Key Insights

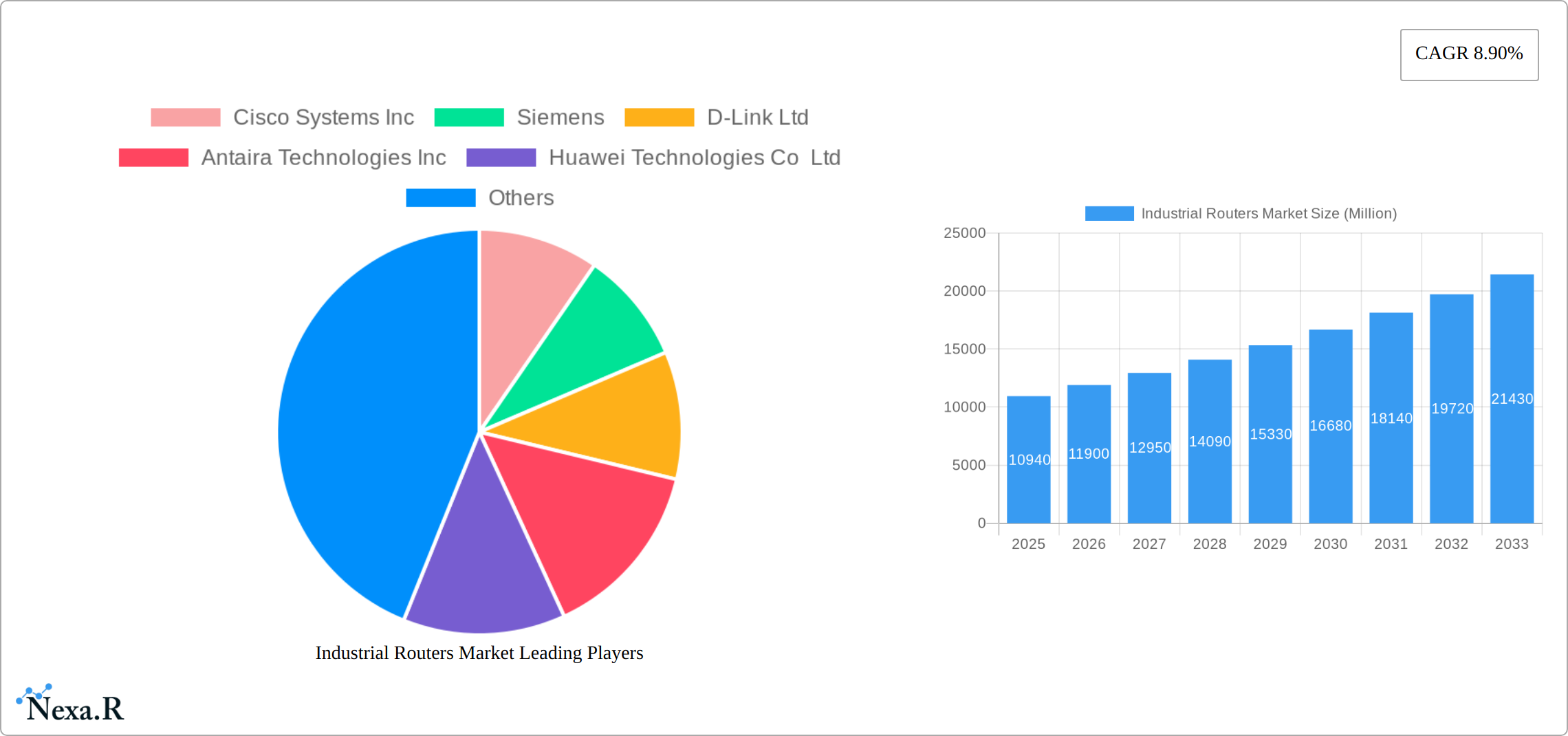

The Industrial Routers market, valued at $10.94 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of Industrial IoT (IIoT) technologies and the expanding need for secure and reliable network connectivity in industrial settings. The market's Compound Annual Growth Rate (CAGR) of 8.90% from 2019 to 2033 signifies a consistent demand for advanced routing solutions capable of handling the complex communication requirements of smart factories, oil and gas operations, and other industrial applications. Key growth drivers include the rising demand for automation, digitization initiatives across various industries, and the need for enhanced data security in critical infrastructure. Furthermore, the emergence of 5G and advancements in network technologies like Ethernet are fueling the adoption of high-performance industrial routers. While challenges exist concerning the complexities of integrating legacy systems and concerns about cybersecurity threats, the overall market trajectory remains positive, spurred by the continuous need for reliable and secure data transmission within industrial environments. The leading players, including Cisco, Siemens, and Huawei, are investing heavily in research and development to enhance their product offerings and meet the evolving demands of this dynamic market. Market segmentation, though not explicitly provided, likely includes variations based on router type (e.g., cellular, Ethernet, wireless), application (e.g., SCADA, process automation), and industry vertical.

The forecast period of 2025-2033 anticipates continued expansion, with a projected market size exceeding $20 billion by 2033, based on a conservative estimation considering the CAGR. This growth is expected to be fueled by broader IIoT adoption, ongoing digital transformation across industries, and the continuing need for robust and secure network infrastructure supporting critical industrial applications. Factors such as stringent regulatory compliance requirements and the ongoing need for improved network reliability will continue to shape the market landscape. The competitive landscape will remain intense, with established players striving to maintain their market share while newer entrants challenge the status quo with innovative solutions.

Industrial Routers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Industrial Routers Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The parent market is the broader networking equipment market, while the child market is specifically industrial communication networks. The total market size is projected to reach xx million units by 2033.

Industrial Routers Market Dynamics & Structure

The Industrial Routers Market is characterized by a moderately concentrated landscape, with key players like Cisco Systems Inc, Siemens, and Huawei Technologies Co Ltd holding significant market share. However, the market also exhibits considerable fragmentation, with numerous smaller players competing on the basis of specialized features and niche applications. Technological innovation, particularly in 5G and other wireless technologies, is a major driver of market growth. Stringent regulatory frameworks related to industrial safety and data security significantly influence the market's trajectory. The increasing adoption of Industrial IoT (IIoT) and Industry 4.0 initiatives fuels demand for robust and reliable industrial routers. Competitive product substitutes include dedicated industrial Ethernet switches and wireless communication modules, although routers retain their advantage in flexibility and connectivity options. End-user demographics are diverse, ranging from manufacturing and energy to transportation and logistics. M&A activity has been moderate, with strategic acquisitions aimed at strengthening technology portfolios and expanding market reach. The market witnessed approximately xx M&A deals between 2019 and 2024, resulting in a xx% market share shift among the top 5 players.

- Market Concentration: Moderately concentrated, with a few major players and several smaller competitors.

- Technological Innovation: 5G, improved security protocols, and enhanced data processing capabilities are key drivers.

- Regulatory Frameworks: Compliance with industrial safety and data security standards is crucial.

- Competitive Substitutes: Industrial Ethernet switches and wireless communication modules pose some competition.

- End-User Demographics: Manufacturing, energy, transportation, and logistics sectors are major end-users.

- M&A Trends: Moderate level of M&A activity, focused on strategic acquisitions and technology integration.

Industrial Routers Market Growth Trends & Insights

The Industrial Routers Market has experienced consistent growth over the historical period (2019-2024), with a CAGR of xx%. This growth is primarily driven by the increasing adoption of IIoT, the expanding smart factory movement, and the rising demand for reliable and secure industrial communication solutions. Technological advancements, such as the emergence of 5G and enhanced cybersecurity features, have further fueled market expansion. Shifting consumer behavior towards automation, data-driven decision-making, and remote monitoring and control further supports the trend. Market penetration within key industrial sectors remains relatively high in developed economies but offers significant untapped potential in emerging markets. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033.

Dominant Regions, Countries, or Segments in Industrial Routers Market

North America currently holds the largest market share, driven by strong industrial automation adoption and robust infrastructure. Asia-Pacific is expected to exhibit the fastest growth rate due to rapid industrialization and increasing investments in smart factories. Europe follows with significant market presence, driven by strong government support for Industry 4.0 initiatives. The manufacturing segment accounts for the largest share, while the energy and transportation segments are expected to show robust growth in the coming years.

- North America: Strong industrial automation, robust infrastructure, and early adoption of advanced technologies.

- Asia-Pacific: Rapid industrialization, increasing investments in smart factories, and growing IIoT adoption.

- Europe: Strong government support for Industry 4.0, well-established industrial base, and focus on digital transformation.

- Manufacturing: Largest segment, driven by the need for automated and connected production lines.

- Energy and Transportation: Fastest-growing segments, fueled by smart grids and autonomous vehicle technologies.

Industrial Routers Market Product Landscape

Industrial routers offer a range of features catering to diverse applications, including VPN support, advanced security protocols, wide temperature operating ranges, and ruggedized designs. Key performance metrics include data throughput, latency, and network security. Unique selling propositions often involve specialized features like cellular backhaul, redundant communication paths, and integrated power over Ethernet (PoE). Technological advancements focus on higher bandwidths, enhanced security, and support for newer wireless technologies like 5G and private LTE networks.

Key Drivers, Barriers & Challenges in Industrial Routers Market

Key Drivers: The primary drivers are the rapid expansion of IIoT, the increasing demand for enhanced security and reliability in industrial networks, and the growing need for remote monitoring and control of industrial assets. Government initiatives promoting digitalization and automation further accelerate market growth.

Key Challenges: Supply chain disruptions, especially regarding semiconductor components, pose a significant challenge. The complexity of integrating industrial routers into existing legacy systems can hinder adoption. Competition from established players and emerging new entrants puts pressure on pricing and margins. Regulatory compliance requirements and cybersecurity threats also present substantial obstacles. These factors are estimated to negatively impact market growth by xx% annually.

Emerging Opportunities in Industrial Routers Market

Untapped markets in developing economies present significant growth potential. The increasing adoption of edge computing creates new opportunities for routers with integrated data processing capabilities. The convergence of IT and OT (operational technology) networks drives demand for routers with advanced security and management features. Growing focus on sustainability and energy efficiency leads to opportunities for routers with low power consumption.

Growth Accelerators in the Industrial Routers Market Industry

Technological breakthroughs in 5G and other wireless technologies, alongside the development of more robust and secure networking protocols, significantly accelerate market growth. Strategic partnerships between router manufacturers and industrial automation providers create synergies and expand market reach. Government incentives and policies supporting digital transformation initiatives further propel market expansion.

Key Players Shaping the Industrial Routers Market Market

- Cisco Systems Inc

- Siemens

- D-Link Ltd

- Antaira Technologies Inc

- Huawei Technologies Co Ltd

- ZTE Corporation

- Dell Technologies Inc

- Inseego Corporation

- ASUSTeK Computer Inc

- Advantech Co Ltd *List Not Exhaustive

Notable Milestones in Industrial Routers Market Sector

- September 2024: Siemens Limited launched private industrial 5G user equipment, including the Scalance MUM856-1 and MUM853-1 routers, significantly advancing manufacturing digital transformation.

- February 2024: Robustel launched the R5010 High Speed 5G Router, supporting both 5G NSA and SA networks, enhancing high-bandwidth fixed wireless access options.

In-Depth Industrial Routers Market Market Outlook

The Industrial Routers Market is poised for continued strong growth, driven by ongoing technological advancements, increasing IIoT adoption, and the expansion of smart factories across various industries. Strategic partnerships, investments in research and development, and the exploration of new applications will be crucial for players to capitalize on the market's vast potential. The increasing focus on edge computing and the demand for enhanced security will also shape the future of the market. The market is expected to reach xx million units by 2033, offering substantial opportunities for growth and innovation.

Industrial Routers Market Segmentation

-

1. Product Type

- 1.1. Wired

- 1.2. Wireless

-

2. End User Industry

- 2.1. Process Industry

- 2.2. Discrete Industry

Industrial Routers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Industrial Routers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Popularity of Industrial 4.; Increasing Government Investment towards Infrastructural Development

- 3.3. Market Restrains

- 3.3.1. Rising Popularity of Industrial 4.; Increasing Government Investment towards Infrastructural Development

- 3.4. Market Trends

- 3.4.1. Processing Industry Expected to Observe Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Routers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Process Industry

- 5.2.2. Discrete Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Industrial Routers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Process Industry

- 6.2.2. Discrete Industry

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Industrial Routers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Process Industry

- 7.2.2. Discrete Industry

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Industrial Routers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Process Industry

- 8.2.2. Discrete Industry

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Industrial Routers Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Process Industry

- 9.2.2. Discrete Industry

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Industrial Routers Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by End User Industry

- 10.2.1. Process Industry

- 10.2.2. Discrete Industry

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Industrial Routers Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Wired

- 11.1.2. Wireless

- 11.2. Market Analysis, Insights and Forecast - by End User Industry

- 11.2.1. Process Industry

- 11.2.2. Discrete Industry

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cisco Systems Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Siemens

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 D-Link Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Antaira Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Huawei Technologies Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ZTE Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dell Technologies Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Inseego Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ASUSTeK Computer Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Advantech Co Ltd*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Global Industrial Routers Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Industrial Routers Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Industrial Routers Market Revenue (Million), by Product Type 2024 & 2032

- Figure 4: North America Industrial Routers Market Volume (Billion), by Product Type 2024 & 2032

- Figure 5: North America Industrial Routers Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Industrial Routers Market Volume Share (%), by Product Type 2024 & 2032

- Figure 7: North America Industrial Routers Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 8: North America Industrial Routers Market Volume (Billion), by End User Industry 2024 & 2032

- Figure 9: North America Industrial Routers Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 10: North America Industrial Routers Market Volume Share (%), by End User Industry 2024 & 2032

- Figure 11: North America Industrial Routers Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Industrial Routers Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Industrial Routers Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Industrial Routers Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Industrial Routers Market Revenue (Million), by Product Type 2024 & 2032

- Figure 16: Europe Industrial Routers Market Volume (Billion), by Product Type 2024 & 2032

- Figure 17: Europe Industrial Routers Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Industrial Routers Market Volume Share (%), by Product Type 2024 & 2032

- Figure 19: Europe Industrial Routers Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 20: Europe Industrial Routers Market Volume (Billion), by End User Industry 2024 & 2032

- Figure 21: Europe Industrial Routers Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 22: Europe Industrial Routers Market Volume Share (%), by End User Industry 2024 & 2032

- Figure 23: Europe Industrial Routers Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Industrial Routers Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Europe Industrial Routers Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Industrial Routers Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Industrial Routers Market Revenue (Million), by Product Type 2024 & 2032

- Figure 28: Asia Industrial Routers Market Volume (Billion), by Product Type 2024 & 2032

- Figure 29: Asia Industrial Routers Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Industrial Routers Market Volume Share (%), by Product Type 2024 & 2032

- Figure 31: Asia Industrial Routers Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 32: Asia Industrial Routers Market Volume (Billion), by End User Industry 2024 & 2032

- Figure 33: Asia Industrial Routers Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 34: Asia Industrial Routers Market Volume Share (%), by End User Industry 2024 & 2032

- Figure 35: Asia Industrial Routers Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Industrial Routers Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Asia Industrial Routers Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Industrial Routers Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Australia and New Zealand Industrial Routers Market Revenue (Million), by Product Type 2024 & 2032

- Figure 40: Australia and New Zealand Industrial Routers Market Volume (Billion), by Product Type 2024 & 2032

- Figure 41: Australia and New Zealand Industrial Routers Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 42: Australia and New Zealand Industrial Routers Market Volume Share (%), by Product Type 2024 & 2032

- Figure 43: Australia and New Zealand Industrial Routers Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 44: Australia and New Zealand Industrial Routers Market Volume (Billion), by End User Industry 2024 & 2032

- Figure 45: Australia and New Zealand Industrial Routers Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 46: Australia and New Zealand Industrial Routers Market Volume Share (%), by End User Industry 2024 & 2032

- Figure 47: Australia and New Zealand Industrial Routers Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Australia and New Zealand Industrial Routers Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Australia and New Zealand Industrial Routers Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Industrial Routers Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Industrial Routers Market Revenue (Million), by Product Type 2024 & 2032

- Figure 52: Latin America Industrial Routers Market Volume (Billion), by Product Type 2024 & 2032

- Figure 53: Latin America Industrial Routers Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 54: Latin America Industrial Routers Market Volume Share (%), by Product Type 2024 & 2032

- Figure 55: Latin America Industrial Routers Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 56: Latin America Industrial Routers Market Volume (Billion), by End User Industry 2024 & 2032

- Figure 57: Latin America Industrial Routers Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 58: Latin America Industrial Routers Market Volume Share (%), by End User Industry 2024 & 2032

- Figure 59: Latin America Industrial Routers Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Latin America Industrial Routers Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Latin America Industrial Routers Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Latin America Industrial Routers Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Middle East and Africa Industrial Routers Market Revenue (Million), by Product Type 2024 & 2032

- Figure 64: Middle East and Africa Industrial Routers Market Volume (Billion), by Product Type 2024 & 2032

- Figure 65: Middle East and Africa Industrial Routers Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 66: Middle East and Africa Industrial Routers Market Volume Share (%), by Product Type 2024 & 2032

- Figure 67: Middle East and Africa Industrial Routers Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 68: Middle East and Africa Industrial Routers Market Volume (Billion), by End User Industry 2024 & 2032

- Figure 69: Middle East and Africa Industrial Routers Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 70: Middle East and Africa Industrial Routers Market Volume Share (%), by End User Industry 2024 & 2032

- Figure 71: Middle East and Africa Industrial Routers Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Middle East and Africa Industrial Routers Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Middle East and Africa Industrial Routers Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East and Africa Industrial Routers Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Routers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Routers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 7: Global Industrial Routers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Industrial Routers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 13: Global Industrial Routers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Industrial Routers Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 17: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 18: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 19: Global Industrial Routers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Industrial Routers Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 23: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 24: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 25: Global Industrial Routers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Industrial Routers Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 29: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 30: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 31: Global Industrial Routers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Industrial Routers Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 35: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 36: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 37: Global Industrial Routers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Industrial Routers Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Global Industrial Routers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Industrial Routers Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 41: Global Industrial Routers Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 42: Global Industrial Routers Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 43: Global Industrial Routers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Industrial Routers Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Routers Market?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the Industrial Routers Market?

Key companies in the market include Cisco Systems Inc, Siemens, D-Link Ltd, Antaira Technologies Inc, Huawei Technologies Co Ltd, ZTE Corporation, Dell Technologies Inc, Inseego Corporation, ASUSTeK Computer Inc, Advantech Co Ltd*List Not Exhaustive.

3. What are the main segments of the Industrial Routers Market?

The market segments include Product Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Popularity of Industrial 4.; Increasing Government Investment towards Infrastructural Development.

6. What are the notable trends driving market growth?

Processing Industry Expected to Observe Significant Growth.

7. Are there any restraints impacting market growth?

Rising Popularity of Industrial 4.; Increasing Government Investment towards Infrastructural Development.

8. Can you provide examples of recent developments in the market?

September 2024: Siemens Limited launched private industrial 5G user equipment, marking a pivotal step for the manufacturing industry's digital transformation. Siemens introduced its inaugural industrial 5G routers, Scalance MUM856-1 and MUM853-1, designed to bolster mobile broadband transmission, facilitate massive machine-type communication, and ensure ultra-reliable low latencies.February 2024: Robustel expanded its 5G router lineup with the R5010 High Speed 5G Router. This router supports both 5G NSA (non-standalone) and 5G SA (standalone) networks, and is compatible with 3GPP Release 16. Measuring just 10cm, the R5010 boasts a compact design, offers multiple power supply options (PoE & USB), and features an Ethernet/USB Modem Mode, making it ideal for enterprises seeking high bandwidth Fixed Wireless Access or mobile internet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Routers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Routers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Routers Market?

To stay informed about further developments, trends, and reports in the Industrial Routers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence