Key Insights

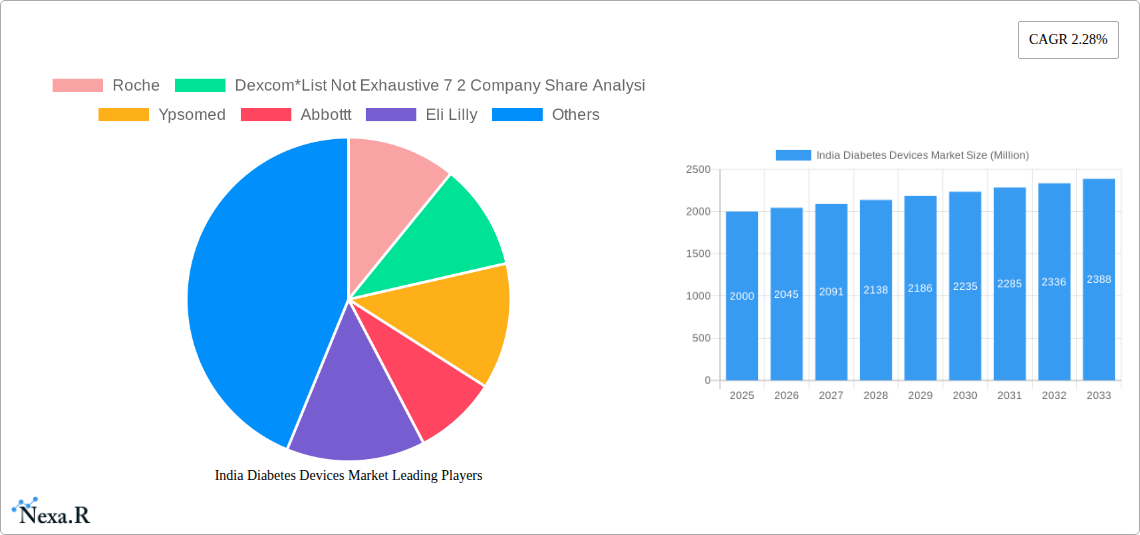

The Indian Diabetes Devices Market is poised for steady growth, projected to reach USD 2.20 billion by the forecast year. This expansion is driven by a confluence of factors, including a rising prevalence of diabetes across all age groups, increasing awareness regarding diabetes management, and a growing demand for technologically advanced monitoring and management solutions. The market's compound annual growth rate (CAGR) stands at an estimated 2.28%, indicating sustained expansion over the study period of 2019-2033. Key growth drivers include the increasing adoption of self-monitoring blood glucose devices (SMBG) such as glucometers, test strips, and lancets, driven by their affordability and ease of use for daily monitoring. Furthermore, the rising incidence of lifestyle diseases and an aging population contribute significantly to the escalating demand for effective diabetes management tools. The market is also witnessing a surge in demand for continuous blood glucose monitoring (CGM) systems, comprising sensors and durables, as patients and healthcare providers seek more comprehensive and real-time insights into glycemic control. This trend is further bolstered by technological advancements leading to more accurate and user-friendly CGM devices.

India Diabetes Devices Market Market Size (In Billion)

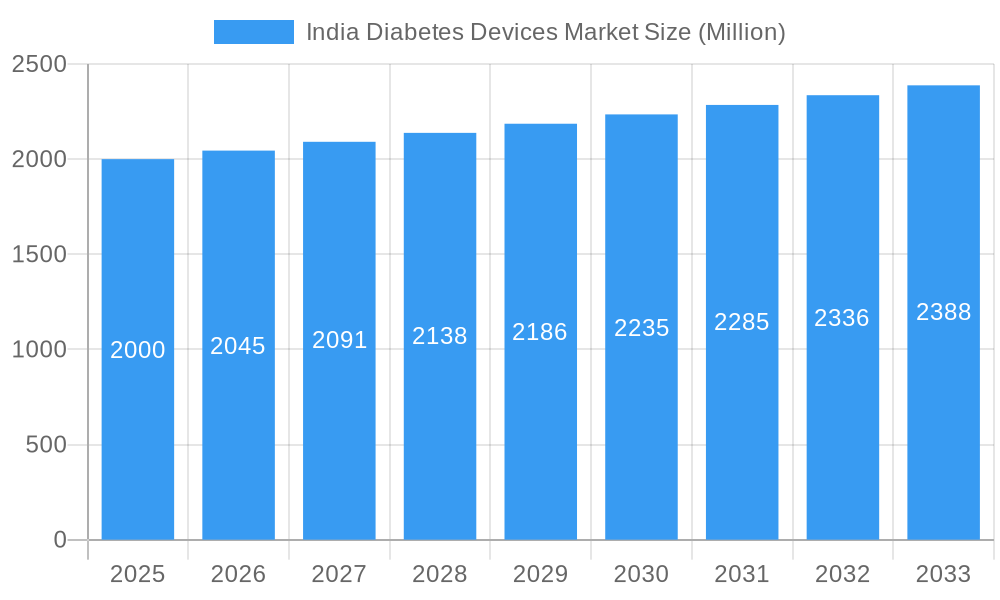

The Indian Diabetes Devices Market encompasses a broad spectrum of products, categorized into monitoring devices and management devices. Within monitoring devices, both SMBG and CGM segments are experiencing robust growth. On the management side, insulin pumps, including their devices, reservoirs, and infusion sets, along with insulin syringes, cartridges, and disposable pens, are crucial components contributing to effective diabetes care. The market landscape is competitive, featuring prominent global players like Roche, Dexcom, Abbott, Medtronic, and Novo Nordisk, alongside domestic players, all vying for market share. Strategic initiatives, product launches, and increasing healthcare expenditure in India are expected to fuel the market's trajectory. While the market exhibits positive growth, certain restraints, such as the cost of advanced devices for a segment of the population and the need for greater healthcare infrastructure in rural areas, need to be addressed to unlock its full potential. However, the overall outlook remains optimistic, driven by the persistent need for effective diabetes management solutions in a country with a high diabetic burden.

India Diabetes Devices Market Company Market Share

Comprehensive Report Description: India Diabetes Devices Market Analysis (2019-2033)

This in-depth report offers a definitive analysis of the India Diabetes Devices Market, meticulously examining market dynamics, growth trends, competitive landscape, and future outlook from 2019 to 2033. With a base year of 2025, this study provides critical insights into the Indian diabetes care market, driven by increasing diabetes prevalence and advancements in diabetes management technology. We explore both monitoring devices and management devices, offering a granular view of segments like self-monitoring blood glucose devices (including glucometer devices, test strips, and lancets) and continuous blood glucose monitoring (covering sensors and durables). Furthermore, the report delves into the insulin delivery devices market, encompassing insulin pumps (with insulin pump devices, insulin pump reservoirs, and infusion sets), insulin syringes, insulin cartridges, and disposable pens. Leveraging high-traffic keywords such as diabetes technology India, blood glucose monitoring devices India, and insulin pump India, this report is optimized for maximum search engine visibility and aims to equip industry professionals, investors, and stakeholders with actionable intelligence.

India Diabetes Devices Market Market Dynamics & Structure

The India Diabetes Devices Market is characterized by a moderately concentrated competitive landscape, with key global and domestic players vying for market share. Technological innovation serves as a primary driver, fueled by the relentless pursuit of more accurate, user-friendly, and integrated diabetes management solutions. The growing prevalence of diabetes in India, driven by lifestyle changes and an aging population, creates a substantial and expanding addressable market. Regulatory frameworks, while evolving, are increasingly focused on ensuring device safety and efficacy, impacting product development and market access. Competitive product substitutes, ranging from traditional blood glucose meters to advanced continuous glucose monitoring (CGM) systems, are influencing adoption rates and product differentiation strategies. End-user demographics, particularly the large and growing diabetic population across various age groups, dictate market demand and product innovation. Mergers and acquisitions (M&A) trends are becoming more prominent as larger companies seek to expand their portfolios and market reach in the high-growth Indian market. For instance, a notable M&A trend within the broader global diabetes devices market indicates a consolidation phase, with companies acquiring innovative startups to accelerate their technological pipeline. The market penetration of advanced devices like CGM sensors is still in its nascent stages but shows significant potential for growth. The market is projected to reach approximately $XXX million units by 2025, with an anticipated CAGR of XX% during the forecast period (2025-2033). Barriers to innovation include the high cost of advanced technology and the need for robust clinical validation in the Indian context.

- Market Concentration: Moderately concentrated, with a mix of multinational corporations and emerging domestic players.

- Technological Innovation Drivers: Miniaturization of devices, wireless connectivity, AI-powered analytics, and closed-loop systems.

- Regulatory Frameworks: Evolving regulations by CDSCO and other health bodies, emphasizing device quality and patient safety.

- Competitive Product Substitutes: Traditional blood glucose meters vs. advanced CGM and hybrid closed-loop insulin pumps.

- End-User Demographics: A vast and growing diabetic population, including Type 1, Type 2, and gestational diabetes.

- M&A Trends: Increasing strategic acquisitions to gain access to innovative technologies and expand market share.

India Diabetes Devices Market Growth Trends & Insights

The India Diabetes Devices Market is poised for substantial growth, driven by a confluence of factors including rising diabetes prevalence, increasing health awareness, and significant technological advancements. The market size is expected to witness a robust expansion from an estimated $XXX million units in 2025 to $YYY million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX%. Adoption rates for advanced diabetes monitoring and management devices are accelerating as healthcare providers and patients recognize their benefits in achieving better glycemic control and reducing long-term complications. Technological disruptions, such as the development of more affordable and accurate CGM sensors, the introduction of smarter insulin pens, and the integration of data analytics for personalized therapy, are reshaping the market landscape. Consumer behavior is shifting towards proactive self-management, with a growing demand for connected devices that offer seamless data sharing and remote monitoring capabilities. The market penetration of self-monitoring blood glucose devices remains high, but the adoption of continuous blood glucose monitoring systems is rapidly increasing, particularly in urban centers and among individuals seeking more comprehensive insights into their glucose fluctuations. The demand for insulin pumps is also on an upward trajectory, driven by the need for more precise insulin delivery and improved quality of life for individuals with Type 1 diabetes. The increasing focus on preventative healthcare and the government's initiatives to improve diabetes care infrastructure are further bolstering market growth. The shift from reactive treatment to proactive management is a key consumer behavior shift, underscoring the importance of real-time data and personalized interventions.

Dominant Regions, Countries, or Segments in India Diabetes Devices Market

The India Diabetes Devices Market is experiencing robust growth across its various segments, with Monitoring Devices currently holding a dominant position, particularly within the Self-monitoring Blood Glucose Devices (SMBG) sub-segment. The sheer volume of individuals managing diabetes in India necessitates widespread access to reliable and affordable glucose monitoring tools. Within SMBG, glucometer devices form the bedrock, followed closely by the critical consumables: test strips and lancets. The projected market size for SMBG alone is estimated to be significant, contributing a substantial portion to the overall market value.

However, Continuous Blood Glucose Monitoring (CGM) is emerging as the fastest-growing segment, showcasing remarkable adoption rates. The introduction of advanced CGM sensors and associated durables offers unparalleled insights into glucose variability, empowering patients and clinicians with data-driven decision-making. This segment is driven by factors such as increasing awareness of hypoglycemia and hyperglycemia risks, the desire for more comprehensive diabetes management, and the growing comfort with wearable technology.

On the management side, the Insulin Pump segment, encompassing insulin pump devices, insulin pump reservoirs, and infusion sets, is experiencing a strong upward trend, particularly among individuals with Type 1 diabetes who require sophisticated insulin delivery. While the initial cost of insulin pumps remains a barrier, advancements in technology, including hybrid closed-loop systems, and increasing insurance coverage are expanding their accessibility. Complementing this, insulin syringes, insulin cartridges, and disposable pens continue to serve a large patient base, offering various options for insulin administration. The market for these consumables is substantial due to the chronic nature of diabetes.

Geographically, the Western and Southern regions of India are leading the market, owing to higher disposable incomes, better healthcare infrastructure, greater awareness of advanced diabetes technologies, and a higher prevalence of lifestyle-related diseases. Major metropolitan cities within these regions act as hubs for early adoption of new technologies. Economic policies promoting healthcare access and government initiatives aimed at improving diabetes care further support this regional dominance. The infrastructure supporting the distribution and availability of diabetes devices is more developed in these areas, facilitating market penetration. The growth potential in Tier 2 and Tier 3 cities is also significant, representing a considerable untapped market as awareness and affordability improve.

India Diabetes Devices Market Product Landscape

The India Diabetes Devices Market is characterized by a dynamic product landscape focused on enhancing accuracy, ease of use, and connectivity. Innovations in Self-monitoring Blood Glucose Devices (SMBG) include faster blood glucose meters with smaller sample size requirements and improved memory functions. Test strips are becoming more sensitive and cost-effective. In the realm of Continuous Blood Glucose Monitoring (CGM), the landscape is evolving with the introduction of smaller, less invasive sensors offering real-time data transmission and longer wear times. Durables for CGM systems are also becoming more sophisticated, integrating with smartphones for enhanced data visualization and sharing. The Insulin Pump segment is witnessing advancements in hybrid closed-loop systems, automating insulin delivery based on real-time glucose readings. Insulin pump devices are becoming more compact and user-friendly. Insulin syringes and cartridges are seeing improvements in material quality and precision for more accurate dosing. Disposable pens offer convenience and improved injection ergonomics. Unique selling propositions often revolve around data integration with health apps, real-time alerts for critical glucose levels, and improved patient comfort.

Key Drivers, Barriers & Challenges in India Diabetes Devices Market

Key Drivers:

- Rising Diabetes Prevalence: India's status as the "diabetes capital of the world" fuels consistent demand for diabetes care devices.

- Increasing Health Awareness: Growing patient and public understanding of diabetes management and the benefits of early detection and control.

- Technological Advancements: Continuous innovation in accuracy, connectivity, and user-friendliness of devices like CGM and smart insulin pens.

- Government Initiatives: Support for public health programs and subsidized access to essential diabetes management tools.

- Growing Disposable Income: Enabling a larger segment of the population to afford advanced diabetes devices.

Barriers & Challenges:

- High Cost of Advanced Devices: Premium pricing of technologies like CGM and insulin pumps limits widespread adoption, especially in lower-income demographics.

- Limited Healthcare Infrastructure: Uneven distribution of healthcare facilities and trained professionals across rural and semi-urban areas.

- Reimbursement and Insurance Gaps: Inadequate insurance coverage for advanced diabetes devices in many cases, hindering patient access.

- Awareness and Education Gaps: A significant portion of the population, especially in rural areas, lacks adequate knowledge about diabetes management and available technologies.

- Supply Chain and Distribution Challenges: Ensuring consistent availability and affordability of devices and consumables across a vast and diverse country.

- Regulatory Hurdles: Navigating complex approval processes for new medical devices can be time-consuming and costly.

Emerging Opportunities in India Diabetes Devices Market

Emerging opportunities within the India Diabetes Devices Market lie in the development and distribution of more affordable and accessible continuous glucose monitoring (CGM) systems, targeting the vast segment of the population currently relying solely on traditional glucometers. The integration of artificial intelligence (AI) and machine learning into diabetes management apps to provide personalized treatment recommendations and predictive analytics presents a significant avenue for growth. Furthermore, the expansion of telemedicine and remote patient monitoring services for diabetes care creates demand for connected devices that can seamlessly transmit patient data to healthcare providers. Untapped rural markets offer substantial potential as awareness campaigns and government initiatives increase. Innovations in closed-loop insulin pump systems that are more user-friendly and cost-effective will also drive adoption.

Growth Accelerators in the India Diabetes Devices Market Industry

Several catalysts are accelerating the growth of the India Diabetes Devices Market. Technological breakthroughs in sensor technology for CGM devices are leading to greater accuracy and longer wear times, making them more attractive to a wider patient base. Strategic partnerships between global device manufacturers and Indian distributors are crucial for expanding market reach and ensuring product availability. The increasing focus on preventative healthcare and the government's commitment to improving diabetes care through initiatives like the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) are significant growth boosters. Market expansion strategies targeting Tier 2 and Tier 3 cities, coupled with educational programs to enhance understanding of advanced diabetes technologies, will further propel growth.

Key Players Shaping the India Diabetes Devices Market Market

- Roche

- Dexcom

- Ypsomed

- Abbott

- Eli Lilly

- Sanofi

- Medtronic

- Tandem

- Insulet

- Lifescan (Johnson & Johnson)

- Becton and Dickenson

- Novo Nordisk

Notable Milestones in India Diabetes Devices Market Sector

- November 2023: Terumo India introduced the Insulin Syringe, a sterile delivery tool designed for patients requiring frequent insulin injections, enhancing patient comfort and therapy adherence.

- March 2022: Medtronic India launched the MiniMed 780G, a next-generation closed-loop insulin pump system for the treatment of Type 1 diabetes in individuals aged 7-80 years, marking a significant advancement in automated insulin delivery.

In-Depth India Diabetes Devices Market Market Outlook

The India Diabetes Devices Market is set for robust and sustained growth, driven by the escalating burden of diabetes and the increasing demand for advanced diabetes management technologies. Future market potential is immense, fueled by continuous innovation in CGM and insulin delivery systems, aiming for greater affordability and accessibility. Strategic opportunities lie in developing integrated platforms that combine monitoring, delivery, and data analytics to empower both patients and healthcare providers. The shift towards value-based care and personalized medicine will further underscore the importance of accurate and real-time data provided by these devices. Continued government support, coupled with increasing private sector investment in R&D and market penetration, will solidify India's position as a key market for diabetes devices globally.

India Diabetes Devices Market Segmentation

-

1. Monitoring Devices

-

1.1. Self-monitoring Blood Glucose Devices

- 1.1.1. Glucometer Devices

- 1.1.2. Test Strips

- 1.1.3. Lancets

-

1.2. Continuous Blood Glucose Monitoring

- 1.2.1. Sensors

- 1.2.2. Durables

-

1.1. Self-monitoring Blood Glucose Devices

-

2. Management Devices

-

2.1. Insulin Pump

- 2.1.1. Insulin Pump Device

- 2.1.2. Insulin Pump Reservoir

- 2.1.3. Infusion Set

- 2.2. Insulin Syringes

- 2.3. Insulin Cartridges

- 2.4. Disposable Pens

-

2.1. Insulin Pump

India Diabetes Devices Market Segmentation By Geography

- 1. India

India Diabetes Devices Market Regional Market Share

Geographic Coverage of India Diabetes Devices Market

India Diabetes Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Increasing use of monitoring devices in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Diabetes Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuous Blood Glucose Monitoring

- 5.1.2.1. Sensors

- 5.1.2.2. Durables

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.2. Market Analysis, Insights and Forecast - by Management Devices

- 5.2.1. Insulin Pump

- 5.2.1.1. Insulin Pump Device

- 5.2.1.2. Insulin Pump Reservoir

- 5.2.1.3. Infusion Set

- 5.2.2. Insulin Syringes

- 5.2.3. Insulin Cartridges

- 5.2.4. Disposable Pens

- 5.2.1. Insulin Pump

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dexcom*List Not Exhaustive 7 2 Company Share Analysi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ypsomed

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbottt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sanofi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tandem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Insulet

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lifescan (Johnson &Johnson)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Becton and Dickenson

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novo Nordisk

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: India Diabetes Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Diabetes Devices Market Share (%) by Company 2025

List of Tables

- Table 1: India Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 2: India Diabetes Devices Market Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 3: India Diabetes Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 5: India Diabetes Devices Market Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 6: India Diabetes Devices Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Diabetes Devices Market?

The projected CAGR is approximately 2.28%.

2. Which companies are prominent players in the India Diabetes Devices Market?

Key companies in the market include Roche, Dexcom*List Not Exhaustive 7 2 Company Share Analysi, Ypsomed, Abbottt, Eli Lilly, Sanofi, Medtronic, Tandem, Insulet, Lifescan (Johnson &Johnson), Becton and Dickenson, Novo Nordisk.

3. What are the main segments of the India Diabetes Devices Market?

The market segments include Monitoring Devices, Management Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Increasing use of monitoring devices in India.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

November 2023: Terumo India, the Indian subsidiary of Terumo Corporation, a renowned player in the field of medical technology, unveiled today the introduction of the Insulin Syringe, a sterile delivery tool designed for patients in need of frequent insulin injections. This move sets a new standard in enhancing patient comfort and adherence to therapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Diabetes Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Diabetes Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Diabetes Devices Market?

To stay informed about further developments, trends, and reports in the India Diabetes Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence