Key Insights

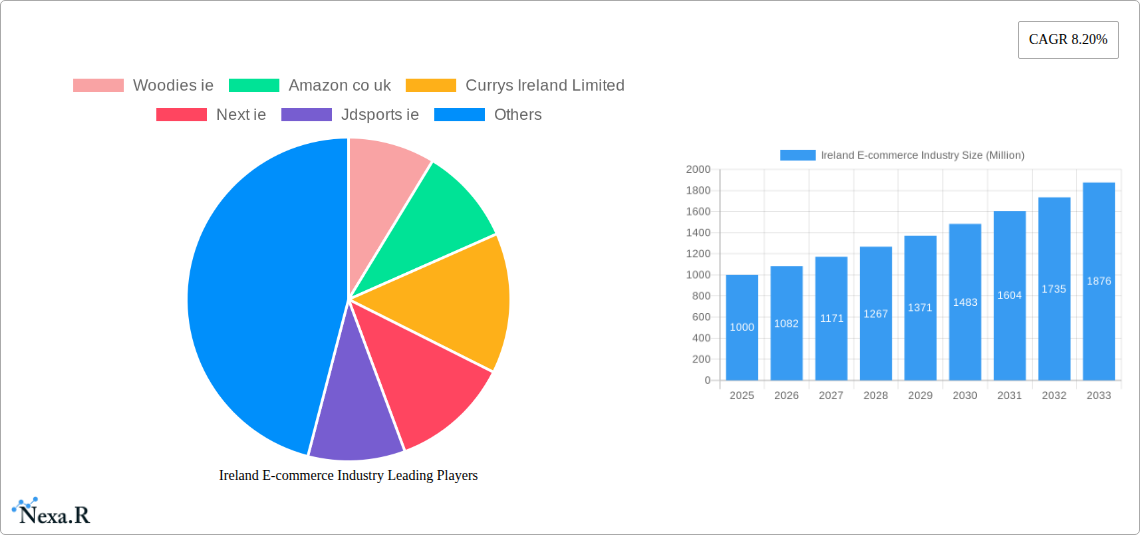

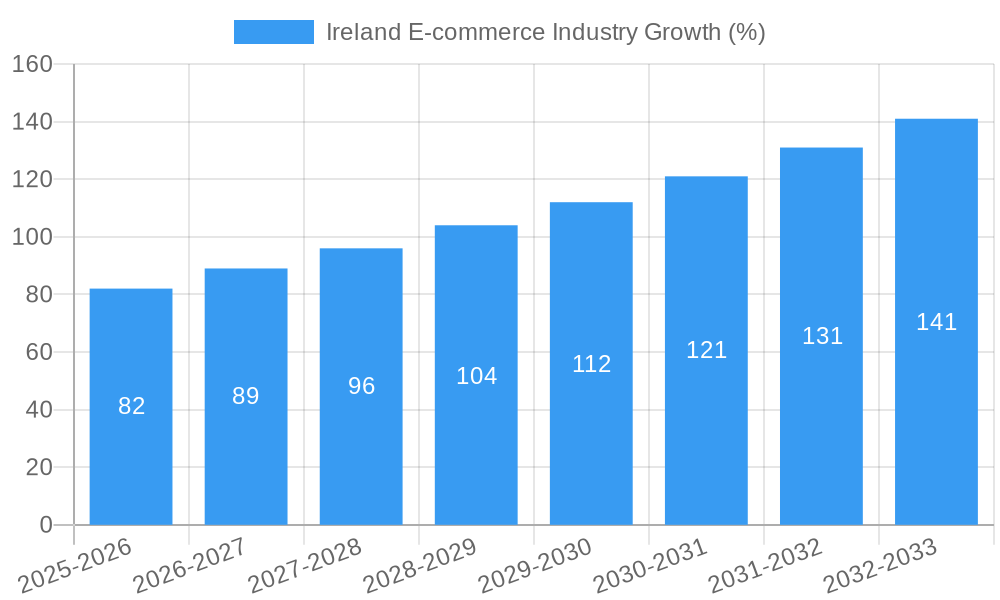

The Irish e-commerce market, currently experiencing robust growth, is projected to maintain a significant upward trajectory throughout the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 8.20% indicates a healthy and expanding sector, driven by increasing internet penetration, rising smartphone usage, and a growing preference for online shopping convenience among Irish consumers. Key drivers include the expanding availability of diverse product categories online, improved logistics and delivery infrastructure, and the rise of mobile commerce. Furthermore, the increasing adoption of digital payment methods and enhanced consumer trust in online platforms contribute to the market's expansion. Competitive forces are strong, with established international players like Amazon and Currys alongside homegrown retailers like Woodies and Harvey Norman vying for market share. This competition fosters innovation and price competitiveness, ultimately benefiting consumers.

However, challenges remain. Potential restraints include concerns about data privacy and security, the digital divide impacting less digitally-literate segments of the population, and the potential for economic downturns to affect consumer spending on non-essential goods. Despite these challenges, the continued development of e-commerce infrastructure, coupled with ongoing consumer adoption, suggests a positive outlook for the Irish e-commerce sector. Market segmentation by application (e.g., fashion, electronics, groceries) will likely see varying growth rates, with sectors like fashion and electronics likely leading the charge. The forecast indicates considerable market expansion by 2033, presenting significant opportunities for both existing and new market entrants. Strategic focus on improving customer experience, enhancing logistics, and addressing security concerns will be crucial for success in this dynamic and competitive landscape.

Ireland E-commerce Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic Ireland e-commerce industry, encompassing market size, growth trends, key players, and future opportunities. From 2019 to 2033, we delve into the intricacies of this thriving sector, offering invaluable insights for businesses, investors, and industry professionals. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects market trends until the estimated year (2025) and forecast period (2025-2033).

Ireland E-commerce Industry Market Dynamics & Structure

The Irish e-commerce market exhibits a complex interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with a few dominant players alongside numerous smaller businesses and startups. Technological innovation, particularly in areas like mobile commerce and AI-powered personalization, is a significant driver. The regulatory framework, while generally supportive, faces ongoing challenges in keeping pace with rapid technological advancements. Competitive product substitutes, both within and outside the online space, exert considerable pressure. End-user demographics are shifting towards younger, tech-savvy consumers increasingly comfortable with online shopping. Finally, M&A activity has been steadily increasing, reflecting both consolidation and expansion strategies.

- Market Concentration: Moderate, with a few dominant players holding xx% market share collectively.

- Technological Innovation: Strong drivers include mobile commerce, AI-powered personalization, and improved logistics.

- Regulatory Framework: Supportive but requires adaptation to new technologies and business models.

- Competitive Product Substitutes: Strong competition from both online and offline retailers.

- End-User Demographics: Young, tech-savvy consumers are driving growth.

- M&A Activity: Steady increase, indicating market consolidation and expansion. xx deals closed in 2024.

Ireland E-commerce Industry Growth Trends & Insights

The Irish e-commerce market has experienced substantial growth over the past few years, driven by rising internet penetration, increasing smartphone usage, and evolving consumer preferences. The market size has witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching €xx million in 2024. Adoption rates are high, particularly amongst younger demographics. Technological disruptions, such as the rise of mobile payments and social commerce, continue to reshape the market landscape. Consumer behaviour is shifting towards convenience, personalization, and omnichannel experiences. We project a CAGR of xx% during the forecast period (2025-2033), with the market size expected to reach €xx million by 2033. Market penetration is predicted to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Ireland E-commerce Industry

While Ireland is a relatively small market, geographical segmentation reveals variations in e-commerce penetration and growth. Dublin, as the largest city and economic hub, dominates the market, accounting for xx% of total e-commerce sales in 2024. However, growth is also evident in other urban areas and regions with improved infrastructure and digital literacy. By application, the apparel and fashion segment leads the market due to high online adoption rates and the wide availability of products. This segment represents xx% of total market value in 2024.

- Key Drivers:

- Strong urban infrastructure in Dublin and other major cities.

- High internet and smartphone penetration.

- Growing disposable income.

- Favorable government policies supporting digital economy.

- Dominance Factors:

- High concentration of businesses and consumers in Dublin.

- Strong brand presence of established retailers.

- Ease of access to logistics and delivery services.

Ireland E-commerce Industry Product Landscape

The Irish e-commerce landscape features a diverse range of products, from electronics and apparel to groceries and home improvement supplies. Product innovation is driven by technological advancements in areas like augmented reality (AR) for virtual try-ons and personalized recommendations based on customer data. Performance metrics, including website conversion rates and customer satisfaction, are closely monitored by businesses to optimize their online operations. Unique selling propositions increasingly focus on speed, convenience, personalized experiences, and seamless omnichannel integration.

Key Drivers, Barriers & Challenges in Ireland E-commerce Industry

Key Drivers:

- Rising internet and smartphone penetration.

- Increased consumer preference for online shopping.

- Technological advancements in payment gateways and logistics.

- Government initiatives promoting the digital economy.

Key Challenges:

- High return rates due to fit and quality issues (estimated xx% in 2024).

- Concerns over data privacy and security.

- Competition from international e-commerce giants.

- Dependence on cross-border logistics.

Emerging Opportunities in Ireland E-commerce Industry

- Growth of mobile commerce and social commerce.

- Expansion of e-commerce into rural areas.

- Increasing adoption of omnichannel strategies.

- Rise of subscription-based e-commerce models.

- Focus on sustainable and ethical e-commerce practices.

Growth Accelerators in the Ireland E-commerce Industry

Continued technological advancements, particularly in artificial intelligence and machine learning, will be crucial growth catalysts. Strategic partnerships between online and offline retailers, aimed at building seamless omnichannel experiences, will also accelerate growth. Expanding e-commerce into rural areas, combined with improving infrastructure and logistics, will create significant new opportunities.

Key Players Shaping the Ireland E-commerce Industry Market

- Woodies.ie

- Amazon.co.uk

- Currys Ireland Limited

- Next.ie

- JDsports.ie

- Harvey Norman.ie

- Tesco.ie

- Screwfix.ie

- Argos.ie

- Littlewoods Ireland

Notable Milestones in Ireland E-commerce Industry Sector

- September 2021: Gap partners with Next Plc to expand its UK & Ireland e-commerce presence.

- March 2022: Clearco invests €100 million in Irish e-commerce startups and establishes a Dublin sales hub, creating 125 jobs.

In-Depth Ireland E-commerce Industry Market Outlook

The Irish e-commerce market holds significant long-term growth potential, driven by technological innovation, evolving consumer behaviour, and supportive government policies. Strategic opportunities exist for businesses focusing on omnichannel strategies, personalized experiences, and sustainable practices. The market’s continued expansion will be shaped by the ability of businesses to adapt to changing consumer preferences and navigate the complexities of the evolving digital landscape.

Ireland E-commerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Beauty and Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion and Apparel

- 1.4. Food and Beverages

- 1.5. Furniture and Home

- 1.6. Others (Toys, DIY, Media, etc.)

Ireland E-commerce Industry Segmentation By Geography

- 1. Ireland

Ireland E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Card Payments and M-commerce; Significant Household Internet Access and High Cross-border Spending

- 3.3. Market Restrains

- 3.3.1. Paid version of some applications can challenge further penetration

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Card Payments and M-commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ireland E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Beauty and Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion and Apparel

- 5.1.4. Food and Beverages

- 5.1.5. Furniture and Home

- 5.1.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ireland

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Woodies ie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon co uk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Currys Ireland Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Next ie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jdsports ie

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Harveynorman ie

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tesco ie

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Screwfix ie

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Argos ie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Littlewoods Ireland

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Woodies ie

List of Figures

- Figure 1: Ireland E-commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ireland E-commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Ireland E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ireland E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Ireland E-commerce Industry Revenue Million Forecast, by B2C E-commerce 2019 & 2032

- Table 4: Ireland E-commerce Industry Volume K Unit Forecast, by B2C E-commerce 2019 & 2032

- Table 5: Ireland E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Ireland E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Ireland E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Ireland E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Ireland E-commerce Industry Revenue Million Forecast, by B2C E-commerce 2019 & 2032

- Table 10: Ireland E-commerce Industry Volume K Unit Forecast, by B2C E-commerce 2019 & 2032

- Table 11: Ireland E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Ireland E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ireland E-commerce Industry?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the Ireland E-commerce Industry?

Key companies in the market include Woodies ie, Amazon co uk, Currys Ireland Limited, Next ie, Jdsports ie, Harveynorman ie, Tesco ie, Screwfix ie, Argos ie, Littlewoods Ireland.

3. What are the main segments of the Ireland E-commerce Industry?

The market segments include B2C E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Card Payments and M-commerce; Significant Household Internet Access and High Cross-border Spending.

6. What are the notable trends driving market growth?

Rising Adoption of Card Payments and M-commerce.

7. Are there any restraints impacting market growth?

Paid version of some applications can challenge further penetration.

8. Can you provide examples of recent developments in the market?

March 2022 - Canadian investment firm Clearco announced to invest EUR 100 million in Irish e-commerce start-ups while also establishing an international sales hub in Dublin. Its expansion in Ireland will create an international sales hub in Dublin, with 125 jobs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ireland E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ireland E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ireland E-commerce Industry?

To stay informed about further developments, trends, and reports in the Ireland E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence