Key Insights

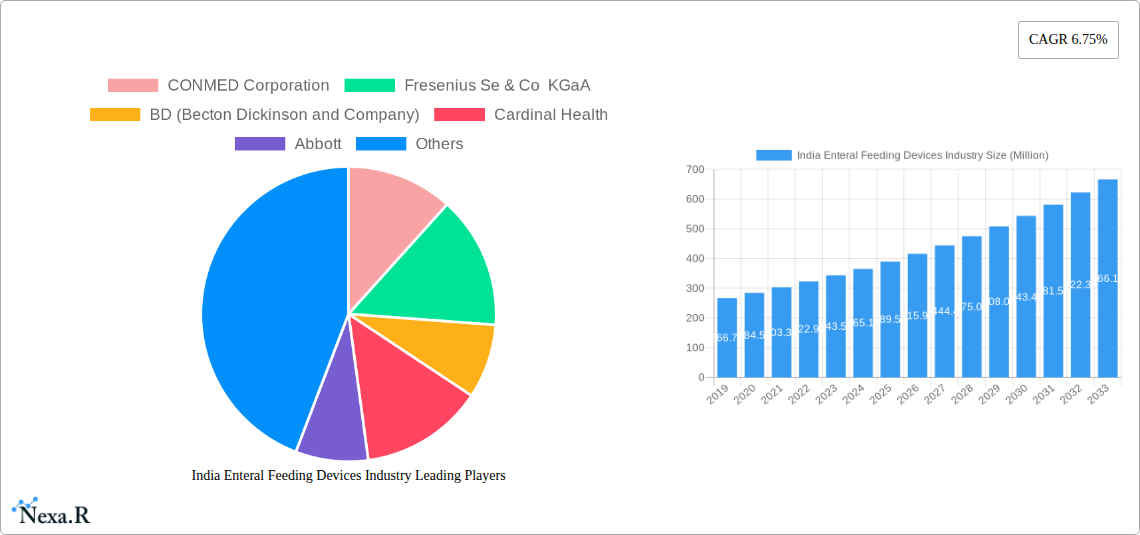

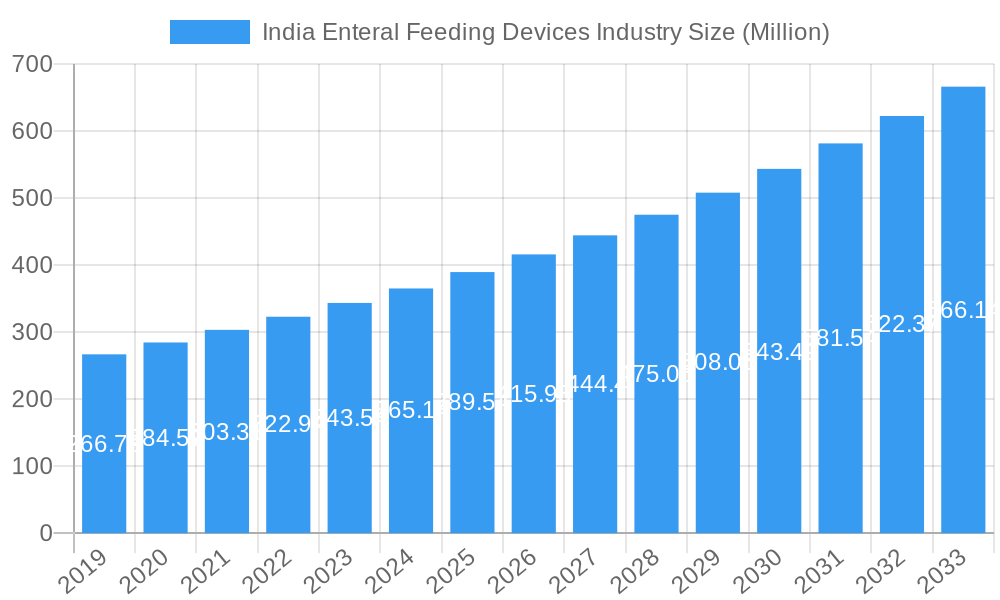

The Indian enteral feeding devices market is poised for significant growth, projected to reach USD 389.54 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.75% expected through 2033. This expansion is fueled by several key drivers. Increasing prevalence of chronic diseases, particularly oncological, gastrointestinal, and neurological disorders, directly correlates with a higher demand for enteral nutrition support. The aging population in India also contributes substantially, as elderly individuals are more susceptible to conditions requiring specialized feeding. Furthermore, rising healthcare expenditure, improved accessibility to advanced medical devices, and growing awareness among healthcare professionals and patients regarding the benefits of enteral feeding over parenteral nutrition are propelling market forward. The shift towards home healthcare and ambulatory care services, driven by cost-effectiveness and patient convenience, is also creating new avenues for market penetration of enteral feeding devices.

India Enteral Feeding Devices Industry Market Size (In Million)

The market landscape is characterized by a diverse range of products including enteral feeding pumps, tubes, and other associated devices, catering to both adult and pediatric patient populations. Hospitals remain the primary end-user segment, followed by a growing contribution from ambulatory care services. Key applications driving demand include oncology, gastroenterology, diabetes management, and neurological disorders, reflecting the complex health needs of the Indian population. Major global and domestic players are actively investing in research and development to introduce innovative and user-friendly enteral feeding solutions. This competitive environment, coupled with increasing government initiatives to enhance healthcare infrastructure, is expected to sustain the upward trajectory of the Indian enteral feeding devices market, offering substantial opportunities for stakeholders.

India Enteral Feeding Devices Industry Company Market Share

India Enteral Feeding Devices Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the India Enteral Feeding Devices Industry, providing critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. With a study period spanning from 2019 to 2033, and a base and estimated year of 2025, this report delivers a robust outlook for industry stakeholders. Our analysis leverages high-traffic keywords and segments the market by product, age group, end-user, and application to provide a granular understanding. Discover market share, CAGR, and key drivers shaping the future of enteral nutrition in India.

India Enteral Feeding Devices Industry Market Dynamics & Structure

The India enteral feeding devices industry is characterized by a moderately consolidated market with key players vying for dominance. Technological innovation is a significant driver, with manufacturers continuously investing in R&D to develop advanced and user-friendly devices. The regulatory framework, overseen by authorities like the Central Drugs Standard Control Organisation (CDSCO), plays a crucial role in ensuring product quality and safety, influencing market entry and product approvals. Competitive product substitutes, such as parenteral nutrition, pose a challenge, although the growing preference for enteral feeding due to its physiological benefits and lower complication rates is a counteracting force. End-user demographics are shifting, with an increasing prevalence of chronic diseases and an aging population driving demand. Mergers and acquisitions (M&A) have been a notable trend, with companies strategically acquiring smaller players to expand their product portfolios and market reach.

- Market Concentration: The market is characterized by the presence of both multinational corporations and domestic manufacturers, with a few key players holding a significant market share.

- Technological Innovation Drivers: Advancements in materials science, miniaturization of devices, and the integration of smart technologies are key innovation drivers.

- Regulatory Frameworks: Stringent quality control and approval processes by regulatory bodies like CDSCO ensure product efficacy and patient safety.

- Competitive Product Substitutes: Parenteral nutrition is a key substitute, though enteral feeding offers superior gut health benefits and cost-effectiveness.

- End-User Demographics: The rising incidence of gastrointestinal disorders, neurological conditions, and malnutrition among the elderly population is a primary demographic driver.

- M&A Trends: Strategic acquisitions are observed as companies aim to broaden their product offerings, gain market access, and enhance their competitive positioning.

India Enteral Feeding Devices Industry Growth Trends & Insights

The India enteral feeding devices market is poised for significant growth, projected to expand at a robust CAGR during the forecast period (2025-2033). This expansion is fueled by a confluence of factors including increasing healthcare expenditure, a rising awareness of the benefits of enteral nutrition among healthcare professionals and patients, and a growing prevalence of chronic diseases necessitating long-term nutritional support. The adoption rates of enteral feeding devices are steadily increasing, driven by their efficacy in managing malnutrition, improving patient outcomes, and reducing hospital stays. Technological disruptions are continuously shaping the market, with the introduction of more sophisticated and patient-friendly devices, including portable and smart feeding pumps, and advanced enteral feeding tubes designed for specific anatomical needs. Consumer behavior shifts are also evident, with a growing preference for home-based enteral nutrition solutions, supported by improved healthcare infrastructure and increased patient education. The market penetration of enteral feeding devices is expected to deepen as accessibility and affordability improve across various healthcare settings.

The evolution of the market size is intrinsically linked to the increasing incidence of conditions such as cancer, diabetes, and neurological disorders, which often require specialized nutritional support. Furthermore, government initiatives aimed at improving healthcare access and infrastructure, particularly in rural areas, are contributing to the market's upward trajectory. The shift towards value-based healthcare is also encouraging the adoption of enteral feeding as a cost-effective and outcome-driven nutritional intervention. The increasing focus on patient comfort and ease of use is driving the demand for innovative product designs and user-friendly interfaces.

Dominant Regions, Countries, or Segments in India Enteral Feeding Devices Industry

The Hospital segment within the India Enteral Feeding Devices Industry is the dominant force driving market growth. This dominance is attributable to several interconnected factors, including the concentration of advanced medical infrastructure, the presence of specialized medical professionals, and the higher patient volumes requiring critical and long-term nutritional support. Hospitals serve as the primary point of diagnosis and treatment for conditions necessitating enteral feeding, making them the largest end-users of enteral feeding pumps, tubes, and associated devices. The reimbursement policies and insurance coverage prevalent in hospital settings also facilitate the adoption of these medical devices.

- Product Dominance: While all product categories are crucial, Enteral Feeding Tubes exhibit significant market share due to their fundamental role in delivering nutrition. The increasing complexity of medical conditions necessitates a wider variety of tube types, from nasogastric and orogastric to gastrostomy and jejunostomy tubes, catering to diverse patient needs.

- Age Group Dominance: The Adult age group represents the largest segment. This is primarily due to the higher prevalence of chronic diseases such as diabetes, cancer, and neurological disorders in the adult population, which often require extended nutritional support.

- End User Dominance: Hospitals emerge as the leading end-user segment, accounting for a substantial portion of the market share. This is driven by the critical care requirements, availability of skilled healthcare professionals, and the incidence of acute and chronic illnesses managed within hospital settings.

- Application Dominance: Gastroenterology applications are a significant contributor to market growth. Conditions such as inflammatory bowel disease, short bowel syndrome, and malabsorption disorders directly drive the demand for enteral feeding solutions. Oncology is another major application, with cancer patients frequently experiencing malnutrition and requiring nutritional support during treatment.

The economic policies of the Indian government, focusing on healthcare infrastructure development and increased medical device manufacturing, further bolster the growth of these dominant segments. The increasing number of specialized gastrointestinal and oncology departments in both public and private hospitals across major metropolitan areas and Tier-2 cities acts as a powerful catalyst.

India Enteral Feeding Devices Industry Product Landscape

The India enteral feeding devices market is characterized by a dynamic product landscape focusing on enhanced patient safety, ease of use, and therapeutic efficacy. Innovations in enteral feeding tubes include materials that minimize tissue irritation and improve patient comfort, alongside advanced placement technologies. Enteral feeding pumps are witnessing advancements in portability, programmability, and connectivity, enabling remote monitoring and personalized therapy. The "Other Devices" category encompasses a range of essential accessories, including feeding bags, syringes, and administration sets, all designed for sterile and efficient nutrient delivery. These products are crucial for managing a spectrum of applications, from oncology and gastroenterology to neurological disorders and hypermetabolism, ensuring optimal nutritional outcomes for patients across all age groups.

Key Drivers, Barriers & Challenges in India Enteral Feeding Devices Industry

Key Drivers: The India enteral feeding devices industry is propelled by a confluence of critical factors. The escalating prevalence of chronic diseases, including diabetes, cancer, and neurological disorders, directly fuels the demand for nutritional support solutions. Increasing healthcare expenditure and a growing emphasis on preventive and curative healthcare are expanding market access. Technological advancements leading to more sophisticated, patient-friendly, and cost-effective devices are significant growth accelerators. Moreover, rising awareness among healthcare professionals and patients about the benefits of enteral nutrition over parenteral nutrition, particularly for gut health and complication reduction, is a pivotal driver. Government initiatives promoting domestic manufacturing and improving healthcare infrastructure also contribute positively.

Key Barriers & Challenges: Despite the strong growth trajectory, the industry faces several hurdles. High initial costs of advanced enteral feeding devices can be a barrier to adoption, especially in resource-limited settings. Inadequate reimbursement policies for certain enteral nutrition products and therapies can also limit market penetration. A shortage of skilled healthcare professionals trained in the proper administration and management of enteral feeding can hinder optimal utilization. Supply chain complexities and logistical challenges in reaching remote areas, coupled with stringent regulatory approval processes that can lead to longer product launch timelines, also pose significant restraints. Intense competition from established players and the threat of counterfeit products further complicate the market landscape.

Emerging Opportunities in India Enteral Feeding Devices Industry

Emerging opportunities in the India enteral feeding devices industry lie in the untapped potential of home healthcare and specialized pediatric nutrition. The increasing preference for home-based medical care, driven by convenience and reduced healthcare costs, presents a significant avenue for expansion. The development of user-friendly, portable enteral feeding devices with remote monitoring capabilities will cater to this growing demand. Furthermore, the rising incidence of prematurity and congenital disorders in infants necessitates specialized enteral nutrition solutions, creating a niche market for advanced pediatric feeding devices and tailored nutritional formulas. The integration of smart technologies, such as AI-powered feeding algorithms and connectivity features for data tracking and analysis, offers opportunities for improved patient management and personalized care. Exploring underserved rural markets with tailored product offerings and distribution strategies also holds substantial promise.

Growth Accelerators in the India Enteral Feeding Devices Industry Industry

Several catalysts are accelerating the long-term growth of the India Enteral Feeding Devices Industry. Breakthroughs in biomaterials are leading to the development of more biocompatible and durable feeding tubes. Strategic partnerships between device manufacturers, pharmaceutical companies, and healthcare providers are fostering innovation and market penetration. The expansion of ambulatory care services and specialized clinics focused on chronic disease management is creating new channels for product adoption. Furthermore, increasing investments in medical device manufacturing and R&D, supported by government policies like "Make in India," are enhancing domestic capabilities and reducing reliance on imports. The growing emphasis on evidence-based medicine and the publication of clinical studies demonstrating the efficacy of enteral nutrition are also bolstering market confidence and driving demand.

Key Players Shaping the India Enteral Feeding Devices Industry Market

- CONMED Corporation

- Fresenius Se & Co KGaA

- BD (Becton Dickinson and Company)

- Cardinal Health

- Abbott

- Cook Medical Incorporated

- Boston Scientific Corporation

- Nestlé

- B Braun SE

Notable Milestones in India Enteral Feeding Devices Industry Sector

- April 2022: Fresenius Kabi launched a new enteral nutrition product app. The enteral nutrition product app makes it easier to access detailed product information and includes a quick comparison tool to compare nutritional values against reference nutrient intakes.

- February 2022: Nestlé Health Science supported feeding tube awareness week. The mission of feeding tube awareness week is to promote the positive benefits of feeding tubes as life-saving medical interventions.

In-Depth India Enteral Feeding Devices Industry Market Outlook

The India Enteral Feeding Devices Industry is set to witness sustained growth driven by a robust outlook for advanced healthcare solutions. The increasing focus on patient-centric care, coupled with technological innovations in smart feeding pumps and biocompatible feeding tubes, will significantly enhance market potential. The expansion of home healthcare services and the growing demand for specialized pediatric nutrition will unlock new market segments. Strategic collaborations and increased domestic manufacturing capabilities are poised to further accelerate growth, ensuring greater accessibility and affordability of enteral feeding devices across India. The industry is on a strong trajectory, poised to meet the evolving nutritional support needs of a growing and aging population.

India Enteral Feeding Devices Industry Segmentation

-

1. Product

- 1.1. Enteral Feeding Pump

- 1.2. Enteral Feeding Tube

- 1.3. Other Devices

-

2. Age Group

- 2.1. Adult

- 2.2. Pediatric

-

3. End User

- 3.1. Hospital

- 3.2. Ambulatory Care Service

- 3.3. Other End Users

-

4. Application

- 4.1. Oncology

- 4.2. Gastroenterology

- 4.3. Diabetes

- 4.4. Neurological Disorder

- 4.5. Hypermetabolism

- 4.6. Other Applications

India Enteral Feeding Devices Industry Segmentation By Geography

- 1. India

India Enteral Feeding Devices Industry Regional Market Share

Geographic Coverage of India Enteral Feeding Devices Industry

India Enteral Feeding Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Geriatric Population and High Prevalence of Chronic Diseases; Increasing Premature Birth Rate

- 3.3. Market Restrains

- 3.3.1. Complications Associated with Enteral Feeding Tubes

- 3.4. Market Trends

- 3.4.1. Oncology Segment Expected to Grow Faster During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Enteral Feeding Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Enteral Feeding Pump

- 5.1.2. Enteral Feeding Tube

- 5.1.3. Other Devices

- 5.2. Market Analysis, Insights and Forecast - by Age Group

- 5.2.1. Adult

- 5.2.2. Pediatric

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital

- 5.3.2. Ambulatory Care Service

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Oncology

- 5.4.2. Gastroenterology

- 5.4.3. Diabetes

- 5.4.4. Neurological Disorder

- 5.4.5. Hypermetabolism

- 5.4.6. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CONMED Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fresenius Se & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BD (Becton Dickinson and Company)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cardinal Health

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cook Medical Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nestlé*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 B Braun SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 CONMED Corporation

List of Figures

- Figure 1: India Enteral Feeding Devices Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Enteral Feeding Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: India Enteral Feeding Devices Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: India Enteral Feeding Devices Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 3: India Enteral Feeding Devices Industry Revenue Million Forecast, by Age Group 2020 & 2033

- Table 4: India Enteral Feeding Devices Industry Volume K Units Forecast, by Age Group 2020 & 2033

- Table 5: India Enteral Feeding Devices Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: India Enteral Feeding Devices Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 7: India Enteral Feeding Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: India Enteral Feeding Devices Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 9: India Enteral Feeding Devices Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: India Enteral Feeding Devices Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 11: India Enteral Feeding Devices Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 12: India Enteral Feeding Devices Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 13: India Enteral Feeding Devices Industry Revenue Million Forecast, by Age Group 2020 & 2033

- Table 14: India Enteral Feeding Devices Industry Volume K Units Forecast, by Age Group 2020 & 2033

- Table 15: India Enteral Feeding Devices Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: India Enteral Feeding Devices Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 17: India Enteral Feeding Devices Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: India Enteral Feeding Devices Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 19: India Enteral Feeding Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Enteral Feeding Devices Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Enteral Feeding Devices Industry?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the India Enteral Feeding Devices Industry?

Key companies in the market include CONMED Corporation, Fresenius Se & Co KGaA, BD (Becton Dickinson and Company), Cardinal Health, Abbott, Cook Medical Incorporated, Boston Scientific Corporation, Nestlé*List Not Exhaustive, B Braun SE.

3. What are the main segments of the India Enteral Feeding Devices Industry?

The market segments include Product, Age Group, End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 389.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Geriatric Population and High Prevalence of Chronic Diseases; Increasing Premature Birth Rate.

6. What are the notable trends driving market growth?

Oncology Segment Expected to Grow Faster During the Forecast Period.

7. Are there any restraints impacting market growth?

Complications Associated with Enteral Feeding Tubes.

8. Can you provide examples of recent developments in the market?

April 2022: Fresenius Kabi launched a new enteral nutrition product app. The enteral nutrition product app makes it easier to access detailed product information and includes a quick comparison tool to compare nutritional values against reference nutrient intakes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Enteral Feeding Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Enteral Feeding Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Enteral Feeding Devices Industry?

To stay informed about further developments, trends, and reports in the India Enteral Feeding Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence