Key Insights

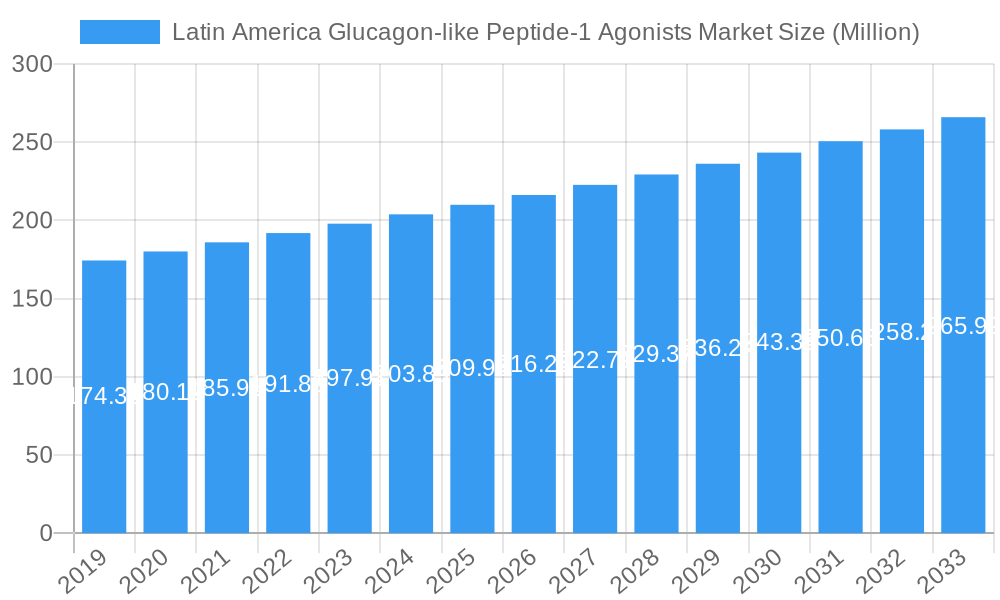

The Latin America Glucagon-like Peptide-1 (GLP-1) Agonists Market is poised for significant expansion, projected to reach a valuation of approximately USD 203.89 million by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 5.50%, indicating a sustained and healthy trajectory for the market through 2033. The escalating prevalence of type 2 diabetes and obesity across Latin America serves as a primary catalyst for this upward trend. GLP-1 agonists offer a novel and effective therapeutic approach for managing these chronic conditions, demonstrating superior glycemic control and contributing to weight reduction, thus addressing critical unmet medical needs. The increasing awareness among healthcare professionals and patients regarding the benefits of these advanced therapies further fuels market adoption. Key drug classes driving this growth include Semaglutide, Liraglutide, and Dulaglutide, which have shown promising clinical outcomes and are gaining traction in treatment protocols.

Latin America Glucagon-like Peptide-1 Agonists Market Market Size (In Million)

Further fueling the market's expansion are advancements in drug development and a growing pipeline of innovative GLP-1 agonist therapies. Companies like Novo Nordisk, AstraZeneca, and Eli Lilly and Company are at the forefront, investing heavily in research and development to introduce more potent and convenient treatment options. The market is also benefiting from increasing healthcare expenditure in the region and a gradual improvement in access to advanced pharmaceuticals, particularly in key economies like Brazil and Mexico. While the market is vibrant, potential restraints such as the high cost of these advanced medications and the need for robust reimbursement policies require careful consideration. Nevertheless, the overarching positive outlook, driven by an aging population, sedentary lifestyles, and a surge in metabolic disorders, positions the Latin America GLP-1 Agonists Market for continued and substantial growth in the coming years.

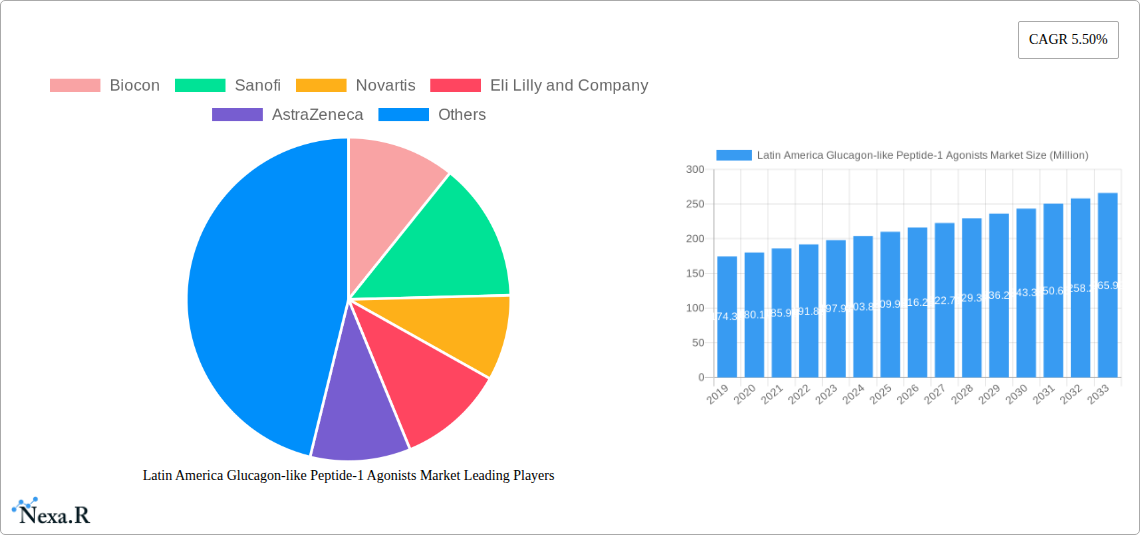

Latin America Glucagon-like Peptide-1 Agonists Market Company Market Share

This in-depth report provides a definitive analysis of the Latin America Glucagon-like Peptide-1 (GLP-1) agonists market, offering unparalleled insights into its current state and projected trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this research delves into market dynamics, growth trends, key segments, product landscape, drivers, challenges, and the strategic moves of leading industry players. With a focus on high-traffic keywords such as "GLP-1 agonists Latin America," "diabetes treatment Brazil," "obesity management Mexico," and "semaglutide market share," this report is designed to maximize search engine visibility and engage pharmaceutical professionals, investors, and market researchers. We present all values in Million units for clarity and actionable insights.

Latin America Glucagon-like Peptide-1 Agonists Market Market Dynamics & Structure

The Latin America GLP-1 agonists market is characterized by a dynamic and evolving landscape, driven by increasing prevalence of type 2 diabetes and obesity. Market concentration is significant, with a few key global pharmaceutical giants dominating the scene, yet the competitive intensity is rising as more players explore this lucrative therapeutic area. Technological innovation remains a critical driver, with ongoing research into novel formulations and expanded therapeutic applications, particularly for weight management. Regulatory frameworks, while supportive of innovation, can also present hurdles, necessitating rigorous clinical trials and market access strategies. Competitive product substitutes, including other anti-diabetic and anti-obesity medications, are present, but the unique efficacy profile of GLP-1 agonists is carving out a distinct market share. End-user demographics are shifting, with a growing middle class and increased health awareness boosting demand. Mergers and acquisitions (M&A) trends are anticipated to shape the market further as companies seek to expand their portfolios and geographical reach. For instance, the acquisition of promising pipeline assets or smaller biotechnology firms focused on metabolic disorders could become more prevalent. Innovation barriers include the high cost of R&D and the need for sustained patient adherence.

- Market Concentration: Dominated by a few global players with an increasing number of regional entrants.

- Technological Innovation: Focus on novel delivery systems, combination therapies, and expanded indications like chronic weight management.

- Regulatory Frameworks: Varying approval processes across countries, with a growing emphasis on real-world evidence.

- Competitive Product Substitutes: Traditional anti-diabetic drugs, bariatric surgery, and other weight-loss medications.

- End-User Demographics: Rising incidence of type 2 diabetes and obesity, coupled with growing disposable incomes.

- M&A Trends: Potential for strategic acquisitions to bolster product pipelines and market presence.

- Innovation Barriers: High R&D costs, complex clinical trial requirements, and pricing pressures.

Latin America Glucagon-like Peptide-1 Agonists Market Growth Trends & Insights

The Latin America GLP-1 agonists market is poised for substantial growth, fueled by a confluence of epidemiological, socioeconomic, and technological factors. The increasing burden of type 2 diabetes, now a leading cause of morbidity and mortality across the region, is a primary catalyst. Coupled with this is the alarming rise in obesity rates, a condition for which GLP-1 agonists have demonstrated significant therapeutic potential beyond glycemic control. Market size evolution is projected to be robust, driven by increased diagnosis rates and a growing appetite for advanced treatment options. Adoption rates, while historically influenced by cost and access, are expected to accelerate as more generic alternatives emerge and government healthcare initiatives expand. Technological disruptions, such as the development of once-weekly and even less frequent dosing regimens, are enhancing patient convenience and adherence, further propelling market penetration. Consumer behavior shifts are also noteworthy; patients are increasingly empowered with information and actively seeking treatments that offer comprehensive benefits, including weight loss and cardiovascular risk reduction, beyond just blood sugar management. The estimated market size in 2025 is approximately $850 Million units, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period 2025–2033. This growth is underpinned by an expanding patient pool, a widening range of approved indications, and improved healthcare infrastructure across key Latin American nations. The introduction of novel dual agonists and combination therapies is also a significant trend, offering enhanced efficacy and a more favorable side-effect profile, thus attracting a broader patient demographic. The market penetration for GLP-1 agonists, currently around xx% for diabetes treatment in major economies, is expected to rise significantly as accessibility improves and awareness campaigns gain traction.

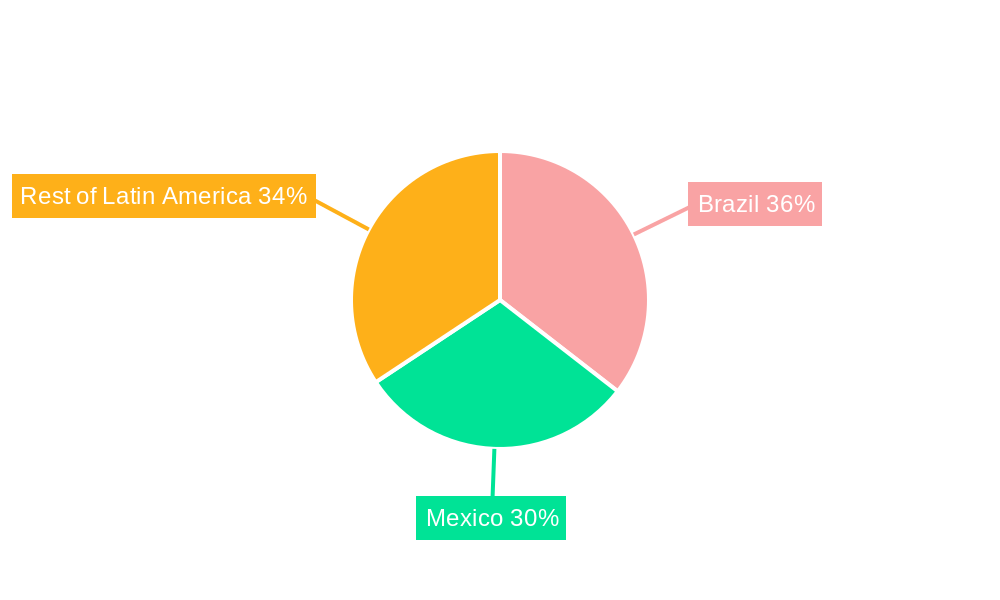

Dominant Regions, Countries, or Segments in Latin America Glucagon-like Peptide-1 Agonists Market

The Latin America GLP-1 agonists market is experiencing robust growth, with certain regions and drug segments leading the charge. Brazil and Mexico stand out as the dominant countries, driven by their large populations, high prevalence of metabolic diseases, and developing healthcare infrastructures. Brazil, with its substantial patient base and increasing healthcare expenditure, represents a significant portion of the market. Mexico follows closely, benefiting from a growing awareness of advanced treatment options and government efforts to manage chronic diseases. The "Rest of Latin America" category, while fragmented, collectively presents substantial untapped potential, with countries like Colombia, Argentina, and Chile showing promising growth trajectories.

Within the drug segments, Semaglutide currently holds the largest market share due to its proven efficacy in both glycemic control and weight management, alongside convenient dosing schedules. Liraglutide remains a strong contender, with established efficacy and widespread adoption for type 2 diabetes. Dulaglutide and Exenatide also contribute significantly to the market, serving specific patient needs and preferences. Lixisenatide, while having a smaller market share, plays a role in specific treatment algorithms.

Key drivers for dominance in these regions and segments include:

- Economic Policies: Favorable reimbursement policies and government initiatives supporting chronic disease management are crucial. For instance, Brazil's public health system (SUS) plays a vital role in increasing access to essential medications.

- Healthcare Infrastructure: The presence of well-equipped healthcare facilities, trained medical professionals, and robust distribution networks facilitates market expansion.

- Disease Prevalence: High and increasing rates of type 2 diabetes and obesity directly translate to a larger addressable market for GLP-1 agonists.

- Market Access & Affordability: Increasing efforts by pharmaceutical companies to make these treatments more accessible and affordable through various pricing strategies and patient support programs.

- Physician and Patient Awareness: Targeted educational campaigns aimed at healthcare providers and patients are crucial for driving prescription rates and patient uptake.

The market share for Semaglutide in the Latin American market is estimated at xx% in 2025, with Liraglutide at xx%. Brazil is projected to account for xx% of the total Latin America GLP-1 agonists market revenue in 2025, followed by Mexico at xx%. The growth potential in the Rest of Latin America is significant, estimated at a CAGR of xx% over the forecast period.

Latin America Glucagon-like Peptide-1 Agonists Market Product Landscape

The product landscape for GLP-1 agonists in Latin America is dynamic, marked by continuous innovation aimed at improving efficacy, convenience, and patient outcomes. Leading products include Semaglutide, known for its potent glucose-lowering and weight management benefits, available in once-weekly injectable formulations. Liraglutide, another prominent player, offers daily injections with a well-established safety profile. Dulaglutide, also a weekly injection, provides a convenient option for managing type 2 diabetes. Exenatide, in both short-acting and long-acting formulations, and Lixisenatide continue to serve specific patient needs. The introduction of tirzepatide, a dual GIP and GLP-1 receptor agonist, signifies a major advancement, offering enhanced glycemic control and significant weight loss, as evidenced by its approvals for chronic weight management and type 2 diabetes. These innovations, characterized by improved pharmacokinetic profiles, reduced side effects, and combination therapies, are reshaping treatment paradigms.

Key Drivers, Barriers & Challenges in Latin America Glucagon-like Peptide-1 Agonists Market

Key Drivers:

- Rising Prevalence of Type 2 Diabetes and Obesity: The growing epidemic of these chronic diseases is the primary force propelling the demand for effective treatment solutions like GLP-1 agonists.

- Clinical Efficacy and Patient Benefits: Demonstrated effectiveness in glycemic control, significant weight loss, and potential cardiovascular benefits are key adoption drivers.

- Advancements in Drug Formulations: Development of once-weekly and other convenient dosing regimens enhances patient adherence and satisfaction.

- Increasing Healthcare Expenditure and Access: Growing investments in healthcare infrastructure and expanding insurance coverage in Latin American countries are improving accessibility.

- Growing Awareness and Physician Education: Increased understanding of GLP-1 agonists' therapeutic potential among healthcare professionals and patients.

Barriers & Challenges:

- High Cost of Treatment: The premium pricing of GLP-1 agonists remains a significant barrier to widespread adoption, particularly in lower-income segments of the population.

- Reimbursement Policies: Inconsistent and often limited reimbursement coverage for GLP-1 agonists across various Latin American healthcare systems.

- Supply Chain and Distribution Complexities: Ensuring consistent availability and proper cold chain management across a geographically diverse region can be challenging.

- Competition from Other Treatment Modalities: The presence of established and cost-effective alternatives, including other anti-diabetic drugs and bariatric surgery.

- Patient Adherence and Injection Burden: Despite advancements, some patients may still find daily or weekly injections challenging, impacting long-term adherence.

- Regulatory Hurdles: Navigating diverse regulatory pathways and approval processes in each country can be time-consuming and resource-intensive.

Emerging Opportunities in Latin America Glucagon-like Peptide-1 Agonists Market

Emerging opportunities in the Latin America GLP-1 agonists market lie in expanding access to underserved populations, developing more affordable formulations, and exploring novel therapeutic applications. The increasing recognition of GLP-1 agonists for their role in chronic weight management presents a significant growth avenue, particularly with the recent approvals of dual agonists for this indication. Furthermore, the potential for combination therapies that address multiple metabolic derangements simultaneously offers a promising area for innovation. The "Rest of Latin America" region, encompassing countries with rapidly developing economies and growing healthcare needs, represents a substantial untapped market for increased penetration. Digital health solutions, telemedicine, and patient support programs tailored to the Latin American context can also enhance adherence and improve patient outcomes, creating new service-based revenue streams. The development of longer-acting formulations or even non-injectable delivery methods in the future could further unlock market potential.

Growth Accelerators in the Latin America Glucagon-like Peptide-1 Agonists Market Industry

Several key factors are acting as growth accelerators for the Latin America GLP-1 agonists market. Technological breakthroughs, such as the development of dual and triple agonists, are enhancing therapeutic efficacy and broadening the appeal of these drugs beyond traditional diabetes management. Strategic partnerships between global pharmaceutical companies and local distributors or research institutions are crucial for navigating complex market access landscapes and fostering local innovation. Market expansion strategies, including targeted marketing campaigns in emerging economies within Latin America and robust pharmacoeconomic data generation to demonstrate value to payers, are vital. The increasing focus on lifestyle-related diseases like obesity and type 2 diabetes by governments and healthcare providers is creating a more conducive environment for the adoption of advanced therapies. Moreover, the growing body of real-world evidence demonstrating the long-term benefits of GLP-1 agonists is building physician confidence and patient demand.

Key Players Shaping the Latin America Glucagon-like Peptide-1 Agonists Market Market

- Biocon

- Sanofi

- Novartis

- Eli Lilly and Company

- AstraZeneca

- Novo Nordisk

Notable Milestones in Latin America Glucagon-like Peptide-1 Agonists Market Sector

- November 2023: The U.S. Food and Drug Administration approved Zepbound (tirzepatide) GLP-1 injection for chronic weight management in adults with obesity or overweight with at least one weight-related condition, for use in addition to a reduced calorie diet and increased physical activity. This approval signals a significant expansion of the GLP-1 market into obesity treatment, with implications for Latin America.

- August 2022: Novo Nordisk announced results from a phase 2 clinical trial with CagriSema, a once-weekly subcutaneous combination of semaglutide and cagrilintide. The trial investigated the efficacy and safety of this fixed-dose combination in people with type 2 diabetes and overweight, highlighting ongoing innovation in combination therapies.

- May 2022: Eli Lilly and Company's Mounjaro (tirzepatide) injection was approved as an adjunct to diet and exercise to enhance glycemic control in adult patients with type 2 diabetes. Mounjaro, a single molecule, is a once-weekly glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 receptor agonist, marking a significant advancement in dual agonist therapy.

In-Depth Latin America Glucagon-like Peptide-1 Agonists Market Market Outlook

The Latin America GLP-1 agonists market is projected for robust and sustained growth, driven by the escalating prevalence of type 2 diabetes and obesity. Key growth accelerators include continuous technological innovation leading to more effective and convenient drug formulations, such as dual and triple agonists, and expanding indications into chronic weight management. Strategic partnerships and market expansion efforts by leading players will be instrumental in navigating regional complexities and increasing accessibility. The increasing healthcare expenditure across Latin America, coupled with a growing emphasis by governments on managing chronic diseases, will further bolster market penetration. Future market potential is significant, especially in the "Rest of Latin America" region, offering substantial opportunities for companies that can effectively address affordability, reimbursement, and local market dynamics. Strategic investments in R&D for novel delivery systems and expanded therapeutic targets will be crucial for capitalizing on this dynamic market.

Latin America Glucagon-like Peptide-1 Agonists Market Segmentation

-

1. Drugs

- 1.1. Exenatide

- 1.2. Liraglutide

- 1.3. Lixisenatide

- 1.4. Dulaglutide

- 1.5. Semaglutide

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

Latin America Glucagon-like Peptide-1 Agonists Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Rest of Latin America

Latin America Glucagon-like Peptide-1 Agonists Market Regional Market Share

Geographic Coverage of Latin America Glucagon-like Peptide-1 Agonists Market

Latin America Glucagon-like Peptide-1 Agonists Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs; Rapid Growth in the Usage of Pre-filled Syringes for Biologics; Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products

- 3.3. Market Restrains

- 3.3.1. High Expenses Associated with Inventory Management; Availability of Alternate Drug Delivery Methods

- 3.4. Market Trends

- 3.4.1. The Dulaglutide Segment holds the highest market share in the Latin America Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Glucagon-like Peptide-1 Agonists Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 5.1.1. Exenatide

- 5.1.2. Liraglutide

- 5.1.3. Lixisenatide

- 5.1.4. Dulaglutide

- 5.1.5. Semaglutide

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 6. Brazil Latin America Glucagon-like Peptide-1 Agonists Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 6.1.1. Exenatide

- 6.1.2. Liraglutide

- 6.1.3. Lixisenatide

- 6.1.4. Dulaglutide

- 6.1.5. Semaglutide

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 7. Mexico Latin America Glucagon-like Peptide-1 Agonists Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 7.1.1. Exenatide

- 7.1.2. Liraglutide

- 7.1.3. Lixisenatide

- 7.1.4. Dulaglutide

- 7.1.5. Semaglutide

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 8. Rest of Latin America Latin America Glucagon-like Peptide-1 Agonists Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 8.1.1. Exenatide

- 8.1.2. Liraglutide

- 8.1.3. Lixisenatide

- 8.1.4. Dulaglutide

- 8.1.5. Semaglutide

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Biocon

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Sanofi

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Novartis

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eli Lilly and Company

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 AstraZeneca

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Novo Nordisk

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Biocon

List of Figures

- Figure 1: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Glucagon-like Peptide-1 Agonists Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 2: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 3: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 8: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 9: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 14: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 15: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 20: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 21: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Glucagon-like Peptide-1 Agonists Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Latin America Glucagon-like Peptide-1 Agonists Market?

Key companies in the market include Biocon, Sanofi, Novartis, Eli Lilly and Company, AstraZeneca, Novo Nordisk.

3. What are the main segments of the Latin America Glucagon-like Peptide-1 Agonists Market?

The market segments include Drugs, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 203.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs; Rapid Growth in the Usage of Pre-filled Syringes for Biologics; Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products.

6. What are the notable trends driving market growth?

The Dulaglutide Segment holds the highest market share in the Latin America Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

7. Are there any restraints impacting market growth?

High Expenses Associated with Inventory Management; Availability of Alternate Drug Delivery Methods.

8. Can you provide examples of recent developments in the market?

November 2023: The U.S. Food and Drug Administration approved Zepbound (tirzepatide) GLP-1 injection for chronic weight management in adults with obesity (body mass index of 30 kilograms per square meter (kg/ m2) or greater) or overweight (body mass index of 27 kg/m2 or greater) with at least one weight-related condition (such as high blood pressure, type 2 diabetes or high cholesterol) for use, in addition to a reduced calorie diet and increased physical activity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Glucagon-like Peptide-1 Agonists Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Glucagon-like Peptide-1 Agonists Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Glucagon-like Peptide-1 Agonists Market?

To stay informed about further developments, trends, and reports in the Latin America Glucagon-like Peptide-1 Agonists Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence