, and exoneration cases. Paternity Testing is another significant application, with increasing consumer awareness and accessibility of testing services. The Forensic Applications segment is estimated to be worth USD 3,000 Million in 2025, with Paternity Testing at USD 1,200 Million.

- Dominant Region: North America, led by the United States.

- Key Technology Drivers: PCR for established applications, NGS for advanced capabilities.

- Leading Product Segment: Instruments and Assay Kits & Reagents are foundational.

- Primary Application: Forensic Applications, followed by Paternity Testing.

- Market Share Growth Potential: NGS and Software & Services segments show strong upward trajectory.

Human Identification Market Product Landscape

The human identification market is characterized by continuous product innovation focused on enhancing speed, accuracy, and multiplexing capabilities. Leading companies are developing advanced instruments, such as high-throughput sequencers and automated DNA extraction systems, to streamline laboratory workflows. The market also sees a steady stream of novel assay kits and reagents tailored for specific applications, including SNP genotyping, STR analysis, and mitochondrial DNA sequencing. Software solutions are increasingly sophisticated, offering advanced bioinformatics tools for data analysis, interpretation, and database management. Unique selling propositions often lie in the development of integrated solutions that combine hardware, software, and consumables for end-to-end identification processes, minimizing hands-on time and reducing the risk of contamination. Technological advancements are pushing towards portable and point-of-need identification devices, particularly for rapid DNA analysis in forensic settings.

Key Drivers, Barriers & Challenges in Human Identification Market

Key Drivers:

- Technological Advancements: Continuous innovation in PCR, NGS, and rapid DNA analysis technologies is enhancing accuracy and speed.

- Increasing Forensic Applications: Growing reliance on DNA evidence in criminal investigations and disaster victim identification.

- Rising Demand for Paternity Testing: Increased consumer awareness and accessibility of direct-to-consumer testing.

- Government Initiatives: Funding for forensic science infrastructure and research programs.

- Growth in Personalized Medicine: The need for accurate genetic profiling for tailored treatments.

Barriers & Challenges:

- High Cost of Advanced Technologies: The initial investment for sophisticated instrumentation can be prohibitive for smaller labs.

- Stringent Regulatory Hurdles: Obtaining approvals for new diagnostic tests and devices is a lengthy and complex process.

- Data Interpretation Complexity: Analyzing vast amounts of genetic data requires specialized expertise and sophisticated bioinformatics tools.

- Ethical and Privacy Concerns: Ensuring the secure handling and ethical use of sensitive genetic information.

- Global Supply Chain Disruptions: Potential impact on the availability of reagents and consumables.

Emerging Opportunities in Human Identification Market

Emerging opportunities in the human identification market are centered around the expanding use of rapid DNA analysis for on-site investigations, significantly reducing identification times. The growing demand for ancestry and genealogical testing, coupled with the integration of AI and machine learning for advanced genomic data interpretation, presents significant avenues for growth. Furthermore, the application of human identification technologies in non-forensic areas like carrier screening, pharmacogenomics, and personalized wellness is a rapidly expanding niche. The development of more cost-effective and accessible sequencing technologies will democratize access to genetic identification tools.

Growth Accelerators in the Human Identification Market Industry

The human identification market industry is experiencing significant growth acceleration due to several key factors. The continuous refinement and cost reduction of Next Generation Sequencing (NGS) technologies are enabling broader adoption and more comprehensive genomic analyses. Strategic partnerships between technology developers and research institutions are fostering innovation and the development of novel applications. The increasing global emphasis on public safety and the need for efficient victim identification in mass casualty events are also major catalysts. Furthermore, the expansion of direct-to-consumer genetic testing services is driving consumer awareness and demand for genetic identification.

Key Players Shaping the Human Identification Market Market

- Laboratory Corporation of America Holdings

- Eurofins Scientific

- GE Healthcare

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Qiagen N V

- Autogen Inc.

- Hamilton Company

- Agilent Technologies Inc.

- Illumina Inc.

Notable Milestones in Human Identification Market Sector

- May 2022: The Denver Office of the Medical Examiner received a USD 386,000 federal grant to purchase an in-house rapid DNA processor, enabling faster genetic-test results for victim identification in mass casualty events or assisting in identifying family members of unidentified bodies.

- January 2022: A Stanford-led research team established the first Guinness World Record for the fastest DNA sequencing technique, successfully sequencing the human genome in 5 hours and 2 minutes, significantly accelerating genetic analysis capabilities.

In-Depth Human Identification Market Market Outlook

The future outlook for the human identification market is exceptionally promising, characterized by sustained growth and expanding applications. The increasing integration of artificial intelligence for faster and more accurate data interpretation, coupled with the development of portable and rapid DNA analysis devices, will revolutionize forensic science and clinical diagnostics. Strategic collaborations and ongoing technological advancements, particularly in NGS and single-cell genomics, will unlock new frontiers in personalized medicine and rare disease diagnosis. The market is poised for significant expansion as regulatory bodies continue to embrace and streamline the adoption of advanced genetic identification tools across diverse sectors.

Human Identification Market Segmentation

-

1. Technology

- 1.1. Polymerase Chain Reaction (PCR)

- 1.2. Next Generation Sequencing (NGS)

- 1.3. Nucleic Acid Purification and Extraction

- 1.4. Capillary Electrophoresis

- 1.5. Rapid DNA Analysis

- 1.6. Other Technologies

-

2. Product & Service

- 2.1. Instruments

- 2.2. Assay Kits and Reagents

- 2.3. Software and Services

-

3. Application

- 3.1. Forensic Applications

- 3.2. Paternity Testing

- 3.3. Other Applications

Human Identification Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Human Identification Market Regional Market Share

Geographic Coverage of Human Identification Market

Human Identification Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in Human Identification System; Increasing Demand for Reducing the Time and Cost of DNA Analysis; Government Initiatives and Support

- 3.3. Market Restrains

- 3.3.1. Expensive Instruments; Shortage of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Forensic Applications Segment is Expected to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Polymerase Chain Reaction (PCR)

- 5.1.2. Next Generation Sequencing (NGS)

- 5.1.3. Nucleic Acid Purification and Extraction

- 5.1.4. Capillary Electrophoresis

- 5.1.5. Rapid DNA Analysis

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Product & Service

- 5.2.1. Instruments

- 5.2.2. Assay Kits and Reagents

- 5.2.3. Software and Services

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Forensic Applications

- 5.3.2. Paternity Testing

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Polymerase Chain Reaction (PCR)

- 6.1.2. Next Generation Sequencing (NGS)

- 6.1.3. Nucleic Acid Purification and Extraction

- 6.1.4. Capillary Electrophoresis

- 6.1.5. Rapid DNA Analysis

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Product & Service

- 6.2.1. Instruments

- 6.2.2. Assay Kits and Reagents

- 6.2.3. Software and Services

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Forensic Applications

- 6.3.2. Paternity Testing

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Polymerase Chain Reaction (PCR)

- 7.1.2. Next Generation Sequencing (NGS)

- 7.1.3. Nucleic Acid Purification and Extraction

- 7.1.4. Capillary Electrophoresis

- 7.1.5. Rapid DNA Analysis

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Product & Service

- 7.2.1. Instruments

- 7.2.2. Assay Kits and Reagents

- 7.2.3. Software and Services

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Forensic Applications

- 7.3.2. Paternity Testing

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Polymerase Chain Reaction (PCR)

- 8.1.2. Next Generation Sequencing (NGS)

- 8.1.3. Nucleic Acid Purification and Extraction

- 8.1.4. Capillary Electrophoresis

- 8.1.5. Rapid DNA Analysis

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Product & Service

- 8.2.1. Instruments

- 8.2.2. Assay Kits and Reagents

- 8.2.3. Software and Services

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Forensic Applications

- 8.3.2. Paternity Testing

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Polymerase Chain Reaction (PCR)

- 9.1.2. Next Generation Sequencing (NGS)

- 9.1.3. Nucleic Acid Purification and Extraction

- 9.1.4. Capillary Electrophoresis

- 9.1.5. Rapid DNA Analysis

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Product & Service

- 9.2.1. Instruments

- 9.2.2. Assay Kits and Reagents

- 9.2.3. Software and Services

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Forensic Applications

- 9.3.2. Paternity Testing

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Human Identification Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Polymerase Chain Reaction (PCR)

- 10.1.2. Next Generation Sequencing (NGS)

- 10.1.3. Nucleic Acid Purification and Extraction

- 10.1.4. Capillary Electrophoresis

- 10.1.5. Rapid DNA Analysis

- 10.1.6. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Product & Service

- 10.2.1. Instruments

- 10.2.2. Assay Kits and Reagents

- 10.2.3. Software and Services

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Forensic Applications

- 10.3.2. Paternity Testing

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Laboratory Corporation of America Holdings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott Laboratories

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qiagen N V *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Autogen Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hamilton Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent TechnologiesInc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Illumina Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Laboratory Corporation of America Holdings

List of Figures

- Figure 1: Global Human Identification Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 5: North America Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 6: North America Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Human Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 13: Europe Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 14: Europe Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Human Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 19: Asia Pacific Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 21: Asia Pacific Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 22: Asia Pacific Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Human Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 29: Middle East and Africa Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 30: Middle East and Africa Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Middle East and Africa Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Human Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Human Identification Market Revenue (Million), by Technology 2025 & 2033

- Figure 35: South America Human Identification Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: South America Human Identification Market Revenue (Million), by Product & Service 2025 & 2033

- Figure 37: South America Human Identification Market Revenue Share (%), by Product & Service 2025 & 2033

- Figure 38: South America Human Identification Market Revenue (Million), by Application 2025 & 2033

- Figure 39: South America Human Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Human Identification Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Human Identification Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 3: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Human Identification Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 7: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 14: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 23: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 24: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 33: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 34: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Human Identification Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 40: Global Human Identification Market Revenue Million Forecast, by Product & Service 2020 & 2033

- Table 41: Global Human Identification Market Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Human Identification Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Human Identification Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Human Identification Market?

The projected CAGR is approximately 11.64%.

2. Which companies are prominent players in the Human Identification Market?

Key companies in the market include Laboratory Corporation of America Holdings, Eurofins Scientific, GE Healthcare, Thermo Fisher Scientific Inc, Abbott Laboratories, Qiagen N V *List Not Exhaustive, Autogen Inc, Hamilton Company, Agilent TechnologiesInc, Illumina Inc.

3. What are the main segments of the Human Identification Market?

The market segments include Technology, Product & Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in Human Identification System; Increasing Demand for Reducing the Time and Cost of DNA Analysis; Government Initiatives and Support.

6. What are the notable trends driving market growth?

Forensic Applications Segment is Expected to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Instruments; Shortage of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

May 2022: the Denver Office of the Medical Examiner received a USD 386,000 federal grant to purchase an in-house rapid DNA processor - technology that can produce genetic-test results in a matter of hours, allowing for faster identification of victims in mass casualty events or assisting in the identification of family members of unidentified bodies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Human Identification Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Human Identification Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Human Identification Market?

To stay informed about further developments, trends, and reports in the Human Identification Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence