Key Insights

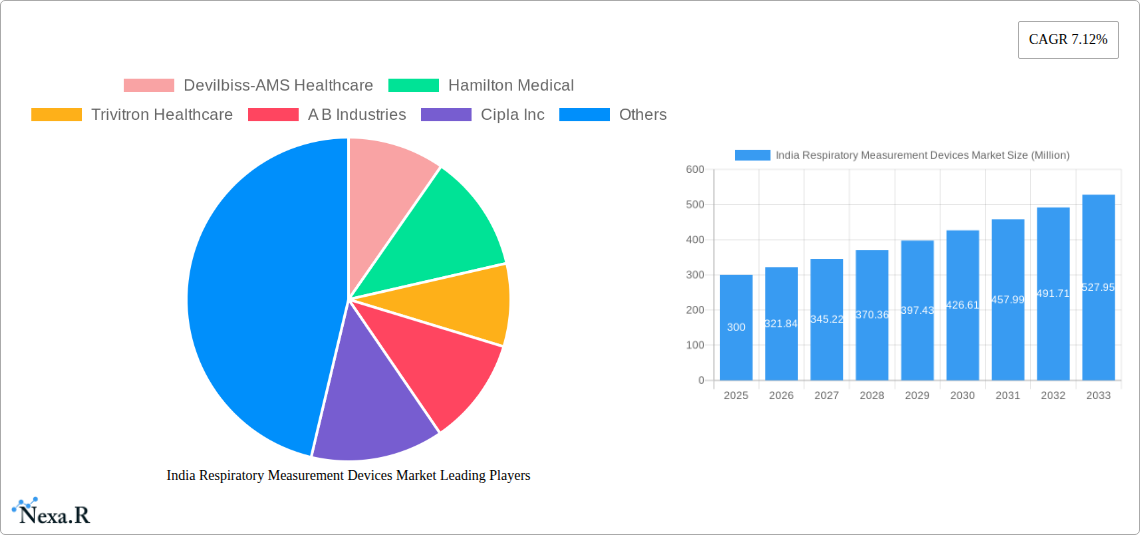

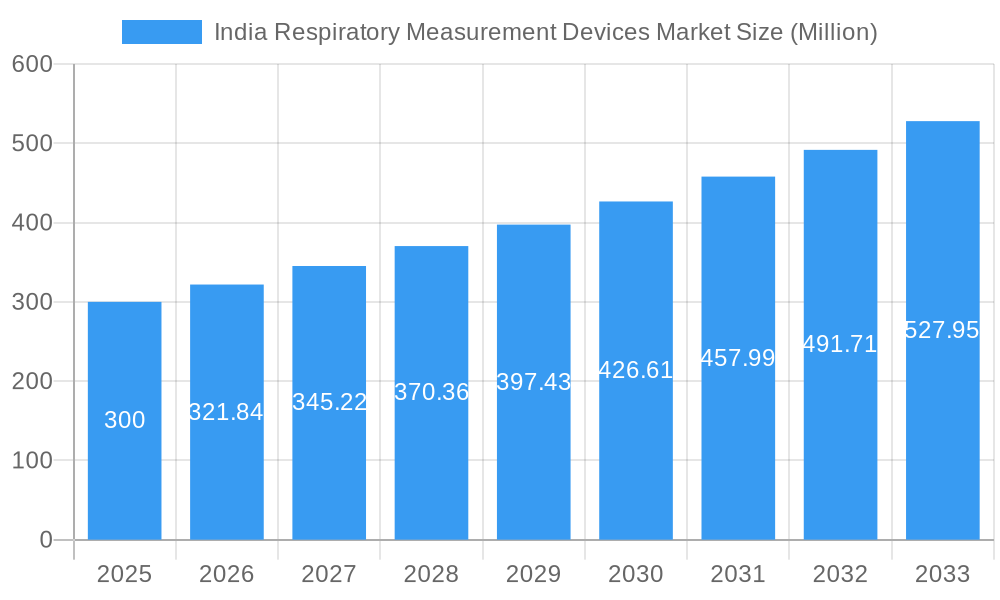

The India Respiratory Measurement Devices Market, valued at approximately ₹300 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.12% from 2025 to 2033. This expansion is fueled by several key factors. Rising prevalence of respiratory illnesses like asthma, COPD, and sleep apnea, coupled with an aging population, significantly increases demand for accurate and reliable diagnostic tools. Technological advancements leading to the development of portable, user-friendly devices, and improved diagnostic capabilities are further driving market growth. Government initiatives focused on improving healthcare infrastructure and raising public awareness about respiratory health also contribute to this positive trajectory. The market is segmented by product type (pulse oximeters, capnographs, etc.), indication (sleep apnea, COPD, etc.), and end-user (home care, hospitals, etc.). The home care segment is anticipated to witness significant growth due to increasing preference for convenient at-home monitoring and telehealth services. Competitive landscape analysis reveals key players like Philips, Medtronic, and ResMed actively participating in the market, driving innovation and expanding product portfolios.

India Respiratory Measurement Devices Market Market Size (In Million)

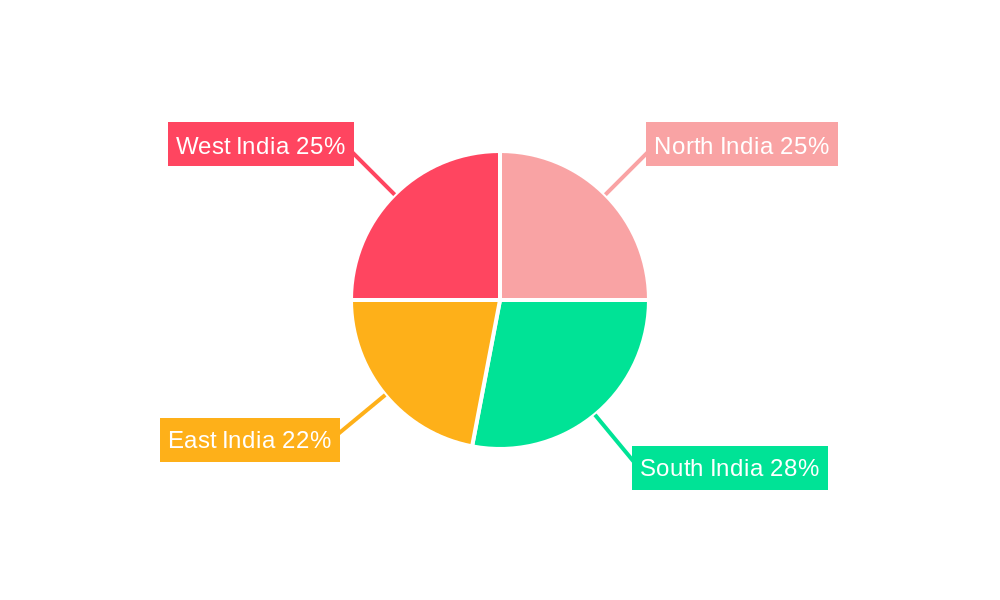

Despite the positive outlook, certain challenges hinder market expansion. High costs associated with advanced respiratory measurement devices, particularly polysomnographs, may limit accessibility, especially in rural areas. Furthermore, a lack of skilled healthcare professionals proficient in operating and interpreting these devices can pose a barrier to widespread adoption. However, initiatives focused on improving healthcare infrastructure and training healthcare professionals, combined with increasing affordability through technological advancements, are expected to mitigate these challenges in the coming years, thus sustaining market growth. The regional distribution of the market across North, South, East, and West India will likely reflect existing healthcare infrastructure and disease prevalence patterns.

India Respiratory Measurement Devices Market Company Market Share

India Respiratory Measurement Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Respiratory Measurement Devices Market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market of medical devices and the child market of respiratory measurement devices, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. Expected market value in Million Units: xx.

India Respiratory Measurement Devices Market Dynamics & Structure

The Indian respiratory measurement devices market is characterized by a moderately fragmented landscape, with several multinational and domestic players vying for market share. Technological innovation, particularly in areas like telehealth and AI-powered diagnostics, is a key driver. Stringent regulatory frameworks, primarily overseen by the CDSCO, influence product approvals and market access. The prevalence of respiratory diseases like COPD, asthma, and sleep apnea fuels demand, while the increasing affordability of devices expands market reach. The market also witnesses competitive pressures from substitute therapies and the emergence of innovative products. M&A activity, while not exceptionally high, shows signs of consolidation, primarily involving smaller players being acquired by larger corporations.

- Market Concentration: Moderately fragmented; top 5 players hold approximately xx% market share (2024).

- Technological Innovation: Focus on portability, connectivity, and AI-driven diagnostics.

- Regulatory Framework: CDSCO regulations influence market entry and product approvals.

- Competitive Substitutes: Alternative therapies and treatment approaches pose competitive pressure.

- End-User Demographics: Growing elderly population and rising prevalence of respiratory diseases drive demand.

- M&A Trends: Occasional acquisitions of smaller companies by larger multinational players.

India Respiratory Measurement Devices Market Growth Trends & Insights

The Indian respiratory measurement devices market is experiencing robust growth, driven by factors such as rising prevalence of respiratory illnesses, increasing healthcare expenditure, and growing awareness about early diagnosis and management of respiratory conditions. Technological advancements, particularly in portable and connected devices, are facilitating wider adoption and improved patient outcomes. The market has witnessed a significant shift towards home-based monitoring and telehealth solutions. The CAGR for the market during the forecast period (2025-2033) is estimated at xx%, with market penetration expected to reach xx% by 2033. This growth is further fueled by government initiatives promoting healthcare infrastructure development and improved access to quality healthcare. Consumer behavior is shifting towards sophisticated, user-friendly, and cost-effective devices.

Dominant Regions, Countries, or Segments in India Respiratory Measurement Devices Market

The market exhibits significant regional variations in growth, with metropolitan areas and states with higher prevalence of respiratory diseases showing stronger performance. Within product types, Pulse Oximeters hold the largest market share due to their widespread use in various healthcare settings and affordability. Sleep Apnea and COPD are leading indications driving demand, followed by Asthma. Hospitals remain the largest end-user segment due to higher volumes of diagnostic procedures and patient admissions.

- Leading Region: Urban centers and states with higher prevalence of respiratory diseases.

- Dominant Product Type: Pulse Oximeters

- Largest Indication Segment: Sleep Apnea and COPD

- Major End-User: Hospitals

- Key Growth Drivers: Rising prevalence of respiratory diseases, increasing healthcare expenditure, government initiatives.

India Respiratory Measurement Devices Market Product Landscape

The market offers a diverse range of respiratory measurement devices, encompassing pulse oximeters, capnographs, spirometers, polysomnographs, peak flow meters, and gas analyzers. Continuous innovation focuses on improving accuracy, portability, connectivity, and user-friendliness. Recent advancements include wireless connectivity for remote monitoring, smaller and more comfortable designs, and integration with telehealth platforms. Unique selling propositions often emphasize ease of use, data analysis capabilities, and integration with electronic health records (EHRs).

Key Drivers, Barriers & Challenges in India Respiratory Measurement Devices Market

Key Drivers:

- Rising prevalence of respiratory diseases (e.g., COPD, asthma, sleep apnea).

- Increasing healthcare expenditure and insurance coverage.

- Government initiatives promoting healthcare infrastructure and access.

- Technological advancements leading to more accurate and portable devices.

Challenges & Restraints:

- High cost of advanced devices limiting affordability.

- Lack of awareness about respiratory diseases and preventive measures in rural areas.

- Stringent regulatory approvals and import restrictions.

- Competition from generic and less expensive alternatives.

Emerging Opportunities in India Respiratory Measurement Devices Market

- Growing adoption of telehealth and remote patient monitoring.

- Expansion into rural and underserved markets.

- Development of cost-effective and user-friendly devices.

- Integration of AI and machine learning for improved diagnostics.

- Increased demand for home care respiratory devices.

Growth Accelerators in the India Respiratory Measurement Devices Market Industry

The market's long-term growth will be propelled by continued technological advancements, strategic partnerships between device manufacturers and healthcare providers, and expansion into untapped market segments. Government initiatives promoting healthcare infrastructure and digital health will further accelerate growth.

Key Players Shaping the India Respiratory Measurement Devices Market Market

- Devilbiss-AMS Healthcare

- Hamilton Medical

- Trivitron Healthcare

- A B Industries

- Cipla Inc

- GE Healthcare

- Medtronic PLC

- AgVa Healthcare

- Koninklijke Philips NV

- Air Liquide Medical Systems India

- ResMed Inc

- Fisher & Paykel Healthcare Ltd

Notable Milestones in India Respiratory Measurement Devices Market Sector

- November 2022: Xplore Health Technologies launched Airofit PRO, a respiratory muscle training device.

- October 2022: AirPhysio partnered with Apollo Hospitals Group and Medsmart to launch respiratory devices.

In-Depth India Respiratory Measurement Devices Market Outlook

The Indian respiratory measurement devices market is poised for sustained growth, driven by a confluence of factors, including rising prevalence of respiratory diseases, technological advancements, and supportive government policies. Strategic partnerships, market expansion initiatives, and the development of innovative, affordable devices will further shape the market's trajectory. The market presents significant opportunities for both established players and new entrants seeking to capitalize on the increasing demand for respiratory healthcare solutions.

India Respiratory Measurement Devices Market Segmentation

-

1. Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Spirometers

- 1.1.2. Sleep Test Devices

- 1.1.3. Peak Flow Meters

- 1.1.4. Pulse Oximeters

- 1.1.5. Capnographs

- 1.1.6. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic Devices

- 1.2.1. CPAP Devices

- 1.2.2. BiPAP Devices

- 1.2.3. Humidifiers

- 1.2.4. Nebulizers

- 1.2.5. Oxygen Concentrators

- 1.2.6. Ventilators

- 1.2.7. Inhalers

- 1.2.8. Other Therapeutic Devices

-

1.3. Disposables

- 1.3.1. Masks

- 1.3.2. Breathing Circuits

- 1.3.3. Other Disposables

-

1.1. Diagnostic and Monitoring Devices

India Respiratory Measurement Devices Market Segmentation By Geography

- 1. India

India Respiratory Measurement Devices Market Regional Market Share

Geographic Coverage of India Respiratory Measurement Devices Market

India Respiratory Measurement Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Prevalence of Respiratory Disorders

- 3.2.2 such as COPD

- 3.2.3 TB

- 3.2.4 Asthma

- 3.2.5 and Sleep Apnea; Technological Advancements and Increasing Applications in Home care Settings

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Spirometers is Anticipated to Have Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Respiratory Measurement Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Spirometers

- 5.1.1.2. Sleep Test Devices

- 5.1.1.3. Peak Flow Meters

- 5.1.1.4. Pulse Oximeters

- 5.1.1.5. Capnographs

- 5.1.1.6. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic Devices

- 5.1.2.1. CPAP Devices

- 5.1.2.2. BiPAP Devices

- 5.1.2.3. Humidifiers

- 5.1.2.4. Nebulizers

- 5.1.2.5. Oxygen Concentrators

- 5.1.2.6. Ventilators

- 5.1.2.7. Inhalers

- 5.1.2.8. Other Therapeutic Devices

- 5.1.3. Disposables

- 5.1.3.1. Masks

- 5.1.3.2. Breathing Circuits

- 5.1.3.3. Other Disposables

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Devilbiss-AMS Healthcare

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hamilton Medical

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trivitron Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 A B Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cipla Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GE Healthcare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AgVa Healthcare

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koninklijke Philips NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Air Liquide Medical Systems India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ResMed Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Fisher & Paykel Healthcare Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Devilbiss-AMS Healthcare

List of Figures

- Figure 1: India Respiratory Measurement Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Respiratory Measurement Devices Market Share (%) by Company 2025

List of Tables

- Table 1: India Respiratory Measurement Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Respiratory Measurement Devices Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: India Respiratory Measurement Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Respiratory Measurement Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: India Respiratory Measurement Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Respiratory Measurement Devices Market Volume K Units Forecast, by Type 2020 & 2033

- Table 7: India Respiratory Measurement Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: India Respiratory Measurement Devices Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Respiratory Measurement Devices Market?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the India Respiratory Measurement Devices Market?

Key companies in the market include Devilbiss-AMS Healthcare, Hamilton Medical, Trivitron Healthcare, A B Industries, Cipla Inc, GE Healthcare, Medtronic PLC, AgVa Healthcare, Koninklijke Philips NV, Air Liquide Medical Systems India, ResMed Inc, Fisher & Paykel Healthcare Ltd.

3. What are the main segments of the India Respiratory Measurement Devices Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 300 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders. such as COPD. TB. Asthma. and Sleep Apnea; Technological Advancements and Increasing Applications in Home care Settings.

6. What are the notable trends driving market growth?

Spirometers is Anticipated to Have Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

November 2022 : Xplore Health Technologies launched a first-of-its-kind respiratory muscle training (RMT) device called Airofit PRO in collaboration with Airofit, Denmark.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Respiratory Measurement Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Respiratory Measurement Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Respiratory Measurement Devices Market?

To stay informed about further developments, trends, and reports in the India Respiratory Measurement Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence