Key Insights

The global Investment Banking market is projected to reach 150.49 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.6%. This steady expansion is underpinned by several key drivers, including heightened mergers and acquisitions (M&A) activity, bolstered by private equity investments and market consolidation. The growing complexity of international financial transactions and the expansion of emerging markets also sustain demand for specialized advisory and underwriting services. Concurrently, the integration of fintech solutions is enhancing operational efficiency and client engagement within the industry.

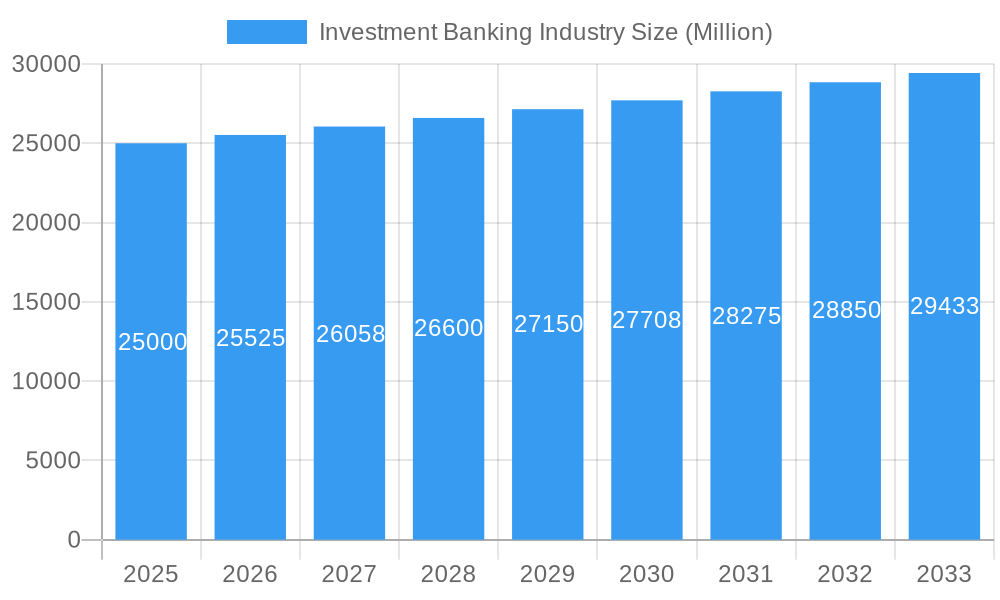

Investment Banking Industry Market Size (In Billion)

Despite robust growth potential, the Investment Banking sector navigates significant challenges. Increased regulatory oversight and associated compliance expenditures pose a substantial hurdle to profitability. Geopolitical instability and macroeconomic fluctuations, including inflation and potential recessions, can adversely affect deal volumes and investor confidence. Intense competition from both established institutions and specialized firms further pressures profit margins. Nevertheless, the fundamental requirement for advanced financial expertise in a dynamic global landscape supports a positive long-term outlook. Market segmentation, encompassing M&A advisory, underwriting, and equity research, will continue to shape industry dynamics and regional growth. Prominent entities such as J.P. Morgan Chase & Co., Goldman Sachs Group Inc., and Morgan Stanley are expected to retain their market leadership due to their extensive networks and strong brand equity.

Investment Banking Industry Company Market Share

Investment Banking Industry: A Comprehensive Market Report (2019-2033)

This meticulously researched report provides a detailed analysis of the global Investment Banking industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes a robust methodology, incorporating both qualitative and quantitative data to offer a comprehensive understanding of this dynamic sector. This report is ideal for investment professionals, financial analysts, industry stakeholders, and anyone seeking in-depth knowledge of the investment banking landscape. The market is segmented by various services offered by Investment Banks including Mergers and Acquisitions, Underwriting, and other services. This report also provides valuable information on the parent market of Financial Services and its influence on the Investment Banking industry.

Target Audience: Investment Professionals, Financial Analysts, Business Strategists, Investors, Government Agencies, and Market Research Firms.

Investment Banking Industry Market Dynamics & Structure

The global investment banking industry, valued at xx Million in 2024, is characterized by high market concentration among a few dominant players and significant regulatory oversight. Technological innovation is a key driver, impacting deal execution, risk management, and client service. The industry faces ongoing challenges from evolving regulatory frameworks, the rise of fintech competitors, and economic fluctuations. M&A activity within the sector itself continues to shape the competitive landscape.

- Market Concentration: High, with top 10 players holding approximately xx% market share in 2024.

- Technological Innovation: Increased adoption of AI, machine learning, and blockchain technologies for enhanced due diligence, risk assessment, and trade execution.

- Regulatory Frameworks: Stringent regulations (e.g., Dodd-Frank, MiFID II) impact operational costs and business strategies.

- Competitive Product Substitutes: Fintech firms and alternative finance platforms offer some competitive pressure, especially in areas like lending and crowdfunding.

- End-User Demographics: Primarily institutional investors, corporations, governments, and high-net-worth individuals.

- M&A Trends: Consolidation continues, with larger firms acquiring smaller players to expand capabilities and market reach. Deal volume in 2024 reached approximately xx Million deals.

Investment Banking Industry Growth Trends & Insights

The global investment banking market exhibited a CAGR of xx% during the historical period (2019-2024), driven by robust M&A activity, increased IPOs, and evolving investor preferences. The adoption rate of technology within the industry has accelerated, particularly in areas like algorithmic trading and data analytics. Shifting consumer behavior towards digital platforms and personalized financial services has influenced service delivery models. The market size is projected to reach xx Million by 2025 and xx Million by 2033, maintaining a CAGR of xx% during the forecast period (2025-2033).

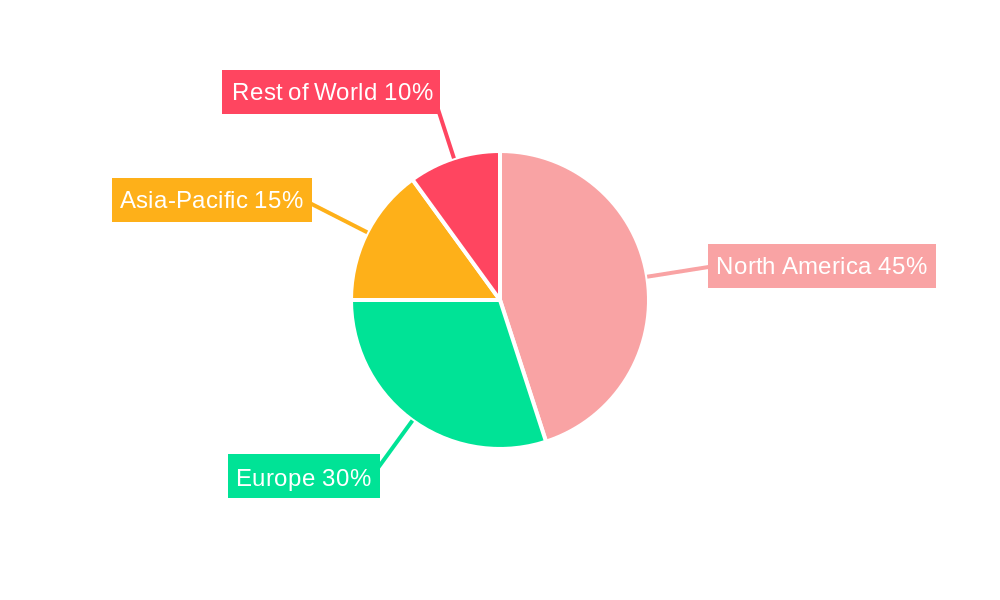

Dominant Regions, Countries, or Segments in Investment Banking Industry

North America remains the dominant region, accounting for xx% of the global market share in 2024, followed by Europe and Asia-Pacific. The United States continues to be the leading country, driven by a robust financial market, strong regulatory environment (though evolving), and the presence of numerous large investment banks.

- Key Drivers in North America: Strong economic growth, mature financial markets, and a large pool of institutional investors.

- Key Drivers in Europe: Recovery post-financial crisis, increasing cross-border M&A activity, and ongoing regulatory reforms.

- Key Drivers in Asia-Pacific: Rapid economic expansion, increasing domestic capital markets, and growing demand for sophisticated financial services.

Investment Banking Industry Product Landscape

Investment banking services encompass a broad range of offerings, including mergers and acquisitions advisory, underwriting (equity and debt), financial restructuring, and wealth management. Recent product innovations focus on technology-enabled solutions, improved data analytics for deal sourcing and risk management, and more sophisticated financial modeling tools. The competitive landscape necessitates continual refinement of service offerings and technological advancements to enhance efficiency and attract clients.

Key Drivers, Barriers & Challenges in Investment Banking Industry

Key Drivers:

- Technological advancements enabling automation and data-driven decision-making.

- Increased cross-border M&A activity fueled by globalization.

- Growth of private equity and venture capital investments.

Challenges & Restraints:

- Stringent regulatory compliance costs and complexities.

- Cybersecurity risks and data breaches.

- Intense competition from both established and emerging players (including fintech). This has resulted in a xx% reduction in average profit margins over the past 5 years.

- Economic downturns significantly impact deal flow and revenue streams.

Emerging Opportunities in Investment Banking Industry

- Growing demand for sustainable finance and ESG (environmental, social, and governance) investing presents significant opportunities.

- Expansion into emerging markets with less developed financial infrastructure.

- Development of specialized financial products and services catering to niche markets.

Growth Accelerators in the Investment Banking Industry

Technological innovation, strategic partnerships (e.g., with fintech firms), and expansion into new geographic markets will be key growth catalysts for the investment banking industry over the next decade. Strategic acquisitions of technology companies and the development of proprietary data analytics capabilities will further enhance market position and service capabilities.

Key Players Shaping the Investment Banking Industry Market

Notable Milestones in Investment Banking Industry Sector

- 2020: Increased use of virtual deal rooms due to the COVID-19 pandemic.

- 2021: Record M&A activity driven by strong economic recovery.

- 2022: Significant volatility in financial markets impacted deal flow.

- 2023: Focus on sustainable finance initiatives gaining momentum.

In-Depth Investment Banking Industry Market Outlook

The investment banking industry is poised for sustained growth over the next decade, driven by technological advancements, strategic partnerships, and increasing demand for sophisticated financial services. The industry’s ability to adapt to regulatory changes, navigate economic uncertainty, and embrace innovation will be crucial to realizing its full market potential. The focus on ESG investing and the expansion into emerging markets represent particularly promising avenues for future growth.

Investment Banking Industry Segmentation

-

1. Product Types

- 1.1. Mergers & Acquisitions

- 1.2. Debt Capital Markets

- 1.3. Equity Capital Markets

- 1.4. Syndicated Loans and Others

Investment Banking Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Latin America

-

2. EMEA

- 2.1. Europe

- 2.2. Russia

- 2.3. United Kingdom

- 2.4. Middle East

-

3. Asia

- 3.1. Japan

- 3.2. China

- 3.3. Others

-

4. Australasia

- 4.1. Australia

- 4.2. New Zealand

Investment Banking Industry Regional Market Share

Geographic Coverage of Investment Banking Industry

Investment Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. 2019 - The Year of Mega Deals yet with Lesser M&A Volume

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 5.1.1. Mergers & Acquisitions

- 5.1.2. Debt Capital Markets

- 5.1.3. Equity Capital Markets

- 5.1.4. Syndicated Loans and Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.2.2. EMEA

- 5.2.3. Asia

- 5.2.4. Australasia

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 6. Americas Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 6.1.1. Mergers & Acquisitions

- 6.1.2. Debt Capital Markets

- 6.1.3. Equity Capital Markets

- 6.1.4. Syndicated Loans and Others

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 7. EMEA Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 7.1.1. Mergers & Acquisitions

- 7.1.2. Debt Capital Markets

- 7.1.3. Equity Capital Markets

- 7.1.4. Syndicated Loans and Others

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 8. Asia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 8.1.1. Mergers & Acquisitions

- 8.1.2. Debt Capital Markets

- 8.1.3. Equity Capital Markets

- 8.1.4. Syndicated Loans and Others

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 9. Australasia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 9.1.1. Mergers & Acquisitions

- 9.1.2. Debt Capital Markets

- 9.1.3. Equity Capital Markets

- 9.1.4. Syndicated Loans and Others

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 J P Morgan Chase & Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Goldman Sachs Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Morgan Stanley

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BofA Securities Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Citi Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Barclays Investment Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Credit Suisse Group AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deutsche Bank AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wells Fargo & Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 RBC Capital Markets

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Jefferies Group LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Blackstone Group Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Cowen Inc**List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 J P Morgan Chase & Co

List of Figures

- Figure 1: Global Investment Banking Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Americas Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 3: Americas Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 4: Americas Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Americas Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: EMEA Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 7: EMEA Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 8: EMEA Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: EMEA Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 11: Asia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 12: Asia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australasia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 15: Australasia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 16: Australasia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Australasia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 2: Global Investment Banking Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 4: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Latin America Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 9: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Russia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Middle East Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 15: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Japan Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: China Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Others Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 20: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Australia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: New Zealand Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Investment Banking Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Investment Banking Industry?

Key companies in the market include J P Morgan Chase & Co, Goldman Sachs Group Inc, Morgan Stanley, BofA Securities Inc, Citi Group Inc, Barclays Investment Bank, Credit Suisse Group AG, Deutsche Bank AG, Wells Fargo & Company, RBC Capital Markets, Jefferies Group LLC, The Blackstone Group Inc, Cowen Inc**List Not Exhaustive.

3. What are the main segments of the Investment Banking Industry?

The market segments include Product Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.49 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

2019 - The Year of Mega Deals yet with Lesser M&A Volume.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Investment Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Investment Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Investment Banking Industry?

To stay informed about further developments, trends, and reports in the Investment Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence