Key Insights

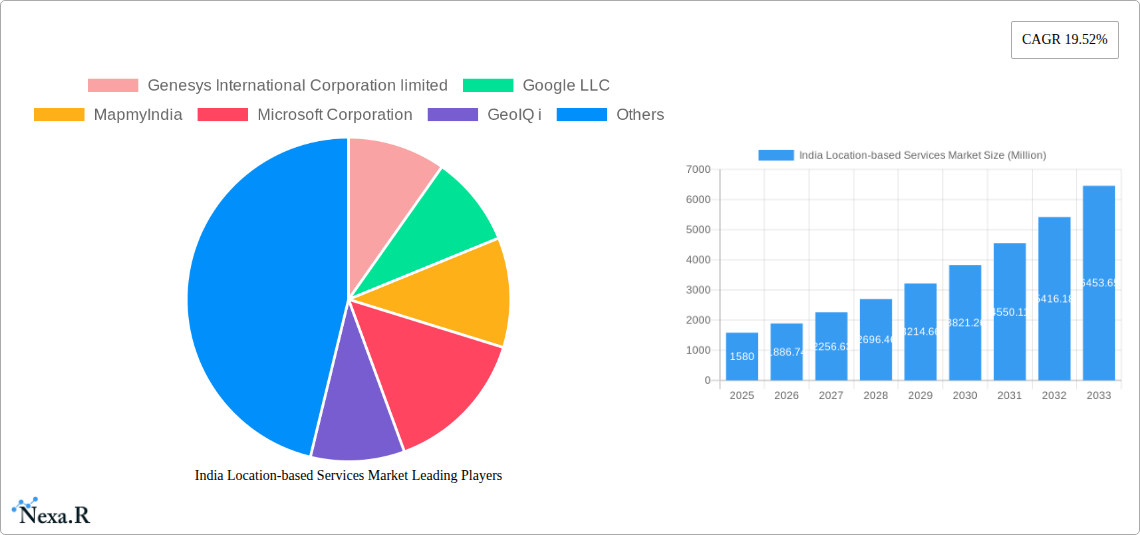

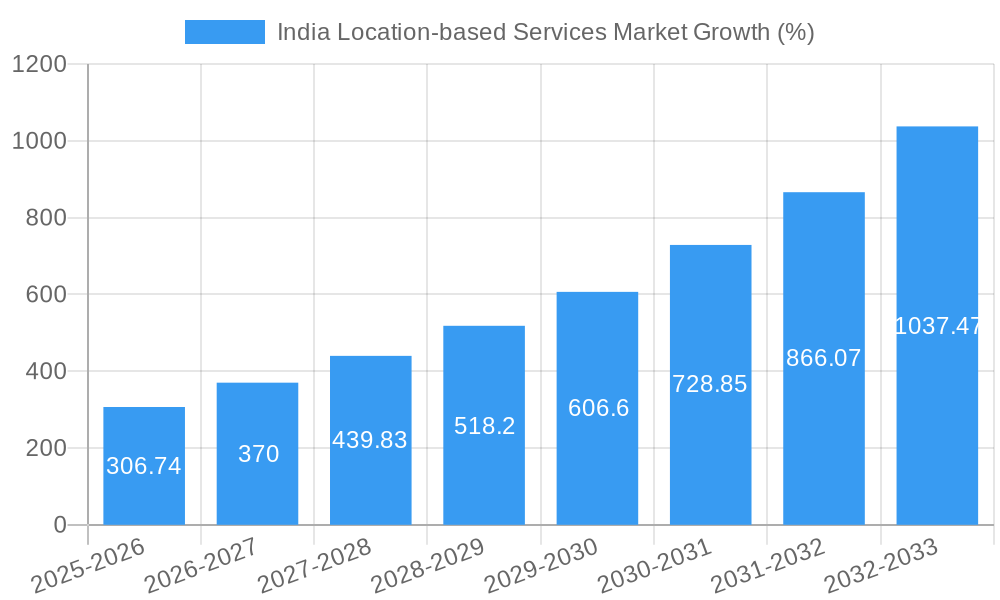

The India Location-based Services (LBS) market is experiencing robust growth, projected to reach $1.58 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 19.52% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing smartphone penetration and affordable data plans are creating a large addressable market for LBS applications. Furthermore, the growth of e-commerce and the rising adoption of digital mapping and navigation tools are significantly boosting the demand. Government initiatives promoting digital infrastructure and smart city projects are further catalyzing market growth. The burgeoning logistics and transportation sectors are heavily reliant on LBS for efficient route optimization, fleet management, and delivery tracking, contributing substantially to market expansion. Finally, the increasing adoption of LBS in diverse sectors like healthcare (location-based emergency services), BFSI (fraud detection and risk management), and advertising (location-targeted campaigns) is diversifying revenue streams and strengthening the overall market.

Significant trends shaping the Indian LBS market include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for enhanced location accuracy and personalized services. The increasing adoption of Internet of Things (IoT) devices is providing a wealth of location data, creating new opportunities for analytics and insights. Growing consumer preference for personalized experiences and targeted advertising further enhances the market's appeal. However, challenges such as data privacy concerns, infrastructure limitations in certain regions, and the need for robust cybersecurity measures represent potential restraints on market growth. The market is segmented by end-user (Transportation & Logistics, IT & Telecom, Healthcare, Government, BFSI, Hospitality, Manufacturing, Others), component (Hardware, Software, Services), location (Indoor, Outdoor), and application (Mapping & Navigation, Business Intelligence & Analytics, Location-based Advertising, Social Networking & Entertainment, Others). The diverse application areas and continuous technological advancements position the India LBS market for sustained and significant growth in the coming years.

India Location-based Services Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the rapidly expanding India Location-based Services (LBS) market, encompassing its current dynamics, future growth trajectory, and key players. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The market is segmented by end-user, component, location, and application, providing a granular understanding of the various factors shaping its evolution. The report's insights are invaluable for businesses, investors, and policymakers seeking to navigate this dynamic landscape. Market values are presented in million units.

India Location-based Services Market Dynamics & Structure

The Indian LBS market is characterized by a moderately concentrated structure, with key players vying for market share. Technological innovation, particularly in areas like AI and 5G, is a significant growth driver. The regulatory environment, while evolving, presents both opportunities and challenges. The emergence of sophisticated mapping technologies and increased smartphone penetration fuels market growth. The market experiences considerable M&A activity, reflecting consolidation and strategic expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025 (estimated).

- Technological Innovation: AI-powered location intelligence, IoT integration, and 5G deployment are key drivers.

- Regulatory Framework: Government initiatives promoting digitalization and smart city projects create opportunities, but navigating regulations requires careful planning.

- Competitive Substitutes: Traditional navigation systems and less precise location technologies pose some competition.

- End-User Demographics: Growing urban population, rising smartphone usage, and increased digital literacy are crucial factors.

- M&A Trends: Consolidation through acquisitions and strategic partnerships is expected to increase in the forecast period. An estimated xx M&A deals were observed in the historical period (2019-2024).

India Location-based Services Market Growth Trends & Insights

The Indian LBS market witnessed significant growth during the historical period (2019-2024), driven by factors such as rising smartphone adoption, increasing urbanization, and growing demand for location-based services across various sectors. The market is projected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the introduction of India's indigenous navigation system, are expected to further accelerate market expansion. Consumer behavior is shifting towards greater reliance on location-based apps and services for navigation, information access, and personalized experiences. Market penetration for LBS in key sectors like transportation and logistics is steadily increasing, with an estimated penetration rate of xx% in 2025, projected to reach xx% by 2033.

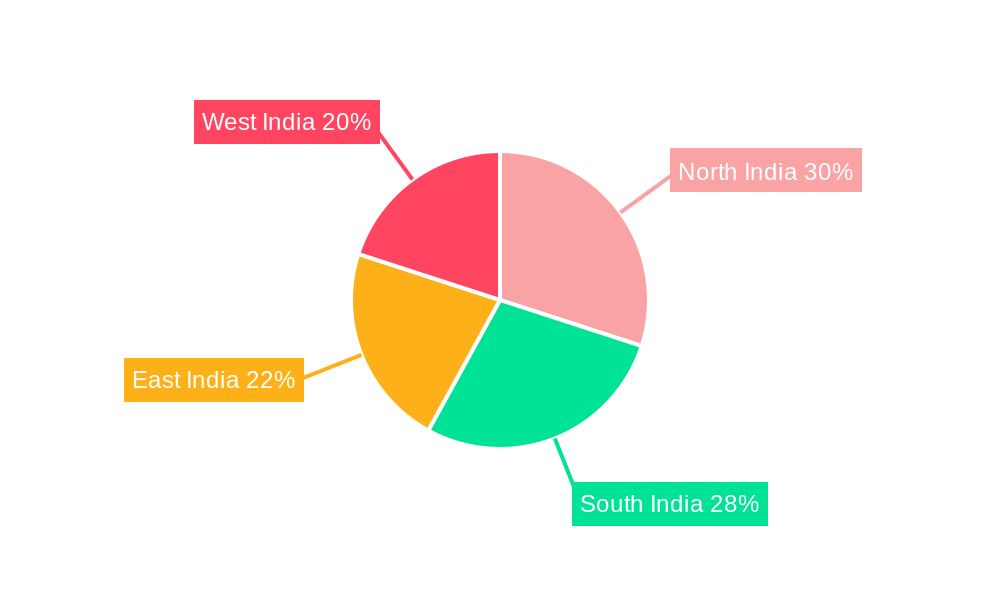

Dominant Regions, Countries, or Segments in India Location-based Services Market

The Transportation and Logistics segment is currently the largest end-user segment within the Indian LBS market, driven by the need for efficient fleet management, real-time tracking, and optimized delivery routes. Urban areas show higher adoption rates compared to rural areas. The Software component holds the largest share of the market, reflecting the increasing reliance on LBS software solutions across various applications. The Mapping and Navigation application leads the market in terms of both revenue and user adoption.

- By End-User: Transportation & Logistics dominates, followed by IT & Telecom and Government.

- By Component: Software segment leads, followed by services and hardware.

- By Location: Urban areas show significantly higher adoption of LBS than rural regions.

- By Application: Mapping & Navigation leads, followed by Business Intelligence & Analytics.

- Key Drivers: Government initiatives for smart cities, growing e-commerce, and increased investment in infrastructure.

India Location-based Services Market Product Landscape

The Indian LBS market showcases a diverse range of products, encompassing hardware components like GPS receivers and sensors, advanced software platforms for data processing and analysis, and a variety of value-added services. Products are increasingly incorporating AI and machine learning for enhanced accuracy, personalization, and predictive capabilities. Key features include real-time location tracking, geofencing, route optimization, and data analytics dashboards. Unique selling propositions often focus on platform integration, data security, and ease of use.

Key Drivers, Barriers & Challenges in India Location-based Services Market

Key Drivers:

- Increasing smartphone penetration and internet connectivity.

- Government initiatives promoting digitalization and smart cities.

- Growing demand for location-based services across diverse sectors.

- Advancements in GPS and mapping technologies.

Challenges:

- Data privacy and security concerns.

- Infrastructure limitations in certain regions.

- Competition from existing players.

- Ensuring interoperability of LBS across different platforms.

Emerging Opportunities in India Location-based Services Market

- Expansion into rural areas and untapped markets.

- Development of location-based services tailored to specific industries (e.g., agriculture, healthcare).

- Increased focus on data analytics and business intelligence capabilities.

- Growing adoption of IoT-enabled devices and sensors.

Growth Accelerators in the India Location-based Services Market Industry

The long-term growth of the Indian LBS market is poised to be significantly propelled by ongoing technological advancements, especially in AI and 5G, fostering innovation and increasing the accuracy and efficiency of location-based services. Strategic partnerships between technology providers, telecom operators, and end-user industries are expected to accelerate market expansion by facilitating seamless integration of LBS into various applications and services. Expansion into underserved rural markets and the development of tailored solutions for specialized industries hold significant potential for future growth.

Key Players Shaping the India Location-based Services Market Market

- Genesys International Corporation Limited

- Google LLC

- MapmyIndia

- Microsoft Corporation

- GeoIQ i

- Roam ai

- Aruba Networks

- LocationIQ

- Pert Telecom Solutions Pvt Ltd

- Mapsense Technologies (OPC) Private Limited

Notable Milestones in India Location-based Services Market Sector

- May 2023: ISRO launched NVS-01, India's indigenous navigation satellite, significantly boosting the accuracy and reach of location-based services.

- September 2022: Bentley Systems and Genesys International partnered to develop 3D city digital twins for urban India, enhancing urban planning and public service delivery.

In-Depth India Location-based Services Market Market Outlook

The Indian LBS market is poised for sustained growth, driven by technological advancements, increasing digital adoption, and government support. The market presents significant opportunities for businesses to leverage innovative technologies and cater to diverse industry needs. Strategic partnerships, expansion into new markets, and the development of niche applications will be key to capitalizing on the market's immense potential. The continued growth of the Indian economy, increasing urbanization, and the ongoing digitalization efforts will create a fertile ground for the LBS market to thrive.

India Location-based Services Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Location

- 2.1. Indoor

- 2.2. Outdoor

-

3. Application

- 3.1. Mapping and Navigation

- 3.2. Business Intelligence and Analytics

- 3.3. Location-based Advertising

- 3.4. Social Networking and Entertainment

- 3.5. Other Applications

-

4. End-User

- 4.1. Transportation and Logistics

- 4.2. IT and Telecom

- 4.3. Healthcare

- 4.4. Government

- 4.5. BFSI

- 4.6. Hospitality

- 4.7. Manufacturing

- 4.8. Other End-Users

India Location-based Services Market Segmentation By Geography

- 1. India

India Location-based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Geo-based Marketing; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption

- 3.3. Market Restrains

- 3.3.1. Rise in the privacy and security issues

- 3.4. Market Trends

- 3.4.1. The Increasing Adoption of Smartphones and Other Mobile Devices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Mapping and Navigation

- 5.3.2. Business Intelligence and Analytics

- 5.3.3. Location-based Advertising

- 5.3.4. Social Networking and Entertainment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Transportation and Logistics

- 5.4.2. IT and Telecom

- 5.4.3. Healthcare

- 5.4.4. Government

- 5.4.5. BFSI

- 5.4.6. Hospitality

- 5.4.7. Manufacturing

- 5.4.8. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North India India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Genesys International Corporation limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Google LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MapmyIndia

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Microsoft Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GeoIQ i

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Roam ai

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Aruba Networks

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LocationIQ

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Pert Telecom Solutions Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mapsense Technologies (OPC) Private Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Genesys International Corporation limited

List of Figures

- Figure 1: India Location-based Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Location-based Services Market Share (%) by Company 2024

List of Tables

- Table 1: India Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: India Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: India Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: India Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: India Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: India Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North India India Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South India India Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: East India India Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West India India Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 13: India Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: India Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: India Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: India Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Location-based Services Market?

The projected CAGR is approximately 19.52%.

2. Which companies are prominent players in the India Location-based Services Market?

Key companies in the market include Genesys International Corporation limited, Google LLC, MapmyIndia, Microsoft Corporation, GeoIQ i, Roam ai, Aruba Networks, LocationIQ, Pert Telecom Solutions Pvt Ltd, Mapsense Technologies (OPC) Private Limited.

3. What are the main segments of the India Location-based Services Market?

The market segments include Component, Location, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Geo-based Marketing; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption.

6. What are the notable trends driving market growth?

The Increasing Adoption of Smartphones and Other Mobile Devices.

7. Are there any restraints impacting market growth?

Rise in the privacy and security issues.

8. Can you provide examples of recent developments in the market?

May 2023: ISRO introduced India's version of GPS with the next-generation navigational satellite NVS-01, which would offer real-time timing and positioning services across India and a region around 1,500 km throughout the mainland. This series primarily incorporates L1 band signals additionally to broaden the services. This would drive the demand for the market's growth significantly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Location-based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Location-based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Location-based Services Market?

To stay informed about further developments, trends, and reports in the India Location-based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence